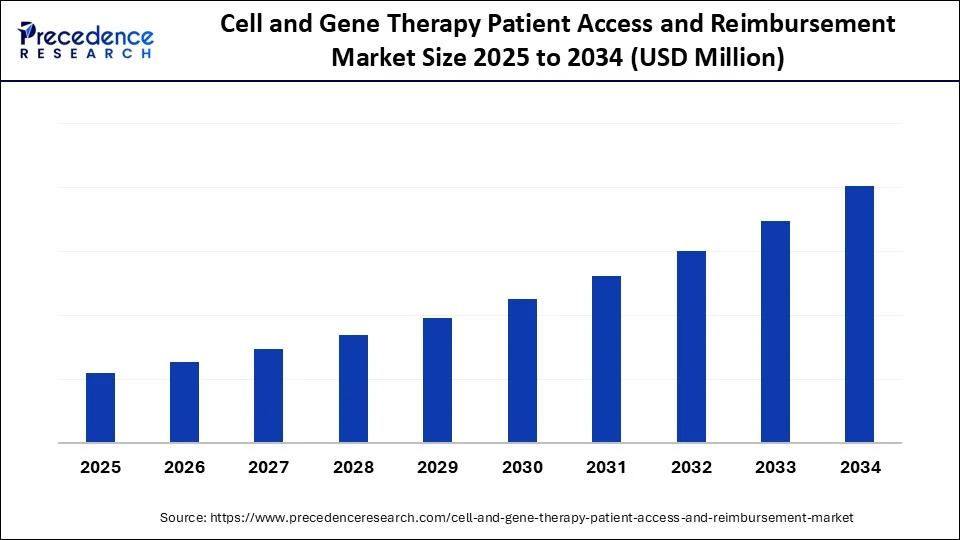

Cell and Gene Therapy Patient Access and Reimbursement Market Size and Forecast 2025 to 2034

The cell and gene therapy patient access and reimbursement market focuses on payer strategies, reimbursement pathways, and innovative payment models (e.g., annuity, outcomes-based) to ensure patient access to costly cell and gene treatments. The cell and gene therapy patient access and reimbursement market is driven by innovative payment models, regulatory support, and growing demand for high-cost, transformative therapies.

Cell and Gene Therapy Patient Access and Reimbursement Market Key Takeaways

- North America dominated the global cell and gene therapy patient access and reimbursement market with the largest market share of 45% in 2024.

- Europe is anticipated to witness the fastest growth during the forecasted years.

- By therapy type, the CAR‑T cell therapies segment captured a revenue share of 60% in 2024.

- By therapy type, the gene-edited therapies (e.g., Casgevy – CRISPR for sickle cell) segment is anticipated to show considerable growth over the forecast period.

- By reimbursement model, the traditional lump-sum segment held the highest market share of 55% in 2024.

- By reimbursement model, the outcomes-based contracts / value-based agreements segment is anticipated to show considerable

- growth over the forecast period.

- By payer type, the public payers segment has captured a revenue share of 50% in 2024.

- By payer type, the private insurers with value-based contracts segment is anticipated to show considerable growth over the forecast period.

- By treatment setting, the hospital/specialty centers segment generated the major market share of 65% in 2024.

- By treatment setting, the home infusion segment is anticipated to show considerable growth over the forecast period.

- By patient demographic, the adult segment held a significant share in 2024.

- By patient demographic, the geriatric segment is anticipated to show considerable growth over the forecast period.

How Is AI Integration Transforming the Cell and Gene Therapy Patient Access and Reimbursement Market?

With the help of AI, the cell and gene therapy market has evolved to the point where the patient access and reimbursement landscape has changed fundamentally, enhancing the efficiency, accuracy, and precision of the value chain. Powered with analytics and artificial intelligence (AI), it is possible to identify potentially eligible patients in the shortest period through predictive modeling and analysis of genomic information. Moreover, AI is also utilized in value-based reimbursement models that rely on predicted and actual treatment outcomes in the real world. It is also utilized to automate the workflow of complex reimbursement channels by automatically filling out forms.

Market Overview

This market addresses how patients access and pay for cell and gene therapies (CGTs)—advanced, often curative one-time treatments (e.g., CAR T, gene editing, cell therapies)—and the complex reimbursement mechanisms required due to their high upfront costs, long-term uncertainty, and limited patient populations.

The cell and gene therapy patient access and reimbursement market is rapidly growing due to the rising approvals at a higher rate and the increasing availability of treatments for rare and genetically based diseases. Moreover, improvements in individualized medicine and targeted treatment are increasing clinical results, which is attracting more investments. The increasing partnerships among biopharma, payers, and governments simplify access channels, lower costs, and provide access to these life-altering therapies for patients worldwide.

What Factors Are Fueling the Rapid Expansion of the Cell and Gene Therapy Patient Access and Reimbursement Market?

- Increasing Acceptance of Cell and Gene Therapies: Greater regulatory diversity and control approvals of CGTs worldwide are broadening the pathways of viable treatments for previously untreatable diseases. These approvals are promoting the development of access and reimbursement plans by healthcare systems, contributing to the market's future growth in a short time.

- Increasing Incidence of Rare and Genetic Diseases: The rise in the number of rare and genetic diseases has created a greater demand for advanced therapies. Cell and gene therapies are curative and thus become critical therapies. The reimbursement helps increase the affordability of long-term treatment and provides effective coverage for more treatments through healthcare providers.

- Government and Regulatory Support: Favourable regulatory environments are catalyzing the use of CGT with fast-track approvals, orphan drug incentives, and healthcare policy. Such proactive activity by the regulators is contributing to increased confidence in reimbursement and the prompt and equitable delivery of therapies to patients.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type, Reimbursement Model, Payer Type, Treatment Setting, atient Demographics, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Adoption of Innovative Reimbursement Models

The high growth rate of the cell and gene therapy patient access and reimbursement market is attributed to the development of innovative reimbursement models that address the financial and clinical characteristics of these therapies. Payers and governments are encouraging pilot programs and regulatory schemes to support these models, as they have seen the involvement of these models in growing patient access while reducing healthcare budgets. The need for flexible and patient-centered payment systems will further catalyze innovation and growth in the reimbursement field as regulators approve more CGTs and become used in clinical settings.

Restraint

High Cost and Limited Infrastructure

The high price of treatment and low healthcare facilities are among the major obstacles that restrain the expansion of the cell and gene therapy patient access and reimbursement market. The upfront cost of most CGTs is very high, with many costing hundreds of thousands of dollars and exceeding a million dollars per patient, which is unaffordable for both the government and non-government sectors. This economic burden is also notably high among low- and middle-income countries due to limited healthcare budgets. These challenges are potentially limiting in scaling down the CGT implementation, even though they are considered to have clinical value.

Opportunity

Government Support and Health Policies

The government's support and favorable health policies present a significant opportunity for the growth of the cell and gene therapy patient access and reimbursement market. As governments around the world recognize the potential of CGTs to revolutionize the treatment of rare and life-threatening diseases, most are implementing policies that encourage innovation, expedite the regulatory process, and simplify reimbursement. Efforts, including orphan drug designations, fast-tracked approvals, tax support, and government-funded research and CGT infrastructure, are also accelerating the clinical and commercial use of these medicines. Moreover, governments are also collaborating with stakeholders in the industry to implement innovative payment models, such as outcomes-based and milestones-based reimbursement contracts, which play a pivotal role in funding expensive CGTs.

Therapy Type Insights

Why Did the CAR-T Cell Therapies Segment Dominate the Market in 2024?

The car‑t cell therapies segment dominated the cell and gene therapy patient access and reimbursement market while holding a 60% share in 2024. This is mainly due to the increased cancer prevalence. CAR-T cell therapies offer a promising treatment option for certain cancers, particularly those that have not responded to other therapies. These treatments involve genetically modifying a patient's T cells to identify and target specific cancer cells, offering revolutionary potential in treating some blood cancers. Patients require hospitalization and undergo pre- and post-treatment checks, which increases costs. Consequently, reimbursement strategies must adapt to support these unique clinical and logistical needs. The confirmed clinical efficacy and the expanding list of regulatory approvals for CAR T-based therapies contribute to growing demand, solidifying their role in the cell therapy field.

The gene-edited therapies (e.g., Casgevy – CRISPR for sickle cell) segment is expected to grow at a significant CAGR over the forecast period. One of the growth drivers is Casgevy, the first FDA-approved treatment that applies to CRISPR/Cas9 genome-editing technology. Casgevy has been accepted to treat sickle cell disease in patients 12 years and above who have frequent attacks of vaso-occlusive crisis. The treatment is associated with the manipulation of a patient's hematopoietic stem cells in a way that corrects the genetic mutation that causes the disease, offering potential cure. Unlike other treatments, gene-edited therapies target the root cause, providing long-term value and reducing chronic care needs.

- In January 2024, Vertex Pharmaceuticals announced that the Saudi Food and Drug Authority (SFDA) has granted Marketing Authorization for CASGEVY. This innovative CRISPR/Cas9 gene-edited therapy is designed to treat sickle cell disease (SCD) and transfusion-dependent beta thalassemia (TDT). CASGEVY is now approved for individuals aged 12 and older who are living with SCD or TDT.

(Source:https://news.vrtx.com)

Reimbursement Model Insights

How Does the Traditional Lump-Sum Payment Segment Dominate the Market in 2024?

The traditional lump-sum payment segment dominated the cell and gene therapy patient access and reimbursement market with a 55% share in 2024. Its dominance is rooted in its simplicity and familiarity within conventional healthcare payment systems. This model provides a straightforward and easily manageable approach for both providers and payers, simplifying the payment process. Payers may find it challenging to cover the full cost upfront due to the uncertainty of future returns. Furthermore, patient access is often restricted by budget limitations, regulatory delays, and uncertainties surrounding reimbursement policies. These factors highlight the need for lump-sum models that better address the unique challenges of CGTs.

The outcomes-based contracts / value-based agreements segment is expected to grow at the highest CAGR during the projection period. These models aim at responding to the specific financial and clinical issues of CGTs, their high initial cost, and unpredictable long-term effects. These models allow dispersion of the treatment cost over several years, easing the immediate financial burden on healthcare systems while ensuring sustained access to treatment. These models enable payers to manage risk, improve financial predictability, and incentivize manufacturers to demonstrate the long-term value of their therapies. As a result, advanced healthcare infrastructures, governments, and private insurance companies are increasingly experimenting with and adopting these innovative models.

Payer Type Insights

What Made Public Payers the Dominant Segment in the Market in 2024?

The public payers segment dominated the cell and gene therapy patient access and reimbursement market while capturing a revenue share of 50% in 2024. Medicare, Medicaid, national health systems, and other public payers are crucial for ensuring access to high-cost therapies, especially for the aging population and those with rare or chronic diseases. Public healthcare budgets face significant challenges due to the high initial costs and long-term follow-up required for CGTs. Consequently, governments are exploring outcomes-based agreements and other innovative payment models that link reimbursements to real-world clinical outcomes. Public payers often have more resources and funding allocated for innovative treatments, enabling them to provide access to these therapies for a broader range of patients.

The private insurers with value-based contracts segment is expected to grow at a significant CAGR over the forecast period. This growth is driven by the need for more dynamic and sustainable reimbursement models for cell and gene therapies. Faced with pressures to innovate and control costs, private insurers are increasingly adopting value-based contracts to manage the high upfront costs of these therapies. Reimbursement based on therapeutic outcomes allows insurers to mitigate financial risks and provide patients with access to potentially curative medications. Furthermore, private insurers often have more operational flexibility than public payers, enabling them to test and expand new payment methods more rapidly.

Treatment Setting Insights

Why Did the Hospitals/Specialty Care Centers Segment Dominate the Market in 2024?

The hospitals/specialty care centers segment led the cell and gene therapy patient access and reimbursement market with a 65% share in 2024. These facilities are the primary centers for administering CGTs due to the complex treatment procedures, specialized infrastructure, and qualified healthcare staff required. CGTs often involve intricate processes such as cell harvesting, genetic manipulation, and reintroduction, which may necessitate hospitalization, observation, and follow-up care. The high initial costs of these treatments and the need for integrated outcome tracking systems also demand robust financing models and support systems.

The home infusion segment is projected to experience significant growth during the forecast period. Home infusion centers are crucial in this transformation, offering personalized services and reducing the strain on hospital infrastructure. Innovative reimbursement models, such as value-based contracts and care bundles, are being adapted to support home-based care and address associated challenges.

Patient Demographic Insights

What Made Adult the Dominant Segment in the Market in 2024?

The adult segment held a significant share of the market in 2024. This is mainly due to the increased need for innovative therapies targeting rare and chronic diseases, which are prevalent in adult populations. Most CGTs target genetic diseases, blood malignancies, and autoimmune disorders, often diagnosed in later adulthood. Adult reimbursement plans are evolving, with health plans adopting outcome-based contracts and milestone-based payment systems to mitigate financial risks and promote equitable access. Strong support systems, including financial counseling, case management, and long-term follow-up care, are crucial to ensure adult patients can benefit from these life-altering therapies.

The geriatric segment is anticipated to show considerable growth in the market over the forecast period, driven by the aging global population and the rise of age-related genetic and chronic diseases. CGTs offer the potential for long-term remission or cures, making them attractive to older individuals affected by conditions like blood cancers, neurodegenerative diseases, and inherited disorders. However, the substantial initial investment in therapy and uncertainties about long-term outcomes raise concerns for payers and providers regarding the cost-effectiveness of these therapies in older age groups. To address these challenges, reimbursement models are gradually adapting to consider the clinical and economic specifics of geriatric patients.

Region Insights

Why Did North America Dominate the Global Market in 2024?

North America led the global cell and gene therapy patient access and reimbursement market with the highest market share of 45% in 2024. North America's market dominance is fueled by a robust healthcare infrastructure and well-established regulatory frameworks that facilitate rapid innovation and market entry. Alternative payer models are increasingly being adopted by both public and private payers in North America to improve affordability and access. The growing awareness of rare genetic disorders and the availability of advanced treatment facilities have solidified North America's leadership in the global CGT landscape.

The U.S. is a major contributor to the market due to its healthcare innovation, regulatory support, and large patient population. The U.S. Food and Drug Administration (FDA) actively promotes CGT development through accelerated approvals, orphan drug designations, and regulatory incentives. Furthermore, the U.S. government and medical organizations are investing in infrastructure and outcome monitoring platforms to support long-term patient care.

Why is Europe Experiencing the Fastest Growth in the Cell and Gene Therapy Patient Access and Reimbursement Market?

Europe is expected to grow at the fastest CAGR during the forecast period, driven by increased regulatory support, enhanced research efforts, and rising healthcare investments. Regulatory initiatives by the European Medicines Agency (EMA), such as PRIME (PRIority Medicines), prioritize the approval of innovative therapies by accelerating their evaluation. Moreover, the European Union's investment in digital health and patient data tracking is enhancing the collection of real-world evidence, crucial for the success of value-based reimbursement models.

Germany plays a vital role in the region's CGT growth, boasting a well-organized healthcare system, comprehensive reimbursement frameworks, and strong government support for innovators. In Germany, the Federal Joint Committee (G-BA) and statutory health insurance funds are actively evaluating the value of CGTs and integrating them into the national reimbursement system. Germany is also investing in digital health infrastructure to support outcome monitoring and real-world evidence generation, essential for performance-based payment models.

What are the Key Factors Driving the Growth of the Cell and Gene Therapy Patient Access and Reimbursement Market in Asia Pacific?

The market in Asia Pacific is anticipated to experience a notable growth, fueled by a booming healthcare sector, increased government investment, and the expansion of clinical research facilities. Countries like Japan, South Korea, China, and Australia are intensifying their efforts in CGT development and commercialization through legislative reforms, enhanced research and development grants, and government-industry collaborations.

The Chinese government has prioritized cell and gene therapy in its national health and innovation strategy, providing funding, accelerating approvals, and supporting infrastructure development to advance clinical and commercial progress. CGT clinical trials and local companies in China, particularly in CAR T-cell therapy and gene-editing technology, are experiencing rapid growth. Chinese health officials are considering including certain CGTs in the national reimbursement drug list (NRDL) and promoting pilot projects focused on outcomes-based and value-driven payment models.

Cell and Gene Therapy Patient Access and Reimbursement Market Companies

- Novartis AG (Kymriah)

- Gilead/Kite (Yescarta, Tecartus)

- Spark Therapeutics (Luxturna)

- Bluebird Bio (Zynteglo, Lyfgenia)

- Vertex & CRISPR Therapeutics (Casgevy)

- Spark Therapeutics (Luxturna)

- Roche / Spark

- Roche / Novartis partnership

- US CMS (Medicare/Medicaid payers)

- Italy's AIFA

- NHS England

- European payer consortia (Nordic, Benelux)

- Harvard Pilgrim Health Care

- CMS innovation / NTAP programs

- Express Scripts / Accredo

- Hospital networks (CAR T-certified centers)

- Duke Margolis Health Policy Consortium

- Clarivate / Decision Resources (consulting)

- American Society of Gene & Cell Therapy (ASGCT)

- Biogen (Spinraza) & other bench-to-bedside enablers

Recent Developments

- In May 2025, the HCG Manavata Cancer Centre (HCGMCC) in Nashik, in collaboration with SunAct - Advanced Cancer Therapies, established the first Centre of Excellence in North Maharashtra dealing with Cell and Gene Therapy (CGT). This latest facility is a cutting-edge facility that is making a big inroad and putting up their fourth facility in the nation with the SunAct Corporation, which is bringing access to the most advanced cancer treatment to semi-urban and underserved regions.

(Source: https://ehealth.eletsonline.com)

- In April 2024, the Centers for Medicare & Medicaid Services (CMS) suggested increasing the New Technology Add-on Payment (NTAP) of cell and gene therapies in the Medicaid program, a government health insurance plan option for older adults. This suggested outcome-based reimbursement identifies consistency in Medicaid and Medicare reimbursement frameworks for cell and gene treatment (CGT) to deal with sickle cell disease.

(Source:https://www.genengnews.com)

Market segment Covered in the Report

By Therapy Type

- CAR T Cell Therapies

- Gene Replacement Therapies (e.g., Luxturna, Zolgensma)

- Gene-Edited Therapies (e.g., Casgevy – CRISPR for sickle cell)

- Cell-Based Therapies (e.g., stem cell transplants)

- RNA-Based Therapies

- Others (e.g., multigenic, combination platforms)

By Reimbursement Model

- Traditional Lump-Sum Payment

- Outcomes-Based Contracts / Value-Based Agreements

- Annuity/Installment Payment Models

- Rights & Outcome-Based Refunds

- Risk-Pooling Funds

- Others (e.g., population-level budgeting)

By Payer Type

- Public Payers (e.g., Medicare, Medicaid)

- Private Insurers

- Specialty Carve-Out Funds

- Payer Consortia & Risk Pools

- Others (e.g., philanthropic funds, hospitals)

By Treatment Setting

- Hospital Clinics / Specialty Centers

- Home Infusion (for select gene therapies)

- Specialty Pharmacies

- Others (e.g., academic/teaching hospitals)

By Patient Demographics

- Pediatric

- Adult

- Geriatric

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting