What is the CAR T-Cell Therapy Market Size?

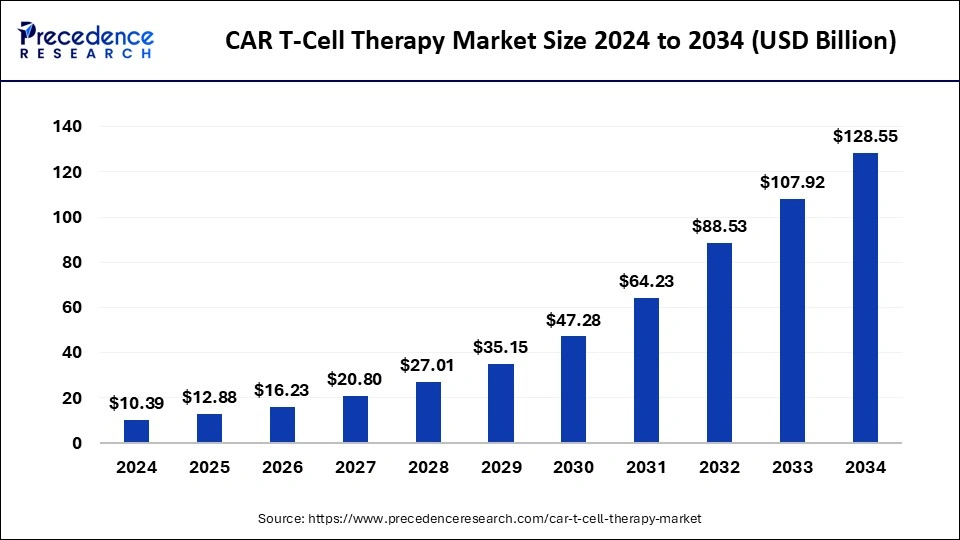

The global CAR T-cell therapy market size is calculated at USD 5,206.15 million in 2025 and is predicted to increase from USD 6,0836.15 million in 2026 to approximately USD 23,247.29 million by 2034, expanding at a CAGR of 18.10% from 2025 to 2034.

CAR T-Cell Therapy Market Key Takeaways

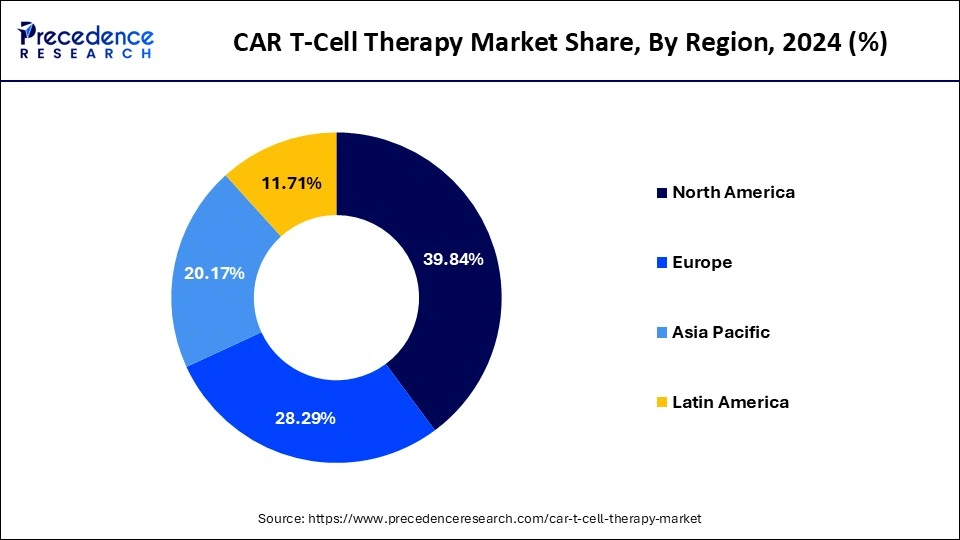

- North America dominates the market with a revenue share of 48.99%in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 20.36% from 2025 to 2034.

- By target antigen, the CD19 segment led the market share of 62.57%in 2024.

- By target antigen, the BCMA (B-cell maturation antigen) segment is expected to grow at a significant CAGR of 24.17% from 2025 to 2034.

- By indication/disease, the hematologic malignancies segment captured the largest market share of 93.85%in 2024.

- By indication/disease, the solid tumors segment is anticipated to grow at a significant CAGR of 23.66%from 2025 to 2034.

- By type of therapy, the autologous CAR-T cell therapy segment held the biggest market share of 81.1% in 2024.

- By type of therapy, the allogeneic CAR-T cell therapy segment is expanding at a significant CAGR of 23.21%from 2025 to 2034.

- By technology/vector, the viral vectors segment dominated the market with the largest share of 65.5%in 2024.

- By manufacturing method, the centralized manufacturing segment led the market with a major market share of 53.3%in 2024.

- By manufacturing method, the in vivo car t therapy segment is expected to grow at a significant CAGR of 24.92%over the projected period.

- By end user, the hospitals segment held a significant market share of 44.0%in 2024.

What is CAR T-Cell therapy?

CAR T-cell therapy is a type of T-cell therapy or cancer therapy that accounts for approximately 27% of the overall T-cell therapy market. The rising incidence of cancer worldwide is anticipated to propel the development of CAR T-Cells for therapeutic applications. The potential use of synthetic T-cell receptors in treating various cancers has been widely accepted. Chimeric immunoreceptors are becoming more popular because they help T-cells find and kill cancer cells that contain the specific protein to which the receptor can bind.

Research and development in life science and biotechnology for treating cancer using chimeric antigen receptors continue to grow.

In various countries, studies are being conducted to validate the efficacy of CAR T-Cell therapy, which will aid in improving data availability regarding efficacy, mechanism of action, and compliance in patients with leukemia and lymphoma.

AI Integration in the CAR T-cell Therapy Market?

Artificial intelligence has revolutionized the application of CAR T-cell treatment to increase efficacy and accuracy. AI can also be used to allow real-time monitoring of patients, even through smart wearables devices when paired with the Internet of Things, enabling clinicians to monitor the patient treatment process and take medical action in case of complications.

In addition, automation using Artificial intelligence can optimize the process of producing CAR T-cells, leading to consistency, accuracy, and scale of manufacturing. This cuts down the chances of human error, cuts down the expenditure as well, and enhances accessibility.

What Factors Are Fueling the Rapid Expansion of the CAR T-cell Therapy Market?

- Rising Cancer Cases: The rise of cancer in the global population is stimulating the need for better and specific treatment modalities. Due to the insufficient effectiveness of traditional treatments, the application of CAR T-cell products is increasingly used in clinical and commercial practice, as this approach demonstrates more effective outcomes, particularly in hematologic malignancies.

- Diverse Applications: CAR T-cell application is no longer limited to oncology, including autoimmune and infectious diseases. The ability to address multiple conditions makes them very valuable, which enhances their desirability in the pharmaceutical segment.

- Increasing Research and Innovation: Current research and innovation in CAR T-cell therapy are speeding up the process. Industries and learning institutions are developing new targets, safety profiles, and better manufacturing processes. Such interest in R&D is bringing up new treatment opportunities, building clinical pipelines, and enhancing the therapy positioning in the global market.

CAR T-Cell Therapy Market Outlook

- Industry Growth Overview: The CAR T-cell therapies market is expected to grow quickly between 2025-2030, due to an increase in cases of cancer, higher clinical success rates, and even more regulatory approvals. The growth is also supported by the clinical progression of different autologous and allogeneic therapy platforms, with a specific focus on North America, Europe, and the Asia-Pacific region.

- Sustainability Trends: There is a wider focus on sustainable biomanufacturing in the CAR T-cell therapies market. Companies are looking at sustainability in cell expansion by using renewable media and closed-system products. Sustainable options for reducing waste and greater scalability are becoming increasingly popular, evidenced by developments in clean bioprocessing technologies and ethically sourced cell components.

- Global Expansion: Major biopharma companies are extending their reach into the Asia-Pacific and European markets to take advantage of local expertise, lower the costs of therapies, and benefit from the increasing regional demand for these therapies. Companies like Novartis and Gilead are increasing strategic partnerships and manufacturing businesses to improve access to the emerging oncology markets.

- Primary Investors: Venture capital and big pharma (pharmaceutical) investment firms are currently pouring capital into the CAR T industry, and it is for its high efficacy rates and significant and sustained profitability. Recent investments by organizations like Bain Capital and Pfizer's investment fund signal confidence in the next phase of immunotherapy development against solid tumors.

- Startup Ecosystem: The CAR T startup ecosystem is developing quickly with inventive minds working on off-the-shelf (allogeneic) platforms and potentially using AI to develop the next generation of cell-line engineering innovations. Emerging companies like Cellectis and Arcellx are raising substantial funding to develop new treatment modalities that will be scalable, safer, and less expensive.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 23,247.29 Million |

| Market Size in 2025 | USD 5,206.15 Million |

| Market Size in 2026 | USD 6,0836.15 Million |

| Growth Rate from 2025 to 2034 | CAGR of 18.10% |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Indication, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Opportunity

Growing Demand for Personalized Medicine

The healthcare environment is shifting towards more personalized approaches to treatment, and CAR T-cell therapy can be considered one of the examples of precision medicine. During this treatment, self T-cells of the patient are genetically modified so that they can identify and kill their cancer cells, and this kind of treatment has the added advantage of being customized to a user. CAR T-cell therapy has one of the central benefits that it offers to treat selectively without much systemic toxicity, which reduces the side effects and positively impacts the overall outcome of a patient.

The development of genomic sequencing, biomarker detection, and cell engineering technologies has also increased the possibilities and success of such individualized therapy. Such scientific breakthroughs allow a more accurate selection of patients and an improved layout of therapies, and ultimately lead to an increased success rate and an enlarged potential patient base.

Restraints

Side effects of CAR-T cell therapy

Like all cancer treatments, CAR T-Cell therapies have serious side effects, such as a mass death of antibody-producing B cells and infections. Cytokine release syndrome (CRS) is one of the most common and severe side effects. T cells release chemical messengers (cytokins) which stimulate and direct immune responses as part of immune-related duties.

In the case of CRS, the infused T cells flood the bloodstream with cytokines, resulting in serious side effects such as highly elevated fevers and sudden drops in blood pressure. Severe CRS can be fatal in some cases. Another primary concern with CAR T-Cell therapies is neurologic side effects such as extreme confusion, seizure-like activity, and impaired speech. The exact cause of these neurologic side effects (immune effector cell-associated neurotoxicity syndrome, or ICANS) is unknown.

Target Antigen Insights

The CD19 segment dominated the CAR-T cell therapy market in 2024. This was primarily due to CD19's consistent and widespread expression on B-cell malignancies, making it a reliable target for CAR-T cell therapy. Its broad expression across various B-cell development stages, including lymphomas and leukemias, results in a larger patient pool and provides greater opportunities for successful treatment. CD19-targeted CAR-T cells have demonstrated high response rates and durable remissions in patients with acute lymphoblastic leukemia (ALL) and certain types of lymphoma, such as diffuse large B-cell lymphoma. This success has facilitated significant research and development, leading to established protocols and manageable manufacturing processes that align with current treatment strategies.

The BCMA (B-cell maturation antigen) segment, on the other hand, is experiencing the fastest growth in the CAR-T cell therapy market. This growth is largely attributed to its targeted approach against multiple myeloma and other B-cell malignancies. BCMA's high expression on malignant plasma cells makes it an effective target for CAR-T cells, inducing a strong immune response. BCMA-targeted CAR-T cell therapies, such as ciltacabtagene autoleucel and idecabtagene vicleucel, have shown impressive results in clinical trials, with high response rates and durable remissions in patients with relapsed or refractory multiple myeloma. The approval of these therapies by the FDA is further fueling market expansion.

CAR T-Cell Therapy Market Revenue, By Target Antigen, 2022 to 2024 (USD Million)

| Target Antigen | 2022 | 2023 | 2024 |

| CD19 | 2,297.03 | 2,550.99 | 2,836.91 |

| BCMA (B-cell Maturation Antigen) | 481.71 | 588.81 | 717.87 |

| CD22 | 220.55 | 252.93 | 290.64 |

| GD2 | 121.37 | 142.22 | 166.88 |

| HER2 | 77.53 | 93.92 | 113.61 |

| GPC3 | 63.63 | 77.13 | 93.33 |

| Others (e.g., EGFRvIII, CD7, CD123, mesothelin) | 236.23 | 272.42 | 314.76 |

Indication / Disease Type Insights

The hematologic malignancies segment led the CAR-T cell therapy market in 2024, due to its demonstrated success in treating cancers, especially in cases of relapsed or refractory B-cell lymphomas and leukemias. CAR-T cell therapy has shown high response rates and durable remissions in patients, particularly those who have not responded to other treatments. Designed to target specific antigens on cancer cells, CAR-T cells offer a more precise and potentially less toxic approach compared to traditional therapies like chemotherapy. Research and development efforts in CAR-T cell therapy have heavily focused on hematologic cancers, resulting in the approval of multiple CAR-T products for these indications.

Meanwhile, the solid tumors segment is experiencing rapid growth in the CAR-T cell therapy market. This growth is primarily driven by ongoing research and development aimed at overcoming the challenges associated with treating solid tumors, such as tumor heterogeneity and the immunosuppressive microenvironment. Solid tumors can be highly variable, even within the same type of cancer, complicating the identification of a universal target antigen for CAR-T cells. Although CAR-T cell therapy has shown great success in hematological cancers like leukemia and lymphoma, researchers are actively working to address the unique hurdles presented by solid tumors to improve efficacy and overcome resistance.

CAR T-Cell Therapy Market Revenue, ByIndication / Disease, 2022 to 2024 (USD Million)

| Indication / Disease | 2022 | 2023 | 2024 |

| Hematologic Malignancies | 3,308.78 | 3,748.45 | 4,255.12 |

| Solid Tumors | 189.28 | 229.98 | 278.88 |

Manufacturing Method Insights

The centralized manufacturing segment dominated the CAR T-cell therapy market in 2024. This dominance is largely due to its ability to ensure standardized quality and facilitate commercialization. Centralized facilities, typically operated by pharmaceutical companies, can implement rigorous quality control measures and minimize variability in the manufacturing process. This is crucial for maintaining consistent product quality and safety, especially for autologous CAR T therapies, where each patient receives a personalized treatment. The complex and labor-intensive nature of autologous CAR T manufacturing favored centralized facilities equipped with the infrastructure and expertise for large-scale production, which is essential for the initial commercialization of CAR T therapies.

The in vivo CAR T therapy segment is experiencing the fastest growth in the market. This rapid growth is primarily because in vivo CAR T therapy offers several significant advantages over traditional ex vivo methods. These advantages include reduced manufacturing complexity, lower costs, faster turnaround times, and potentially broader patient access. In vivo methods bypass the labor-intensive and time-consuming ex vivo process of cell modification and expansion, which involves collecting a patient's T cells, genetically modifying them in a laboratory, and then reinfusing them. Instead, in vivo methods deliver the CAR gene directly into the patient's T cells within the body, often using engineered nanocarriers or viral vectors.

Technology / Vector Insights

The viral vectors segment dominated the global market in 2024 due to their high transduction efficiency and ability to achieve stable gene expression, particularly with lentiviral and retroviral vectors. These vectors effectively integrate the CAR gene into the host T cell's genome, ensuring sustained expression of the therapeutic protein and long-term efficacy. While safety concerns exist, advancements in vector design and manufacturing processes are continuously being made to minimize these risks. Integration into the host cell's genome ensures that the CAR gene is maintained and expressed throughout the cell's life, including its progeny.

The dual and multiple antigen targeting CAR T-cell segment is experiencing the fastest growth during the forecast period. This growth is attributed to its ability to overcome tumor antigen escape, a significant challenge in CAR T-cell therapy. By targeting multiple antigens, these CAR T-cells can continue to recognize and attack cancer cells even if one antigen is lost. This approach enhances the effectiveness of the therapy, particularly in solid tumors where antigen heterogeneity and varying expression levels are common. Additionally, dual and multiple targeting improve overall anti-tumor activity and patient survival compared to single-antigen targeting.

CAR T-Cell Therapy Market Revenue, By Technology / Vector Used, 2022 to 2024 (USD Million)

| Technology / Vector Used | 2022 | 2023 | 2024 |

| Viral Vectors | 2,377.64 | 2,655.61 | 2,971.04 |

| Non-viral Vectors | 584.06 | 691.43 | 818.99 |

| Armored CAR T-Cells (enhanced T-cell persistence/activity) | 220.79 | 264.06 | 315.72 |

| Dual/Multiple Antigen Targeting CAR T-Cells | 222.50 | 259.41 | 302.89 |

| Safety Switch-Equipped CAR T Cells | 93.07 | 107.92 | 125.36 |

Type of Therapy Insights

The autologous CAR-T cell therapy maintained its dominant position in the global market in 2024, primarily due to its personalized nature and success in treating certain blood cancers. Autologous CAR-T cell therapy is tailored to each patient, minimizing the risk of immune rejection by utilizing their cells. In this approach, a patient's T cells are genetically modified and reinfused, avoiding the risks of immune rejection associated with allogeneic (donor-derived) therapies. This therapy has shown remarkable success, particularly in treating B-cell lymphomas and leukemia, including aggressive forms that are resistant to other treatments.

Conversely, allogeneic CAR-T cell therapy is witnessing the fastest growth in the global market. This is largely because it has the potential to address challenges associated with autologous therapies, such as high costs, lengthy manufacturing times, and strict patient selection criteria. Allogeneic approaches utilize cells from healthy donors, offering a more accessible and universally applicable treatment option for a broader patient population. These therapies, which use a standardized product from healthy donors, provide a more reliable option, especially in regions with limited access to specialized healthcare facilities.

End User Insights

The hospitals segment led the market in 2024, primarily due to their robust infrastructure, multidisciplinary teams, and capacity to manage complex treatments and side effects. This dominance is further supported by increased investment in oncology facilities and advancements in hospital-based treatment protocols. Hospitals are equipped with specialized facilities, such as dedicated operating theaters and intensive care units, which are essential for administering CAR T-cell therapy. They also employ multidisciplinary teams, including oncologists, nurses, and pharmacists, who are experienced in managing the complexities of this therapy. Furthermore, hospitals provide a holistic approach to patient care, encompassing pre-treatment evaluations, the infusion process, and post-treatment monitoring for potential side effects.

The contract development and manufacturing organization (CDMO) segment is experiencing rapid growth in the CAR T-cell therapy market, mainly due to the complexities and specialized requirements associated with developing and manufacturing these advanced therapies. Many biopharmaceutical companies, especially smaller ones, lack the necessary resources and expertise to establish and maintain in-house production facilities. Partnering with CDMOs allows these companies to manage costs and mitigate the financial risks of in-house development and manufacturing. CDMOs with experience in navigating regulatory requirements can provide essential guidance and ensure compliance, which is critical for bringing therapies to market.

CAR T-Cell Therapy Market Revenue, By End User, 2022 to 2024 (USD Million)

| End User | 2022 | 2023 | 2024 |

| Hospitals | 1,594.83 | 1,781.32 | 1,992.94 |

| Cancer Treatment Centers | 1,033.37 | 1,178.78 | 1,347.39 |

| Academic & Research Institutes | 447.85 | 501.36 | 562.25 |

| Specialty Clinics | 211.60 | 260.55 | 319.66 |

| Contract Development and Manufacturing Organizations (CDMOs) | 210.41 | 256.41 | 311.77 |

Regional Insights

U.S. CAR T-Cell Therapy Market Size and Growth 2025 to 2034

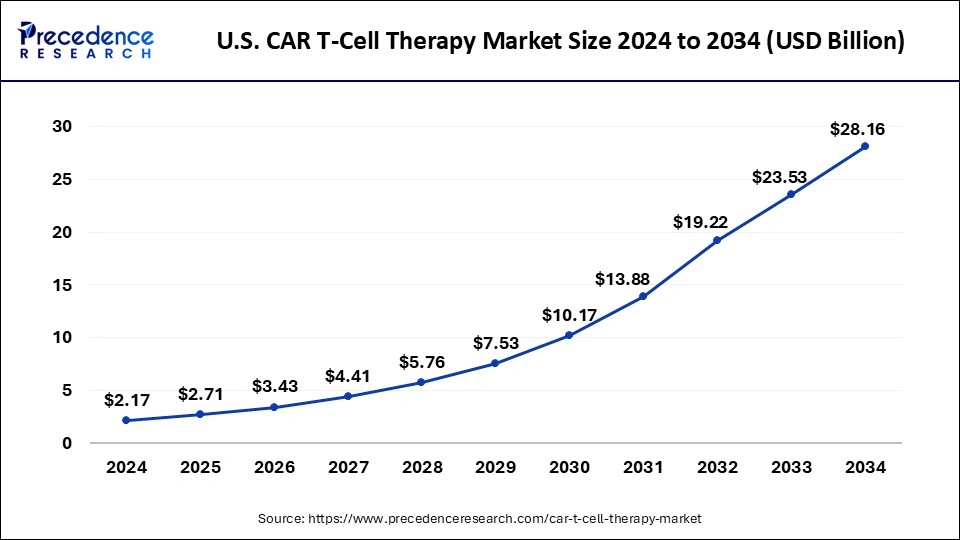

The U.S. CAR T-cell therapy market size is evaluated at USD 2,299.97 million in 2025 and is projected to be worth around USD 9,961.54 million by 2034, growing at a CAGR of 17.69% from 2025 to 2034.

North America Title: Engineering Hope: North America's Command of the CAR T-Cell Arena

North America dominated the CAR T-cell therapy market with the largest share in 2024. This is mainly due to the increased investment in cell-based research and development activities. The region boasts well-established healthcare and research facilities, accelerating the rapid development and adoption of CAR T-cell therapy. The U.S. is a major contributor to the market. The country is known as the early adopter of CAR T-cell therapy. The rising approvals for CAR T-cell therapy support market growth. In addition, the rise in the prevalence of blood cancer contributes to market expansion.

- For instance, according to the Leukemia and Lymphoma Society's Blood Cancer Statistics, every 3 minutes, one person in the US is diagnosed with leukemia, myeloma, or lymphoma.

U.S. CAR T-cell Therapy Market Trends

In 2024, the U.S. became the leader in the market due to the growing incidence of cancers like lymphoma and multiple myeloma, a trend that has led to the high demand for effective targeted therapies like CAR T-cell therapy. Moreover, the increasing elderly population, who are more prone to cancer, has also contributed to the necessity of advanced therapeutics. The U.S. has an advanced and thoroughly developed healthcare infrastructure supporting early detection, individualized treatment planning, and access to art therapy. The biotechnology and pharmaceutical services, a high number of clinical tests, and the close cooperation between the academic and business sectors have contributed to the fast commercialisation and optimisation of CAR T-cell treatment in the U.S.

China CAR T-cell Therapy Market Trends

China became one of the fastest-growing CAR T-cell therapy markets in 2024, as a growing cancer cases, favorable government regulations, and increasing biotech industries. As the number of patients and the prevalence of hematologic malignancies, including leukemia and lymphoma, are on the rise, the need for new and efficient treatment methods is growing. Cell and gene therapies have gained significant funding because the Chinese government has focused on biotechnology advancement. Moreover, the emphasis on accessibility to healthcare and infrastructure poses an additional boost to the market development in the country, making China one of the key players in the global market of CAR T-cell treatments.

Europe CAR T-cell Therapy Market Trends

The European CAR T-cell therapy market is expected to account for a substantial market share in 2024. The favorable demographic trends and improvements in cancer care, the European CAR T-cell therapy market is predicted to represent a significant share. These include the rising geriatric population, increasing cases of cancer, the ability to detect diseases early, and the growing popularity of personalized medicine. The healthcare infrastructure and established research ecosystem of Europe are extremely strong and are in a position to grow and continue to build in other advanced therapies, such as CAR T-cell treatment.

Germany owned the largest share of revenue in the European CAR T-cell therapy market, mainly because of its superior medical facilities and active medical policies. German universities and research centers, and pharmaceutical industries are working to accelerate CAR T development through clinical trials, product development, and commercialization. As more cases of blood cancer, especially lymphoma and multiple myeloma, emerge in Germany, it remains an innovator and leader in the European market.

Asia Pacific Title: Engineering Hope in the East: Asia-Pacific's Rapid CAR T-Cell Expansion

Asia Pacific is seen to grow at a notable rate in the foreseeable future. With the growing prevalence of cancer, there is a high demand for cell-based therapies. People in the region have become more aware of the benefits of cell therapies to treat various conditions. The rising healthcare spending further supports market growth. Moreover, the rising government investments in cell and gene therapy research contribute to the growth of the market in the region.

Emerging Cells of Hope in Latin America

Latin America grew at a considerable rate in the CAR T therapy market as the understanding of cell-based treatment increased. Countries started to invest in improving their healthcare infrastructure and partnering with external companies so they could eventually localize advanced therapies. There were opportunities for expansion in clinical trials, medical training, and regional collaborations to produce more affordable CAR T treatments.

Brazil CAR T-Cell Therapy Market Trends

Brazil led the Latin American region in the CAR T therapy market, with an increase in research funding and the establishment of government-backed cancer care programs. The increase in collaborations with some of the leading global pharmaceutical companies added to the ability to expand trials in CAR T therapies. Biotech manufacturing became a larger focus, placing Brazil at the forefront of Biologics in Latin America.

Middle East & Africa: The Emerging Oasis of Cell Therapy

The region of the Middle East & Africa highlights a significant opportunity, driven by growth in investments into health and government-led cancer programs. Increasing collaboration with Western biotech firms and an increase in specialized (cancer) hospitals provided significant opportunities in these countries for healthcare reforms. Ongoing development of local manufacturing initiatives and improving awareness around CAR T-cell therapy and other technologies enabled a gradual introduction of CAR T-cell therapies into the regional landscape.

United Arab Emirates CAR T-Cell Therapy Market Trends

The UAE has the most advanced medical private health infrastructure, and the government plans to incentivize biotech investments and partnerships. Again, partnerships with global firms and the establishment of contemporary cancer centers contributed to the increased availability of CAR T-cell therapy in the UAE. Moreover, the UAE was also attractive to the global healthcare community for several reasons, including a focus on innovation and being positioned as a global center of advanced medical research.

Recent Developments

- In April 2025, Johnson & Johnson reported that the European Commission had expanded the indication of Darzalex (daratumumab) subcutaneous formulation to include only their multiple myeloma drug combination, bortezomib, lenalidomide, and dexamethasone combination as the treatment of newly diagnosed multiple myeloma (NDMM) patients, including those otherwise ineligible to receive a transplant. It had earlier been indicated in isolated patients who are transplant eligible (ASCT).

- In March 2025, Bristol Myers Squibb declared its plans to buy 2seventy Bio at approximately USD 286 million. The two firms collaborated on Abecma, a CAR T-cell medicine against multiple myeloma.

- In November 2024, the Food and Drug Administration (FDA) approved obecabtagene autoleucel (Aucatzyl, Autolus Inc.), a CD19-directed genetically modified autologous T cell immunotherapy, to be used in treating adult patients with relapsed or refractory B-cell precursor acute lymphoblastic leukemia (ALL).

Source : ( https://www.jnj.com )(https://www.reuters.com) (https://www.fda.gov)

CAR T-Cell Therapy Market Companies

- Johnson & Johnson Services, Inc.

- ALLOGENE THERAPEUTICS

- Lonza

- Aurora Biopharma

- Cartesian Therapeutics, Inc.

- Novartis

- Bristol-Myers Squibb company

- Gilead Sciences

- Curocell Inc

- JW Therapeutics

Segments Covered in the Report

By Target Antigen

- CD19

- BCMA (B-cell Maturation Antigen)

- CD22

- GD2

- HER2

- GPC3

- Others (e.g., EGFRvIII, CD7, CD123, mesothelin)

By Indication / Disease Type

- Hematologic Malignancies

- Acute Lymphoblastic Leukemia (ALL)

- Diffuse Large B-cell Lymphoma (DLBCL)

- Mantle Cell Lymphoma (MCL)

- Follicular Lymphoma (FL)

- Multiple Myeloma (MM)

- Chronic Lymphocytic Leukemia (CLL)

- Hodgkin's Lymphoma

- Other Non-Hodgkin Lymphomas (NHL)

- Solid Tumors

- Neuroblastoma

- Glioblastoma

- Breast Cancer

- Pancreatic Cancer

- Ovarian Cancer

- Lung Cancer

- Prostate Cancer

- Colorectal Cancer

- Others

By Type of Therapy

- Autologous CAR T-cell Therapy

- Allogeneic CAR T-cell Therapy

By Technology / Vector Used

- Viral Vectors

- Lentiviral vectors

- Retroviral vectors

- Non-viral Vectors

- CRISPR/Cas9 gene editing

- Transposons (Sleeping Beauty, PiggyBac)

- mRNA electroporation

- Armored CAR T-Cells (enhanced T-cell persistence/activity)

- Dual/Multiple Antigen Targeting CAR T-Cells

- Safety Switch-Equipped CAR T Cells

By Manufacturing/Delivery Method

- Point-of-Care Manufacturing

- Centralized Manufacturing

- In vivo CAR T therapy (emerging)

- Off-the-shelf / Ready-to-use therapies

By End User

- Hospitals

- Cancer Treatment Centers

- Academic & Research Institutes

- Specialty Clinics

- Contract Development and Manufacturing Organization

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting