What is the Cloud Infrastructure Services Market Size?

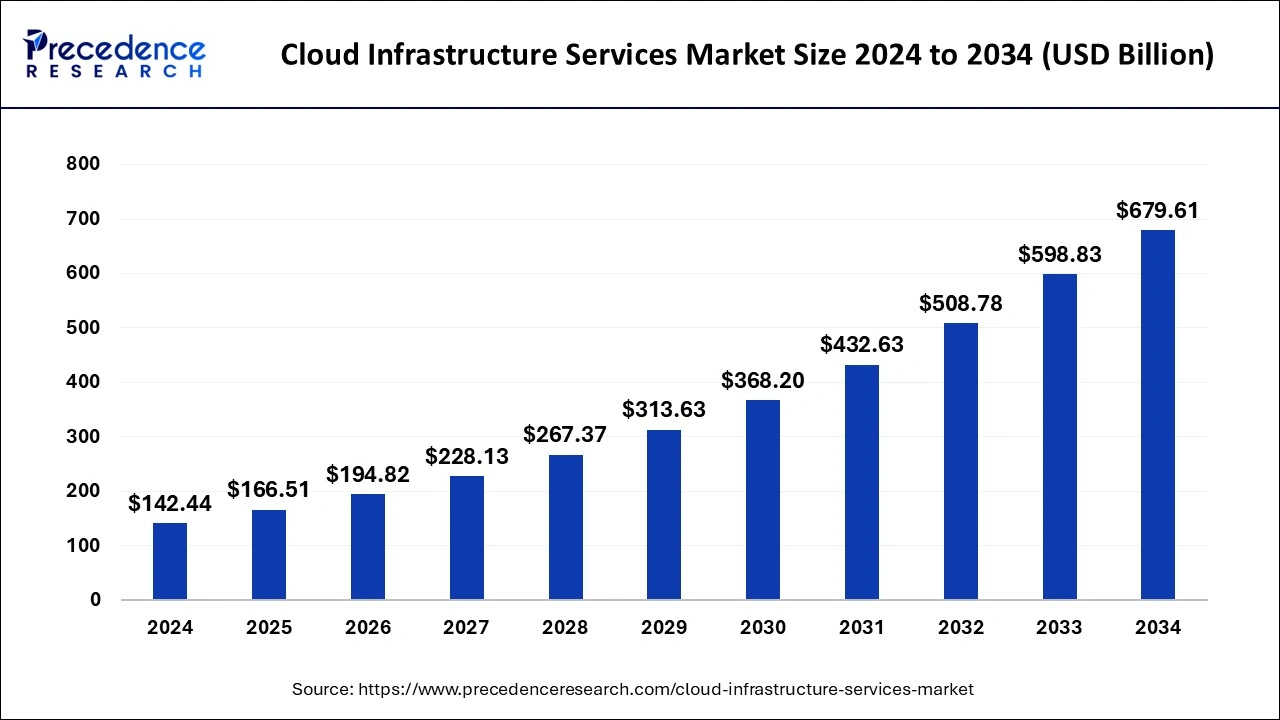

The global cloud infrastructure services market size accounted for USD 166.51 billion in 2025 and is predicted to increase from USD 194.82 billion in 2026 to approximately USD 766.57 billion by 2035, expanding at a CAGR of 16.50 % from 2026 to 2035.

Cloud Infrastructure Services Market Key Takeaways

- The global cloud infrastructure services market was valued at USD 166.51 billion in 2025.

- It is projected to reach USD 766.57billion by 2035.

- The cloud infrastructure services market is expected to grow at a CAGR of 16.50% from 2026 to 2035.

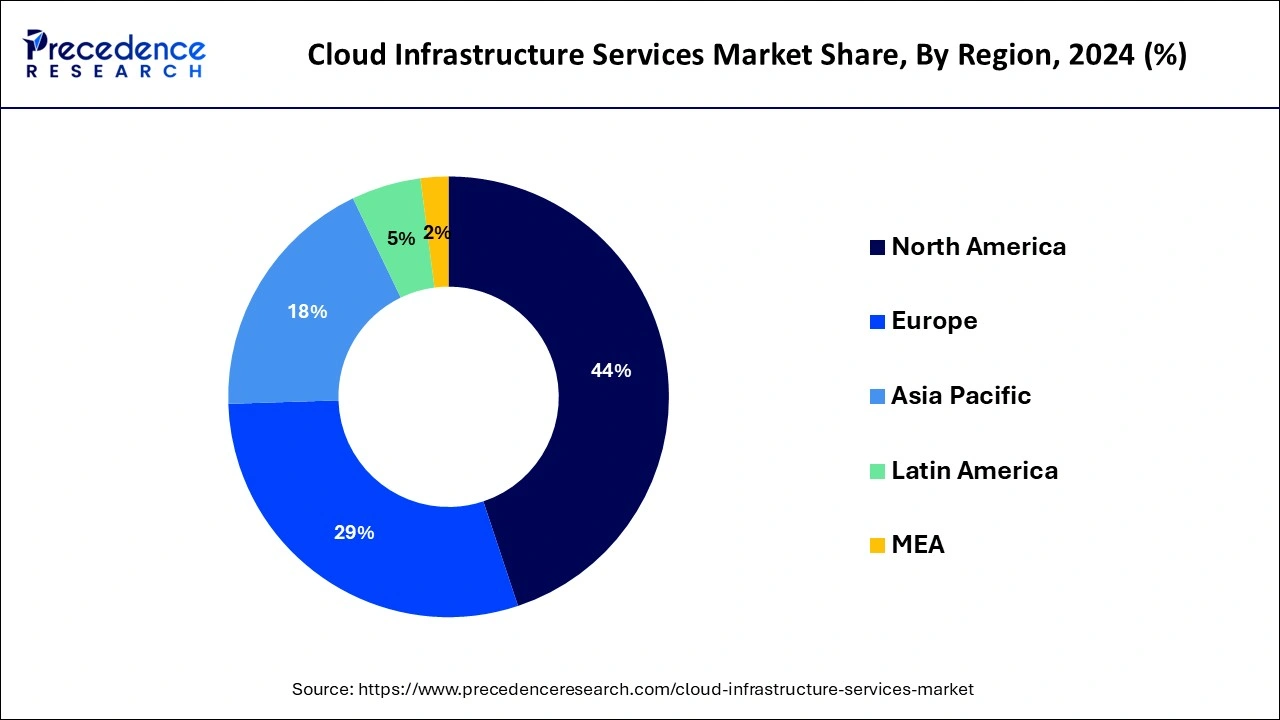

- North America contributed more than 44% of market share in 2025.

- Asia-Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By service type, the compute as a service segment has held the largest market share of 33% in 2025.

- By service type, the networking as a service segment is anticipated to grow at a remarkable CAGR of 18.9% between 2026 and 2035.

- By deployment model, the public cloud segment generated over 36% of the market share in 2025.

- By deployment model, the hybrid cloud segment is expected to expand at the fastest CAGR over the projected period.

- By organization size, the small and medium-sized enterprises (SMEs) segment generated over 56% of the market share in 2025.

- By organization size, the large enterprises segment is expected to expand at the fastest CAGR over the projected period.

- By end-user vertical, the IT & telecommunications segment generated over 21% of market share in 2025.

- By end-user vertical, the retail segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Cloud infrastructure services involve the flexible provision of computing resources, including virtualized hardware, storage, and networking, accessible on-demand via the internet. This approach liberates both businesses and individuals from the burdens of maintaining physical infrastructure, providing seamless access to computational capabilities. Noteworthy for its scalability, adaptability, and cost-effectiveness, these services empower users to modify their infrastructure according to changing demands. The pivotal role of cloud infrastructure in contemporary IT architectures is unmistakable, alleviating organizations from the complexities of hardware management. It ensures a dependable and secure channel for accessing computational resources, creating an environment conducive to innovation and development.

Cloud Infrastructure Services Market Data and Statistics

- According to Eurostat, cloud computing in the EU is primarily utilized for email services (66%) and file storage (53%). While email management remains consistent, file storage applications have seen a significant 15% increase.

- In December 2022, Microsoft and LSEG revealed a one-year strategic collaboration, involving equity investments by Microsoft in LSEG through share acquisition. The focus of this collaboration is on next-generation data and analytics, as well as cloud infrastructure solutions.

- In October 2022, Oracle announced the expansion of its cloud infrastructure portfolio. This expansion enables partners, including system integrators and telecommunications companies, to offer and deliver cloud services to their respective customer bases.

- A report by Global Workplace Analytics found that remote work has grown by 140% since 2005, underscoring the necessity for cloud services to support a dispersed workforce.

- The Cost of a Data Breach Report by IBM Security found that the average cost of a data breach is $4.24 million, emphasizing the importance of robust cloud security solutions.

- IDC predicts that the global datasphere will grow to 175 zettabytes by 2025, propelling the demand for cloud storage and processing capabilities.

Cloud Infrastructure Services Market Growth Factors

- Cloud infrastructure services provide organizations with the ability to scale their computing resources based on demand.

- Cloud infrastructure allows for a pay-as-you-go model, eliminating the need for significant upfront investments in physical hardware.

- Cloud services foster innovation by providing a platform for the rapid development and deployment of applications. This agility allows businesses to respond quickly to market demands, experiment with new ideas, and stay ahead in competitive environments.

- Cloud infrastructure services offer a global presence with data centers strategically located around the world. This global reach ensures low-latency access to resources for users across different geographic locations, supporting businesses with an international footprint.

- Cloud providers invest heavily in security measures and compliance certifications. This enhances data protection, access control, and regulatory compliance, addressing concerns related to the security of sensitive information and ensuring adherence to industry-specific regulations.

- Cloud infrastructure facilitates seamless collaboration among teams by providing centralized access to data and applications. It promotes connectivity through integration with various tools and services, supporting a cohesive and interconnected digital ecosystem for businesses.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 16.50% |

| Market Size in 2025 | USD 166.51 Billion |

| Market Size in 2026 | USD 194.82 Billion |

| Market Size by 2035 | USD 766.57 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Deployment Model, y Organization Size, and End-user Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for digital transformation

The escalating demand for digital transformation has become a driving force behind the surging market demand for cloud infrastructure services. As organizations increasingly prioritize adopting digital-first strategies, cloud services play a pivotal role in facilitating this transformative journey.

- According to a comprehensive survey by IDG, a staggering 89% of enterprises have either initiated or planned digital transformation initiatives.

Cloud infrastructure services provide the scalable, flexible, and innovative foundation necessary for businesses to modernize their operations, enhance agility, and stay competitive in rapidly evolving markets. Businesses leveraging cloud infrastructure witness streamlined processes, enhanced collaboration, and improved customer experiences, all of which are central to successful digital transformation efforts.

The ability of cloud services to offer on-demand computing resources, cost-efficiency, and a platform for rapid development positions them as a fundamental enabler of digital initiatives across various industries. As the demand for digital transformation continues to intensify, the cloud infrastructure services market is poised to expand further, providing the essential technological backbone for organizations navigating the complexities of the digital age.

Restraint

Limited customization for certain workloads

The limitation of customization for certain workloads acts as a notable restraint on the market demand for cloud infrastructure services. In industries with highly specialized computing needs, the one-size-fits-all nature of some cloud offerings may fall short of meeting specific requirements. Organizations engaged in niche sectors, such as scientific research or complex simulations, often demand customized configurations that may not be easily accommodated within standardized cloud infrastructures. This limitation hampers the adoption of cloud services in sectors where tailored solutions are integral for optimal performance and efficiency.

The reluctance of businesses to migrate workloads to the cloud due to inadequate customization options can impede the overall growth of the cloud Infrastructure services market. To address this restraint, cloud service providers need to enhance flexibility and offer more tailored solutions to cater to the diverse and unique demands of industries requiring specialized computing configurations, ensuring broader market acceptance and accelerated adoption.

Opportunity

Edge computing expansion

The expanding landscape of edge computing is creating significant opportunities for the cloud infrastructure services market. As edge computing gains prominence, there is a growing need for decentralized infrastructure that brings computational power closer to data sources. Cloud infrastructure services can capitalize on this trend by developing solutions tailored to edge environments. Offering scalable and flexible resources for processing data at the edge allows businesses to optimize performance, reduce latency, and enhance overall efficiency. Cloud providers that strategically position themselves to meet the demands of edge computing scenarios can unlock new revenue streams and cater to industries requiring real-time data processing capabilities.

Moreover, the integration of cloud infrastructure services with edge computing enables a seamless and interconnected computing ecosystem. This collaboration not only enhances the capabilities of edge devices but also ensures a cohesive infrastructure that spans from the edge to centralized cloud resources. The synergy between cloud infrastructure and edge computing presents an opportunity for service providers to offer comprehensive solutions, addressing the evolving needs of businesses across various sectors, from manufacturing and healthcare to smart cities and IoT applications.

Segment Insights

Service Type Insights

The compute as a service segment had the highest market share of 33% in 2025. Compute as a service (CaaS) is a facet of cloud infrastructure services that delivers instant access to computing resources like processing power and storage. This eliminates the necessity for organizations to manage physical servers. Current trends in CaaS involve the rising popularity of serverless computing, enabling users to pay solely for actual compute usage and enhancing cost-effectiveness. Furthermore, the growth of containerization technologies, notably Kubernetes, is fostering the creation of more adaptable and scalable compute solutions within the cloud infrastructure services landscape.

The networking as a service segment is anticipated to expand at a significant CAGR of 18.9% during the projected period. This approach allows businesses to access scalable networking resources without the burden of extensive physical infrastructure, encompassing virtualized routers, switches, and related components. Trends in NaaS involve the increasing adoption of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV), enhancing network agility. This evolution enables businesses to efficiently manage and optimize their networking resources, fostering improved scalability and responsiveness in the rapidly changing cloud infrastructure landscape.

Deployment Model Insights

The public cloud segment has held a 36% market share in 2025. In the cloud infrastructure services market, the public cloud segment refers to services provided by third-party vendors over the internet, accessible to multiple users.

- As of the latest data, Visual Capitalist reports that Amazon Web Services (AWS) is a dominant factor in the public cloud infrastructure services sector. AWS boasts over a million active users spanning 190 countries, solidifying its global reach and widespread adoption.

Public cloud adoption continues to surge due to its cost-effective, scalable, and on-demand nature. Organizations increasingly leverage public cloud services for applications, storage, and computing resources. Key trends include a focus on multi-cloud strategies, emphasizing workload distribution across multiple public cloud providers for enhanced resilience and flexibility. Additionally, the integration of advanced technologies such as artificial intelligence and machine learning within public cloud offerings is driving innovation and efficiency.

The hybrid cloud segment is anticipated to expand fastest over the projected period. Hybrid cloud deployment in the cloud infrastructure services market involves a combination of on-premises infrastructure and cloud services. This model allows businesses to leverage the benefits of both environments, maintaining sensitive data on-premises while utilizing the scalability and flexibility of the cloud for other workloads. A notable trend in the hybrid cloud segment is the increasing adoption of multi-cloud strategies, where businesses use services from multiple cloud providers. This approach provides redundancy, avoids vendor lock-in, and optimizes performance, reflecting a dynamic shift in how organizations architect their IT infrastructure for enhanced efficiency and resilience.

Organization Size Insights

The small and medium-sized enterprises (SMEs) segment held 56% market share in 2025. Within the cloud infrastructure services market, Small and Medium-sized Enterprises (SMEs) represent businesses with modest employee and revenue figures. A discernible trend is the growing embrace of cloud services by SMEs to bolster operational efficiency, scalability, and cost-effectiveness. SMEs are increasingly utilizing cloud infrastructure for functions such as data storage, application hosting, and collaborative tools, positioning themselves competitively alongside larger enterprises. This trend underscores the acknowledgment among SMEs of the strategic benefits inherent in leveraging cloud infrastructure services to facilitate their expansion and digital transformation endeavors.

The large enterprises segment is anticipated to expand fastest over the projected period. In the cloud infrastructure services market, large enterprises, characterized by their extensive operations and substantial IT needs, form a crucial segment. These organizations demand scalable, secure, and reliable cloud solutions to support their complex infrastructure requirements. Trends indicate a growing preference for hybrid and multi-cloud strategies among large enterprises, allowing them to maintain critical workloads on-premises while leveraging the cloud for flexibility. Additionally, there is an emphasis on specialized solutions catering to industry-specific demands, reflecting the nuanced requirements of diverse large-scale enterprises in their cloud adoption strategies.

End-user Vertical Insights

The IT & telecommunications segment has held a 21% market share in 2025. In the cloud infrastructure services market's IT & Telecommunications segment, businesses within the Information Technology and Telecommunications sectors leverage cloud services for scalable and agile infrastructure. This involves cloud-based storage, computing resources, and networking solutions. A notable trend in this segment is the increasing adoption of hybrid cloud models, allowing IT and Telecom companies to balance performance and security by integrating on-premises and cloud infrastructure. This strategic approach enhances flexibility, supporting the dynamic nature of IT operations and the evolving demands of the telecommunications industry.

The retail segment is anticipated to expand fastest over the projected period. In the context of the cloud infrastructure services market, the retail segment refers to businesses involved in the sale of goods and services to consumers. Retailers leverage cloud infrastructure to enhance customer experiences, optimize supply chain operations, and facilitate e-commerce platforms. A growing trend in this sector is the adoption of cloud-based solutions for inventory management, personalized marketing, and seamless omnichannel experiences. Cloud services enable retailers to scale resources based on demand, improve operational efficiency, and stay agile in a rapidly evolving digital retail landscape.

Regional Insights

What is the U.S. Cloud Infrastructure Services Market Size?

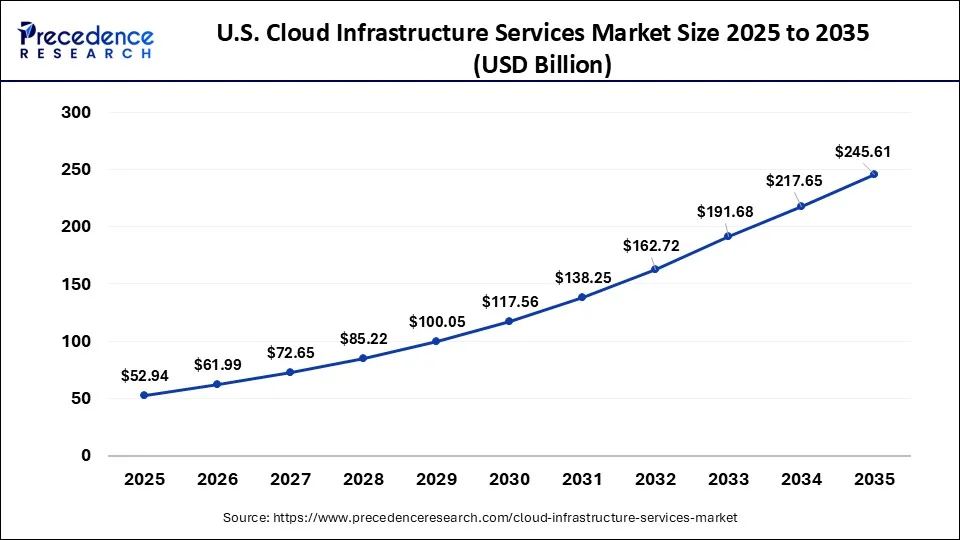

The U.S. cloud infrastructure services market size was exhibited at USD 52.94 billion in 2025 and is projected to be worth around USD 245.61 billion by 2035, growing at a CAGR of 16.59% from 2026 to 2035.

North America held a share of 44% in the cloud infrastructure services market in 2025, primarily attributable to its advanced technological ecosystem, resilient IT infrastructure, and widespread adoption of cloud solutions. The region's early commitment to digital transformation, coupled with a dense concentration of technologically adept enterprises, propels a considerable demand for cloud services. Key industry players such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform play pivotal roles, contributing to North America's predominant market position. Furthermore, the region's proactive stance toward innovation, favorable regulatory frameworks, and substantial investments in cloud technologies collectively reinforce North America's leadership in the global cloud infrastructure services landscape.

Asia-Pacific is gearing up for substantial growth in the cloud infrastructure services market, driven by the surge in digital transformation endeavors, widespread internet accessibility, and a rising preference for cloud-based solutions. The dynamic technological landscape in the region sees businesses increasingly embracing cloud services to bolster flexibility, scalability, and cost-efficiency. The escalating need for data storage and processing capabilities, coupled with the emergence of edge computing, adds significant impetus to the flourishing potential of the Asia-Pacific cloud infrastructure services market, positioning it prominently in the global digital landscape.

Meanwhile, Europe is witnessing significant growth in the cloud infrastructure services market due to a surge in digital transformation initiatives across industries. The region's businesses are increasingly embracing cloud solutions to enhance scalability, agility, and cost-efficiency. Factors such as the rising demand for remote work solutions, increased data generation, and a focus on cyber security are driving this adoption. Additionally, strategic collaborations and expansions by major cloud service providers contribute to the region's robust cloud infrastructure market growth, positioning Europe as a key player in the global digital economy.

What are the Advancements in the Cloud Infrastructure Services Market in Latin America?

Latin America is expected to witness a substantial amount of growth throughout the forecast period. This growth and development are mainly driven by factors like increasing digitalization in the banking, retail, and telecommunications sectors, as well as expanding internet penetration. Brazil and Mexico are leading players in the region, as they are supported by growing demand for cost-effective cloud-based business solutions and partnerships between global providers and local data center operators

Brazil Cloud Infrastructure Services Market Trends: The country is witnessing a rising demand for scalability and cost efficiency, alongside the growing importance of data analytics, which are helping to boost market expansion and development. Adoption of public, private, and hybrid cloud infrastructures is rising, especially in finance, healthcare, retail, and government, supported by major investments in data centers and digital initiatives that attract global providers and boost local capabilities.

What are the Key Trends in the Cloud Infrastructure Services Market in the Middle East and Africa?

The Middle East and Africa are expected to grow at a steady pace in the upcoming years. This growth is driven by increasing digital transformation investments from the government and enterprise sectors. Cloud adoption in areas such as smart city development, fintech innovation, and e-governance is gaining traction, supported by investments from global providers. Moreover, additional factors like rising mobile internet penetration, government-led digital initiatives, and partnerships drive the market forward.

South Africa Cloud Infrastructure Services Market Trends: Factors such as increasing adoption of cloud-based business tools among startups and SMEs are helping the country turn into an emerging hub for digital innovation and cloud-based enterprise solutions. Global hyperscalers and local data center investments are expanding cloud infrastructure in the region, while enterprises increasingly use high-performance computing resources for advanced workloads.

Cloud Infrastructure Services Market Companies

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud

- Alibaba Cloud

- VMware Cloud

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Salesforce

- Red Hat

- SAP

- Adobe

- Rackspace Technology

Recent Developments

- In August 2025, Google Cloud launched a new suite of AI-driven tools designed to optimize cloud resource management for enterprises. This initiative reflects Google's ongoing commitment to innovation and its focus on providing advanced solutions that meet the complex needs of modern businesses. By leveraging artificial intelligence, Google Cloud aims to differentiate itself in a crowded market, potentially attracting clients looking for cutting-edge technology to enhance operational efficiency.

(Source: https://indianexpress.com) - In November 2025, Microsoft Azure announced a partnership with a leading telecommunications provider, August AI, to produce its AI health companion. This collaboration is strategically significant as it allows Microsoft to extend its services closer to end-users, thereby improving latency and performance. Such partnerships are indicative of a broader trend where cloud providers seek to integrate their services with telecommunications infrastructure.

(Source: https://www.sourcingcares.com) - In December 2022, Avalanche unveiled a strategic partnership with Alibaba Cloud, focusing on empowering users in Asia to deploy validator nodes on Avalanche's public blockchain platform. The collaboration leverages Alibaba Cloud's plug-and-play infrastructure, providing Avalanche developers with seamless access to launch new validators. This initiative is poised to enhance the accessibility and efficiency of Avalanche's blockchain services, particularly in the rapidly evolving Asian market.

- In June 2022, VMware, Inc. introduced VMware vSAN+ and VMware vSphere+, offering organizations a seamless integration of cloud benefits into their existing on-premises infrastructure. This strategic move allows businesses to leverage the advantages of the cloud without disrupting ongoing workloads or host operations. VMware's launch underscores a commitment to facilitating a smooth transition to cloud-based solutions, providing organizations with the flexibility and scalability needed to optimize their infrastructure and adapt to evolving technological landscapes.

Segments Covered in the Report

By Service Type

- Compute as a Service

- Storage as a Service

- Networking as a Service

- Other Service Types (Desktop as a Service, Managed Hosting)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By End-user Vertical

- BFSI

- IT & Telecommunications

- Retail

- Healthcare & Life Sciences

- Government

- Other End-user Verticals (Energy & Utilities, Media & Entertainment)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting