Data Center RFID Market Size and Forecast 2025 to 2034

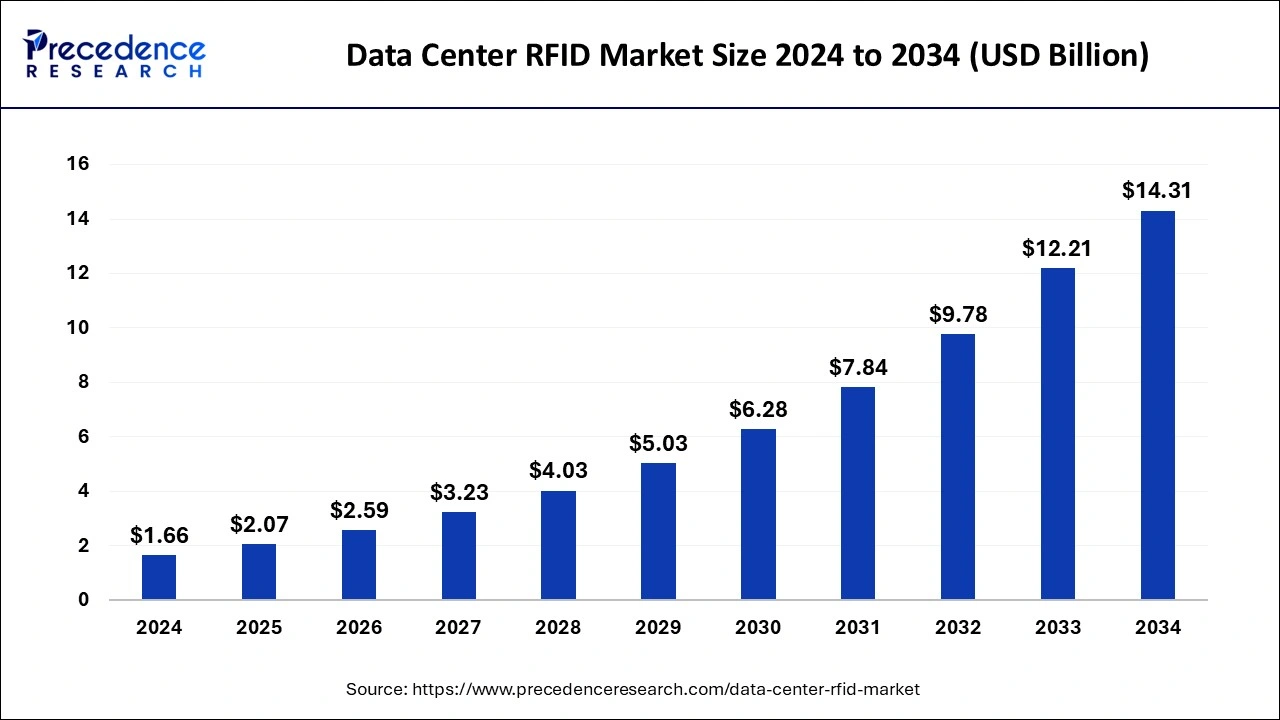

The global data center RFID market size was calculated at USD 1.66 billion in 2024 and is predicted to increase from USD 2.07 billion in 2025 to approximately USD 14.31 billion by 2034, expanding at a CAGR of 24.04% from 2025 to 2034. The rise in demand for larger data processing and storage led to an effective and secure asset management system to avoid data breaches and unauthorized access, which are major factors driving the market growth globally.

Data Center RFID Market Key Takeaways

- The global data center RFID market was valued at USD 1.66 billion in 2024.

- It is projected to reach USD 14.31 billion by 2034.

- The market is expected to grow at a CAGR of 24.04% from 2025 to 2034.

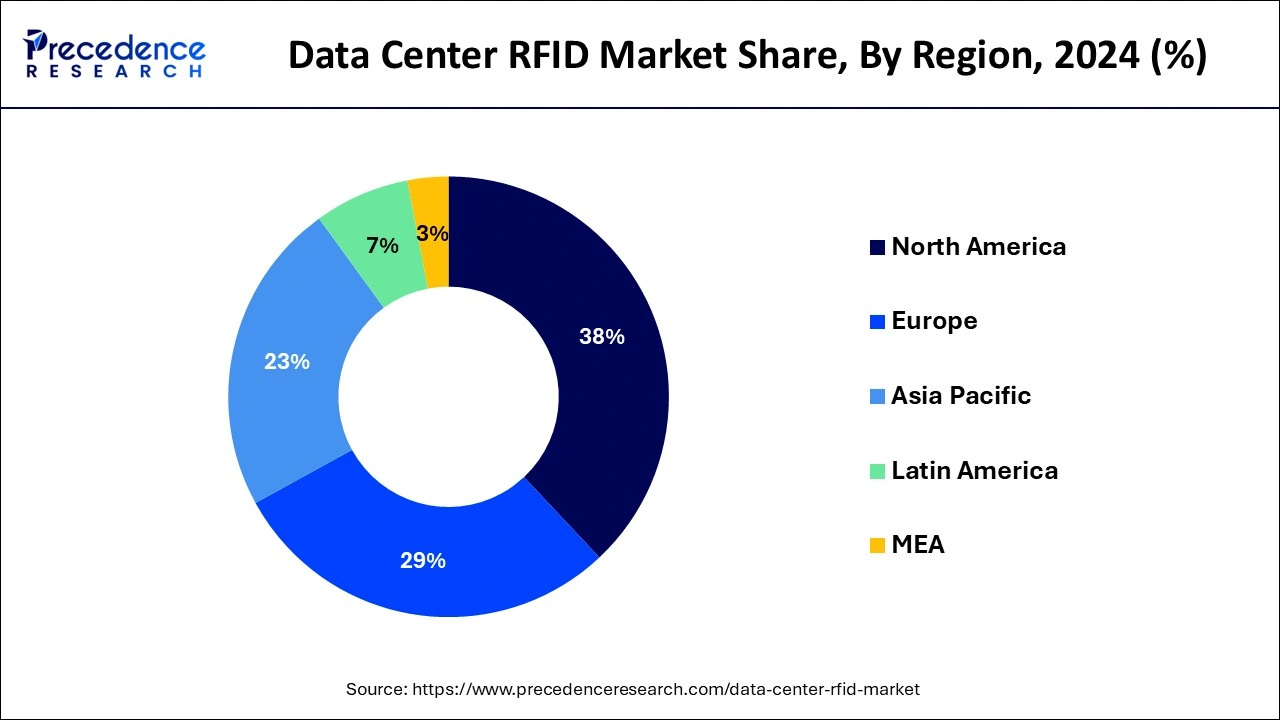

- The North America data center RFID market size accounted for USD 510 million in 2024 and is expected to attain around USD 4,640 million by 2034.

- North America has generated more than 38% of market share in 2024.

- Asia Pacific emerges as a rapidly growing region in the global market.

- By component, the hardware segment held the largest share of 73% in 2024.

- By component, the services segment is anticipated to register rapid growth in the upcoming years.

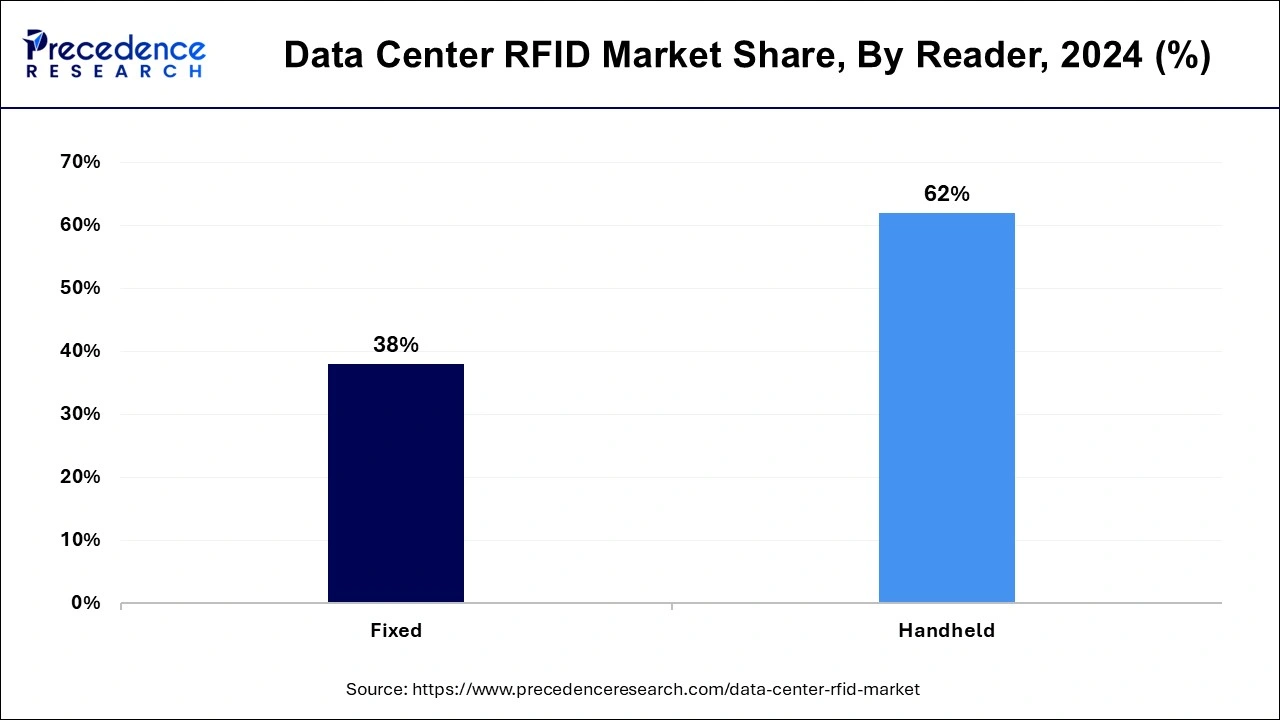

- By hardware, the readers segment has accounted for the highest market share of 62% in 2024.

- By hardware, the antenna segment is expected to witness a rapid CAGR over the forecasted years.

- By tags, the passive tags segment has held the major market share of 72% in 2024.

- By tags, the active tags segment is anticipated to gain a notable share of the market during the foreseen period.

- By tag frequency, the UFH segment has contributed the biggest market share of 71% in 2024.

- By tag frequency, the HF tags frequency segment is anticipated to witness the fastest growth in the upcoming years.

- By reader type, the handheld segment has held the largest market share of 62% in 2024.

- By reader type, the fixed reader type segment is expected to showcase the fastest CAGR over the foreseen years.

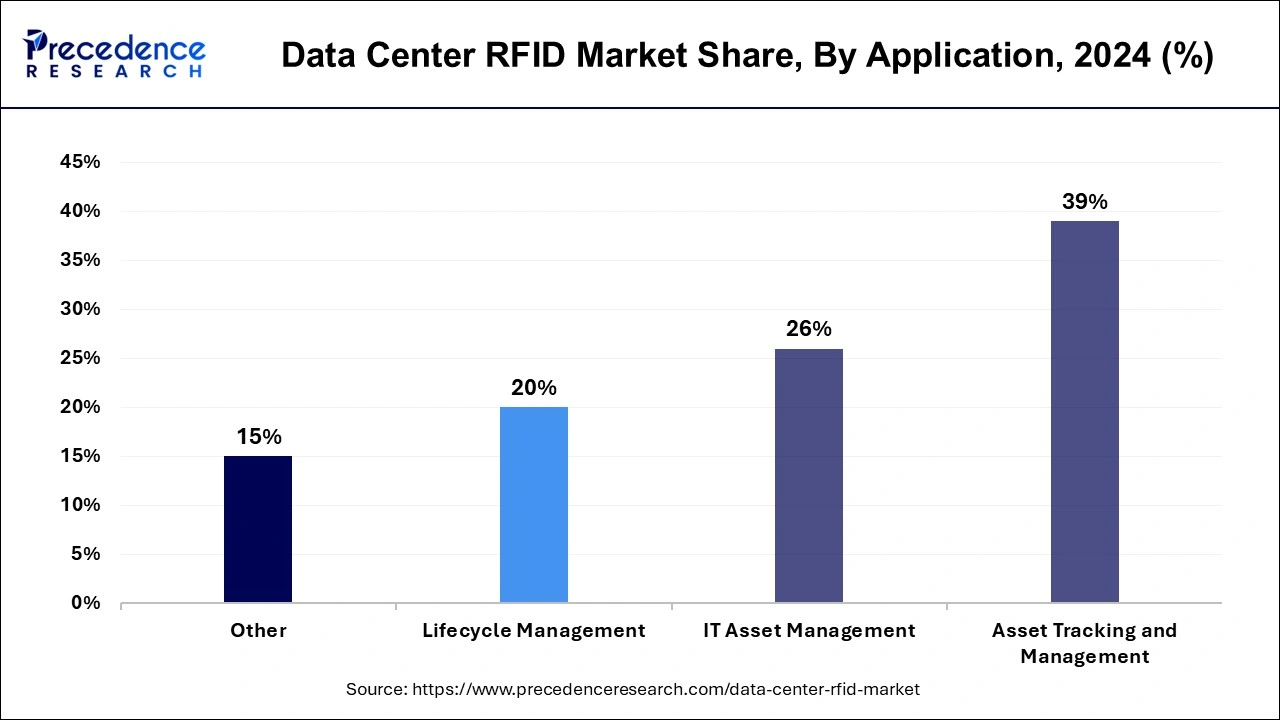

- By application, the asset tracking and management segment has captured more than 39% of market share in 2024.

- By application, the lifecycle management segment is projected to grow rapidly in the forecasted years.

U.S.Data Center RFID Market Size and Growth 2025 to 2034

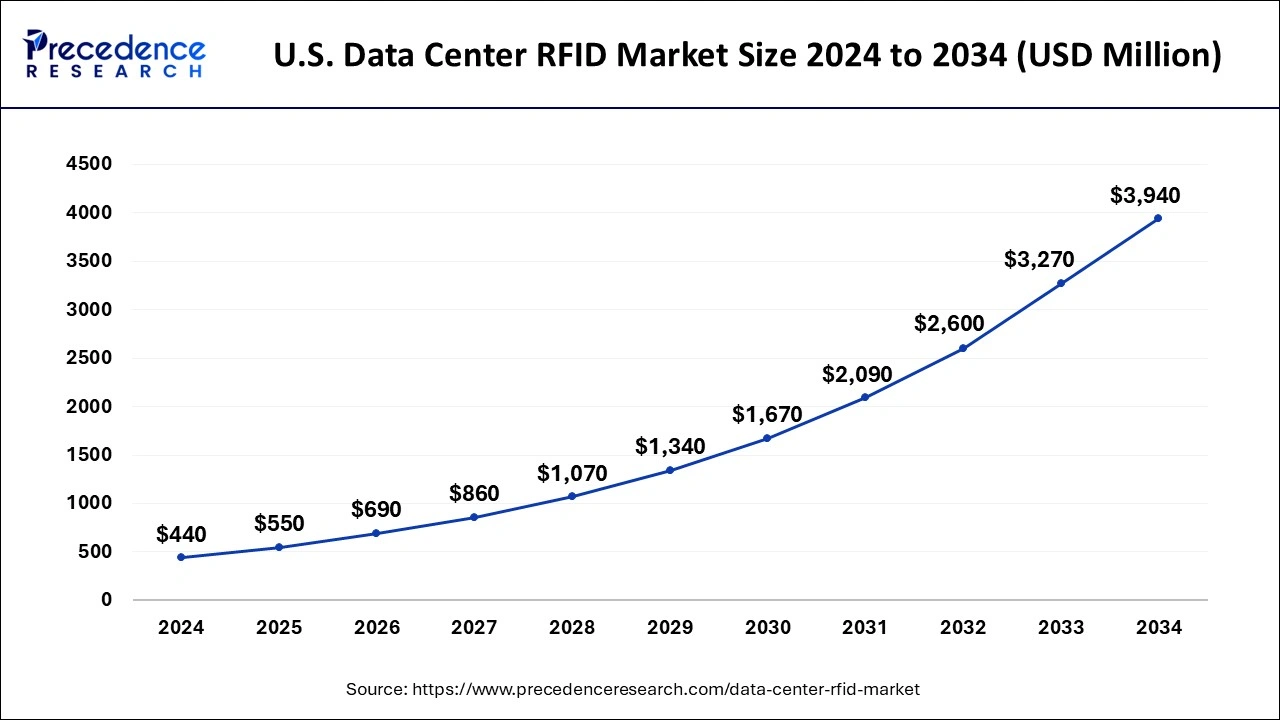

The U.S. data center RFID market size was exhibited at USD 440 million in 2024 and is projected to be worth around USD 3,940 million by 2034, growing at a CAGR of 24.51% from 2025 to 2034.

North America stood out as the dominating region in the data center RFID market in 2024. Several factors, including a high concentration of data center facilities, strong demand for advanced technology solutions, and a supportive regulatory environment, drive this dominance. Moreover, the region benefits from a mature ecosystem of technology vendors and research institutions collaborating to drive innovation. So that the evolving needs of data center operators can be addressed. As a result, North America continues to lead the global data center RFID market, with sustained growth expected in the foreseeable future.

Another reason behind North America's expanding market is its robust infrastructure, advanced technological capabilities, and a strong focus on innovation. Several countries like unites states, Canada, and Mexico within North America contribute to its dominance in the market. Several factors, including a high concentration of data center facilities, strong demand for advanced technology solutions, and a supportive regulatory environment, further facilitate the market. Moreover, the region benefits from a mature ecosystem of technology vendors and research institutions collaborating to drive innovation.

The United States is a global technology leader that adopted data center RFID solutions. The country is home to numerous large-scale data center operators, technology companies, and innovative startups driving the market forward. Major cities such as Silicon Valley, New York City, and Dallas serve as key hubs for data center development and innovation.

Moreover, with a thriving technology sector and a stable business environment, Canada plays a significant role in the North American Data Center RFID market. Canadian companies leverage RFID technology to enhance data center security, streamline operations, and improve asset management practices.

Asia Pacific emerges as a rapidly growing region in the global data center RFID market, fueled by a booming digital economy, increasing infrastructure investments, and a growing emphasis on data center modernization. Several countries in the region, such as China, India, Japan, and South Korea, contributed to its accelerated growth.

As one of the world's largest and fastest-growing markets for data center infrastructure, China plays a pivotal role in driving the adoption of RFID technology. Major cities like Beijing and Shanghai are witnessing significant investments in data center construction and expansion, driving demand for RFID solutions to optimize asset management and enhance operational efficiency.

While India has a proliferating IT sector and a rapidly expanding digital infrastructure, India presents substantial opportunities for the data center RFID market. The country's initiatives, such as Digital India and Smart Cities, drive the demand for advanced data center solutions, including RFID technology, to support the growing volume of digital transactions and data storage requirements.

Japan is known for its technological innovation and advanced infrastructure; Japan is a key market for data center RFID solutions. Japanese companies are investing in RFID technology to improve data center security, automate asset tracking, and enhance operational visibility, which are some of the major factors driving market growth in the region. The country's focus on data center optimization and efficiency drives the adoption of RFID technology to streamline operations and enhance asset management practices.

Other countries in Asia Pacific, such as Singapore and Malaysia, are also experiencing rapid growth in the data center RFID market, driven by factors such as digital transformation initiatives, cloud adoption, and the proliferation of IoT devices. Therefore, Asia Pacific represents a dynamic and fast-growing market for data center RFID solutions with a robust ecosystem.

Market Overview

The data center RFID market is experiencing steady growth due to the increasing adoption of RFID technology for efficient asset management and inventory tracking in data centers. With the rising demand for data storage and management solutions, data center operators are turning to RFID systems to streamline operations, enhance security, and improve asset utilization. The market is witnessing significant innovation, with advancements such as passive and active RFID tags, real-time location systems (RTLS), and cloud-based RFID solutions catering to diverse data center requirements.

Regulatory compliance mandates and the need for better visibility into data center assets are driving market growth. Key players in the market are focusing on strategic partnerships, product enhancements, and mergers and acquisitions to gain a competitive edge. However, challenges related to interoperability, data privacy, and initial implementation costs pose constraints to market expansion. Despite these challenges, the data center RFID market is poised for continued growth in the foreseeable future.

Data Center RFID Market Growth Factors

- An Increasing demand for data storage and management solutions.

- Rising adoption of RFID technology for asset management and inventory tracking.

- Enhanced security measures driving RFID adoption in data centers.

- Advancements in passive and active RFID tags technology.

- Growing importance of real-time location systems (RTLS) in data center operations.

- Inclination towards cloud-based RFID solutions for scalability and flexibility.

- Regulatory compliance mandates driving RFID implementation in the data centers.

- Strategic partnerships, product enhancements, and mergers and acquisitions fostering market growth.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 24.04% |

| Market Size in 2025 | USD 2.07 Billion |

| Market Size in 2024 | USD 1.66 Billion |

| Market Size by 2034 | USD 14.31 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Hardware, Tags, Tag Frequency, Reader, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Efficient asset management and inventory tracking

The significant driver propelling the growth of the data center RFID market is the increasing demand for efficient asset management and inventory tracking solutions within data centers. As data centers continue to expand in size and complexity to meet the escalating demands of digital transformation, the need for effective management of assets becomes essential. Traditional methods of asset tracking, such as manual inventory checks or barcode scanning, are becoming insufficient in the surge of rapid data center expansion and the market's dynamic requirements.

RFID technology offers a compelling solution by enabling real-time, automated identification and tracking of assets throughout the data center environment. With RFID tags attached to equipment and assets, data center operators can gain instant visibility into the location, status, and usage of resources to optimize resource utilization. This enhanced visibility not only improves operational efficiency but also enables proactive maintenance, reduces downtime, and enhances overall data center performance.

Moreover, RFID technology provides data center operators with micro-level insights into asset movements, enabling better decision-making. Which thereafter helps in inventory optimization and compliance with regulatory requirements. As data centers continue to evolve into supporting digital economies, the demand for RFID-based asset management solutions is expected to grow exponentially, driving the expansion of the data center RFID market.

Restraint

Initial implementation costs

The notable restraint facing the data center RFID market is the initial implementation costs associated with deploying RFID infrastructure and systems within data center environments. At the same time, RFID technology offers numerous benefits, including improved asset visibility and enhanced security. Still, the upfront investment required to install RFID readers, antennas, tags, and software can be substantial, leading to significant hindrances to the market's expansion.

Data center operators often face budgetary constraints and inadequate financial considerations when evaluating new technologies and solutions. The initial capital expenditure required to deploy RFID systems may deter some organizations from investing in RFID technology, especially smaller data centers or those operating on limited budgets.

The complexity of integrating RFID systems with existing data center infrastructure and management systems can further escalate implementation costs and project timelines. Moreover, while the long-term benefits of RFID technology are significant, the return on investment (ROI) may not be immediately notable. This delay in ROI realization can be a deterrent for some organizations, particularly those focused on short-term financial goals or facing pressure to demonstrate immediate cost savings.

Opportunity

Migration to hyperscale facilities

A major opportunity for the data center RFID market lies in the growing trend toward data center consolidation and migration to hyperscale facilities. As organizations strive to optimize their IT infrastructure and enhance scalability and flexibility, many are consolidating their data center, migrating to hyperscale facilities that offer greater efficiency and capacity. This trend presents a significant opportunity for the market, as RFID technology can play a crucial role in facilitating the seamless transition and ongoing management of assets. RFID enables data center operators to gain real-time visibility into the location, status, and usage of assets, regardless of the scale or complexity of the facility.

In consolidated data centers, RFID technology can streamline the identification and tracking of assets as they are relocated or consolidated into fewer facilities. RFID tags attached to equipment and assets provide granular insights into asset movements, facilitating efficient inventory management and minimizing the risk of asset loss or misplacement during the consolidation process.

Similarly, in hyperscale data centers characterized by massive scale and high-density computing, RFID technology can help optimize asset utilization, improve resource allocation, and enhance operational efficiency. Real-time asset tracking and management capabilities enable data center operators to effectively monitor and manage assets across vast facilities while ensuring optimal performance, which in turn minimize downtime of the data center.

Component Insights

The hardware segment held the largest share of the market in 2024. The reason behind this growth is a strategic partnership between major key players in the market, as a rising need for data storage and processing capabilities leads to the construction of data centers. Hardware components such as RFID readers, antennas, tags, and other infrastructure play a crucial role in enabling efficient data center operations, including asset tracking, inventory management, and security. With the increasing adoption of RFID technology in data centers worldwide. The demand for reliable and advanced hardware solutions continues to rise, solidifying its position as the leading segment in the market.

- In September 2023, Digitalor and HyperView announced a partnership to integrate the technologies made by Digitalor. This partnership will help develop environmental sensors and asset-tracking hardware that allows consumers to track an asset's entire lifecycle, from receipt to decommission.

The services segment is anticipated to register rapid growth in the upcoming years. Service providers offer a range of solutions, including implementation, integration, consulting, and maintenance services tailored to the specific needs of data center operators. As businesses seek to optimize their operations and enhance efficiency through RFID technology, the demand for expert services to support deployment and management is steadily increasing.

Hardware Insights

The readers segment accounted for the largest share of the data center RFID market. RFID readers are a fundamental component of RFID systems, responsible for transmitting and receiving radio signals to communicate with RFID tags. In data center environments, RFID readers play a crucial role in tracking and managing assets, inventory, and equipment. RFID readers in data centers support a wide range of applications, including asset tracking, inventory management, access control, and security. These readers can be deployed at various points within the data center infrastructure, such as entry/exit points, equipment racks, and storage areas, to enable comprehensive asset visibility and tracking.

The antenna segment is observed to grow at a notable rate during the forecast period. Antennas play a critical role in establishing communication between RFID tags and readers, facilitating accurate data capture and transmission. As data centers expand and adopt more sophisticated RFID systems to improve asset management and operational visibility, the demand for advanced antenna solutions is escalating, making it a fast-growing segment in the market.

Tags Insights

The passive tags segment held the largest share of the data center RFID market. These tags require no internal power source, relying on energy from RFID readers for operation. With their simplicity and affordability, passive tags are widely adopted in data centers for inventory management, asset tracking, and security applications, solidifying their position as the leading segment of the market.

The active tags segment is observed to grow at a significant rate during the forecast period. Equipped with their power source, typically a battery, active tags offer extended read ranges and real-time tracking capabilities, making them ideal for applications requiring high accuracy and frequent asset monitoring. As data centers increasingly prioritize real-time visibility and proactive asset management, the demand for active tags continues to surge, driving growth in this segment.

Tag Frequency Insights

The UFH segment accounted for the largest share of the data center RFID market in 2024. UHF technology offers longer read ranges and high data transfer rates, making it ideal for large-scale asset tracking and inventory management within data center environments. With its versatility and widespread adoption, UHF frequency tags continue to dominate the market, providing robust solutions for data center operations.

The HF tags frequency segment is anticipated to witness the fastest growth in the upcoming years. HF tags offer shorter read ranges but provide higher data security and reliability, making them suitable for applications requiring proximity identification and access control within data center facilities. As data centers increasingly prioritize security and efficiency, the demand for HF frequency tags is rapidly expanding, driving growth in this segment.

Reader Insights

The handheld reader type segment held a significant share of the data center RFID market in 2024. Handheld readers emerge as the dominant segment, offering portability and flexibility for on-the-go asset tracking and inventory management tasks. Handheld readers provide convenience and ease of use, allowing data center personnel to efficiently locate and manage assets within the facility. With their widespread adoption and practicality, handheld readers solidify their position as the leading segment in the market.

The fixed reader type segment is expected to showcase the fastest CAGR over the foreseen years. Fixed readers are stationary devices installed at key locations throughout the data center. They provide continuous monitoring and tracking of assets within the facility. As data centers seek to enhance operational efficiency and real-time visibility, the demand for fixed reader solutions is rapidly increasing, driving growth in this segment.

Application Insights

The asset tracking and management segment is estimated to hold a significant share of the global data center RFID market. Data centers extensively utilize RFID technology for real-time tracking and management of assets, including servers, networking equipment, and storage devices. With RFID-enabled asset tracking systems providing increased efficiency and accuracy, this segment solidifies its position as the leading application in the market.

The lifecycle management segment is projected to grow rapidly in the forecasted years. The lifecycle management segment is experiencing rapid growth in the data center RFID market because lifecycle management solutions leverage RFID technology to track assets throughout their entire lifecycle, from procurement to decommissioning. As data centers prioritize asset optimization and lifecycle efficiency, the demand for RFID-based lifecycle management solutions continues to surge, driving growth in this segment.

Recent Developments

- In March 2023, Zebra Technologies and MASS group announced their integration with newer additions of fixed readers-FX9600 and FX7500, respectively. The capability of integration of both fixed and handled hardware solutions will enable the MASS group to offer and fulfill clients' demands extensively with a spectrum of solutions, which will eventually lead to strengthening their position in the market.

- In May 2022, Vizinex RFID was acquired by HID Global. This acquisition made the HID portfolio globally appealing in the rapidly expanding RFID tag market. Standard and high-quality tags provided by Vizinex RFID enable consumers to save money and increase their efficiency by improving the tracking system, security, and authentication process. These customized tags hold a promising specialty of integration into the various range of product designs, making them more compatible with respect to the ever-evolving market's attention.

Data Center RFID Market Companies

- Alien Technology

- AVERY DENNISON CORPORATION

- Confidex

- Detego

- GAO Group

- HID Global

- Honeywell International Inc.

- Impinj, Inc.

- MOJIX

- Nedap

- NXP Semiconductors

- SATO Holdings Corporation

- Semiconductor Components Industries, LLC

- ThingMagic

- Zebra Technologies Corp.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Hardware

- Tags

- Reader

- Printer

- Antenna

- Others

By Tags

- Active

- Passive

By Tag Frequency

- LHF

- HF

- UHF

By Reader

- Fixed

- Handheld

By Application

- Asset Tracking and Management

- IT Asset Management

- Lifecycle Management

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting