Cholesterol Testing Products Market Size and Forecast 2025 to 2034

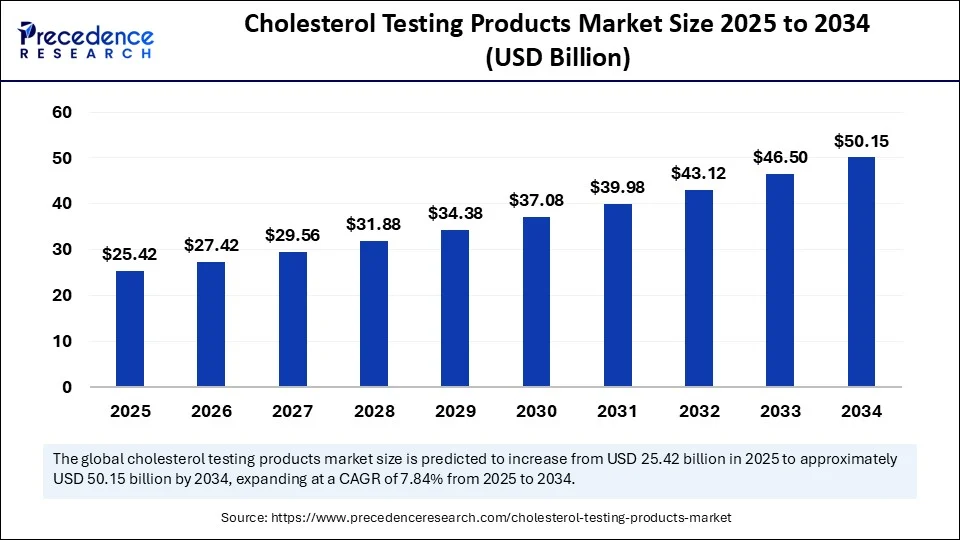

The global cholesterol testing products market size accounted for USD 23.57 billion in 2024 and is predicted to increase from USD 25.42 billion in 2025 to approximately USD 50.15 billion by 2034, expanding at a CAGR of 7.84% from 2025 to 2034. The demand for cholesterol testing products is increasing due to the rising prevalence of cardiovascular diseases, which is likely to boost the growth of the market during the forecast period.

Cholesterol Testing Products Market Key Takeaways

- In terms of revenue, the global cholesterol testing products market was valued at USD 23.57 billion in 2024.

- It is projected to reach USD 50.15 billion by 2034.

- The market is expected to grow at a CAGR of 7.84% from 2025 to 2034.

- North America dominated the global cholesterol testing products market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product type, the test kits and reagents segment captured the largest revenue share in 2024.

- By product type, the cholesterol analyzers segment is expected to grow at the fastest CAGR during the forecast period.

- By test type, the total cholesterol test segment generated the highest revenue share in 2024.

- By test type, the comprehensive lipid panel (CLP) segment is expected to grow at the fastest CAGR during the projected period.

- By mode of testing, the laboratory-based testing segment contributed the highest revenue share in 2024.

- By mode of testing, the home-based testing segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By end user, the diagnostic laboratories segment generated the major revenue share in 2024.

- By end user, the home care setting segment is expected to grow at the fastest CAGR during the projection period.

- By distribution channel, the hospital pharmacies segment held the highest revenue share in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at the fastest CAGR during the forecast period.

How is AI Revolutionizing the Cholesterol Testing Products Market?

Artificial intelligence is significantly transforming the market for cholesterol testing products by improving accuracy and enabling personalized risk assessments. AI can accurately analyze data from cholesterol tests, leading to precise diagnoses. AI also accelerates the analysis of test results, leading to rapid diagnoses. It predicts potential risks by analyzing historical and current data of cholesterol test results, optimizing patient outcomes.

Market Overview

The cholesterol testing products market refers to the ecosystem of diagnostic tools, reagents, consumables, and devices used to measure cholesterol levels total cholesterol, HDL, LDL, and triglycerides in blood samples. These products play a critical role in screening, diagnosing, and managing cardiovascular diseases, metabolic disorders, and related health risks. The market encompasses both clinical lab-based and home-based testing solutions, including test strips, analyzers, reagents, and digital platforms. The rising incidence of hypercholesterolemia, lifestyle diseases, and increasing preventive healthcare adoption drives demand.

What are the Major Growth Factors of the Cholesterol Testing Products Market?

- The rising aging population is one of the crucial growth factors that has led to the increasing risk for high cholesterol, which demands preventive care for these individuals. According to the United Nations data, in 2024, approximately 10.3% of the global population is aged 65 and over.(Source: https://www.unfpa.org)

- The growing prevalence of lifestyle disorders like diabetes, obesity, and hypertension is also one of the major factors that indirectly lead to abnormality in cholesterol levels. According to data from the World Health Organization (WHO), 2.5 billion adults (18 years and older) were overweight in 2022. Of these, 890 million were living with obesity.(Source: https://www.who.int)

- The rising health awareness is also playing a crucial role in increasing the consumer expenditure on healthcare diagnosis in the developing economies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 50.15 Billion |

| Market Size in 2025 | USD 25.42 Billion |

| Market Size in 2024 | USD 23.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Test Type, Mode of Testing, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Government Initiatives

The rising government initiatives and health screening programs are among the major drivers boosting demand for cholesterol testing products. Governments around the world are highly focused on the early detection of various non-communicable diseases. For example, India's National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS) includes cholesterol and lipid profile screening as part of routine health check-ups conducted across the country. Private institutions are also adopting advanced technologies that help cater to patient demand.(Source: https://www.mohfw.gov.in)

Restraint

Lower Accessibility in Underdeveloped Areas

Underdeveloped regions, especially rural areas, often lack adequate healthcare infrastructure. This comes after limited financial availability that restricts the adoption of advanced medical devices due to their higher costs. The cholesterol testing products market may also face certain challenges due to the lack of awareness among individuals in rural areas about the importance of cholesterol testing. As a result, the adoption of these products is low in underdeveloped areas, restraining market growth.

Opportunity

Digital Health Integration

The global healthcare system has been undergoing a significant digital transformation, enabling organizations and companies to streamline their processes and improve treatment outcomes. The introduction of real-time monitoring and data tracking through mobile applications has enabled the testing of cholesterol from remote locations. The cholesterol testing products market is expected to gain popularity as these devices are designed to help track cholesterol levels remotely. The AI integration is expected to facilitate other analyses and provide recommendations for enhancing patient outcomes. The digital shift is also expected to increase engagement through constant alerts and test reminders for the patients. Moreover, the rising demand for point-of-care testing presents new opportunities for market growth.

Product Type Insights

What made test kits & reagents the dominant segment in the cholesterol testing products market in 2024?

The test kits & reagents segment dominated the market while holding the largest share in 2024. The dominance of the segment is attributed to the higher usage of these products in clinics and home-based settings for cholesterol testing. These products have gained immense popularity due to the growing demand for routine check-ups. Reagents are crucial in cholesterol testing. Their ease of use and ability to deliver rapid results make them the preferred choice in multiple settings.

On the other hand, the cholesterol analyzers segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the segment is attributed to the rising demand for point-of-care testing, which provides rapid and on-site results. Cholesterol analyzers are versatile tools suitable for multiple applications, including clinical and pharmacy tests. The rising focus on preventive healthcare is a major reason contributing to the increasing number of screening programs, which require these products. Technological innovations in analyzers further support segmental growth.

Test Type Insights

Why did the total cholesterol testing segment dominate the market in 2024?

The total cholesterol testing segment registered its dominance in the cholesterol testing products market by capturing the largest share in 2024. The segment's dominance is attributed to the widespread use of total checkups in many routine programs. The majority of professionals opt for these tests due to their comprehensive coverage, which helps them achieve more desirable results. The rising health awareness among individuals is one of the major factors that has been promoting the use of complete cholesterol testing. Additionally, the initial assessment requirement for various testing includes total testing in the first step. With the growing awareness of early detection of cardiovascular risks, there is a high demand for total cholesterol testing, which is expected to drive the segment's long-term growth.

The comprehensive lipid panel (CLP) segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is attributed to the increasing demand for detailed analysis of cholesterol testing to achieve more accurate results. These panels help measure LDL, HDL, triglycerides, and VLDL. Clinical settings are investing heavily in lipid panels to create more personalized treatment plans for some patients. The increasing use of these tests in chronic disease management, such as diabetes and obesity, is expected to drive demand for lipid panel testing in the future.

Mode of Testing Insights

How does the laboratory-based testing segment dominate the cholesterol testing products market in 2024?

The laboratory-based testing segment accounted for the highest revenue share in 2024. The segment's dominance is attributed to patients' higher reliance on laboratory-based tests, which offer comprehensive testing capabilities and the availability of skilled expertise. These settings ensure accurate results and data collection during testing. Additionally, these settings have a higher patient volume due to their sophisticated infrastructure. Rising investments in urban diagnostics centers and laboratories are expected to increase the patient volume in these settings in the coming years.

The home-based testing segment is expected to grow at the fastest CAGR in the upcoming period. The growth of the segment is attributed to the rising demand for convenience and privacy, which is boosting the demand for home-based testing. Healthcare providers are investing heavily in easy-to-use and point-of-care testing products to expand home healthcare services. Due to the increased healthcare costs, individuals are rapidly turning toward home-based healthcare solutions to reduce hospital visits, which is expected to support segmental growth.

End-User Insights

Why did the diagnostic laboratories segment dominate the cholesterol testing products market in 2024?

The diagnostic laboratories segment dominated the market, accounting for the highest revenue share in 2024. The dominance of the segment stems from the higher testing volume in these settings, creating the need for various tests and tools. Individuals often undergo these tests under professional recommendations, which makes these settings the dominant ones. The well-developed infrastructure of these laboratories is also helping them to attain more revenue in the market. Additionally, some insurance plans cover the testing and diagnostic procedures offered by these settings, which is expected to sustain their dominance in the coming years.

The home care settings segment is expected to grow at the fastest CAGR over the projection period. The growth of the segment is attributed to the rising number of aging population that are looking to reduce frequent visits to hospitals. Many companies are investing in cutting-edge technologies that make it possible to deliver healthcare from remote locations. The rise of telehealth and remote monitoring solutions further supports segmental growth.

Distribution Channel Insights

How does the hospital pharmacies segment dominate the cholesterol testing products market in 2024?

The hospital pharmacies segment marked its dominance in the market by generating the highest revenue share in 2024. The dominance of the segment is attributed to the easy availability of various testing products in these pharmacies. The rising partnerships between hospitals and pharmacy chains are expected to maintain a steady supply of these cholesterol testing products in pharmacies. Additionally, these settings often purchase testing products in bulk quantities from manufacturers, contributing to more revenue generation. These pharmacies also provide guidance, attracting more patients.

The online pharmacies segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the segment is attributed to the rise of e-commerce in the developing and developed regions. These pharmacies offer access to a wide range of products from multiple brands, allowing patients to select products tailored to their specific needs. The rising trend of home-based healthcare further supports segmental growth. Moreover, these pharmacies provide easy doorstep delivery, enabling patients to visit the hospital and pharmacies. This flexibility attracts more patients.

Regional Insights

What made North America the dominant region in the cholesterol testing products market in 2024?

North America marked its dominance in the market by generating the highest revenue in 2024. The dominance of the region is attributed to the increased prevalence of cardiovascular diseases, which is a major cause of death. According to the data from the New York State Department of Health, approximately 695,000 people die from heart disease each year, which accounts for around 1 in 5 deaths. There is a heightened awareness regarding routine checkups, which is boosting the demand for cholesterol testing products.

(Source: https://www.health.ny.gov)

U.S. Cholesterol Testing Products Market Trends

The U.S. is a major contributor to the market. This is primarily due to its well-established healthcare infrastructure, which enables citizens to access various healthcare services. Additionally, the country is home to major medical device manufacturing companies, leading to the rapid development of cholesterol testing devices. Higher awareness of the importance of timely cholesterol level checks also plays a major role in generating significant revenue from home-based testing products. The U.S. government is also investing in initiatives like NHLBI's National Cholesterol Education Program (NCEP) to promote awareness and screening among the citizens, especially focusing on adults. The growing aging population in the country is also expected to support market growth.(Source: https://www.ahajournals.org)

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to grow at the fastest rate during the forecast period of 2025 to 2034. The growth of the market within the region is attributed to the rising prevalence of lifestyle-related diseases, such as diabetes, CAD, and obesity. The prevalence of these conditions is increasing due to the sedentary lifestyles among the middle-class population. Moreover, governments around the region, especially in countries such as China, Japan, and India, are also focused on improving healthcare services. There is a high demand for point-of-care testing due to the growing awareness of early disease detection. The higher population base in the region is also a major factor that has consistently attracted investments in health screening and checkups.

India Cholesterol Testing Products Market Trends

India is a major player in the market, with a high death rate due to heart disease. The Indian government has been focusing on launching programs and policies to improve healthcare awareness and services across both urban and rural regions. A survey conducted by Healthians in 2024 revealed that 31% Indians have high cholesterol. The report also noted that people in the 35-54 age group are particularly affected by this condition. The major reasons behind the rising levels of cholesterol are sedentary habits, poor diet, stress, and sleep problems among Indians. (Source: https://www.hdfcergo.com)

Cholesterol Testing Products Market Companies

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Danaher Corporation (Beckman Coulter)

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Randox Laboratories

- Nova Biomedical

- PTS Diagnostics

- ACON Laboratories

- Bioptik Technology Inc.

- Sekisui Diagnostics

- F. Hoffmann-La Roche AG

- Alere Inc. (now part of Abbott)

- ARKRAY Inc

- Bayer AG

- Jant Pharmacal Corporation

- Trividia Health

- Quest Diagnostics

- Laboratory Corporation of America (LabCorp)

Recent Developments

- In September 2024, the Family Heart Foundation introduced Cholesterol Connect, a free nationwide program that offers at-home lipid screening kits. The initiative helps users to receive test kits like LDL-C, total testing, and many more.(Source: https://www.fiercepharma.com)

- In January 2025, Utrahuman partnered with InsideTracker to launch blood vision, a preventive cardiovascular health package that combines wearable sensor data, metabolic markets and personalized blood panels including lipid profiles.(Source: https://www.globenewswire.com)

Segments Covered in the Report

By Product Type

- Test Kits & Reagents

- Cholesterol Analyzers

- Cholesterol Test Strips

- Lipid Profile Panels

- Lancets & Capillary Tubes

By Test Type

- Total Cholesterol Test

- High-Density Lipoprotein (HDL) Test

- Low-Density Lipoprotein (LDL) Test

- Triglycerides Test

- Comprehensive Lipid Panel (CLP)

By Mode of Testing

- Home-Based Testing

- Point-of-Care Testing (POCT)

- Laboratory-Based Testing

By End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Home Care Settings

- Ambulatory Surgical Centers

- Research Institutes & CROs

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

- Direct Sales (B2B)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting