What is the Blockchain in Banking Market Size?

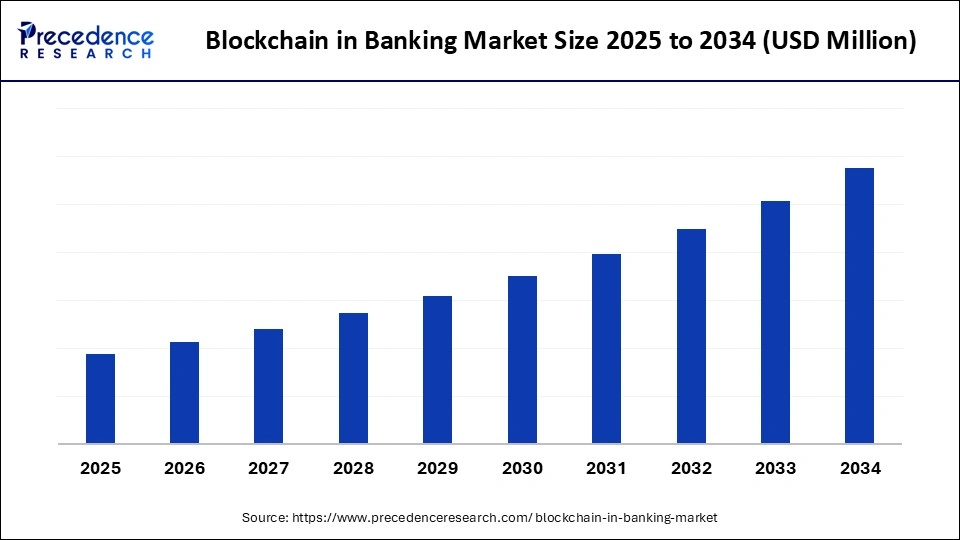

The global blockchain in banking market is witnessing rapid growth as banks and financial institutions implement blockchain to enhance security, transparency, and efficiency in transactions.Expansion of digitalization and cross-border payment requires highly secure transaction lines, which are offered by Blockchain technology. Each evolving phase, along with a reduction in manual intervention for banking processes, has further fueled the market's growth.

Blockchain in Banking Market Key Takeaways

- North America dominated the largest blockchain in banking market share of 38% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By application, the cross-border payments and remittances segment held the biggest market share of 36% in 2024.

- By application, the digital identity and KYC segment is expected to witness the fastest CAGR during the foreseeable period.

- By component, the software/platforms segment captured the biggest market share of 48% in 2024.

- By component, the services segment is expected to witness the fastest CAGR during the foreseeable period.

- By deployment mode, the cloud-based segment contributed the highest market share of 50% in 2024.

- By deployment mode, the hybrid segment is expected to witness the fastest CAGR during the foreseeable period.

- By end-user, the commercial banks segment generated the major market share of 42% in 2024.

- By end-user, the fintech companies and cooperative banks segment is expected to witness the fastest CAGR during the foreseeable period.

Market Overview

The blockchain in banking market refers to the global industry leveraging blockchain technology to enable secure, transparent, and decentralized banking operations. Applications include cross-border payments, fraud detection, smart contracts, trade finance, and digital identity management. The market is driven by increasing demand for faster and cost-effective transactions, regulatory support, rising cybersecurity concerns, and the adoption of digital banking solutions.

How is AI Transforming the Blockchain in Banking Market?

The integration of artificial intelligence into blockchain in the banking sector would offer unprecedented benefits by improving consumers' experiences, accelerating efficiency, and reassuring security claims. The combination of blockchain technology and AI in banking creates a robust defense system against cyber-attacks by leveraging real-time monitoring capabilities of AI and blockchain's immutable records.

AI can further automate repetitive tasks related to financing and optimize workflows without constant attention from humans, while blockchain streamlines transactions will providing faster and cost-effective services, which creates a robust financial system. Also, AI can leverage secure data from the blockchain's ledger to gain insights from it and offer precise future predictions.

What are the Key Trends in the Blockchain in Banking Market?

- Decentralized Finance (DeFi): A notable trend that the blockchain in banking market is witnessing is, some banks are seeking partnerships with DeFi projects or resembling some of its features in their working pattern to stay competitive in the global market by recognizing the potential of decentralized lending and trading platforms.

- Simplified KYC: The application of the blockchain in banking market further simplifies the KYC (know your customer process, which is to ensure a person's identity to avoid fraudulent activities. The technology enables a shared and immutable database of consumer identity with high precision and security, which minimizes verification time and cost.

- Central Bank Digital Currencies: Many global-level central banks are adopting CBDCs that are digital forms of fiat currency. Due to the potential for faster transactions and financial inclusion, blockchain technology is ideal for its design to work seamlessly.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Component, Deployment Mode, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Enhanced transparency and security

A significant driving factor for the expansion of the blockchain in banking market is enhanced transparency about financial statements and highly secured transmission of finance-related data due to blockchain technology. Blockchain offers immutable recorded data for every transaction in a block while ensuring compliance and non-violation of legal standards, which increases trust among consumers.

The auditing process can be simplified in fintech firms and offer easy accessibility to complete digital data, which saves time and unnecessary hustle due to offline processes that banks were used to doing before. Also, the decentralized nature of blockchain further reduces the chances of cyber-attacks or data glitches and offers highly secured transactions even over a longer distance.

Restraint

Regulatory Disputes and Scalability Reasons

Despite offering unparalleled security and a decentralized approach to data storage, the blockchain in banking market is still witnessing hurdles like uncertainty of proper regulations and scalability issues. Lack of a clear and smooth regulatory system for the application of blockchain in banking is creating a barrier for market expansion. Different countries have various legal frames for the application of blockchain in the banking sector. Also, public blockchain networks may face scalability issues. As the number of transactions grows, the system may become unstable and insufficient to handle such huge data.

Opportunity

Highly secured cross-border payments

By leveraging the benefits of blockchain, the Society for Worldwide Interbank Financial Telecommunications (SWIFT is looking to start worldwide payment initiatives and trying to enhance the experience of cross-border payments with smooth and seamless transactions along with high security. This approach holds greater future opportunities to expand the use of blockchain in the banking sector.

Blockchain technology in banking will be helpful to minimize the number of people required for repetitive tasks and allow for resolving urgent queries and focusing on sensitive financial tasks, like allowing consumers to pay with fiat currencies and cryptocurrencies. With a decentralized nature and a digital fingerprint for consumer identification, the market shows a promising future in the foreseeable period.

Segment Insights

Application Insights

Why are cross-border payments and remittances preferred in the blockchain in banking market?

The cross-border payments and remittances segment held the largest market share of nearly 36% in 2024. The segment's dominance can be related to blockchain's approach to directly addressing the drawbacks of conventional international money transfers and providing significantly lower costs by increasing transparency and faster processing. It further removes the need for intermediary banks to process the payments securely with the help of a blockchain ledger.

The digital identity and KYC segment is expected to witness the fastest CAGR during the foreseeable period. Digital identity offers tamper tamper-proof and highly secure way to recognize users' identity without chances of fraudulent activities and aligns with regulatory compliance. On the other hand, smart contracts offer secure and automated execution of agreements by lowering the need for manual intervention all the time.

Component Insights

How does the software platform help the blockchain in banking market to grow significantly?

The software/platforms segment held the largest market share of nearly 48% in 2024. The software/ platforms offered require tools and regulatory frameworks, which are crucial to build, deploy, and manage applications of blockchain, such as smart contracts and decentralized applications. These platforms provide secure and cost-effective transactions, which further enhance operational efficiency.

The services segment is expected to witness the fastest CAGR during the foreseeable period. The reason behind the segment's growth is that blockchain technology is new and complex to deploy for the expected domain, especially sensitive ones like banking and finance require precise consulting and support services for smooth functioning. Use cases like cross-border payments are crucial and need expert advice before processing to avoid the possibility of misuse.

Deployment Mode Insights

What is offered by cloud-based deployment in the blockchain in banking market?

The cloud-based segment held the largest market share of nearly 50% in 2024. The cloud-based deployment does not require substantial investment to build a separate infrastructure that supports blockchain technology with scalability and cost-effectiveness, and allows banks to easily adapt to the market's evolving needs. This deployment mode further facilitates collaborations, faster deployment, and easy access for specialized services, making it a highly preferable option for various banks.

The hybrid segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. Hybrid models offer high scalability and flexibility to banks to leverage the full potential of blockchain technology using cloud or private deployment as per requirement. A hybrid background offers fertile ground to proliferate blockchain in banking while scaling fluctuating needs of consumers cost-effectively.

End-user Insights

How do commercial banks leverage blockchain in banking technology?

The commercial banks segment held the largest market share of nearly 42% in 2024. The commercial banks are already handling vast datasets with sensitive information of consumers that need to be processed and stored securely. Thus, large banks are initiating the application of blockchain as it offers highly secured and various features to avoid malicious activities during sensitive transactions like cross-border payments. Blockchain further supports collaboration among banks on the same platform without compromising ownership of data.

The fintech companies and cooperative banks segment is expected to witness the fastest CAGR during the foreseeable period. A major benefit of blockchain for fintech companies includes lowered operational costs, enhanced efficiency and security, improved transparency with real-time traceability that builds trust between banking processes and their end users.

Regional Insights

Why is North America considered a pioneer of the blockchain in banking market?

North America held the largest market share of nearly 38% in 2024. The region is home to the development and initiative of blockchain applications in various sectors, including banking. Nearly 90% of banks in the North America region are exploring and experimenting differently with blockchain technology by recognizing its benefits, like high security and decentralized data storage with multiple copies that are immutable and hard to access by unauthorized sites.

Moreover, recent changes in regulations by federal regulators have supported the adoption of blockchain technology by reducing restrictions in finance infrastructure. The GENIUS Act in 2025 offered clarity on the usage of stablecoins. Also, leading companies like IBM, Microsoft, and Ripple are major providers of blockchain solutions, along with collaborations with top U.S. banks.

What factors support the growth of the Asia Pacific blockchain in banking market?

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The leading reasons behind the expansion of the Asia Pacificblockchain in banking include the region's complex financial system, along with emerging economies, which recognize the potential benefits of blockchain technology in the banking sector. Increasing cross-border payments by developing countries in the Asia Pacific further accelerates the use of blockchain technology in banking processes for highly secured transactions.

With the help of supportive regulatory frameworks, leading countries like India, Japan, Singapore, and China are heavily investing in adopting blockchain technology in a range of sectors, including finance and banking, to stay competitive globally. Government-led initiatives and investments to build supportive infrastructure further fuel the region's growth remarkably.

Leading Use Cases of Blockchain in Banking

- Reserve Asset like Bitcoin: Bitcoin is considered an alternative to sovereign bonds and gold. However, the U.S. Federal Reserve announced that it cannot hold the value of Bitcoin under regulations that have recently been added. Though on a global platform, Bitcoin is viewed as a potential asset as a hedge against volatile inflation in the market.

- Trade Finance: Trade finance is highly susceptible to fraudulent activities due to excessive paperwork and manual verification. Blockchain here creates a secure layer by sharing ledger access to each involved party, like banks, importers, exporters, and regulators. Platforms such as We. Trade is supported by HSBC to automate the crucial processing of smart contracts.

- Tokenization In Finance: Financial assets like investment funds and real estate are complex to divide and hard to transfer. Blockchain has presented a notable solution for it by converting these assets into digital tokens and enabling fractional ownership with simplified transactions. Thus, UBS introduced its first tokenized fund with the help of the Ethereum blockchain and enabling investors to trade digital assets.

Blockchain in Banking Market Companies

- IBM Corporation

- Ripple Labs Inc.

- R3

- ConsenSys

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Chain Inc.

- Infosys Limited

- Wipro Limited

- Accenture plc

- TCS (Tata Consultancy Services)

- Deloitte

- Capgemini

- FIS Global

- Temenos AG

- Digital Asset Holdings

- Guardtime

- Cognizant Technology Solutions

- Bitfury Group

Recent Developments

- In August 2025, the Indian banking system is leveraging blockchain technology as the RBI started the Digital Rupee. According to the data, nearly 600,000 users were registered to use this facility. The foundation is built on blockchain, but its goals are more human: reach, flexibility, control.

(Source: https://www.thenewsminute.com) - In December 2024, Germany's largest financial institution, Deutsche, started utilizing blockchain technology. For this, they are developing their own layer-2 blockchain on Ethereum. The bank hopes to address compliance challenges and bridge the gap between decentralised public blockchains and the regulated financial sector by using ZKsync technology.(Source: https://blockchaintechnology-news.com)

Segments Covered in the Report

By Application

- Cross-Border Payments and Remittances

- Fraud Detection and Risk Management

- Trade Finance and Supply Chain

- Smart Contracts

- Digital Identity and KYC

- Asset Management and Tokenization

By Component

- Software/Platforms

- Services (Consulting, Implementation, Maintenance)

- Infrastructure (Cloud/On-Premises Solutions)

By Deployment Mode

- Cloud-Based

- On-Premises

- Hybrid

By End-User

- Commercial Banks

- Investment Banks

- Credit Unions and Cooperative Banks

- Fintech Companies

- Other Financial Institutions

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting