Asia Pacific Denatonium Saccharide Market Size and Forecast 2025 to 2034

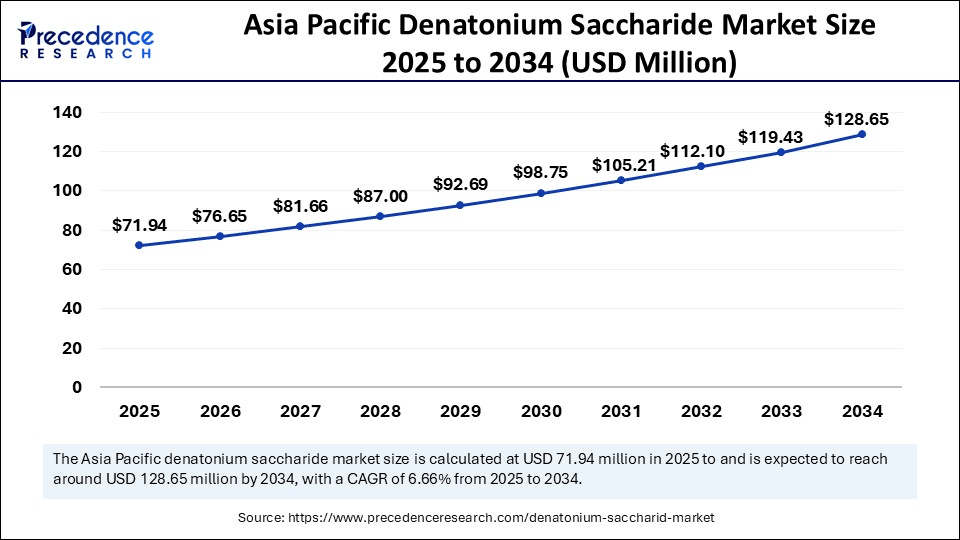

The Asia Pacific denatonium saccharide market size accounted for USD 67.53 million in 2024 and is predicted to increase from USD 71.94 million in 2025 to approximately USD 128.65 million by 2034, expanding at a CAGR of 6.66% from 2025 to 2034. The market is growing due to its increasing use as the world's most bitter compound in consumer products, industrial applications, and safety formulations to prevent accidental ingestions.

Asia Pacific Denatonium Saccharide MarketKey Takeaways

- In terms of revenue, the Asia Pacific denatonium saccharide market was valued at USD 67.53 million in 2024.

- It is projected to reach USD 128.65 million by 2034.

- The market is expected to grow at a CAGR of 6.66% from 2025 to 2034.

- By form, the power segment held the largest share of the Asia Pacific denatonium saccharide market in 2024.

- By form, the liquid solution segment is expected to grow at the fastest CAGR during the forecast period.

- By purity level, the≥98% purity segment led the market in 2024.

- By purity level, the <98% purity segment is projected to grow at the fastest CAGR during the forecast period.

- By application, the household & industrial cleaning products segment captured the biggest market share in 2024.

- By application, the automotive products segment is the fastest-growing during the forecast period

- By end user, the household & consumer goods manufacturers segment contributed the major market share in 2024.

- By end user, the automotive & transportation sector segment is emerging as the fastest growing.

- By distribution, the direct sales (B2B) sales segment held the largest share in 2024.

- By distribution, the online sales channel segment is expected to grow at the fastest CAGR during the forecast period.

How Are Technological Advancements Influencing the Asia Pacific Denatonium Saccharide Market Growth?

Allowing the creation of novel formulations, including liquid granular and encapsulated forms, which enhance stability and usability, thereby impacting the Asia Pacific denatonium saccharide market. Advances in nanoencapsulation and controlled-release coatings are improving the compounds' suitability for intricate consumer and industrial goods. Adoption in the pharmaceutical home care and agricultural industries is also being aided by automation and AI-driven manufacturing processes, which lower production costs, boost efficiency, and guarantee greater consistency in quality.

Market Overview

Which Industries Widely Use the Asia Pacific Denatonium Saccharide Market Products?

The Asia Pacific denatonium saccharide market products are widely used across industries such as household cleaning products, automotive fluids (antifreeze, windshield washer solutions), paints and coatings, detergents, agrochemicals, and personal care items. In the pharmaceutical industry, they are utilized as denaturants in formulations like cough syrups and topical creams. These applications highlight the market's importance in ensuring safety by deterring accidental ingestion and misuse.

Furthermore, because of its intense bitterness, the compound is a dependable addition to crop protection formulations and pest control products, lowering the possibility of unintentional animal and human consumption. In the industrial and automotive sectors, denatonium saccharide reduces liability risks for manufacturers by ensuring product safety compliance with government standards. Its expanding use in consumer products also reflects the growing international regulations that place a greater emphasis on product responsibility and child safety.

Asia Pacific Denatonium Saccharide Market Growth Factors

- Rising safety regulations to prevent accidental ingestion.

- Increasing use in pharmaceuticals as a denaturant.

- Expanding adoption in household, automotive, and industrial products.

- Growing focus on child and pet safety.

- Emerging applications in agriculture and pest control.

- Preference for eco-friendly and nontoxic additives.

- Demand growth in detergents and cleaning solutions.

- Used in pest control products for added safety.

- Rising healthcare applications in syrups and topical drugs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 128.65 Million |

| Market Size in 2025 | USD 71.94 Million |

| Market Size in 2024 | USD 67.53 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.66% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, End-User Industry, Distribution Channel, Application |

Market Dynamics

Drivers

Regulatory Support Driving Growth in the Asia Pacific Denatonium Saccharide Market

The use of bittering agents in dangerous products is strongly supported by governments and regulatory agencies like the FDA, WHO, and Health Canada. These precautions are meant to guard against unintentional poisoning of children, pets, and vulnerable populations. Adoption of bitterants has increased significantly as a result of their mandatory inclusion in products like pesticides and automotive fluids. In the upcoming years, the market might grow even faster if regulations are harmonized across regions.

Rising Consumer Awareness Is Pushing Denatonium Saccharide Market Expansion in the Asia Pacific

Products containing bittering agents are becoming more and more popular as consumers' concerns about the safety of children and pets grow. In response, manufacturers are promoting safety features based on denatonium to foster confidence. Adoption of household and personal care products is accelerated by this consumer-driven push, which supports legislative actions. Another factor bolstering this change is the increased media coverage of unintentional poisoning incidents.

Restraints

Regulatory Barriers Providing Obstacles To Growth

International marketing of denatonium saccharide presents difficulties for businesses due to regulatory variations among nations. Some jurisdictions have strict or ambiguous regulations, while others require it to be included in dangerous goods. Manufacturers deal in dangerous goods. Manufacturers incur higher costs due to complicated documentation, inconsistent approval timelines, and different maximum permissible concentrations.

Alternatives and Substitutes Threaten the Market

There is less dependence on denatonium saccharide due to competition from less expensive bittering agents and mechanical safety measures like child-resistant packaging. In low-profit industries, many manufacturers choose to use less expensive alternatives, particularly when denatonium is not strictly required by regulations. Growth prospects are further constrained by some packaging innovations that also eliminate the need for chemical bitterants. Due to intense competition, businesses are compelled to provide safety benefits to justify the higher price of denatonium.

Opportunities

Rising Demand for Child & Pet Safety Products to Drive Future Growth

There is a high demand for bittering agents in consumer goods due to growing awareness of the risks of accidental ingestion. Products with safety additives like denatonium saccharide are becoming increasingly popular among parents and pet owners. As a result, manufacturers of consumer goods now have the chance to set themselves apart from the competition by emphasizing safety. This trend is being further accelerated by expanding regulations requiring bitterants in hazardous goods.

Adoption in Agriculture and Pest Control Is Set to Propel Future Growth

Denatonium saccharide is perfect for use in crop protection products and animal repellents because of its intense bitterness. Farmers are using it to prevent humans and animals from inadvertently consuming treated crops and pesticides. It is anticipated that agrochemical companies will increase their use in formulations due to the global emphasis on safer agricultural practices and lead to growth in the Asia Pacific denatonium saccharide market. Particularly in agrarian economies, this presents long-term prospects.

Form Insights

Why Did the Power Segment Dominate the Asia Pacific Denatonium Saccharide Market in 2024?

The power segment dominated the Asia Pacific denatonium saccharide market in 2024 because it is easier to blend with different formulations, has a longer shelf life, and is more affordable when transported in bulk because it guarantees superior stability and enables easy distribution to producers of both industrial and consumer goods manufacturers for large-scale applications in cleaning products, paints and coatings.

Liquid solution form is the fastest-growing segment, driven by rising demand from industries requiring ready-to-use formulations, particularly in automotive fluids, household sprays, and liquid detergents. This format reduces processing steps for downstream users, aligning with the region's growing trend toward efficiency and convenience in industrial supply chains. Furthermore, liquid solutions are gaining favor among SMEs due to reduced handling costs. As e-commerce distribution of chemicals expands, liquid formats are also reaching broader markets quickly.

Purity Level Insights

Why Did the ≥98% Segment Dominate the Market?

≥98% purity level dominates in the Asia Pacific denatonium saccharide market because it is widely used in sectors where high standards of quality are crucial. For expensive goods where consistency, safety, and compliance are crucial, it is the recommended option. The increasing regional emphasis on product safety and regulatory alignment serves to further strengthen the demand. Its dominance can also be attributed to the growing use of high-purity grades in research and development.

The <98% purity segment is expanding fastest, because industries that do not need ultra-high purity standards can benefit from its affordable solutions. Because of this, it is very appealing for high-volume uses like chemical formulations and industrial cleaning. As companies look for less expensive options that still function well, the market is expanding. This expansion is being further fueled by growing adoption in end markets that are price-sensitive.

Application Insights

Why Did the Household & Industrial Cleaning Products Segment Dominate the Market in 2024?

The household & industrial cleaning products segment dominates the Asia Pacific market, demonstrating the high demand for biocides in disinfectants, detergents, and surface cleaners. This application area continues to be strengthened by the increased emphasis on consumer safety and hygiene. Consistent growth is ensured by widespread use in the industrial and residential cleaning sectors. The segment's leadership is further cemented by partnerships between cleaning brands and chemical manufacturers.

The automotive products segment is expected to be the fastest growing in the Asia Pacific denatonium saccharide market, encouraged by growing uses in automotive fluids like windshield cleaners and antifreeze. Because it prevents accidental ingestion, denatonium saccharide is essential to safety compliance. The growing focus on consumer protection in the transportation industry is driving this demand. This segment's growth is being accelerated by the increasing integration of bitterants into a wider range of automotive chemicals.

End User Insights

Why Did the Household and Consumer Goods Manufacturers Segment Dominate the Market in 2024?

Household & consumer goods manufacturers dominate demand in the Asia Pacific denatonium saccharide market because denatonium saccharide is an essential component of many commonplace goods. The dominance of this market is further supported by growing consumer preference for reliable brands and increased awareness of product safety. Growing consumer use of cleaning household and personal care products accelerates their growth. This position is further reinforced by established supply relationships with consumer goods manufacturers.

The automotive & transportation sector is the fastest-growing end user, motivated by the growing application of denatonium saccharide in safety and vehicle maintenance products. Adoption has accelerated in this sector due to the emphasis on meeting industry safety standards. Expansion is still being driven by the increasing significance of chemical safety in transportation applications. This segment's growth is further enhanced by strategic alliances between manufacturers of transportation products and suppliers.

Distribution Insights

Why Did Direct Sales (B2B) Sales Segment Dominate the Asia Pacific Denatonium Saccharide Market in 2024?

Direct sales (B2B) sales dominate the market because manufacturers and major industrial buyers handle the majority of denatonium saccharide transactions. Long-term contracts and bulk purchase agreements give both suppliers and customers stability. This model guarantees consistent quality cost cost-effectiveness, and dependability for large-scale applications. The dominance of established distribution networks further reinforces B2B channels.

The online sales channel is expanding fastest in the Asia Pacific denatonium saccharide market, driven by regions' digitization of procurement. Due to cost transparency, order size flexibility, and faster supplier access, businesses are increasingly choosing online platforms. The popularity of online sourcing is increasing due to the expanding role of B2B e-commerce platforms. The competitive pricing and quicker transactions provided by digital channels further support this change.

Regional Insights

Why Did Asia Pacific Dominate the Market in 2024?

Asia Pacific denatonium saccharide market shows diverse dynamics across its sub-regions, with industrially advanced areas driving demand for high-purity grades due to strict quality standards and regulatory compliance, while emerging and rapidly industrializing areas are fueling growth in cost-effective, lower purity variants for large-scale applications such as cleaning agents and automotive fluids. On the one hand developing regions are increasingly embracing online procurement channels and flexible order models while mature markets in the region prioritizing product consistency safety and established B2B distribution networks all things considered the areas exhibits a dual trend of rapid growth in mass market cost sensitive industries that place a higher priority on volume and accessibility as well as dominance in high value applications where purity and compliance are crucial.

China Denatonium Saccharide Market Trends

China market for denatonium saccharide is shaped by its position as a hub for large scale chemical manufacturing where suppliers emphasize high purity forms to meet suppliers emphasize high purity forms to meet strict safety and quality requirements. While the demand for liquid solutions is steadily increasing in consumer and automotive formulations, powder forms continue to dominate due to their ease of handling and sustainability for bulk industrial applications. Suppliers can effectively meet demand in the residential, commercial, and automotive sectors thanks to robust domestic infrastructure and well-established B2B distribution networks. The steady integration of bitterants into consumer goods and growing consumer awareness of product safety further support growth.

India Denatonium Saccharide Market Trends

The Indian market for denatonium saccharide is witnessing rapid expansion driven by both rising export activity and robust domestic consumption. Cost-effective grades of denatonium saccharide are in high demand, especially in cleaning agents, household goods, and large-volume industrial applications where affordability is critical for flexible and ready-to-use applications. Liquid solutions are becoming the preferred option even though powder form still predominates. As small and mid-sized buyers embrace digital procurement, online platforms are becoming more popular, but direct B2B sales continue to be the main distribution channel. India is one of the Asia Pacific markets with the fastest rate of growth because of increased emphasis on safety standards in consumer and automotive goods.

Asia Pacific Denatonium Saccharide Market Companies

- Zhejiang Synose Tech Co., Ltd.

- Simagchem Corporation

- Zhejiang Deyer Chemicals Co., Ltd.

- Leap Chem Co., Ltd.

- Sinocure Chemical Group

Recent Development

- On 7 May 2025, Novopor Advanced Science Private Limited announced the acquisition of a pressure chemical company to expand specialty chemistry and CDMO capabilities (a strategic move that can strengthen regional specialty chemicals capacity supporting adjacent markets, including bitterants).

(Source: https://www.novopor.com)

Segments Covered in the Report

By Form

- Powder

- Liquid Solution

By Purity Level

- ≥98% Purity

- <98% Purity

By Application

- Household & Industrial Cleaning Products

- Automotive Products

- Pharmaceuticals

- Cosmetics & Personal Care

- Pest Control

- Industrial Applications

By End-User Industry

- Household & Consumer Goods

- Automotive & Transportation

- Pharmaceuticals

- Cosmetics & Personal Care

- Industrial Manufacturing

By Distribution Channel

- Direct Sales (B2B)

- Retail

- Online Platforms

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting