What is the Unified Communication as a Service Market Size?

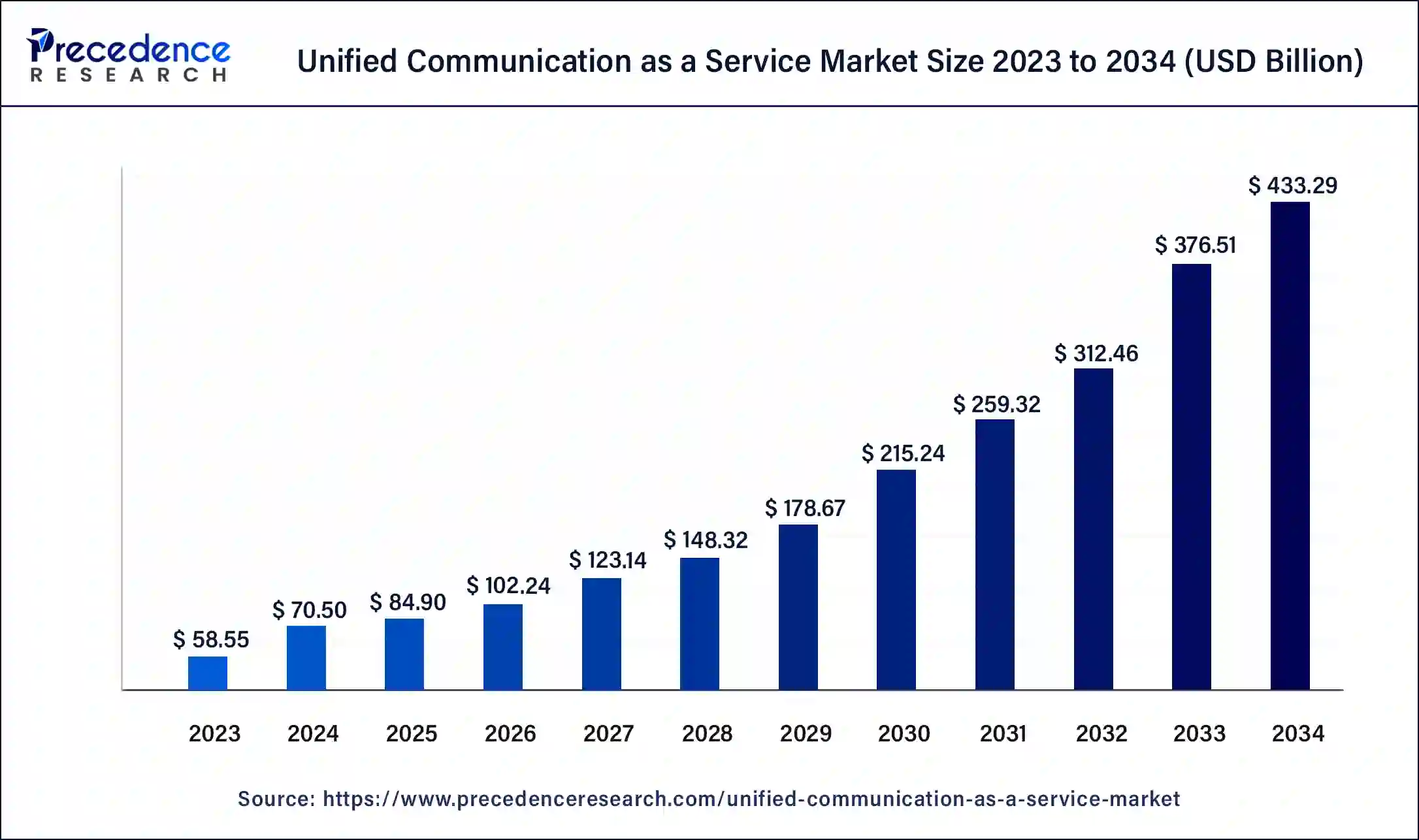

The global unified communication as a service market size was valued at USD 84.90 billion in 2025, calculated at USD 102.24 billion in 2026 and is expected to reach around USD 494.92 billion by 2035, expanding at a CAGR of 19.28% from 2026 to 2035.

Unified Communication as a Service Market Key Takeaways

- The global unified communication as a service market is valued at USD 84.90 billion in 2025.

- It is projected to reach USD 494.92billion by 2035.

- The unified communication as a service market is expected to grow at a CAGR of 19.28% from 2026 to 2035.

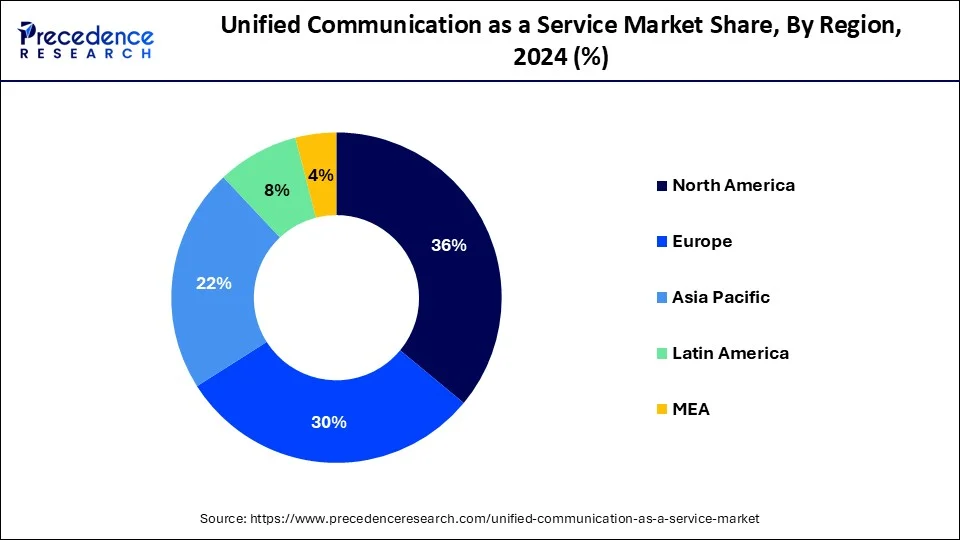

- North America contributed more than 36% of market share in 2025.

- Asia-Pacific is estimated to expand at the fastest CAGR between 2026 and 2035.

- By industry vertical, the healthcare segment has held the largest market share of 19% in 2025.

- By industry vertical, the hospitality segment is anticipated to grow at a remarkable CAGR of 22.12% between 2026 and 2035.

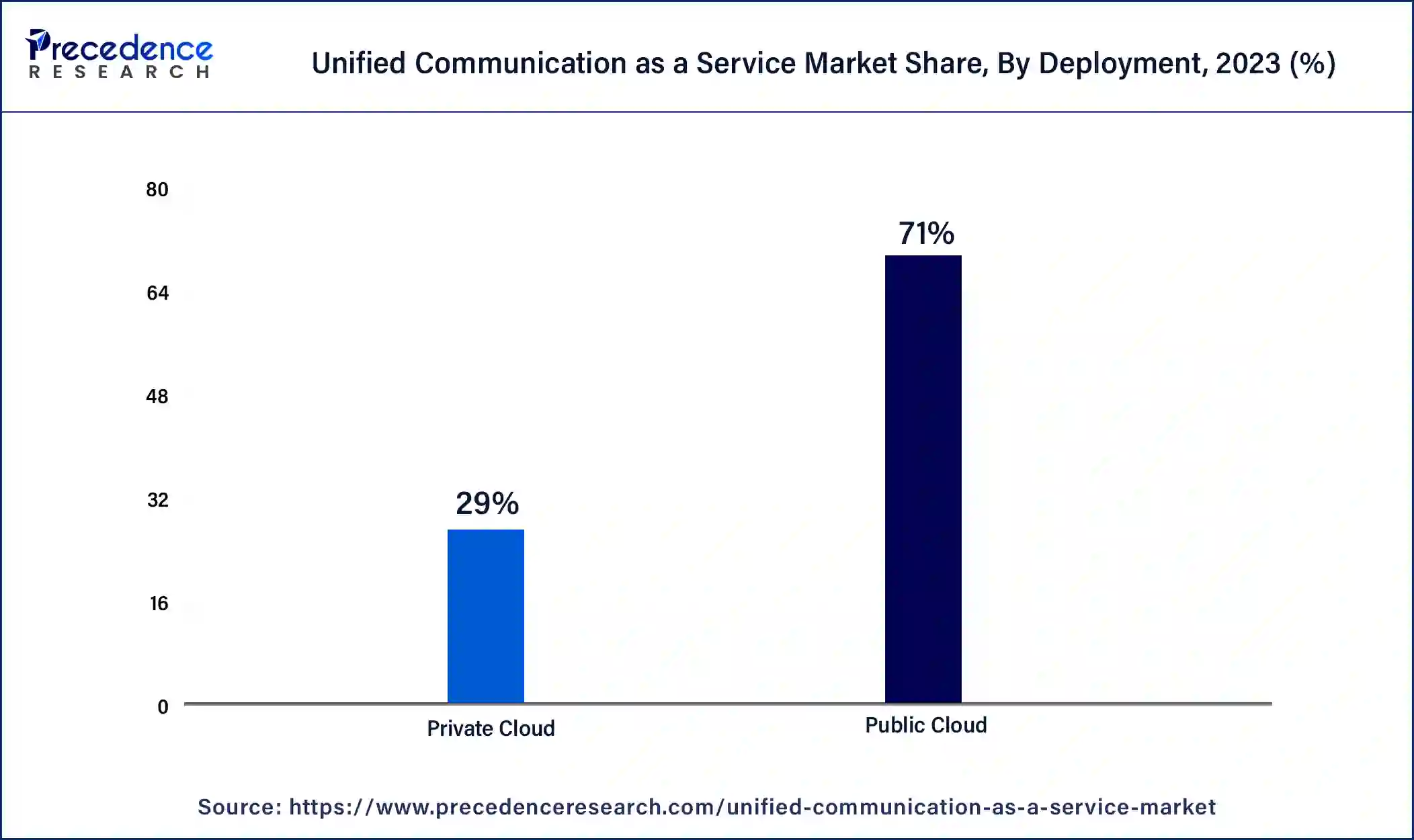

- By deployment, the public cloud segment generated over 71% of the market share in 2025.

- By deployment, the private cloud segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Unified communication as a service (UCaaS) is a cloud-based communication solution that integrates various tools and services into a single platform, streamlining collaboration and enhancing efficiency for businesses. It combines features like voice and video calling, instant messaging, email, and conferencing, allowing users to communicate seamlessly across different devices. UCaaS eliminates the need for on-premise hardware and offers a scalable, flexible, and cost-effective alternative. Users can access communication tools through the internet, facilitating remote work and increasing overall productivity. This service promotes a unified and cohesive communication experience, breaking down silos between different channels and simplifying the way teams connect and collaborate.

Key Factors Influencing Future Market Trends

- Integration of Automation and AI: As AI keeps advancing, UCaaS is helping users by making services more dependable, flexible, and quicker, ensuring companies have better access to data and improved engagement tools.

- Scalability and Cloud Migration: Cloud migration is the process of taking a system into the cloud. Scalability and Cloud Migration, Due to the rapid pace of digital transformation, organizations are opting for cloud-based UCaaS because of an organization's ability to adjust and scalability.

- Increased Remote Work and Hybrid Models: With more work occurring remotely and in a hybrid model of work, the demand for UCaaS is expanding. Businesses need systems that combine video conferences, messaging, file sharing, and collaboration. It is anticipated that this trend will lead to long-term growth in demand for communication solutions.

- In June 2025, the collaboration between Great Plains Communication (GPC), which is a leading Midwestern telecommunications provider, and Intermedia Cloud Communications, which is a leader in AI-powered Cloud communications, collaboration, and customer engagement solutions, announced the launch of GPC Unified Communications, which is powered by Intermedia Cloud Communications. Thus, all-in-one hosted PBX and Unified Communications (UC) solution will be provided to the enterprises and businesses with a feature-rich business phone system by this GPC Unified Communications product suite, which consists of video conferencing, security, multi-channel archiving, voice, SMS, business email, chat, file sharing, contact center, and many more, as well as integrated desktop and mobile apps which enhances the seamless communications, anytime-anywhere, will be provided by it.

(Source: https://finance.yahoo.com)

- In March 2025, to amplify delivery of life-transforming treatments by the global biopharmaceutical leaders, the go-live of an end-to-end technology platform powered by the Veeva Development Cloud was announced by Boehringer Ingelheim and Cognizant. This launch is a significant milestone of Phase One of the collaboration. Moreover, this "One Medicine Platform" of Boehringer replaces around 20 legacy platforms. With the aim of enhancing operational efficiencies and cross-functionality, this platform helps in unifying the data sources and medicinal development processes into a connected ecosystem.

(Source: https://www.prnewswire.co.uk)

Unified Communication as a Service Market Data and Statistics

- Since April 2020, unexpected school closures have affected over 1.20 billion students in 186+ countries, as reported by the World Economic Forum.

- Major industry players like Avaya, Inc. and IntelePeer Cloud Communications are actively engaged in creating advanced API-driven solutions, aiming to streamline communication and intricate business processes.

- Leading companies such as Twilio, Inc. and Vonage Holdings Corp. are intensifying their growth and innovation efforts by developing API-centric programmable communication solutions.

- According to Gartner, by the close of 2021, 51% of global knowledge workers are anticipated to adopt remote work arrangements, marking a significant shift in the traditional workplace landscape.

Unified Communication as a Service Market Growth Factors

- The global shift towards remote work has been a significant driver for the growth of Unified Communication as a Service (UCaaS) market. The demand for seamless communication and collaboration tools has surged as businesses adapt to flexible work arrangements.

- UCaaS offers a cost-effective alternative to traditional communication systems. Organizations benefit from reduced capital expenditures on hardware, maintenance, and upgrades. This cost efficiency has been a compelling factor contributing to the market's expansion.

- The scalability and flexibility of UCaaS solutions accommodate the dynamic needs of businesses. As companies grow or experience fluctuations in demand, the ability to scale communication tools easily has become a key factor driving the adoption of UCaaS.

- Continuous advancements in technology, such as the integration of artificial intelligence and machine learning, enhance the capabilities of UCaaS platforms. Features like intelligent automation and analytics contribute to the market's growth by providing more sophisticated communication solutions.

- Businesses are placing a higher emphasis on improving customer experience, and UCaaS facilitates this by providing seamless communication channels. Enhanced customer engagement and satisfaction are driving organizations to invest in UCaaS solutions.

- The growing emphasis on data security and privacy compliance is pushing organizations to adopt UCaaS solutions that prioritize robust security measures. The assurance of secure communication platforms is a critical factor influencing the market's growth, particularly in industries handling sensitive information.

Market Scope

| Report Coverage | Details |

| Global Market Size by 2035 | USD 494.92Billion |

| Global Market Size in 2025 | USD 84.9 Billion |

| Global Market Size in 2026 | USD 102.24 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 19.28% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Industry Vertical, Deployment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Cost savings

- The cost-effectiveness of UCaaS solutions is a significant growth factor. Businesses can save up to 30% on communication expenses by adopting cloud-based UCaaS services.

Cost savings play a pivotal role in driving the increasing demand for unified communication as a service (UCaaS) solutions. Businesses are drawn to UCaaS because it offers a cost-effective alternative to traditional communication systems. By adopting cloud-based UCaaS, companies can significantly reduce capital expenditure associated with maintaining on-premise hardware, upgrading infrastructure, and managing complex communication networks. Moreover, UCaaS eliminates the need for extensive IT support, reducing operational costs and freeing up resources for other critical business functions.

The scalability and flexibility of UCaaS solutions further contribute to cost savings, allowing organizations to pay for only the services they need, especially beneficial for businesses experiencing fluctuations in demand. This emphasis on cost efficiency not only attracts enterprises looking to optimize their budgets but also opens the door for smaller businesses to access advanced communication tools that were once financially challenging to implement, thereby fostering a surge in the market demand for UCaaS.

Restraint

Employee resistance to change

Employee resistance to change serves as a notable restraint in the unified communication as a service (UCaaS) market. The introduction of new communication tools and the shift to cloud-based collaboration platforms often face opposition from employees accustomed to traditional methods. This resistance can stem from a lack of familiarity, fear of the unknown, or concerns about disruptions to established workflows. As a result, businesses may encounter challenges in achieving widespread adoption of UCaaS solutions within their workforce.

Overcoming employee resistance requires effective change management strategies, including comprehensive training programs, clear communication about the benefits of UCaaS, and addressing concerns transparently. Without successful change management, organizations may struggle to harness the full potential of UCaaS, limiting its market demand. Recognizing and addressing employee concerns early in the implementation process is crucial for fostering a positive attitude toward the adoption of UCaaS and ensuring that the technology aligns seamlessly with the needs and preferences of the workforce.

Opportunity

Integration with emerging technologies

Integration with emerging technologies is a key driver of opportunities in the unified communication as a service (UCaaS) market. The infusion of artificial intelligence (AI) and the Internet of Things (IoT) into UCaaS platforms enhances communication experiences and functionality. AI-powered features, such as intelligent chatbots and automated workflows, streamline communication processes, increasing efficiency and reducing response times. Additionally, IoT integration allows for the incorporation of smart devices into communication networks, creating a more connected and dynamic environment.

These technological advancements not only improve the user experience but also open new avenues for innovation. For instance, AI-driven analytics can provide valuable insights into communication patterns, enabling organizations to make data-driven decisions. As businesses increasingly recognize the potential of these integrated solutions to optimize operations and enhance collaboration, the demand for UCaaS is expected to grow. This presents a significant opportunity for providers to stay at the forefront of the market by continually advancing and integrating emerging technologies into their UCaaS offerings.

Segment Insights

Industry Vertical Insights

The healthcare segment held the highest market share of 19% in 2025. In the unified communication as a service (UCaaS) market, the healthcare segment focuses on providing seamless communication solutions tailored to the unique needs of the healthcare industry. This includes secure and compliant messaging, telehealth support, and collaborative tools for healthcare professionals. The trend in the healthcare segment of UCaaS involves a growing emphasis on virtual care and remote collaboration, aiming to enhance patient care delivery, improve operational efficiency, and ensure secure communication in compliance with healthcare regulations such as HIPAA. As the healthcare sector embraces digital transformation, the demand for specialized UCaaS solutions continues to rise.

The hospitality segment is anticipated to witness rapid growth at a significant CAGR of 22.12% during the projected period. In the hospitality segment, unified communication as a service (UCaaS) refers to cloud-based communication solutions tailored for the unique needs of the hospitality industry. This includes integrated communication tools like voice, video, and messaging services, enhancing guest experiences and optimizing staff collaboration. Trends in this sector involve the increasing adoption of UCaaS to facilitate seamless guest interactions, streamline internal communications, and leverage features like virtual concierge services. As the hospitality industry evolves, UCaaS proves instrumental in delivering efficient and personalized communication solutions to meet the demands of modern travelers and hotel operations.

Deployment Insights

The public cloud segment has held a 71% market share in 2025. In the unified communication as a service (UCaaS) market, the public cloud deployment segment involves delivering communication services over a shared cloud infrastructure accessible to multiple users. This approach offers scalability, cost-effectiveness, and flexibility, allowing organizations to access UCaaS solutions without the need for extensive on-premise infrastructure. A notable trend in this segment is the increasing adoption of public cloud UCaaS due to its ease of implementation, reduced upfront costs, and the ability to support remote work, aligning with the growing trend of flexible work environments.

The private cloud segment is anticipated to witness rapid growth over the projected period. In the unified communication as a service (UCaaS) market, the private cloud segment refers to the deployment of communication services on a dedicated, secure cloud infrastructure exclusively for a single organization. This approach ensures greater control over data, security, and customization. A current trend in the private cloud segment of UCaaS is the increasing adoption among enterprises with specific security and compliance requirements. Businesses prioritize private cloud solutions to maintain a high level of data protection, making this deployment option a growing preference in the evolving UCaaS landscape.

Regional Insights

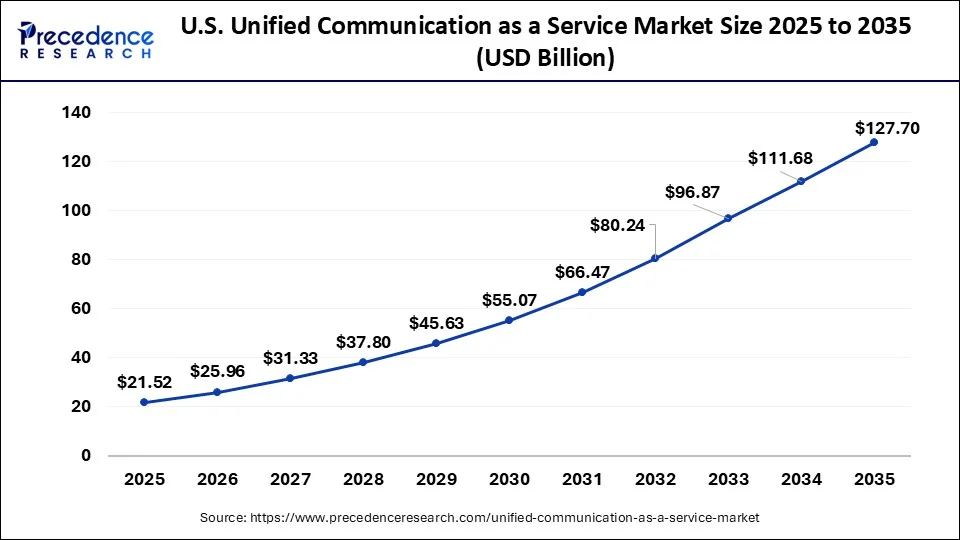

What is the U.S. Unified Communication as a Service Market Size?

The U.S. unified communication as a service market size was calculated at USD 21.52 billion in 2025 and is expected to reach around USD 127.70 billion by 2035, poised to grow at a CAGR of 20.93% from 2026 to 2035.

North America holds a share of 36% in 2025 of the unified communication as a service market due to its early and widespread adoption of cloud-based communication solutions. The region's robust technological infrastructure, high internet penetration, and the presence of key market players contribute to its major share. Additionally, a proactive approach to remote work and the constant need for advanced communication tools in enterprises further drive the demand for UCaaS. The well-established corporate landscape, combined with a strong emphasis on technological innovation, positions North America as a significant leader in the UCaaS market.

Asia-Pacific is set for rapid growth in the unified communication as a service (UCaaS) market due to increasing digitization, expanding internet connectivity, and a surge in remote work. As businesses in the region embrace cloud-based communication solutions to enhance collaboration, UCaaS offers a scalable and cost-effective approach. The rising demand for flexible communication tools, coupled with the region's economic development, positions the Asia-Pacific market as a key player in the global UCaaS landscape, poised for substantial expansion.

Meanwhile, Europe is experiencing notable growth in the unified communication as a service (UCaaS) market due to the increasing adoption of flexible work models, digital transformation initiatives, and the demand for streamlined communication tools. The region's businesses are recognizing the benefits of cloud-based UCaaS solutions in fostering collaboration and productivity. Additionally, the emphasis on data security and compliance aligns with the advanced features offered by UCaaS providers. As a result, the market is witnessing significant traction, with organizations across Europe leveraging UCaaS to enhance communication and adapt to evolving workplace dynamics.

The Middle East and Africa are expected to grow significantly in the unified communication as a service market during the forecast period. The growing digitalization is increasing the use of unified communication as a service in various small and large enterprises. Moreover, to enhance its security and application, various developments are also being made. Furthermore, the initiatives provided by the government are accelerating their development as well as adoption. Thus, this promotes the market growth.

What are the Advancements in the Unified Communication as a Service Market in Latin America?

Latin America is set to witness a substantial amount of growth in the market throughout the forecast period. This growth and development are fueled by rapid digital transformation and increasing internet penetration in the region. Countries such as Brazil and Mexico are leading players as they are seen actively investing in advanced communication technologies in order to improve their business operations. The region is also witnessing a rise in SMEs and startups, which is propelling the market even further.

Brazil Unified Communication as a Service Market Trends: The country is witnessing a rapid push towards digitalization, backed by government policies and investments, which is driving up the adoption of cloud-based services. Businesses in the region are recognizing the importance of efficient communication tools to enhance productivity and competitiveness.

What are the Key Trends in the Unified Communication as a Service Market in the Middle East and Africa?

Saudi Arabia Unified Communication as a Service Market Trends: The increasing number of startups and SMEs in the region is fueling demand for cost-effective and scalable communication solutions. Remote work and hybrid work models are also gaining traction, leading to a higher focus on advanced, collaborative tools. Enterprises, SMEs, healthcare, and education sectors are increasingly leveraging integrated UCaaS platforms that combine voice, video, messaging, and collaboration tools, often enhanced with AI and analytics.

Unified Communication as a Service Market Companies

- Microsoft Corporation: Teams integrates chat, video, and telephony into the Microsoft 365 ecosystem.

- Cisco Systems, Inc.: Webex provides secure video meetings and messaging paired with proprietary hardware.

- Avaya Inc.: Offers hybrid solutions bridging on-premises reliability with cloud-based digital channels.

- RingCentral, Inc.: A mobile-first platform featuring global cloud PBX and deep app integrations.

Mitel Networks Corporation: Provides versatile communication tools for both hybrid and pure cloud environments. - 8x8, Inc.: Combines unified communications and contact center capabilities with shared AI analytics.

- Alcatel-Lucent Enterprise (ALE): Connects people and processes via cloud-based messaging and voice services.

- Fuze, Inc.: Now part of 8x8, it provides a consistent global experience for enterprise voice and video.

- Zoom Video Communications, Inc.: Unifies Zoom Phone, Chat, and AI collaboration tools in one interface.

- Vonage Holdings Corp.: Merges programmable APIs with standard UCaaS features for customizable workflows.

- Twilio Inc.: Provides flexible APIs for businesses to build bespoke communication and contact center solutions.

- Unify (Atos SE): Offers secure collaboration software tailored for digital workplaces and enterprise security.

- BroadSoft: Acquired by Cisco, its tech powers cloud calling solutions for global service providers.

- IBM Corporation: Focuses on AI-driven enterprise integration and collaboration rather than a retail platform.

- Google LLC: Integrates Voice and Meet into Workspace for a simple, cloud-native collaboration experience.

Recent Developments

- In April 2025, FirstLight, a major provider of digital solutions to large customers across the Northeast and mid-Atlantic, announced that it is improving its Unified Communications (UC) plan. This update adds new capabilities intended to make the customer experience better.

- In March 2025, Tata Communications Ltd., which specializes in private cloud services, launched Vayu to help businesses use cloud services at lower rates. Because Vayu is designed from the start with a single focus, it deals with rising cloud bills, the complexity of working with several clouds, and the needs of AI, all while allowing businesses to smoothly enter the age of intelligent enterprises.

- In February 2025, Zoom and Mitel introduced a new hybrid cloud solution worldwide that merges Zoom Workplace and Zoom AI Companion with Mitel's flagship communication products. To match the increased request for hybrid UC in businesses, the new method offers a way for companies to provide critical communications tools as well as powerful collaboration features to improve how they work.

- In October 2023, ALE International, a leading provider of communication and cloud solutions, is expanding its global distribution network through the Rainbow Hub, supported by its extensive partner network. This move aims to meet the rising demand from businesses seeking innovative solutions to effectively connect and collaborate with their teams, customers, and suppliers.

- In August 2023, 8x8, Inc., a prominent provider of integrated cloud contact center and unified communications platforms, achieved significant recognition. The company received a prestigious Gold Stevie Award in the Technology Team of the Year category at the 20th Annual International Business Awards.

- In June 2023, Cisco formed a strategic partnership with AT&T mobile network to seamlessly integrate Webex Calling. This collaboration is anticipated to deliver a robust, mobile-first unified collaboration experience, allowing users to operate with a single business mobile number. Such advancements are poised to propel the growth of the industry.

- In October 2023, Avaya Inc. joined forces with Flouris, a major Dutch mortgage lender, leveraging OneCloud CCaaS to enhance customer experience. This collaboration also enables contact center personnel to operate effectively in a hybrid work environment.

Segments Covered in the Report

By Industry Vertical

- Automotive

- Education

- Healthcare

- BFSI

- Hospitality

- Real Estate

- Legal

- IT & Telecom

- Others

By Deployment

- Public Cloud

- Private Cloud

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting