Cyanide-Free Gold Bath Plating Solutions Market Size and Forecast 2025 to 2034

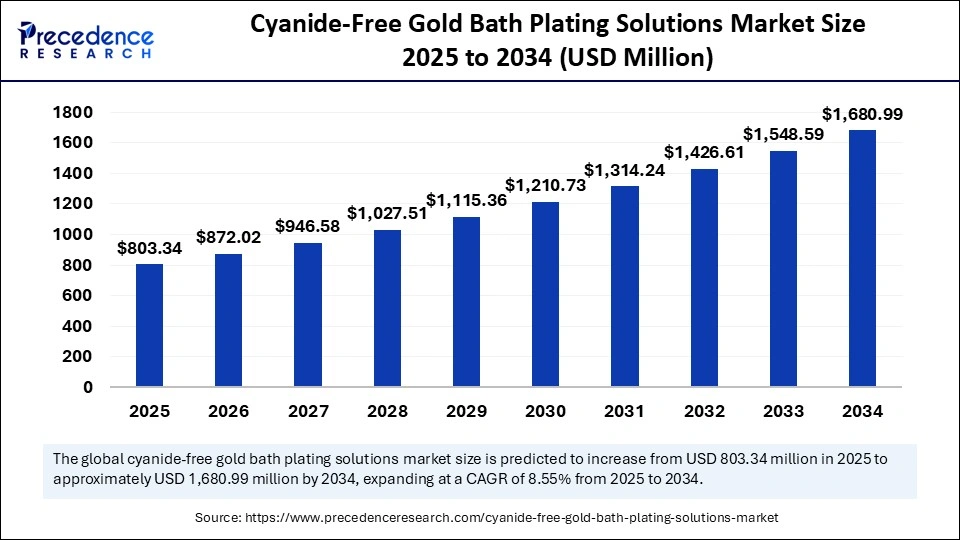

The global cyanide-free gold bath plating solutions market size accounted for USD 803.34 million in 2024 and is predicted to increase from USD 740.06 million in 2025 to approximately USD 1,680.99 billion by 2034, expanding at a CAGR of 8.55% from 2025 to 2034. The increased demand for sustainable and eco-friendly products in electronics and jewellery drives the global market.

Cyanide-Free Gold Bath Plating Solutions MarketKey Takeaways

- In terms of revenue, the global cyanide-free gold bath plating solutions market was valued at USD 740.06 million in 2024.

- It is projected to reach USD 1,680.99 million by 2034.

- The market is expected to grow at a CAGR of 8.55% from 2025 to 2034.

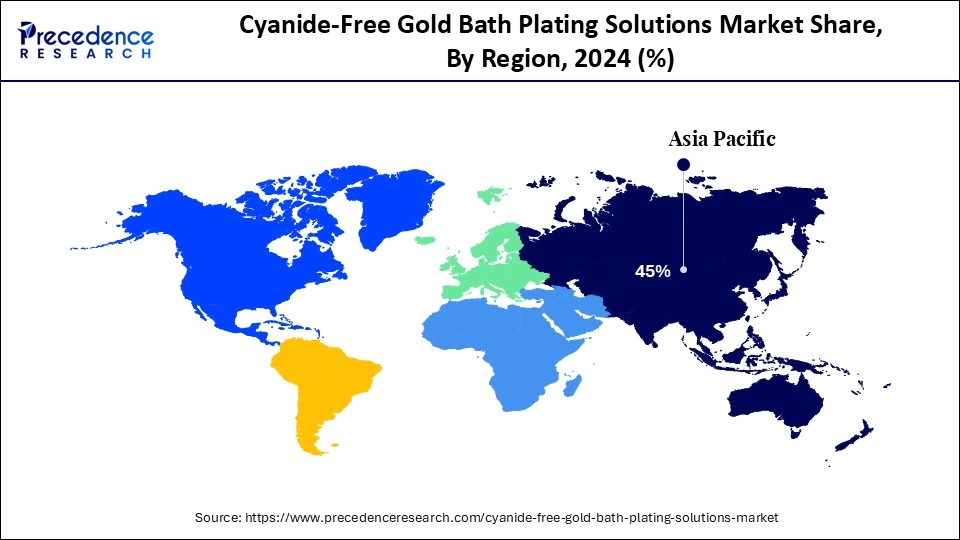

- Asia Pacific dominated the global cyanide-free gold bath plating solutions market with the largest share of approximately 45% in 2024.

- Europe is expected to grow at a significant CAGR from 2025 to 2034.

- North America is a notable region in the global market.

- By chemistry/complexing system, the sulfite-based gold baths segment contributed a market share of 35% in 2024 and is expected to grow fastest over the forecast period.

- By chemistry/complexing system, the ionic liquid and deep eutectic solvent systems segment is expected to grow at a notable CAGR between 2025 and 2034.

- By plating process type, the electroplating (pulse and DC) segment captured the biggest market share of 50% in 2024.

- By plating process type, the electroless plating (auto-catalytic deposition) segment will grow at a notable CAGR between 2025 and 2034.

- By product formulation/offering, the concentrated liquid kits segment contributed the largest market share of 45% in 2024.

- By product formulation/offering, the ready-to-use baths segment will grow at the highest CAGR between 2025 and 2034.

- By performance/plating specification, the functional/contact finishes (0.5–2.5 µm) segment generated the major market share of 50% in 2024.

- By performance/plating specification, the thick/wear-resistant coatings (>2.5 µm) segment will grow rapidly between 2025 and 2034.

- By service and value-add, the on-site bath management/replenishment services segment accounted for the significant market share of 40% in 2024.

- By service and value-add, the waste treatment and regulatory compliance services segment will grow at a considerable CAGR between 2025 and 2034.

- By application/use case, the electronics and connectors segment contributed the largest market share of 40% in 2024.

- By application/use case, the medical devices and implants segment will grow rapidly between 2025 and 2034.

- By distribution channel, the direct sales to large OEMs/tier-1 platers segment held the largest market share of 60% in 2024.

- By distribution channel, the online/e-commerce platforms segment will grow rapidly between 2025 and 2034.

Digital Transformation of Plating Operations: To Revolve the Cyanide-Free Gold Bath Plating Solutions

The cyanide-free gold bath plating solutions area has experienced significant emerging trends and technologies. The increased integration of AI and Internet of Things technologies for monitoring and optimizing plating processes is gaining traction in the field. The increased trend for eco-friendly alternatives to traditional processes and hazardous components is accelerating the focus toward Artificial Intelligence integration. AI is playing a crucial role in enhancing efficiency, process optimization, and quality control to ensure optimal performance, predict maintenance needs, enable early intervention, and reduce waste and cost. AI enables the discovery of novel, sustainable, and more efficient cyanide-free gold plating solutions through analyzing broad data and identifying promising chemical combinations.

Asia Pacific Cyanide-Free Gold Bath Plating Solutions Market Size and Growth 2025 to 2034

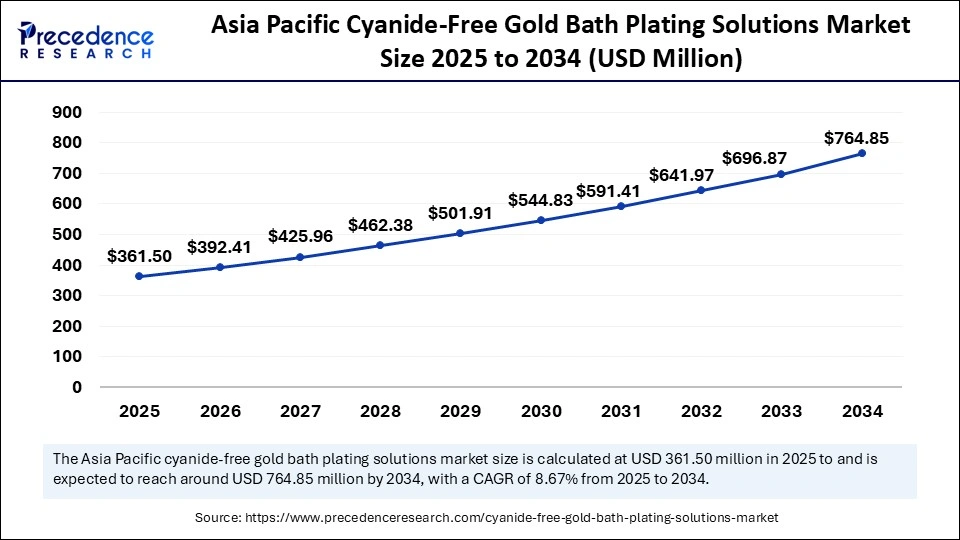

The Asia Pacific cyanide-free gold bath plating solutions market size was exhibited at USD 333.03 million in 2024 and is projected to be worth around USD 764.85 million by 2034, growing at a CAGR of 8.67% from 2025 to 2034.

Asia Pacific Cyanide-Free Gold Bath Plating Solutions Market

Asia Pacific dominates the global cyanide-free gold bath plating solutions market, driven by regions' rapid industrialization, increasing growth for high-quality gold platter products, and rising environmental concerns. Asia Pacific's strong electronic industry in countries like Japan, China, South Korea, and India. The strong electronic manufacturing industry and growing industrialization in emerging countries like China, Japan, and India, with supportive government initiatives and strong investments in green technologies, are fostering the market.

China and India are leading the regional market due to increased demand for consumer goods and rapid industrial growth. The strong electronics and automotive industries of these countries are driving the adoption of cyanide-free gold bath plating solutions. Government initiatives such as support for local manufacturing capabilities and investments in green technologies drive the adoption of cyanide-free gold plating solutions in China and India.

European Cyanide-Free Gold Bath Plating Solutions Market

Europe is the fastest-growing region in the global market, driven by its strong presence of strict environmental regulations and a strong industrial base. European stringent regulations for the limited use of toxic chemicals like cyanide have boosted the need for eco-friendly alternatives like cyanide-free gold bath plating solutions. Europe has a strong focus on sustainability drives the production of practices and eco-friendly products. Additionally, advancements in plating processes and innovative cyanide-free gold bath formulations contribute to the market growth.

Germany is a major player in the regional market, growth driven by countries' robust adoption of sustainable practices in various industries. The strict regulation on the use of hazardous chemicals and the strong presence of key market players like Atotech and BECE Leiterplatten-Chemie GmbH are driving significant innovations in this area within Germany.

North America Cyanide-Free Gold Bath Plating Solutions Market

North America is a notable region in the global market, contributing to the growth due to increased environmental regulations and increasing demand for sustainable manufacturing practices. The North American electronics industry is rapidly accelerating green technologies to meet growing demand for sustainability and fulfill regulatory requirements. Additionally, the rising demand for high-quality gold-plated components in industries like automotives and electronics is driving innovations in improving the reliability and performance of cyanide-free gold bath plating solutions.

The U.S. is a major player in the regional market, growth driven by the strong presence of robust electronics and automotive industries and a growing emphasis on eco-friendly and sustainable manufacturing practices. Government initiatives like the CHIPS Act are driving innovations in cutting-edge manufacturing practices, supporting areas of sustainable plating solutions. The robust metal finishing chemicals industry of the U.S. contributes to the rising demand for cyanide-free gold bath plating solutions.

Cyanide-Free Gold Bath Plating Solutions Market: An Overview

The cyanide-free gold bath plating solutions market covers production, formulation, supply, and supporting services for gold electroplating and electroless plating chemistries that do not use cyanide as a complexing agent. These alternatives are engineered to deposit decorative, corrosion-resistant, and conductive gold layers while reducing the environmental, regulatory, and worker-safety risks associated with cyanide-based electrolytes. Offerings include concentrated liquid chemistries, ready-to-use baths, bath maintenance products, process controls, and on-site management services. End markets span electronics and PCBs, connectors and semiconductor packaging, jewelry and decorative finishes, medical devices, aerospace, automotive components, and specialty industrial applications where gold's conductivity, corrosion resistance, and solderability are required.

What are the Key Trends of the Cyanide-Free Gold Bath Plating Solutions Market?

- Wide Industrial Adoption: The demand for cyanide-free gold bath plating solutions is high in various industries like jewelry, electronics, aerospace, and healthcare, driving the requirement for high-quality solutions.

- Rapid Industrialization: The growing industrialization in emerging countries is driving demand for cyanide-free gold bath plating solutions.

- Environmental Concerns: The growing awareness about the environmental impact of toxic chemicals is driving demand for sustainable gold plating solutions, like cyanide-free gold bath plating solutions.

- Demand for Safer Alternatives: growing concern over health and safety has boosted demand for safer alternatives, driving a shift toward cyanide-free gold bath plating solutions.

- Technological Advancements: The ongoing research and development for more affordable and efficient cyanide-free gold bath formulations are helping to enhance the performance and reliability of these solutions.

According to a study published on ScienceDirect.com, defective WO3 nanoparticles are being explored for photocatalytic gold recovery from cyanide-free plating bath solutions.(Source: https://www.sciencedirect.com)

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,680.99 Million |

| Market Size in 2025 | USD 803.34 Million |

| Market Size in 2024 | USD 740.06 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.55% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Chemistry/Complexing System, Plating Process Type, Product Formulation/Offering, Performance/Plating Specification, Service and Value-Add, Application/Use Case, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Environmental Regulations

Governments worldwide have implemented several stringent regulations on utilizing cyanide in industrial processes. The growing ban on hazardous products is driving a shift toward safer alternatives. Strict environmental regulations like the U.S. Environmental Protection Agency (EPA) and international standards, including REACH (registration, evaluation, authorization, and restriction of chemicals) in the European Union, have placed emphasis on stricter hazardous chemicals controls used in electroplating processes. These environmental regulations reduce environmental and human health risks regarding cyanide-based solutions. The regulatory compliance regarding the development of safer and compliant alternatives is fueling innovation and the development of cyanide-free gold bath plating solutions.

Restraint

High Cost

The complex formulation and materials of cyanide-free gold bath plating solutions contribute to higher production costs. Cyanide-free gold bath plating solutions need upfront investments in advanced and new equipment and specialized solutions, leading to the more costs of these solutions. This cost hinders the adoption of cyanide-free gold bath plating solutions in small businesses with a smaller profit margin. The higher cost is increasing emphasis on the need for research and development to develop cost-effective cyanide-free alternatives.

Opportunity

Growing Shift Toward Sustainable Practices

The awareness of health and safety concerns has boosted the shift toward sustainable practices. The regulatory push for greener manufacturing has driven demand for sustainable alternatives. Industries like jewelry, automotives, and electronics are experiencing rapid sustainable practices trends due to increased miniaturization and complex components, driving the need for high-precision and efficient gold plating. The growing need for sustainable and corrosion-resistant coatings in jewelry, electronics, and automotive applications is fostering the demand for cyanide-free gold bath plating solutions.

Chemistry/Complexing System Insights

Which Chemistry/Complexing System Dominated the Cyanide-Free Gold Bath Plating Solutions Market in 2024?

In 2024, the sulfite-based gold baths segment dominated the market due to their ability to offer high-quality and pure gold coatings. The sulfite-based gold baths produce smooth, ductile, and bright gold deposits, enabling to advancement of safety and environmental impacts. The stability of sulfite-based gold baths with nitrogen-free dispersive components enhances bath stability and deposit brightness. The growing demand for eco-friendly alternatives and the need to meet strict regulations are driving the adoption of sulfite-based gold baths.

The ionic liquid and deep eutectic solvent systems segment is the second-largest segment, leading the market, driven by their unique properties and environmental advantages. The lower toxicity and high biodegradability properties of the ionic liquid and deep eutectic solvent make them ideal alternatives to conventional cyanide. Industries like semiconductor, jewelry, electronics, and precision instruments and meters are major adopters of the ionic liquid and deep eutectic solvents.

Plating Process Type Insights

Which Plating Process Type Segment Dominates the Cyanide-Free Gold Bath Plating Solutions Market?

The electroplating (pulse and DC) segment dominated the market in 2024, due to its ability to produce high-quality gold coatings. The segment growth is attributed to the widespread adoption of electroplating (pulse and DC) in various industries, driven by their high efficiency and versatility. The electroplating (pulse and DC) offers more uniform gold deposits. The use of electroplating (pulse and DC) is large in industries like jewelry, electronics, and semiconductors.

The electroless plating (auto-catalytic deposition) segment is expected to grow fastest over the forecast period, due to increased demand for eco-friendly and sustainable plating processes. The electroless plating (auto-catalytic deposition) enables deposit gold without an external electrical current. The use of electroless plating (auto-catalytic deposition) has increased in electronics and jewelry applications due to its ability to deposit uniform gold coatings.

Product Formulation/Offering Insights

What Made the Concentrated Liquid Kits Lead the Cyanide-Free Gold Bath Plating Solutions Market?

The concentrated liquid kits segment led the market in 2024, due to its flexibility and affordability. The concentrated liquid kits (requiring on-site dilution/mixing) are easy to transport, cost-effective, and flexible in adjusting bath composition, making them a suitable option for various industries. The concentrated liquid kits (requiring on-site dilution/mixing) enable on-site dilution and mixing, helping businesses to reduce waste and cost burden.

The ready-to-use baths segment is expected to grow fastest over the forecast period, due to convenience and easy-to-use nature. The ready-to-use baths ensure consistent performance and quality, making them ideal for high precision and reliability needs in industries like electronics and aerospace. The easy-of-use nature of these baths helps to reduce the risk of errors and achieve high-quality gold plating.

Performance/Plating Specification Insights

What made the Functional/Contact Finishes (0.5–2.5 µm) Segment Dominate the Cyanide-Free Gold Bath Plating Solutions in 2024?

In 2024, the functional/contact finishes (0.5–2.5 µm) segment dominated the market, due to increased demand for gold plating in various industries, including connectors, semiconductors, and electronics. The functional/contact finishes (0.5–2.5 µm) offer precise and reliable coating to the components. The functional/contact finishes (0.5–2.5 µm) thickness, suitable for various functional applications, enables high conductivity and wear resistance.

The thick/wear-resistant coatings (>2.5 µm) segment is expected to grow fastest over the forecast period, due to its high wear resistance and thickness, crucial for jewelry and decorative finishes. The demand for high-quality, durable, and aesthetically pleasing gold plating in jewelry and decorative applications has increased, driving demand for thick/wear-resistant coatings (>2.5 µm) cyanide-free gold bath plating solutions. The growing shift toward ethical production methods and sustainability contributes to the segment's growth.

Service and Value-Add Insights

Which Service and Value-Add Dominates the Cyanide-Free Gold Bath Plating Solutions Market?

The on-site bath management/replenishment services segment dominated the market in 2024, due to increased demand for high efficiency, promoting sustainable approaches, and reducing waste in gold bath plating. The on-site bath management/replenishment services are widely used in industries like electronics and aerospace for precise control over plating processes. These services reduce chemical consumption and operational cost, and offer comprehensive optimization of plating bath performance.

The waste treatment and regulatory compliance services are the second-largest segment, leading the market due to high emphasis on regulations to promote the adoption of eco-friendly and sustainable alternatives to traditional cyanide gold bath plating solutions. The strict environmental regulations have boosted the offering of waste treatment and regulatory compliance services in various industries. Additionally, growing concern over health and safety is driving industrial focus on meeting regulatory requirements, driving the need for sophisticated waste treatment and regulatory compliance services.

Application/Use Case Insights

Why the Electronics and Connectors Segment Led the Cyanide-Free Gold Bath Plating Solutions Market in 2024?

In 2024, the electronics and connectors segment led the market, due to the high conductivity, reliability, and corrosion resistance offered by cyanide-free gold bath plating solutions. Gold plating is crucial in electronic components; the growing demand for eco-friendly alternatives is driving the adoption of cyanide-free gold bath plating solutions in electronics and connectors (PCB finishes, contacts) applications. The growing demand for high-end and luxury consumer goods is driving demand for cyanide-free gold bath plating solutions for electronics and connectors (PCB finishes, contacts).

The medical devices and implants segment is the fastest-growing segment of the market, growth driven by increased demand for biocompatible medical devices and implants. Cyanide-free gold bath plating offers high biocompatibility, corrosion resistance, and electrical conductivity to medical devices and implants. Medical devices, including electrical contacts, implants, and medical lasers, are increasingly using cyanide-free gold bath plating solutions for high-tech productions, high conductivity, and corrosion resistance.

Distribution Channel Insights

Which Distribution Channel Dominated the Cyanide-Free Gold Bath Plating Solutions Market in 2024?

The direct sales to large OEMs/tier-1 platers segment dominated the market in 2024, due to high volume and strict quality requirements provided by this distribution. The direct sales to large OEMs/tier-1 platers enable suppliers to connect with high-end consumers, helping to address the specific needs of their consumers directly. The direct sales to large OEMs/tier-1 platers are an affordable and efficient method for both manufacturers and customers.

The online/e-commerce platforms segment is expected to lead the market over the forecast period, driven by wide accessibility and convenience. The online/E-commerce platforms are highly convenient, offer various products and technical support, making them an ideal option for end-users. The purchasing value of kits and small quantities of cyanide-free gold bath plating solutions is high through online/E-commerce platforms.

Cyanide-Free Gold Bath Plating Solutions Market Companies

- Johnson Matthey

- Galvanic Applied Sciences

- Atotech

- MacDermid Enthone

- Shenzhen Jiuding Gold

- Spa Plating

- Gold Touch Inc.

- TWL

- Krohn Industries

- LEGOR GROUP SpA

Recent Developments

- In March 2025, a global provider of enabling technologies that transform the world, MKS Instruments, announced the participation of its strategic brand, Atotech (process chemical, software, equipment, and services), at the ISPEC held at Mahatma Mandir in Gandhinagar, Gujarat. ISPEC is cultivating a dynamic ecosystem that unites researchers, developers, manufacturers, suppliers, and end-users in India's fast-growing semiconductor and packaging industry.(Source:https://www.atotech.com)

- In November 2024, Krohn Industries launched the ready-to-use gold bath plating solutions, such as 14k color and 18k color options, available for purchase on Amazon, with the 18k color solutions being a 1-quart (32 oz) bottle, designed for bath plating applications. (Source: https://www.amazon.com)

Segment Covered in the Report

By Chemistry/Complexing System

- Sulfite-based Gold Baths (e.g., sodium gold sulfite systems)

- Thiosulfate/Thiourea-based Systems

- Ammonia/Amine Complex Systems (non-cyanide)

- Ionic Liquid and Deep Eutectic Solvent Systems

- Chelator/Ligand-stabilized Proprietary Formulations

- Mixed/Hybrid Non-cyanide Systems

By Plating Process Type

- Electroplating (Pulse and DC)

- Electroless Plating (auto-catalytic deposition)

- Selective/Brush Plating

- Immersion/Displacement Methods (specialty non-cyanide)

By Product Formulation/Offering

- Concentrated Liquid Kits (requires on-site dilution/mix)

- Ready-to-Use Baths

- Additives and Bath Management Chemicals (brighteners, complexers)

- Process Control and Monitoring Solutions (analytical reagents, sensors)

- Waste Treatment and Recycling Solutions for Non-cyanide Spent Baths

By Performance/Plating Specification

- Decorative Thin Coatings (<0.5 µm)

- Functional/Contact Finishes (0.5–2.5 µm)

- Thick/Wear-Resistant Coatings (>2.5 µm)

By Service and Value-Add

- On-site Bath Management/Replenishment Services

- Contract Plating/Toll Plating Services

- Waste Treatment and Regulatory Compliance Services

- Technical Service and Process Development

By Application/Use Case

- Electronics and Connectors (PCB finishes, contacts)

- Semiconductor Packaging and MEMS

- Jewellery and Decorative Finishes

- Medical Devices and Implants

- Aerospace and Defense Components

- Automotive (sensors, connectors)

- Industrial and Precision Parts (valves, instrumentation)

By Distribution Channel

- Direct Sales to Large OEMs/Tier-1 Platers

- Chemical Distributors and Metal Finishing Suppliers

- Plating Equipment and Consumables Dealers

- Online/E-commerce Platforms (kits and small quantities)

By Region

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting