What is the Data Center Outsourcing Market Size?

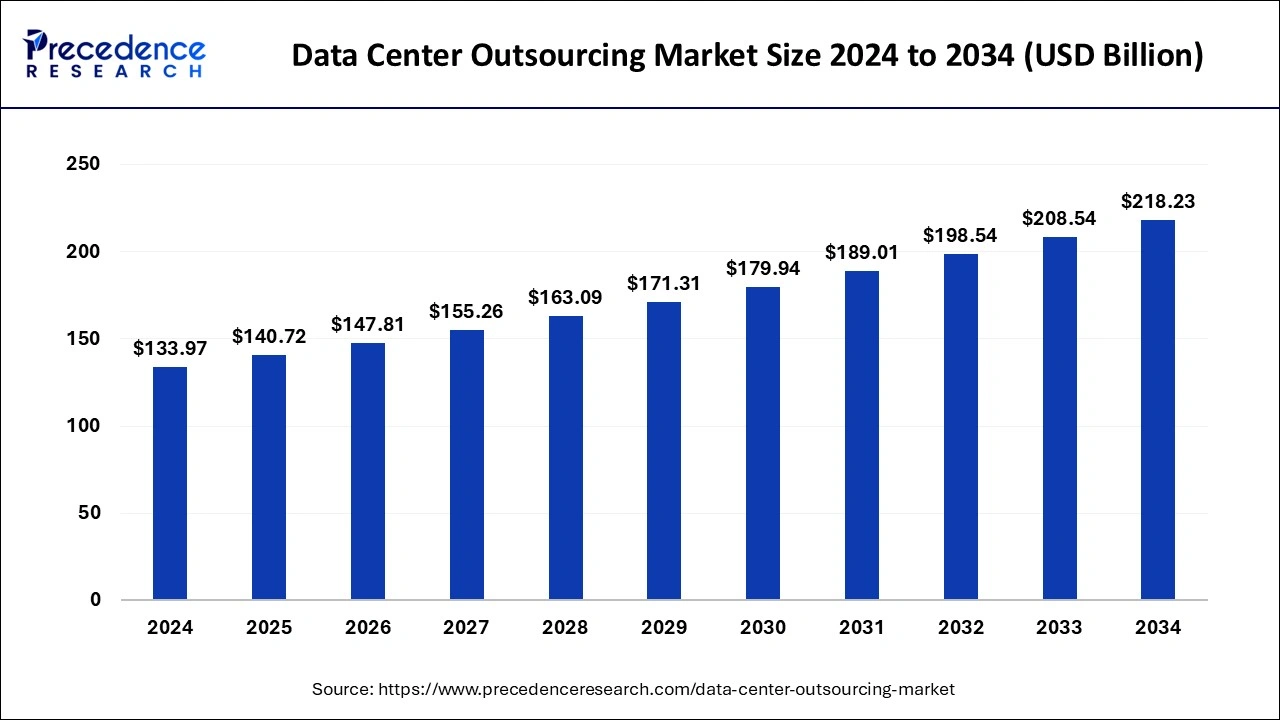

The global data center outsourcing market size was estimated at USD 140.72 billion in 2025 and is predicted to increase from USD 147.81 billion in 2026 to approximately USD 228.13 billion by 2035, expanding at a CAGR of 4.95% from 2026 to 2035. The increasing need for better IT infrastructure scalability, efficiency, and cost-effectiveness are the significant factors that are driving the market.

Data Center Outsourcing Market Key Takeaways

- The global data center outsourcing market was valued at USD 140.72billion in 2025.

- It is projected to reach USD 228.13billion by 2035.

- The data center outsourcing market is expected to grow at a CAGR of 4.95% from 2026 to 2035.

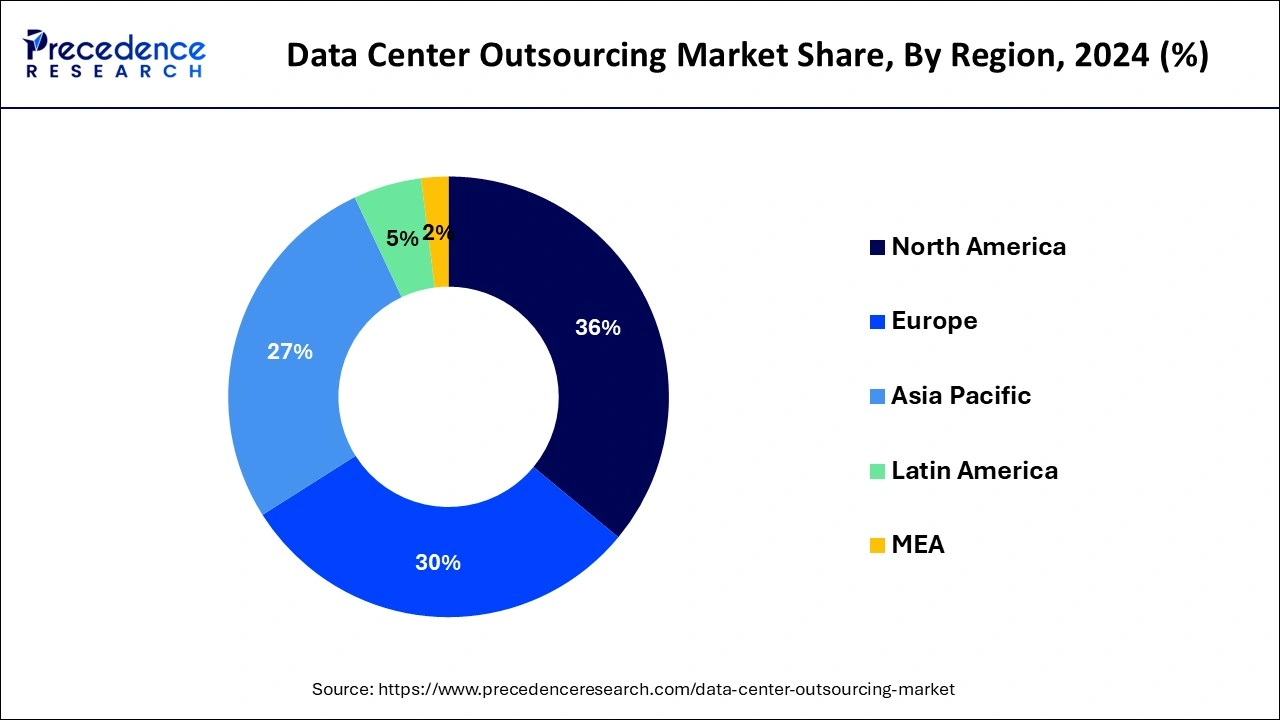

- The North America data center outsourcing market size accounted for USD 45.91 billion in 2025 and is expected to expand around USD 75.07 billion by 2035.

- North America led the largest market share of 36% in 2025.

- Asia Pacific emerges as the fastest-growing region in the market.

- By component, the hardware segment is represented as a dominant segment in the data center outsourcing market.

- By physical infrastructure, the data center facilities segment led the market in 2025.

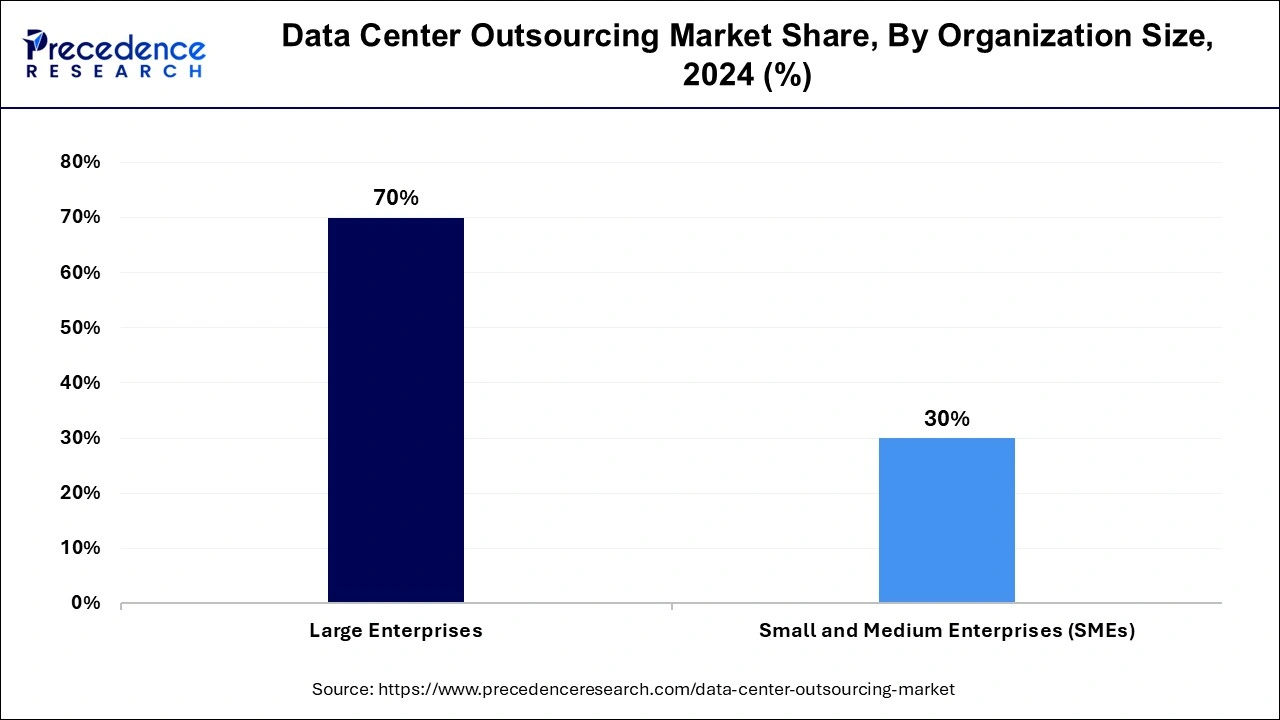

- By organization size, the large enterprises segment emerged as dominant in 2025.

- By end use, the IT and telecom segment dominated the data center outsourcing market in 2025.

What is Data Center Outsourcing?

The data center outsourcing market refers to the industry that deals with services that involve managing as well as maintaining data center infrastructure of any organization. The growth of this market is attributed to the higher demand of cost effective and scalable IT solutions in the market to reduce the expenses of the capital of the enterprises. The market is poised to grow at the highest CAGR during the foreseeable period, driven by the rising use of cloud computing and ongoing digital transformation.

The rapid increase in the data traffic and the spur in the e-commerce business including banking sector and cloud-based services are the major factors which will present with the promising business development possibilities. Data center outsourcing is the data outsourcing method to manage a day-to- day data activities as a provision of storage and computing resources by employing a third-party provider that have an expertise in deploying and maintaining the data center outsourcing facilities. Such a practises helps enable the enterprises to extensively manage their ICT infrastructure with reliability and security.

How is AI contributing to the Data Center Outsourcing Industry?

AI can enhance outsourced data centers by enhancing intelligent automation, predictive maintenance, adaptive security monitoring, and energy optimization. It allows proactive operation, scalable capacity planning, quicker incident resolution, and long-term infrastructure operation, and facilitates providers to provide reliable, secure, and cost-effective services in complex and distributed data center settings.

Data Center Outsourcing Market Growth Factors

- The rising demand for virtual storage services due to the growth of industries and increased in shared infrastructure services.

- modernization of manufacturing practices, and rising demand from emerging economies.

- Reduced cost by deploying IT infrastructure in the well managed data centers.

- Rising demand for cost-effective solutions at industries promotes the expansion of the market.

Market Outlook

- Industry Growth Overview: The worldwide investments in outsourcing and large-scale colocation are taking place along with AI workloads, cloud, and edge computing adoption.

- Sustainability Trends: The decisions of the operators regarding the carbon-neutral outsourced operations involve the use of renewables, liquid cooling, water efficiency, and circular designs.

- Global Expansion: North America and the Asia Pacific are the leaders in growth, whereas emerging markets are quickly enhancing their digital infrastructure capacity that is outsourced.

- Major Investors: The expansion is mainly powered by Blackstone, KKR, Bain Capital, Macquarie, Stonepeak, EQT, Actis, Ardian, Saudi PIF, GIC, etc.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 4.95% |

| Market Size in 2025 | USD 140.72 Billion |

| Market Size in 2026 | USD 147.81 Billion |

| Market Size by 2035 | USD 228.13Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Physical Infrastructure, Organization Size, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Need for scalable and secure data

The data storage strategies play vital role in managing enterprises data activities as it will reflects upon data management efforts and cybersecurity traits of the enterprises. As companies are generating vast amount of data and data must be retrievable, secure and scalable as well. Hence, effective strategies to use data storage are essential for business growth. Security features such as, self-encrypting drives are essential for any kind of data storage strategies.

Scalability of the data is the ability of the data expansion and accommodation without compromise on data integrity and its authencity. As highly scalable data is the cornerstone of the any enterprise's successful operation, it is essential to allow an enterprise to handle rising flux of vast data efficiently and with ease. Organization requires robust system and infrastructure to manage vast amount of scalable data to avoid the data hamper during operations. Hence, organisation must use the perfect data structures to manage the vast amount of unstructured data.

Restraint

Privacy concern

Amidst rising technological advancements, security and privacy are the major concerns for existing business models. The headline and news flooded with major data breaches are underscores the importance of security and privacy measures in the data centers. The companies engaged with outsourcing it is essential to confirm the safeguard methods as, data leaks happening globally poses a challenge to keep the data secure.

The path to secure outsourcing has many challenges as government as well as corporate groups are vulnerable to the prominent security risks and a data breach by the hacker's groups globally. As outsourcing has invaded boundaries of the industry and becoming large scale practises for many industries, data security would be the topmost priority that must be fulfilled by outsourcing members.

Opportunity

Adoption of AI and ML

One of the major future opportunities and emerging trend in the data center outsourcing industry is integration of Artificial industry and machine learning in the data centers. Advanced technologies such as AI and ML aids in a data integrity by improving efficiency, by automating routine tasks and improving predictive maintenance. By harnessing the power of AI and ML data center outsourcing providers can meet the ever-evolving market trends that caters an enterprise in rapidly rising digital ecosystem.

- For instance, in august 2023, a prominent global provider for data center solutions known as, digital reality, has launched high-density colocation services on its own platform, platformDIGITAL. These services bound to provide an infrastructure configuration that supports high-performance computing to helps in a growth of businesses.

Segment Insights

Component Insights

The hardware segment represented as a dominant segment in the data center outsourcing market, driven by their need for specialized infrastructure to support product development, testing, and deployment. For hardware manufacturers, maintaining in-house data centers can be prohibitively expensive and resource intensive. Outsourcing data center operations allows them to streamline costs, optimize resource utilization, and access state-of-the-art infrastructure without the burden of ownership and management.

Furthermore, hardware manufacturers often require highly secure and reliable environments to safeguard their intellectual property, sensitive data, and proprietary technologies. Outsourced data centers offer robust security measures, compliance frameworks, and disaster recovery capabilities to meet these stringent requirements.

Physical Infrastructure Insights

The data center facilities segment held a significant market share and dominated the market globally. Data center facilities encompass a wide range of services, including colocation, managed hosting, andcloud infrastructure, catering to the diverse needs of businesses seeking to outsource their IT infrastructure requirements. These facilities invest heavily in state-of-the-art infrastructure, including redundant power systems, cooling mechanisms, and security measures, to ensure uninterrupted operations and optimal performance for their clients.

The data center facilities specialize in providing tailored solutions to meet the unique requirements of different industries and use cases. Additionally, the rise of digital transformation initiatives and the proliferation of data-intensive technologies drive the demand for outsourced data center services, further solidifying the position of data center facilities as a dominated segment in the market. Overall, data center facilities play a pivotal role in enabling businesses to leverage advanced infrastructure, mitigate risks, and focus on core competencies helping in establishing them as a cornerstone of the data center outsourcing market.

Organization Size Insights

The large enterprises segment dominated the data center outsourcing market in 2024. These enterprises, characterized by their expansive operations and diverse IT requirements, often face challenges in managing their data center environments efficiently. As their digital footprint grows, maintaining in-house data centers becomes increasingly complex and resource-intensive, prompting many large organizations to turn to outsourcing providers for specialized expertise and scalable solutions.

Large enterprises prioritize reliability, security, and performance in their data center operations, making them prime candidates for outsourcing partnerships. Outsourcing allows them to leverage the advanced infrastructure and stringent security measures offered by specialized data center providers.

Outsourced data center services enable them to adapt quickly to changing business requirements, scale their infrastructure on-demand, and access cutting-edge technologies without significant upfront investments. Overall, large enterprises dominate the data center outsourcing market by virtue of their scale, complexity, and strategic moves, driving substantial growth and innovation in the industry.

End-use Insights

The IT and telecom segment dominated the data center outsourcing market in 2024, showcasing a profound reliance on outsourced data center services to support their critical operations and infrastructure needs. Within the IT and telecom sector, companies operate in highly competitive environments where technological innovation and operational efficiency are paramount. As a result, these organizations prioritize scalable and secure data center solutions. Data center outsourcing enables IT and telecom companies to focus on their core competencies, such as software development, network management, and customer service. By partnering with outsourcing vendors, they gain access to advanced infrastructure, redundant systems, and 24/7 support.

Regional Insights

What is the U.S. Data Center Outsourcing Market?

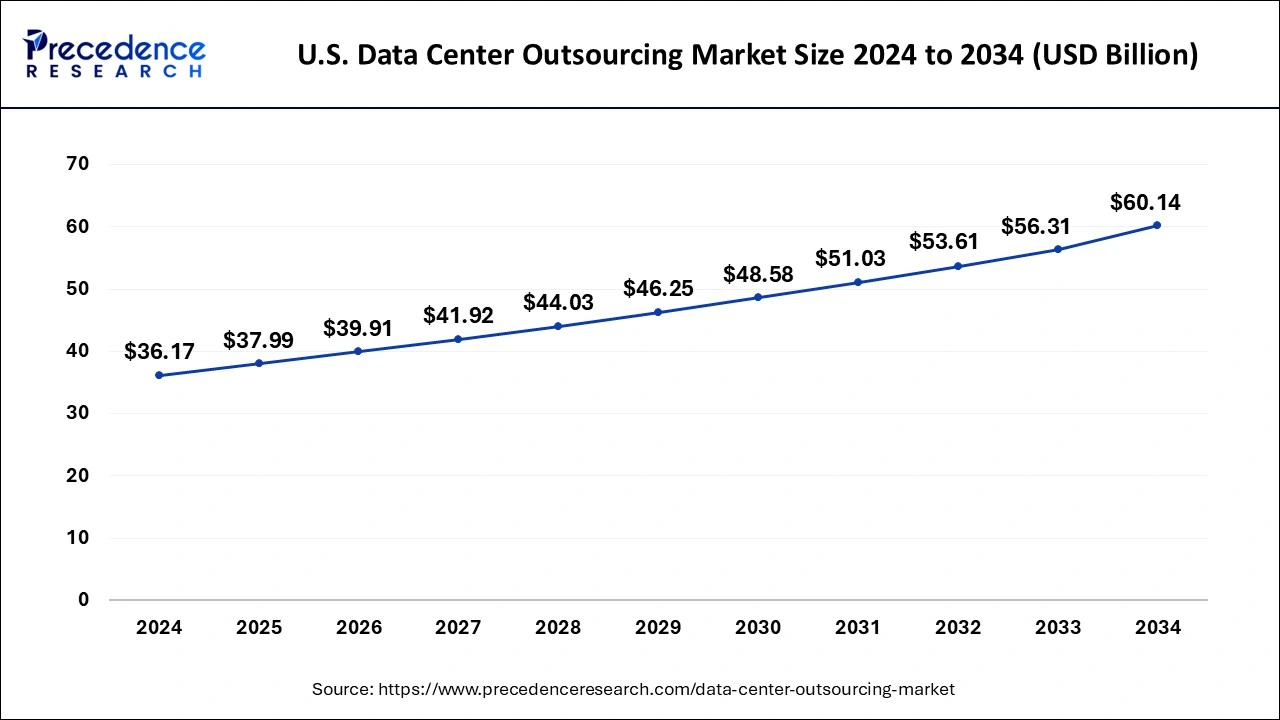

The U.S. data center outsourcing market size was exhibited at USD 37.99 billion in 2025 and is projected to be worth around USD 63.22 billion by 2035, growing at a CAGR of 5.22% from 2026 to 2035.

North America dominated the data center outsourcing market globally while holding the highest market share in 2024. North America is considered as a highly developed technological infrastructure, making it conducive for the establishment and operation of data centers. With advanced telecommunications networks and robust internet connectivity, the region provides an ideal environment for outsourcing data center services.

Moreover, the presence of numerous multinational corporations headquartered in North America fuels the demand for data center outsourcing. These companies often seek scalable and cost-effective solutions to manage their expanding data needs while focusing on their core business activities. As a result, they turn to outsourcing providers to handle their data center operations efficiently. Additionally, North America leads in the adoption of cloud computing technologies, which further drives the demand for data center outsourcing services.

Furthermore, the region's regulatory landscape emphasizes data security and compliance, prompting organizations to seek outsourcing partners with expertise in ensuring regulatory adherence. Data center outsourcing providers in North America often offer comprehensive security measures and compliance frameworks to address these requirements effectively. North America benefits from a highly skilled workforce with expertise in managing complex data center environments. This pool of talent enables outsourcing providers to deliver high-quality services and support to their clients.

U.S. Data Center Outsourcing Market Trends

The U.S. leads in outsourcing with robust cloud requirements and Artificial Intelligence load. Businesses enjoy hybrid models that are run by experts. Facility strategies are remodeled by power constraints, pre-release capacity by hyperscalers, and hyperscalers enforce outsourcing partnerships to enjoy a secure, high-density computing environment.

Asia Pacific emerges as the fastest-growing region in the data center outsourcing market, driven by a combination of factors that underscore the region's dynamic economic landscape and digital transformation initiatives.

One of the primary catalysts for the rapid growth of data center outsourcing in Asia Pacific is the region's expanding digital infrastructure. As countries across Asia Pacific continue to invest heavily in telecommunications networks, internet connectivity, and cloud computing capabilities, the demand for outsourced data center services escalates. This trend is particularly evident in rapidly developing economies such as China, India, and Southeast Asian nations, where businesses are increasingly relying on outsourced data centers to support their digital operations.

Furthermore, the proliferation of mobile devices, internet-enabled services, and e-commerce platforms fuels the exponential growth of data generation in Asia Pacific. This surge in data volume necessitates scalable and secure data center solutions, driving organizations to seek outsourcing partners for their infrastructure needs. government initiatives aimed at promoting digitalization and fostering a conducive business environment play a crucial role in driving the adoption of data center outsourcing services in the region.

Overall, Asia Pacific's status as the fastest-growing region in the data center outsourcing market is influenced by its robust digital infrastructure, escalating data volumes, vibrant tech industry, and supportive government policies, all of which converge to create a thriving ecosystem for outsourced data center services.

India Data Center Outsourcing Market Trends

India is the fastest-growing market, which is being led by localization requirements and online expansion. The inland edge facilities are being established by hyperscale investments concentrated in coastal hubs. The major focus of providers is on renewable energy, liquid cooling, and scalable infrastructure to support cloud, artificial intelligence, and connectivity demand.

What Are the Driving Factors of The Data Center Outsourcing Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. Europe has a high outsourcing demand due to the growing AI infrastructure and pressure from regulations. The needs of data privacy compliance and sustainability prompt the use of localized energy-efficient facilities. Existing hubs are still appealing, and Middle Eastern markets are moving to managed services to achieve a scalable and compliant digital infrastructure.

Germany Data Center Outsourcing Market Trends

Germany is the European leader in outsourcing, with the stringent regulations of efficiency and data sovereignty. Businesses prefer onshore operators that have national qualifications. Capacity pressures lead to growth outside of major hubs, and waste-heat reuse and renewable integration will make sustainability a competitive requirement.

Data Center Outsourcing Market Companies

- Dell: Provides complete ecosystems of infrastructure that facilitate hybrid cloud operations, modernization, automation, and secure operations of data centers on behalf of business organizations.

- Infosys: Offers infrastructure outsourcing services, which are consulting-based and help to achieve cloud migration, automation of operations, and efficient management of hybrid data center environments.

- Tata Consultancy Services: Provides integrated data center outsourcing, which is a blend of cloud and infrastructure management and analytics-driven security that supports large operations.

Other Major Key Players

- Tech Mahindra

- IBM Corporation

- HCL

- Accenture

- Atos

- Capgemini

- Cognizant

- Fujitsu Ltd

- Unisys

- Wipro

- Oracle Corporation

- Hewlett Packard Enterprises

Recent Developments

- Tata Consultancy Services (TCS) aims to be the largest AI-led technology services company globally. It plans to set up a wholly owned subsidiary in India for multiple AI and data centres with 1GW capacity. Recently, TCS established an AI and Services Transformation unit, led by Amit Kapur, enhancing its focus on AI. (Source: TCS doubles down on AI, launches wholly owned subsidiary for AI data centres )

- ST Telemedia Global Data Centres has launched STT Tokyo 1, its inaugural facility in Japan, situated in Inzai City. This centre will provide 32 MW of IT capacity when operational. It is part of a two-building campus in Goodman Business Park, with a total potential capacity of 70 MW.

(Source: ST Telemedia Global Data Centres launches first DC in Japan – w.media ) - In August 2023, Fujitsu has been declared as a Visionary in their most recent Data Center Outsourcing and Hybrid Infrastructure by gartener. listed in the Gartner Magic Quadrant as a Visionary, highlights its advantages, progressive business practices, and steady expansion. According to the Fujitsu.

- In July 2023, a global leader in digital business and IT services, NTT DATA has announced the launch of an outsourcing service for security management (MDR service1) to help prevent incidents and minimize damage when they do occur

Segments Covered in the Report

By Component

- Hardware

- Servers

- Storage Devices

- Networking Equipment

- Cooling Systems

- Power Distribution Units (PDUs

- Software

- Operating Systems

- Virtualization Software

- Management and Monitoring Software

- Security Software

- Services

- Colocation Services

- Cloud Services

- Managed Services

- Network Services

- Security Services

By Physical Infrastructure

- Data Center Facilities

- Racks and Cabinets

- Cabling and Wiring

- Power and Cooling Infrastructure

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End Use

- BFSI

- Colocation

- Energy

- Government

- Healthcare

- IT and Telecom

- Manufacturing

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting