Denatonium Saccharide Market Size and Forecast 2025 to 2034

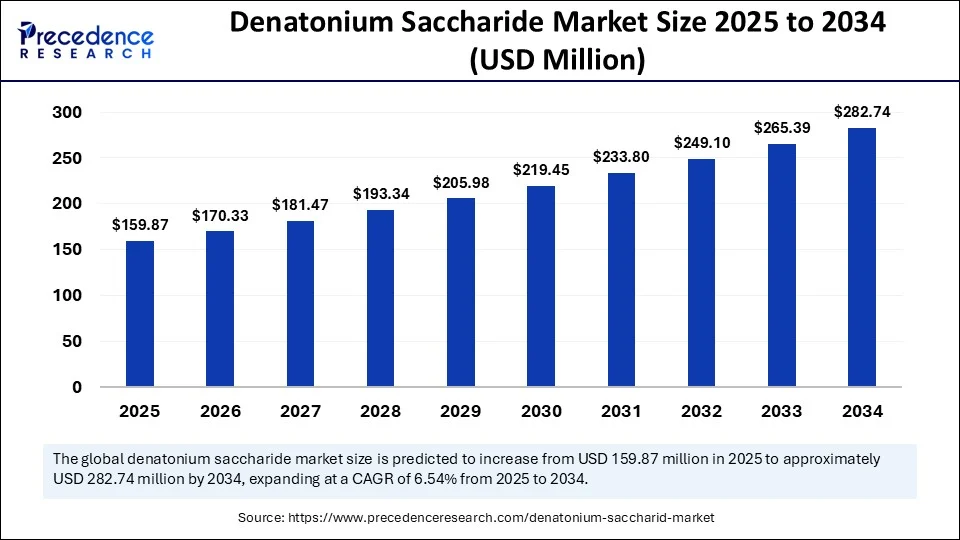

The global denatonium saccharide market size accounted for USD 150.06 million in 2024 and is predicted to increase from USD 159.87 million in 2025 to approximately USD 282.74 million by 2034, expanding at a CAGR of 6.54% from 2025 to 2034. The market growth is attributed to increasing regulatory emphasis on product safety and the rising incorporation of denatonium saccharide as an effective bittering agent across diverse industrial and consumer applications.

Denatonium Saccharide Market Key Takeaways

- In terms of revenue, the global denatonium saccharide market was valued at USD 150.06 million in 2024.

- It is projected to reach USD 282.74 million by 2034.

- The market is expected to grow at a CAGR of 6.54% from 2025 to 2034.

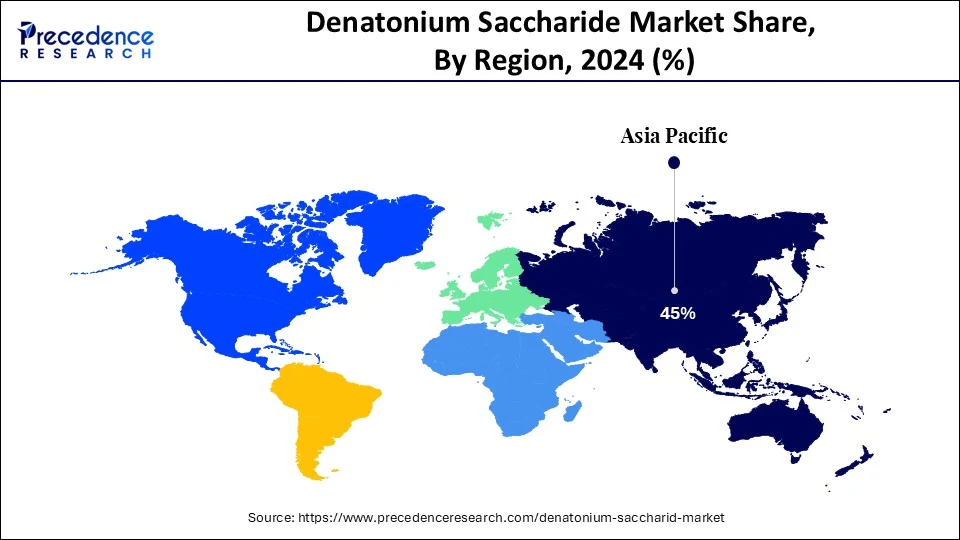

- Asia Pacific dominated the global market with the largest share of 45% in 2024.

- Middle East & Africa is expected to grow at a notable CAGR from 2025 to 2034.

- By form, the powder segment held the largest market share of 65% in 2024.

- By form, the liquid solution segment is projected to grow at a CAGR between 2025 and 2034.

- By purity level, the ≥98% purity segment contributed the biggest market share of 70% in 2024.

- By purity level, the <98% Purity segment is expanding at a significant CAGR between 2025 and 2034.

- By application, the household & industrial cleaning products segment generated the major market share of 30% in 2024.

- By application, the automotive products segment is expected to grow at a significant CAGR over the projected period.

- By end-user, household & consumer goods held the largest market share of 35% in 2024.

- By end-user, the automotive & transportation segment is expected to grow at a notable CAGR from 2025 to 2034.

- By distribution, the direct sales (B2B) segment captured the maximum market share of 60% in 2024.

- By distribution, online chemical marketplaces are expected to grow at a notable CAGR from 20245 to 2034.

What Has the Impact of Artificial Intelligence Been on the Denatonium Saccharide Market?

Artificial intelligence is impacting the denatonium saccharide market by enabling companies to accelerate their product development, manufacturing processes, and regulatory compliance. Based on the huge database of chemical, toxicological, and market data. AI algorithms are used to determine the best formulations in the context of household products or industrial applications. Furthermore, the use of AI in research, production, and supply chain management enables the stakeholders in the denatonium saccharide market to react more quickly to emerging trends and position themselves in a competitive/regulated industry.

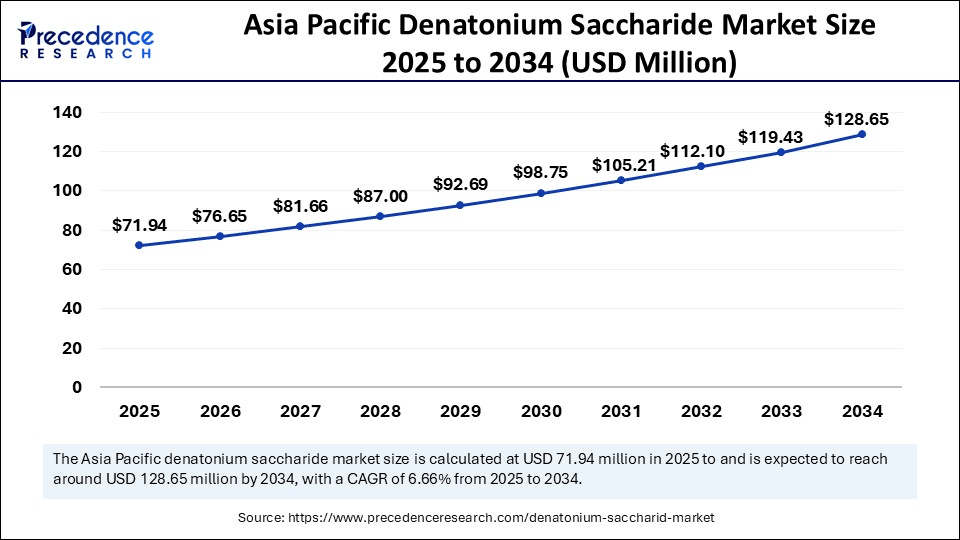

Asia Pacific Denatonium Saccharide Market Size and Growth 2025 to 2034

The Asia Pacific denatonium saccharide market size is evaluated at USD 71.94 million in 2025 and is projected to be worth around USD 128.86 million by 2034, growing at a CAGR of 6.66% from 2025 to 2034.

How Are Direct Sales Shaping the Denatonium Saccharide Market Landscape?

Asia Pacific led the denatonium saccharide market, capturing the largest revenue share in 2024, driven by strong demand in industrial manufacturing centers in China, India, Japan, and South Korea. UNIDO, aiming at studying major trends in the process of medium and high-tech production, has identified the fastest change in the production of this kind in East and South Asia. This underlines East and South Asian positions as the key initiators of specialty chemicals consumption.

This level of industrial scale makes large-scale procurement and manufacturing of denatonium-based bitterants affordable for various uses, including household uses and automobile antifreeze. In 2024, APEC Chemical Dialogue initiatives highlighted harmonised systems of hazard classification and labelling to allow more rapid product registrations in more than one jurisdiction. Furthermore, the existing major manufacturers expanded regional application labs, which helped to increase the consistency of product quality through technical training, further facilitating the market growth in this region.(Source: https://www.apec.org)

The Middle East & Africa are anticipated to grow at the fastest rate in the market during the forecast period, owing to the efforts towards industrial diversification strategies, as well as a highly modernising regulatory strategy. The GCC economies are investing in building the capacity of specialty chemicals, and this can be correlated with the national plans in Saudi Arabia's Vision 2030 and the UAE plans, emphasising the need to enhance the local production of industrial chemicals. Additionally, due to large-scale infrastructure spending situations in Sub-Saharan Africa, and despite a maturing automotive aftermarket, stable demand is likely as manufacturers seek this type of chemical compound.

Market Overview

The denatonium saccharide market covers the production and use of denatonium saccharide, one of the most bitter chemical compounds known, used as a denaturant and aversive agent to prevent accidental ingestion of toxic, harmful, or hazardous products. It is a white, odorless, crystalline powder highly soluble in water and alcohol. Denatonium saccharide is widely used in industries such as household cleaning products, industrial chemicals, automotive fluids, pesticides, personal care products, and paints & coatings. Its primary function is safety enhancement by adding an unpleasant taste without affecting product efficacy.

Heightened need by the consumer industry for the types of bittering agents boosts the high rate of use in the household care, individual care, and automobile sectors. Since manufacturers of the products are integrating denatonium saccharide into consumer products, this prevents unintentional ingestion and meets the safety regulations, which aim to prevent poisoning cases. Furthermore, the commercial demand is fuelled by end users who prefer products with safety claims and comply with ECHA/NIOSH recommendations, including retailers and institutional buyers.

Denatonium Saccharide Market Growth Factors

- Rising Demand in Household Cleaning Products: Growing consumer preference for tamper-proof and child-safe cleaning solutions is boosting denatonium saccharide integration in household formulations.

- Driving Safety Measures in Automotive Coolants: Increasing focus on preventing accidental ingestion is propelling the adoption of denatonium saccharide in antifreeze and coolant products.

- Boosting Use in Industrial Chemicals: Expanding industrial safety protocols are fuelling the incorporation of bittering agents in hazardous chemical manufacturing and storage.

- Growing Applications in Pesticide Formulations: Rising demand for safer agricultural products is driving the usage of denatonium saccharide to reduce accidental exposure risks.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 282.74 Million |

| Market Size in 2025 | USD 159.87 Million |

| Market Size in 2024 | USD 150.06 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.54% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Purity Level, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Increasing Demand for Bittering Agents Shaping the Future of the Denatonium Saccharide Market?

Increasing demand for bittering agents in consumer products is expected to drive the market in the coming years. Rising usage of bittering agents in consumer goods would lead to increased use of denatonium saccharide in household cleaning, personal care, and automotive fluids. Producers include it in recipes to discourage unintentional consumption, especially in jurisdictions where child-safety requirements are very demanding. The taste threshold of the compound is very low to achieve the aversive effect of the product without altering the product's performance or appearance.

In North America and Europe, strict safety-labeling and compliance requirements support its application-OSHA revised all of its Hazard Communication Standard in May 2024. This has been enforced since July 2024, which requires labeling and safety data sheets to contain more sensible hazard classification and better disclosure of trade secrets, Mondaqchemscape.com. Manufacturers of industrial cleaning solutions comply with the Occupational Safety and Health Administration guidelines and with the NIOSH recommendations to emulate safe handling practices, reinforcing this form in functionalized settings. Furthermore, the stringent standards increase the contribution of bittering agents such as denatonium saccharide by correlating the product safety with the regulatory and occupational health.

(Source: https://www.osha.gov)

Restraint

Stringent Regulatory Scrutiny Limiting Market Expansion

Stringent regulatory scrutiny is expected to affect growth across several application sectors in the denatonium saccharide market, further hindering the market in the coming years. There exist strict standards of chemical additives assessment developed by such regulatory agencies as the European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA). Such requirements lead to higher production expenses for manufacturers who incorporate denatonium saccharide into the end products. Moreover, the denatonium saccharide's limited solubility and formulation compatibility are anticipated to impact integration into certain complex chemical systems, thus further hindering their widespread adoption.

Opportunity

How Is Innovation in Formulation and Delivery Systems Expanding Opportunities in the Denatonium Saccharide Market?

Spurring innovation in formulation and delivery systems is likely to create immense opportunities for the market. Attempting to use denatonium saccharide in a diverse variety of products is likely to boost development in formulation and drug delivery systems. Research groups study nano-encapsulation and polymer coatings, as well as controlled-release approaches. This helps increase the stability and compatibility of the compound with different chemical matrices. The improvements enable the use in more complex products, such as high-performance lubricants and specialty coatings.

Perpetual innovation enhances efficiency in manufacturing and aids in product differentiation in competitive industries. In 2024, the insertion of biosurfactants into natural polymer carriers, such as alginate and chitosan, was presented by researchers, as these approaches present an upsurge in compatibility and functional stability. Furthermore, the industry players like Evonik Industries AG and BASF SE are to pilot delivery systems of the bittering agents that comply with the developing handling and safety policies and material standards, thus boosting the market growth.(Source: https://ijrbat.in)

Form Insights

Which Denatonium Saccharide Form Is Driving the Largest Share of the Market?

The powder segment dominated the denatonium saccharide market in 2024, accounting for an estimated 65% market share, due to its utilization in a large range of end uses, such as paints, adhesives, and industrial cleaners. Bulky transportation of solid products makes shipping and storage management easy, decreases the weight of the product on transport, and reinforces the efficiency of the supply chain.

The powder is preferred over research and development teams since the material has a greater shelf life at different temperatures and humidity levels, which minimizes susceptibility to degradation during warehousing and distribution. Regulator filings and safety data sheets provided by the European Chemicals Agency and OSHA 2024 report point to powder as having a lower risk of spill and exposure than volatile liquid forms during handling. Furthermore, Various specialty chemical manufacturers such as BASF SE and Clariant AG increased the capacity of powdered grades of denatonium in 2024 to meet the industrial and consumer demand in controlled uses, thus further fuelling the segment growth.(Source: https://www.osha.gov)

The liquid segment is expected to grow at the fastest rate in the coming years, as they streamline the downstream processing and minimize the risk of operator exposure by enabling consumer-grade manufacturing lines. Personal care and household goods end-use applications require even dispersion of ready-to-use liquids. This enhances uniformity in product applications in viscous media or when using solvents. Moreover, the availability of denatonium saccharide liquid grades with low airborne particulate exposure risks further facilitates the market growth.

Purity Level Insights

Why Does ≥98% Purity Lead the Denatonium Saccharide Market's Purity Level Segment?

The ≥98% Purity segment dominated the denatonium saccharide market in 2024, accounting for 70% of the market share, as they provide predictable dose-to-dose potency. This allows the formulator to reach formulated bitterness benchmarks by using simple dosing with raw material ingredients. The analytical tests and filings mentioning the tight impurity profile simplify the manufacturers ' compliance with the product safety and registration dossiers. Additionally, the long-term (≥98% grades) contracts are the top priorities of procurement groups required to make the critical applications, further propelling the segment demand.

<98% Purity segment is expected to grow at the fastest CAGR in the coming years, owing to its affordability for achieving high-volume, low-sensitivity requirements. They are beneficial for manufacturing products, such as bulk industrial cleaners, some agrochemical formulations, and maintenance fluids that do not require ultra-low concentrations of impurities. R&D groups work on compatibility testing procedures to precondition <98% material to solvent systems and carrier matrices. This allows wider use of the products with minimal purification requirements worldwide, thus further facilitating the market growth.

Application Insights

What Application Segment Is Holding the Dominant Position in the Market?

The household & industrial cleaning products segment dominated the denatonium saccharide market in 2024 that holding a market share of about 30%. Manufacturers add high-bitterness denatonium saccharide to concentrated cleaners, degreasers, and disinfectants. This discourages accidental human or pet consumption to protect the user and help everyone avoid liability. The regulatory authorities only serve to inspire this preference-ECHA 2024 dossiers on chemicals include denatonium saccharide among such compounds. They are to be necessarily included in high-grade risk cleaning products, posing evidence of their safety necessity.

The Hazard Communication updates on OSHA 2024 underline proper bitterant marking of industrial cleaning solutions to abide by the new worker safety measures. Formulation R&D departments establish formulations that perform over a wide pH range to ensure the bitter ingredient performs effectively in both acidic bathroom cleaners at low pH and in alkaline industrial degreasers with high pH. Moreover, the consumer and institutional purchasers confirm the threats of poisoning, thus further fuelling the demand for denatonium saccharide chemical. (Source: https://www.osha.gov)

Automotive products, especially the antifreeze segment, are expected to grow at the fastest CAGR in the coming years, owing to the high safety regulations specifically towards denatonium saccharide. U.S. EPA 2024 antifreeze safety guidance brought the ethylene glycol coolant standards to state minimum levels of bitterant, in retail and OEM products. Furthermore, the integration of the bittering agent in the antifreeze formulations is further achieved faster by the technical support of the top chemical suppliers of customized specifications of solubility and handling requirements in various markets.

(Source: https://www.govinfo.gov)

End-User Insights

Which End-Use Industry Accounts for the Highest Consumption of Denatonium Saccharide?

The household & consumer goods segment held the largest revenue share in the denatonium saccharide market in 2024, with a market share of about 35%, as manufacturers focus on bittering agents, which help reduce the risk of unnecessary consumption of concentrated cleaners, hand sanitizers, and multipurpose solutions.

Retailers and institutional customers insist on compliant labeling and verifying safety precautions. Hence, the procurement teams are willing to buy a standardized powder grade and a stabilized liquid grade that has current safety data sheets. Additionally, the increased implementation of denatonium-based repellents further facilitates the demand for denatonium saccharide in this segment.

The automotive segment is expected to grow at the fastest rate in the coming years in the denatonium saccharide market, owing to the rising safety regulations and the adoption of factory-filled coolants. This comprises bittering substances to prevent accidental ingestion of fluids based on ethylene glycol.

OEM engineering teams ensure that pre-blended antifreeze combinations include grades of denatonium. They are compatible with corrosion inhibitors and have low-temperature tolerance, maintaining system life expectancy within safety limits. Furthermore, the growing fleets of automobiles in new territories and increasing frequencies of vehicle servicing create demand for bitrex-based safer coolant products.

Distribution Insights

How Are Direct Sales Shaping the Denatonium Saccharide Market Landscape?

Direct sales segment dominated the denatonium saccharide market in 2024, due to the propensity of large-scale industrial buyers in household, automotive, and industrial clean sectors to favor supplier-managed procurement over consistency and safety. Direct contacts with the client companies remove an adversarial relationship between buyers and chemical suppliers.

This allows buyers to obtain long-term contract supplies, technical advice on formulation, and shipment tracking. Furthermore, the direct sourcing strategies are incorporated into procurement processes by specialized individuals to maximize delivery accuracy and to make them responsive to the changing demand patterns.

The online chemical marketplaces segment is expected to grow at the fastest CAGR in the coming years, owing to the ongoing digitalization of specialty chemical distribution chains. The availability of centralised catalogues, real-time inventory, and clear compliance checks and verifications facilitates such sourcing of bitterants amongst mid-sized formulators and regional manufacturers via platforms. Additionally, the Digital access, rapidity of transactions, and guarantees of compliance that such platforms are providing are appreciated by market participants.

Denatonium Saccharide Market Companies

- Aversion Technologies

- Fengchen Group

- Top Pharm Chemical Group

- UPL

- Zhejiang Synose Tech

Recent Developments

- In June 2025, Torrent Pharmaceuticals announced the acquisition of a controlling stake in JB Chemicals and Pharmaceuticals in a ?19,500 crore deal, positioning it as the second most valued pharmaceutical company in India. The transaction includes the purchase of a 46.39% stake from promoters Tau Investment Holdings Pte Ltd, a KKR unit, for approximately ?11,917 crore, and an additional 2.80% stake from JB Chemicals employees for ?719 crore, both at ?1,600 per share. In line with regulatory obligations, Torrent will launch a mandatory open offer to acquire a further 26% from public shareholders at ?1,639.18 per share, amounting to ?6,842.8 crore.(Source: https://economictimes.indiatimes.com)

- In June 2025, DCM Shriram Ltd announced Board approval for the acquisition of a 100% equity stake in Hindusthan Speciality Chemicals Limited (HSCL) for ?375 crore. The payment will be executed in one or more tranches, subject to adjustments in the final terms of definitive agreements. The acquisition was approved during the company's board meeting on June 12, 2025, and is expected to conclude by September 2025, pending regulatory and shareholder approvals. The move is part of DCM Shriram's strategic expansion into specialty chemicals to enhance its value-added product portfolio.

(Source: https://www.business-standard.com) - In May 2025, Novopor Advanced Science Private Limited, a performance chemicals and material science CDMO, announced its acquisition of Pressure Chemical Company, an affiliate of Minafin Group and a specialist in high-pressure and specialty chemistry services. While financial details remain undisclosed, Novopor emphasized that the deal strengthens its integrated specialty chemicals platform by combining early-stage development expertise with large-scale manufacturing capabilities. The acquisition will enable the company to expand its facility footprint, enhance technical capabilities, and provide customers with seamless access to fine and specialty chemical manufacturing at commercial scale.(Source: https://www.expresspharma.in)

(Source: https://timesofindia.indiatimes.com)

(Source: https://www.indianchemicalnews.com)

Segments Covered in the Report

By Form

- Powder

- Liquid Solution

By Purity Level

- ≥98% Purity

- <98% Purity

By Application

- Household & Industrial Cleaning Products

- Automotive Products

- Antifreeze & Coolants

- Windshield Washer Fluids

- Pesticides & Rodenticides

- Paints, Coatings & Solvents

- Personal Care & Cosmetics

- Alcohol Denaturing

- Other Industrial Chemicals

By End-User Industry

- Household & Consumer Goods

- Automotive & Transportation

- Agriculture & Pest Control

- Paints, Coatings & Construction

- Chemical Manufacturing

- Personal Care & Cosmetics

By Distribution Channel

- Direct Sales (B2B)

- Distributors & Chemical Suppliers

- Online Chemical Marketplaces

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting