What is the Camera Accessories Market Size?

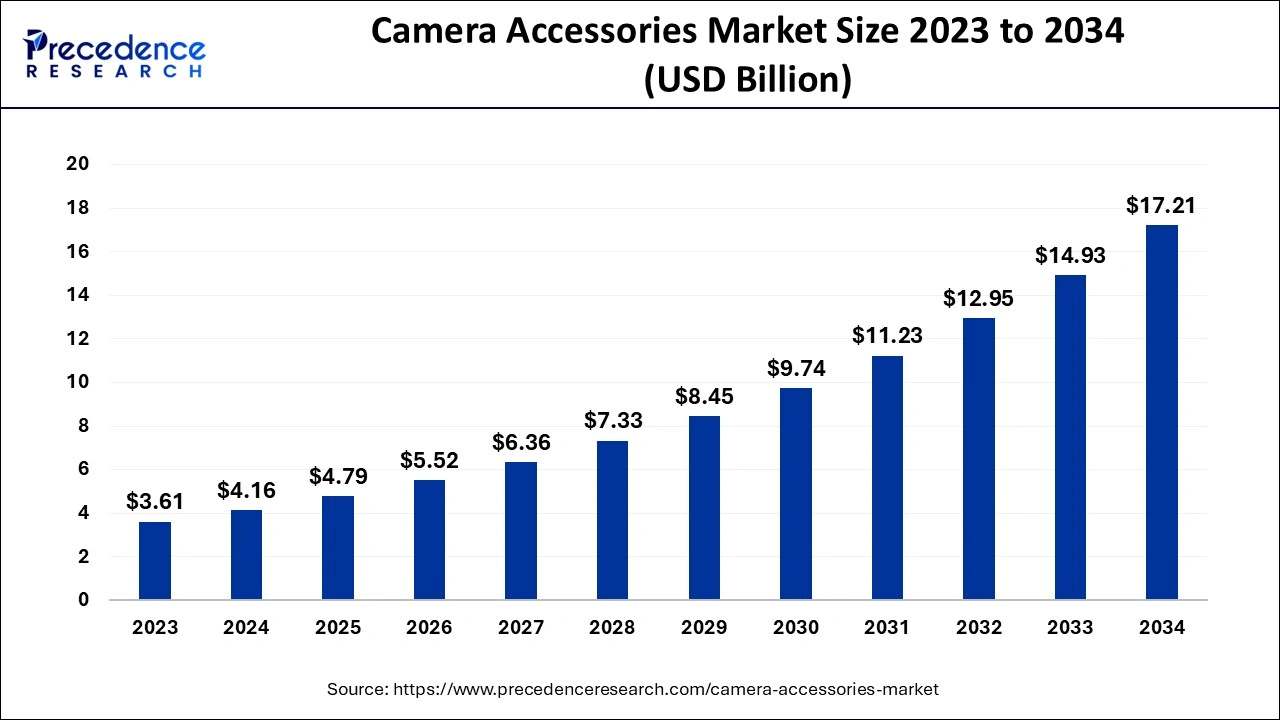

The global camera accessories market size is calculated at USD 4.79 billion in 2025 and is predicted to increase from USD 5.52 billion in 2026 to approximately USD 19.29 billion by 2035, expanding at a CAGR of 14.95% from 2026 to 2035. The rising adaptation of photography and videography on different occasions and the increasing number of video content creators on social media platforms are accelerating the growth of the market.

Camera Accessories Market Key Takeaways

- In terms of revenue, the camera accessories market is valued at $4.79 billion in 2025.

- It is projected to reach $19.29 billion by 2035.

- The camera accessories market is expected to grow at a CAGR of 14.95% from 2026 to 2035.

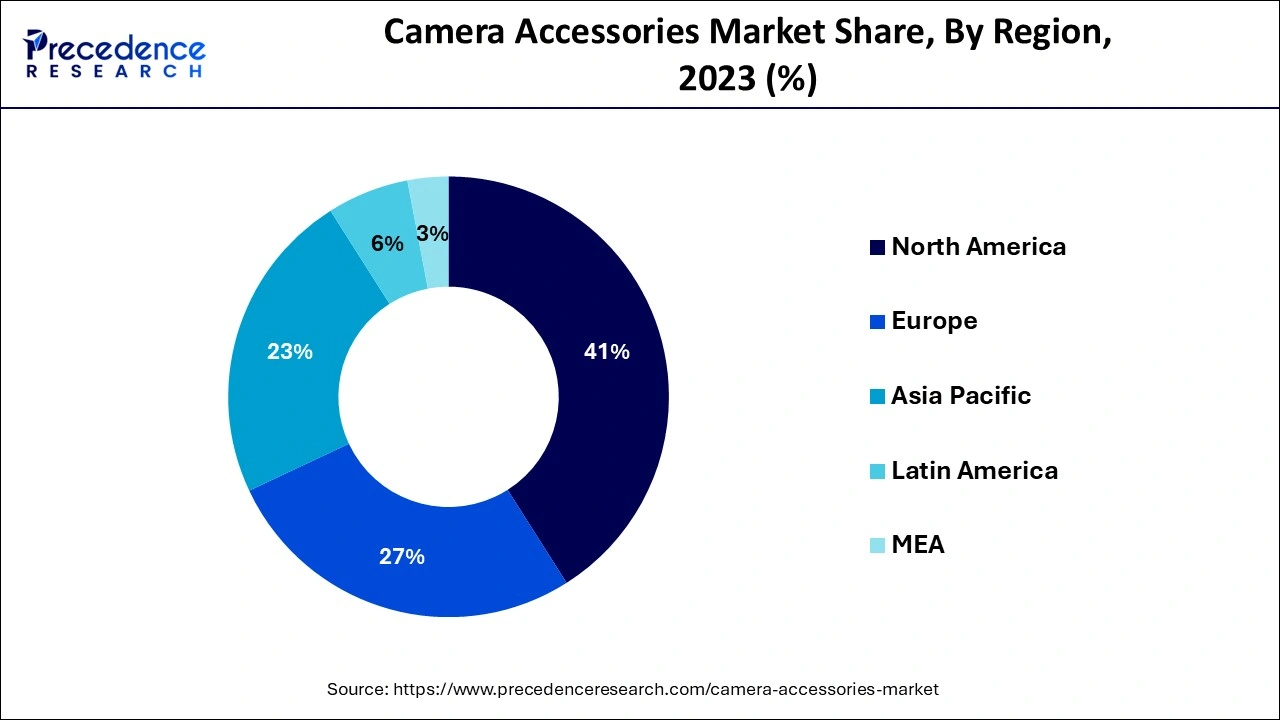

- North America dominated the global market with the largest market share of 41% in 2025.

- Asia Pacific expects considerable growth in the market during the forecast period.

- By type, the lens segment contributed the highest market share in 2025.

- By type, the batteries segment is expected to expand at the fastest CAGR in the forecast period.

- By distribution channel, the offline segment captured the biggest market share in 2025.

- By distribution channel, the online segment is anticipated to grow at the fastest CAGR from 2026 to 2035.

How Can AI Impact the Camera Accessories Market?

The artificial intelligence in the camera helps enhance the quality of photos, videos, and video intelligence. The AI camera increases the capabilities and quality of professional and smartphone photography. AI in cameras uses machine learning algorithms to optimize and automate camera settings, resulting in high-quality photographs in any type of low- and high-light dynamics scenario. Artificial intelligence software plays an important role in enhancing the quality of images by featuring better autofocus and low-light performance with IR night vision.

- In October 2024, Raspberry Pi and Sony come into a collaboration for the designing and launching of the AI camera module for all Pi computers with the pricing of $70, bringing onboard processing and efficiency for the SBCs to work with visual data.

Market Overview

Camera accessories are the equipment or devices that are used to take photos and videos more accurately and help protect the equipment. The camera accessories further include the remote shutter release, tripod, polarized filter, external flash, lens cleaning kit, lens hood, UV filter, teleconverters, battery grips, camera straps and bags, spare batteries, power banks, specialty cleaning wipes, and kits. The increasing inclination towards photography and videography in the younger population as a career is contributing to the expansion of the camera accessories market.

Emerging Trends in the Camera Accessories Market

The camera accessories market is rapidly evolving in response to growing demand from both professional photographers and enthusiastic content creators. With the proliferation of social media platforms and the increasing popularity of vlogging, virtual tours, e-commerce photography, and cinematic storytelling, the ecosystem surrounding cameras has expanded dramatically. Accessories like tripods, gimbals, lighting systems, lens filters, memory cards, and camera bags are no longer optional; they are essential for performance enhancement and content quality.

In the camera accessories market, a noticeable shift is observed towards modular, lightweight, and multi-functional accessories, which cater to the needs of travel photographers and mobile filmmakers. Meanwhile, the adoption of AI-integrated accessories, such as smart gimbals with object tracking and automated lighting systems, is gaining traction among tech-savvy users. Additionally, sustainability-conscious consumers are opting for eco-friendly camera bags, rechargeable batteries, and accessories made with recycled materials.

Camera Accessories Market Growth Factors

- Rise in younger population: The increasing younger population in the countries is inclining towards technologically advanced and digital electronic gadgets, and rising preference towards photography and shooting are collectively driving the growth of the camera accessories market.

- Increasing technological advancements: The rising technological advancements in electronic gadgets and the digitization of the camera for improving the quality and enhancing lifespan are driving the sales of the digital camera, which is anticipated in the higher demand for camera accessories.

- The availability of products: The higher availability of different types of camera accessories such as camera lenses, bags, tripods, straps, lens caps, and others with different sizes, colors, brands, and qualities in the online and offline sales platform is accelerating the expansion of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 19.29 Billion |

| Market Size in 2025 | USD 4.79 Billion |

| Market Size in 2026 | USD 5.52 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.95% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Drivers

The rise in the entertainment industry

The increasing media and entertainment industry around the world is contributing significantly to the demand for cameras and camera accessories. Digitization across industries and the economic growth in the population are driving electronic and digitally advanced gadgets, increasing the sales of digital cameras and demand for the camera accessories market.

Restraint

High cost

The increasing cost of the camera and camera accessories due to the higher manufacturing cost and digitization association is limiting the use and restraints the growth of the camera accessories market.

Opportunity

Increasing market competition

The increasing market competition in the development and launch of camera and camera accessories and the continuous participation of new market players are driving the expansion of the market. The continuous investment in research and development for the evaluation of the camera and the launch of different camera accessories by the leading brand is accelerating the growth of the market.

Type Insights

The lens segment dominated the camera accessories market in 2025. The lenses are one of the most important parts of the camera. Lenses work the same as the human eye and allow the camera to enter the required light. There are different types of lenses found in the market with different focal lengths and properties. There are different types of lenses and cameras used in the different types of cameras for shooting or photography purposes. Zoom lenses, prime lenses, telephoto lenses, wide-angle lenses, and macro lenses are some types of lenses that have been majorly used in cameras.

The batteries segment expects significant growth in the camera accessories market during the forecast period. Camera batteries are one of the most significant parts of cameras. The increasing adoption of advanced cameras by people for enhanced quality photography and shooting is increasing the sales of camera batteries. Additionally, the continuous evaluation of the batteries for improving the quality, faster recharge, and improve the battery quality and lifespan. The increasing demand for digital cameras is driving the growth of rechargeable batteries such as lithium-ion batteries, nickel-metal-hydride batteries, and disposable AA and AAA batteries, which are some of the types of rechargeable batteries for digital cameras.

Distribution Channel Insights

The offline segment accounted for the largest growth in the camera accessories market in 2025. The increasing demand for camera accessories from offline stores such as specialty stores, supermarkets, malls, and other offline stores is due to the higher assurance of quality and in-person quality checks. The offline sales distributors provide greater discounts with attractive offers included. The availability of different products with an affordable price range drives the expansion of the offline distribution channel segment.

The online segment is estimated to grow at a significant rate in the camera accessories market during the predicted period. The increasing adoption of online sales platforms for buying electronics and sales gadgets and the rising e-commerce market globally are driving the growth of the online distribution channel. The rising preference towards online shopping in the younger generation and the great discounts, EMI offers, and offers included in the online sales of electronics and gadgets are increasing the sales of camera accessories from the online distribution channel.

Regional Insights

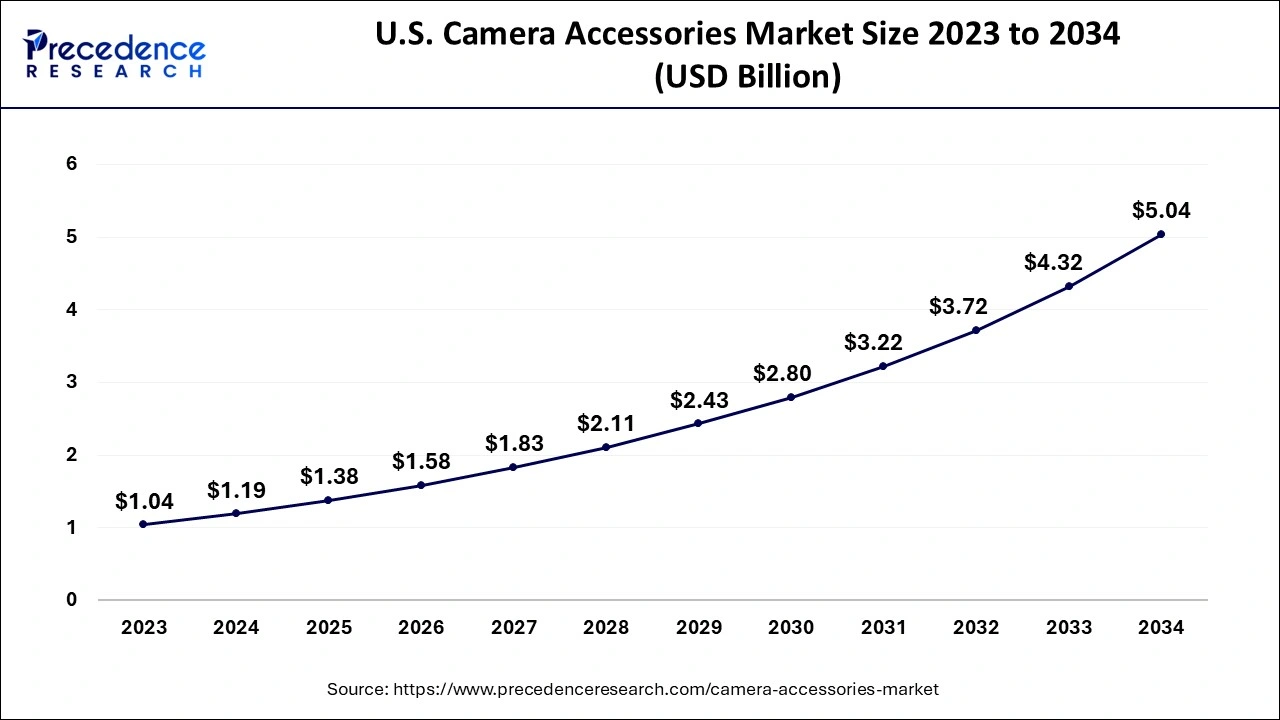

U.S. Camera Accessories Market Size and Growth 2026 to 2035

The U.S. camera accessories market size is exhibited at USD 1.38 billion in 2025 and is projected to be worth around USD 5.68 billion by 2035, growing at a CAGR of 15.20% from 2026 to 2035.

North America dominated the camera accessories market in 2025. The growth of the market is attributed to the rising demand for cameras by the population due to the rising attraction towards photography and shooting on a personal level is driving the sales of cameras, which anticipated the higher demand for camera accessories such as lenses, batteries, bags, tripod, and others. Furthermore, technological advancements in cameras, such as the rise of digital cameras with improved quality and focus length, are also contributing to the growth of the camera accessories market in the region.

- Photographer employment is expected to increase by 4% from 2025 to 2034, an average faster than all other occupations. There are 13,700 openings for the photographer forecasted every year.

- The overall employment of film and video editors and camera operators is expected to increase by 3 % from 2025 to 2034, which is an average faster than all other occupations. There are 7,100 openings for film and video editors and camera operators, which are forecasted every year.

North America continues to dominate the camera accessories market, driven by the region's mature photography industry, technological innovation, and consumer willingness to invest in premium products. The United States is a major contributor due to the high concentration of content creators, YouTubers, journalists, and professional photographers who require high-performance gear for everyday use. Government support for creative industries, especially in digital media and advertising, has created a robust backdrop for camera accessory consumption. Moreover, the presence of established brands and a thriving e-commerce sector allows for widespread access to the latest innovations in gear and equipment.

Key Growth Drivers in North America

- High disposable income and preference for advanced camera technology

- Strong presence of established brands and specialist retailers

- Booming content creation and digital storytelling industries

- Evolving photography education ecosystem and amateur creator platforms

- Demand for rugged and weatherproof accessories for outdoor photography

Asia Pacific expects considerable growth in the market during the forecast period. The growth of the market is attributed to the rising number of younger generations, which are inclining towards photography, driving the demand for the market. The increasing entertainment industry in India and the rising availability of the varieties of camera accessories in online and offline sales platforms are accelerating the expansion of the camera accessories market across the region.

- The media and entertainment industry in India is projected to reach $100 billion by 2030.

- The filmed entertainment industry segment in the media and entertainment industry has increased by 14%, with a reach of INR 197 billion in 2023. Approximately 1790+ films were released in 2023, generating an all-time high theatrical revenue of INR 120 billion.

Asia Pacific is rapidly emerging as the fastest-growing market for camera accessories, thanks to the surge in smartphone photography, wedding videography, influencer marketing, and digital content production. Countries such as India, China, South Korea, and Indonesia are seeing a boom in small-scale production houses, vloggers, and even social media photographers who seek cost-effective yet high-quality accessories to improve their output. Moreover, local manufacturing capabilities in China and Japan are making high-performance gear accessible to a wider consumer base.

Europe Trends for the Camera Accessories Industry

Europe's market shows a significant growth rate during the forecast period. It is driven by content creators, travel, and even the shift to mirrorless cameras, with a strong need for smart stabilization, AI features, and even sustainable products, alongside booming online sales, mainly for versatile lighting, compact bags, and telephoto or wide-angle lenses.

France Camera Accessories Market Trends

France's market is driven by mirrorless camera acceptance and social media's influence. Popularity of smaller, versatile mirrorless cameras along with compact cameras boosts the need for complementary portable accessories such as lens adapters, flashes, and filters.

Latin America Trends for the Camera Accessories Industry

Latin America's market shows notable growth during the forecast period. It is driven by the rising adoption of digital imaging devices and the increasing need for enhanced photography experiences. The market outlook is shaped by developments in camera technologies, rising user interest in professional and hobbyist photography, and even the proliferation of social media platforms that encourage high-quality image capture.

Argentina Camera Accessories Market Trends

Argentina's market is driven by the popularity of mirrorless or compact cameras, increased content creation, and the need for high-quality visuals, with online channels dominating sales. Overall, the market is projected to expand steadily as technological adoption increases and more consumers pursue visual content creation for personal and commercial purposes.

MEA Trends for the Camera Accessories Industry

MEA's market shows a rapid growth rate during the forecast period. It is driven by rising content creation, social media, and e-commerce, with trends favoring mirrorless-specific gear, app-integrated smart accessories, and the need for high-quality video tools like lighting, gimbals for remote work or vlogging, alongside strong offline retail for hands-on experience.

South Africa Camera Accessories Market Trends

South Africa's market is experiencing steady growth as content creation, vlogging, and social media use drive demand for supporting gear such as tripods, lighting, microphones, and protective cases. The rise of hybrid and professional photography, along with increased adoption of mirrorless and action cameras, is expanding opportunities for high-performance accessories.

Value Chain Analysis for the Camera Accessories Market

- Raw Material Procurement

It dictates product quality, manufacturing expenses, supply chain stability, and sustainability. It serves as the initial step in the value chain, sourcing components such as lenses, tripods, and batteries, which enables producers to meet growing, specialized consumer demand.

Key Players: Sony Group Corporation, Canon Inc., Nikon Corporation - Wafer Fabrication

It offers the camera accessories market, mainly for mobile devices, security cameras, and even compact cameras, a method to manufacture smaller, more cost-effective, and highly integrated components.

Key Players: Sony Group Corp., GlobalFoundries & UMC, Hua Hong Semiconductor & DB HiTek - Photolithography and Etching

It drives innovation in the camera accessories market by allowing extreme miniaturization, high-precision manufacturing, and improved performance of optical and electronic components.

Key Players: EV Group (EVG), SÜSS MicroTec SE, Canon Inc. & Nikon Corporation

Camera Accessories Market Companies

- Canon Inc.

- Panasonic Corporation

- Sony Corporation

- Nikon Corporation

- Peak Design

- Samsung

- Olympus Corporation

- GoPro

- Fujifilm

- RED

Recent updates on camera accessories

Technological advancements transforming photography gear

- On 15 March 2025, Photography has changed dramatically as a result of advancements in camera accessories such as wireless triggers, AI-powered stabilizers, and modular lenses. These improvements are now essential in propelling market expansion worldwide due to rising demand from vloggers, content producers, and professional photographers. The smooth integration with mirrorless systems and smartphones has particularly increased user interest.

Emerging products offer new opportunities

- On 5 April 2025, numerous next-gen accessories are in development or entering markets, such as compact gimbals with built-in tracking AI, ultra-light carbon fiber tripods, and magnetic mounting systems. Products like the DJI RS 4 Mini, Peak Design mobile creator kit, and the Rode Wireless PRO microphone system are expected to dominate due to their versatility, portability, and creator-focused designs. Their commercial rollout is anticipated to elevate market value significantly.

Latest Announcements by Industry Leaders

- In October 2024, Canon announced the RF50mm F1.4 L VCM, RF70-200mm F2.8 L IS USM Z, and RF24mm F1.4 L VCM, these three RF lenses will be the integral part of the video creator and hybrid shooter's toolkit. The three lenses integrate classic focal length maximum aperture and their EF mount predecessors, which are popular among professionals.

- In July 2024, Panasonic Marketing Middle East & Africa (PMMAF) announced the regional launch of the latest 4K PTZ Camera. Expanding line-up of 4K integrated cameras AW-UE30 with 74.1° wide-angle lens and 20x Optical Zoom.

- In October 2024, Sony launched the two latest camera power supply solutions for the Alpha series, in addition to its Cinema Line cameras using NP-FZ100 batteries to cater to the increasing demand for the creators.

Recent Developments

- On 20 February 2025, Joby launched a new range of Gorilla Pod kits with integrated LED lighting and MagSafe-compatible phone mounts. The kits target mobile creators seeking compact in one shooting setups. Joby also announced collaborations with TikTok influencers for global digital campaigns.

- On 10 January 2025, Sony launched the GPVPT2BT Gen 2, a wireless shooting grip with customizable controls and Bluetooth 5.2 compatible with its Alpha and ZV camera lines. The accessory enhances one-hand usability and supports vertical content creation.

- In March 2025, Rode released the Wireless GO IV, a compact wireless mic system with advanced noise cancellation and real-time level adjustments. It includes dual-channel recording, making it ideal for interviews and podcasts. Rode is targeting YouTuber journalists and mobile filmmakers with this next-gen system.

- On 7 April 2025, Manfrotto unveiled its pro lite carbon series ultralight travel-friendly tripods with built-in level indicators and a quick lock mechanism. The series is aimed at hybrid shooters using both DSLR.

- In November 2024, IDS Imaging Development Systems GmbH is adding a new range of cameras in line with the launching of uEye XCP, which is soon to go into production. The uEye XCP is a USB3 camera that comes with monochrome and color versions and an IMX636 event-based CMOS global shutter sensor developed by Prophesee and Sony.

- In September 2024, GoPro announced the launch of two cameras, the HERO and the HERO13 Black, with different capabilities and features.

- In June 2024, Nikon launched the latest Z6III full-frame mirrorless camera for redefining photography and videography by featuring the world's first-ever partially-stacked CMOS sensor.

- In October 2024, SmallRigs launched the latest range of accessories for the Fujifilm X-M5 camera. The accessories kit includes hand straps, cages, and thump grips, which make shooting more comfortable with a compact camera.

Segments Covered in the Report

By Type

- Lens

- Bags and Cases

- Batteries

- Tripod

- Flashes

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting