Corn Fiber Market Size and Growth 2025 to 2034

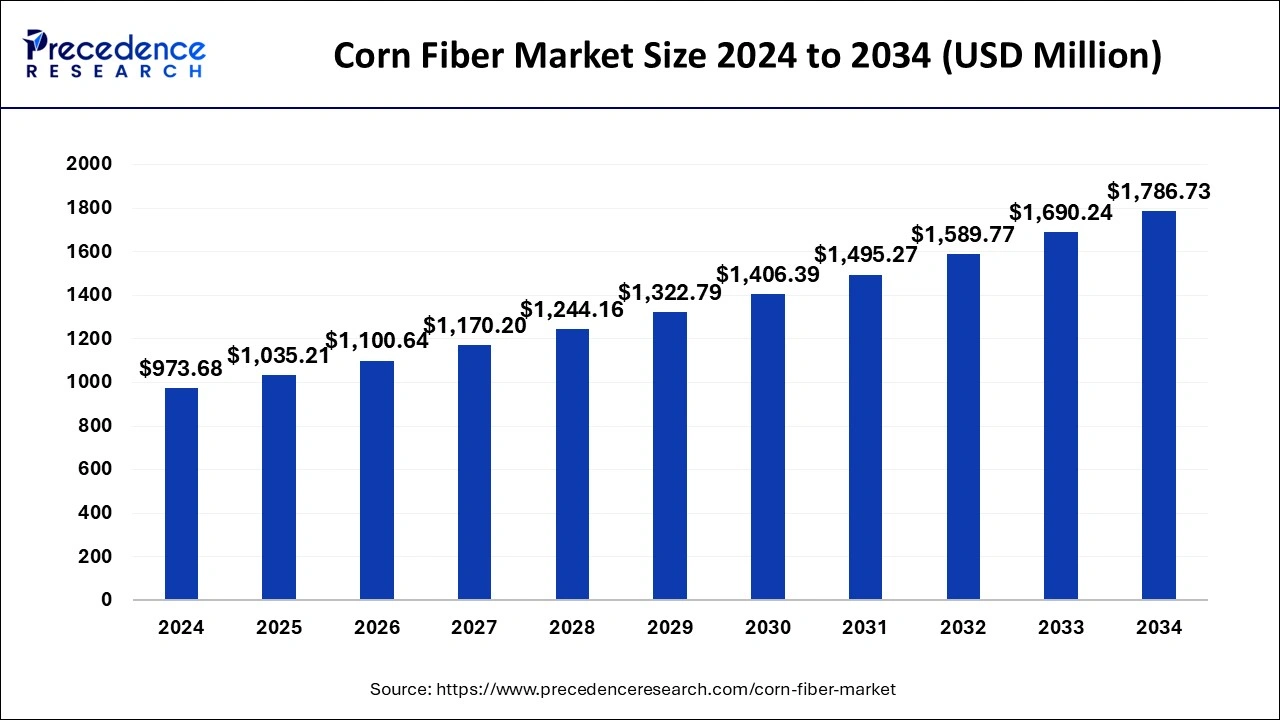

The global corn fiber market size was estimated at USD 973.68 million in 2024 and is predicted to increase from USD 1,035.21 million in 2025 to approximately USD 1,786.73 million by 2034, expanding at a CAGR of 6.26% from 2025 to 2034.The corn fiber market is driven by increasing consumer demand for sustainable and eco-friendly products, coupled with a growing awareness of the health benefits of dietary fiber.

Corn Fiber MarketKey Takeaways

- The global corn fiber market was valued at USD 973.68 million in 2024.

- It is projected to reach USD 1,786.73 million by 2034.

- The corn fiber market is expected to grow at a CAGR of 6.26% from 2025 to 2034.

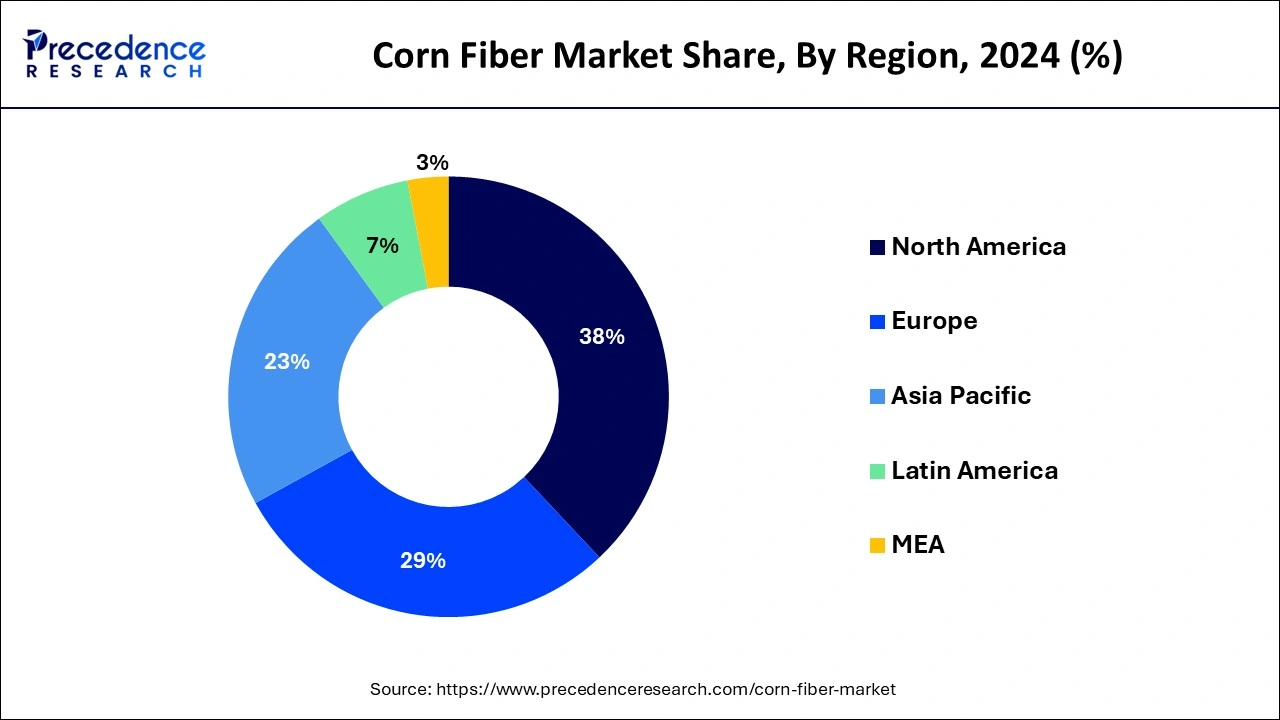

- North America led the largest market share of 38% in 2024.

- Asia Pacific is projected to expand at the fastest rate during the forecast period of 2025-2034.

- By application type, the pharmaceuticals held the largest share of the market in 2024.

- By application type, the textile industry segment is expected to witness the fastest growth.

U.S.Corn Fiber Market Size and Growth 2025 to 2034

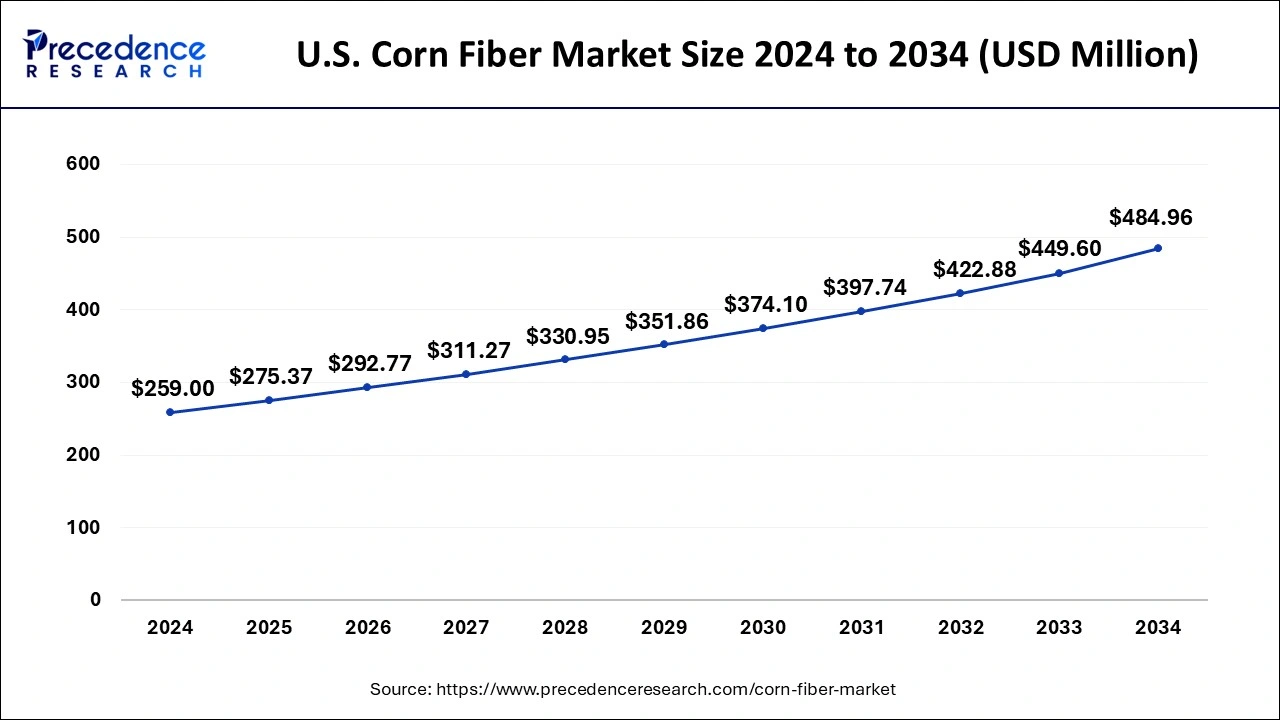

The U.S. corn fiber market size was estimated at USD 259 million in 2024 and is predicted to be worth around USD 484.96 million by 2034 at a CAGR of 6.47% from 2025 to 2034.

North America led the global market with the highest market share of 38% in 2024. The corn fiber market in North America is observed to continue to maintain its dominance, primarily due to the region's established infrastructure, stringent regulatory standards, and increasing consumer awareness regarding sustainability and health-conscious choices. Countries like United States and Canada have emerged as key players in the North American corn fiber market, with robust demand from industries such as pharmaceuticals, textiles, food, and beverages. Additionally, the region's emphasis on eco-friendly practices and sustainable production methods has further propelled the adoption of corn fiber as a renewable and biodegradable alternative, driving its market growth.

Asia-Pacific is expected to witness growth at a significant rate in the corn fiber market during the forecast period from 2025-2034. The Asia Pacific region has emerged as an increasingly important player in the market in recent years. Rapid industrialization, urbanization, and changing consumer preferences towards healthier and eco-friendly products have spurred the demand for corn fiber across various industries in countries like China, India, and Japan.

Moreover, the growing middle-class population and rising disposable incomes in the region have contributed to the increased consumption of processed foods, dietary supplements, and functional textiles, further fueling the demand for corn fiber. With Asia Pacific witnessing significant economic growth and infrastructural developments, coupled with a shift towards sustainable practices, the region is poised to become a key driver of growth in the global corn fiber market in the coming years.

Market Overview

The corn fiber market encompasses the production, distribution, and consumption of fibrous materials derived from corn, primarily extracted from corn kernels or other corn processing by-products. Corn fiber is valued for its versatility, sustainability, and biodegradability, making it a sought-after material in various industries. Its applications range from food and beverage processing, where it is used as a dietary fiber additive, to the textile industry, where it is employed in the production of fabrics and bio-based polymers. Additionally, corn fiber finds utility in the pharmaceutical sector, where it serves as a carrier for drug delivery systems, as well as in the manufacturing of paper products and biofuels.

In recent years, the corn fiber market has witnessed significant growth due to increasing consumer demand for eco-friendly and renewable alternatives to traditional materials. As sustainability concerns continue to drive innovation and market expansion, the corn fiber industry is poised for further development and diversification. Companies within the sector are investing in research and development to enhance production processes and explore new applications, thereby contributing to the growth and sustainability of the market on a global scale.

Corn Fiber MarketGrowth Factors

- The increasing demand for sustainable and eco-friendly materials is driving the adoption of corn fiber across various industries. As consumers become more environmentally conscious, there is a growing preference for products made from renewable resources, such as corn fiber, which is biodegradable and reduces reliance on non-renewable materials.

- Advancements in technology have led to improvements in corn fiber extraction and processing techniques, resulting in higher yields and better-quality products. These technological innovations have made corn fiber more cost-effective and viable for a wide range of applications, thereby stimulating market growth.

- Government initiatives and regulations promoting the use of renewable resources and reducing carbon emissions are also propelling the growth of the corn fiber market. Subsidies, tax incentives, and mandates for the use of bio-based materials encourage businesses to invest in corn fiber production and incorporate it into their products.

- The versatility of corn fiber and its ability to be used in multiple industries, including food and beverage, textiles, pharmaceuticals, and biofuels, contribute to its growing popularity. As companies seek to diversify their product offerings and cater to changing consumer preferences, the demand for corn fiber continues to rise, driving market expansion.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.26% |

| Market Size in 2025 | USD 1,035.21 Million |

| Market Size by 2034 | USD 1,786.73 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Sustainability trends

One of the key drivers of the corn fiber market is the increasing focus on sustainability across various industries. As consumers and businesses alike become more aware of environmental issues and seek eco-friendly alternatives, the demand for renewable and biodegradable materials like corn fiber continues to grow. This trend is particularly evident in sectors such as packaging, textiles, and biofuels, where the use of corn fiber helps reduce carbon footprint and reliance on non-renewable resources.

Technological advancements

Technological advancements play a crucial role in driving the growth of the corn fiber market. Innovations in extraction, processing, and manufacturing techniques have led to improvements in efficiency, cost-effectiveness, and product quality. Enhanced technologies enable higher yields, better purity, and increased versatility of corn fiber, making it more attractive to a wider range of industries. These advancements also drive down production costs, making corn fiber more competitive with traditional materials and further stimulating market growth.

- In 2023, Sheet Society introduced its innovative Cloud Corn bedding range, offering plant-based pillows and quilts from corn starch. Addressing the need for comfortable, affordable, hypoallergenic, and eco-friendly bedding, the Cloud Corn range revolutionizes the market by providing luxurious softness and weight, setting a new standard for sustainable bedding solutions.

Restraint

Competition from alternative fibers

A significant restraint faced by the corn fiber market is the competition from alternative fibers derived from sources such as bamboo, hemp, and flax. While corn fiber offers various benefits, including sustainability and biodegradability, other natural fibers also possess similar attributes and may sometimes be perceived as more environmentally friendly or economically viable.

Additionally, the availability and cost of corn fiber can be influenced by factors such as weather conditions, crop yields, and fluctuating commodity prices, which can impact its competitiveness against alternative fibers. As a result, the corn fiber market faces challenges in establishing itself as the preferred choice among consumers and industries, particularly in the face of strong competition from alternative fiber sources.

Opportunities

Expanded applications in bio-based materials

An opportunity for the corn fiber market lies in the expansion of its applications in bio-based materials. With growing consumer demand for sustainable alternatives to conventional plastics and synthetic materials, there is a significant opportunity for corn fiber to be utilized in the production of bio-based plastics, biocomposites, and other eco-friendly materials. By leveraging its renewable and biodegradable properties, corn fiber can contribute to the development of innovative products that reduce reliance on fossil fuels and minimize environmental impact.

Emerging markets and industries

Corn fiber market lies in tapping into emerging markets and industries. As awareness of sustainability and environmental concerns continues to rise globally, there is increasing demand for renewable and biodegradable materials in various sectors, including automotive, construction, and consumer goods.

Corn fiber providers have the opportunity to enter and expand within these burgeoning markets, offering sustainable solutions that align with the values and preferences of consumers and businesses alike. By targeting emerging industries and markets, the corn fiber market can capitalize on growing demand and diversify its revenue streams.

Application Insights

The pharmaceuticals segment dominated the corn fiber market with the largest share in 2024. In recent years, the market has witnessed significant growth, particularly in the pharmaceutical sector. Corn fiber, derived from corn husks, offers a sustainable and eco-friendly alternative to traditional materials used in pharmaceutical applications. Its biodegradable properties make it ideal for drug delivery systems, packaging, and even as a source of excipients in pharmaceutical formulations. Additionally, corn fiber's hypoallergenic nature and ability to be tailored for specific release profiles have contributed to its increasing adoption in the pharmaceutical industry, where safety, efficacy, and sustainability are paramount concerns.

The textile industry segment is expected to show the fastest growth in the corn fiber market during the forecast period. The textile industry has also seen a surge in the use of corn fiber due to its unique properties and versatility. As consumers become more environmentally conscious, there's a growing demand for sustainable textile materials. Corn fiber offers a renewable and biodegradable option for textile production, reducing reliance on synthetic fibers derived from petroleum-based sources. Its natural moisture-wicking and antibacterial properties make it particularly attractive for sportswear, activewear, and other textiles requiring performance features. Additionally, advancements in processing techniques have made corn fiber more cost-effective and more accessible to incorporate into existing textile manufacturing processes, further driving its popularity in the textile market.

The food segment is another significantly growing segment of the corn fiber market. In the food and beverages industry, the demand for natural and healthy ingredients drives corn fiber adoption due to its functional properties and nutritional benefits. As consumers seek out products with added fiber content and reduced sugar levels, corn fiber offers an ideal solution for enhancing the nutritional profile of various food and beverage products.

Corn Fiber Market Companies

- Grain Processing Corporation

- Doshi Group

- Archer Daniels Midland Company

- Cargill Inc.

- Tate & Lyle PLC

- Roquette Freres

- HL Agro Products Pvt. Ltd.

- SunOpta Inc.

- Ingredion Incorporated

- J. Retentate & Sohne GmbH & Co. KG

Recent Developments

- In October 2023, Tate & Lyle unveiled a significant investment initiative for its corn wet mill in Boleráz, Slovakia, focusing on expanding capacity for its renowned non-GMO PROMITOR Soluble Fiber. The move underscores the company's commitment to meeting the growing demand for healthier ingredient solutions in the food and beverage industry.

- In July 2023, Green Plains Inc. and Equilon Enterprises LLC (Shell) announced a groundbreaking technology collaboration. Leveraging Fluid Quip Technologies' precision separation and processing technology (MSC) alongside Shell Fiber Conversion Technology (SFCT), this collaboration aims to unlock distillers corn oil, produce low-carbon ethanol, and generate high-quality ingredients for animal feed diets, revolutionizing the industry.

Segments Covered in the Report

By Application

- Food

- Bakery

- Breakfast Cereals & Snacks

- Confectionery

- Dairy

- Meat Products

- Infant Food

- Beverages

- Pharmaceutical

- Animal Nutrition

- Swine

- Ruminants

- Poultry

- Pet

- Personal Care & Cosmetics

- Textiles

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting