Dental Equipment and Maintenance Market Size and Forecast 2025 to 2034

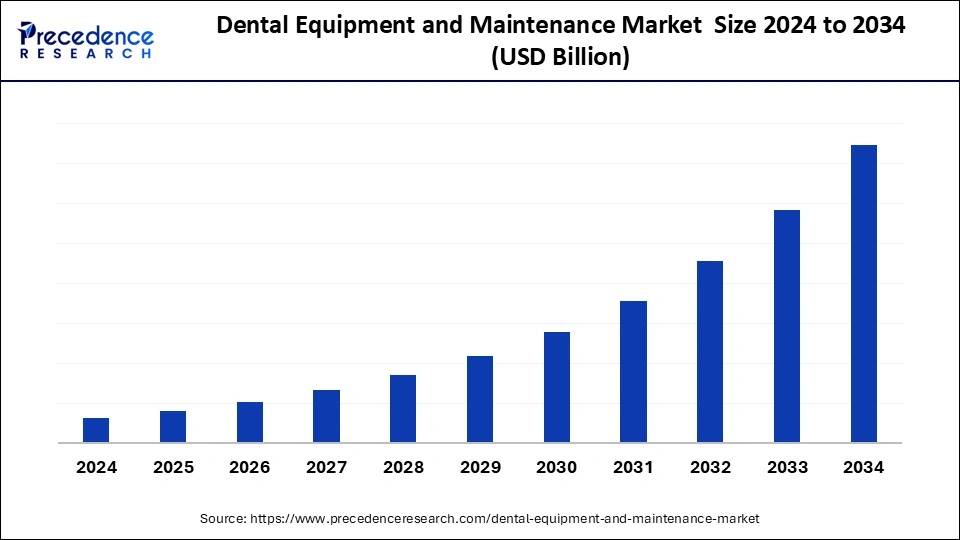

The dental equipment and maintenance market is growing at a faster pace with substantial growth rates over the last few years and is estimated that the market will grow significantly in the forecasted period from 2025 to 2034. The dental equipment and maintenance market is expanding as a result of dental tourism, which is the practice of people traveling to other nations for dental procedures in order to save money or receive better care.

Dental Equipment and Maintenance Market Key Takeaways

- North America holds the largest share of the global dental equipment and maintenance market.

- Europe is expected to host the fastest-growing market over the forecast period

- By type, the prosthetics & orthodontics segment held the largest share of the market in 2024.

- By type, the restorative segment is expected to grow rapidly in the market during the forecast period.

- By application, the hospitals segment led the market in 2024.

- By application, the emergency room segment is expected to grow rapidly in the market during the forecast period.

Market Overview

Dental professionals can find a wide range of goods and services in the dental equipment and maintenance industry that help with oral health diagnosis, treatment, and prevention. The dental equipment and maintenance market covers a range of dental equipment, tools, machinery, and maintenance services required to keep the equipment in good working order and last a long time.

The need for dental treatments and supplies is increased by the rising incidence of dental conditions such as cavities, periodontal disease, and oral cancer. Dental technology innovation, such as 3D printing, CAD/CAM systems, and digital imaging, is what propels the dental equipment and maintenance market. An increasing number of senior citizens, who are more vulnerable to oral problems, is driving up market demand.

Rising demand for cosmetic dentistry treatments, including veneers, smile makeovers, and teeth whitening. Demand for routine dental checkups and preventive care is increasing as people become more conscious of oral health and hygiene. Dental practices are changing as a result of the use of digital instruments, including intraoral scanners, CAD/CAM technology, and digital radiography.

Growing inclination toward less intrusive treatments, such as laser dentistry, to improve patient comfort and speed of recuperation. Quick market expansion brought about by expanding dental health awareness, rising healthcare spending, and growing dental tourism. Developing nations where the need for dental care products and services is rising despite a delayed uptake of cutting-edge solutions because of financial limitations.

Dental Equipment and Maintenance Market Growth Factors

- The dental equipment and maintenance market has grown as a result of the development of cutting-edge dental equipment like digital radiography, 3D imaging systems, and CAD/CAM technology. Combining machine learning and artificial intelligence with dental diagnosis and treatment planning.

- The need for dental care services has increased due to the rising prevalence of periodontal diseases, dental caries, and other oral health disorders. Increasing knowledge of preventive dental care and oral hygiene.

- Due to age-related dental diseases, the world's aging population needs more dental care, which increases the demand for dental equipment and upkeep.

- Due to their more affordable prices and superior dental care, many nations are growing in popularity as dental travel destinations, which is increasing the need for dental equipment in these areas.

- The demand for the dental equipment and maintenance market is being driven by an increase in the demand for cosmetic operations, including veneers, orthodontics, and teeth whitening.

- The dental equipment and maintenance market is being driven by government initiatives and funding to enhance the accessibility and infrastructure of dental care, particularly in developing nations.

- The demand for dental equipment has increased as a result of better dental insurance coverage and payment guidelines that have increased accessibility to dental care.

- The demand for the dental equipment and maintenance market has increased as a result of a greater focus on preventive dental care, which has increased the frequency of dental examinations and maintenance.

- Dental equipment and maintenance services are in great demand due to the increasing number of group practices and DSOs.

Market Scope

| Report Coverage | Details |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing dental care expenditure

Advanced dental technologies, including laser dentistry, CAD/CAM systems, digital imaging, and 3D printing, have greatly enhanced the field's capacity for diagnosis and treatment. As the world's population ages, dental diseases like periodontal disease, tooth loss, and the need for restorative procedures become more common. This results in rising demand for the dental equipment and maintenance market. Specialized equipment and routine maintenance are required due to the rising demand for cosmetic dental procedures such as veneers, orthodontics, and teeth whitening. In some areas, higher disposable incomes are associated with higher dental care costs and the use of cutting-edge dental technologies.

Restraint

Market saturation

When the supply of dental goods and services equals or surpasses demand, the dental equipment and maintenance market is said to be saturated. At this point, there are few chances for substantial development, and the market becomes extremely competitive. Saturation may result from an increase in the number of businesses providing comparable dental services and equipment. This covers both long-standing businesses and recent additions. A high level of market penetration means that a sizable fraction of prospective buyers already possess or utilize the products, which reduces the pool of possible buyers. Economic downturns can have an impact on dental practices' capacity to invest in new equipment and their purchasing power, which can lead to market saturation.

Opportunity

Preventive and cosmetic dentistry

Within the dental equipment and maintenance market, two important sectors are preventive and cosmetic dentistry. The need for various dental equipment, technology, and maintenance services is driven by these segments. The industry is driven by an increase in demand for cosmetic dentistry operations as people grow increasingly self-conscious about their appearance. Greater use of digital technology to improve the accuracy and efficiency of cosmetic operations, such as CAD/CAM and 3D printing.

The market's maintenance sector is driven by the need for regular maintenance to guarantee optimal operation of advanced cosmetic dental equipment. There is a growing focus on individualized treatment programs that are made to fit the needs and preferences of each patient. Growing knowledge of and desire for environmentally friendly dentistry procedures and materials.

Type Insights

The prosthetics & orthodontics segment held the largest share of the dental equipment and maintenance market in 2024. An essential component of dental healthcare is the prosthetics and orthodontics market segment within the dental equipment and maintenance industry. Orthodontics treats abnormalities in the teeth or jaws, whereas prosthetics refers to artificial substitutes for missing teeth or other oral structures. This market includes a broad range of goods and services designed to improve patients' general quality of life, oral function, and appearance. Crowns, which are caps designed like teeth, are replaced over injured teeth to restore their size, strength, shape, and look. By securing artificial teeth to nearby natural teeth, bridges are utilized to close the spaces left by lost teeth. Orthodontists employ a variety of instruments, tools, and materials in this category to carry out tasks like placing brackets, adjusting archwires, and taking impressions.

The restorative segment is expected to grow rapidly in the dental equipment and maintenance market during the forecast period. Materials and tools used in dental operations to restore or repair damaged or destroyed teeth are referred to as restoratives. These components are essential for restoring teeth's integrity, appearance, and functionality. Because they are utilized in many different operations like fillings, crowns, bridges, and dental implants, restoratives are important. Glass ionomers, amalgam, ceramics, and dental composites are a few typical kinds of restorative materials. Growing desire for esthetic dentistry, the prevalence of dental problems, technological improvements, and increased awareness of oral health all have an impact on the market for restoratives in dental equipment and maintenance. The preferences of dental practitioners, government laws, and reimbursement policies are other elements that affect the dynamics of the market.

Application Insights

The hospitals segment led the dental equipment and maintenance market in 2024. A broad range of goods and services are provided by the dental equipment and maintenance market to hospitals and clinics for the diagnosis, treatment, and upkeep of patients' oral health. Even though most hospitals have dental departments or clinics on-site, the extent of dental equipment and maintenance varies according to the hospital's size and area of expertise. Dental chairs, dental drills, ultrasonic scalers, and other instruments for fillings, root canals, and extractions may be found in hospitals. Dental equipment maintenance contracts, which guarantee routine servicing, calibration, and repairs to preserve best practices and safety requirements, can also be provided by hospitals.

The emergency room segment is expected to grow rapidly in the dental equipment and maintenance market during the forecast period. Dental care is greatly aided by the emergency room (ER), especially in cases of extreme urgency, such as acute toothaches, shattered teeth, or injuries to the mouth and jaw. Portable dental units with basic instruments for dental exams and little operations may be available in emergency rooms. When a patient presents with a dental emergency, these units are crucial for providing emergency care. To relieve the pain associated with dental emergencies, emergency rooms (ERs) need to stock a variety of anesthetic agents and pain management drugs, such as local anesthetics and analgesics. When sterilization is done correctly, it is crucial to avoid infections when doing dental work. Autoclaves and other sterilizing equipment should be available in emergency rooms to guarantee that dental instruments are thoroughly cleaned and sanitized.

Regional Insights

North America holds the largest share of the global dental equipment and maintenance market. Over the next few years, the North American dental equipment market is anticipated to develop significantly due to both growing elderly populations and technological advancements. An increase in dental issues in elderly adults, including tooth decay and periodontal disorders. Due to rising dental care costs and technology breakthroughs, North America's market for dental equipment and maintenance is expected to rise rapidly. To guarantee sustained growth, nevertheless, issues like high costs and regulatory compliance must be resolved.

Europe is expected to host the fastest-growing dental equipment and maintenance market over the forecast period. Growing dental diseases, growing consumer awareness, and technological developments in dental products are driving the constant rise of the European market for dental equipment and maintenance. The efficiency and efficacy of dental treatments are being improved by technological advancements in dentistry, such as the creation of sophisticated dental lasers, imaging systems, and computer-aided design/computer-aided manufacturing (CAD/CAM) systems.

The industry is expanding because of the increased demand for cosmetic dental operations like veneers, teeth whitening, and aligners. It is anticipated that the industry will keep expanding due to constant innovation and strategic alliances between major players. Collaborations such as the one between A-dec, Inc. and KaVoDental Technologies, for example, are intended to improve the caliber of services and products offered.

Dental Equipment and Maintenance Market Companies

- 3M

- Dentsply Sirona

- GC Corporation

- A-Dec Inc.

- Aseptico Inc.

Recent Developments

- In August 2023, the newest addition to the limited-edition collection of advantages and value provided as part of the Henry Schein Thrive Rewards program, Henry Schein announced the debut of its new equipment repair subscription product, Henry Schein Thrive Service Plus, delivered by ServiceFirst. This brand-new subscription plan, available only through Henry Schein, provides full access to the company's highly skilled ServiceFirst technicians, who are committed to providing individualized in-office repair services.

- In July 2023, Tristate Biomedical Solutions, LLC (TBS), a provider of medical equipment sales and services for new, used, and refurbished imaging and biomedical equipment, with a specialty in C-Arms, X-Rays, as well as other imaging equipment, was acquired by Radon Medical Imaging (Radon), a leading provider of maintenance and repair services for medical imaging equipment.

Segment Covered in the Report

By Type

- Prosthetics & Orthodontics

- Endodontics

- Restoratives

- Others

By Application

- Hospital

- Clinic

- Emergency Room

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting