What is the Catalyst Fertilizers Market Size in 2026?

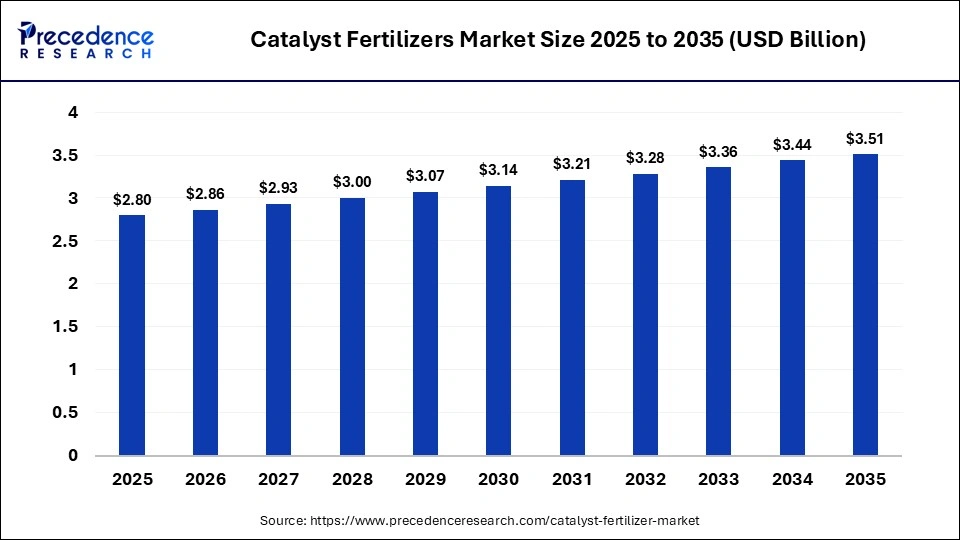

The global catalyst fertilizers market size was calculated at USD 2.80 billion in 2025 and is predicted to increase from USD 2.86 billion in 2026 to approximately USD 3.51 billion by 2035, expanding at a CAGR of 2.30% from 2026 to 2035.This market is growing because of the increasing demand for fertilizer as the population is growing, which is driving food demand.

Key Takeaways

- North America dominated the catalyst fertilizers market in 2025.

- Asia Pacific is expected to be the fastest-growing region between 2026 and 2035.

- By product form type, the liquid segment held a dominant position in the market in 2025.

- By product form type, the granular segment is expected to grow at the fastest CAGR during the forecast period.

- By production method, the Haber-Bosch process segment dominated the market in 2025.

- By production method, the contact process segment is expected to show the fastest growth with a CAGR over the forecast period.

- By application, the nitrogenous fertilizers segment led the global market in 2025.

- By application, the complex fertilizers segment is expected to witness the fastest growth in the market with a CAGR over the forecast period.

- By end-user, the agriculture segment registered its dominance over the global catalyst fertilizers market in 2025.

- By end-user, the horticulture segment is expected to expand rapidly in the market with a CAGR in the coming years.

Market Overview

The catalyst fertilizers market is about materials that help to speed up chemical reactions in industry. Metals such as iron, cobalt, platinum, and rhodium are used as catalysts in fertilizers to improve their performance. These catalysts are mainly used in making fertilizers like ammonia and urea, and oil refineries to produce fuels and chemicals such as petrol, diesel, and propylene. This market includes refining catalysts, synthetic catalysts, and process-specific catalysts developed for different industrial requirements. Agriculture needs a continuous supply of fertilizers, and refineries depend on an efficient conversion process to produce fuel and chemicals, which encourages steady demand for the catalyst fertilizer market.

What is the Role of AI in the Market?

Artificial intelligence is slowly changing the catalyst fertilizers market. Fertilizer manufacturers use AI-based monitoring systems to track temperature, pressure, and reaction performance inside ammonia and urea production facilities. AI helps to make data-driven decisions to improve operational efficiencies.

For example, CLARITYTM Prime, a new digital service with a machine learning based performance projecting tool, enhances the operation of Clariant catalysts.

What are the Major Market Trends?

- Rising demand for food production due to a growing population requires more agricultural output. This demands a fertilizer catalyst to produce ammonia and urea to ensure a steady supply to the expanding catalyst fertilizers market.

- Precision agriculture and technology adoption are widely accepted among the population. The soil sensors help to understand the actual needs of the fields and prevent overuse. The fertilizer manufacturers are integrating smart systems and catalysts to meet site-specific requirements.

- Environmental regulations are becoming strict across many regions, which encourages fertilizer producers to adopt clean technologies that reduce environmental impact, use low energy, and comply with standards.

- Growing awareness of soil health is making farmers understand the importance of maintaining soil fertility. Catalyst fertilizers offer enhanced nutrient availability, which is important for long-term crop productivity. This increases the demand for catalyst fertilizers in agriculture.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.80 Billion |

| Market Size in 2026 | USD 2.86 Billion |

| Market Size by 2035 | USD 3.51 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 2.30% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Form, Production Method , Application, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Form Insights

Why Did the Liquid Segment Dominate the Catalyst Fertilizers Market?

The liquid segment registered its dominance over the global market in 2025 due to its ease of handling and uniform distribution with reactors. Ammonia and urea plants prefer liquid formats as they allow smooth flow and consistent performance. Liquid fertilizers are easy to mix, which enhances their usage in agriculture. Liquid catalyst is the preferred choice in modern plants across large-scale production facilities.

The granular segment is expected to gain the highest share of the market during the forecast period because of its strength and durability under pressure and high-temperature conditions. Granular formats are easy to handle during maintenance and shutdown times. In agriculture, granules are used for controlled nutrient release, which reduces application frequency to crops.

Production Method Insights

How the Haber-Bosch Process Segment Dominated the Catalyst Fertilizers Market?

The Haber-Bosch process segment held a dominant position in the market in 2025 because it produces ammonia, which is a key element of nitrogen fertilizers. Without this process, large-scale production would not be possible. Countries are heavily investing in increasing the capacity of ammonia fertilizers because nitrogen is essential for plant growth. Catalysts used in this process improve efficiency and lower energy use.

The contact process segment is expected to expand rapidly in the market in the coming years because it is used in the production of sulfuric acid, which is needed to make phosphate fertilizers. Phosphate helps crops develop strong roots and improve overall plant health. Due to this, sulfuric acid plants are active and maintains steady demand for contact process catalysts.

Application Insights

Why the Nitrogenous Fertilizers Segment Dominated the Catalyst Fertilizers Market?

The nitrogenous fertilizers segment dominated the global market in 2025 because it is widely used across every major crop, as it is essential for plant growth. Ammonia production relies on catalyst-based processes to produce nitrogen fertilizers, which result in a consistent demand for catalysts. With a growing population and food needs, nitrogen consumption is high in both developed and developing countries, which is steadily increasing demand in the market.

The complex fertilizers segment is expected to grow in the catalyst fertilizer market during the studied years because complex fertilizers combine nutrients like nitrogen, phosphorus, and potassium in one product. Their production involves various chemical steps, with different catalyst systems at various stages. Farmers prefer these fertilizers when balanced crop nutrition is required.

End-user Insights

What Made the Agriculture Segment Lead the Catalyst Fertilizers Market?

The agriculture segment dominated the global market in 2025 because large-scale crop production depends on nitrogen, phosphate, and other nutrient-based fertilizers. Wheat, rice, maize, and oilseeds required consistent nutrient supply to maintain high yields. This increases demand for ammonia and other nutrient-based catalyst fertilizers. Farming covers vast land areas and supports growing populations. Agriculture drives the bulk demand of fertilizers, making this segment dominate in the catalyst fertilizer market.

The horticulture segment is expected to witness the fastest growth in the market over the forecast period. It includes fruits, vegetables, flowers, and plantation crops that require controlled and balanced nutrients. The farmers focus more on crop quality, soil condition, and yield consistency. This supports the demand for complex fertilizers produced by a catalyst-based process.

Regional Insights

Why Does North America Lead in the Catalyst Fertilizers Market?

North America dominated the catalyst fertilizer market in 2025 due to its large-scale agricultural production and well-established fertilizer manufacturing industries. Large commercial farms across the region depend on nitrogen supply, which keeps ammonia and urea plants active. These production facilities rely heavily on catalyst systems. These factors are strengthening catalyst fertilizer demand in the market.

U.S. Catalyst Fertilizers Market Trends

The U.S. represents the largest contributor within North America. The country produces a high yield of corn, soybeans, and wheat, which require nitrogen fertilizers. Large domestic ammonia production facilities drive demand for catalyst systems used in Haber-Bosch processes. The government in the country supports agriculture, and regulatory guidelines favor environmentally friendly fertilizers, further pushing demand. Companies like Nutrien, Mosaic, and CF Industries are heavily investing to improve fertilizer efficiency.

Which Factors Influence the Fastest Growth of the Asia Pacific in the Catalyst Fertilizers Market?

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period, driven by rising food demand and expanding agricultural activity. Countries such as China, India, and Southeast Asia rely heavily on nitrogen fertilizers to improve crop productivity. Rapid population growth and limited agricultural land push the government to focus on higher yields and increasing fertilizer production capacity. Companies like Yara International and the ICL group are advancing their products to meet the growing demand in these countries. Local manufacturers are also taking part to fulfil the need for efficient fertilizers.

India Catalyst Fertilizers Market Trends

India plays a vital role in the Asia Pacific catalyst fertilizer market due to its large farming population and heavy dependence on agriculture. Crops like rice, wheat, and sugarcane require consistent fertilizer application, especially nitrogen-based fertilizers. The country has numerous ammonia plants that depend on catalyst performance for consistent output. The government encourages the use environment friendly fertilizers to reduce environmental damage.

Catalyst Fertilizers Market Value Chain Analysis

- Feedstock Procurement

Feedstock procurement focuses on sourcing raw materials used in catalyst production. A steady and affordable raw material supply is important for smooth catalyst production.

Key Players: Haldor Topsoe, Clariant International, Johnson Matthey, Rubamin.

- Chemical Synthesis and Processing

Raw materials are converted into active catalyst compounds through chemical reactions. Processing involves calcination, drying, and activation steps to achieve the required activity, strength, and stability for fertilizer production processes.

Key Players: Topsoe (formerly Haldor Topsoe), Johnson Matthey PLC, BASF SE, Honeywell International Inc.

- Compound Formulation and Blending

Active materials are blended with binders to form finished products such as pellets or granules. The finished product ensures uniform performance and mechanical strength.

Key Players: Clariant AG, Unicat Catalyst Technologies, LLC, QuantumSphere, Inc., Albemarle Corporation.

- Quality Testing and Certification

Catalysts undergo laboratory testing to check their chemical and physical performance. Certification ensures the product meets quality standards as per industry standards.

Key Players: QuantumSphere Inc, Johnson Matthey PLC, Haldor Topsoe, Intertek, Geo-chem Laboratories, FARE Labs.

- Distribution to Industrial Users

Finished products are supplied directly to fertilizer plants and chemical manufacturers. Most sales happen through contracts. Timely delivery and technical support help factories avoid production delays.

Key Players: Axens SA, Sinopec Group, W. R. Grace & Co., Casale SA, N.E. CHEMCAT, Johnson Matthey PLC.

- Waste Management and Recycling

Catalysts are collected after their use, and valuable metals and materials are recovered through a recycling process. Toxic and harmful materials are disposed of carefully without impacting the environment.

Key Players: Clariant AG, BASF SE, Rubamin, Yara International ASA.

- Regulatory Compliance and Safety Monitoring

Manufacturers must follow regulatory guidelines during the production of the catalyst and during transportation.

Key Players: Clariant AG, BASF SE, Topsoe (formerly Haldor Topsoe), Johnson Matthey PLC

Catalyst Fertilizers Market Companies

- Clariant AG

- Johnson Matthey

- Unicat Catalyst Technologies

- Albemarle Corporation

- LKAB Minerals AB

- Quality Magnetite

- Oham Industries

- BASF SE

- Casale SA

- Axens

- Agricen

- Thyssenkrupp AG

- Albemarle Corporation

- Agricen

- Cabot Corp.

- Haldor Topsoe AS

- N.E. CHEMCAT Corp.

- The Dow Chemical Co.

- Xieta International SL

Recent Developments

- In January 2026, South Korea and the United States launched an eco-friendly ammonia plant, increasing demand for the catalyst fertilizer market. Samsung E&A secured a $480 million contract, showing growing investment in low-carbon ammonia projects supporting Midwest fertilizer demand.(Source: https://www.chosun.com)

- In October 2025, Bharat Petroleum Corporation Limited (BPCL) discontinued fuel oil production after the launch of a new 2 MTPA Propylene Recovery Fluid Catalytic Cracking Complex. The shift focuses on propylene and higher-value petrochemicals, driving demand for advanced refining catalysts as Indian refiners shift towards cleaner, more profitable products. (Source: https://scanx.trade)

- In March 2024, Clariant, a chemical company, launched CLARITYTM Prime, a new digital service designed to improve catalyst performance. The platform uses advanced data analysis to support performance monitoring and operational improvement. The launch shows increasing industry focus on digital tools to enhance productivity and minimise operational costs. (Source: https://www.clariant.com)

Segments Covered in the Report

By Product Form

- Solid

- Liquid

- Granular

By Production Method

- Haber-Bosch Process

- Contact Process

- Others

By Application

- Nitrogenous Fertilizers

- Phosphatic Fertilizers

- Potassic Fertilizers

- Complex Fertilizers

By End-Use

- Agriculture

- Horticulture

- Forestry

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting