Diagnostic Ultrasound Market Size and Forecast 2025 to 2034

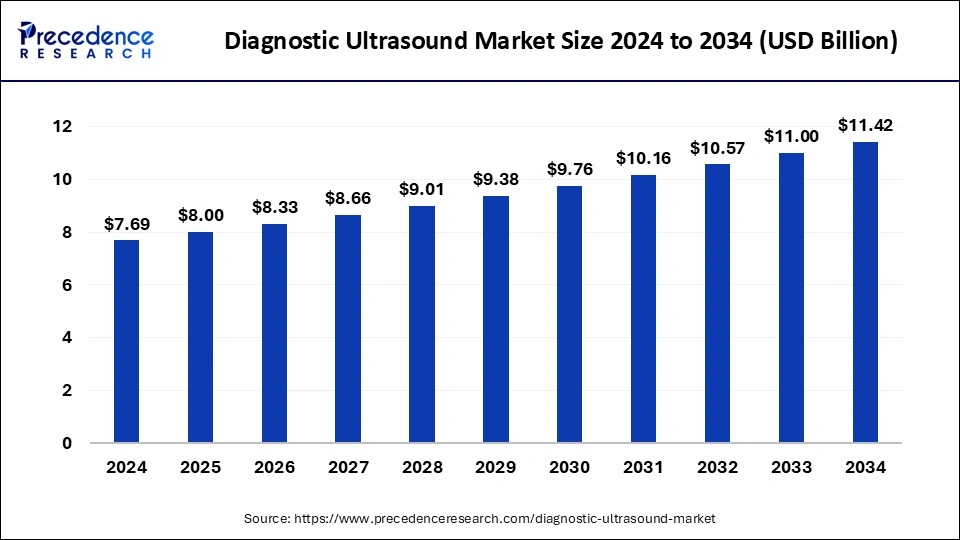

The global diagnostic ultrasound market size was estimated at USD 7.69 billion in 2024 and is predicted to increase from USD 8.00 billion in 2025 to approximately USD 11.42 billion by 2034, expanding at a CAGR of 4.03%.

Diagnostic Ultrasound MarketKey Takeaways

- The global diagnostic ultrasound market was valued at USD 7.69 billion in 2024.

- It is projected to reach USD 11.42 billion by 2034.

- The diagnostic ultrasound market is expected to grow at a CAGR of 4.03% from 2025 to 2034.

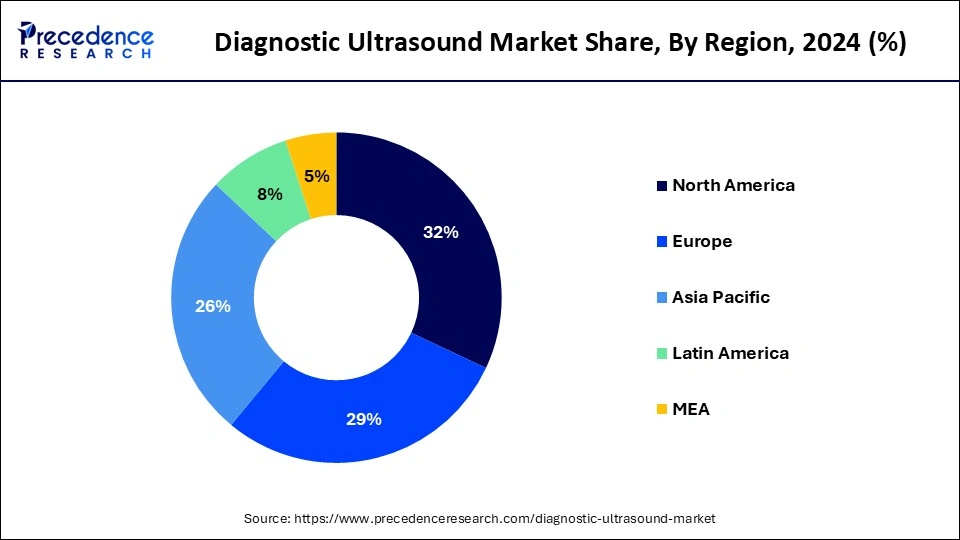

- North America has held the largest market share of 32% in 2024.

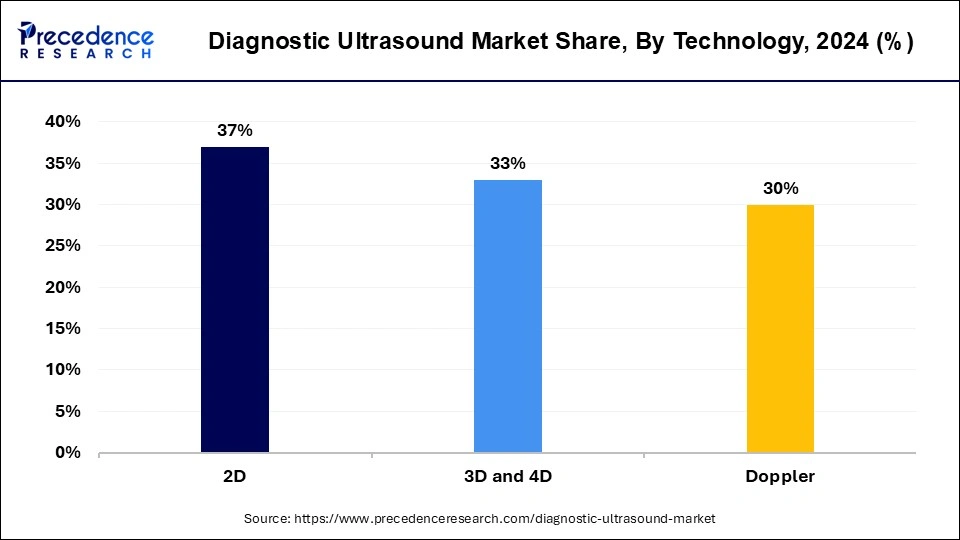

- By technology, the 2D segment has accounted the largest market share of 37% in 2024.

- By portability, in 2024, the trolley segment has captured the biggest market share of 66% in 2024.

- By application, the obstetrics/gynecology segment held a significant share in 2024.

- By end use, the maternity centers segment holds the largest share of the market.

U.S. Diagnostic Ultrasound Market Size and Growth 2025 to 2034

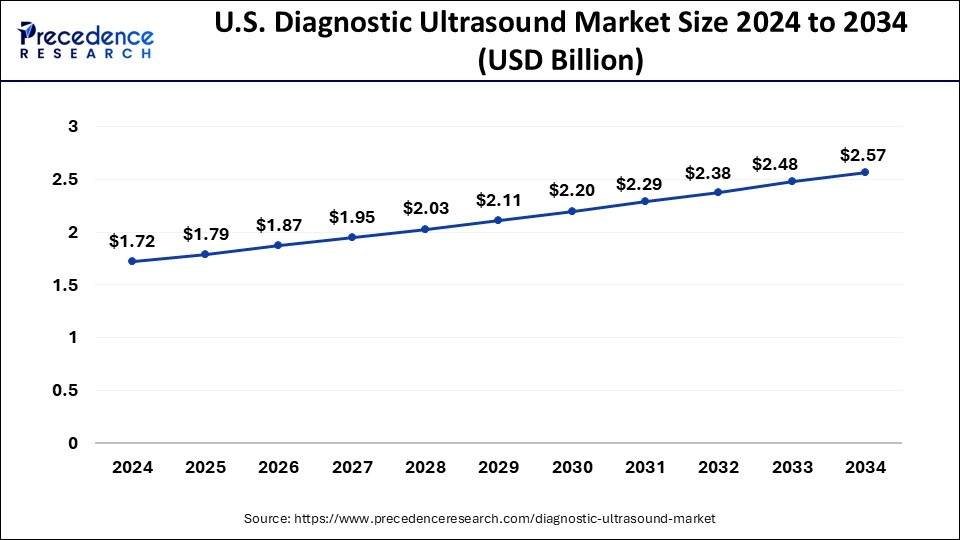

The U.S. diagnostic ultrasound market size was exhibited at USD 1.72 billion in 2024 and is projected to be worth around USD 2.57 billion by 2034, growing at a CAGR of 4.10%.

North America dominates the diagnostic ultrasound market share of 32% in 2024, driven by advancements in ultrasound imaging technology. Despite these advancements, prehospital ultrasound utilization remains limited in the region. Factors such as provider training, system size, population served, and transport type are believed to influence the adoption of prehospital ultrasound.

Barriers to prehospital ultrasound implementation persist, including equipment costs, training expenses, and limited evidence of improved outcomes. These challenges hinder widespread adoption in North America's emergency medical services (EMS) systems despite the technology's potential to enhance patient care in the prehospital setting.

The American Institute of Ultrasound in Medicine (AIUM) recognizes leaders, innovators, and contributors in medical ultrasound through its national awards. The 2023 class of award recipients were honored during UltraCon in Orlando for their outstanding contributions to the field.

- In August 2023, Pulsenmore emerged victorious in the AIUM's Shark Tank Competition at UltraCon, presenting a groundbreaking patient-centered home ultrasound solution.

- In UltraCon 2024, esteemed experts and professionals across various skill levels in the medical ultrasound field gathered to delve into, deliberate, and commemorate the transformative progressions in ultrasound technology and practice.

- In January 2024, Mindray collaborated with Aegle Medical Solutions to broaden its array of non-invasive liver care solutions, extending its offerings to the U.S. market.

Market Overview

Diagnostic ultrasound, commonly known as sonography or diagnostic medical sonography, is a pivotal imaging technique leveraging sound waves to generate precise images of internal body structures. These images serve as critical diagnostic tools, aiding in the identification and management of various diseases and conditions. The versatility of ultrasound is evident in its wide-ranging applications, including prenatal care to monitor fetal health, gallbladder disease diagnosis, assessment of blood flow, and guidance for biopsy procedures or tumor treatments. Moreover, ultrasound plays a vital role in examining breast lumps, thyroid glands, and genital and prostate issues, as well as evaluating joint inflammation and metabolic bone diseases.

Further categorization reveals two primary types of diagnostic ultrasound: anatomical and functional. Anatomical ultrasound focuses on producing detailed images of internal organs or structures within the body. Conversely, functional ultrasound integrates additional data, such as softness or hardness of tissue, other physical characteristics, and tissue or blood movement, with anatomical illustrations to generate exhaustive 'information maps.' These maps help healthcare professionals to visualize changes or variations in function within a particular structure or organ, facilitating more precise diagnoses and treatment planning.

- In March 2023, Siemens Healthineers unveiled the evolution of the Acuson Sequoia Flagship series at this year's European Congress of Radiology (ECR) in Vienna.

- In November 2022, Philips launched a new compact ultrasound system at RSNA 2022, aimed at enabling first-time-right diagnosis for a broader range of patients.

Diagnostic Ultrasound Market Growth Factors

- In the diagnostic ultrasound market, increased demand is observed due to ultrasound's effectiveness in examining vital organs like the kidney, bladder, prostate gland, liver, pancreas, uterus, and ovaries, leading to early detection of abnormalities such as tumors, cysts, and growths.

- Expanded diagnostic capability for musculoskeletal conditions, including muscle and tendon tears, addresses a broader range of medical concerns.

- The market has a significant role in prenatal care by monitoring fetal development without exposing the fetus to ionizing radiation, ensuring proper growth and health assessment, thereby increasing utilization during pregnancy.

- Valuable in assessing vascular conditions and guiding treatment decisions by visualizing blood vessels and assessing blood flow to various organs, thus enhancing its utility and driving market expansion.

- Enhanced confidence among patients and healthcare providers for this technology is seen due to ultrasound's safety profile, non-invasiveness, and ability to be repeated as necessary, leading to increased utilization of ultrasound services.

- The versatility of ultrasound probes, including internal placement via the gastrointestinal tract, vagina, blood vessels, or during surgery, expands its applications across various medical specialties, driving market growth by accommodating a wide range of procedures and applications.

Market Scope

| Report Coverage | Details |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.03% |

| Market Size in 2025 | USD 8.00 Billion |

| Market Size by 2034 | USD 11.42 Billion |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Portability, Application, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Prenatal ultrasound technology

The utilization of prenatal ultrasound technology is a significant driver in propelling growth within the diagnostic ultrasound market. Expectant parents widely embrace routine ultrasound examinations during pregnancy for the essential assessment of fetal and maternal health and the emotional connection it fosters. These examinations offer a unique opportunity for parents to witness and engage with the developing fetus, often including the experience of hearing the fetal heartbeat and capturing images to share with loved ones.

The evolution of ultrasound technology, particularly the introduction of three-dimensional (3D) and four-dimensional (4D) ultrasound imaging, has further revolutionized the prenatal experience. These advancements enable more detailed visualization of fetal features, including facial characteristics and limb movements, in real-time, enhancing both diagnostic capabilities and the overall bonding experience for parents.

This heightened consumer demand for innovative imaging technologies drives continuous growth and expansion within the diagnostic ultrasound market, emphasizing the importance of ongoing technological advancements to meet evolving consumer preferences and market needs.

- In July 2022, GE Healthcare introduced its latest ultra-premium ultrasound technology as part of its Women's Health portfolio.

- In February 2024, Fujifilm India rolled out an advanced endoscopic ultrasound machine.

Utilization of high-frequency sound waves

The use of high-frequency sound waves emitted by ultrasound probes serves as a primary driver in advancing the diagnostic ultrasound market. These sound waves are directed into the body, where they reflect off internal organs and structures, providing valuable insights for medical professionals. The reflected ultrasound waves are then detected by transducers, enabling the creation of detailed images of the organs and structures within the body.

The diagnostic ultrasound market leverages state-of-the-art ultrasound equipment to offer patients and referring doctors a comprehensive range of ultrasound scans. Notably, ultrasound imaging is a painless procedure, making it widely accepted among patients. By utilizing high-frequency sound waves, ultrasound scanners generate images of the body's interior, facilitating the detection of tissue changes in organs. This capability not only enhances diagnostic accuracy but also drives the growth of the diagnostic ultrasound market by addressing a broad spectrum of medical needs efficiently and effectively.

- In February 2023, Lantheus announced its acquisition of Cerveau Technologies, Inc., expanding its imaging pipeline into Alzheimer's disease.

Restraints

Limitations in imaging depth and bone obstruction

While ultrasound remains a valuable diagnostic tool, its effectiveness is constrained by inherent limitations. One notable limitation in the diagnostic ultrasound market arises from the poor transmission of sound waves through air or bone, rendering ultrasound ineffective at imaging body parts containing gas or obstructed by bone, such as the lungs or head. Additionally, ultrasound may struggle to visualize objects situated deep within the human body.

Healthcare providers may often resort to alternative imaging modalities such as computed tomography CT scans, magnetic resonance imaging MRI scans, or X-rays to overcome these limitations. This reliance on complementary imaging tests imposes constraints on the growth of the diagnostic ultrasound market, as it underscores the necessity for diversified diagnostic approaches to address specific anatomical challenges and achieve comprehensive diagnostic outcomes.

Dependency on body habitus

A significant limitation of diagnostic ultrasound lies in its reliance on body habitus. While a 12 MHz linear array transducer can effectively visualize superficial structures with high resolution, imaging deeper structures such as the hip joint or rotator cuff in individuals with obesity or extreme muscularity can be severely limited. The penetrance of ultrasound waves into tissue is inversely proportional to the wave frequency employed.

The dependence on body habitus presents a considerable constraint on the growth of the diagnostic ultrasound market, as it impedes the technology's ability to deliver comprehensive imaging solutions across diverse patient populations. As a result, healthcare providers may turn to alternative imaging modalities to overcome these limitations, thereby restraining the broader adoption and expansion of diagnostic ultrasound services.

Opportunities

Advancements in ultrasound technology

Ultrasound technology continues to evolve, presenting significant opportunities for the diagnostic ultrasound market. Recent developments have seen the emergence of new ultrasound techniques such as plane wave imaging, high-resolution contrast-enhanced ultrasound, micro-elastography, 3D ultrasound, and high-frequency ultrasound. Moreover, the invitation for submissions of original research and review papers covering advanced ultrasound technologies across all aspects of clinical and research domains further underscores the growing opportunities within the diagnostic ultrasound market.

Exploration of cutting-edge ultrasound innovations fosters collaboration and knowledge exchange among researchers, clinicians, and industry stakeholders. Furthermore, advancements enhance imaging capabilities, allowing for more precise and comprehensive diagnostic assessments. Overall, the continuous advancement of ultrasound technology presents a fertile ground for expansion and innovation within the diagnostic ultrasound market.

- In July 2023, Canon Medical introduced the Aplio Flex and Aplio Go Ultrasound Systems in Europe to tackle healthcare challenges.

- In January 2024, a private equity-backed imaging supplier continued its rapid expansion with another acquisition.

3D ultrasound volume imaging

The introduction of three-dimensional (3D) volume imaging represents a significant milestone in modern sonography, offering promising opportunities for the diagnostic ultrasound market. While MRI holds its value, the maturation of 3D ultrasound technology is poised to rival MRI's capabilities. With 3D ultrasound volume imaging, practitioners can capture volumes that allow for reconstruction in any plane post-patient visit, a capability that may catalyze the development of standardized ultrasound techniques akin to those seen in MRI.

This advancement is expected to solidify ultrasound's position in body imaging, particularly when compared to MRI. The ability to reconstruct multiplanar slices from 3D ultrasound volumes offers a standardized approach to diagnosis, enhancing simplicity, reliability, and overall diagnostic accuracy. As a result, ultrasound is transitioning from an artistic approach to imaging towards standardized planes understandable by a wider range of practitioners.

The emergence of 3D volume imaging not only addresses the need for standardization in ultrasound but also creates new opportunities for growth in the diagnostic ultrasound market. By offering enhanced diagnostic capabilities and greater accessibility to a broader range of practitioners, 3D ultrasound technology is poised to expand the market's reach and competitiveness, ultimately driving improved patient care and outcomes.

- In May 2023, Probo Medical completed the acquisition of National Ultrasound.

- In February 2024, RadNet announced its entry into the Houston, Texas market through the platform acquisition of Houston Medical Imaging.

- In January 2023, Abdul Latif Jameel Health and iSono Health joined forces to introduce the world's first AI-driven portable 3D breast ultrasound scanner, potentially benefiting millions of women across the Global South.

Technology Insights

The 2D segment held the largest market share of 37% in 2024, representing the most prevalent form of ultrasound imaging. Characterized by its ability to generate black-and-white images displaying the skeletal structure of the baby and its internal organs, 2D ultrasound plays a pivotal role in diagnosing fetal health during pregnancy. The simplicity and effectiveness of 2D ultrasound lie in its real-time, radiation-free process utilizing high-frequency sound waves to provide live imaging of the pelvis.

As its name suggests, 2D ultrasound produces flat images without depth, offering a familiar and widely recognized imaging modality for both healthcare providers and patients. Typically utilized until week 24 of pregnancy, 2D ultrasound remains the cornerstone of prenatal imaging, offering essential insights into fetal development and well-being.

While advancements in ultrasound technology have introduced alternative imaging modalities such as 3D and 4D ultrasound, 2D ultrasound retains its prominence due to its accessibility, reliability, and established track record in clinical practice. Despite its limitations in depth perception, the widespread adoption and familiarity of 2D ultrasound contribute to its continued dominance in the diagnostic ultrasound market.

Portability Insights

The trolley segment captured the biggest share in the diagnostic ultrasound market in 2024, particularly the portable ultrasound systems. These carts are specifically designed to provide mobility and stability to ultrasound machines, facilitating easy transportation between different locations within healthcare facilities. A mobile trolley cart for ultrasound imaging scanner systems typically consists of a wheeled cart with a locking mechanism to secure the ultrasound machine during transit.

The use of mobile trolley carts brings several advantages, including improved mobility and flexibility in clinical settings. Additionally, it offers shelves and compartments for storing probes, cables, and other accessories essential for ultrasound procedures. Healthcare professionals can effortlessly move ultrasound machines between patient rooms, exam areas, or even different healthcare facilities, enhancing operational efficiency. Moreover, they help mitigate the risk of damage to ultrasound equipment by providing a stable and secure platform during transport.

Mobile trolley carts come in various sizes and configurations to accommodate different types of ultrasound machines, offering durability and reliability in medical environments. Overall, trolley carts play a crucial role in enhancing the portability and functionality of ultrasound systems, contributing significantly to their widespread adoption in healthcare settings.

Application Insights

The obstetrics/gynecology segment held a significant share of the diagnostic ultrasound market in 2024, driven by the widespread utilization of ultrasound technology in this specialized field. Obstetrical ultrasound plays a crucial role in providing detailed images of embryos or fetuses within a woman's uterus, as well as assessing the health of the mother's uterus and ovaries. Doppler ultrasound, a specialized technique within obstetrical ultrasound, enables the evaluation of blood flow in arteries and veins throughout the body.

During obstetrical ultrasound examinations, healthcare providers can assess blood flow in vital structures such as the umbilical cord, fetus, or placenta, offering valuable insights into fetal health and development. Importantly, obstetric ultrasound utilizes sound waves instead of ionizing radiation, making it a safe and preferred method for observing pregnant ladies and their fetuses. This non-invasive imaging modality carries no known harmful effects, underscoring its significance as the primary tool for prenatal care and monitoring.

Overall, obstetrical ultrasound's ability to provide detailed imaging and evaluate blood flow dynamics contributes significantly to its dominance in the diagnostic ultrasound market. Its widespread application in obstetrics/gynecology underscores its importance in ensuring the health and well-being of pregnant women and their unborn babies, making it an indispensable component of prenatal care worldwide.

End-use Insights

The maternity centers segment holds the largest share of the diagnostic ultrasound market in 2024, supported by the well-documented safety of ultrasonography in pregnancy. Ultrasound examinations conducted during pregnancy have been shown to effectively diagnose approximately 50% of major anomalies, with a notable emphasis on multiple examinations throughout gestation. The distribution of ultrasound examinations reflects 10.1% in the first trimester, 57.0% in the second trimester, and 32.9% in the third trimester.

Despite the prevalence of ultrasound, approximately 15.3% of pregnancies surveyed also received X-ray examinations, highlighting a need for diverse diagnostic modalities. Moreover, a significant portion, around 74.6%, of pregnancies were monitored using electronic fetal monitoring (EFM) during labor. This monitoring comprised external EFM alone in 54.9% of cases and combined external and internal EFM in 19.7% of cases, indicating a comprehensive approach to maternal and fetal healthcare.

Maternity centers play a pivotal role in leveraging diagnostic ultrasound technology to ensure the safety and well-being of both mothers and babies throughout pregnancy and childbirth. The utilization of ultrasound and complementary diagnostic methods underscores the commitment to comprehensive prenatal care, positioning maternity centers at the forefront of the diagnostic ultrasound market.

Recent Developments

- In January 2024, Canon Medical Systems and Olympus revealed a business alliance concerning Endoscopic Ultrasound Systems.

- In February 2024, IBA acquired Radcal Corporation to enhance its Medical Imaging Quality Assurance offering and bolster its presence in the U.S.

- In February 2023, GE HealthCare announced its acquisition of Caption Health, broadening its ultrasound capabilities to support new users through FDA-cleared, AI-powered image guidance.

- In June 2023, UltraSight and EchoNous partnered to facilitate more accessible cardiac ultrasound for patients.

- In February 2023, Leader Healthcare entered into a strategic partnership with Hisense Medical to redefine ultrasound imaging at Arab Health 2023.

Diagnostic Ultrasound Market Companies

- Canon Medical Systems

- FujiFilm

- GE Healthcare

- Hitachi

- Kalamed

- Samsung Electronics

- Koninklijke Philips

- TELEMED Medical Systems

- Siemens Healthcare

- Toshiba Medical Systems

Segments Covered in the Report

By Technology

- 2D

- 3D and 4D

- Doppler

By Portability

- Trolley

- Compact/Handheld

By Application

- General Imaging

- Cardiology

- Obstetrics/Gynecology

- Others

By End-use

- Hospitals

- Maternity Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content