What is Chemical Tanker Shipping Market Size?

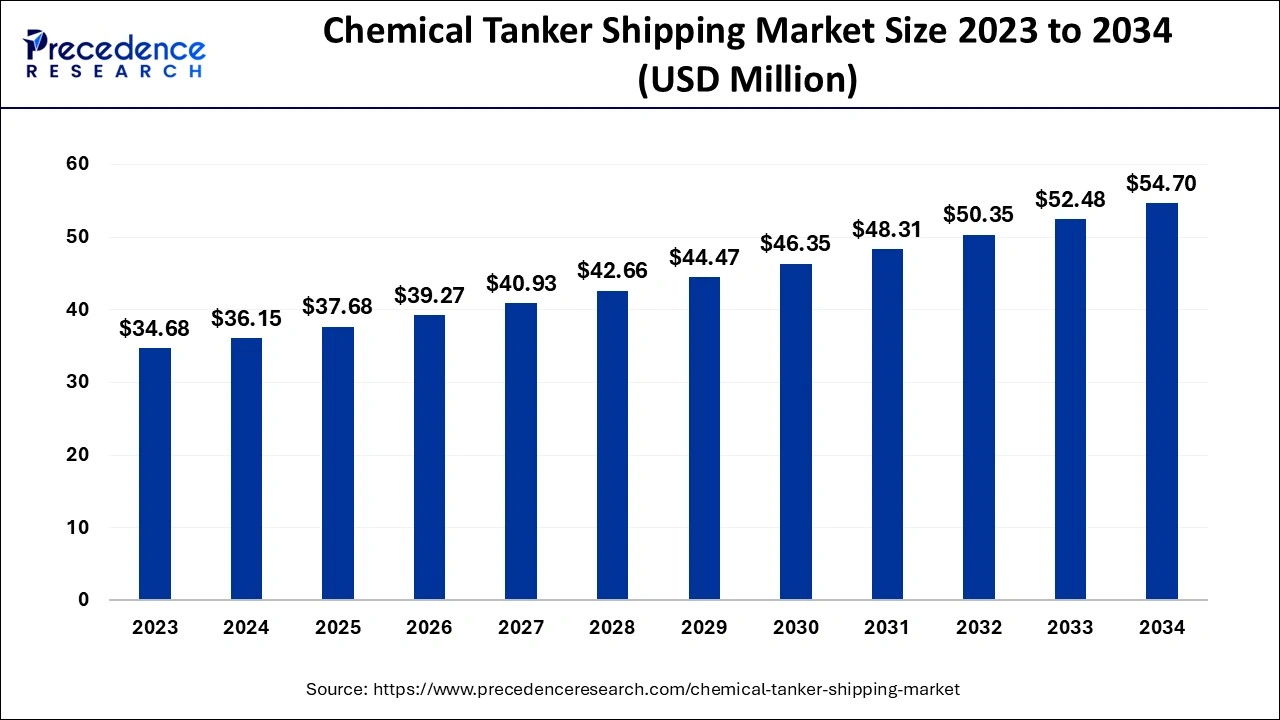

The global chemical tanker shipping market size is valued at USD 37.68 million in 2025 and is predicted to hit around USD 54.70 million by 2034, growing at a CAGR of 4.23% from 2025 to 2034. The wide adoption of the chemical industry in different end-use industries is driving the chemical tanker shipping market growth.

Market Highlights

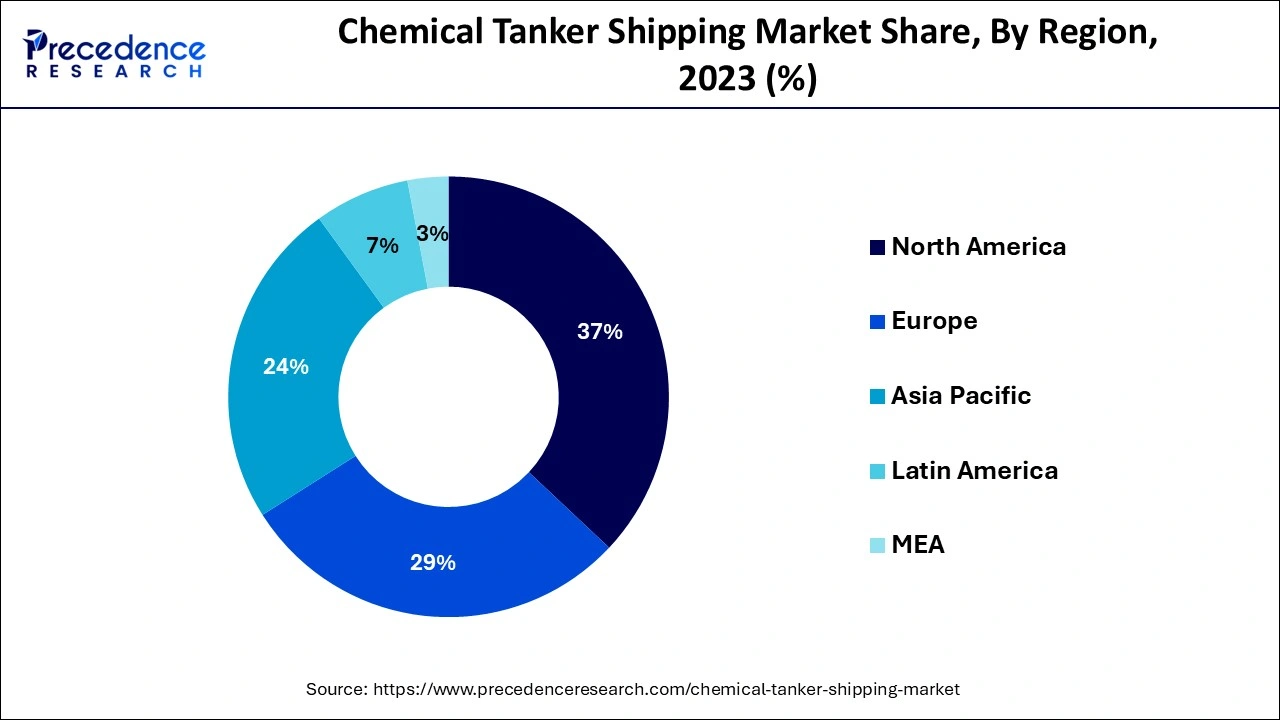

- North America dominated the global market with the largest market share of 37% in 2024.

- Asia Pacific is expected to witness the fastest growth in the forecast period.

- By fleet type, the IMO 2 fleet segment contributed the highest market share of 51% in 2024.

- By fleet type, the IMO 1 fleet segment will witness a significant CAGR of 4.13% during the forecast period.

- By product, the deep-sea chemical tankers segment captured the biggest market share in 2024.

- By product, the inland chemical tankers segment is expected to grow at a notable CAGR during the forecast period.

- By application, the vegetable oil and fats segment generated the major market share in 2024.

- By application, the inorganic chemicals segment expected significant growth during the predicted period.

Market Overview

Chemical tanker shipping is the type of ship that is specially designed for the transportation of chemicals in heavy amounts. It is a cargo shipment that is used for the transportation of any type of chemicals. The rising import and export activities and the rising demand for the chemical industry across the industries are driving the demand for chemical tanker shipping. The rising investment in the development of new and advanced chemical tanker ships is accelerating the growth of the chemical tanker shipping market.

How Can AI Impact the Chemical Tanker Shipping Market?

The integration of artificial intelligence (AI) into the chemical tanker shipping market for the advancements in technology and improving the efficiency of the services. AI improves real-time monitoring; its algorithms analyze the different sources such as sea conditions, weather, and vessel traffic, which offers real-time data, helps in decision-making, and enables automated alerts to ship operators for efficient navigation. AI helps with predictive modeling, such as predicting potential dangers such as collisions, storms, and equipment failure.

- In October 2024, Mitsubishi Heavy Industries (MHI) launched the AIRIS or Artificial Intelligence Retraining in Space, a satellite-mounted detector, an AI-equipped data processor composed of an Earth-observation camera. The launch was marked as an advancement in maritime monitoring.

Chemical Tanker Shipping Market Growth Factors

- Increasing industrialization: The increasing global population and the rising demand for industrialization from economically developing countries are driving the growth of the industries, which created the demand for safer and more economical transportation medium that boosts the growth of the market.

- Increasing demand for the chemical industry: The increasing demand for organic and inorganic chemicals in a wide range of industrial applications such as pharmaceutical operations, energy development, and automobile applications. The fueling demand for chemicals such as crude oil and petrochemicals as the major source of energy production is driving the demand for the chemical tanker shipping market.

- Rising government interventions: The rising interference of government in transportation activities for strengthening the economies and the rise in the international trade of goods and services is driving the demand for the maritime industry, which anticipates the expansion of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 37.68 Million |

| Market Size in 2026 | USD 39.27 Million |

| Market Size in 2034 | USD 54.70 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.23% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fleet Type, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Drivers

Expansion of the chemical industry

The increasing demand for the chemical industry and the rising importance of the chemical industry in daily life are driving the growth of the chemical tanker shipping market. The chemical industry is used in different industrial applications such as agriculture, decor, hygiene, agriculture, mobility, and others. Chemicals are used in the manufacturing of plastic and polymers and help in advanced research; the chemical industry plays an important role in the manufacturing of fertilizers, pesticides, personal products, toiletries, and food.

Restraint

The risk associated with the leakage

The handling of hazardous chemicals in the tanker and managing the leakproof tankers are among the leading challenges, and the maritime environmental impact due to chemical tanker shipping is restraining the expansion of the chemical tanker shipping market.

Opportunity

Increasing import and export activities

The increasing international trade across borders and the increasing chemical import and export activities are driving the growth of the chemical tanker shipping market. The increasing demand for the chemical industry from the different end-use industries, such as personal care and food processing, drives the demand for the chemical industry globally. Additionally, increasing demand for petrochemical products and crude oil is driving the demand for the chemical industry.

Segment Insights

Fleet Type Insights

The IMO 2 fleet segment dominated the chemical tanker shipping market in 2024. The IMO is the international maritime organization, the specialized agency that works under the United Nations to ensure the responsibility of the security and safety of shipping and prevent the atmosphere and marine pollution by ships. The IMO 2 is the type of ship that is made for transporting oils, chemicals, and other fluid materials. The rising demand for industries such as oil and chemicals, agrochemicals, pharmaceuticals, and others is driving the demand for efficient fleet management for the safer transportation of chemicals.

The IMO 1 fleet segment will witness significant growth in the chemical tanker shipping market during the forecast period. There is an increasing demand for the chemical fleet to transport hazardous oils and chemicals without leakage and polluting the marine environment. The increasingly stringent regulations associated with the pollution level and transport security of hazardous chemicals and the increasing demand for industries such as petrochemicals, pharmaceuticals, and chemical manufacturing industries.

Product Insights

The deep-sea chemical tankers segment accounted for the largest share of the chemical tanker shipping market in 2024. Deep-sea chemical tankers are specially designed ships that are used to transport heavy-weight and hazardous chemicals via the deep sea. The increasing demand for the oils and chemical industries such as pharmaceuticals, agriculture, and petrochemicals worldwide and the rising international trade between the countries are driving the demand for the deep-sea chemical tankers products segment.

The inland chemical tankers segment is expected to grow at a notable rate in the chemical tanker shipping market during the forecast period. The increasing demand for localized chemical transportation into the region, the rapid demand for chemicals such as pharmaceuticals, petrochemicals, and other hazardous chemicals for the different applications and manufacturing of the different products are highly driving the demand for the regional extensive inland waterways.

Application Insights

The vegetable oil and fats segment dominated the chemical tanker shipping market in 2024. Vegetable oils and fats are used in different products and applications, such as cosmetics and pharmaceutical products. The vegetable oils are extracted from different types of seeds, nuts, fruits, and grains. The rising global population is accelerating the demand for vegetable oil and fats, which anticipated the demand for chemical tanker shipping. The increasing preference for organic products and plant-based products is driving the adoption rate of vegetable oil and fats.

The inorganic chemicals segment will experience substantial growth in the chemical tanker shipping market during the predicted period. Inorganic chemicals are used in a wide range of industrial applications and products, such as it used in medication, coatings, paints, chemical catalysts, pigments, surfactants, jewelry, and others. The increasing industrialization and the international trade between the countries are fueling the import and export of inorganic chemicals.

Regional Insights

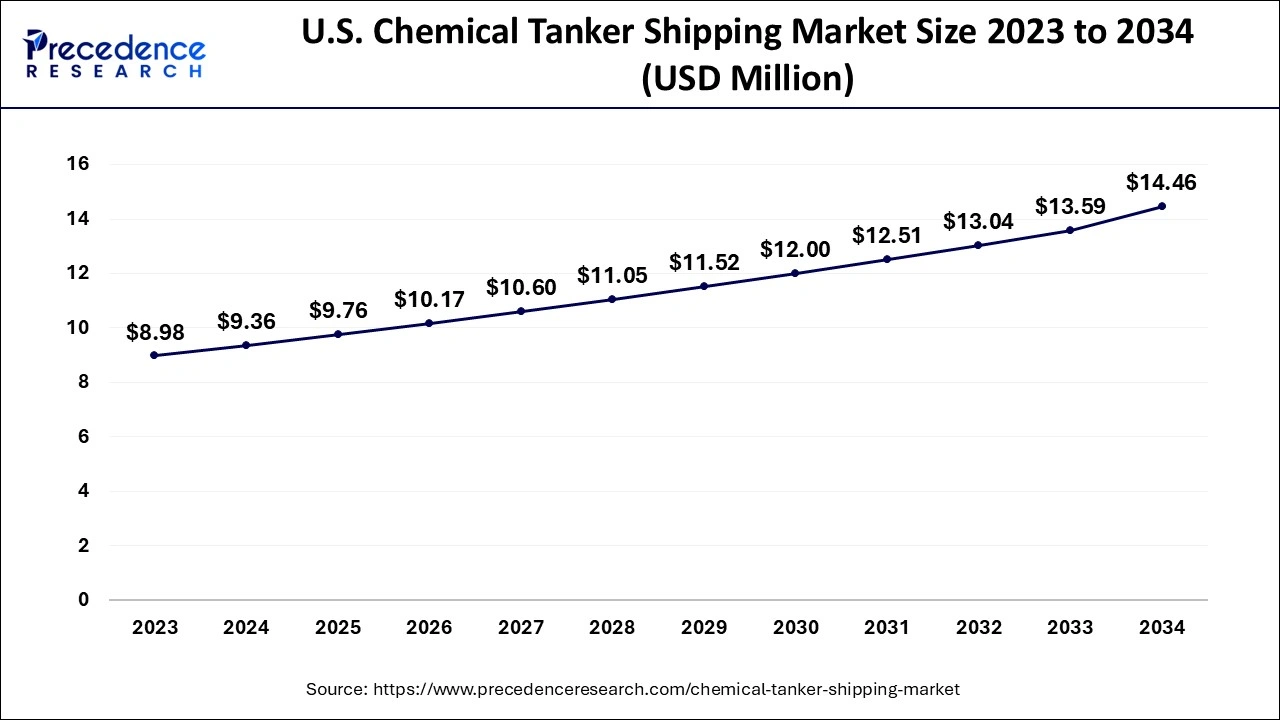

U.S. Chemical Tanker Shipping Market Size and Growth 2025 to 2034

The U.S. chemical tanker shipping market size is evaluated at USD 9.76 million in 2025 and is expected to be worth around USD 14.46 million by 2034, growing at a CAGR of 4.45% from 2025 to 2034.

North America dominated the global chemical tanker shipping market. The growth of the market is attributed to the rising growth of industrialization and international trade across countries, which are driving the demand for the market. The increasing availability of leading ship manufacturers, the continuous investment in the oil and refinery industries, and the government interventions to strengthen the shipping industry for international trade are collectively leading to a higher demand for chemical shipping tankers across the region.

- The chemical industry is one of the leading contributors to the United States GDP, supporting the production of domestic and commercial goods. 96% of the goods in the U.S. are manufactured using the chemical sector products. It is the 2nd largest producer of chemicals, accounting for 13% of the global chemicals.

- The U.S. chemical industry is valued at USD 486 million and supports more than 25% of the overall U.S. GDP, hosting approximately 11,128 chemical manufacturing facilities, 459 refineries, and petrochemical facilities across 39 states.

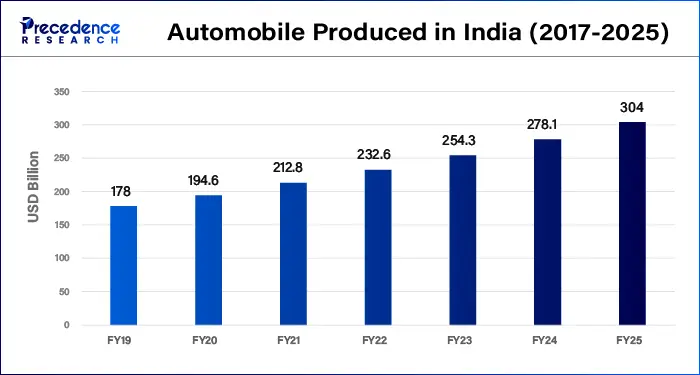

Asia Pacific is expected to witness the fastest growth in the chemical tanker shipping market during the forecast period. The growth of the market is attributed to the rising regional population and economic development in countries such as India, China, and Japan, which results in the increasing industrialization that anticipated the increased demand for transportation that boosts the growth of the maritime industry. The rising oil and gas industries in the countries and the demand for petrochemicals and pharmaceutical chemicals are accelerating.

- India is one of the emerging nations in the development of the chemical industry; India is the 6th largest producer of chemicals in the world and the 3rd largest in Asia, with a contribution of 7% to India's GDP.

- The chemical industry in India is currently valued at USD 220 million and is predicted to reach USD 300 million by 2030 and USD 1 trillion by 2040.

- The organic and inorganic chemical exports reached USD 4.78 million in April-May 2024. The imports of organic chemicals were USD 2.69 million, and inorganic chemicals were USD 1.09 million from April 2024 to May 2024.

Chemical Tanker Shipping Market Companies

- Ardmore Shipping Corporation

- Odfjell

- Team Tankers International Ltd.

- Tokyo Marine Asia Pte Ltd.

- Hafnia

- MOL CHEMICAL TANKERS PTE. LTD

- Stolt-Nielsen

- Bahri

- Navig8 Chemical Tankers Inc.

- MISC Berhad

- Ultrabulk

- IINO KAIUN KAISHA, LTD.

- Iino Marine Service Co., Ltd

Latest Announcements by the Industry Leaders

- Odfjell is increasing its fleet range with six new buildings with the integration of long-term time charter and pool agreements, which represent the continuity of its relationship with Japanese shipowners and shipyards. The new series consists of the built at multiple shipyards in Japan, and the delivery has been rescheduled from 1H2026 to 1H2027. Two of the vessels are 40,000 dwt stainless steel stainless steel chemical tankers with 28 tanks, and the other four are 25-26,000 dwt stainless steel chemical tankers with 24 tanks.

- In March 2024, TOKYO-Mitsui O.S.K. Lines, Ltd. announced its subsidiary, MOL Chemical Tankers Pte. Ltd., a chemical tanker operator, completed its acquisition with all shares of Fairfield Chemical Carriers Pte. Ltd.

Recent Developments

- In September 2024, Maersk Tankers, operated by the Danish Tanker, launched a new range of chemical tankers to increase its service offerings. The organization brings together J19 vessels from its existing partners.

- In October 2024, Jiangxi Xinjiang Shipbuilding Heavy Industry of China is launched the latest chemical tankers ordered by the local owner Zhoushan Yongcheng Shipping. The tanker is undertaken according to China Classification Society rules.

- In April 2024, Fukuoka Shipbuilding, a Japanese ship manufacturer, launched the 3rd series of its four stainless steel chemical tankers driven by liquefied natural gas (LNG) for US-based shipowner Fairfield Chemical Carriers.

- In August 2024, SEACOR Holdings and Crowley launched Fairwater Holdings, integrating the chemical tanker fleets and the pair's American petroleum. Fairwater Holdings operated in all the major Jones Act coastwise tank vessel trades.

- In February 2024, Chemship, a Netherlands-based ship manufacturer, launched its first ship equipped with wind-assisted propulsion.

Segments Covered in the Report

By Fleet Type

- IMO 1

- IMO 2

- IMO 3

By Product

- Inland Chemical Tankers (1,000-4,999 DWT)

- Coastal Chemical Tankers (5,000-9,999 DWT)

- Deep-Sea Chemical Tankers (10,000-50,000 DWT)

By Application

- Organic Chemicals

- Inorganic Chemicals

- Vegetable Oils and Fats

- Liquified Gases

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting