What is the T-cell Therapy Market Size?

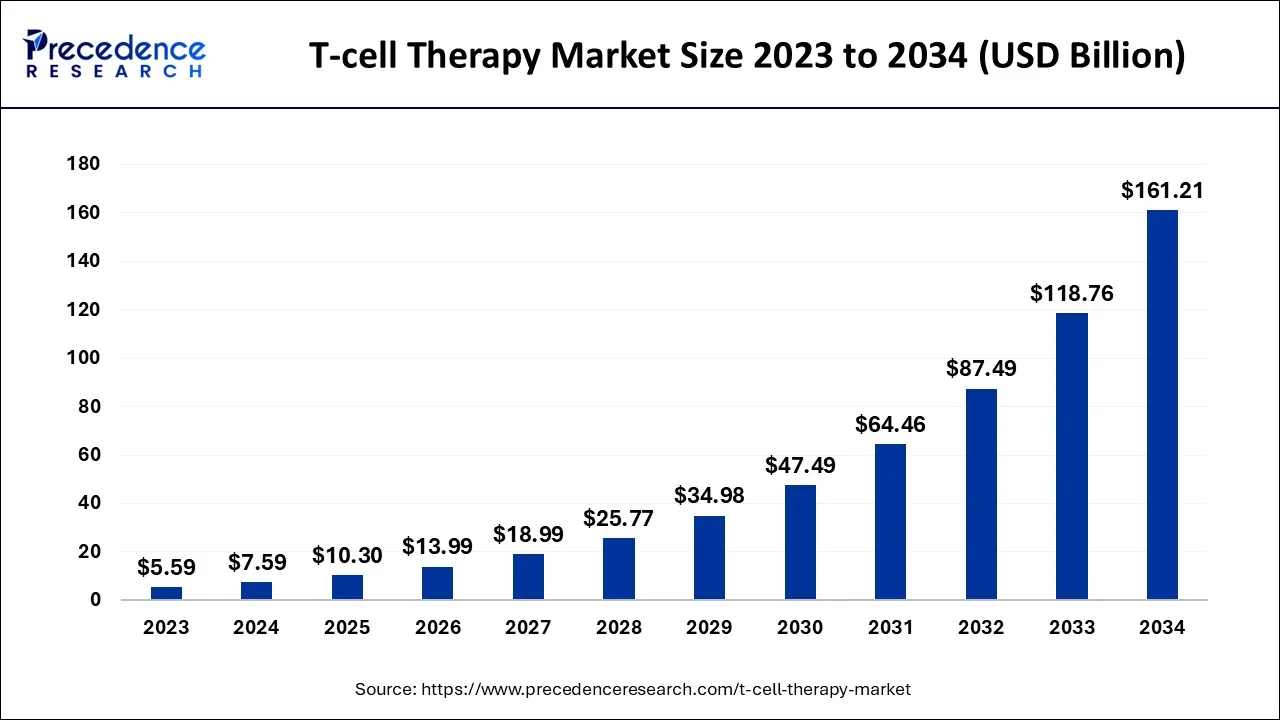

The global T-cell therapy market is expected to be valued at USD 10.30 billion in 2025and is predicted to increase from USD 13.99 billion in 2026 to approximately USD 196.21 billion by 2035, expanding at a CAGR of 34.27% over the forecast period from 2026 to 2035.

T-cell Therapy Market Key Takeaways

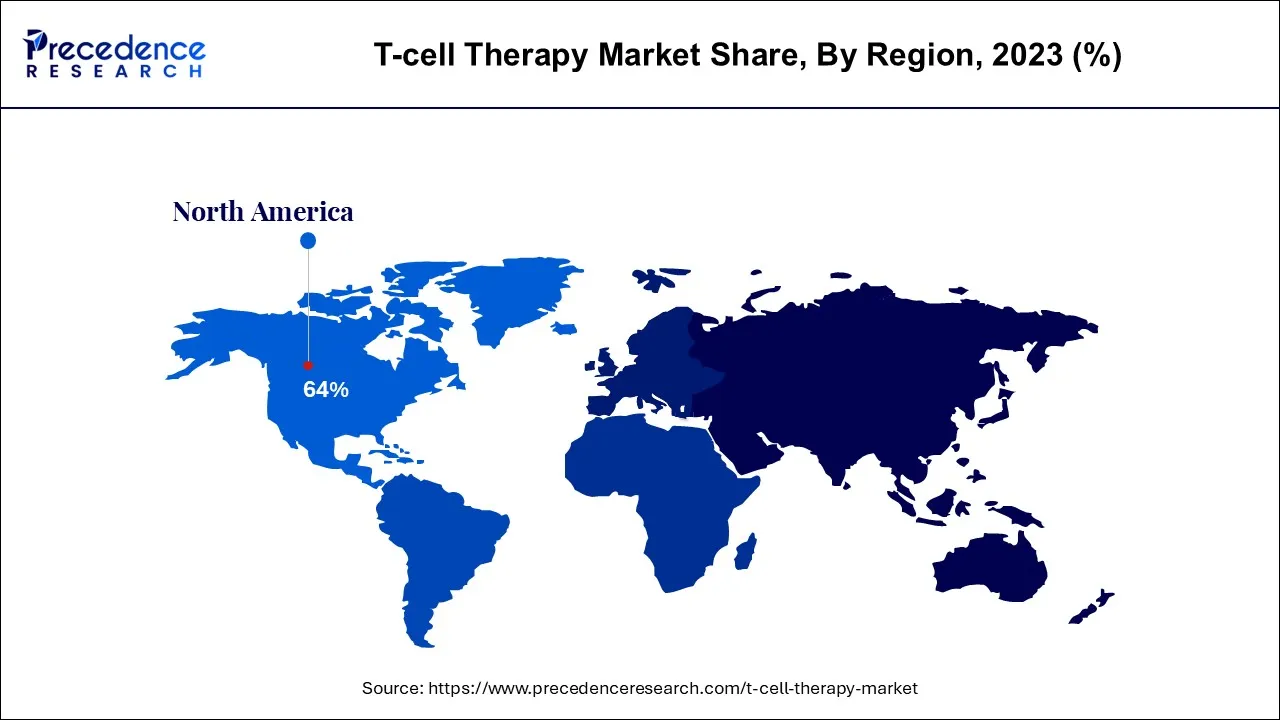

- North America captured more than 64% of the market share in 2025.

- By therapy type, the CAR T-cell therapy segment generated more than 96% of the market revenue share in 2025.

- By indication, the hematologic malignancies segment contributed more than 51% of revenue share in 2025.

- By end user, the hospital segment is expected to grow at a significant rate over the forecast period.

Market Overview

T-cell therapy is a type of medical treatment that harnesses the power of a specific subset of immune cells called T cells to target and destroy diseased cells, particularly cancer cells. T cells are a crucial component of the immune system, responsible for recognizing and eliminating abnormal cells, including those infected by viruses or transformed into cancerous forms. T-cell therapy involves modifying or enhancing a patient's T cells to make them more effective in targeting and eliminating specific disease-causing cells. The rising cases of cancer across the globe are observed to supplement the growth of the market. As per the statistics by IARC, it is anticipated that there are going to be approximately 28 million new cancer cases worldwide each year by 2040 if incidence remains steady and population growth and aging continue at current rates.

T-cell Therapy Market Growth Factors

The T-cell therapy market is being driven by numerous factors including the growing prevalence of cancer, rising FDA approvals, growing collaboration among the market players, and rising government initiatives. Moreover, the healthcare sector is focused on offering multiple immunotherapies to patients. This factor also promotes the growth of the market.

Market Outlook

- Industry Growth Overview: The T cell therapy industry is showing great development based on the increase in the number of people with hematologic malignancies, successful treatment with CAR-T treatment, and the number of new approvals worldwide, beyond just relapsed or non-responsive cancers.

- Sustainability Trends: The sustainability of T cell therapy is growing through decreased environmental impact from the use of bioprocessing that has less plastic used in cell manufacturing, with more manufacturing done locally, and the use of energy-efficient cold chain logistics.

- Global Growth: The global growth of T cell therapy is due to the development of regulatory harmonization, cross-border clinical trials, and technology transfer agreements that will give advanced T-cell platforms access to alternative healthcare markets outside North America and Western Europe.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.30Billion |

| Market Size in 2026 | USD 13.99 Billion |

| Market Size by 2035 | USD 196.21Billion |

| Growth Rate from 2026 to 2035 | CAGR of 34.27% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Therapy Type, By Indication, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of cancer

The global burden of cancer continues to rise, with a growing number of patients diagnosed each year. T-cell therapy presents a novel approach that addresses unmet medical needs, providing an alternative for patients who have exhausted conventional treatment options. For instance, according to the National Center for Health Statistics, the United States is expected to witness 1,958,310 new cancer cases and 609,820 cancer-related deaths in 2023. Therefore, the increasing prevalence of cancer is expected to propel the T-cell therapy market during the forecast period.

Restraint

High cost

T-cell therapy, particularly CAR T-cell therapy, can be expensive to develop, manufacture, and administer. The complex process of modifying a patient's T cells, the need for specialized facilities, and the personalized nature of the treatment contribute to high costs. These costs can limit accessibility for patients and strain healthcare systems. For instance, according to the Journals of the American Medical Association, the cost of CAR T-cell therapy is around USD 373,000 to USD 475,000. Thus, the high cost of therapy limits patients and acts as a major restraint for the market.

Opportunity

Increasing approvals for therapies

The increasing approvals by the Food and Drug Administration (FDA) and other agencies in the area of cancer cell therapy are expected to provide a potential opportunity for market growth over the forecast period. For instance, in May 2022, Penn Medicine developed CAR T cell therapy and won FDA's third approval. The FDA and other agencies for approval of therapies have noticed the importance of cell therapies, especially while considering the rising number of cancer patients. Moreover, strict and firm regulatory framework for the development and trials of these therapies provided by FDA is being followed by developers and researchers. Thus, it becomes easier to approve therapies. Hence, the increasing rate of approval for therapies by FDA highlights the market's development.

Segment Insights

Therapy Type Insights

Based on the therapy type, the global T-cell therapy market is segmented into CAR T-cell therapy, T Cell Receptor (TCR)-based and Tumor Infiltrating Lymphocytes (TIL)-based. The CAR T-cell therapy is expected to dominate the market over the forecast period. CAR T cell therapy has shown impressive response rates, with a substantial number of patients achieving complete remission in tumor burden. This is particularly notable for patients who have not responded well to other treatments.

Moreover, in some cases, CAR T cell therapy has resulted in long-lasting remissions, even in patients with advanced or refractory cancers. This can significantly improve the quality of life and prognosis for these patients. Furthermore, CAR T cell therapy is personalized to each patient's unique immune system and disease characteristics. The patient's T cells are modified and engineered to target specific cancer antigens, making the treatment more targeted and potentially more effective. Thus, owing to these benefits CAR T-cell therapy is expected to dominate the market during the forecast period.

Indication Insights

Based on the indication, the global T-cell therapy market is segmented into hematologic malignancies, solid tumors, and others. The hematologic malignancies segment is expected to capture a significant market share over the forecast period and it is further sub-categorized into lymphoma, leukemia, and myeloma.

The leukemia sub-segment is expected to dominate the market over the analysis period. T-cell therapy, particularly CAR T cell therapy, has made significant strides in the treatment of leukemia, primarily in pediatric and young adult patients with relapsed or refractory acute lymphoblastic leukemia (ALL).

End User Insights

Based on the end user, the global T-cell therapy market is segmented into hospitals and cancer treatment centers. The hospital segment is expected to grow at a significant rate over the forecast period. Hospitals with advanced oncology departments and specialized centers for cellular therapies are equipped to provide T-cell therapy. These institutions have the necessary laboratory facilities, skilled personnel, and multidisciplinary teams to ensure safe and effective T-cell therapy administration.

Additionally, hospitals play a crucial role in evaluating patients for T-cell therapy eligibility. A rigorous assessment of a patient's medical history, disease status, and overall health is conducted to determine whether they are suitable candidates for treatment. Thereby, propelling the segment growth over the projected period.

Regional Insights

What ise the U.S. T-cell Therapy Market Size?

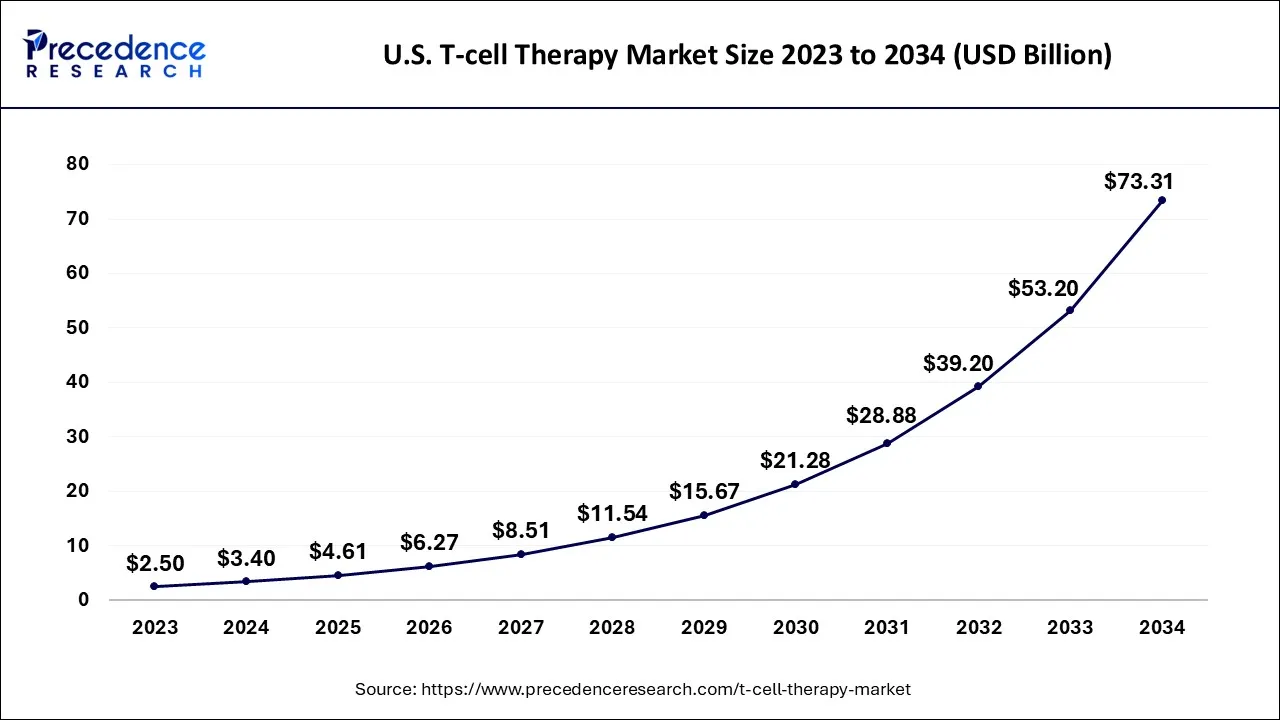

The U.S. T-cell therapy market size is accounted for USD 4.61 billion in 2025 and is projected to be worth around USD 89.35 billion by 2035, poised to grow at a CAGR of 34.51% from 2026 to 2035.

North America is expected to dominate the market over the forecast period.The market growth in the region is owing to the increasingclinical trialsand approvals. North America, particularly the United States, has been at the forefront of T-cell therapy development. Several clinical trials investigating the safety and efficacy of CAR T cell therapies have been conducted in the region. In addition, The U.S. Food and Drug Administration (FDA) has granted approvals to CAR T cell therapies for certain indications.

The U.S. market is also driven by rising cancer and autoimmune disease prevalence, increased clinical trials, and FDA approvals of CAR T-cell therapies. Strong healthcare infrastructure, advanced research facilities, and growing investments in biotechnology and immunotherapy are driving innovation, while patient awareness and demand for personalized treatments further support market growth across the country.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The market is expanding in this area due to reasons such as the rising prevalence of autoimmune diseases and cancer, rising healthcare expenditures, and growing public awareness of the benefits of T-cell therapy. China, Japan, and India are the three countries with the greatest market shares in the Asia-Pacific T-cell therapy market. It is projected that these countries' expanding healthcare infrastructure investments and huge patient populations would drive market growth.

India T-Cell Therapy Market Trends

India's market is growing due to the increasing incidence of cancer and autoimmune diseases, rising healthcare expenditures, and expanding healthcare infrastructure. Growing awareness of advanced immunotherapies, investments in research and clinical trials, and a large patient population seeking innovative treatments are further driving the adoption of T-cell therapies across the country.

Europe is expected to hold a substantial market share over the forecast period.The region has been actively involved in T-cell therapy research and clinical trials. Academic institutions, research centers, and hospitals in countries like Germany, the United Kingdom, France, and others have contributed to the development and testing of T-cell therapies. Moreover, European countries with advanced healthcare systems and specializedoncology centers are equipped to deliver T-cell therapies. These centers provide the necessary facilities, expertise, and support for patient evaluation, treatment administration, and follow-up care. Thus, this is expected to drive the market growth in the region.

UK T-Cell Therapy Market Trends

In the UK, the market is expanding due to rising cancer prevalence, strong government support for advanced healthcare technologies, and active clinical research. Investments in biotechnology, specialized oncology centers, and collaborations between hospitals and research institutions are enhancing treatment availability, while growing patient awareness and demand for personalized immunotherapies further drive market growth in the country.

Latin America: Gradual Adoption

The Latin American market is growing gradually due to the increase in the number of people who have cancer and therefore require access to advanced forms of biologics, increasing access to enter multi-center clinical trials for T-cell therapy, and the establishment of formal types of public/private partnerships, both inside and outside of the region.

Brazil T-Cell Therapy Market Trends

Brazil is leading the growth in the region because of improved clarity surrounding regulations and the increasing number of large hospitals developing their T-cell therapy programs to be included within their oncology care pathways. The market is expected to expand at a healthy pace over the coming years, supported by regulatory reforms and growing healthcare investments that facilitate clinical trials and localized manufacturing capacity.

Middle East/Africa (MEA): Early-stage Markets with Major Opportunities

The MEA region has good long-term potential for the development of T-cell therapy offerings in the marketplace owing to the development of improved treatment facilities for cancer, increases in the total amount of money spent on health by all countries in the region, and the introduction of government initiatives to provide local access to advanced forms of medicines in selected geographic locations.

Saudi Arabia T-Cell Therapy Market Trends

In Saudi Arabia, there has been a significant amount of work being conducted to develop the T-cell therapy market because the country has established a national strategy for biotechnology, an increasing effort to develop genomic medicine, and a growing number of international companies that are developing T-cell therapies that view Saudi Arabia as a potential development partner.

Value Chain Analysis

- Research & Development (R&D)

This stage involves the discovery of novel T-cell targets, the development of CAR-T and TCR therapies, and preclinical testing.

Key players: Novartis, Gilead Sciences (Kite Pharma), Bristol Myers Squibb, and Adaptimmune. - Cell Engineering & Genetic Modification

T-cells are genetically engineered, often using viral vectors, CRISPR, or other gene-editing methods to enhance therapeutic efficacy.

Key players: Sarepta Therapeutics, Bluebird Bio, and Editas Medicine. - Quality Control & Testing

This stage ensures safety, purity, potency, and compliance with regulatory standards before release.

Key players: Charles River Laboratories, WuXi AppTec, and Lonza. - Distribution & Logistics

T-cell therapies are transported to treatment centers under strict cold-chain conditions.

Key players: Cryoport, Marken, and World Courier.

T-cell Therapy Market Companies

- Pfizer Inc.: Develops innovative immunotherapies, including CAR T-cell and TCR-based therapies, targeting hematologic malignancies and solid tumors, with ongoing clinical trials to expand therapeutic indications.

- Fate Therapeutics: Specializes in off-the-shelf, iPSC-derived natural killer (NK) and T-cell therapies, focusing on cancer and immune-related disorders, with next-generation cellular immunotherapies in development.

- Sorrento Therapeutics: Offers CAR-T, CAR-NK, and other cellular immunotherapies for oncology, emphasizing off-the-shelf approaches and combination strategies to enhance safety and efficacy.

- TCR2 Therapeutics Inc.: Focuses on engineered T-cell receptor therapies (TCR-T) for solid tumors, leveraging proprietary ImmTAC technology to recognize intracellular tumor antigens.

- Bluebird Bio Inc.: Develops gene and cell therapies, including CAR-T approaches, targeting genetic disorders and cancers, with emphasis on durable responses and personalized treatment.

- Gilead Sciences Inc.: Through its Kite Pharma division, provides CAR T-cell therapies for blood cancers and develops next-generation allogeneic and solid tumor T-cell immunotherapies.

Other Major Key Players

- Merck KGaA

- Novartis AG

- Amgen

- Celgene Corporation

Recent Developments

- In April 2024, Bristol Myers Squibb entered a global capacity reservation and supply agreement with Cellares to support large-scale CAR T-cell therapy manufacturing. The deal, valued at up to $380 million, includes upfront and milestone-based payments and strengthens clinical and commercial production capabilities.

(Source: www.cellares.com/ ) - In February 2024, Autolus Therapeutics and BioNTech announced a strategic partnership to advance autologous CAR T-cell programs toward commercialization, pending regulatory approval. The collaboration includes licensing, option, and equity agreements, with BioNTech committing $200 million to support development and manufacturing efforts.

(Source: investors.biontech.de ) - In June 2023,Galapagos NV announced that it will exhibit the CAR-T point-of-care manufacturing platform and present previously disclosed initial Phase 1/2 data with CD19 CAR-T candidate, at the European Hematology Association 2023 in Germany.

- In May 2023,AbbVie officially announced that the FDA approved EPKINLYTM, the only T-cell engaging bispecific antibody, for the treatment of adult patients with diffuse large B-cell lymphoma. Due to response rate and response durability, EPKINLY received FDA approval under the procedure for accelerated approval.

Segments Covered in the Report

By Therapy Type

- CAR T-cell Therapy

- T Cell Receptor (TCR)-based

- Tumor Infiltrating Lymphocytes (TIL)-based

By Indication

- Hematologic Malignancie

- Lymphoma

- Leukemia

- Myeloma

- Solid Tumors

- Melanoma

- Brain & Central Nervous System

- Liver Cancer

- Others

- Others

By End User

- Hospitals

- Cancer Treatment Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting