What is the Coating Equipment Market Size?

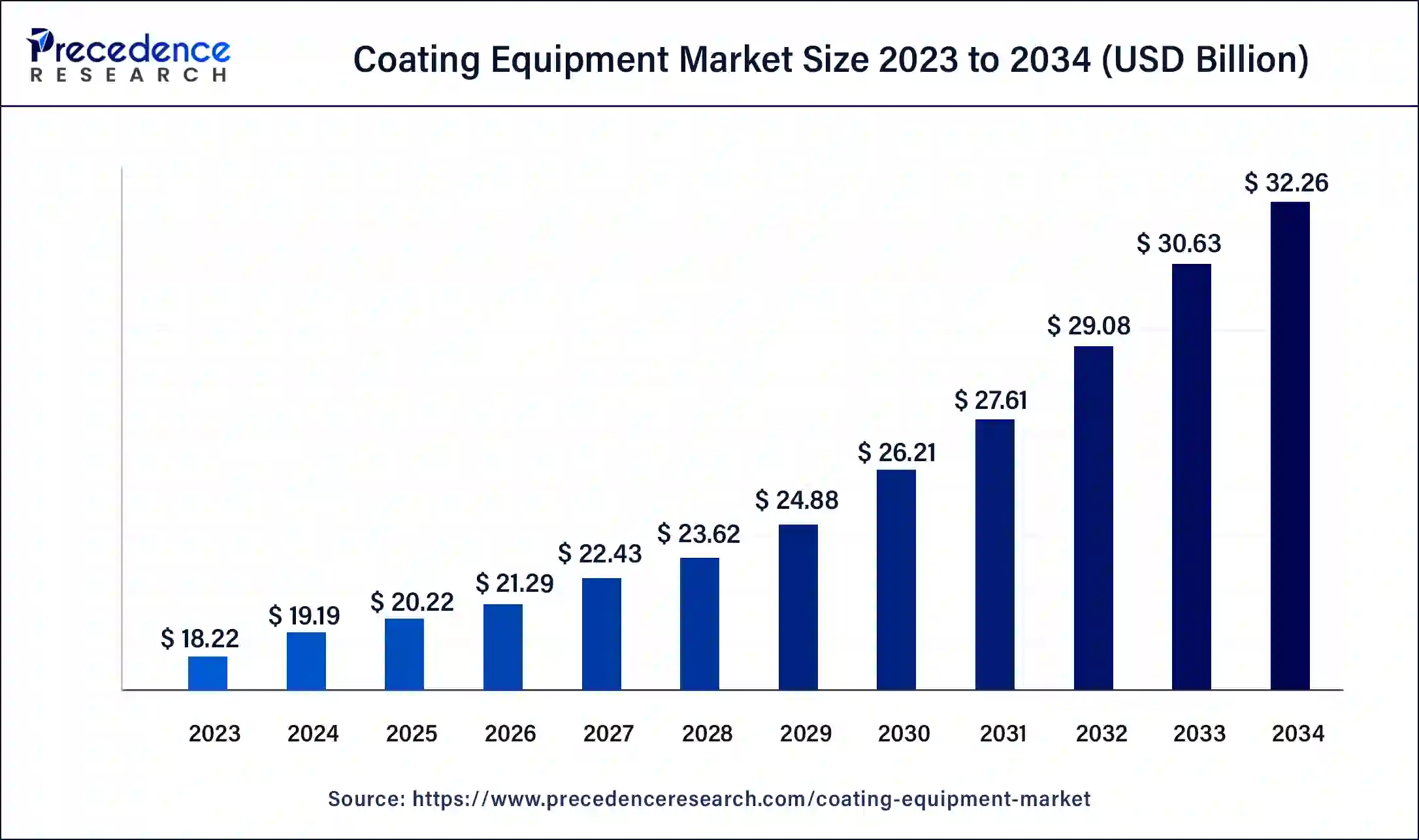

The global coating equipment market size is calculated at USD 20.22 billion in 2025 and is predicted to increase from USD 21.29 billion in 2026 to approximately USD 33.89 billion by 2035, expanding at a CAGR of 5.33% from 2026 to 2035. Increasing adoption of EVs with sustainable coatings demand for its components and advancements in electronics sector are the major driving factors of the coating equipment market.

Coating Equipment Market Key Takeaways

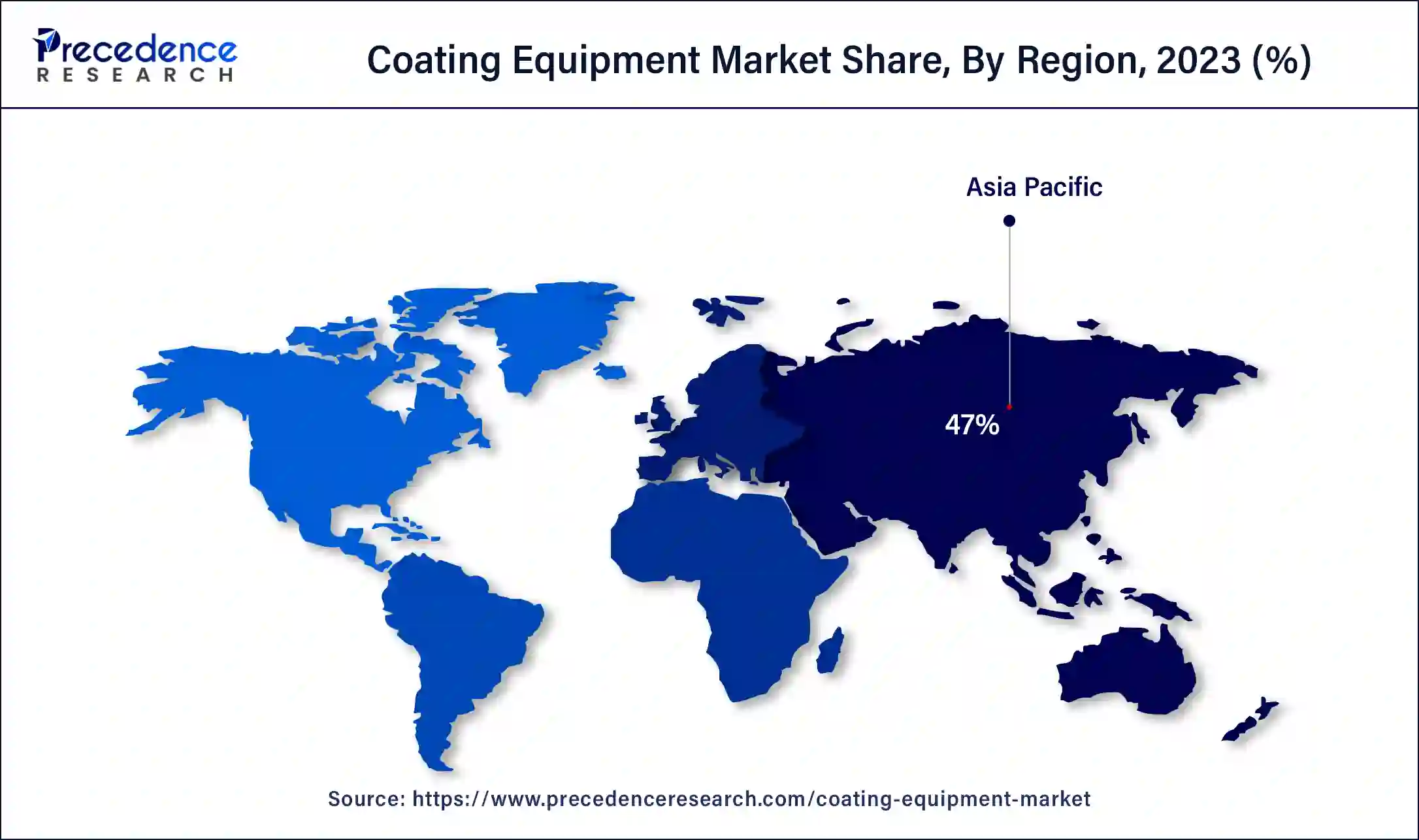

- Asia Pacific dominated the coating equipment market with the largest market share of 47% in 2025.

- By product, the powder coating equipment segment dominated the global market in 2025.

- By product, the specialty equipment segment is estimated to witness significant growth in the market during the forecasted period.

- By application, the automotive segment is anticipated to witness substantial growth in the market during the forecasted years.

- By application, the construction segment is expected to showcase considerable growth in the market in the upcoming period.

- By application, the aerospace segment is expected to witness notable growth in the global market in the forecast period.

What is the role of AI in Coating Industry?

AI is significantly impacting the coating equipment market by providing features like high precision and predictive maintenance.AI driven technology helps in real-time monitoring with control on coating process to avoid wastage of coating material and ensuring smooth, consistent application on the surface. To minimize downtime and maintenance cost AI can be used to predict failure of equipment before time by analyzing huge amount of data. Artificial intelligence (AI) has the ability to connect with IoT devices to collect real-time data and allows for seamless data analysis which enables manufacturers to make data driven decisions to stay as a frontier in the global market.

AI algorithms can also optimize production lines to improve the overall quality of coated products. This technology enables smart coatings that can adapt according to climatic conditions and able to self-heal if they get damaged due to environmental wear and tear.

- In July 2023, AkzoNobel, Netherlands a leading global company for paints and coatings launched a new product in their production line including AI driven technology with it. This AI system helps to smoothen application by analyzing real-time data to ensure consistent thickness of coating and its quality.

Market Overview

The global coating equipment market is poised for significant growth, driven by rising demand from industries such as automotive, aerospace, and electronics. Advancements in technology, emphasizing precision and efficiency, are bolstering the adoption of advanced coating systems. Environmental regulations promoting eco-friendly coatings further enhance market prospects. Asia Pacific, particularly China and India, is a key growth region due to robust industrialization and infrastructure development.

The coating equipment market is characterized by innovations in coating techniques, including powder coating and thermal spray, which offer improved durability and aesthetics. Leading players are investing in R&D to develop sustainable solutions, aiming to meet evolving customer demands while complying with stringent environmental standards.

Coating Equipment Market Growth Factors

- Rapid advancements in the automotive sector are fuelling the coating equipment market growth.

- Expansion of the semiconductor industry and its applications on considerable growth.

- Increasing the adoption of EVs that require the protection of components by using various types of coatings is a significant growth factor.

- Rapid urbanization and infrastructure development.

- Manufacturers invest in R&D for innovative coating methods.

- The adoption of technically advanced coatings fuelling the coating equipment market demand globally.

- Alternatives for customizable coatings solutions.

- Advancements and expanding applications of the aerospace industry.

Growth Trends

- Increased Demand in Automotive Market- The growth of automotive production is into advanced coatings that provide corrosion-resistant properties and aesthetic improvements, which has created greater demand for effective coating equipment to ensure quality and adhere to regulations.

- Growth of Construction Industry- Construction activities are growing, especially in emerging economies, driving demand for protective and decorative coatings, which will drive demand for coating equipment to promote durability and improve appearance.

- Technological Advancements-There are increasing advances in coating technology, such as the use of automated and robotic coating systems, that promote accuracy and efficiency and reduce waste, and allow industries to utilize coating equipment and maintain performance, and have aesthetically beautiful coatings that are cost-effective.

- Government Regulations-Manufacturers have strict government regulations in regard to VOC emissions, which means that they must begin establishing application technologies and equipment that are environmentally friendly, while still performance bound with reasonable sustainability agent.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 33.89 Billion |

| Market Size in 2025 | USD 20.22 Billion |

| Market Size in 2026 | USD 21.29 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.33% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rapid expansion of the electric vehicle market

One of the major driving factors that propel the growth of the coating equipment market is the rising demand for electric vehicles on a large scale globally, owing to their features and eco-friendly technology on which they operate. To protect the components of EVS, it's essential to coat them with materials that are able to combat rust and other environmental stress that cause damage to the important parts of the vehicle.

It also fulfils the purpose of aesthetic look and plays a significant role in the damage-free parts of the vehicle. Since the adoption of EVs has surged, it becomes essential to make it sustainable in terms of the longevity of the vehicle's components. Therefore, coating has its own benefits, which protect and sustain major electronics parts as well.

Governments initiatives

Additionally, to purchase electric vehicles that reduce overall carbon emissions and help reduce carbon footprints, governments, and major authorities globally offer incentives and subsidies along with other plans that promote the adoption of EVs over conventional petrol/diesel-based engine vehicles. Incentives are provided due to rising climate concerns, which can be mitigated by replacing petrol and diesel fuels with battery-operated charging station points.

Therefore, many governments around the world have set a target to maximize the use of EVs by establishing a robust infrastructure for charging point stations, which again fuels the demand for EVs and, in turn, coating the equipment market on a wider scale. Furthermore, the evolving field of electronics and its technological implications positively affect the coating equipment market growth and aid in cost reduction.

Restraint

Budget-friendly alternatives

A significant restraint that affects the global market negatively is the availability of cost-friendly options for specific equipment that may hinder the global coating equipment market. The type of material, the whole coating process, and its application play crucial roles in sustaining the product in the long run. Customization also affects the process of coating as some client may prefer customized coating as per their requirement for the low-cost coating to reduce overall expenses for more profit Margine.

Hence, the conventional coating method that involves brushes and rollers may provide economical yet long-lasting coating similar to advanced techniques that are relatively higher in cost and need more maintenance in some applications. In a nutshell, the easy availability of budget-friendly options in coating equipment impedes the expansion of the market on a global level.

Opportunity

Technological evolution in the equipment coating process

The major opportunities for the coating equipment market are technological advancements and continuous evolution for the better process of coatings and to increase its finishing with sustainability along with low cost. Many end-use industries like automotive and transportation, consumer electronics, aerospace, and others are in search of customized coating equipment processes with technically sound methods for the longevity of the equipment. By recognizing these necessities in the market, a lot of manufacturers are investing heavily in the development of advanced techniques for coatings and conducting R&D to establish a technique that supports customization and fulfils the consumers' needs for coating equipment with a budget-friendly variety of options.

Moreover, innovative techniques for coatings offer long-lasting coating with faster coating processes, further creating new avenues for establishing the market globally. One such example is the development of tribo guns, which aids in the expansion of powder coating. Another is the innovative coating method, which helps minimize air drag and mitigate debris buildup that causes damage to the equipment. Therefore, technological ideas and advancements create a lucrative opportunity that helps develop and expand the coating equipment market on a wider scale.

- In January 2024, SATAke Corporation and FANUC Corporation announced a strategic agreement to create next-generation automated liquid painting systems. This cooperation intends to combine FANUC's expertise in industrial robots and automation with SATAke's knowledge of liquid paint systems. The goal is to create intelligent, high-precision robotic painting solutions for diverse sectors.

Product Insights

The powder coating equipment segment dominated the global coating equipment market in 2025. The growth of this segment is attributed to its ability to effectively cover and coat the desired surface of the equipment. Powder coating can be an antidote for corrosion and abrasion due to unpredicted changes in the environment. Additionally, powder coating is relatively efficiently used without product wastage, which further propels market expansion on a wider scale.

- In January 2024, ITW Corporation's Finishing Systems division receives a large order for powder coating equipment from a major European vehicle manufacturer. This substantial order from a renowned European automobile manufacturer demonstrates the increasing need for powder coating technology in the automotive industry.

The specialty equipment segment is estimated to witness significant growth in the coating equipment market during the forecasted period. The growth of this segment is due to its ability to coat different types of surfaces and materials like wood, metal, and different floors. Moreover, sudden surges in technologies like physical vapor deposition and chemical vapor deposition throughout the major industries are driving the demand for this specialty coating equipment. It is, therefore, anticipated to surpass the powder coating equipment in the foreseeable period.

Application Insights

The automotive segment is anticipated to witness substantial growth in the coating equipment market during the forecasted years. The growth of the automotive sector can be related to the increasing use of coating technologies like vacuum deposition coating and physical vapor deposition, which helps in creating the thin film coating that is most probably used in the outer layer of the automotive. Also, coatings for electronic devices further increase the demand for the coating equipment.

- In January 2024, Wagner Group introduced the ePump Pro, a revolutionary, energy-efficient electric paint pump for industrial applications. This new electric paint pump addresses the growing demand for energy-efficient industrial painting solutions.

The construction segment is expected to showcase considerable growth in the coating equipment market in the upcoming period. The expansion of this segment can be attributed to factors such as an increased rate of urbanization and a rise in disposable incomes driving the high living standard globally, fuelling the construction sector further. The coating is an integrated part of the construction sector as tools and equipment used for construction can be protected well with proper coatings, and they can also be sustainable. Coating windows and doors are preferably used for commercials and residential buildings, propelling the market growth.

The aerospace segment is expected to witness notable growth in the global coating equipment market in the forecast period. The growth of this segment is attributed to factors like the necessity to provide robust security coatings to save aircraft from temperature differences while flying through the atmosphere's different layers. These coatings are mainly used to provide optimal performance, durability, safety factors against corrosion, rapid changes in dynamics of the flight, and overall safety as aerospace missions are time-critical.

- In July 2024, AkzoNobel commenced work on a €22 million redevelopment and modernization program at its aerospace coatings production site at Pamiers, France. The work is expected to be finished by the end of 2026, with AkzoNobel expecting a 50% increase in overall capacity. Product innovation will be supported by investment into two dedicated research and development laboratories for aircraft structure coatings and aircraft cabin interior coatings, where work will continue to develop more chromate-free products for the future.

Regional Insights

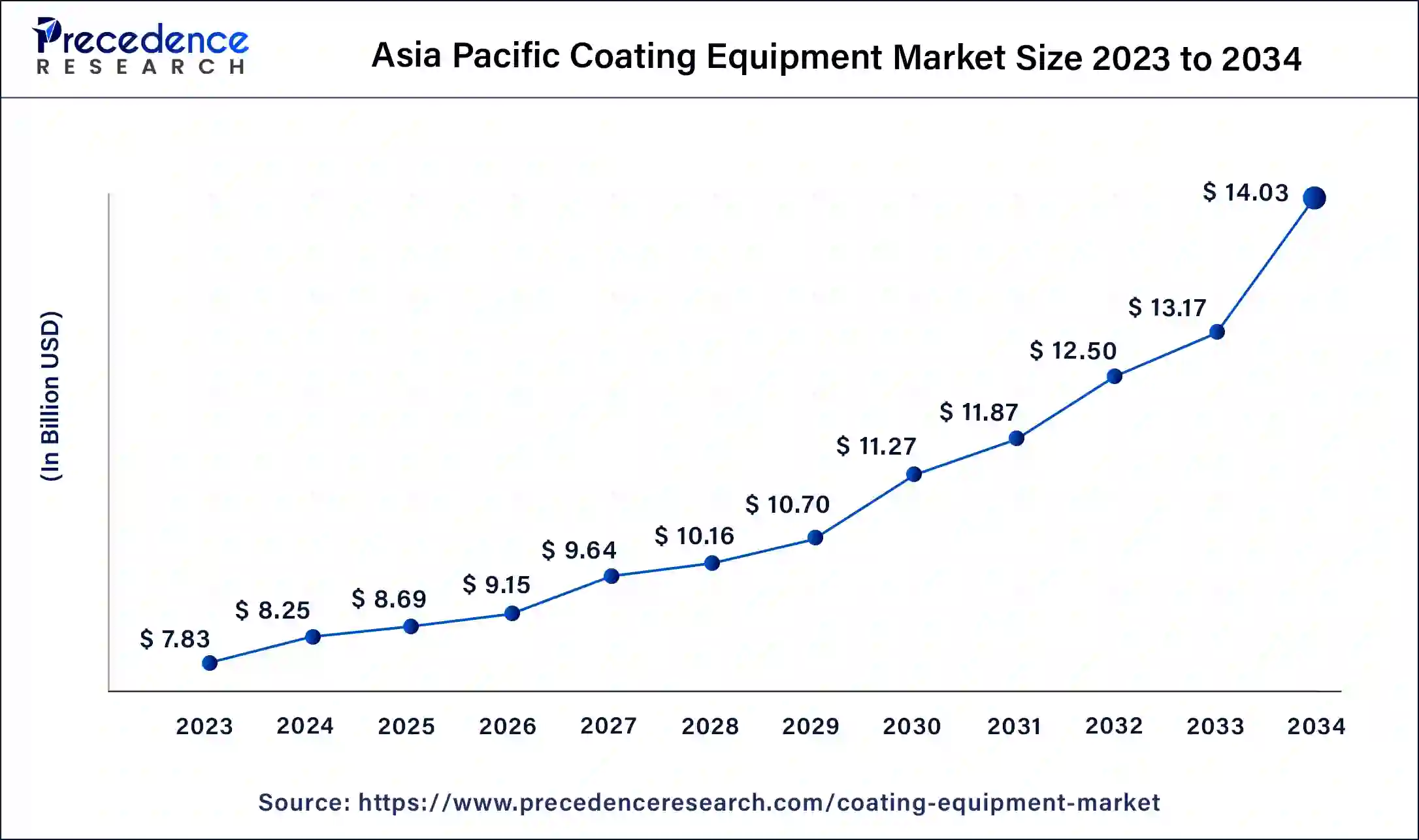

Asia Pacific Coating Equipment Market Size and Growth 2026 to 2035

The Asia Pacific coating equipment market size is exhibited at USD 8.69 billion in 2025 and is projected to be worth around USD 14.89 billion by 2035, poised to grow at a CAGR of 5.53% from 2026 to 2035.

Asia Pacific accounted for the largest market share of the coating equipment market in 2025. Rapid urbanization and growing population are the major factors driving the region's growth in the market. Asia Pacific, witnessing robust changes in the construction sector due to increasing industrialization, needs a sophisticated infrastructure as per the requirements of the type of industry.

- In February 2024, Nikon Paint India (Decorative) launched the 2024 to 2025 color vision book at an event in Bangalore, Outdoor Connections. This project is a collaboration between Nippon Paint and Doctor Kostov Sengupta, a color expert from NIFT. Doctor Sengupta also works as a color consultant for Nippon Paint India.

Moreover, the automotive sector is witnessing rapid changes due to technological evolutions, which in turn propelling the adoption and manufacturing of electric vehicles across the region. Governments' stringent regulations to protect the climatic equilibrium assert an adoption of eco-friendly products and equipment used to manufacture EVs. Such changes in the automotive market inevitably led to a higher demand for coatings, thus fuelling the growth of the coating equipment market across the Asia Pacific and on a global scale.

North America holds a substantial share of the global coating equipment market. The market is proliferating due to the dominance of the U.S. in North America. The U.S. dominates the market in North America due to its strong industrial base and advanced manufacturing capabilities. Major sectors like automotive, aerospace, and electronics rely heavily on high-quality coatings, driving demand for advanced coating equipment.

The presence of leading manufacturers and significant investments in R&D contribute to innovation and technological advancements. Moreover, stringent environmental regulations in the U.S. promote the adoption of eco-friendly and efficient coating technologies, influencing market dynamics across North America. This dominance creates ripples as neighboring countries align with U.S. standards and practices, leading to regional market growth and increased competitiveness in coating technology advancements.

- In April 2022, Biocoat Incorporated, a US-based specialty manufacturer specializing in hydrophilic biomaterial coatings, services, and dip-coating equipment, launched the EMERSE coating equipment line. This line features an in-house dip coating system specifically designed for coating medical devices and facilitating the entire production process.

Europe is expected to showcase notable growth in the coating equipment market during the foreseeable period. Europe contributes to the market's growth through its robust industrial sectors, particularly automotive and aerospace, which demand advanced coatings. Stringent environmental regulations drive the adoption of eco-friendly and efficient coating technologies.

European companies invest heavily in R&D, fostering innovation in the coating equipment market. The region's strong focus on sustainability and energy efficiency further boosts market demand. Additionally, ongoing infrastructure development and renovation projects require high-performance coatings, enhancing market expansion. Government support for sustainable manufacturing and technological advancements also plays a crucial role in propelling the market's growth in Europe.

What are the Key Trends in the Coating Equipment Market in Latin America?

Latin America is expected to witness substantial growth in the market throughout the forecast period. The increasing production of electric vehicles in the region and the emergence of key automotive OEMs are expected to increase demand for coating equipment. In addition to that, technical developments in product development are expected to boost innovation and drive the market even further.

Brazil Coating Equipment Market Trends: The country is expanding due to rising demand for high-quality surface finishing in automotive, industrial, electronics, and construction sectors. Rapid industrialization in manufacturing and metalworking industries is also accelerating the utility of advanced coating technologies.

How is the Middle East and Africa Region Growing in the Coating Equipment Market?

The Middle East and Africa region is expected to witness steady growth in the market, driven by increasing investments in infrastructure and construction projects. The demand for high-quality coating solutions seems to be on the rise, especially in the oil and gas sector. Regulatory support for local manufacturing hubs is also fostering market growth. Countries like the UAE and South Africa are leading the market, with companies focusing on innovation and sustainability to meet regional demands.

Saudi Arabia Coating Equipment Market Trends: The country's market seems to maturing at a steady pace, with a mix of local and international players trying to gain competitive advantage. The market landscape is evolving and there are several opportunities for growth and expansion, thus attracting investments from global players.

Value Chain Analysis of the Coating Equipment Market

- Raw Material Sourcing

The raw materials used for this market include various types of resins, including acrylics, alkyds, epoxies, polyurethanes, and silicones. The selection of quality raw materials determines the performance and quality of the final product.

Key Players: Siemens, Rockwell, Emerson - Manufacturing Process

This stage involves several key steps, including the design, development, and production of the equipment. Innovations such as robotic coating systems, spray guns, and advanced powder coating technologies now offer increased precision and efficiency.

Key Players: Nordson, Graco, Krones - Distribution Process

The distribution process is carried out in various ways, such as direct sales, long-term contracts with automotive companies, and even e-commerce platforms. The automotive, aerospace, and construction industries are key end users.

Key Players: Fastenal, Motion Technologies, Bosch

Coating Equipment Market Companies

- Nordson Corporation

- Gema Switzerland GmbH

- J. Wagner GmbH

- ANEST IWATA Corporation

- Carlise Companies Inc

- IHI Ionbond AG

- Statfield

- SAMES KREMLIN

- The Eastwood Company

- Graco Inc

- RED LINE INDUSTRIES LIMITED

- Pittsburgh Spray

- Reliant Finishing Systems

- ANEST IWATA USA, Inc.

- IHI HAUZE B.V.

Recent Developments

- In May 2025, Herculite Products Inc. announced the acquisition of Strata Film Coatings, a manufacturer of advanced film coating solutions. The acquisition of Strata Films Coatings is part of Herculite's strategic plan, which the company says is to expand its market capability and strengthen its position as a total solution provider in high-performance technical textile composites. (Source: specialtyfabricsreview.com )

- In August 2024, Daich Coatings introduced a new version of the DaiHard MAX Industrial Strength Epoxy Floor Coating Kit. DaiHard MAX Industrial Strength Epoxy Floor Coating Double Kit offers expanded options for providing finishes to interior concrete floors. Peter Daich, president of Daich Coatings, stated, “The price on these kits will only increase by $60 during our summer promotion, but we're providing lots of options with that second gallon for people to truly customize and expand their flooring project.” (Source: forconstructionpros.com )

- In July 2024, AkzoNobel launched the Selva Pro range of 2K polyurethane and acrylic coatings systems for the professional and industrial woodworking community. The Selva Pro range is backed by decades of industry expertise and research and development to provide proven, well-rounded performance for drying time, sanding, hardness, chemical resistance, and potlife. (Source: coatingsworld.com )

Segments Covered in the Report

By Product

- Specialty Coating Equipment

- Powder Coating Equipment

- Liquid Coating Equipment

By Application

- Automotive

- Aerospace

- Construction

- Industrial

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting