What is the Bubble Wrap Packaging Market Size?

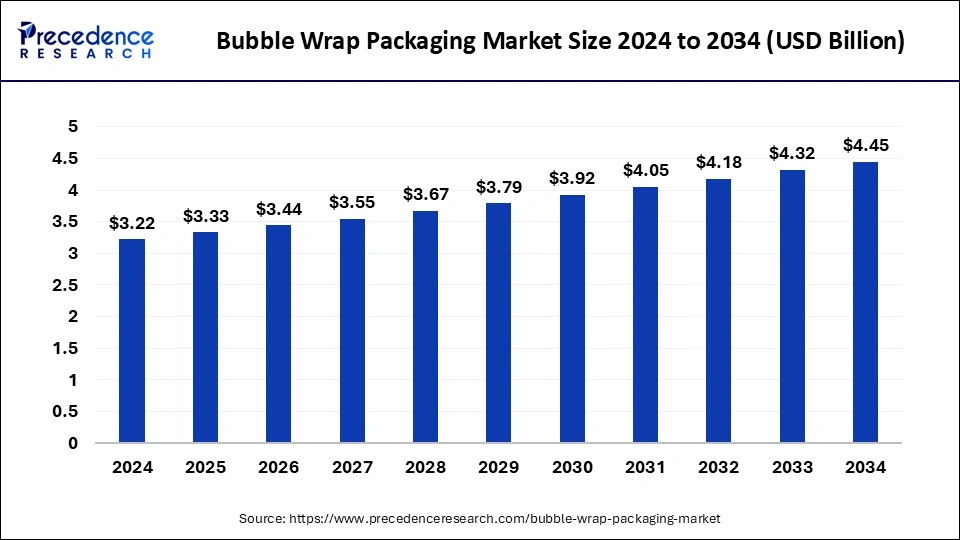

The global bubble wrap packaging market size is estimated at USD 3.33 billion in 2025 and is predicted to increase from USD 3.44 billion in 2026 to approximately USD 4.59 billion by 2035, expanding at a CAGR of 3.26% from 2026 to 2035. The bubble wrap packaging market is expanding because corporations are seeking safe, and environmentally responsible ways to protect their goods while they are being transported and improve consumer happiness.

Bubble Wrap Packaging Market Key Takeaways

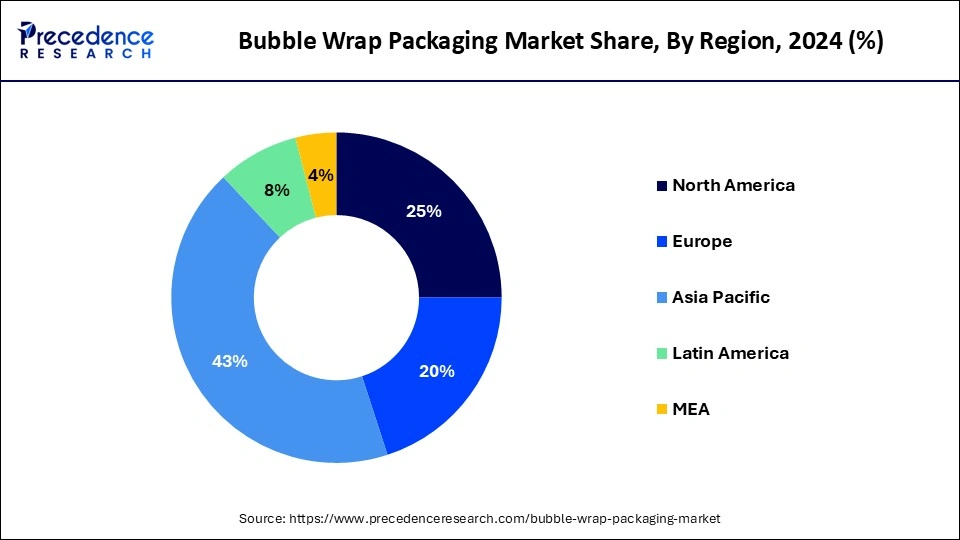

- Asia Pacific dominated the market with the largest revenue share of 43% in 2025.

- North America is expected to host the fastest-growing market over the forecast period.

- By product, the high-grade bubble wraps segment dominated the market in 2025.

- By product, the general grade bubble wrap segment is projected to grow at the fastest rate in the market over the forecast period.

- By application, the e-commerce segment dominated the market in 2025 and is expected to continue growing during the forecast period.

What is Bubble Wrap Packaging?

Bubble wrap is a transparent plastic material with air-filled bubbles, primarily made from polyethylene film. The packaging consists of a two-layer polyethylene film with trapped air to form bubbles, cushioning the packaged products. Bubble sizes typically range from 6mm to 26mm in diameter, with 10mm being the most commonly used size in various industries. Manufacturers widely use bubble wrap as a packaging solution, especially for fragile items, to ensure protection and safety during transportation.

Bubble wrap is available in two main types: single-layer regular grade and double-layer heavy-duty, with thicknesses ranging from 10 mm to 20 mm. It is lightweight, durable, and cost-effective, which makes it an ideal packaging option to protect objects from damage during handling, storage, and shipment. It is extensively used across different industries for wrapping fragile items that need a thick layer of support to shield them from direct contact with other objects.

Bubble Wrap Packaging Market Outlook

- Industry Growth Overview: From 2025 to 2030, the bubble wrap packaging market is expected to steadily expand due to increased e-commerce shipments, the desire for protective packaging, and fast fulfillment. The most aggressive growth occurred in Asia-Pacific and North America, where companies demanded lower cost cushioning materials and a shorter logistic cycle.

- Sustainability Trends:Sustainability involved changes to the market as brands directed more attention toward recyclable and biodegradable bubble films. Major manufacturers added capacity for recycled-content resins and used downgauged films to reduce plastic. Companies in Europe and the United States are allocating more funds for research and development to comply with tighter waste management and packaging regulations.

- Global Expansion: Key manufacturers expanded their reach into Southeast Asia, Eastern Europe, and Latin America to be closer to logistics hubs and lower shipping costs. New facilities increased supply resilience and supported rising demand from third-party logistics companies involved with cross-border e-commerce.

- Major Investors:Investors from private equity and strategic buyers displayed considerable interest as a result of stable demand, low substitution risk, and increasing opportunities for protective packaging. Recent investments have focused on automated bubble-wrap production systems and innovative, sustainable materials.

- Startup Ecosystem:The startup ecosystem has expanded with the growing adoption of compostable bubble films or air-based cushioning technology and uses for smart packaging. New startups in the U.S., India, and South Korea are funding alternatives for the protective packaging market that provide lighter, greener, and automated packaging.

What are the Growth Factors in the Bubble Wrap Packaging Market?

- The growing interest in environmentally friendly packaging choices can fuel the growth of the bubble wrap packaging market.

- The growth of the industrial and logistics sectors in developing economies is driving the demand for the bubble wrap packaging market.

- Technological advancements in new materials and designs for bubble wrap that meet various consumer demands are expected to drive the bubble wrap packaging market growth further.

- The growing need for specialized bubble wrap materials suited to certain industries can propel the bubble wrap packaging market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.33 Billion |

| Market Size in 2026 | USD 3.44 Billion |

| Market Size by 2035 | USD 4.59 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.26% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growth in the retail market

The bubble wrap packaging market is experiencing significant changes across all sectors, including supermarkets, megastores, and retail e-commerce websites. Manufacturers and distributors invest substantial effort and resources into their products to achieve performance targets. The impact of damaged items can result in losses amounting to thousands of dollars. However, bubble wrap packaging offers a positive user experience while focusing on product safety.

The increased use of mobile devices and the digital revolution in the telecom sector have driven the expansion of the e-commerce industry. Bubble wrap is essential in the shipping and transporting of fragile and delicate items as it reduces the risk of product damage from manufacturing and warehousing until the products reach their destination.

- In April 2023, Woola switched from plastic packaging to wool bubble wrap. Woola is an Estonian startup that uses waste sheep wool to produce packaging products. The firm sources wool locally and transforms it into envelopes, bubble wraps, and bottle sleeves.

Restraint

The increasing emphasis on environmental sustainability

As the retail market expands both online and in physical stores, the demand for protective packaging solutions like bubble wrap also increases. This need arises from the necessity to safeguard products during transit, enhance visual appeal on shelves, and ensure product quality upon delivery. As consumer preferences shift towards convenient, ready-to-use products, effective packaging becomes crucial for maintaining brand reputation and customer satisfaction. This highlights the importance of the bubble wrap packaging market in preserving product integrity and supporting the evolving retail landscape.

Opportunity

Emphasis on I-bubble packaging

I-bubble wrap packaging's unique functionality positions it to capture a significant share of the bubble wrap packaging market. Its innovative design and superior protective qualities enhance the customer experience while safeguarding items during transit. As the retail industry evolves with increased e-commerce activity and a greater focus on sustainable packaging, I-bubble wrap emerges as a distinctive choice.

Retailers and consumers favor it for its ability to meet diverse product needs with minimal environmental impact. The growing demand for reliable and efficient packaging solutions, driven by expanding online shopping and mobile connectivity, offers numerous opportunities for I-bubble wrap to secure its place in the bubble wrap packaging market.

- In May 2024, Seaman Paper, a leading global manufacturer of environmentally sustainable specialty paper and packaging solutions, announced the launch of SeaStretch™, a patented lightweight paper-based alternative to single-use plastic stretch film used to wrap and contain shipping and storage loads.

Segmental Insights

Product Insights

The high-grade bubble wrap segment was the dominant product in the bubble wrap packaging market in 2024. High-grade bubble wraps are commonly used for demanding packaging needs, particularly for protecting fragile electronic devices and medical equipment during transportation. They are utilized in bubble sheets, which are in high demand for vertically transporting electronic equipment, especially during long-distance shipping. These bubble wraps feature larger bubbles that can absorb significant shocks, providing a high level of protection during transit.

- In March 2024, LEIPA UK Ltd and Papair's PapairWrap, the first bubble wrap made from 100% paper, scooped the coveted Innovation Gallery Award at Packaging Innovations & Empack 2024.PapairWrap, which commenced production at Papair's Rethem an der Aller facility, is a synthetic- and adhesive-free bubble wrap made entirely of paper and promises to protect both products and the environment.

The general grade bubble wrap segment is projected to grow at the fastest rate in the bubble wrap packaging market over the forecast period. General-grade bubble wraps offer an efficient and cost-effective packaging solution for wrapping products and protecting them from damage. The wrap rolls can be conveniently cut to the desired width. General Wrap is available in two types—regular and heavy-duty, with thicknesses of 10mm and 20mm, respectively.

Application Insights

The e-commerce segment dominated the bubble wrap packaging market in 2024 and is expected to continue growing during the forecast period. The increasing trend of online shopping for fragile and electronic items has significantly boosted the demand for bubble wrap packaging. Customers expect their orders to arrive in perfect condition, hence driving the need for reliable protective packaging. The growth of e-commerce has increased the demand for materials like bubble wrap to ensure the safe and secure delivery of goods to consumers. These factors positively influence the market growth for bubble wrap packaging.

- In April 2022, The Shiseido brand introduced new eco-friendly alternatives to traditional packaging materials for e-commerce customers to choose from. One option includes the Eco-friendly Clear Bag, which is made of Polyvinyl Alcohol (known as PVA), starch, glycerin, and water and is considered a “green” plastic bag.

Regional Insights

What is the Asia Pacific Bubble Wrap Packaging Market Size?

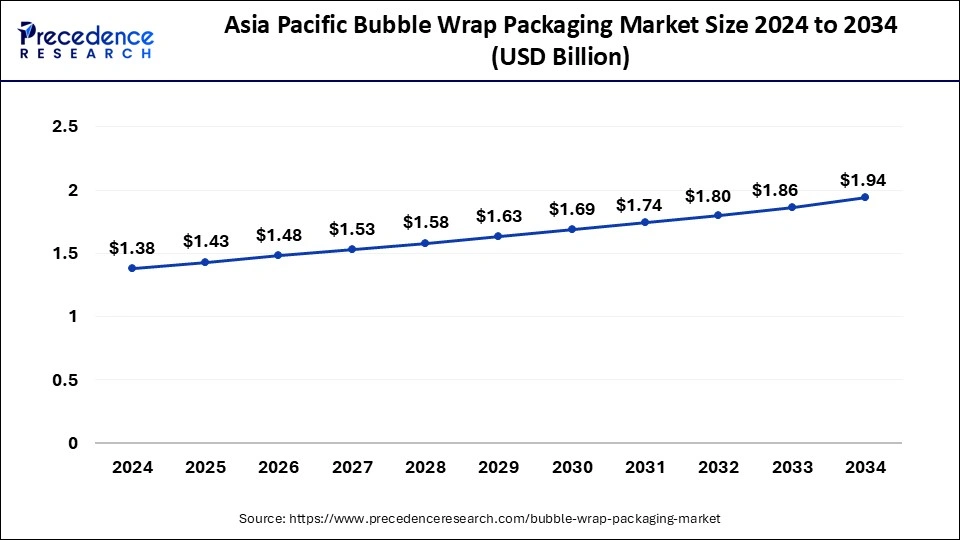

The Asia Pacific bubble wrap packaging market size surpassed USD 1.43 billion in 2025 and is projected to attain around USD 2.01 billion by 2035, poised to grow at a CAGR of 3.46% from 2026 to 2035.

Asia Pacific dominated the global bubble wrap packaging market in 2024. This growth is largely attributed to the region's increased internet penetration. The flourishing e-commerce sector, coupled with rising purchasing power in India and China, will significantly boost the global bubble wrap packaging market in the coming year. South Asian markets, particularly Japan and Thailand, are projected to expand at a much faster rate than most other neighboring countries.

- In June 2023, Dow and Procter & Gamble China developed a mono-PE air capsule for e-commerce packaging, which was said to reduce material usage and offer a weight reduction of over 40% compared to traditional corrugated parcel boxes. The pack is made from ELITE AT PE resins from Dow, which reportedly enables recyclability and replaces traditional, multi-material alternatives.

China Market Analysis

China is a major contributor to the Asia Pacific bubble wrap packaging market due to its large-scale manufacturing base, well-established polymer and packaging industries, and high domestic and export demand. The country's rapid growth in e-commerce, logistics, and consumer goods sectors has significantly increased the need for protective packaging solutions like bubble wrap, making China a key market driver in the region.

What Makes North America the Fastest-Growing Region?

North America is expected to host the fastest-growing bubble wrap packaging market over the forecast period. The expansion of e-commerce companies in this region is also contributing to market growth. The U.S. holds the largest market share, followed by Canada and Mexico. The strong presence of e-commerce companies drives significant demand in this area. Furthermore, the U.S. bubble wrap packaging market holds the largest market share in North America, while the Canadian market is the fastest growing.

U.S. Market Analysis

The bubble wrap packaging market in the U.S. is growing due to the rapid expansion of e-commerce and online retail, which has increased the demand for protective packaging during shipping and logistics. Additionally, rising consumer awareness of product safety, fragile item protection, and efficient packaging solutions is driving the adoption of bubble wrap across industries such as electronics, food, and consumer goods.

What made the European region experience significant growth in the bubble wrap packaging market?

Europe experienced significant growth due to strict recycling rules, strong retail sectors, and rising demand for premium protective packaging. Companies switched to recycled and biodegradable bubble wrap to meet EU sustainability targets. Growth was also boosted by an increase in cross-border trade and e-commerce shipments. Investments in lightweight and recyclable packaging materials created new opportunities for manufacturers. The region also saw more automated packaging systems in warehouses.

Germany Bubble Wrap Packaging Market Trends

Germany led the European market thanks to its strong manufacturing sector and high-quality logistics network. Industries such as automotive parts, machinery, and electronics use bubble wraps to prevent damage during transport. The country advocated for eco-friendly packaging, which heightened the demand for recyclable bubble wrap. With strict environmental laws and sophisticated technology, Germany became the leading user of bubble wrap in Europe.

Why did the Latin American region show steady growth in the bubble wrap packaging market?

Latin America showed steady growth due to more online shopping, increased logistics activity, and the expansion of small businesses. Companies used bubble wrap to protect fragile items during long-distance shipping. The region also saw new manufacturing facilities focused on low-cost protective packaging. Opportunities rose as more consumers purchased electronics and household goods online. Improved transport networks and urban growth further fueled the demand for bubble wrap solutions.

Brazil Bubble Wrap Packaging Market Trends

Brazil led the Latin American market due to having the largest retail and e-commerce base in the region. Businesses used bubble wraps to protect electronics, cosmetics, and home products. The country also expanded its logistics hubs, which increased packaging needs. With more local manufacturing and rising demand for protective packaging, Brazil remained the biggest contributor to bubble wrap usage in Latin America.

Why did the Middle East & Africa region expand significantly in the bubble wrap packaging market?

The Middle East and Africa expanded significantly due to rising trade, increased imports, and growth in retail and electronics. The region turned into a bubble wrap to safeguard goods during long-distance transportation. E-commerce activity also rose, especially in Gulf countries. Opportunities grew as companies invested in modern warehouses and packaging technologies. Demand for lightweight and recyclable bubble wrap supports steady growth in the region.

The UAE Bubble Wrap Packaging Market Trends

The UAE led the regional market as a major trade and logistics hub. Companies used bubble wraps for electronics, luxury goods, and re-export shipments. Strong e-commerce platforms and advanced warehouses increased the need for packaging. The country also promoted sustainable packaging, which raised demand for recyclable bubble wrap. With high levels of import and export activities, the UAE became the largest contributor in the region.

Value Chain Analysis

- Raw Material Sourcing

Raw materials for bubble wrap packaging are usually derived from petrochemical-derived polymers, low-density polyethylene, and linear low-density polyethylene.

Key Players: Dow, ExxonMobil, Braskem - Manufacturing Process

The manufacturing process involves the extrusion of these polyethylene films, followed by bubbles forming through vacuum or pressure molding, then lamination and cooling.

Key Players: Pregis, Berry Global, Storopack - Distribution Process

Distribution channels include direct B2B supply to e-commerce companies, logistics providers, and retail packaging distributors.

Key Players: Amazon, Sealed Air, Smurfit Kappa

Bubble Wrap Packaging Market Companies

- Veritiv Corporation (U.S.)

- Sealed Air Inc. (U.S.)

- Jiffy Packaging Co. (UK)

- Pregis Inc. (U.S.)

- Smurfit Kappa PLC (Ireland)

- Barton Jones Packaging Ltd. (U.S.)

- IVEX Protective Packaging Inc (U.S.)

- Automated Packaging System Inc. (U.S.)

Recent Developments

- In December 2025, Globe Packaging expanded its range of biodegradable bubble wrap rolls, offering options for e‑commerce businesses and warehouses seeking more sustainable packaging materials. The range features 500mm‑wide rolls with small air bubbles, made from low‑density polythene with a biodegradable additive that accelerates breakdown in landfill‑like conditions.(Source: https://news.marketersmedia.com/)

- In October 2024, Cortec Corporation introduced bubble sheets and bags with permanent electrostatic discharge (ESD) protection and VPCI technology to prevent corrosion of metals during storage and transit. This innovative packaging solution provides comprehensive protection for electronics throughout the manufacturing, shipping, and storage processes.(Source: https://www.cortecvci.com/ )

- In January 2024, Antalis acquired 100 metros of Soluções de Embalagem, Unipessoal, a leading packaging distribution company in Portugal, further expanding its presence in the Iberia packaging market.

- In November 2023, Estonian startup RAIKU secured USD 6.3 million from the European Innovation Council and USD 3.5 million from private sector investors to advance its chemical-free and compostable packaging material technology.

- In September 2023, Go Do Good Studio, a Pune-based material innovation company, developed a versatile film from algae harvested from India's coastal regions, offering various packaging applications.

- In February 2022, Sealed Air Packaging announced the acquisition of Foxpak Flexibles Ltd, which is a privately held Irish packaging solutions firm that pioneered digital printing on flexible packaging. This acquisition will help them accelerate the firm's digital future with innovations and emerge as a global smart-packaging solution brand.

Segments Covered in the Report

By Product

- Bubble Wrap Packaging Product Outlook

- High-grade Bubble Wraps

- General Grade & Temperature-Controlled Bubble Wraps

- Limited-grade Bubble Wraps

- Others

By Application

- E-commerce

- Automotive and Allied Industries & Consumer Goods

- Pharmaceutical, Food, and Beverages & Personal Care

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting