What is In-silico Drug Discovery Market Size?

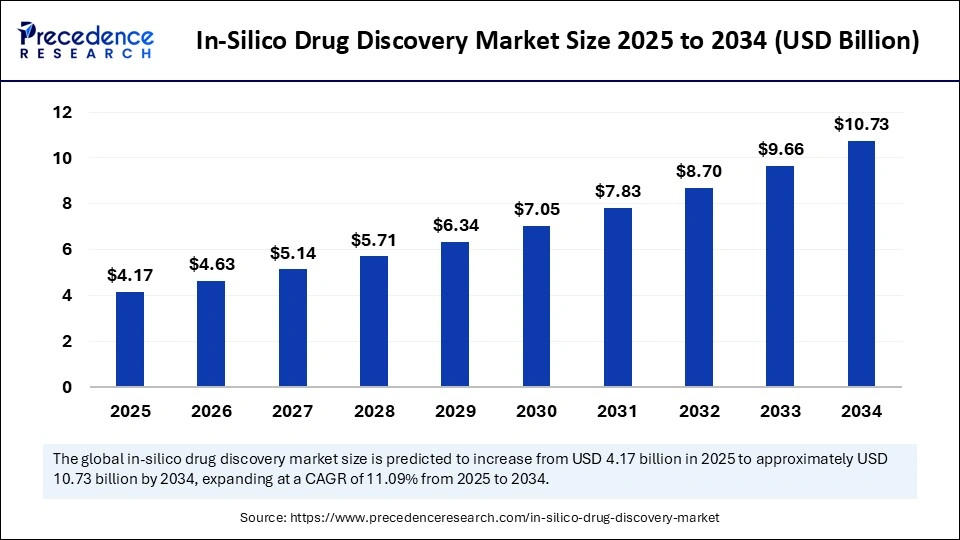

The global in-silico drug discovery market size was calculated at USD 4.17 billion in 2025 and is predicted to increase from USD 4.63 billion in 2026 to approximately USD 10.73 billion by 2034, expanding at a CAGR of 11.09% from 2025 to 2034.

Market Highlights

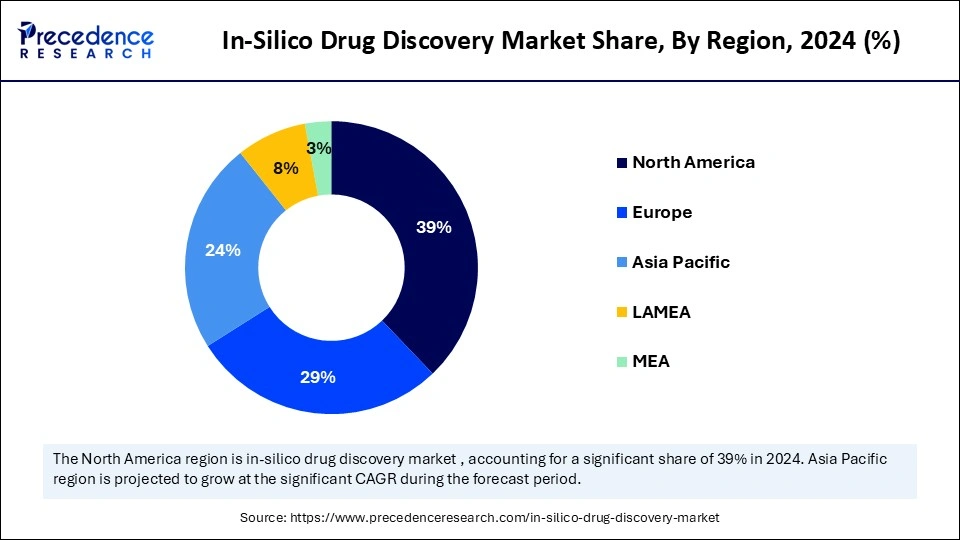

- By region, North America held the largest market share of 39% in 2024.

- By product type, the software as a service (SaaS) segment accounted for the dominating share of 40.5% in 2024 and is expected to is anticipated to grow with the highest CAGR of 12.5% in the market during the studied years.

- By application, the target identification segment held the major market share of 36.5% in 2024 and is predicted to witness significant growth of 12.4% in the market over the forecast period.

- By end-user, the pharmaceutical and biopharmaceutical companies segment held a dominant presence in the market in 2024 with 34.8% and is expected to grow at the fastest rate of 12.2% in the market during the forecast period of 2025 to 2034.

- By target therapeutic area, the oncological disorders segment registered its dominance over the global in-silico drug discovery market in 2024 with 32.8% and is expected to grow at a CAGR of 11.9% between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 4.17 Billion

- Market Size in 2026: USD 4.63 Billion

- Forecasted Market Size by 2034: USD 10.73 Billion

- CAGR (2025-2034): 11.09%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Is In-Silico Drug Discovery?

The rapid technology advancement in computational biology and the increasing development of new pharmacological compounds are anticipated to boost the expansion of the in-silico drug discovery market during the forecast period. In-silico drug discovery is the use of computational methods and computer-based simulations to identify, design, and evaluate potential drug candidates. It leverages bioinformatics, molecular modeling, artificial intelligence, and machine learning to predict how molecules interact with biological targets, reducing the need for extensive laboratory experiments. This approach accelerates the drug development process, minimizes costs, and improves efficiency. It does so by screening large compound libraries, optimizing drug properties, and predicting efficacy and toxicity, supporting faster development of safe and effective therapeutics.

In-Silico Drug Discovery Market Outlook:

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to see accelerated growth, owing to the rising demand for more efficient and cost-effective drug development processes, the rising complexity of diseases, increasing emphasis on reducing drug discovery costs and timelines, rapid growth in the biomarker identification field, increasing focus on minimizing prescription errors, increasing application of cloud-based technologies in drug discovery, and a surge in preclinical trials.

- Global Expansion: Leading players are expanding their geographical presence. For instance, in November 2021, Novadiscovery (NOVA), a leading health tech company that uses in silico clinical trials to predict drug efficacy and accelerate clinical development, announced the opening of its US headquarters in Boston, Massachusetts, as part of the company's international expansion plan.(Source: https://www.globenewswire.com)

- Major Investors: Several private equity and strategic investors are actively engaged in the market, accelerating its growth during the forecast period. For instance, in March 2025, Insilico Medicine, a clinical-stage generative artificial intelligence (AI)-driven drug discovery company, announced that it had secured a USD 110 million Series E financing led by a private equity fund of Value Partners Group to advance AI-driven drug discovery innovation.

- High initial costs: The high initial costs are anticipated to hamper the market's growth. The advanced in-silico platforms require significantly high upfront costs and specialized technical professionals, which often pose a challenge for smaller organizations due to budget constraints. Moreover, regulatory hurdles and rising concerns about data security, due to the increased use of computational platforms, may hinder the growth of the global in-silico drug discovery market during the forecast period.

AI Shifts in the In-Silico Drug Discovery Market

In the rapidly evolving technological landscape, Artificial Intelligence (AI) and machine learning (ML) emerge as game-changers for growth and innovation in the in-silico drug discovery market by reducing costs, speeding up R&D activities, enhancing treatment personalization, and improving clinical trials. The integration of AI and ML has the potential to increase efficiency and precision. The use of in-silico methods for clinical trials is expanding due to the rapid advancement in AI technology. The market is increasingly shifting towards generative AI, which can design new and optimized molecular structures with desired properties. Leveraging the power of generative AI and deep reinforcement learning allows researchers to accelerate drug development, significantly reduce costs, and explore novel chemical spaces with unprecedented efficiency and precision.

In September 2025, Eli Lilly and Company announced the launch of Lilly TuneLab, an artificial intelligence and machine learning (AI/ML) platform that provides biotech companies access to drug discovery models trained on years of Lilly's research data. Lilly estimates that this first release of AI models includes proprietary data obtained at a cost of over USD 1 billion, representing one of the industry's most valuable datasets for training an AI system available to biotechnology companies. (Source: https://investor.lilly.com)

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.17 Billion |

| Market Size in 2026 | USD 4.63 Billion |

| Market Size by 2034 | USD 10.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.09% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End-User Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Major Trends in the In-Silico Drug Discovery Market

In May 2025, Insilico Medicine announced a pilot project in the United Arab Emirates to discover the first novel drug candidate for oncology therapeutics, with the entire process from target identification to preclinical nomination conducted locally. Earlier, drug discovery and development were complex and lengthy processes, often spanning over 10 years, costing over USD 2 billion per drug, and failing in >90% of cases. In 2024, the U.S. FDA cleared only 50 novel drugs, representing a stark delay in novel therapeutic approvals throughout the industry.

In January 2025, Absci Corporation, a data-first generative AI drug creation company, and Owkin, a TechBio that uses agentic AI to unlock complex targets for drug discovery, development, and diagnostics, announced a partnership. This collaboration brings together two leading AI platforms to rapidly discover and design novel therapeutics for patients.(Source: https://investors.absci.com)

In February 2025, Harbour BioMed and Insilico Medicine, a clinical-stage generative artificial intelligence (AI)-driven biotechnology company, announced a strategic collaboration to accelerate the discovery and development of innovative therapeutic antibodies, leveraging their respective technological strengths in antibody discovery and artificial intelligence.

In July 2025, Atombeat Inc., a leading force in AI for drug discovery, and BioDuro, a globally trusted Contract Research, Development, and Manufacturing Organization (CRDMO), announced a strategic collaboration to develop an AI-powered platform for accelerated peptide drug discovery. This collaboration brings together Atombeat's in silico modeling expertise and an AI-accelerated & data-driven design platform with BioDuro's expertise in discovery chemistry, biology, and DMPK to accelerate the development of next-generation peptides.(Source: https://www.prnewswire.com)

Breakthroughs in the In-Silico Drug Discovery Market

|

Key player |

Date |

Breakthrough |

|

MIT researchers |

In August 2025 |

In August 2025, Researchers from the Massachusetts Institute of Technology (MIT) used artificial intelligence (AI) to design two novel antibiotics that can combat two hard-to-treat infections: drug-resistant Neisseria gonorrhoeae and multidrug-resistant Staphylococcus aureus (MRSA). Using generative AI algorithms, the research team designed more than 36 million possible compounds and computationally screened them for antimicrobial properties. (Source: https://news.mit.edu) |

|

Dassault Systèmes |

In January 2025 |

In January 2025, the U.S. Food and Drug Administration (FDA), in collaboration with Dassault Systèmes, embarked on a groundbreaking project to revolutionize patient care through the use of virtual twins. The FDA and Dassault Systèmes' ENRICHMENT project uses virtual twins and AI-driven in silico trials to transform life sciences by improving medical device evaluation and accelerating regulatory approval. (Source: https://emag.medicalexpo.com) |

|

Insilico Medicine |

In February 2025 |

In February 2025, Insilico Medicine announced a set of preclinical drug discovery benchmarks from the 22 developmental candidate nominations achieved by its platform from 2021 to 2024. These benchmarks underscore the platform's efficiency and represent a potential new standard for the drug discovery industry by significantly reducing developmental times, costs, and allowing resources to be redirected toward further research and development. (Source: https://firstwordpharma.com) |

Segment Insights

Which Segment Is Dominating the Market by Product Type in the In-Silico Drug Discovery Market?

The Software-as-a-Service (SaaS) segment dominated the global in-silico drug discovery market with a 40.5% share in 2024, reflecting a structural shift toward cloud-based, collaborative R&D environments. The SaaS model offers scalable, subscription-based access to powerful computational tools for molecular modeling, target validation, and virtual screening, eliminating the need for costly on-premise infrastructure. Its flexibility and ability to support decentralized data management and real-time analytics make it particularly attractive for globally distributed research teams.

As the volume of biological and chemical data grows exponentially, SaaS platforms enable seamless integration with AI-driven analytics, high-performance computing resources, and public datasets, thereby accelerating hypothesis testing and decision-making. In response, several leading pharmaceutical and biotechnology companies are forging strategic alliances and co-development partnerships with specialized in-silico firms to enhance computational capabilities and shorten drug discovery timelines. This trend underscores a broader movement toward digital transformation in the life sciences sector, where cloud-enabled ecosystems are becoming central to competitive differentiation and innovation velocity.

What Causes the Target Identification Segment to Dominate the In-Silico Drug Discovery Market?

The target identification segment held a dominant presence in the in-silico drug discovery market with a 36.5% share in 2024, owing to the rising availability of biological data and the increasing need for more efficient drug development. Target identification is a crucial step that uses computational methods such as bioinformatics, AI, and data mining to find potential drug targets. In addition, the increasing need to identify and validate promising drug targets, mainly proteins linked to chronic diseases, is likely to propel the segment's expansion in the coming years.

How Do Pharmaceutical and Biopharmaceutical Companies' Segments Dominate the In-Silico Drug Discovery Market in 2024?

The pharmaceutical and biopharmaceutical companies segment held the largest share of 34.8% in the in-silico drug discovery market. The growth of the segment is attributed to the increasing AI and computational biology, and the growing need for faster, more cost-effective drug development. Major biopharmaceutical and pharmaceutical companies are actively developing their in-house capabilities by partnering with specialized in-silico companies like Insilico Medicine, Atomwise, Exscientia, Schrödinger, Evotec, and Dassault Systèmes to accelerate their pipelines. Several large companies are increasingly investing in computational and AI drug discovery teams to strengthen internal capabilities.

How Did the Oncology Segment Dominate the In-Silico Drug Discovery Market in 2024?

The oncology disorders segment held the majority of the in-silico drug discovery market share of 32.8% in 2024. The growth of the segment is driven by the increasing prevalence of cancer globally, the rising demand for AI-powered drug discovery, rapid advancements in computational biology, and the high costs and time associated with conventional methods. Oncology is the largest segment, owing to the cancer's complex nature and the rising need for personalized therapies. In-silico methods are widely used to analyze massive datasets, identify novel drug targets, predict treatment outcomes, and design targeted therapies more efficiently.

Regional Insights

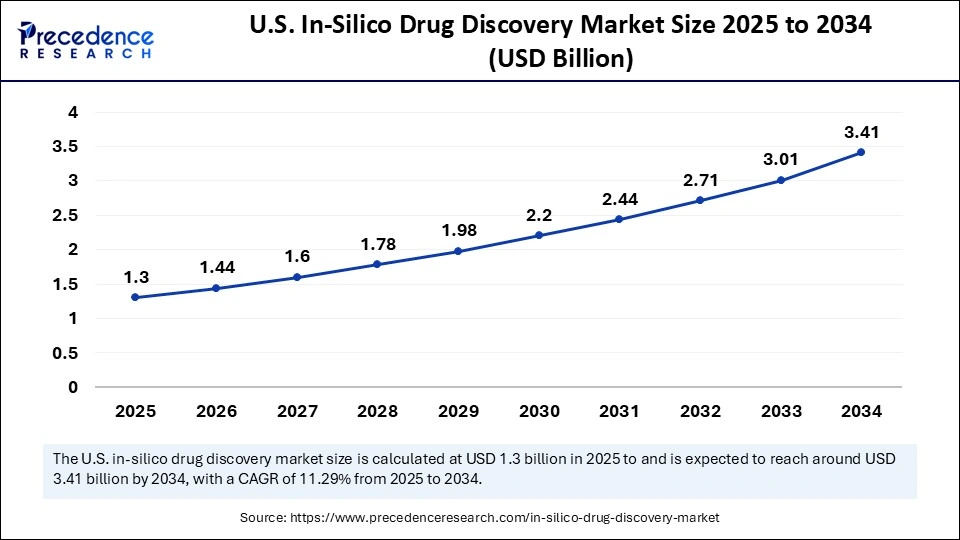

U.S. In-silico Drug Discovery Market Size and Growth 2025 to 203

The U.S. In-silico drug discovery market size is exhibited at USD 1.3 billion in 2025 and is projected to be worth around USD 3.41 billion by 2034, growing at a CAGR of 11.29% from 2025 to 2034.

What Made North America Dominate the In-Silico Drug Discovery Market in 2024?

North America held a dominant presence in the in-silico drug discovery market with a 38.8% share in 2024. This region holds a strong position, driven by robust R&D investment, a modern technology ecosystem, high healthcare spending by governments, the presence of advanced AI technology infrastructure, increasing adoption of cloud-based platforms, and surging funding for drug discovery. Moreover, the increasing prevalence of oncological disorders, metabolic disorders, HIV, infectious diseases, musculoskeletal disorders, mental disorders, neurological disorders, and others is expected to propel the regional market's growth. Furthermore, the rapid advancements in computational biology and AI are expected to accelerate the market's growth during the forecast period.

The United States is a major contributor to the growth of the in-silico drug discovery market. The country has a well-established presence of pharmaceutical and biopharmaceutical companies, Contract Research Organizations (CROs), and academic and research institutes. Several companies in the country are increasingly incorporating advanced technologies such as artificial intelligence (AI) and machine learning into their in-silico platforms to increase efficiency and precision. Factors such as advanced healthcare infrastructure, rising adoption of cloud-based platforms, a surge in clinical trials, growing focus on minimizing prescription errors, increasing investment in advanced therapies, rising cases of chronic diseases, growing demand for personalized medicine, and increasing regulatory approvals are anticipated to propel the growth of the market during the forecast period. In January 2025, the US Food and Drug Administration (FDA) showed increasing support for computational methods. It issued draft guidance for the use of AI in drug development, providing a clearer path for regulatory acceptance.

On the other hand, the Asia Pacific region is expected to grow at a notable rate during the forecast period. The market in the Asia Pacific is expanding steadily, driven by developing healthcare infrastructure, increasing integration of AI and machine learning, rising funding for in-silico drug discovery, the adoption of cloud-based platforms, the digitization of pharmaceutical R&D, the growing need for treatments for rare diseases, and a supportive regulatory environment. Additionally, the greater R&D spending by major players and the increasing number of clinical trials are likely to boost the expansion of the in-silico drug discovery market in the region. The increasing burden of chronic diseases and growing focus on precision medicine in the region offer substantial market growth opportunities for innovative therapies of complex diseases. Some companies are increasingly focusing on various applications, such as molecular modeling, virtual screening, and de novo drug design.

Country-Level Investments & Trends in In-Silico Drug Discovery Market:

Major economies are witnessing a surge in strategic investments and collaborations aimed at advancing AI-driven drug discovery capabilities, leading to growth in the in-silico drug discovery market. In the U.K., Isomorphic Labs raised USD 600 million in March 2025 to accelerate development of its next-generation AI drug design engine and bring therapeutic programs closer to clinical application, reflecting strong national momentum in AI-first pharmaceutical R&D. In the U.S., NVIDIA's USD 50 million investment in Recursion Pharmaceuticals, alongside its acquisition of Cyclica and Valence, highlights growing integration between computational infrastructure providers and biotech innovators to scale AI-assisted discovery through cloud-based platforms.

Similarly, Accenture's investment in Hungary-based Turbine underscores the rising role of predictive biology and digital twins in European drug development pipelines. Collectively, these investments signal a broader global shift toward computational biology and decentralized, data-driven research ecosystems, as countries compete to establish leadership in in-silico innovation.

In March 2025, Isomorphic Labs, an AI-first drug design and development company, announced it had raised USD 600 million to further develop its next-generation AI drug design engine and advance therapeutic programs into the clinic. The investment will accelerate Isomorphic Labs' frontier AI research and development, rapidly advancing the company's next-generation AI drug design engine.

NVIDIA announced a USD 50 million private investment in public equity in tech-focused Recursion Pharmaceuticals to create artificial intelligence (AI)-assisted drug discovery models. The investment is accompanied by plans for collaboration to distribute these using NVIDIA cloud services. It follows the strategic acquisition of Cyclica and Valence to enhance Recursion's machine-learning and AI capabilities.(Source: https://www.pharmaceutical-technology.com)

In May 2024, Accenture made a strategic investment through Accenture Ventures in Turbine, a predictive simulation company building a platform for interpreting human biology. Accenture's investment helps Turbine further extend its capabilities to global biopharma companies, enabling them to benefit from Turbine's ability to uncover hidden biological insights, which can guide and accelerate key drug development workstreams. Turbine's AI-based platform has clearly demonstrated the ability to unlock high-quality biological insights for our clients across the biopharma industry. (Source: https://newsroom.accenture.com)

Recent Developments:

- In January 2025, Novo Nordisk A/S and Valo Health, Inc. announced they had entered into an expanded agreement to discover and develop novel treatments for obesity, type 2 diabetes, and cardiovascular disease based on Valo's exten¬sive human dataset and computation powered by artificial intelligence (AI).

- In December 2024, Relation, an industry leader in deploying computation and experimentation to drug discovery, announced two multi-program strategic collaborations with GSK. The collaborations will focus on the identification and validation of novel therapeutic targets for fibrotic diseases and osteoarthritis. These debilitating diseases affect millions of patients worldwide and represent areas of significant unmet medical need.(Source:https://www.globenewswire.com)

Top Key Players in the In-Silico Drug Discovery Market & Their Offerings:

- Schrödinger, Inc.: Schrödinger is a global leader in computational molecular design, offering physics-based modeling and quantum mechanics tools through platforms like Maestro and LiveDesign. It's integrated in-silico suite enables structure-based drug discovery, lead optimization, and virtual screening, which are widely used by pharmaceutical and biotech companies to reduce R&D timelines.

- Insilico Medicine: Insilico Medicine combines AI-driven generative chemistry, target discovery, and clinical prediction within its Pharma.AI platform. The company has demonstrated real-world success in designing novel preclinical candidates in fibrosis and oncology, establishing itself as a key innovator in end-to-end AI drug discovery.

- Atomwise, Inc.: Atomwise revolutionized virtual drug discovery with AtomNet, the first deep convolutional neural network for structure-based drug design. Its platform screens billions of compounds digitally, identifying potential binders for difficult targets, and partners with global pharma companies to accelerate small molecule discovery.

- Exscientia: Exscientia leads in AI-driven drug design and precision medicine, integrating deep learning, adaptive algorithms, and patient data to optimize candidate molecules. With over a dozen AI-designed molecules entering clinical trials, Exscientia is transforming drug R&D through its automated discovery and decision-making ecosystem.

- BenevolentAI: BenevolentAI uses knowledge graphs and machine learning models to connect biological data, uncover novel disease mechanisms, and identify therapeutic targets. Its platform supports hypothesis generation and drug repurposing, with a strong focus on immunology, neurodegenerative disorders, and rare diseases.

Other Companies in the Market

- Recursion Pharmaceuticals: Employs automated high-content imaging and AI-based phenotypic screening to map cellular biology and accelerate drug discovery across multiple disease areas.

- Iktos: Specializes in generative AI for de novo drug design, providing virtual molecule creation and optimization tools for pharmaceutical R&D partners.

- Deep Genomics: Focuses on AI-driven RNA therapeutics, using predictive modeling to identify and correct genetic mutations responsible for rare and complex diseases.

- Insitro:Combines machine learning and stem cell biology to develop predictive disease models, enhancing target discovery and therapeutic candidate validation.

- Valo Health: Integrates AI, cloud computing, and real-world patient data through its Opal Computational Platform to optimize drug discovery and development.

- Curia Global, Inc.: Offers AI-assisted contract research and development services, leveraging computational chemistry to enhance small-molecule discovery and preclinical design.

- Certara: Provides biosimulation and in-silico modeling software for drug development, including virtual clinical trial simulations and pharmacokinetic modeling.

- Charles River Laboratories: Expands its preclinical CRO services with in-silico screening and computational biology to streamline target validation and early drug design.

- GenScript: Offers computational biology and protein design tools integrated with lab automation, enabling rapid molecule synthesis and optimization for biopharma partners.

- Sygnature Discovery: Provides integrated AI- and computational chemistry-enhanced drug discovery services, combining in-silico design with medicinal chemistry expertise.

Segments Covered in the Report:

By Product Type

- Software as a Service (SaaS)

- Consultancy as a Service

- Software

By Application

- Target Identification

- Lead Optimization

- Preclinical Testing

- Clinical Trials

- Adverse Effect Prediction

By End-User

- Pharmaceutical and Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Academic and Research Institutes

- Others

By Target Therapeutic Area

- Oncological Disorders

- Metabolic Disorders

- HIV

- Infectious Diseases

- Musculoskeletal Disorders

- Mental Disorders

- Neurological Disorders

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting