What is the Communication Platform as a Service Market Size?

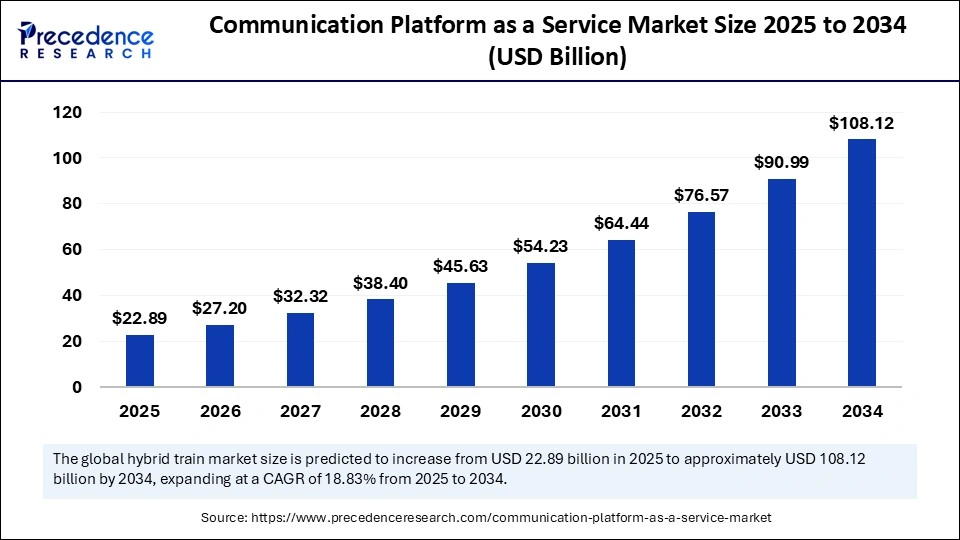

The global communication platform as a service market size is accounted at USD 22.89 billion in 2025 and predicted to increase from USD 27.20 billion in 2026 to approximately USD 108.12 billion by 2034, expanding at a CAGR of 18.83% from 2025 to 2034. Growing due to increasing demand for real-time, scalable, and API-driven communication solutions across industries.

Communication platform as a service market Key Takeaways

- In terms of revenue, the communication platform as a service market is valued at $22.89 billion in 2025.

- It is projected to reach $108.12 billion by 2034.

- The market is expected to grow at a CAGR of 18.83% from 2025 to 2034.

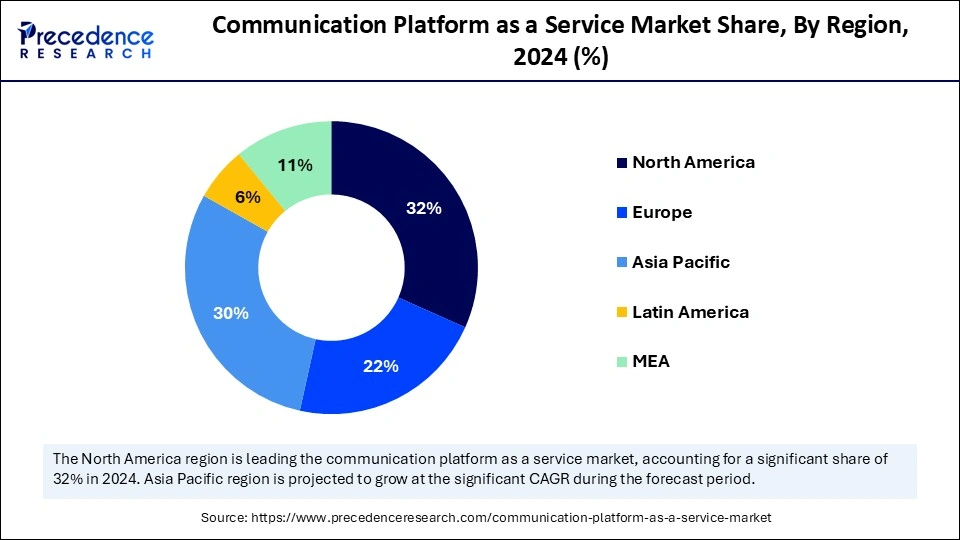

- North America dominated the market with the largest market share of 32% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 31.62% during the forecast period.

- Europe is expected to grow at a considerable CAGR of 25.7% in the upcoming period.

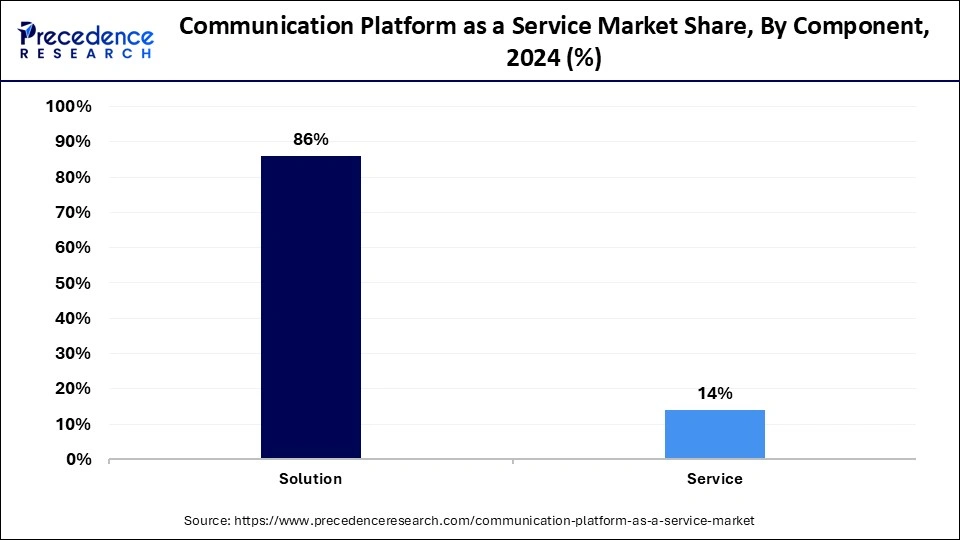

- By component, the solution segment held the largest market share of 86% in 2024.

- By component, the services segment is expected to witness significant growth in its market share during the predicted timeframe.

- By enterprise size, the large enterprises segment dominated the market.

- By enterprise size, the small & medium enterprises segment is expected to grow at the fastest rate in the market during the forecast period.

- By end user, the BFSI segment dominated the communication platform as a service market with the largest share in 2024.

- By end user, the healthcare segment is expected to grow at the fastest rate in the market.

Artificial Intelligence: The Next Growth Catalyst in Communication Platform as a Service

Artificial Intelligence improves automation, personalization, and analytics. It is a major driver of innovation in the Communication Platform as a Service (CPaaS) market. Real-time intelligent customer interactions are made possible by AI-powered chatbots and virtual assistants, which also lower operating costs and improve response times. Natural language processing (NLP) and machine learning allow companies to have more human-like conversations and customize messages according to user preferences and behavior.

Additionally, by using sentiment analysis and advanced analytics, AI helps businesses learn from customer interactions and improve their strategies. Features like predictive engagement, smart routing, and fraud detection are changing how CPaaS is used in various industries. It is anticipated that as AI develops further, its incorporation will open even more creative uses, enhancing the intelligence, security, and effectiveness of CPaaS platforms.

What is driving the rapid growth of the communication platform as a service market?

- Omnichannel Communication Demand: Businesses are increasingly seeking unified communication solutions (Voice, Video, SMS, chat, etc.) across multiple customer touchpoints.

- Rise of Remote Work & Hybrid Models: The global shifts to remote and hybrid work environments have increased the need for real-time integrated communication platforms.

- Adoption of Mobile First and App-Based Services: CPaaS enables embedding communication features into mobile apps and websites, enhancing customer experiences.

- APIs and Developer Friendliness: Easy-to-integrate API allows companies to quickly build and scale communication features without building infrastructure from scratch.

- Cloud-based scalability: CPaaS offers scalable and cost-effective solutions, especially appealing to startups and SMEs that need flexibility.

Strategic Overview of the Global Communication Platform as a Service Industry

The communication platform as a service market has emerged as a transformative force in the global communication landscape, enabling businesses to embed real-time communication features such as chat messaging, video, and voice straight into their apps through APIs. CPaaS provides the adaptability, scalability, and integration capabilities needed to satisfy changing customer expectations as businesses move more and more toward digital-first strategies. Several industries, including e-commerce, healthcare, banking, and education, have seen an increase in the adoption of CPaaS due to the rise of remote work, mobile-first engagement, and the growing need for seamless and personalized customer interactions.

The ability of CPaaS to lower infrastructure costs and unify omnichannel communications is what makes it unique. To boost automation, increase user engagement, and streamline customer support operations, cutting-edge technologies like artificial intelligence (AI) chatbots and analytics are being incorporated into CPaaS platforms. Additionally, CPaaS is becoming more accessible to both large and small businesses due to the global expansion of internet connectivity, smartphone usage, and cloud-based services. The CPaaS market is poised for long-term growth and broad adoption in the years to come, thanks to ongoing innovation and an increasing focus on API-driven architecture.

Market Outlook:

- Market Growth Overview: The communication platform as a service market is expected to grow significantly between 2025 and 2034, driven by a growing focus on businesses on enhancing customer service and engagement across multiple channels. Digital transformation, technological advancement, 5G deployment, and API monetization.

- Sustainability Trends: Sustainability trends involve energy-efficient cloud infrastructure, a shift from hardware to software, and support for remote work.

- Major Investors: Major investors in the market include Twilio Inc., Sinch AB, Venture Capital (VC) Firms, Tofino Capital, Hellman & Friedman, and SoftBank Group.

- Startup Economy: The startup economy is focused on niche opportunities, acquisition by incumbents, and ancillary services.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 108.12 Billion |

| Market Size in 2025 | USD 22.89 Billion |

| Market Size in 2026 | USD 27.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component,Enterprise Size, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing time for real-time communication

One major factor propelling the CPaaS market is the growing demand for real-time communication across industries. Instant voice calls, video conferencing, and messaging businesses today strive to provide quicker, more engaging customer service. The infrastructure and APIs required to incorporate these features straight into apps and websites are offered by CPaaS platforms, improving user experience and operational effectiveness.

Rising adoption of omnichannel engagement

Across various communication channels, including SMS, voice calls, emails, chat apps, and social media, modern consumers anticipate a smooth and cohesive experience. Organizations can use a single platform to manage and coordinate these channels thanks to CPaaS. CPaaS helps businesses increase customer satisfaction, retain customers, and maintain consistent communication by supporting omnichannel engagement strategies.

Restraints

Data Security and Privacy Concerns

The market for CPaaS is primarily constrained by worries about data security and privacy. Any breach or misuse of CPaaS platforms can cause serious financial and reputational harm because they handle sensitive user data such as payment information, personal information, and communication content. Companies may be reluctant to fully implement CPaaS solutions without solid guarantees of encryption compliance and data control, particularly in industries like healthcare and finance. Concerns regarding platform vulnerabilities are also raised by the rise in phishing attempts and cyberattacks. For CPaaS providers, maintaining regulatory compliance and end-to-end encryption becomes an ongoing challenge.

High Competition and Pricing Pressure

The CPaaS market is getting more and more crowded with both newcomers and well-established tech giants providing comparable services. Price pressure brought on by this fierce competition has decreased providers' profit margins. Furthermore, companies frequently evaluate providers only based on price, which can discourage investment in platforms with more features but at a slightly higher cost. Because of this, the competition to provide the least expensive solution may stifle innovation. Additionally, in a highly commoditized market, providers might find it difficult to stand out.

Opportunities

Increased adoption by SEMs and SMEs Startups

As CPaaS streamlines internal communication, marketing, and customer service, small and medium-sized businesses (SMEs) and startups are becoming more and more aware of its benefits. They can easily deploy scale and afford solutions with CPaaS without requiring a lot of infrastructure. Small business non-technical users can now implement CPaaS features thanks to the increasing number of low-code and no-code tools available. It is anticipated that the democratization of communication technology will greatly accelerate adoption in this industry.

Demand for Personalized Customer Engagement

Customers of today demand contextualized, tailored communications across all platforms. Businesses can use CPaaS platforms to send customized messages based on past interactions, preferences, and customer behavior. Personalized outreach can be automated at scale by businesses by integrating CPaaS with CRM and analytics systems. The need for programmable and adaptable communication solutions is being driven by this trend toward hyper-personalization

Insights

Component Insights

Solution segment dominated the communication platform as a service market with the largest share of 86% in 2024, because there is a growing need for integrated communication tools that provide workflow automation, voice video, and messaging. The broad market share of this segment is driven by businesses' preference for all-inclusive CPaaS solutions that facilitate smooth internal collaboration and customer engagement. These solutions increase productivity and customer satisfaction by assisting businesses in streamlining communication across various channels. The need for strong CPaaS solutions is further increased by the growing trend toward omnichannel communication tactics. Furthermore, these solutions integrated AI and analytics innovations add substantial value, making them essential for contemporary businesses.

Services segment is expected to grow at the fastest rate in the market, driven by the growing use of implementation support and consulting services. As more businesses incorporate CPaaS into their current infrastructure, they need professional assistance to optimize these systems. Growth in this market is also accelerated by the high demand for continuously managed services and maintenance to guarantee scalability, security, and seamless operation. To optimize CPaaS ROI, businesses are increasingly depending on professional services due to the growing complexity of communication requirements. Furthermore, the rapid expansion of the service segment is being aided by the growing trend of outsourcing CPaaS management to outside providers.

Enterprise Size Insights

Large enterprises segment dominated the communication platform as a service market with the largest share in 2024, because they have greater IT budgets, significant communication needs, and the capacity to purchase sophisticated specialized solutions. These companies frequently need sophisticated, scalable platforms to handle numerous divisions of international operations and a high volume of client contacts. Their dominant market position is maintained by their early adoption and ongoing demand for cutting-edge features. Large companies also gain from having specialized teams that can efficiently manage and optimize CPaaS deployments, which strengthens their position.

Small & medium enterprises segment is expected to grow at the fastest rate in the market. The benefits of cloud-based communication platforms for enhancing customer engagement and operational efficiency without requiring significant upfront investments are becoming more widely acknowledged by SMEs. These companies can now swiftly adopt and scale communication technologies thanks to the availability of CPaaS solutions that are flexible, inexpensive, and simple to implement. Additionally, SMEs with limited technical resources can now take advantage of CPaaS features thanks to the emergence of low-code/no-code platforms, which are speeding up market penetration in this sector.

End User Insights

BFSI segment dominated the communication platform as a service market with the largest share in 2024, because it requires multi-channel, secure, and real-time communication. Large-scale adoption is fueled by BFSI organizations' heavy reliance on CPaaS solutions for transaction alerts, fraud detection, customer verification, and personalized communication. Additionally, the industry's strict regulations demand advanced security features and compliance, which CPaaS providers have adapted to satisfy. As a result, BFSI continues to be a significant influencer and source of revenue in the CPaaS industry.

Healthcare segment is expected to grow at the fastest rate in the market, encouraged by the growing use of virtual care services, telehealth, and remote patient monitoring. The HIPAA-compliant communication platforms that facilitate patient engagement include appointment reminders and video consultations. To boost operational effectiveness and improve patient experience, healthcare providers are investing in CPaaS solutions. The need for tailored CPaaS applications in the field is anticipated to increase quickly as digital health keeps growing.

Regional Insights

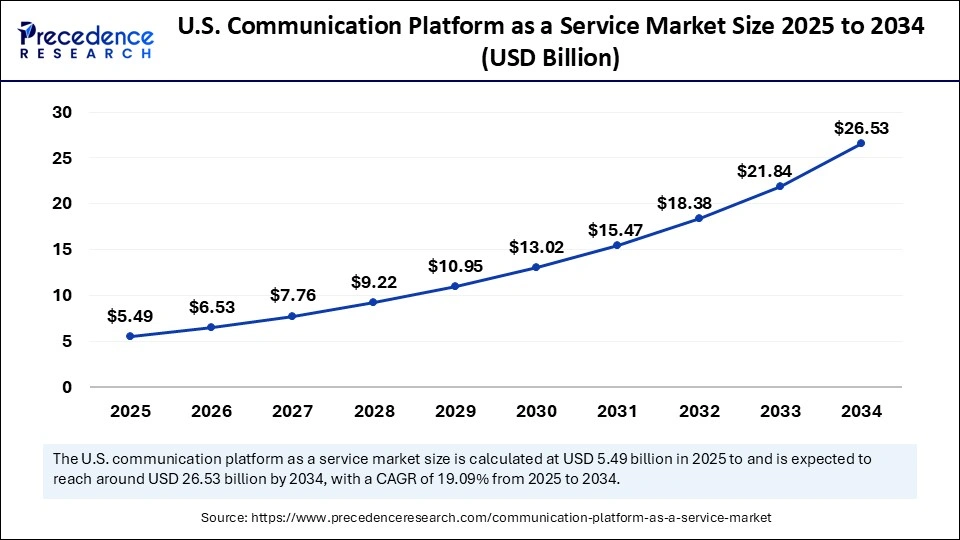

U.S. Communication Platform as a Service Market Size and Growth 2025 to 2034

The U.S. communication platform as a service market size is exhibited at USD 5.49 billion in 2025 and is projected to be worth around USD 26.53 billion by 2034, growing at a CAGR of 19.09% from 2025 to 2034.

North America contributed the highest market share of 32% in 2024, because it has a sophisticated telecommunications infrastructure, a high rate of cloud adoption, and big tech companies that are driving innovation. The area gains from significant IT budgets, a sizable base of early adopters, and pro-digital transformation regulatory frameworks. Strong demand from important sectors like retail, healthcare, and BFSI also contributes to the market's expansion. The adoption and growth of CPaaS solutions across numerous industries are also accelerated by North America's ongoing advancements in AI and 5G technologies.

Asia Pacific is expected to grow at the fastest CAGR of 31.62% in the upcoming years, driven by the quickening pace of digital transformation, the expanding use of cloud-based services, and the growing penetration of mobile and internet devices. Real-time communication solutions are becoming increasingly popular in the region in industries like fintech, e-commerce, healthcare, and education. The adoption of CPaaS is also being accelerated by a sizable SME base and government-led digital initiatives. Additionally, the need for scalable and adaptable CPaaS platforms to improve customer engagement is being driven by the market's cost sensitivity.

Europe is growing at a notable CAGR of 25.7% in the upcoming period, supported by an established IT ecosystem and strict data protection laws. The modernization of enterprise communication is progressing in the region, particularly in sectors like public services, telecom, and finance. A steady increase in demand for compliant and safe communication solutions is fueling this growth. Additionally, rising investments in AI and next-generation connectivity are anticipated to help CPaaS's future growth throughout the European market. Growing due to increasing demand for real-time, scalable, and API-driven communication solutions across industries.

U.S. Communication Platform as a Service Market Trends

The U.S. growth is driven by the integration of AI for personalized interactions and the adoption of omnichannel communication strategies. The increased adoption across diverse sectors like healthcare and retail, and a greater focus on security and compliance, are needed to build customer trust. The availability of low-code/no-code platforms and strategic alliances is also contributing to market expansion.

China Communication Platform as a Service Market Trends

China's rapid growth is fueled by extensive 5G rollout and a massive mobile-first population, heavily utilizing CPaaS functionalities within "super-apps" like WeChat. AI-driven enhancements and large-scale cloud infrastructure investments are key trends, alongside strategic expansion into other parts of Asia.

Germany Communication Platform as a Service Market Trends

The German communication platform as a service market is driven by a strong emphasis on data privacy, security, and GDPR compliance, leading to the preference for localized and hybrid cloud solutions. With the increasing digitalization and government initiatives, telemedicine and digital patient engagement initiatives, the healthcare vertical is showing strong growth.

Value Chain Analysis of the Communication Platform as a Service Market

- Inbound Logistics

This stage involves the procurement and management of the underlying infrastructure required for communication services. - Operations

This stage encompasses the development, deployment, and management of the CPaaS platform itself, including APIs, SDKs, and underlying software. - Outbound Logistics

Outbound logistics covers the distribution of the platform to customers and partners, which, in a cloud-based software environment, is largely a digital process. - Marketing and Sales

This stage involves all efforts to attract and onboard developers and business customers, from technical documentation and developer community engagement to traditional enterprise sales. - Service

The service stage focuses on post-sales support, including customer service, technical assistance for developers, and ongoing platform maintenance and updates.

Top Companies in the Communication Platform as a Service Market & Their Offerings:

- TWILIO INC.: As a market leader, Twilio provides a comprehensive and highly programmable platform for developers to build voice, messaging, and video applications using simple web APIs.

- Avaya Inc.: While traditionally known for enterprise communications, Avaya contributes to the CPaaS market by offering solutions for integrating communication channels into customer engagement platforms.

- Vonage America, LLC: Acquired by Ericsson, Vonage offers a programmable CPaaS platform that allows developers to embed voice, video, chat, and AI capabilities into various products and systems via APIs.

- MessageBird: MessageBird offers an omnichannel automation platform with a suite of APIs covering SMS, voice, WhatsApp, and more, allowing businesses to engage with customers globally.

- Infobip Ltd.: Infobip provides a global cloud communication platform enabling businesses to engage with customers through a wide range of channels, including SMS, voice, and chat apps.

- Plivo Inc.: Plivo provides a CPaaS platform with APIs for voice, SMS, and messaging, enabling developers to integrate communication features into their applications. They focus on delivering a reliable, scalable, and secure platform for businesses of all sizes.

- Telnyx LLC: Telnyx offers a "next-gen" communications platform built on its own global, private IP network, providing carrier-grade voice and messaging services. Their developer-focused APIs, reliable infrastructure, and 24/7 engineering support differentiate their contributions to the market.

- TEXTUS: TEXTUS specializes in business texting and communication, providing a platform that facilitates two-way, personalized, and conversational SMS marketing and engagement.

- Voximplant: Voximplant is a global CPaaS innovator that offers a platform simplifying the development and deployment of voice and video communication features using APIs, SDKs, and no-code options. Their customizable solutions are utilized by a wide range of businesses, including those in finance and retail.

- Bandwidth Inc.: Bandwidth provides the underlying communication APIs and infrastructure for enterprise customers, offering voice, messaging, and emergency services.

Communication platform as a service market Companies

- TWILIO INC.

- Avaya Inc.

- Vonage America, LLC

- MessageBird

- Infobip Ltd.

- Plivo Inc.

- Telnyx LLC

- TEXTUS

- Voximplant

- Bandwidth Inc.

Latest Announcements by Industry Leaders

- On 08 January 2025, Infobip announced partnered with NTT Com Online to launch NTT CPaaS in Japan. The platform leverages Infobip's global CPaaS infrastructure, combined with NTT's local service strength. This partnership highlights Infobip's growing footprint in Asia. CEO of the company, Silvio Kutic, stated, "Together, we're enabling businesses to deliver transformative omnichannel experiences."(Source- https://www.infobip.com)

- On 08 January 2025, Ericsson announced the appointment of Anthony Bartolo as CEO of Aduna, its global network API venture. The joint initiative includes telecom giants like Verizon, Deutsche Telekom, and Jio. Aduna will focus on monetizing carrier-grade APIs for real-time applications. The executive of the company, Niklas Heuveldop, stated, "Anthony is a proven leader who will drive innovation in global network APIs."(Source- https://www.ericsson.com)

Recent Developments

- On January 28, 2025, Infobip partnered with NTT Com Online Marketing Solutions Corporation to support the launch of NTT's omnichannel communication platform, NTT CPaaS, in Japan. This partnership provides businesses with an innovative communication solution integrating reliable SMS and Voice delivery and CPaaS technology localized for the Japanese market.(Source- https://www.businesswire.com)

- On February 11, 2025, Infobip announced a partnership with White Label Communications to enhance its full-stack CPaaS solution for medium and large enterprises. This partnership equips White Label Communications with cloud-based, multi-layered middleware to develop, run, and distribute communication software, empowering its customers to deliver the best possible end-user experience.(Source - https://www.whitelabelcomm.com)

- On November 21, 2024, Vonage released a platform update introducing a new maximum bitrate setting for composed archives in its Video API. This allows developers to set the maxBitrate option when using the REST API to start a composed archive, providing greater control over the size of the archive.(Source - https://tokbox.com)

Segments Covered in the Report

By Component

- Solution

- API Platform

- Messaging API

- Voice API

- Video API

- Others

- SDK Platform

- Service

- Managed Services

- Professional Services

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End User

- BFSI

- IT & Telecom

- Retail & E-commerce

- Healthcare

- Transportation & Logistic

- Travel & Hospitality

- Others

By Region

- North America

- Europe

- Asia-Pacific,

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting