Dental CAD/CAM Market Size and Forecast 2025 to 2034

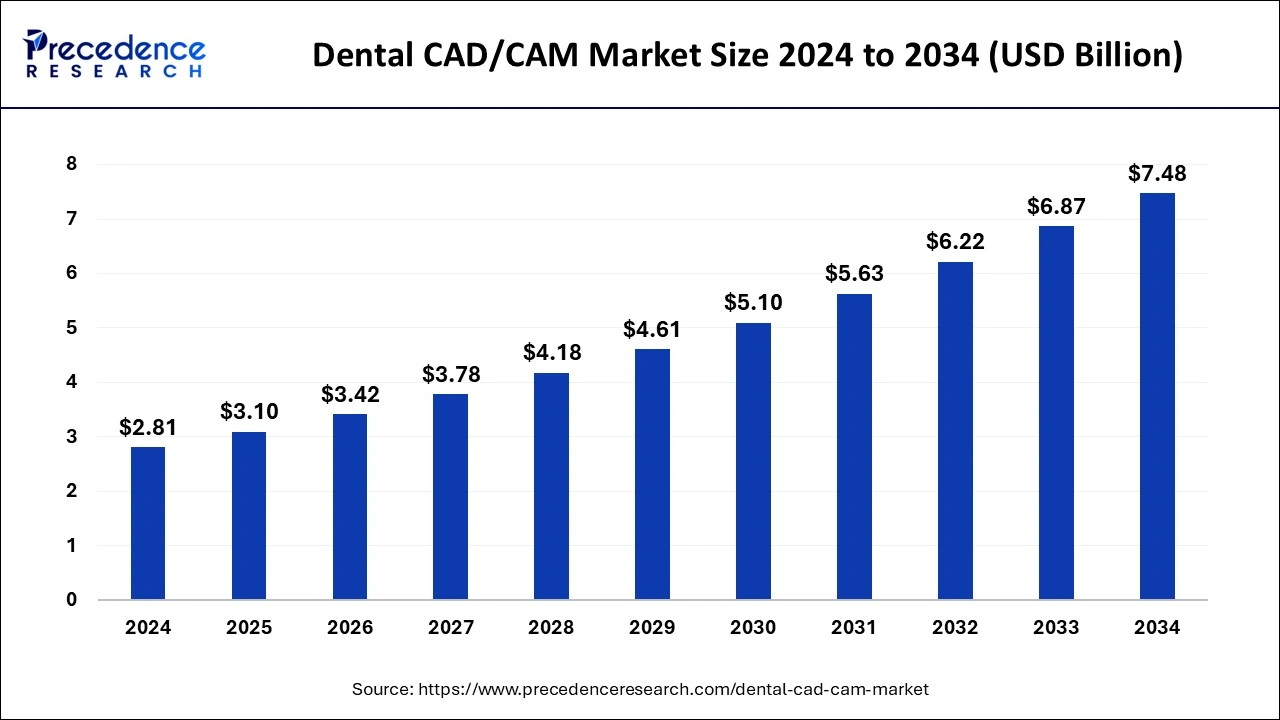

The global dental CAD/CAM market size was estimated at USD 2.81 billion in 2024 and is predicted to increase from USD 3.10 billion in 2025 to approximately USD 7.48 billion by 2034, expanding at a CAGR of 10.29% from 2025 to 2034. The increasing prevalence of dental disease among the population and the technological advancements in the dental industry are driving the growth of the market.

Dental CAD/CAM MarketKey Takeaways

- The global dental CAD/CAM market was valued at USD 2.81 billion in 2024.

- It is projected to reach USD 7.48 billion by 2034.

- The dental CAD/CAM market is expected to grow at a CAGR of 10.29% from 2025 to 2034.

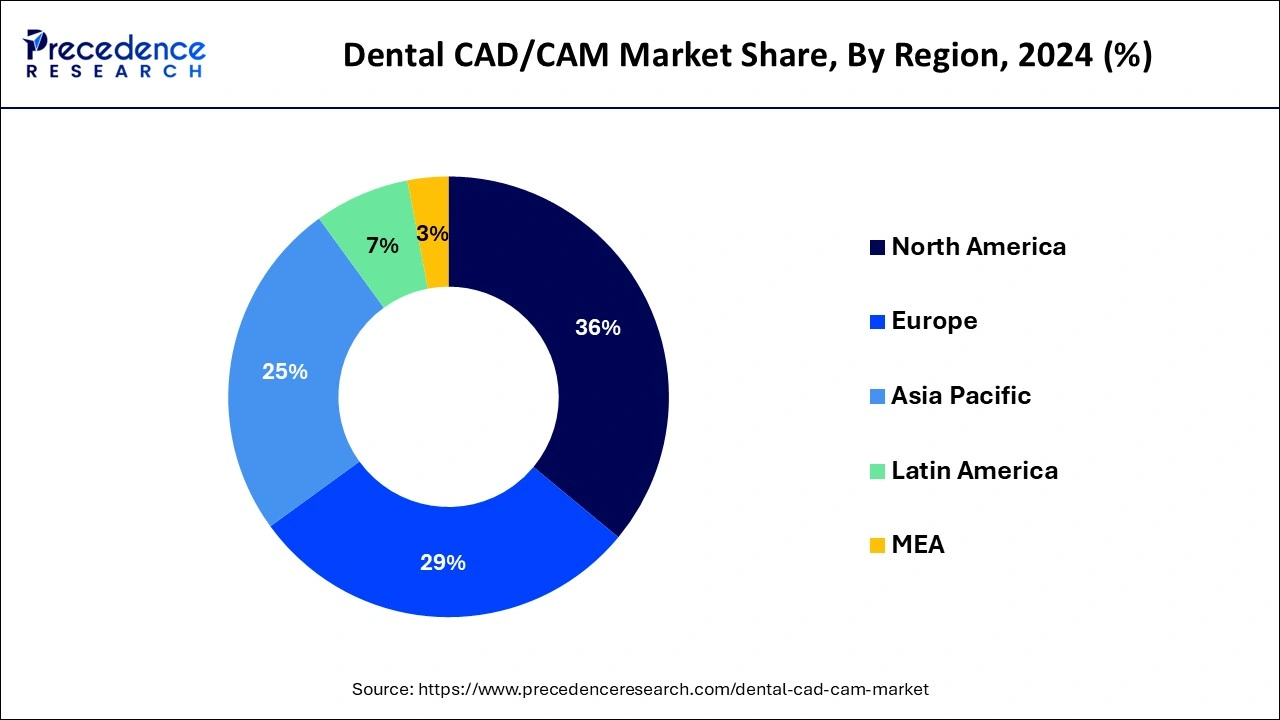

- North America led the market with the biggest market share of 36% in 2024.

- Asia Pacific is expected to witness notable growth in the market during the forecast period.

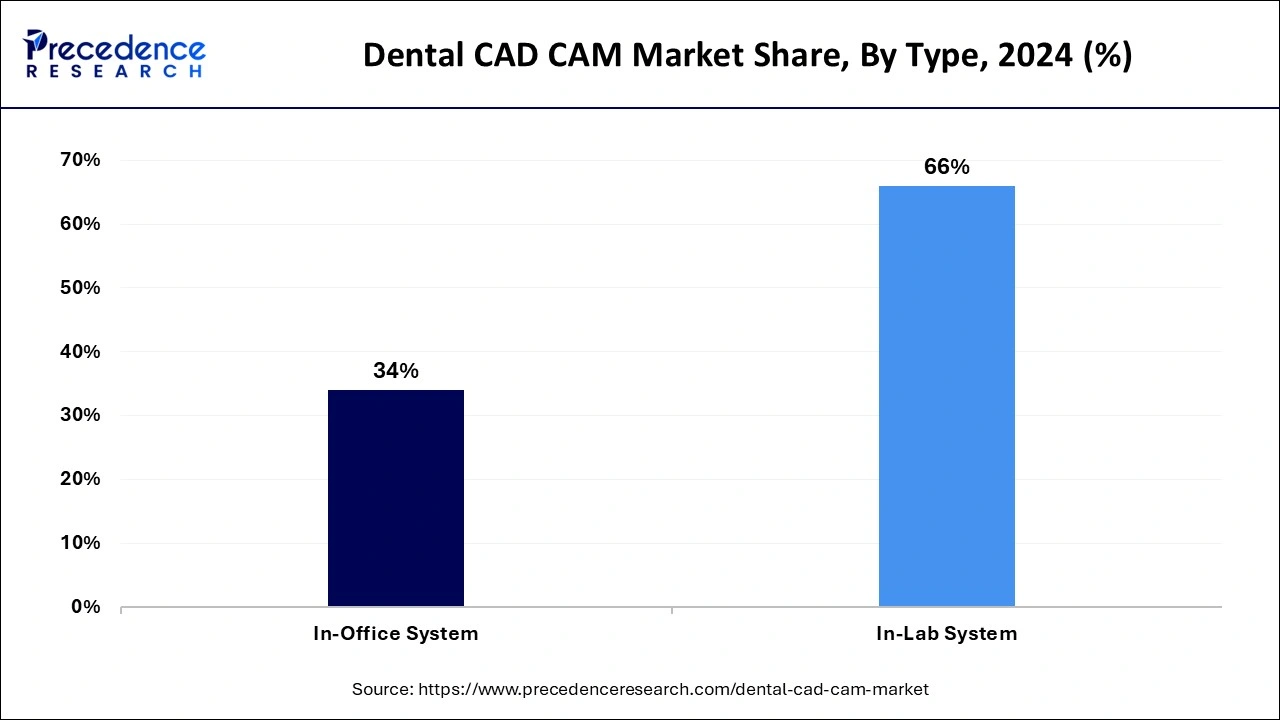

- By type, the in-lab system segment dominated the dental CAD/CAM market in 2024.

- By component, the hardware segment had the highest market share in 2024.

- By component, the software segment is expected to grow in the market during the forecast period.

- By end-user, the dental clinics segment dominated the market with the largest share in 2024.

U.S.Dental CAD/CAM Market Size and Growth 2025 to 2034

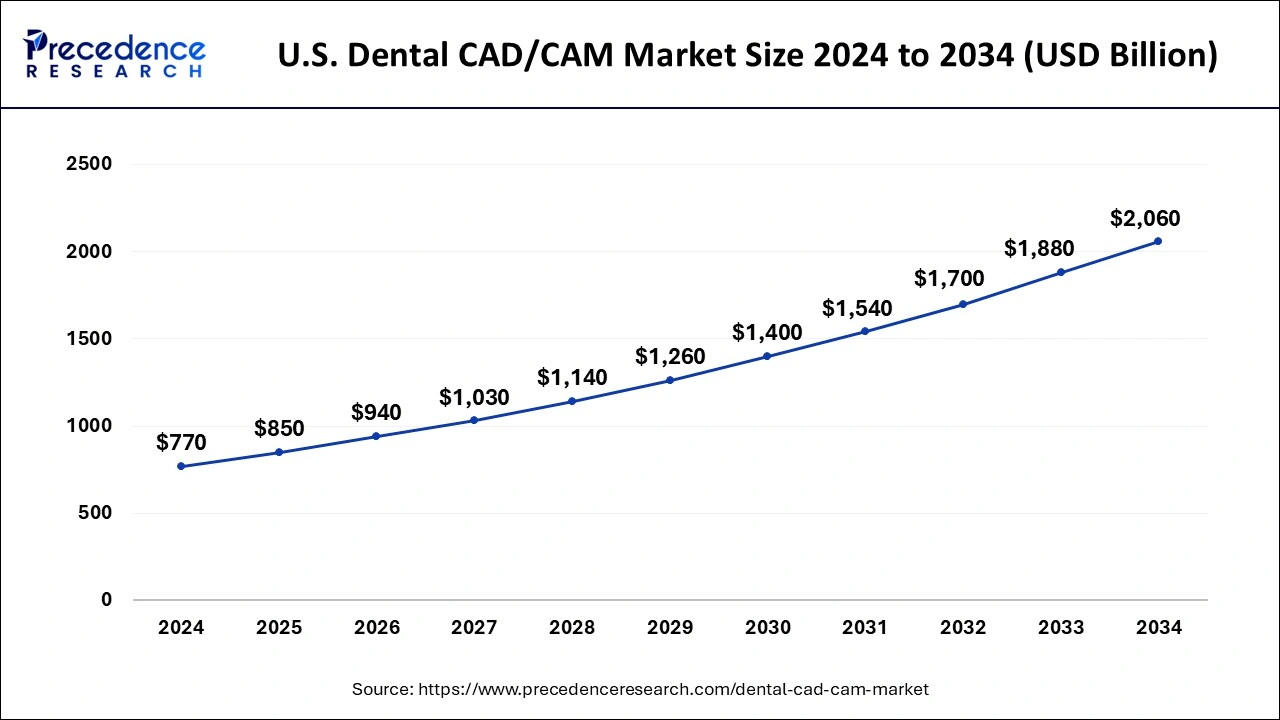

The U.S. dental CAD/CAM market size was exhibited at USD 770 million in 2024 and is projected to be worth around USD 2,060 million by 2034, growing at a CAGR of 10.34% from 2025 to 2034.

North America dominated the global dental CAD/CAM market share of 36% in 2024. The growth of the market in the region is increasing due to the well-established healthcare infrastructure, and the rising disposable income of the population in economically developed countries is surging the expenditure on healthcare, which is driving the growth of the market. The increasing cases of dental diseases among the younger generation due to the increasing consumption of unhealthy foods and drinks, which anticipated severe toothache and other dental-related problems, driving the demand for dental CAD/CAM devices.

Most of the United States adults, about 92%, and the parents, about 96%, considered the importance of oral health. About 4 in 5 adults regularly visit dental care centers.

Asia Pacific is expected to witness significant growth in the dental CAD/CAM market during the forecast period. The growth of the market in the region is growing due to the rising population and the increasing geriatric population that is less likely to be prone to dental diseases, driving the demand for dental CAD/CAM devices for the treatment of dental diseases. The rising trend in cosmetic dentistry is also propelling the demand for dental CAD/CAM devices for aesthetic appearance. Additionally, the rising investment in the development of new technologies for dental treatment is contributing to the growth of the market in the region.

Europe is another significant marketplace for industry to grow in the upcoming years. The European dental CAD/CAM market is observed to continue to grow with the well-established healthcare infrastructure in the region. European dental professionals have shown a strong inclination towards embracing digital dentistry solutions, including CAD/CAM technology. The region has witnessed early adoption and widespread acceptance of CAD/CAM systems for various dental applications, such as crown and bridge restorations, dental implants, and orthodontic appliances. Europe is home to leading dental CAD/CAM technology companies and research institutions that drive innovation in the field. These entities continually develop and refine CAD/CAM systems, software algorithms, and materials to meet the evolving needs and preferences of dental professionals and patients.

Market Overview

With the use of 3D printing technology, dental prosthodontics are designed, planned, and eventually created using computer-aided design (CAD) and computer-aided manufacture (CAM). dental crowns, veneers, onlays, inlays, dentures, and implant-supported prostheses can all be produced quickly and effectively by dentists using CAD/CAM. The market is expanding due to the rising incidence of dental problems and the growing advancements in dental technology. There should be lucrative chances for the global dental CAD/CAM materials & systems market to expand due to technological advancements in the dental industry, which are used to make sophisticated dental goods in the forecast period.

Dental CAD/CAM Market Growth Factors

- The growing aged population and the increasing prevalence of tooth loss in people are driving the demand for the dental CAD/CAM market.

- The growing advancements in dental care, growing dental services organization, and the rising demand for advanced dental solutions are boosting the growth of the market.

- The increasing prevalence of tooth decay and other dental diseases is accelerating the market's growth.

- The rising trends and awareness about the appearance in the population and the rising technological evolution in the dental industry and healthcare sector are driving the demand for the dental CAD/CAM market.

- The increasing investments in research and development activities for innovations in dental care and other technological advancements are driving the growth of the market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.29% |

| Market Size in 2025 | USD 3.10 Billion |

| Market Size by 2034 | USD 7.48 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Component, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Advancements in dentistry

Technological developments like digital dentistry and the higher adoption of the technologies over the traditional dentistry methodology are driving the growth of the market. The technological adoption in CAD CAM dentistry provides better outcomes, efficiency, precision, and aesthetic outcomes to the patient, which fuels the demand for the market. The rising trend in cosmetic dentistry in which patients do procedures like smile makeovers, dental restoration, crowns, and bridges is also propelling the demand for the dental CAD/CAM market. CAD CAM dentistry also provides personalized dental restoration that enhances the customer experience, which also accelerates the market's growth.

Restraint

Higher cost of the treatment

The increased cost of the treatment is associated with the higher cost of the devices, equipment, training, software, etc., which lead to the increasing setup and maintenance cost for the dental practices contributed to the high cost of the treatment, which is not affordable by every individual is restraining the growth of the dental CAD/CAM market.

Opportunity

Emerging technologies

The emerging technological advancements in the dental industry, such as 3D printing technologies, enhanced screening capabilities, software integration, and materials, are driving the opportunities for the growth of the market. The rising technological advancement in CAD CAM dentistry enhances the functionalities, efficiency, and accuracy of dental CAD/CAM devices. Additionally, the rising awareness of dental treatment and the rising disposable income in people resulted in a higher number of cosmetic dentists. The increasing investments in innovative dental care devices are further propelling the growth of the dental CAD/CAM market.

Requirement of personalization and customization

Customization allows dental professionals to tailor treatment plans to meet the unique needs and preferences of each patient. This patient-centric approach enhances treatment outcomes, satisfaction, and overall oral health. CAD/CAM technology enables the creation of highly precise and accurate dental restorations, including crowns, bridges, and implants. Customized restorations ensure optimal fit, function, and aesthetics, leading to improved long-term success rates and patient satisfaction. Customized dental restorations produced using CAD/CAM technology streamline the treatment process, reducing chairside time and improving workflow efficiency for dental professionals. This allows practitioners to treat patients more effectively while maintaining high-quality standards. Thereby, the requirement of personalization and customization acts as an opportunity for the dental CAD/CAM market.

Type Insights

The in-lab system segment dominated the dental CAD/CAM market with the largest market share of 66% in 2024. The growth of the segment is attributed to the rising patient preference for dental treatment and for the implementation of dental CAD/CAM and their dental conditions. The technological advancements and the increasing preferences towards dental CAD/CAM services are driving the expansion of the segment in the market. Dental CAD/CAM offers several advantages in dental care, such as dental restoration, efficiency, accuracy, and durability, that enable great opportunities in the growth of the market.

The growing adoption of the in-lab system due to the better availability of the products and the ongoing innovations in support of the dental CAD/CAM drives the growth of the market.

Component Insights

The hardware segment held the highest share of the dental CAD/CAM market in 2024. The growing adoption of hardware like intraoral scanners is driving the growth of the market. In dentistry, an intraoral scanner is a tool used to make impressions digitally. A light source is projected onto the region that has to be scanned by the scanner. Following the use of imaging sensors to collect thousands of photographs, scanning software processes the data to create an accurate 3D surface model that displays the teeth. A computer can be used to design and manufacture a "custom-made dental device, or a patient-specific dental device from an industrialized product," according to the FDI World Dental Federation. This opens up a world of opportunities for CAD/CAM dentistry. The practice can benefit greatly from adding an intraoral scanner.

The software segment is expected to grow significantly in the dental CAD/CAM market during the forecast period. The increase in the adoption of software applications in dental care, like 3D printing, is driving the demand for the segment. Significant progress has been made in the production of whole and partial dentures since the advent of digital technology. The ease of care and speed of treatment will be significantly altered by digital manufacturing in the near future. In prosthodontics, 3D printing technology opened up intriguing new avenues, especially for the creation of detachable prostheses.

End-user Insights

The dental clinics segment dominated the dental CAD/CAM market, with the highest growth in 2024. The growth of the segment is attributed to the increasing number of dental diseases and the rising awareness of dental treatment in the population. The rising preferences for dental treatment from the dental clinic due to the higher availability of specialized doctors and trained professionals and increased availability of dental care and treatment equipment and devices are driving the growth of the dental clinic segment in the market. The increasing healthcare infrastructure and accessibility are driving the growth of the market.

Dental CAD/CAM Market Companies

- 3M Company

- Amann Girbach AG

- Danaher Corporation

- Dental wings Inc.

- Dentsply Sirona Inc.

- Institut Straumann AG

- Ivoclar vivadent AG

- Planmeca OY

- Roland DAG

- Zirkonzahn GMBH

Recent Developments

- In February 2024, Carbon announced the launch of automated 3D printing tools for the advancements in print preparation, post-processing, and print production for dental users of their 3D printing technology. The organization also collaborates with Desktop Health.

- In February 2024, Halo Dental Technologies announced the launch of its "Digital Dental Mirror." The launch is the advancement in dentistry that transformed and enhanced the patient's care.

- In February 2024, Kerr Dental, a leading manufacturer of quality dental and restorative products, launched the new SimpliCut™ rotary products. The latest launch is the pre-sterilized single patient-use diamond burs line, manufactured to enhance efficiencies and reduce the requirement for sterilization, cleaning, and processing.

- In February 2024, Havant MP Alan Mak launched the mobile dental service, allowing NHS care for the residencies of Hampshire and the Isle of Wight with the risk of social exclusion.

- In February 2024, Nexa3D announced its collaboration with North American dental partners Harris Discount Dental Supply and CAD-Ray. Additionally, it launched the three resins from dental market juggernaut Pac-Dent, Inc., allowing efficiency in the workflow of the restorative and surgical applications for labs for the practices using Nexa3D's XiP desktop printer by LSPc technology.

Segments Covered in the Report

By Type

- In-lab System

- In-office System

By Component

- Hardware

- Software

By End-user

- Dental Clinics

- Dental Laboratories

- Dental Milling Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content