Dental Composites Market Size and Forecast 2025 to 2034

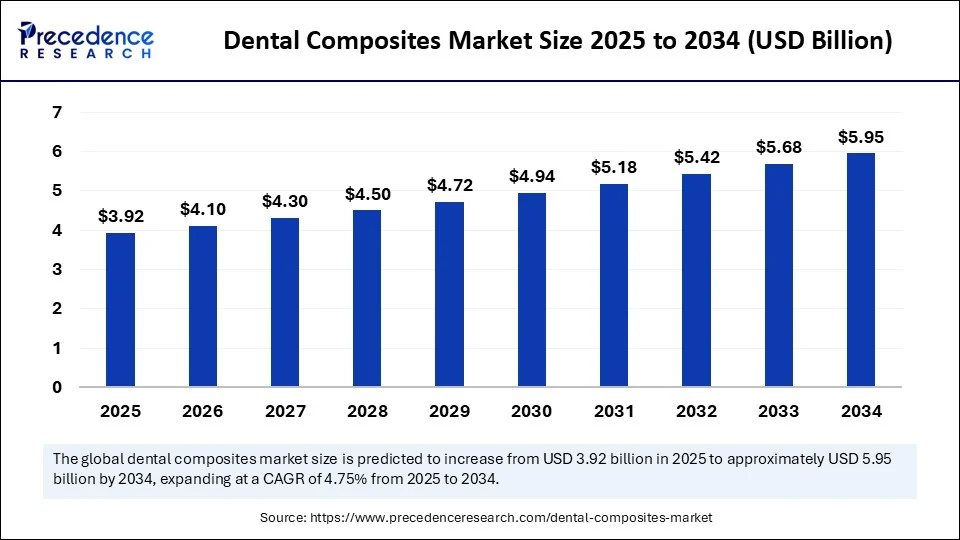

The global dental composites market size accounted for USD 3.74 billion in 2024 and is predicted to increase from USD 3.92 billion in 2025 to approximately USD 5.95 billion by 2034, expanding at a CAGR of 4.75% from 2025 to 2034.The market is experiencing significant growth due to the rising incidence of dental disorders and the increasing demand for aesthetic restorative materials. Advances in composite technologies provide enhanced durability and a natural tooth-like appearance. Additionally, the growing awareness of oral health and the increasing adoption of advanced dental procedures are expected to drive market growth.

Dental Composites MarketKey Takeaways

- The global dental composites market was valued at USD 3.74 billion in 2024.

- It is projected to reach USD 5.95 billion by 2034.

- The market is expected to grow at a CAGR of 4.75% from 2025 to 2034.

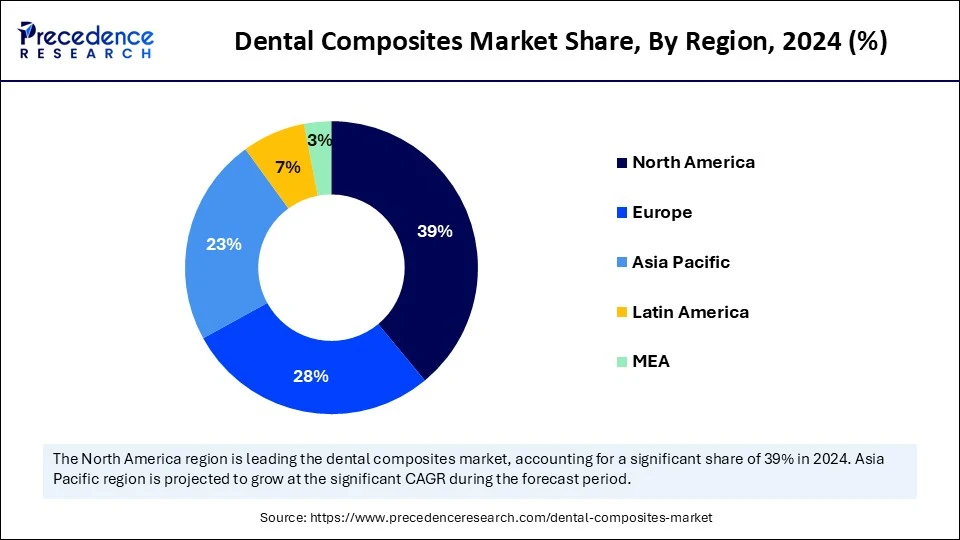

- North America dominated the global dental composites market with the largest share of 39% in 2024.

- Asia Pacific is expected to grow at the highest CAGR from 2025 to 2034.

- By types of dental composite, the microfill composites segment contributed the biggest market share in 2024.

- By types of dental composites, the nanofill composites segment is expected to grow at a significant CAGR over the projected period.

- By types of composite filling, the direct segment held the highest market revenue share in 2024.

- By type of composite filling, the indirect segment is expected to expand at a significant CAGR from 2025 to 2034.

- By application, the dental fillings segment captured the major market share in 2024.

- By application, the dental bridges segment is expected to grow at a rapid pace during the forecast period.

- By end-user, the dental clinics segment held a significant market share in 2024.

- By end-user, the hospitals segment is projected to grow at the fastest CAGR between 2025 and 2034.

How Does AI Influence the Dental Composites Market?

Artificial intelligence (AI) is transforming the dental composites market by enhancing material development, diagnostic accuracy, and treatment planning. AI algorithms can analyze extensive datasets of material properties to predict and optimize the performance of dental composites, leading to improved durability, strength, and aesthetaics. Moreover, AI tools can assess dental radiographs, such as panoramic and CBCT scans, to detect issues like cavities, periodontal disease, and bone loss with greater accuracy and efficiency than traditional methods. Furthermore, AI aids in treatment planning by evaluating patient data to determine the optimal placement of dental restorations and implants.

U.S. Dental Composites Market Size and Growth 2025 to 2034

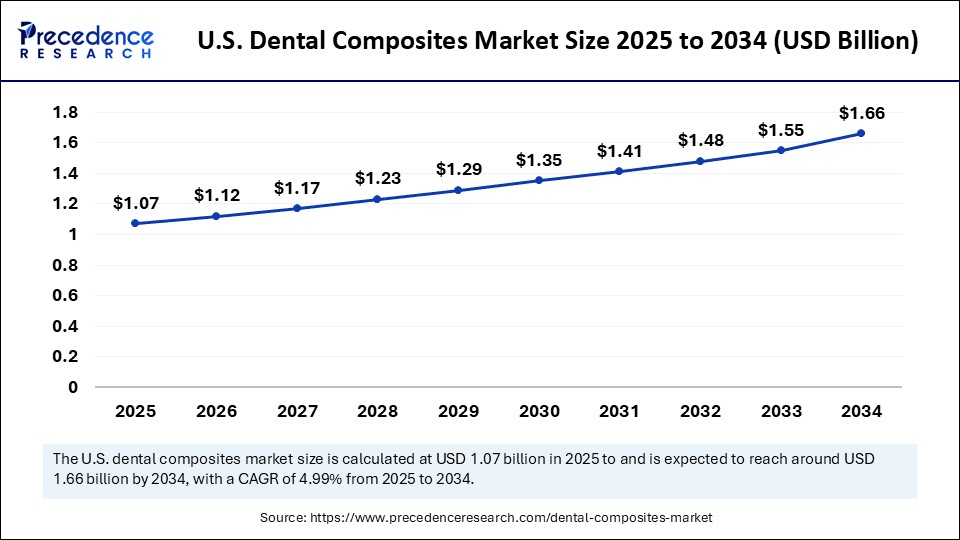

The U.S. dental composites market size was exhibited at USD 1.02 billion in 2024 and is projected to be worth around USD 1.66 billion by 2034, growing at a CAGR of 4.99% from 2025 to 2034.

What Factors Contribute to North America's Dominance in the Market?

North America dominated the dental composites market by holding the largest revenue share in 2024. This is primarily due to high dental awareness, advanced healthcare infrastructure, and strong demand for cosmetic and restorative procedures. North American people have become highly aware of the benefits of oral health on overall well-being, significantly increasing the demand for dental treatments, which include composite fillings, often used for aesthetic reasons and for restoring teeth damaged by decay. The region's dominance is further attributed to the high adoption rate of advanced dental technologies and robust insurance coverage for dental treatments, making it easier for patients to access dental care and utilize advanced materials like composites. Additionally, the presence of prominent companies like 3M, Dentsply Sirona, Ivoclar Vivadent, and GC Corporation further drive innovation in the market.

U.S. Dental Composites Market Trends

The U.S. plays a major role in the global market by holding the maximum share in 2024. This is primarily due to its strong dental sector. The rising number of cosmetic dentistry procedures and an increasing preference for minimally invasive treatments further support market growth. The U.S. is projected to continue its growth trajectory with advancements in materials and technology.

What are the Major Trends in the Asia Pacific Dental Composites Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period, driven by increasing healthcare expenditure, heightened awareness of oral health, and the adoption of advanced dental technologies. Government initiatives focused on improving healthcare infrastructure and a growing demand for cosmetic dental procedures, particularly in countries like China, India, and Japan, further fuel the market growth. Moreover, the growth of dental tourism, especially in countries like India, is also contributing to the demand for dental composites. Governments across the region are investing in improving healthcare infrastructure, including dental facilities, which directly supports the growth of the market.

Recently, the Indian Endodontic Society (IES) held the IES-PRIDE Innovation Challenge, which encouraged dental professionals to develop and implement innovative ideas in dental technology. This initiative involved collaboration between academia, clinicians, and industry, with winners receiving funding and mentorship to further develop their projects.

(Source: https://www.ies.org.in)

China Dental Composites Market Trends

China plays a distinctive role in the market, both as a manufacturer and a consumer. Its rising middle class and growing disposable income are driving the demand for dental care, which includes restorative procedures utilizing dental composites. Simultaneously, China's manufacturing sector is becoming more prominent, producing a range of dental materials, including composites, that are both cost-effective and increasingly competitive on the global stage.

India Dental Composites Market Trends

India is emerging as a major player in the market. The growth of the market in the country is primarily driven by growing awareness of oral hygiene, government initiatives promoting dental care, and the rise of medical tourism. While still heavily reliant on imports for dental materials, India is also experiencing a push towards domestic manufacturing and technological advancements. As India becomes a hub for low-cost, high-quality dental treatment, it attracts patients from developed nations. This influx of patients further boosts the demand for dental composites.

What Opportunities Exist in the Dental Composites Market Within Europe?

Europe is considered to be a significantly growing area. This is mainly due to its advanced healthcare infrastructure, high demand for cosmetic dentistry, and preference for composite fillings over amalgam. With a well-developed healthcare system emphasizing dental care, Europe exhibits a higher adoption rate of advanced dental materials like composites. Additionally, Europe is at the forefront of dental technology, with ongoing research and development in areas like bioactive composites, digital dentistry, and AI integration in dental practices. Supportive regulatory frameworks and standards in Europe contribute to the growth of the market.

Market Overview

Dental composites are tooth-colored, synthetic restorative materials mainly used to repair damaged and decayed teeth. They are a popular alternative to traditional amalgam fillings due to their aesthetic appeal and their ability to match the natural color of teeth. These materials are designed to imitate the appearance of natural teeth and are utilized in a wide range of applications such as fillings, bonding, and even as components in some orthodontic appliances. The market is experiencing significant growth due to various factors, including rising demand for aesthetic dentistry, increasing disposable incomes, and advancements in dental materials, where dental composites are often preferred over traditional treatments like dental crowning because they conserve more of the natural tooth by offering versatile treatment options.

What Are the Key Trends in the Dental Composites Market?

- Increasing Prevalence of Dental Caries: Nowadays, dental caries or tooth decay is becoming more common due to dietary and lifestyle changes, increased sugar consumption, and poor oral hygiene practices, along with an aging global population, which contributes to the creation of a greater need for restorative treatments

- Rising Demand for Aesthetic Dentistry: The increasing demand for aesthetic dental solutions and, thus, preference for tooth-colored restoration is driving the adoption of dental composites by offering a natural-looking alternative to traditional fillings and other treatments.

- Oral Hygiene Awareness: The growing awareness about the importance of oral health and aesthetics is also contributing to the increased use of dental composites by facilitating dentists with more versatile treatment options.

- Technological Advancements: Continuous innovation in dental composites, including 3D printing and computer-aided design, leads to more precise and efficient treatments with improved properties like enhanced durability, wear resistance, and aesthetics, further driving market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.95 Billion |

| Market Size in 2025 | USD 3.92 Billion |

| Market Size in 2024 | USD 3.74 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.75% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Dental Composite, Type of Composite Filling, Application, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Aesthetic Dental Procedures

One of the major factors driving the growth of the dental composites market is the growing demand for aesthetic dental procedures. Nowadays, patients increasingly prefer tooth-colored, natural-looking restorations over traditional metal fillings, promoting the use of composite materials. Hence, the desire for a more attractive smile and the heightened awareness of cosmetic dentistry drives the market for composites. The shift toward minimally invasive procedures, which are well-suited for smaller, more conservative restorations, along with the rise of dental tourism in countries offering lower-cost dental care, further contributes to the demand for dental composites.

Restraint

Rigorous Clinical and Regulatory Processes

The main restraint in the dental composites market is the rigorous clinical and regulatory processes. These processes, which include lengthy and expensive clinical trials and approvals from regulatory bodies like the FDA and the European Commission, can significantly delay market entry and increase costs for manufacturers. As the FDA still lacks comprehensive regulations for composite implants, this underscores the ongoing challenge of navigating these regulatory hurdles. This exemplifies the long-term impact of regulatory processes on the market.

Opportunity

Demand for Biomimetic and Smart Composite Materials

A key future opportunity in the dental composites market lies in the rising demand for biomimetic and smart composite materials. These materials aim to replicate and restore the natural features of tooth structure, offering improved aesthetics, durability, and functionality compared to traditional composites. Biomimetic composites are designed to mimic the structure, composition, and properties of natural tooth enamel and dentin. They often integrate advanced fillers and resins that imitate how teeth interact with light, saliva, and other oral substances. Meanwhile, smart composite materials go beyond merely imitating natural teeth and can actively respond to changes in the oral environment.

Type of Dental Composite Insights

How Did the Microfill Composites Segment Dominate the Market in 2024?

The microfill composites segment dominated the dental composites market with the largest share in 2024. This is mainly due to their superior aesthetics and polishability, which enable a smooth, natural-looking finish that closely resembles enamel. These characteristics enhance their ability to blend seamlessly with adjacent teeth. They can be polished to a high shine, making them ideal for aesthetic restorations in the anterior region. Consequently, their ability to mimic the appearance of natural teeth has made them a popular choice for cosmetic procedures.

The nanofill composites segment is expected to grow at the fastest rate in the upcoming period, driven by their improved aesthetics, strength, and durability. Their small particle size allows for excellent polishability, resulting in a smooth, natural-looking finish that reduces plaque buildup. Furthermore, nanofilled composites provide enhanced wear resistance and improved polish retention, making them a preferred choice for both restorative and cosmetic procedures. Their improved aesthetic makes them suitable for aesthetically demanding restorations, particularly in visible areas of the mouth.

Type of Composite Filling Insights

Why Did the Direct Segment Dominate the Dental Composites Market in 2024?

The direct segment dominated the market by capturing the largest share in 2024. This is mainly due to the aesthetic appeal, minimally invasive nature, and ease of application of direct composite restoration. Additionally, the rising demand for aesthetic and minimally invasive dentistry, along with advancements in composite materials, has further bolstered their adaptability. Moreover, innovations like the development of nanocomposites and bulk-fill composites have contributed to their dominance by enhancing their strength, durability, and usability, making them highly sought after for cosmetic procedures like veneers and bonding.

The indirect segment is expected to grow at the fastest rate during the forecast period due to its unique aesthetic qualities, durability, and improved marginal adaptation compared to direct restorations. The preference for indirect composite filling is further reinforced by the increasing demand for minimally invasive and aesthetically pleasing dental procedures. Furthermore, the growing adoption of CAD or CAM technology for creating indirect composite restorations allows for precise customization and efficient fabrication.

Application Insights

What Made Dental Fillings the Dominant Segment in the Market?

The dental fillings segment dominated the dental composites market with a major revenue share in 2024. This is mainly due to the increased prevalence of dental caries and the global use of composites for restoring decayed teeth. These composite fillings also provide a more natural-looking restoration than traditional materials like amalgam, enhancing their appeal. Additionally, advancements such as Stress Reduced Direct Composite (SRDC) restorations, which mimic the natural structure of the tooth and distribute stress more effectively, have expanded the application of composites, particularly in cases where crowns were previously the only option. Such advancements make restoration procedures more precise and efficient, leading to increased adoption of composite fillings.

The dental bridges segment is expected to grow at the fastest rate during the period due to several factors, including the rising prevalence of tooth loss, advancements in materials and techniques, and increasing awareness of oral health. This has led to a greater demand for effective and aesthetically pleasing solutions to replace missing teeth while also supporting speech function and preventing adjacent teeth from shifting. Furthermore, new materials like zirconia and improved composite resins, combined with CAD/CAM technology, have enhanced the durability, aesthetics, and fit of dental bridges, making them a more appealing option for patients.

End-User Insights

Why Did the Dental Clinics Segment Dominate the Dental Composites Market in 2024?

The dental clinics segment dominated the market with the biggest share in 2024, primarily due to a strong preference for minimally invasive procedures, the rising need for aesthetic dentistry, and the growing number of specialized dental clinics equipped with advanced technology. The emphasis on specialized care and personalized treatment plans within clinics further contributes to their market leadership by positioning them well for performing complex composite restorations. Additionally, increased awareness of oral health and the desire for aesthetic improvements, coupled with the impact of social media, further drive the demand for dental composites.

The hospitals segment is expected to expand at the fastest growth rate in the coming years. The growth of the segment can be attributed to favorable reimbursement policies, the presence of specialized dental professionals, and the availability of advanced equipment and infrastructure. Patients often prefer the convenience and comprehensive care offered by hospitals for various dental needs. As a result, hospitals are increasingly favored for complex dental procedures and comprehensive care, leading to a growing demand for high-quality composites, especially those required for extensive treatments.

Dental Composites Market Companies

- 3M

- Dentsply Sirona

- Ivoclar Vivadent

- Ultradent Products Inc.

- Kulzer GmbH

- Kerr Corporation

- COLTENE Group

- VOCO GmbH

- GC America Inc.

- Zest Dental Solutions

- YAMAKIN CO.LTD.

- Den-Mat Holdings

- DMG Dental Centrix Inc

- BISCO, Inc.

- Shandong Huge Dental Material Corporation

- Prime Dental Manufacturing, Inc.

- Tokuyama Dental America Inc.

- Mutsumi Chemical Industries

- Denjoy Dental Co., Ltd

Recent Developments

- In October 2024, Parkell launched its new HyperFIL+ dual-cure bulk-fill composite. HyperFIL+ is a next-generation dual-cure bulk-fill composite featuring zirconia nanofillers for improved mechanical strength, optimal aesthetics, shade-matching, and polishability. Thus, HyperFIL+ surpasses traditional light-cure-only materials by combining the best of both worlds for total restoration polymerization and improved marginal seal.

(Source: https://decisionsindentistry.com) - In December 2023, Kerr Dental introduced SimpliShade Bulk Fill and SimpliShade Bulk Fill Flow, two new innovative composites that offer dental practices added flexibility and simplicity for their restorations. Powered by Ternary Adaptive Response Technology (ART3), both SimpliShade bulk fill composites require just one shade to match all 16 VITA classical shades for ease of sculpting and seamless blending.

(Source: https://www.kerrdental.com) - In October 2023, DMG introduced its new Ecosite Elements nanohybrid universal composite shade system at the Greater New York Dental Meeting. Ecosite Elements is the result of extensive collaboration with leading clinicians and in-depth research by DMG scientists. This nanohybrid composite system empowers dental professionals to develop aesthetically impressive restorations swiftly and efficiently.

(Source: https://www.dentalproductsreport.com)

Segments Covered in the Report

By Type of Dental Composite

- Microfill Composites

- Hybrid Composites

- Nanofill Composites

- Bulk-fill Composites

- Flowable Composites

- Others (Giomer Composites, etc.)

By Type of Composite Filling

- Direct

- Indirect

By Application

- Dental Fillings

- Dental Crowns

- Dental Bridges

- Others (Teeth Reshaping, etc.)

By End-user

- Hospitals

- Dental Clinics

- Others (Academic and Research Institutes, etc.)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting