Cancer IVD Market Size and Forecast 2025 to 2034

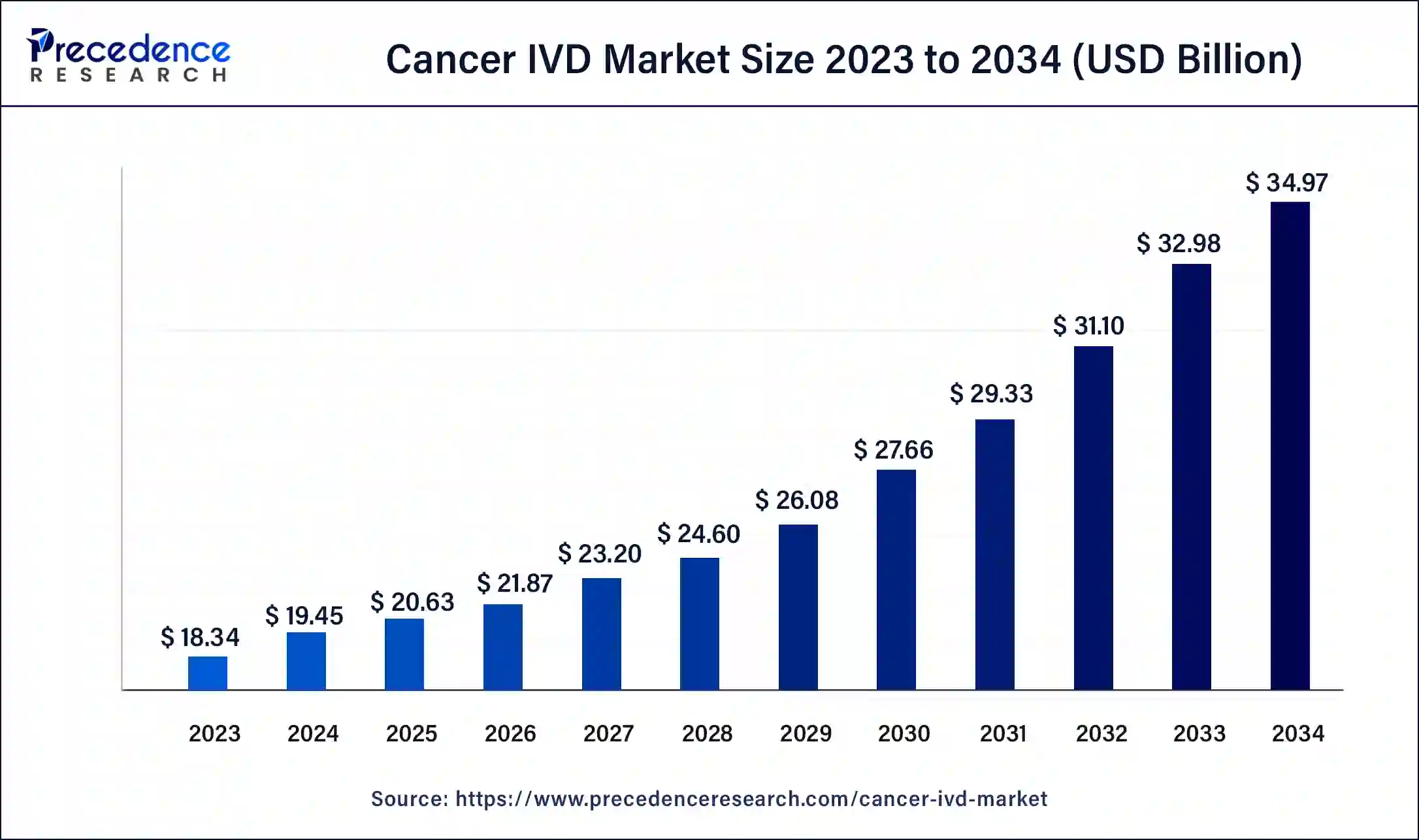

The global cancer IVD market size was estimated at USD 19.45 billion in 2024 and is predicted to increase from USD 20.63 billion in 2025 to approximately USD 34.97 billion by 2034, expanding at a CAGR of 6.04% from 2025 to 2034. The rising cancer incidences, advancement of technologies, enhancement in the healthcare sector, and increased awareness among patients drive the market growth

Cancer IVD Market Key Takeaways

- In terms of revenue, the global cancer IVD market was valued at USD19.45 billion in 2024.

- It is projected to reach USD 34.97 billion by 2034.

- The market is expected to grow at a CAGR of 6.04% from 2025 to 2034.

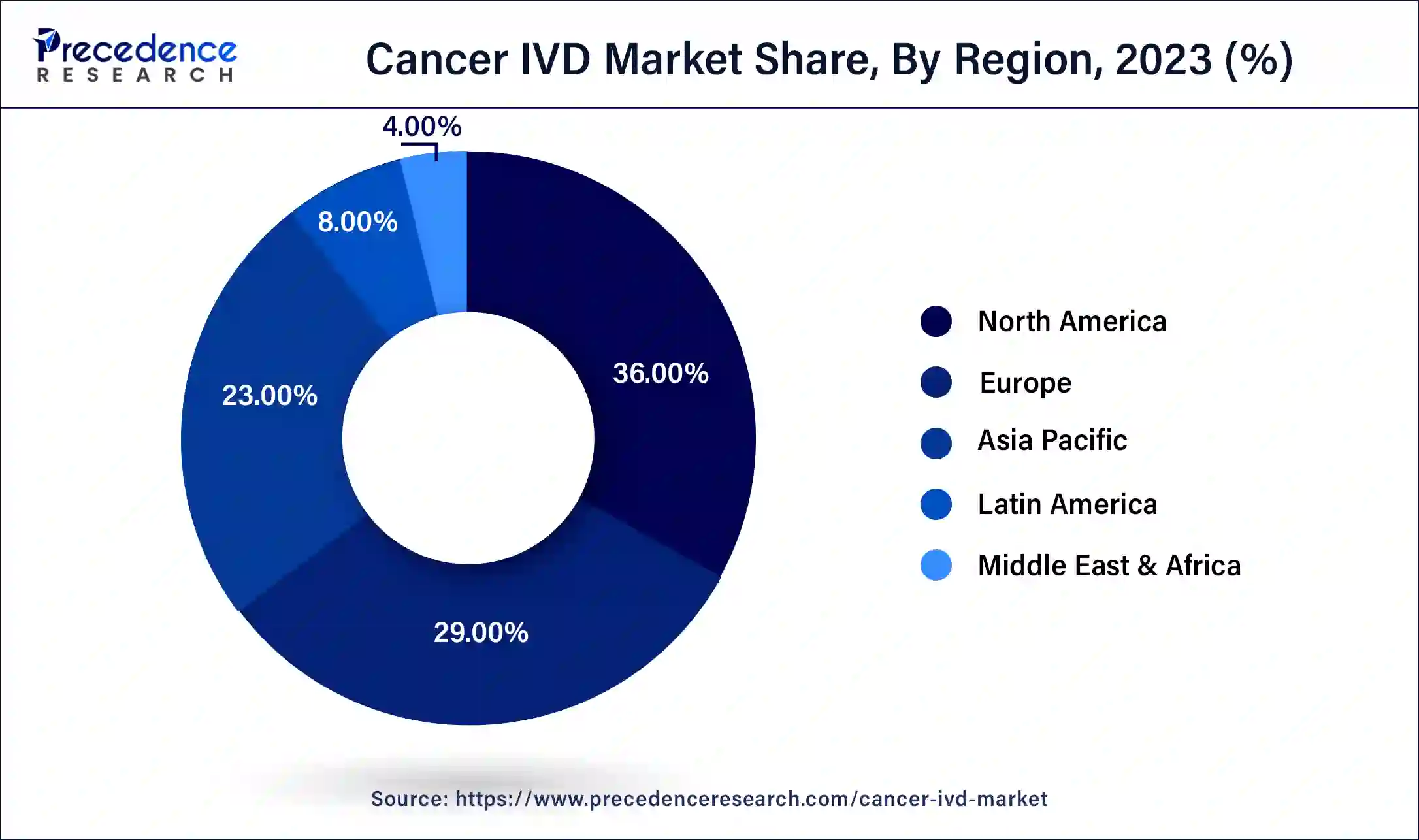

- North America led the global cancer IVD market with the largest market share of 36% in 2024.

- Asia Pacific is anticipated to grow notably in the market during the forecast period.

- By product and service, the reagents segment accounted for the largest share of the market in 2024.

- By product and service, the service segment is expected to witness significant growth in the market during the forecast period.

- By technology, the clinical chemistry segment registered the biggest share of the market in 2024.

- By technology, the immunochemistry/immunoassay segment is expected to grow significantly in the market during the forecast period.

- By end-user, the hospitals segment dominated the market in 2024.

- By end-user, the patient self-testing segment is anticipated to grow significantly in the market during the forecast period.

U.S. Cancer IVD Market Size and Growth 2025 to 2034

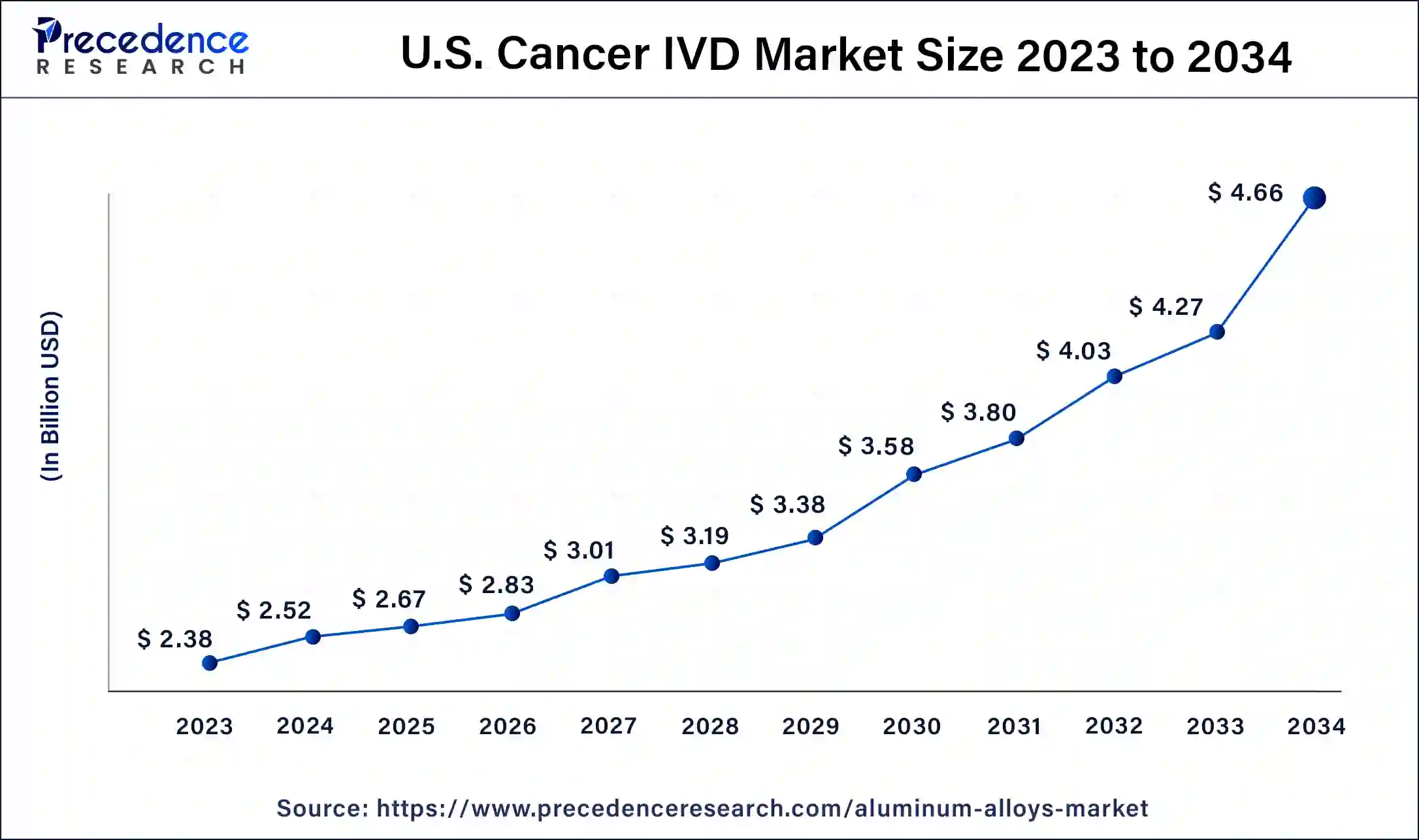

The U.S. cancer IVD market size was exhibited at USD 2.52 billion in 2024 and is projected to be worth around USD 4.66 billion by 2034, poised to grow at a CAGR of 6.34% from 2025 to 2034.

North America led the global cancer IVD market in 2023 due to the efficient healthcare infrastructure, high investment in R&D, and stringent regulatory system. Great healthcare networks and high incidences of cancer help to improve the market. Additionally, the favorable government regulations in the United States and Canada accelerate the development of the new in vitro cancer diagnostic tool.

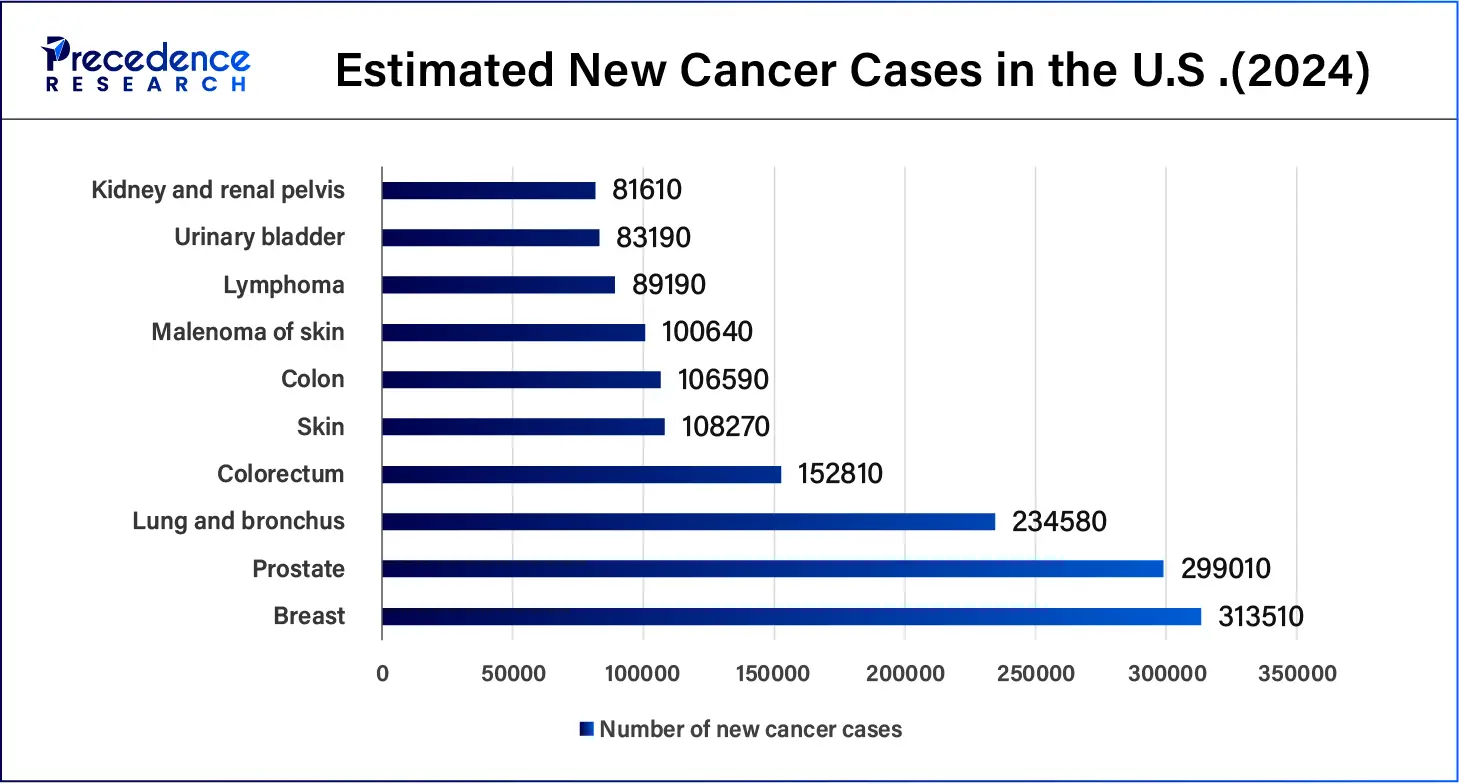

- According to the American Cancer Society, in January 2024, it was estimated that more than 2 million cancer cases would be diagnosed in the United States in 2024 compared to 1.9 million in 2023. In 2024, over 611,000 deaths from cancer are projected for the U.S.

- In June 2023, the U.S. Food and Drug Administration announced a new voluntary pilot program for certain oncology drug products used with certain corresponding in vitro diagnostic tests to help clinicians select appropriate cancer treatments for patients.

Asia Pacific is anticipated to grow notably in the cancer IVD market during the forecast period due to factors such as increased incidence of cancer, developments in the healthcare infrastructure, and an increase in healthcare spending. Asia Pacific countries, such as China, India, South Korea, and Japan, are expected to have increasing public concern with the early diagnosis of cancer, and the development of diagnostic tools also affects the market in the region.

- In June 2023, Toray Industries, Inc. received marketing approval from Japan's Ministry of Health, Labour, and Welfare for its Toray APOA2-iTQ used to diagnose pancreatic cancer.

- In China, there were about 4.8 million new cancer cases in 2022, with lung cancer being the most prevalent type.

Market Overview

In vitro diagnostics (IVD) tests are performed on blood samples, urine samples, stool samples, or tissue samples that provide medical information used to diagnose conditions from mild infections to life-threatening cancers. IVDs can also be used self-administered by patients mostly for monitoring of chronic diseases. In vitro diagnostics offer the opportunity to detect cancer early for more effective and timely treatment. IVDs are specific tests or medical devices that examine specimens taken from the human body and provide essential data for screening, diagnosis, and treatment.

List of cleared or approved companion in-vitro cancer diagnostic devices

| Diagnostic Name | Manufacturer | Indication-sample Type |

| XT CDx | Tempus Labs, Inc. | Colorectal Cancer (CRC) - Tissue (Matching Blood/Saliva) |

| Vysis ALK Break Apart FISH Probe Kit | Abbott Molecular Inc. | Non-Small Cell Lung Cancer (NSCLC) – Tissue |

| Ventana PD-LI (SP263) Assay | Ventana Medical Systems, Inc | Non-Small Cell Lung Cancer (NSCLC) – Tissue |

| Agilent Resolution ctDx FIRST assay | Resolution Bioscience, Inc. | Non-Small Cell Lung Cancer (NSCLC) – Plasma |

| Bond Oracle HER2 IHC System | Leica Biosystems | Breast Cancer – Tissue |

| BRACAnalysis CDx | Myriad Genetic Laboratories, Inc. | Ovarian Cancer - Whole Blood |

| BRACAnalysis CDx | Myriad Genetic Laboratories, Inc. | Breast Cancer - Whole Blood |

| cobas 4800 BRAF V600 Mutation Test | Roche Molecular Systems, Inc. | Melanoma – Tissue |

| FoundationFocus CDxBRCA Assay | Foundation Medicine, Inc. | Ovarian Cancer – Tissue |

| Dako c-KIT pharmDx | Dako North America, Inc. | Gastrointestinal Stromal Tumors – Tissue |

How is AI Changing the Cancer IVD Market?

Artificial Intelligence (AI) innovatively improves the cancer IVD market. AI tools are aimed at improving pathology understanding and providing better outcomes for cancer patients via targeted treatment based on precision medicine. AI is set to become an important asset necessary in the diagnosis as well as the treatment of patients in the medical device industry.

The strength of AI is in interrupting disease diagnosis and showing high efficiency when examining large volumes of data, in contrast to the recognition of tumors with the help of traditional methods based on the study of medical images, which take a lot of time and are influenced by human error.

- In September 2024, Roche added new algorithms to the open digital pathology environment, reaching over 20 newly developed artificial intelligence algorithms by eight partners. Such collaborations are believed to assist pathologists and scientists in carrying out cancer research and diagnosing cancer with the help of AI technologies.

- In May 2022, Indica Labs received a CE-IVD Mark for HALO Prostate AI, a deep learning-based software for screening to help pathologists identify and grade prostate cancer in CMPNBs.

Cancer IVD Market Growth Factors

- The increasing prevalence of cancer worldwide drives demand for effective diagnostic solutions.

- The increased investment in the development of healthcare facilities results in the enhancement of diagnostic equipment.

- The increased public awareness of cancer raises the demand for the cancer IVD market.

- Government policies and programs planned to improve cancer diagnosis and treatment facilitate a boost in market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 34.97 Billion |

| Market Size in 2025 | USD 20.63 Billion |

| Market Size in 2024 | USD 19.45 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.04% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Service, Technology, End-users, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of cancer

The global incidence of cancer continues to rise, hence making people more interested in diagnostic procedures, thus fueling the growth of the cancer IVD market. The rapidly growing cancer burden reflects both population aging as well as changes in people's exposure to risk factors, several of which are associated with socioeconomic development. Tobacco, alcohol, and obesity are key factors behind the increasing incidence of cancer, with air pollution still a key driver of environmental risk factors. Cancer rates are highest in countries whose populations have the highest life expectancy, education level, and standard of living.

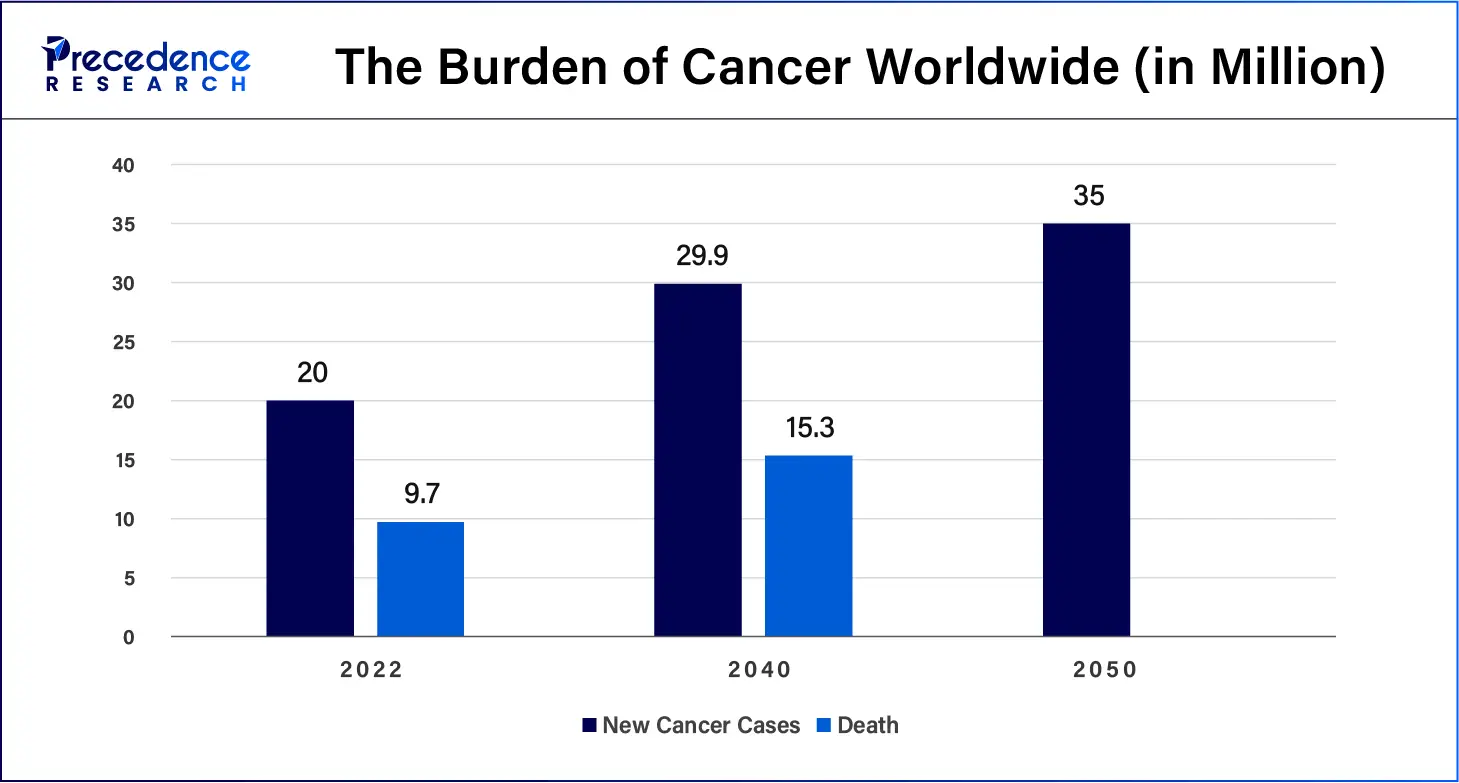

- Data published by WHO estimated that in 2022, there were 20 million new cancer cases and 9.7 million deaths. About 1 in 5 people develop cancer in their lifetime. Approximately 1 in 9 men and 1 in 12 women die from the disease. Over 35 million new cancer cases are predicted in 2050, a 77% increase from the estimated 20 million cases in 2022.

- As per the National Cancer Institute, by 2040, the number of new cancer cases per year is expected to rise to 29.9 million and the number of cancer-related deaths to 15.3 million.

Restraint

Regulatory hurdles

Regulatory compliance can act as a limiting factor for the cancer IVD market. Rigorous approval processes that are demanded by regulatory authorities such as the FDA and other regulatory bodies are usually time-consuming and increase costs. Requirement for an extended clinical trial to prove the precision and accuracy of the devices that also add on in the expanses.

- In April 2024, the FDA also published a final rule to assist in safeguarding the safety and effectiveness of laboratory-developed tests (LDTs). The rule clarifies that FDA regulations on IVDs are under the Federal Food, Drug, and Cosmetic Act (FD&C Act), including when the manufacturer of the IVD is a laboratory.

Opportunity

Increasing investment and developing mergers and acquisitions

Increasing investment and high levels of mergers and acquisitions are projected to boost the demand for the cancer IVD market. This leads to improved research and development, resulting in the innovation of diagnostic technologies that aid in the early identification and monitoring of cancer. This has the effect of increasing capital investment for new product development and growth of product portfolios. Also, there is a high frequency of mergers and acquisitions, specifically in the development and utilization of improved and innovative platforms.

- In May 2024, Lunit completed the acquisition of Volpara, which transformed cancer care delivery to the next level with the help of AI.

- In August 2022, BD and LabCorp collaborated to develop, manufacture, and commercialize cytometry-based companion diagnostics for cancer & other diseases.

- In May 2023, Freenome, a privately held biotech company, announced that it has acquired Oncimmune Ltd, a UK-based global immunodiagnostics developer with commercialized CE-IVD marked EarlyCDT lung blood test and autoantibody platform along with an R&D of 7+ cancer detection signature pipeline.

Product and Service Insights

the reagents segment accounted for the largest share of the cancer IVD market in 2024. Reagents are special biological/chemical solutions that can react with target substances or samples. The reagents segment is gradually developing because of the growth of cancer incidence rates and the need for effective and early diagnostics. The reagents segment is emerging primarily due to the increase in the frequency of cancer diseases and the need for their early detection.

- In February 2023, the BD Onclarity HPV Assay test was approved in the US market for use with the ThinPrep Pap Test. Increasing R&D activities to facilitate quicker cancer detection and precision medicine are enabling companies to focus on specialized high-revenue generating areas of the IVD business.

- In March 2023, QIAGEN entered into a partnership agreement with Servier, an independent integrated pharmaceutical company, to offer the companion diagnostic test in sufferers of acute myeloid leukemia through TIBSOVO.

the service segment is expected to witness significant growth in the cancer IVD market during the forecast period. It also embraces the support services for the upkeep of the diagnostic tools and equipment, data and information process and analysis, and education and training programs ranging from the upgrade of the health care experts. These services are critically important for diagnosis, treatment planning, and integrating newer technologies efficiently into clinical practice, thereby contributing to improving patient care for cancer.

Technology Insights

the clinical chemistry segment registered the biggest share of the cancer IVD market in 2024. Clinical chemistry uses chemical processes to measure levels of chemical components in body fluids and tissues. The tumor markers and disease status, as well as the treatment plans, require the use of clinical chemistry tests. Developments in clinical chemistry applied to cancer examinations improve the test's sensitivity and specificity, which positively affect diagnostic accuracy. In response to the increasing demand for early diagnosis and individualized approaches to therapy, the segment of clinical chemistry remains at the forefront of the development of the market.

- In July 2023, Siemens Healthineers launched the Atellica CI Analyzer, a compact testing system to tackle lab challenges. The Atellica CI Analyzer for immunoassay and clinical chemistry testing aims to address pain points in labor shortages.

the immunochemistry/immunoassay segment is expected to grow significantly in the cancer IVD market during the forecast period. Immunoassay techniques have become the dominant test method in the clinical quantitative detection of tumor markers. The objective diagnostic tools include immunoassays such as ELISA and chemiluminescent immunoassays (CLIAs) that have been proven to produce high specificity and sensitivity for tumor markers and disease prognosis.

- In October 2023, Sysmex Corporation and Fujirebio Holdings, Inc. collaborated to enhance their R&D, production, clinical development, and marketing activities in immunoassay.

End-user Insights

the hospitals segment dominated the cancer IVD market in 2024. Cancer tests can also be carried out in hospitals, and they are well-equipped and staffed by well-trained personnel. They have estimated that the further development of health care and infrastructure coupled with favorable initiatives are expected to primarily help in improving the hospital facilities. Therefore, the IVD tests which are conducted in the hospital have become popular. They include screening and diagnostic procedures as well as treatments.

the patient self-testing segment is anticipated to grow significantly in the cancer IVD market during the forecast period. This segment is progressing due to the continued improvement in technology and greater awareness by consumers as self-testing is becoming easier and more accurate. The growing incidence of cancer as well as rising the geriatric population has increased the demand for self-testing IVD devices.

- In January 2024, the National Cancer Institute (NCI), launcced a new clinical trial network to gather data on a self-collection method of human papillomavirus (HPV) testing to prevent cervical cancer.

Cancer IVD Market Companies

- Abbott

- BioMérieux SA

- QuidelOrtho Corporation

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Qiagen

- Sysmex Corporation

- Charles River Laboratories

- Quest Diagnostics Incorporated

- Agilent Technologies, Inc.

- Danaher Corporation

- BD

- Hoffmann-La Roche Ltd.

Recent Developments

- In April 2024, Pillar Biosciences announced that the U.S. Food and Drug Administration (FDA) has approved the company's Premarket Approval (PMA) supplement application for its oncoReveal CDx pan-cancer solid tumor in vitro diagnostic (IVD).

- In November 2023, Veracyte joined Illumina to develop molecular tests for decentralized IVD applications. Companies are focusing on the development of Prosigna breast cancer and Percepta nasal swab tests of Veracyte.

- In February 2023, Mylab Discovery Solutions announced it is all set to roll out new in vitro diagnostic (IVD) medical devices and kits to empower small labs in India.

- In February 2022, Invite launched its First CE-IVD Cancer Testing Kits In Europe.

- In March 2022, Illumina announced the launch of TruSight Oncology (TSO) Comprehensive, a single test that assesses multiple tumor genes and biomarkers to reveal the specific molecular profile of a patient's cancer. With its global launch first taking place in Europe, the in vitro diagnostic kit will help inform precision medicine decisions for cancer patients across the continent.

- In February 2022, Invitae announced the availability of FusionPlex Dx and LiquidPlex Dx in Europe, part of its industry-leading Anchored Multiplex PCR chemistry in-vitro diagnostic products. Invitae is delivering essential high-quality innovation for precision oncology in the fight against cancer.

Segments Covered in the Report

By Product and Service

- Reagents and Kits

- Instruments

- Data Management Software

- Services.

By Technology

- Clinical Chemistry

- Immunochemistry/Immunoassays

- Hematology

- Coagulation

- Hemostasis

- Microbiology

- Molecular Diagnostics

- Others.

By End-users

- Hospitals

- Laboratories

- Academics

- Point-of-care Testing

- Patient Self-testing

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting