Commercial Refrigeration Equipment Market Size and Forecast 2025 to 2034

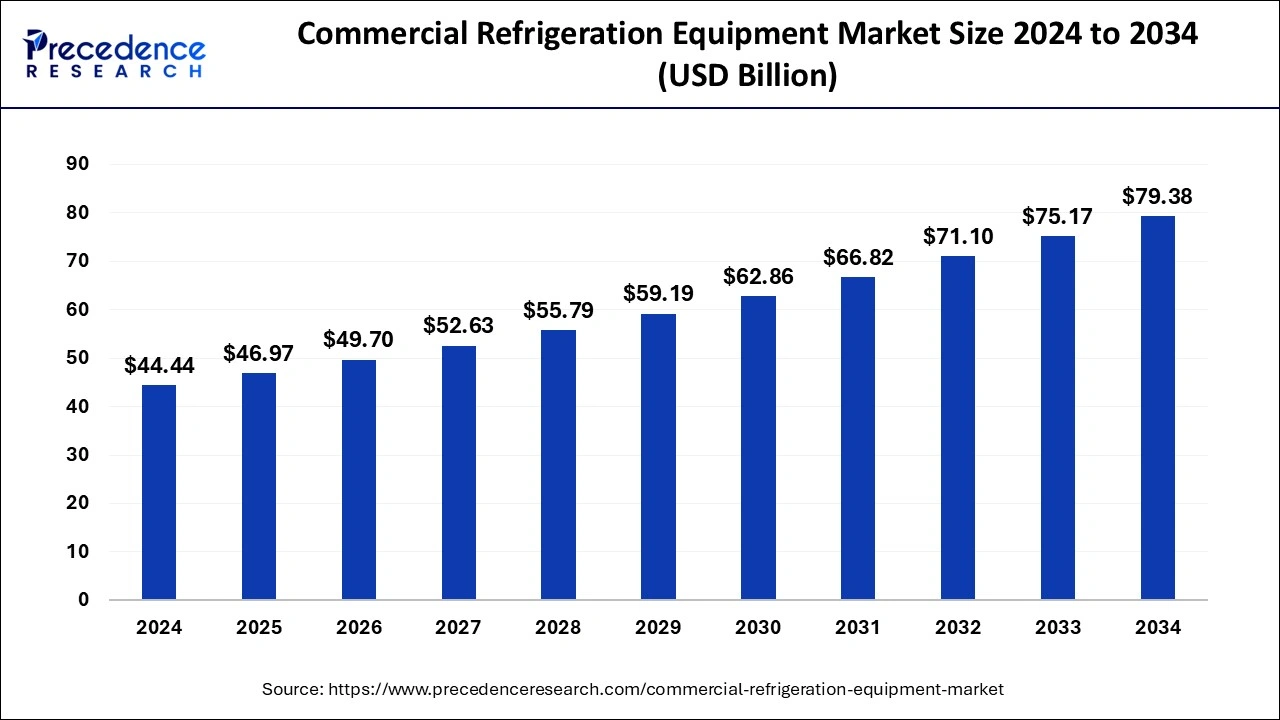

The global commercial refrigeration equipment market size was calculated at USD 44.44 billion in 2024 and is predicted to reach around USD 79.38 billion by 2034, expanding at a CAGR of 5.97% from 2025 to 2034.

Commercial Refrigeration Equipment Market Key Takeaways

- In terms of revenue, the commercial refrigeration equipment market is valued at $46.97 billion in 2025.

- It is projected to reach $79.38 billion by 2034.

- The commercial refrigeration equipment market is expected to grow at a CAGR of 5.97% from 2025 to 2034.

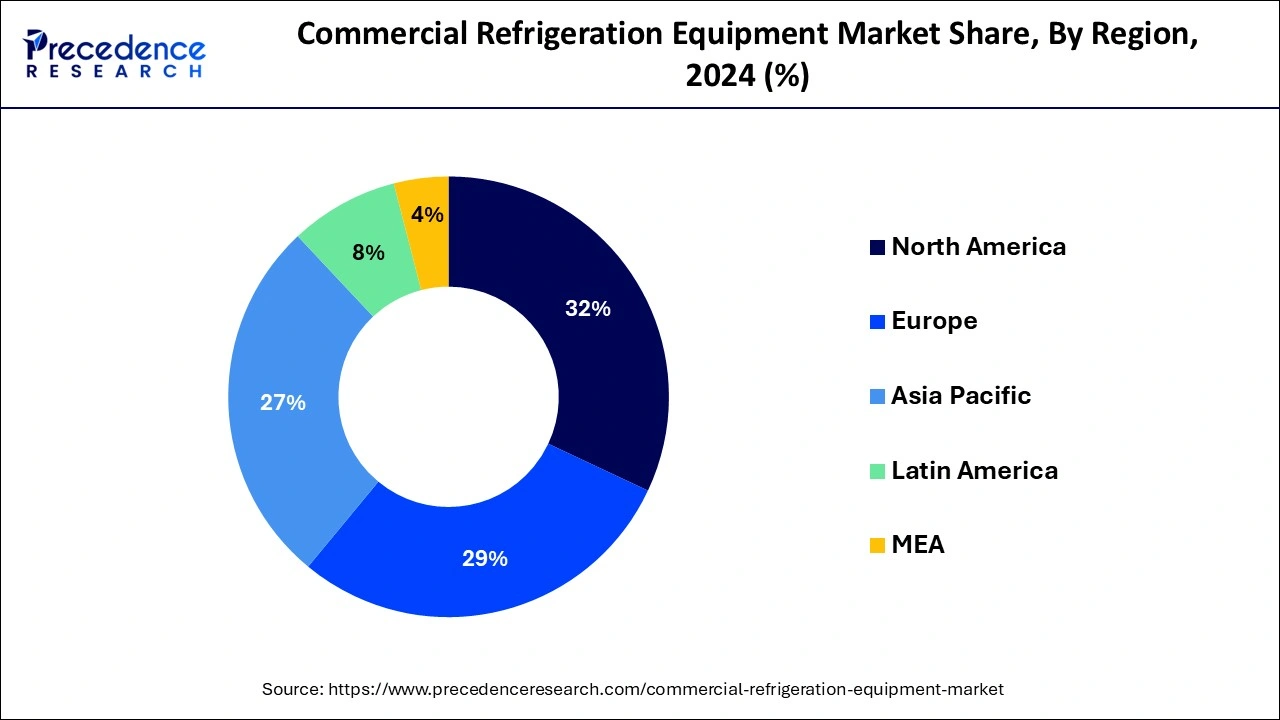

- North America dominates the global market and generated more than 31.14% of the revenue share in 2024.

- By Product, the refrigerators & freezers segment is predicted to capture the largest market share between 2025 and 2034.

- By Application, the food & beverage distribution segment is expected to generate the highest market share between 2025 and 2034.

- By System Type, the self-contained segment is projected to record the maximum market share between 2025 and 2034.

U.S.Commercial Refrigeration Equipment Market Size and Growth 2025 to 2034

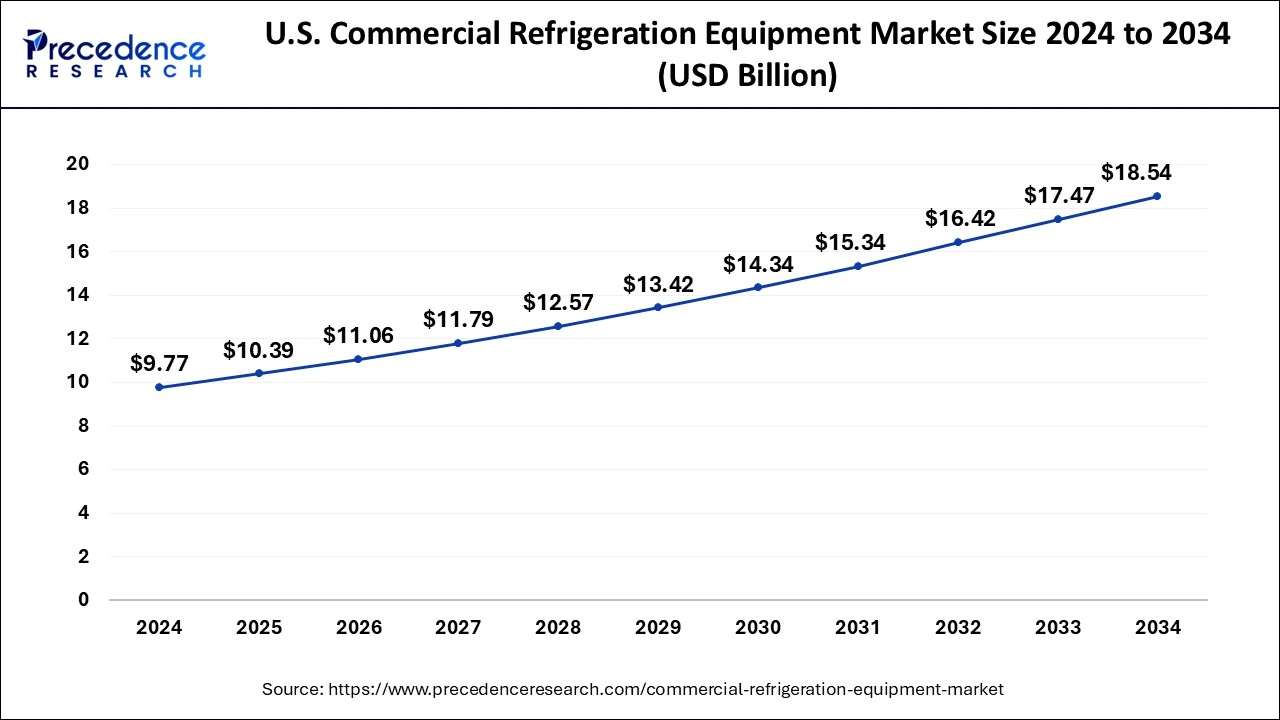

The U.S. commercial refrigeration equipment market size was exhibited at USD 9.77 billion in 2024 and is projected to be worth around USD 18.54 billion by 2034, growing at a CAGR of 6.62% from 2025 to 2034.

On the basis of geography, North America dominates the market, primarily driven by the large food and beverage industry and the need for cold storage and transportation of temperature-sensitive products. Also, the market in North America has seen a shift towards more energy-efficient and environmentally friendly refrigeration equipment. Regulations and policies drive this to reduce energy consumption and greenhouse gas emissions. Manufacturers have responded to this trend by developing new technologies, such as advanced insulation and compressor technologies, that improve energy efficiency and reduce operating costs.

Europe is a significant market for commercial refrigeration equipment, with Germany, the United Kingdom, and France being the major contributors to the market's growth. The market is driven by the well-developed food industries, including food processing andcold chain logistics, which are major users of commercial refrigeration equipment. In addition, consumer preferences are also driving the demand for more sustainable refrigeration equipment. Consumers are becoming more conscious of the effect of their purchasing choices on the environment and are demanding more environmentally friendly products. This trend is expected to continue to drive innovation in Europe's commercial refrigeration equipment market.

The region in Asia-Pacific is anticipated to have the greatest CAGR. This growth is primarily driven by the growing food and beverage industry, the increasing demand for processed food products, and the rising awareness of food safety and hygiene. In addition, the growth of the retail sector, including convenience stores, supermarkets, and hypermarkets, is also driving the demand for commercial refrigeration equipment in the region.

- In October 2024, Tata Power Trading Company Limited, one of India's leading integrated power companies, announced a collaboration with Keppel, a Singapore-headquartered global asset manager and operator with strong expertise in sustainability-related solutions spanning the areas of infrastructure, real estate and connectivity, to launch sustainable Cooling-as-a-Service (CaaS) solutions in India. CaaS enables businesses and building owners to subscribe to long-term, energy-efficient space cooling solutions without having to invest heavily in infrastructure, thus allowing them to enjoy significant energy and cost savings.

Market Overview

The commercial refrigeration equipment market refers to equipment used to store and display food and beverages at commercial establishments such as restaurants, supermarkets, convenience stores, and other food service outlets. Commercial refrigeration equipment is essential for preserving the quality and safety of perishable food items and is used to maintain consistent temperatures for various types of food and beverages. Commercial refrigeration equipment includes various products such as refrigerators, freezers, coolers, display cases, beverage dispensers, ice machines, and walk-in coolers and freezers. These products are available in various sizes and configurations to meet the needs of different types of businesses.

Several factors, such as the growth of the food service industry, the increasing demand for convenience foods, and the need for energy-efficient refrigeration solutions, drive the commercial refrigeration equipment market. Government regulations on refrigerants, food safety standards, and consumer preferences for sustainable and eco-friendly refrigeration solutions also influence the market.

Furthermore, the food service industry continues to grow, and the demand for commercial refrigeration equipment is also increasing. Restaurants, cafes, convenience stores, and other food service establishments need refrigeration equipment to store and display their products. Also, the demand for convenience foods such as ready-to-eat meals, snacks, and beverages is increasing, driving the demand for commercial refrigeration equipment. These products require refrigeration to maintain their quality and freshness.

However, high initial investment, maintenance and repair costs, competition from used/refurbished equipment and environmental concerns are anticipated to impede the market growth. There is rising fear about the environmental impact of refrigeration equipment, particularly concerning greenhouse gas emissions. Businesses may face pressure to adopt more sustainable and eco-friendly refrigeration solutions, impacting demand for traditional refrigeration equipment. Also, Commercial refrigeration equipment can be expensive to purchase and install, which may be a barrier for some businesses, particularly small and medium-sized enterprises.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have increased demand for commercial refrigeration equipment in the healthcare industry. The pandemic has led to demand for refrigeration equipment for storing vaccines and other medical supplies. However, the pandemic has severely impacted the hospitality industry, including restaurants and hotels. Many businesses in this sector have closed or reduced their operations, resulting in decreased demand for commercial refrigeration equipment.

In addition, the pandemic has disrupted supply chains and caused delays in the production and delivery of commercial refrigeration equipment. This has increased lead times and higher costs for businesses purchasing new equipment.

- In April 2025, Continental introduced its latest innovation in data center cooling solutions: DataGuard and FlexCool premium data cooling hoses. These advanced hoses ensure the reliable operation of sensitive electronic components by preventing overheating, malfunctions, data corruption, and hardware damage.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.97% |

| Market Size in 2025 | USD 46.97 Billion |

| Market Size by 2034 | USD 79.38 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and System Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growth of the food service industry to brighten the market prospect

The food service industry includes restaurants, cafeterias, hotels, and other establishments providing customers with meals and beverages. As the food service industry grows, so does the need for reliable refrigeration equipment to store and preserve food and beverages. Commercial refrigeration equipment such as refrigerators, freezers, and coolers are essential for keeping food fresh, safe, and at the proper temperature.

In addition, the increasing demand for convenience food and ready-to-eat meals has boosted the demand for commercial refrigeration equipment. Such food items require proper storage and preservation to maintain quality and safety.

Moreover, advancements in technology have led to the development of more efficient and environmentally friendly refrigeration equipment, which has further fueled the growth of the commercial refrigeration equipment market. Thus, the growth of the food service industry, coupled with the demand for convenience food and advancements in refrigeration technology, are key drivers of the commercial refrigeration equipment market.

Increasing demand for specialty refrigeration equipment

As the food industry continues to expand and diversify, there is a growing need for specialized refrigeration equipment that can maintain specific temperatures, humidity levels, and other environmental conditions to ensure the quality and safety of various food products. This includes refrigeration equipment for specific foods, such as dairy products, meat, seafood, fruits and vegetables, and specialized equipment for food processing and storage facilities. The pharmaceutical industry also uses specialty refrigeration equipment to store and transport sensitive medications and vaccines.

Thus, manufacturers of commercial refrigeration equipment are developing new and innovative products to meet the evolving needs of the food industry, which is driving demand for these products in the market. For instance, in November 2022, Chemours collaborated with BOHN to innovate the cold food chain and launched the first low GWP Solution in the Americas based on A2L technology.

In addition to meeting the specific needs of different industries, specialty refrigeration equipment is also becoming more energy-efficient and environmentally friendly. This is due to the growing demand for sustainable solutions and the need to reduce energy costs associated with operating refrigeration systems. Thus, the increasing demand for specialty refrigeration equipment is driving the demand for the commercial refrigeration equipment market.

Key Market Challenges:

Limited accessibility is causing hindrances to the market:

The cost of purchasing and installing refrigeration systems can vary widely depending on the size, type, and complexity of the equipment needed. For instance, a small walk-in cooler may cost several thousand dollars, while a larger industrial refrigeration system can cost hundreds of thousands of dollars. The initial investment required can be particularly daunting for small businesses, which may not have the financial resources to purchase the equipment outright. In addition to the initial cost, ongoing maintenance and repair expenses and energy costs may be associated with operating the refrigeration equipment. These expenses can add up over time and may further deter some businesses.

To address this issue, some manufacturers are developing more cost-effective and energy-efficient refrigeration systems to help reduce overall business costs. Additionally, leasing and financing options may help businesses spread out the cost of equipment purchases over time. Some businesses may opt for used or refurbished equipment, a more affordable alternative to buying new equipment. While used equipment may come with some risks, it can be a viable option for businesses looking to save money on equipment purchases. Thus, the high initial cost of commercial refrigeration equipment can significantly restrain the demand in the market. However, various solutions, such as more cost-effective and energy-efficient systems, leasing and financing options, and used or refurbished equipment, can help businesses overcome this barrier and invest in the necessary equipment to grow and thrive.

Key Market Opportunities:

These are the following factor which is likely to create opportunity over the forecast period.

- Growing demand for energy-efficient equipment

- Advancements in technology

- Expansion of the retail food industry

Product Insights

On the basis of product, the commercial refrigeration equipment market is divided into transportation refrigeration equipment, refrigerators & freezers, beverage refrigeration, display showcases, ice merchandisers & ice vending equipment and other equipment, with the refrigerators & freezers segment accounting for most of the market. This is due to the increasing demand for cold storage and preservation of food products and the growth of the food and beverage industry.

Refrigerators and freezers are widely used in restaurants, hotels, supermarkets, and convenience stores, among other places. The beverage refrigeration segment is also expected to grow significantly in the coming years, driven by the increasing demand for cold drinks, juices, and other beverages.

Application Insights

On the basis of the application, the commercial refrigeration equipment market is divided into food service, food & beverage retail, food & beverage distribution, food & beverage production, and others, with food & beverage distribution accounting for most of the market. This is due to the increasing demand for cold storage and transportation of food products and the growth of the food and beverage industry. Food and beverage distributors require commercial refrigeration equipment for storing, transporting, and displaying food products.

The food and beverage retail segment is also expected to grow significantly, driven by the increasing demand for supermarkets, hypermarkets, and convenience stores. Commercial refrigeration equipment is used in these retail outlets to store and display food products, including fruits, vegetables, meat, and dairy.

System Type Insights

On the basis of system type, the commercial refrigeration equipment market is divided into self-contained and remotely operated, with the self-contained accounting for most of the market. This is because self-contained systems are typically used in smaller refrigeration units and are easy to install and operate. They comprise a single unit that includes all the necessary components for cooling and refrigeration.

The remote compressor system segment is expected to grow significantly, driven by the increasing demand for energy-efficient and eco-friendly refrigeration systems. Remote compressor systems are designed to separate the compressor from the refrigeration unit, allowing for more flexibility in the design and installation of the system.

Commercial Refrigeration Equipment Market Companies

- AB Electrolux

- Ali Group S.r.l. a Socio Unico

- AHT Cooling Systems GmbH

- Carrier

- Daikin Industries, Ltd.

- Dover Corporation

- Hussmann Corporation

- Excellence Industries

- Hillphoenix, A Dover Company

- Illinois Tool Works Inc.

- Imbera

- Lennox International Inc.

- Metalfrio Solutions S.A.

- Minus Forty Technologies Corp.

- Ojeda Usa Inc.

- Panasonic Corporation

- Qingdao Hiron Commercial Cold Channel Co., Ltd.

- True Manufacturing Co., Inc.

- Victory Refrigeration

- Whirlpool Corporation

- Zero Zone, Inc.

Recent Developments

- In April 2024, Rockwell, a pioneer in commercial refrigeration products, launched its new range of kitchen and commercial refrigeration products. The unveiling of products took place at the company's exclusive sub-dealers' meet at Jammu in India. The new range represents a breakthrough in HORECA refrigeration products, offering unparalleled features, performance, and value to the customers.

- In May 2024, Blue Star Limited launched a comprehensive new range of energy-efficient and eco-friendly deep freezers varying in capacities from 60 to 600 litres to cater to a wide set of customer segments for diverse applications. The new range of deep freezers offers higher storage, enhanced cooling capacity, and is embedded with superior technologies that ensure greater heat transfer for efficient cooling.

- In March 2025, Phoenix Energy Technologies announced a strategic partnership with the Hussmann Corporation aimed at accelerating the deployment of solutions that address energy, asset health, and reduce refrigerant leaks in facilities with refrigeration by leveraging AI. Phoenix announced its plan to introduce Refrigeration IQ Powered by Hussmann's StoreConnect, an advanced refrigeration solution. This innovative solution combines Phoenix's expertise in data integration and analytics with Hussmann's proven automated refrigerant leak detection “ALD” technology.

- In June 2021, Emerson Electric Co. announced a partnership with Soft Robotics to develop a new robotic refrigeration system for the food and beverage industry.

- In September 2020, Daikin Industries, Ltd. acquired the Italian refrigeration equipment manufacturer, Zanotti S.p.A., to expand its product offerings in the commercial refrigeration equipment market.

- In November 2021, Whirlpool Corporation announced investing a sum worth USD 65 million over the next few years in Ottawa, Ohio, to position the plant as the Superior Refrigeration Factory in North America. This strategic initiative will help the company expand the Ottawa plant to accommodate manufacturing premium refrigeration products, such as Built-In refrigerators (BIR).

- In November 2022, Chemours Company, a chemical company with titanium technologies, thermal & specialized solutions, and advanced performance materials, announced its collaboration with Bohn de Mexico, an industrial and commercial refrigeration equipment technology and manufacturing company a presence in the Latin American region. With this collaboration, Bohn de Mexico will adopt the low global warming potential (GWP) and non-ozone depleting (ODP) refrigerants such as Opteon XL10 (R-1234yf), Opteon XL20 (R-454 C), and Opteon XL40 (R-454A), for its BOHN Ecoflex condensing units.

- In December 2022, Smart Care announced the acquisition of Refrigeration Anytime, LLC, a commercial refrigeration and HVAC equipment repair company. The acquisition strengthens Smart Care's presence in Texas.

Segments Covered in the Report

By Product

- Transportation Refrigeration Equipment

- Refrigerators & Freezers

- Beverage Refrigeration

- Display Showcases

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

By Application

- Food Service

- Food & Beverage Retail

- Food & Beverage Distribution

- Food & Beverage Production

- Others

By System Type

- Self-contained

- Remotely Operated

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting