What is the Counter-Unmanned Aerial System (C-UAS) Market Size?

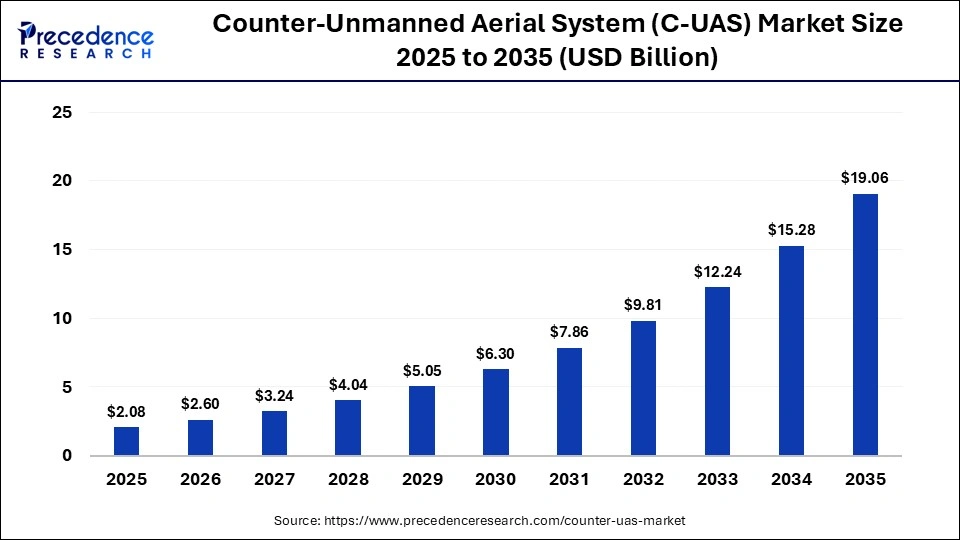

The global counter-unmanned aerial system (C-UAS) market size was calculated at USD 2.08 billion in 2025 and is predicted to increase from USD 2.6 billion in 2026 to approximately USD 19.06 billion by 2035, expanding at a CAGR of 25.8% from 2026 to 2035.The counter-unmanned aerial system (C-UAS) market is growing steadily, driven by escalating drone-related security threats, rising adoption across defense and homeland security, and increasing civil and commercial use cases.

Market Highlights

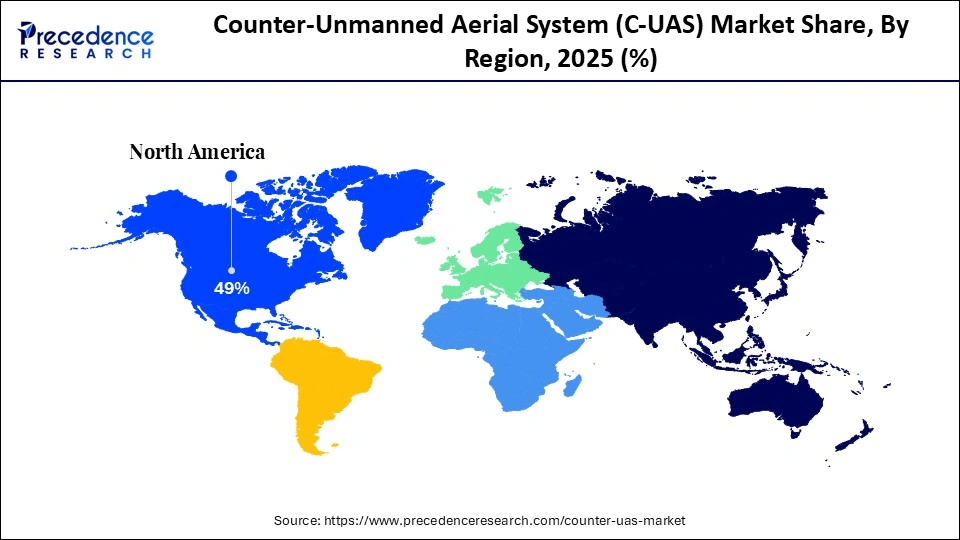

- North America led the counter-unmanned aerial system (C-UAS) market with the biggest market share of 49% in 2025.

- Asia Pacific is estimated to expand the most in the market between 2026 and 2035.

- By component, the sensors segment held the dominant share in the market in 2025.

- By component, the control systems segment is growing at the highest CAGR between 2026 and 2035.

- By platform, the ground-based systems segment led the market and market share in 2025.

- By platform, the airborne systems segment is expected to expand at a notable CAGR from 2026 to 2035.

- By end use, the defense segment held the dominant market share in 2025.

- By end use, the aerospace segment is projected to grow at a solid CAGR between 2026 and 2035.

- By technology, the laser systems segment led the market and market share in 2025.

- By platform, the radio frequency systems segment is expected to expand at the highest CAGR from 2026 to 2035.

- By application, the military segment held the dominant share in the market in 2025.

- By application, the commercial segment is growing at the highest CAGR between 2026 and 2035.

How Are Counter-UAS Systems Reshaping Airspace Security?

A counter-unmanned aerial system refers to integrated technologies designed to detect, track, identify, and neutralize unauthorized or hostile drones operating in protected airspace. Market growth is driven by the rising frequency of drone-related security incidents, increasing defense and homeland security spending, expanding protection requirements for airports and critical infrastructure, and rapid advancements in radar, radio frequency sensing, and AI-enabled threat classification. Growing regulatory attention on airspace safety is further accelerating deployment across civilian and military environments.

Increasing use of layered defense architectures combining detection, identification, and mitigation capabilities is improving response effectiveness. Adoption of AI-driven command-and-control platforms is enhancing real-time decision-making and threat prioritization. Expansion of counter-UAS deployment beyond military use into commercial aviation, public events, and energy infrastructure is widening the addressable market. In parallel, advancements in electronic warfare and non-kinetic neutralization methods are improving operational safety and compliance.

How Can AI Integration Transform the Counter-UAS Market?

AI integration can dramatically transform counter-unmanned aerial systems by enabling real-time threat detection, classification, and response with minimal human intervention. Advanced machine learning models analyze sensor data from radar, radio frequency, and electro-optical or infrared systems to distinguish drones from birds and environmental clutter, reducing false positives. AI-powered decision engines prioritize threats and recommend optimal mitigation actions, while deep learning–based adaptive tracking, predictive behavior modeling, and sensor fusion improve detection accuracy and response speed. AI also enables automated electronic countermeasures such as intelligent jamming and spoofing that adapt to evolving drone communication protocols, improving operational efficiency and reducing cognitive workload for operators.

Growing deployment of AI-enabled counter-UAS solutions at airports, public venues, and critical infrastructure is expanding civilian adoption beyond defense use cases. Continuous learning models are improving system performance over time by adapting to new drone types and flight behaviors. In parallel, integration with centralized command-and-control systems is enhancing coordinated airspace security across multiple sites and jurisdictions.

Primary Trends Influencing the Development of the Counter-Unmanned Aerial System (C-UAS) Market

- Multi-sensor fusion technologies: C-UAS solutions increasingly combine radar, radio frequency sensors, electro-optical, infrared, and acoustic systems to enhance detection accuracy. This multi-layered approach ensures reliable performance in complex environments, urban settings, and adverse weather conditions, while improving tracking precision and reducing blind spots caused by single-sensor limitations.

- Rising adoption of non-kinetic countermeasures: The market is shifting toward non-kinetic solutions such as electronic jamming, spoofing, and cyber takeover technologies. These methods allow authorities to neutralize drones without physical destruction, minimizing collateral damage, ensuring public safety, and meeting regulatory requirements in civilian areas like airports, stadiums, and urban infrastructure.

- Integration with broader air defense and security networks: Counter-unmanned aerial systems are increasingly being integrated into existing air defense, surveillance, and command-and-control networks. This integration enables real-time data sharing, coordinated threat responses, and centralized monitoring, strengthening situational awareness and enhancing overall security across military bases, borders, and critical national assets.

- Growing demand for mobile and portable C-UAS platforms: There is rising demand for compact, vehicle-mounted, and man-portable counter-drone systems to support tactical operations and rapid deployment. These solutions offer flexibility, ease of transport, and suitability for temporary security needs, disaster response, and field operations where fixed installations are impractical.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.08 Billion |

| Market Size in 2026 | USD 2.6 Billion |

| Market Size by 2035 | USD 19.06Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 25.8% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Platform, End Use,Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Why Was the Sensors Segment Dominant in the Counter-Unmanned Aerial System (C-UAS) Market?

The sensors segment dominated the counter-unmanned aerial system (C-UAS) market in 2025 because advanced radar, radio frequency, electro-optical, and infrared sensors are critical for accurate detection, tracking, and classification of drones. Growing demand for multi-sensor fusion, enhanced situational awareness, and low false-alarm rates in complex environments boosts sensor adoption. Continuous technological improvements and integration with AI further strengthen its market leadership.

The control systems segment is estimated to be the fastest-growing component in the counter-unmanned aerial system (C-UAS) market between 2026 and 2035, due to increasing demand for integrated command interfaces, real-time threat response coordination, and automated decision support. Enhanced connectivity with detection sensors, advanced software controls, and AI-driven threat prioritization improve operational efficiency and scalability, making control systems essential for coordinated, adaptive airspace defense across military and civilian applications.

Platform Insights

What Is the Reason for Ground-Based Systems to Be the Leader in This Counter-Unmanned Aerial System (C-UAS) Market?

The ground-based systems segment dominates the global counter-unmanned aerial system market due to its cost-effectiveness, ease of deployment, and wide applicability across defense, border security, airports, and critical infrastructure. These systems offer stable power availability, robust sensor integration, and continuous coverage, making them well suited for fixed installations that require persistent monitoring and rapid response to unauthorized drones. Longer operational lifecycles and lower maintenance complexity further support widespread adoption across civilian and military facilities. In addition, integration with existing surveillance and command-and-control infrastructure enhances situational awareness and response coordination.

The airborne systems segment is anticipated to be the fastest-growing in the global market due to rising demand for extended surveillance range, rapid response capability, and operational flexibility in dynamic environments. Airborne platforms improve situational awareness, enable mobile threat tracking, and address coverage gaps where ground-based systems are constrained, particularly in military operations, border patrol, and wide-area monitoring missions. Advancements in endurance, payload capacity, and sensor miniaturization are improving mission effectiveness and deployment duration. Growing use of unmanned and manned airborne platforms for layered airspace security is further accelerating segment growth.

End-Use Insights

Why Does Defense Represent the Largest Segment in the Counter-Unmanned Aerial System (C-UAS) Market during 2025?

The defense segment dominates the global counter-unmanned aerial system (C-UAS) market because armed forces prioritize airspace security against hostile drones. High investment in advanced detection and mitigation technologies, stringent strategic requirements, and continuous threat evolution drive adoption. Defense applications demand integrated, robust C-UAS solutions for battlefield superiority, border protection, and critical asset defense, reinforcing its leading market position.

The aerospace segment is estimated to be the fastest-growing in the global market due to increased emphasis on securing aircraft, airports, and airspace from unauthorized drones. Growing commercial aviation traffic, stricter safety regulations, and demand for integrated C-UAS solutions in airport operations and airborne platforms drive rapid adoption to protect flights, passengers, and critical aerospace infrastructure.

Technology Insights

Why Was the Laser Systems Segment Dominant in the Counter-Unmanned Aerial System (C-UAS) Market?

The laser systems segment dominates the global market due to its precision targeting, rapid response, and ability to neutralize multiple threats without relying on explosive measures. Its cost-effectiveness, minimal collateral damage, and integration with advanced detection technologies make it a preferred choice for military and defense applications worldwide.

The radio frequency systems segment is anticipated to be the fastest-growing in the global market due to its ability to detect, track, and disrupt multiple drones simultaneously over long distances. Its non-lethal approach, ease of integration with existing defense networks, and growing adoption by military and critical infrastructure sectors are driving rapid market expansion.

Application Insights

Why Does the Military Represent the Largest Segment in the Counter-Unmanned Aerial System (C-UAS) Market During 2025?

The military segment dominates the global counter-unmanned aerial system (C-UAS) market due to rising use of hostile drones in modern warfare, border surveillance, and asymmetric threats. Armed forces prioritize advanced detection, electronic warfare, and integrated command systems to protect bases, troops, and critical assets, driving sustained investments and rapid deployment of C-UAS technologies.

The commercial segment is anticipated to be the fastest-growing in the global market due to rising concerns about drone interference at airports, critical infrastructure, and public events. Regulatory mandates for safer airspace, expanding industrial drone use, and demand for non-kinetic mitigation solutions drive commercial adoption of C-UAS for security, asset protection, and operational continuity.

Regional Insights

How Big is the North America Counter-Unmanned Aerial System (C-UAS) Market Size?

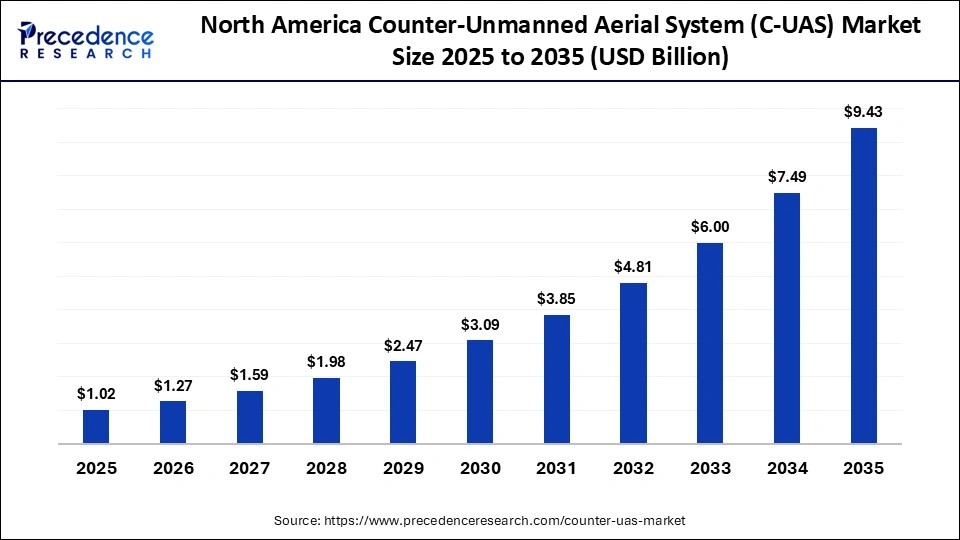

The North America counter-unmanned aerial system market size is estimated at USD 1.01 billion in 2025 and is projected to reach approximately USD 9.43 billion by 2035, with a 24.91% CAGR from 2026 to 2035.

Why Is North America the Top Region for the Counter-Unmanned Aerial System (C-UAS) Market?

North America dominates the global counter-unmanned aerial system market due to strong defense spending, early adoption of advanced security technologies, and rising drone-related threats. The region benefits from robust military modernization programs, extensive critical infrastructure protection initiatives, a strong presence of leading C-UAS developers, and supportive regulatory frameworks focused on airspace security.

High deployment across airports, military bases, energy facilities, and public event venues is reinforcing sustained demand. Strong collaboration between defense agencies, technology firms, and research institutions is accelerating innovation and system integration. In addition, continued investment in AI-enabled surveillance and multi-sensor fusion platforms is strengthening North America's leadership in advanced C-UAS capabilities.

What is the Size of the U.S. Counter-Unmanned Aerial System (C-UAS) Market?

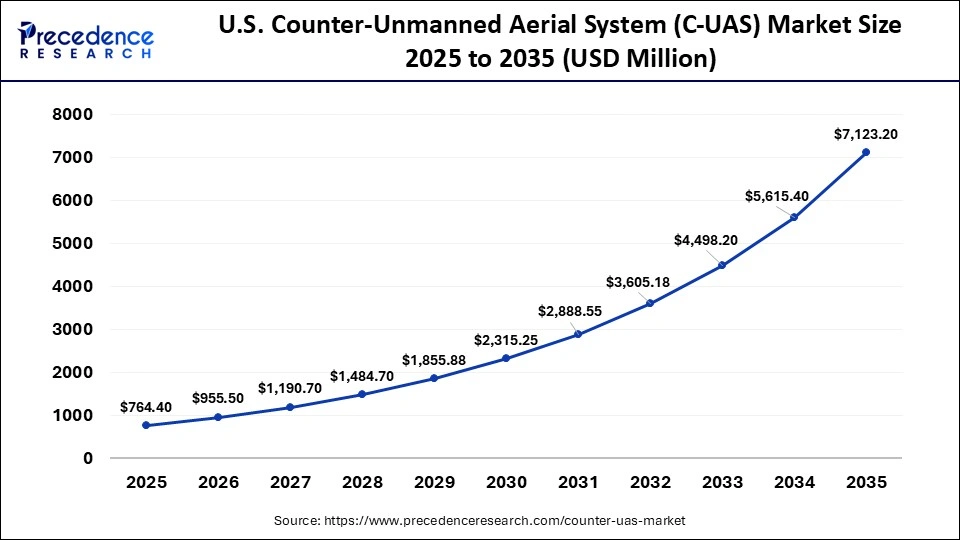

The U.S. counter-unmanned aerial system market size is calculated at USD 764.40 million in 2025 and is expected to reach nearly USD 7,123.20 million in 2035, accelerating at a strong CAGR of 25.01% between 2026 and 2035.

U.S. Global Counter-Unmanned Aerial System (C-UAS) Market Trends

In the U.S., the counter-unmanned aerial system (C-UAS) market is rising due to increasing homeland security concerns, growing drone misuse incidents, and strong defense modernization efforts. High investments in advanced detection, electronic warfare, and AI-enabled C-UAS solutions support protection of military bases, airports, borders, and critical infrastructure nationwide.

Why Is Asia Pacific Experiencing the Fastest Growth of the Counter-Unmanned Aerial System (C-UAS) Market?

Asia Pacific is the fastest-growing region in the global counter-unmanned aerial system market due to rising defense modernization, increasing geopolitical tensions, and expanding drone-related security risks. Rapid infrastructure development, growing military budgets, and adoption of advanced surveillance technologies by countries such as China and India are increasing demand for C-UAS solutions to protect borders, airspace, and critical assets.

Expansion of smart cities, airports, and energy infrastructure is widening civilian demand beyond military use cases. Growing domestic defense manufacturing and technology partnerships are improving regional availability of C-UAS systems. Increasing regulatory focus on airspace management and public safety is reinforcing long-term market growth across the Asia Pacific region.

China Counter-Unmanned Aerial System (C-UAS) Market Trends

China dominates the Asia-Pacific market due to significant investments in defense modernization, advanced surveillance technologies, and indigenous C-UAS development. Growing concerns over border security, industrial drone threats, and strategic airspace protection drive adoption, while strong government support, technological innovation, and integration of AI-enabled detection and mitigation systems reinforce China's leading position in the regional market.

How Big is the Opportunity for the Growth of the Counter-Unmanned Aerial System (C-UAS) Market?

Europe is witnessing notable growth in the global counter-unmanned aerial system (C-UAS) market due to increasing concerns over unauthorized drone activities near airports, borders, and critical infrastructure. Rising defense and homeland security investments, adoption of advanced detection and mitigation technologies, and stringent regulatory frameworks for airspace safety are driving market expansion. Additionally, collaboration between governments and technology providers supports rapid deployment and operational efficiency of C-UAS solutions across the region.

Who are the Major Players in the Counter-Unmanned Aerial System (C-UAS) Market?

The major players in the counter-unmanned aerial system (C-UAS) market include Leonardo (IT), BAE Systems (GB), DroneShield (AU), Textron (US), SAAB (SE), Northrop Grumman (US), Raytheon Technologies (US), Lockheed Martin (US), Thales Group (FR)

Recent Developments

- In January 2026, Axon Vision announced that it received a strategic order from Leonardo DRS for its new AI powered counter unmanned aerial system designed to detect, classify, track, and intercept aerial threats in real time. This modular system enhances situational awareness and survivability, integrates on both manned and unmanned platforms, and supports operational evaluations with U.S. defense and homeland security forces, strengthening AI driven C UAS capability deployment.(Source:https://www.morningstar.com)

- In January 2026, At CES 2026, Velodyne Space showcased a breakthrough counter UAS solution that uses lidar, thermal imaging, and AI assisted tracking to safely capture unauthorized drones with net based technology instead of destructive interception. Its electromagnetic launch system can rapidly deploy nets to entangle targets, reducing collateral damage and preserving forensic evidence. The vehicle mounted platform is suited for critical infrastructure and public safety protection.(Source:https://lidarnews.com)

- In December 2025, VisionWave Technologies, in partnership with BladeRanger, unveiled its Argus space enabled, AI driven C UAS platform. Designed as a persistent wide area drone defense “kill chain,” Argus uses satellite sensors, high frequency resilient communications, and AI object recognition to detect, classify, and coordinate responses across vast regions. The architecture aims for global monitoring of borders, infrastructure, and urban areas. (Source: https://www.globenewswire.com)

- In August 2025, L3Harris Technologies launched its dedicated Counter Unmanned Systems (C UxS) initiative to accelerate AI integrated solutions across air, land, and sea domains. Leveraging passive sensors, autonomous software, and existing C UAS products, this effort aims to address rapidly evolving drone threats with coordinated, modular detection and mitigation technologies tailored to modern defense needs. (Source: https://www.l3harris.com)

Segments Covered in the Report

By Component

- Sensors

- Cameras

- Control Systems

- Communication Systems

- Power Supply

By Platform

- Airborne Systems

- Naval Systems

- Portable Systems

- Fixed Systems

By End Use

- Defense

- Aerospace

- Transportation

- Energy

- Telecommunications

By Technology

- Laser Systems

- Radio Frequency Systems

- Kinetic Systems

- Cyber Systems

- Electromagnetic Systems

By Application

- Military

- Commercial

- Homeland Security

- Public Safety

- Infrastructure Protection

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting