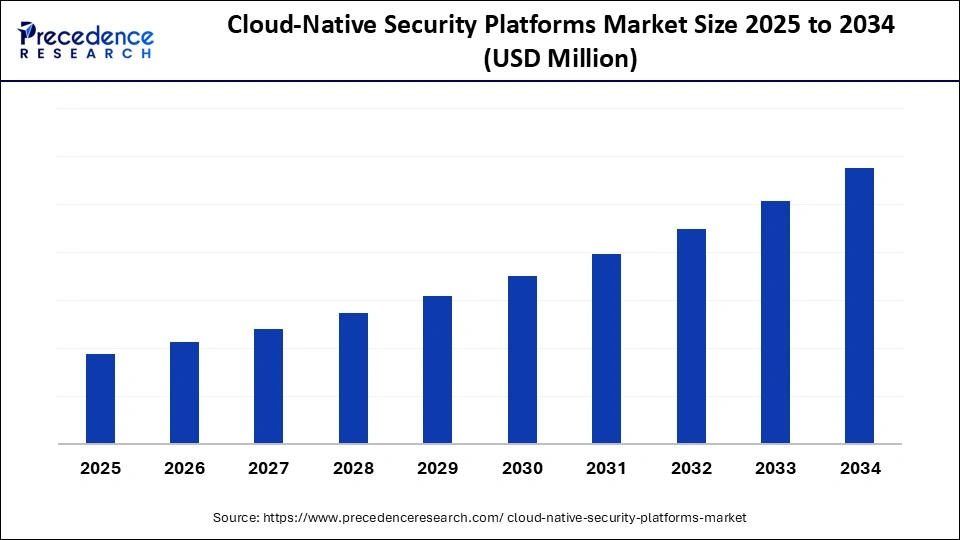

What is the Cloud-Native Security Platforms Market Size?

The global cloud-native security platforms market is witnessing rapid growth as enterprises implement security solutions tailored for cloud-native applications, microservices, and containerized environments.The increasing adoption of digitalization creates growing incidences of malicious activities and cybercrimes that need to be resolved and protect confidential datasets of various sectors are the primary reasons for the market growth.

Cloud-Native Security Platforms Market Key Takeaways

- North America dominated the largest cloud-native security platforms market share of 40% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By component, the platform/software segment led the market in 2024.

- By component, the services segment is anticipated to have the fastest CAGR over the studied period.

- By deployment, the public cloud segment held the biggest market share of 50% in 2024.

- By deployment, the hybrid cloud segment is expected to witness the fastest CAGR during the foreseeable period.

- By organization size, the large enterprises segment captured the highest market share of 60% in 2024.

- By organization size, the small and medium enterprises (SMEs) segment is expected to witness the fastest CAGR during the foreseeable period.

- By security type, the application security segment led the market in 2024 and is expected to grow at the fastest CAGR in the coming years.

- By vertical, the BFSI segment generated the major market share of 30% in 2024.

- By vertical, the healthcare and life sciences segment is expected to witness the fastest CAGR during the foreseeable period.

What are Cloud-Native Security Platforms?

Cloud-native security platforms consist of integrated security solutions designed for cloud-native environments, including containerized applications, microservices, and serverless architectures. These platforms protect workloads, data, and APIs across public, private, and hybrid cloud deployments by combining cloud workload protection, security posture management, container and Kubernetes security, identity and access management, and compliance monitoring. They offer automation, real-time threat detection, and continuous monitoring to address evolving cyber risks. Adoption is driven by the growing shift toward DevOps and agile software delivery, increased deployment of multi-cloud infrastructures, and the need for scalable, adaptive security.

How is AI Transforming the Cloud-Native Security Platforms Market?

The integration of artificial intelligence with cloud-native security platforms can offer various benefits by automating threat detection and responses in real-time to avoid further damage. AI can find out cloud-specific risks like unauthorized access and changes in configuration by analyzing user behavior and malicious activity by the end user. AI algorithms can automate responses like blocking suspicious IPs or changes in vulnerable software after identifying risks in system activity.

AI continuously monitors cloud environments and is able to automatically fix configurations that are responsible for fraudulent activities. It helps ensure to meet security standards are met by converting them into actionable steps within the cloud environment. AI-powered Indicators of Attack offers alerts on a prior basis. Allowing the team to interrupt before breach.

What are the Key Trends in the Cloud-Native Security Platforms Market?

- Zero Trust Architecture: A significant market trend includes frequent use of zero-trust architecture to comply with security standards. It requires constant validation of every access request and does not allow access implicitly without proper verification, which is a crucial step to ensure the security of cloud-native platforms.

- Security integration: Another major trend that the cloud-native security platforms market is witnessing includes the integration of security steps directly into the development lifecycle. This approach offers unparalleled security for applications from malicious activities and supports rapid deployment.

- Data Security and IAM System: The enhanced identity and access management system is a basic requirement for enabling granular access controls. Continuous authentication of consumers and devices under a zero-trust architecture and its principles is essential for robust data security.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode, Organization Size, Security Type, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Complexity of cloud structure

A significant driving factors for the cloud-native security platforms market growth include the complex and dynamic properties of cloud-native applications, the growing need for continuous monitoring and threat detection response, along with evolving security paradigms. Traditional and static security models fall short as cloud-native applications are continuously evolving, expanding, and moving across diverse cloud platforms.

The security measures are moving towards highly granular or micro security that revolves around identity, workloads, and data. Organizations should manage security protocols according to the cloud providers' instructions that require robust IAM and highly stable cloud resource configurations. Organizations are further consolidating security tools like CWPP, CSPM, and KSPM on the same platform for precise visibility of risks.

Restraint

Complexity of Cloud Environment

A restraining factor for the cloud-native security platforms market is the complex nature of cloud-native environments that may lead to misconfiguration, which may translate into potential vulnerabilities for malicious attack by hackers. Cloud-native applications are distributed and use various microservices, APIs, and require frequent deployments, leading to a highly complex architecture. Also, relying on various security tools creates a gap in security coverage.

Opportunity

Unified Security Platforms

A significant opportunity that the cloud-native security platforms market holds is the expansion of cloud-native platforms with unified security solutions. The increasing complexity of the cloud infrastructure has created an urgency for a cloud-native application protection platform. It offers integrated visibility and control and reduces potential threats with robust security backup. The future involves the utilization of AI/ML models to automate threat detection by analyzing a vast number of datasets to find malicious patterns and enable constant real-time threat remediation, as many organizations are increasingly adopting cloud platforms and securing their cloud platforms across various cloud providers.

Segment Insights

Component Insights

Why is platform/software majorly preferred in the cloud-native security platforms market?

The platform/software segment led the market in 2024, with the cloud workload protection platforms (CWPP) sub-segment accounting for nearly 40% of the revenue share. The segment is dominating due to growing enterprises' demand for comprehensive, integrated, and end-to-end results, which further protects the complex and dynamic cloud environment. Also, a unified platform simplifies management, offers constant visibility, and provides security throughout the development lifecycle, making it a preferred option for various enterprises.

The managed security services sub-segment of the services segment is anticipated to have the fastest growth rate. The increasing rate of cyberthreats, the growing complex nature of cloud platforms, along with shortage of skilled professionals that can handle complex issues of cloud infrastructure. At the same time, managed security services offer highly specialized expertise, automated response to queries, along 24/7 monitoring, fueling the segment's growth.

Deployment Insights

How does public cloud deployment help the cloud-native security platform market grow rapidly?

The public cloud segment held the largest market share of nearly 50% in 2024. The segment dominance can be attributed to the increasing adoption of cloud services by all sizes due to their high scalability, flexibility, and cost-effectiveness. Leading cloud providers like AWS, Google Cloud, and Microsoft Azure offer integrated security solutions that appeal to companies looking for agile deployment and managed infrastructure. The growing prevalence of cloud-native architecture and DevOps methods further strengthens the leading position of public cloud platforms.

The hybrid cloud segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The segment is expanding as hybrid cloud offers businesses the chance to balance the benefits of private and public clouds, along with regulatory compliance. It further enables seamless integration with various technologies like IoT, AI, and edge computing.

Organization SizeInsights

How are large enterprises supporting the growth of the cloud-native security platforms market globally?

The large enterprises segment held the largest cloud-native security platforms market share of nearly 60% in 2024. Large enterprises have a complex IT infrastructure that needs special support and constant monitoring to work seamlessly. Also, the organizations must follow strict industry-specific regulations and data privacy regulations like GDPR, HIPAA, further expanding the need for native cloud infrastructure along with robust features for sensitive data.

The small and medium enterprises (SMEs) segment is expected to witness the fastest CAGR during the foreseeable period. The cloud-native security platforms offer subscriptions as per need, making it highly cost-effective, which is a leading requirement for SMEs without a huge investment to build cloud infrastructure for simpler solutions. They allow SMEs to grow and allow scalable solutions.

Security Type Insights

Why do virtual firewalls dominate the cloud-native security platforms market?

The virtual firewalls subsegment of the network security segment held the largest market share of nearly 35% in 2024. Virtual firewalls provide inherent scalability, flexibility, and cost-effectiveness with faster deployment speeds as compared to conventional hardware devices. Virtual firewalls can scale up easily as per fluctuating demands, which is a crucial capability in dynamic cloud environments. Cloud-based solutions minimize capital expenses related to purchasing and maintaining physical hardware.

The runtime protection subsegment of the application security segment is expected to have the fastest growth rate. The reason behind the segment's expansion includes the emergence of containerization, multi-cloud strategies, and microservices that require specialized tools to handle. The cloud native architecture is basically dynamic and highly scalable, which is crucial for the segment's growth.

Vertical Insights

Why is the BFSI segment majorly utilizing the cloud-native security platforms market?

The BFSI segment held the largest share of nearly 30% in 2024. The segment's dominance can be attributed to a couple of stringent regulations and high-volume datasets that are crucial to protect. Increasing cyber-threats and growing need for scalability and resilience for financial operations. These platforms provide advanced data protection and the agility for the required digital changes in the financial sector. Cloud-native security platforms offer real-time monitoring, which further reduces potential threats by interrupting at the same instance.

The healthcare and life sciences segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The segment is remarkably growing due to increasing adoption of cloud computing for digital health programs like telehealth monitoring and medical research, which generate massive datasets with sensitive information. It requires strong data protection to avoid malicious activities, which are offered by cloud-native security platforms, propelling the segment's growth largely.

Regional Insights

Why does North America dominate the cloud-native security platforms market?

North America held the largest market share of nearly 40% in 2024. The region's dominance can be attributed to various factors, including the increasing adoption of cloud platforms, a highly developed cybersecurity ecosystem, substantial investment in cybersecurity and AI, growing digitalization across various sectors, supportive government policies and regulations, and the presence of leading marketers in cloud technologies. The region holds a mature cybersecurity ecosystem with well-established cybersecurity vendors and startups with cloud-based technologies, further facilitating innovative solutions and service provider platforms in the market. Key marketers like AWS, Google Cloud, and Microsoft Azure fuel demand for security solutions, expanding market growth.

How does digitalization support the cloud-native security platforms market in the Asia Pacific?

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The increasing adoption of digitalization by leading countries in the region, along with a rise in cybersecurity breaches, are significant factors driving the market's growth. Cloud protective platforms have become a crucial part of cloud-based technologies, fueling the demand for a highly secure cloud environment. Different sectors like finance, e-commerce, healthcare, and manufacturing are increasingly embracing cloud technologies, creating a huge demand for cloud-native platforms to safeguard sensitive data about enterprises and their finances. Many organizations are outsourcing their IT management to third-party providers, enabling a greater need for cloud security in real time with monitoring solutions.

Value Chain Analysis

- Development and Supply Chain Security

This stage focuses on the integration of security practices at the initial stage of the development lifecycle. It addresses potential threats before production, creating high-end security.

Key players:Aikido Security, Fugue, Tenable Cloud Security, Wiz, Palo Alto Networks, and Red Hat.

- Deployment and Runtime Security

This stage involves cloud security posture management-CSPM which evaluates and increases security across different cloud platforms while finding the gaps in the configurations.

Key players: SentinelOne, CrowdStrike, Microsoft Azure, Checkpoint Software Technologies, and Orca Security.

- Operations and Incident Management

The stage involves constant monitoring, potential risks detection, and response with real-time alerts for malicious activities. It further establishes and tests incident response plans without the need for manual intervention.

Key players: Securonix, Hunters Security, Rapid7, Panther Labs, Gurucul, Exabeam, and Microsoft Sentinel.

Cloud-Native Security Platforms Market Companies

- Palo Alto Networks (Prisma Cloud)

- Wiz

- CrowdStrike

- Fortinet (FortiCNP)

- Trend Micro (Cloud One)

- Zscaler

- Qualys

- Lacework

- Check Point Software Technologies

- SentinelOne

Recent Developments

- In June 2025, a leading player in the cloud-native market, Fortinet, expanded its portfolio for cloud-native protection with enhanced capabilities and a range of availability of services in the AWS marketplace. Their updates are related to focus on enhancing real-time visibility, minimizing operational overhead, and offering simplified protection solutions.(Source: https://www.msspalert.com)

- In July 2025, a global leader in cloud security-Wiz forged a new partnership with Telefonica Tech. Their collaboration is aiming to help Spanish businesses manage a multi-cloud environment more securely. Under the agreement, Telefónica Tech will integrate Wiz's industry-leading cloud security platform into its portfolio of services.(Source: https://cybermagazine.com)

Segments Covered in the Report

By Component

- Platform/Software

- Cloud Workload Protection Platforms (CWPP)

- Cloud Security Posture Management (CSPM)

- Container Security

- Kubernetes Security

- API Security

- Services

- Consulting Services

- Managed Security Services

- Training and Support

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Security Type

- Network Security

- Virtual Firewalls

- Intrusion Detection and Prevention

- Application Security

- Code Scanning and Testing

- Runtime Protection

- Endpoint Security

- Cloud Identity and Access Management (IAM)

- Data Security and Compliance

- Encryption

- Tokenization

- Regulatory Compliance

By Vertical

- Banking, Financial Services and Insurance (BFSI)

- Healthcare and Life Sciences

- Retail and E-Commerce

- IT and Telecom

- Government and Défense

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting