What is Category Management Software Market Size?

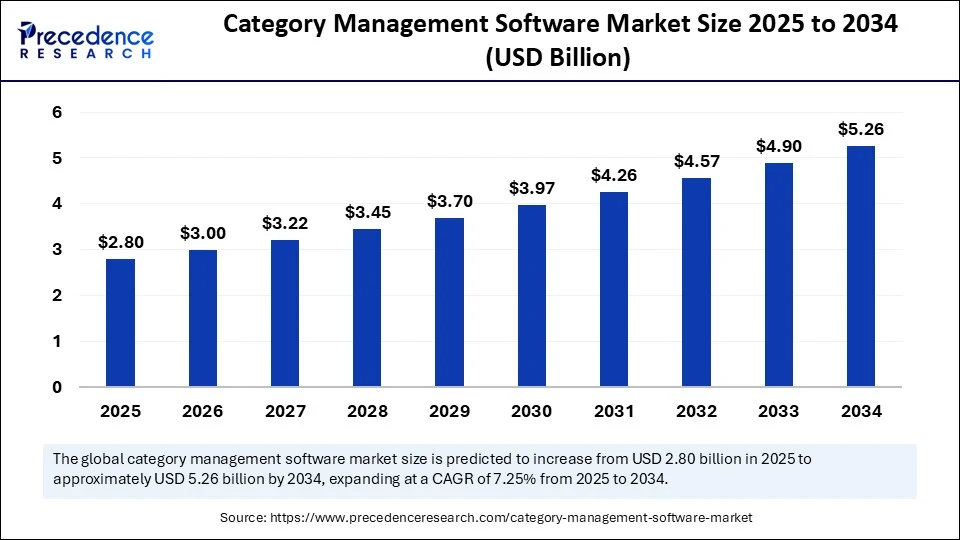

The global category management software market size is estimated at USD 2.80 billion in 2025 and is predicted to increase from USD 3.00 billion in 2026 to approximately USD 5.26 billion by 2034, expanding at a CAGR of 7.25% from 2025 to 2034. The market growth is attributed to the increasing demand for real-time assortment planning, pricing optimization, and supply chain collaboration across omnichannel retail environments.

Market Highlights

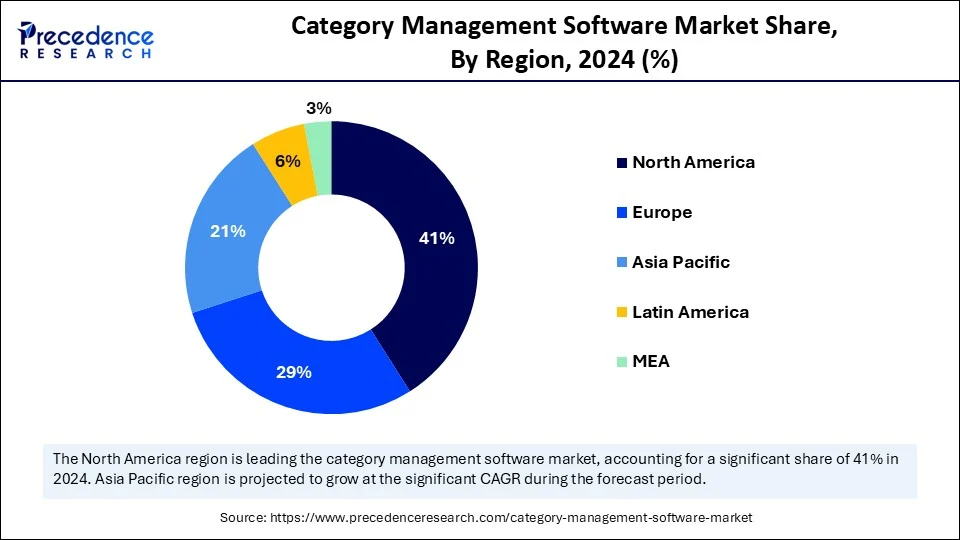

- North America dominated the category management software market with the largest market share of 41% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By deployment mode, the cloud-based segment contributed the biggest market share of 63% in 2024.

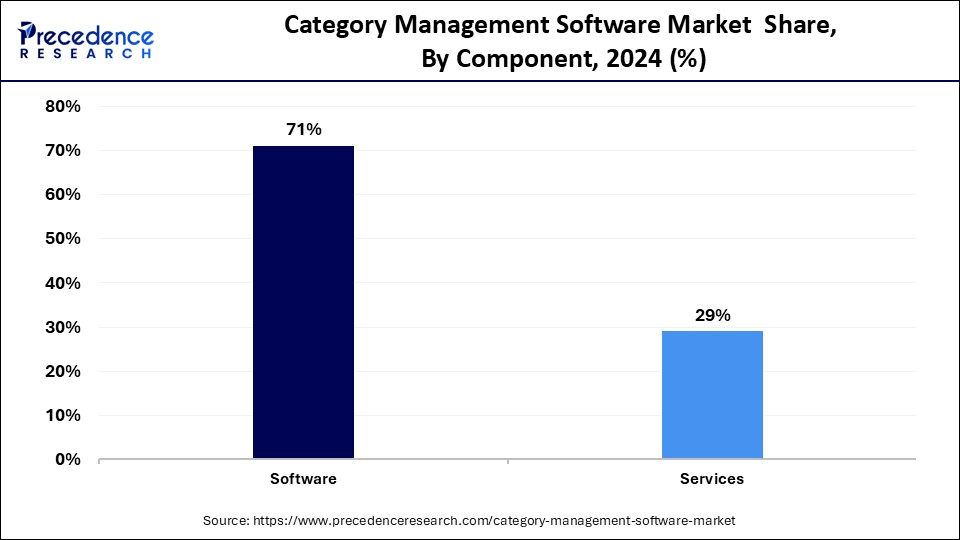

- By component, the software segment captured the highest market share of 71% in 2024.

- By component, the services segment is expected to expand at a significant CAGR between 2025 and 2034.

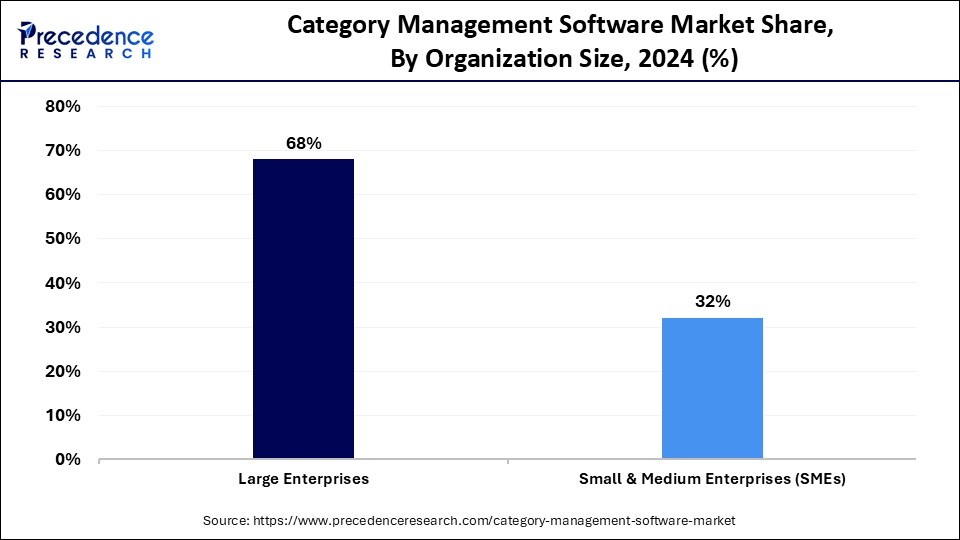

- By organization size, the large enterprises segment held the largest market share of 68% in 2024.

- By organization size, the SMEs segment is expected to grow at the fastest CAGR over the projection period.

- By application, the product assortment optimization segment generated the major market share of 27% in 2024.

- By application, the supplier collaboration and negotiation segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end-user, the retail segment accounted for a remarkable market share of 36% in 2024.

- By end-user, the e-commerce and online marketplaces segment is expected to grow at the highest CAGR from 2025 to 2034.

Market Overview

Category management software refers to digital solutions that assist businesses—especially in retail, CPG, and procurement-driven industries in managing product categories as strategic business units. These tools integrate data analysis, supplier management, performance tracking, and collaboration capabilities to optimize assortment, pricing, promotions, and supply chain decisions across categories.

The increasing complexity of supply chains and consumer behavior is driving a need for real-time retail optimization, accelerating the adoption of category management software. This software helps retailers manage product assortment, pricing, and promotions, improving supply planning and supplier negotiations. Utilizing machine learning and real-time analytics, these systems enable data-driven decisions across retail operations. The demand for smart category planning platforms is further boosted by the need to coordinate local planning with global supply chain disruptions.

Impact of Artificial Intelligence on the Category Management Software Market

Artificial intelligence is revolutionizing the category management software market. AI algorithms are now integrated into software platforms to quickly understand customer behavior, supplier performance, and market trends. This intelligence enables companies to create more strategic assortments, achieve better market penetration, and tailor promotions to current consumer demand. AI algorithms analyze vast datasets to provide deeper insights into consumer behavior, market trends, and supplier performance. This enables more informed and data-driven decisions regarding product assortment, pricing, and promotions. Furthermore, AI facilitates the personalization of product recommendations, promotions, and pricing strategies. By understanding individual customer preferences, AI helps retailers create more engaging and relevant shopping experiences.

Category Management Software Market Growth Factors

- Rising Adoption of Predictive Analytics: The growing use of advanced forecasting models is boosting retailers' ability to anticipate demand patterns and optimize category decisions.

- Growing Emphasis on Personalization Engines: Expanding demand for hyper-personalized shopping experiences is fueling the integration of AI-driven recommendation systems within category platforms.

- Expanding Use of Mobile-First Retail Interfaces: The shift toward mobile-enabled retail operations is propelling demand for responsive, cloud-based category management tools.

- Driving Supply Chain Resilience Investments: Ongoing disruptions in global logistics are driving retailers to strengthen category-level sourcing strategies and supplier diversification.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.80 Billion |

| Market Size in 2026 | USD 3.00 Billion |

| Market Size by 2034 | USD 5.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.25% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Mode, Component, Organization Size, Application Area / Functionality, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is Increasing Reliance on Real-Time Data Analytics Driving the Growth of the Category Management Software Market?

The rising reliance on real-time data analytics drives the growth of the market. Businesses now prioritize tools that swiftly analyze large datasets, aiding in the optimization of inventory planning, pricing strategies, and product assortments. Retailers, by leveraging timely insights, can better regulate storage, prevent overstocking or understocking, and promptly address new customer trends. Category management software, enhanced with AI-powered analysis, boosts operational efficiency.

This shift toward agile, data-driven planning improves profitability and competitiveness within a dynamic market. Furthermore, major enterprise platforms such as SAP and Oracle Retail, along with Blue Yonder, integrated real-time capabilities into their analytics in 2024, increasing the focus on investments in category management innovations via AI, which is expected to fuel the market in the coming years further.

Restraint

Data Silos and Fragmented Operations are Likely to Weaken Real-Time Decision-Making

Data silos and fragmented retail operations are likely to weaken real-time decision-making, thereby hindering the market. Data disconnects within stores of the same format, geography, and business units complicate the centralization of category planning. Retailers lacking a unified data architecture face challenges in establishing a single source of truth for assortment, pricing, and promotional strategies. Furthermore, these silos limit the insights and real-time performance monitoring provided by AI, reducing software efficiency and negatively impacting market expansion.

Opportunity

In What Ways Is Surging E-Commerce Penetration Influencing Cross-Channel Strategy in the Category Management Software Market?

The growing complexity of supply chain operations is anticipated to generate significant opportunities for market players. The increasing penetration of e-commerce is likely to amplify the importance of cross-channel product matching and inventory trade-offs. With the integration of online and offline retail channels, companies require software that can manage a diverse range of product categories.

Retailers utilize this technology to ensure consistency in pricing and availability, leading to improved customer satisfaction and brand perception. In April 2024, Salesforce announced new integrations with Salesforce Commerce Cloud to connect order management capabilities with AI-driven product recommendations across all channels. Furthermore, the complexity of managing numerous digital touchpoints increases the need for category management software solutions.

Segment Insights

Deployment Mode Insights

Why Did the Cloud-Based Segment Dominate the Category Management Software Market in 2024?

The cloud-based segment dominated the market with a significant revenue share of 63% in 2024 and is expected to sustain its growth trajectory in the upcoming period, driven by the scalability, affordability, and flexibility of cloud solutions, which appeal to retailers. Cloud-based platforms enable businesses to unify large datasets for consistent management. These solutions offer real-time updates, rapid system deployment, and remote connectivity, which are essential for organized omnichannel operations.

The year 2024 saw further cloud offerings from vendors like SAP, Oracle, Salesforce, and Blue Yonder, supporting the shift to cloud-first implementations. In April 2024, ZDNet reported that cloud-based category platforms reduced average deployment time compared to legacy systems, reinforcing the need for agile implementation cycles. Moreover, the growing demand for flexible and modular category planning tools adaptable to dynamic business conditions further drives segment growth.

Component Insights

How Does the Software Segment Dominate the Category Management Software Market in 2024?

The software segment held the largest revenue share of 71% in the category management software market in 2024. This is mainly due to the increased retailers' focus on investing in new category management platforms for real-time analytics, AI-powered assortment planning, and end-to-end merchandising. Software products enabled retailers to centrally manage prices, product positioning, supplier management, and multi-channel performance. The 2024 Retail Technology Trends report by Gartner indicated that retailers are rapidly implementing composable software architectures. Moreover, the increasing demand for cloud-based, modular platforms also contributes to this dominance as businesses aim to modernize their existing systems.

The service segment is projected to grow at the fastest CAGR in the coming years. This growth is driven by the increasing complexity of software deployment, the need for continuous system updates, and the demand for performance optimization. Retailers also require specialized assistance with third-party application configuration and evolving compliance regulations. Furthermore, major competitors like Tata Consultancy Services (TCS), Capgemini, Infosys, and HCLTech have expanded their managed services portfolios in retail software, thereby supporting the segment's growth.

Organization Size Insights

What Made Large Enterprises the Dominant Segment in the Category Management Software Market in 2024?

The large enterprises segment led the market with the share of 68% in 2024, holding a significant share. These companies invested heavily in robust category-planning tools to manage complex product groupings, diverse supply chains, and international stores. Major corporations needed high-performance software to centralize information, ensuring real-time synchronization across departments and improving category performance at scale.

They also focused on strategic procurement, dynamic pricing, and AI-driven analytics, which increased the demand for enterprise-grade platforms. Moreover, cloud infrastructure alliances with enterprise software vendors, such as Microsoft Azure, Google Cloud, and Amazon Web Services (AWS), further boosted the segment in 2024.

The SMEs segment is expected to grow at the fastest rate in the coming years due to the increased availability of affordable, cloud-based category management programs tailored for small and medium-sized stores. These businesses are recognizing the importance of data-driven decision-making and lean operations to compete with larger players in both physical and online channels.

Vendors have begun offering modular, extensible platforms on a subscription basis, reducing the cost of entry for SMEs. In 2024, products from Zoho, Coupa Software, and Salsify targeted mid-market retailers with specific needs, including local assortment optimization and accelerated time-to-value. The 2024 SMB Technology Report by IDC noted that much of SME IT spending shifted to intelligent retail planning tools, especially where retail digitization was advanced. Salesforce and Infor reached their SME clients with lean IT departments and quicker deployment needs, announcing simpler cloud-first models of their category software. Furthermore, the availability of low-code and no-code platforms to help smaller retailers build customized planning workflows further support segmental growth.

Application Area/Functionality Insights

Why Did the Product Assortment Optimization Segment Dominate the Category Management Software Market in 2024?

The product assortment optimization segment held the biggest revenue share of 27% in 2024, driven by its ability to enhance shelf productivity and enable SKU rationalization. Retailers implemented assortment planning systems using AI to analyze past sales and customer behavior. This helps understand demand trends, leading to better forecasts of products for each store format. Furthermore, the capacity to analyze variable customer demand and transition to precision merchandizing further supports segmental growth.

The supplier collaboration & negotiation segment is expected to grow at the fastest rate in the coming years, as it allows retailers to build more agile and flexible supply chains. Category management software enables automated contract negotiation, rebate tracking, and vendor scorecarding. These features are offered by GEP, Ivalua, JAGGAER, and Coupa Software to meet the growing demand for transparency and accountability. Moreover, the ability to improve companies' financial performance through cost savings, reduced lead times, and enhanced availability further fuels the segment's growth in the coming years.

End-User Insights

How Does the Retail Segment Dominate the Category Management Software Market in 2024?

The retail sector, especially grocery stores and supermarkets, led the market, holding the largest share of 36% in 2024. These retailers faced challenges with extensive product catalogs, high inventory turnover, and low margins, necessitating strong category planning. These retailers adopted software to automate assortment planning, shelf planning, and pricing across thousands of SKUs.

The need to quickly adapt to changing consumer demand and unpredictable supply chains increased investments in platforms offering real-time analytics and predictive forecasting. Retailers like Kroger, Tesco, and Albertsons continued to expand their use of SAP, Oracle Retail, and Symphony RetailAI platform systems. This improves in-store performance and reduces operational inefficiencies. In 2024, Microsoft Azure partnered with grocery retail chains to provide elastic cloud infrastructure for dynamic category planning. Furthermore, grocery chains' focus on optimizing stock turns and minimizing food waste further boosts segmental growth.

The e-commerce & online marketplaces segment is expected to grow at the fastest CAGR in the coming years due to the increasing complexity of digital retailing and the rising need for consistent product information across various online channels. E-commerce businesses are also increasingly adopting category management software to automate various tasks. A 2024 Statista survey indicated that global digital commerce surpassed pre-pandemic rates, establishing higher demand in retail technology. Moreover, the growing practice of e-commerce analytics further drives the market.

Regional Insights

U.S. Category Management Software Market Size and Growth 2025 to 2034

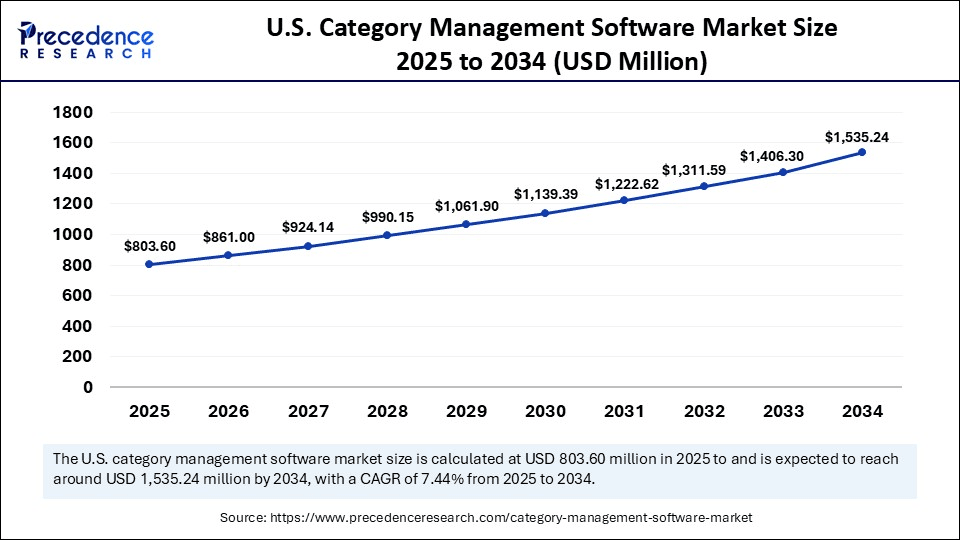

The U.S. category management software market size is evaluated at USD 803.60 million in 2025 and is projected to be worth around USD 1,535.24 million by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

What Factors Position North America at the Forefront in the Category Management Software Market?

North America led the category management software market, holding the largest revenue share of 41% in 2024. This is mainly due to its well-developed retail infrastructure, which provides a solid foundation for the adoption of category management software. There is a high rate of digital adoption, with retailers readily embracing technology to improve operations. Enterprises in the U.S. and Canada are investing in category management platforms to streamline SKU rationalization and supply chain visibility.

Companies like Oracle Retail, Blue Yonder, and SAP provide advanced solutions that are used by major retail companies to optimize assortment planning. Gartner predicted in its 2024 report that North America would become the leading region for AI-based retail technology implementation due to increased use of predictive analytics and joint vendor planning. Additionally, Salesforce and IBM launched cross-channel retailing analytics applications specifically targeting U.S. retailers, further fueling the market.

Asia Pacific is expected to experience the fastest market growth during the forecast period, driven by the rapid digitalization in retail, leading to increased demand for category management software to manage the complexities of online and offline channels. The growing middle class in countries like China, India, and Indonesia is driving consumer spending, leading retailers to adopt category management solutions to optimize product assortments and meet evolving consumer demands. Zoho, Salsify, and Anaplan are expanding in Asia Pacific with cloud-based solutions tailored to the region and local retailers. Furthermore, the rapid digital pace and the need for agile, large-scale software in the region further propel the market.

How is Europe Emerging as Notably Growing Region for Category Management Software Market?

Europe represents a continuing growing market for category management software, as the region adapts to rapid digital transformation in retail, FMCG and large industry, procurement-driven sectors. European organizations increasingly adopted structured sourcing tools to enhance supplier transparency in bids, improve category planning and comply with rigorous procurement laws. Cloud-first environments, increasing investment in AI-driven procurement tools, and growth in interest from organizations in the mid-market is also driving longer term software adoption throughout the region.

China

China's market is growing, driven by the transition of large manufacturing, e-commerce platforms, and state-linked companies toward structured procurement digitalization. Increasing investment in cloud-based platforms, data governance, and AI-enabled supply management fueled adoption of category management software in China. Local vendors are gaining traction through offering customizable, multilingual, and compliance aligned category management solutions that fit complex supplier networks.

Germany

Germany represents one of Europe's most active countries for digital procurement and category management platform adoption given its expansive manufacturing ecosystem that has structured supply chains, all while looking to source the best possible products and price. German companies are relying more heavily on AI-enabled spend analytics and automated supplier scoring to create additional operational visibility. The regulatory environment in Germany improves the adoption of software to enhance compliance, sustainability tracking, and supplier risk monitoring activity within a stressful compliance environment. Further, Germany's ongoing transition to Industry 4.0 creates a natural pull of an integrated category management tool that would work as part of the end-to-end digital procurement experience.

How Is Middle East & Africa Showing Significant Growth In Category Management Software Industry?

The Middle East and Africa region is becoming a growing market for category management software. Organizations are gradually moving from manual procurement practices to digital and automated tools. This growth is driven by increasing government digital programs, more investment in cloud-based procurement systems, and a booming retail and construction sector. Companies in MEA are using category management tools to improve supplier diversity, cut sourcing inefficiencies, and increase contract visibility. United Arab Emirates

The UAE is becoming a top adopter in MEA because of its strong national digital strategy and quick modernization of procurement systems in both public and private sectors. Organizations in the UAE are increasingly using category management platforms to improve supplier negotiations, automate category planning, and fulfill transparency requirements for government projects. Furthermore, the UAE's emphasis on cloud adoption and AI-driven operations speeds up the use of new procurement technologies across businesses of all sizes.

U.S.

The U.S. category management software market is benefitting from three components: fast adoption of artificial intelligence (AI) and data-driven procurement solutions, strong growth in software-as-a-services (SaaS) penetration, and mature, digital first, retail ecosystems. Companies emphasize automation of supplier benchmarking, spend optimization, and visibility into contracts, spurring continuous upgrades to platforms and effort to integrate with enterprise resource planning (ERP) systems, analytic capabilities, and workflow orchestration tools.

Category Management Software Market Companies

- Oracle Corporation

- SAP SE

- JDA Software (Blue Yonder)

- IBM Corporation

- GEP

- Coupa Software

- PROS Holdings

- Infor Inc.

- Periscope by McKinsey

- RELEX Solutions

- Vistex Inc.

- Zycus Inc.

- Ivalua

- Wiser Solutions

- dotActiv

- RangeMe

- 4R Systems

- Retail Insight

- Hubert Company (a Bunzl Company)

- Clear Demand

Recent Developments

- In May 2025, Coupa, a leader in AI-native total spend management, announced the acquisition of Croatia-based Cirtuo, a key player in AI-powered category management. This strategic move accelerates Coupa's autonomous spend management vision and reinforces its focus on delivering AI-based solutions that enhance productivity, agility, and resilience while driving measurable margin improvements.(Source: https://www.prnewswire.com)

- In June 2024, Danone unveiled a new category management website aimed at supporting convenience retailers. With Danone holding eight of the top 10 water SKUs through brands like Volvic and Evian, and leading in plant-based and baby milk categories, the company is leveraging its expertise to help retailers boost sales. The platform offers essential tools such as category trend insights, downloadable planograms, range guidance, merchandising strategies, and practical tips.(Source: https://www.talkingretail.com)

Latest Announcement by Industry Leader

- In Feb 2025, RELEX Solutions unveiled a modernized method for conducting category reviews with the launch of RELEX Space for Category Management. Designed with a cloud-native interface, RELEX Space enables retailers to fine-tune merchandising plans to ensure the right products are available at the right time and location, aligning with consumer demand and enhancing both sales and profitability. “Retailers often face difficulties due to the massive volume of sales, inventory, and customer behavior data necessary for effective category management and space planning. Add to that the need to identify the best shelf space allocation for each category to boost sales and profitability, and the complexity becomes clear,” stated Tommi Ylinen, Chief Product Officer at RELEX Solutions. “Our latest features address these challenges using a unified approach that improves inventory and shelf availability through data-driven decision-making, while increasing sales and satisfying consumer expectations.”(Source: https://www.relexsolutions.com)

Segments Covered in the Report

By Deployment Mode

- Cloud-Based

- On-Premise

- Hybrid

By Component

- Software

- Services

- Consulting

- Implementation & Integration

- Support & Maintenance

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application Area / Functionality

- Product Assortment Optimization

- Supplier Collaboration & Negotiation

- Category Performance Analytics

- Space Planning & Planogramming

- Pricing & Promotion Management

- Inventory & Replenishment Optimization

By End-User Industry

- Retail

- Grocery/Supermarkets

- Apparel & Footwear

- Electronics

- Convenience Stores

- Consumer Packaged Goods (CPG)

- E-Commerce & Online Marketplaces

- Manufacturing (Non-Retail)

- Healthcare & Pharmaceuticals

- Automotive

- Food & Beverage

- Logistics & Distribution

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting