What is the Digital Breast Tomosynthesis Equipment MarketSize?

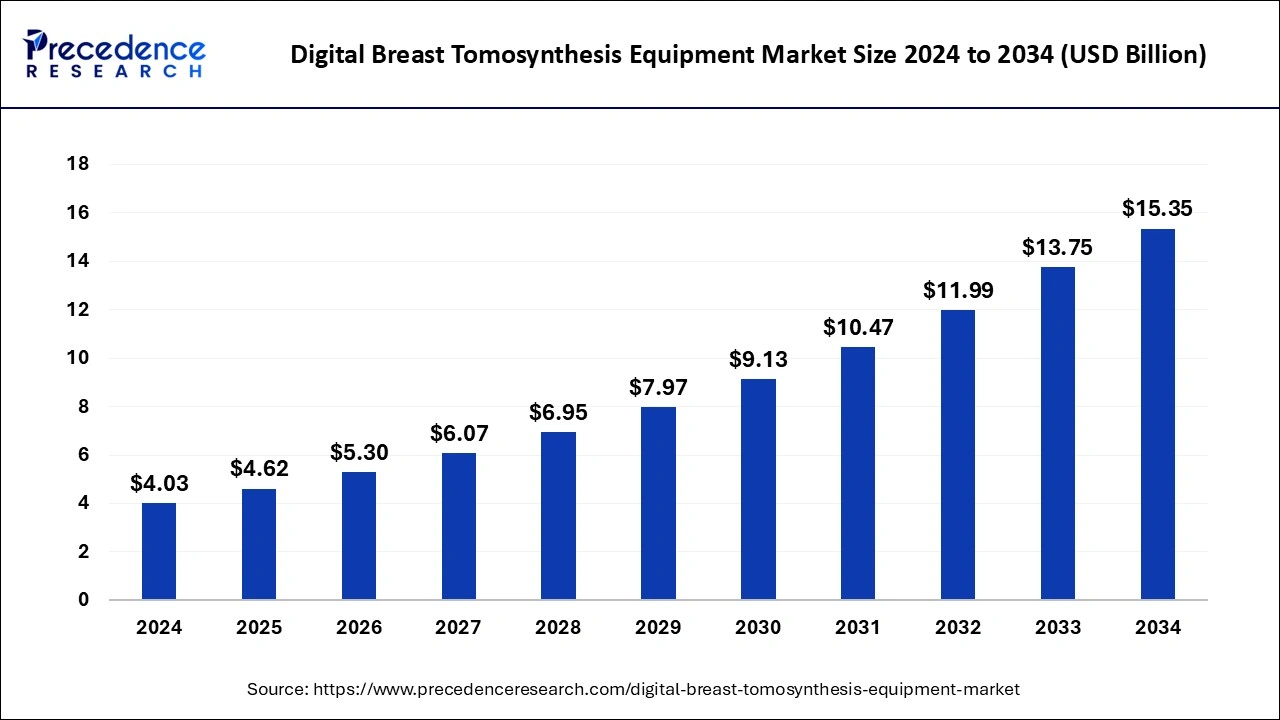

The global digital breast tomosynthesis equipment market size is calculated at USD 4.62 billion in 2025 and is predicted to increase from USD 5.30 billion in 2026 to approximately USD 17.06 billion by 2035, expanding at a CAGR of 13.96% from 2026 to 2035.

Digital Breast Tomosynthesis Equipment Market Key Takeaways

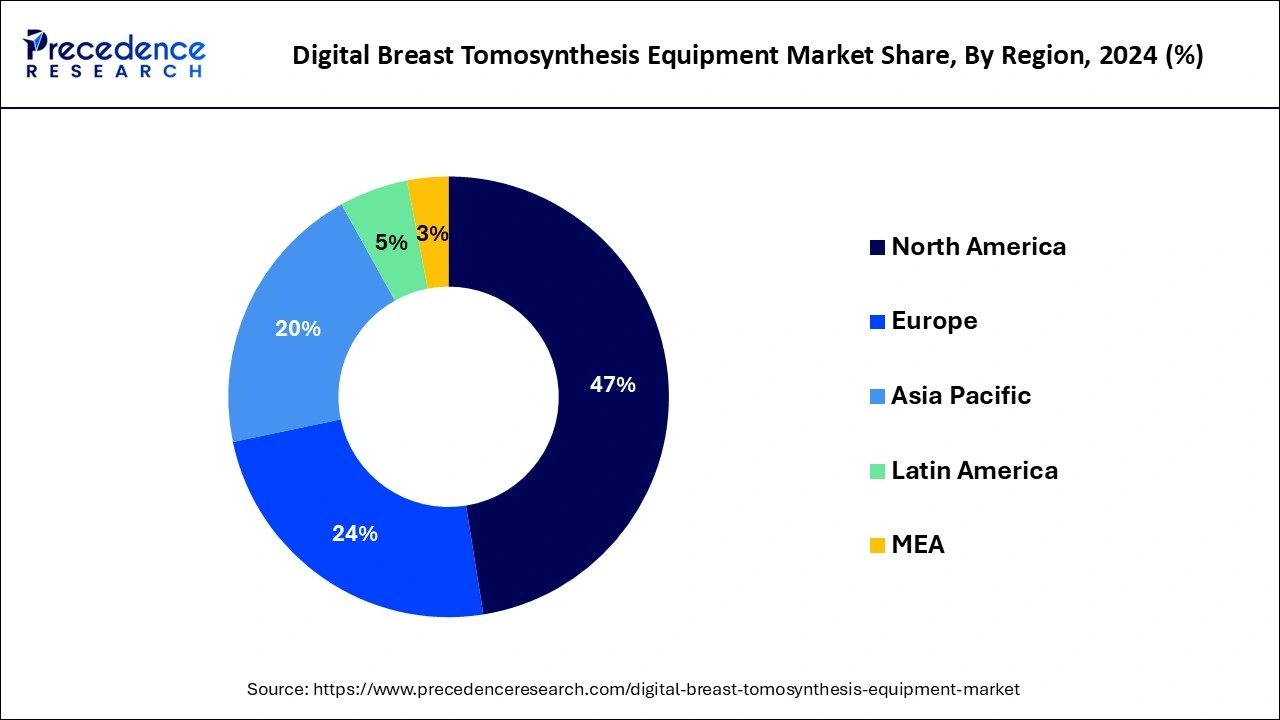

- North America captured more than 47.14% of revenue share in 2025.

- By Product, Standalone 3D dominates the digital breast tomosynthesis equipment market.

- By End-user, Hospitals share the maximum CAGR during the projection period.

Impact of Artificial Intelligence (AI) on the Digital Breast Tomosynthesis Equipment Market

Artificial intelligence algorithms can help reduce antibiotic dosage and improve lesion conspicuity in synthetic 2D DM images. The use of AI algorithms can also improve workflow efficiency and reduce electricians' translation time. There has been significant growth in research using cognitive behavioral therapy for DBT, and several concepts have been approved for clinical use by the U.S. Food and Drug Administration. Further development of AI models for DBT has the potential to improve applications for cancer screening and diagnosis, and ultimately improve patient health outcomes. The use of AI-powered tools can reduce reader interpretation time compared to independent raters while providing the same level of performance measurement. The development of an AI model for DBT could help predict cancer risk because it combines analysis of patient history, improved cancer diagnosis by visually extracting tissue from the breast, and the production of SDM images at lower radiation doses, which has led to the growth of the digital breast tomosynthesis equipment market.

What is Digital Breast Tomosynthesis Equipment?

Breast tomosynthesis is a breast imaging technique that uses low-dose X-rays to diagnose cancer in an early phase when it is most treatable and an advanced form of mammography. It is only available in some imaging facilities. Digital breast tomosyntheses, like digital mammography and film, still require breast compression. It offers the potential to overcome one of the fundamental drawbacks of mammography, which is the inability to image over-lapping dense normal tissue. This common clinical finding can reduce conventional and digital mammography's accuracy in distinguishing malignant and benign lesions. It creates multiple projections reflected across various viewing angles to produce a series of section images. It eventually reduces the superimposition of breast tissue in each tomosynthesis section with presumed improved sensitivity for small tumors.

Hologic, a global medical-based technology company, offers cutting-edge solutions that focus on improving people's lifestyles. The company has stated its annual revenue in the breast health market to be $275.1 million by 2022.

Digital Breast Tomosynthesis Equipment Market Growth Factors

- DBT can help save lives by improving the ability to detect cancer early. The technology has also been proven to reduce defects, thereby driving the growth of the digital breast tomosynthesis equipment market.

- 3D tomosynthesis mammography cameras help improve early detection and diagnosis of breast cancer, leading to better treatment and driving the growth of the digital breast tomosynthesis equipment market.

- Digital breast tomosynthesis (DBT) is a tool designed to improve the detection and characterization of breast cancers, which is driving the growth of the digital breast tomosynthesis equipment market.

- Digital breast tomosynthesis can be used for diagnostic purposes to identify lesions, identify abnormalities, and assess the extent of disease in patients with known or suspected breast cancer, leading to the growth of the digital breast tomosynthesis equipment market.

Market Outlook

- Industry Growth Overview: The market is enlarging because of clinical advantages, improved detection, and the replacement of outdated systems.

- Sustainability Trends: Manufacturers' main concern is the environment, which will result in green manufacturing, low-dose systems, the use of recyclable materials, and a decrease in the carbon footprint of devices.

- Global Expansion: North America and Europe are on top, while the Asia Pacific is moving faster in the adoption of awareness and investment initiatives.

- Major Investors: Among others, Hologic, GE Healthcare, Siemens Healthineers, and Fujifilm Corporation are the primary investors who are backing innovation all over the world.

- Startup Ecosystem: The startups are integrating the AI software, which is going to enhance the image processing workflows and the speed, accuracy, and efficiency of diagnostics.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.62 Billion |

| Market Size in 2026 | USD 5.30 Billion |

| Market Size by 2035 | USD 17.06 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 13.96% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 To 2035 |

| Segments Covered | Product and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The dominance of digital breast tomosynthesis equipment over mammography

With the advancements in the overall healthcare sector, the oncology sector also demands multiple technological advancements. Digital breast tomosynthesis equipment digital breast tomosynthesis is used to improve the detection and characterization of breast lesions especially in women with non-fatty breasts. As tomosynthesis is the only equipment that detects the total radiation dose, patient motion, image time, detector motion, and detector performance, and even picturizes the whole breast, with a complete future biopsy ability for those lesions fueling the breast tomosynthesis equipment market.

- According to the published journal in the Radiological Society of North America, researchers have established that digital breast tomosynthesis has developed breast cancer screening performance in the community and identifies more invasive cancers.

Restraint

Mainly in the developing regions, the high cost of equipment is hindering the growth of the market. The cost of digital breast tomosynthesis equipment varies for different models and companies. For instance, the 2D model mammography price is between $65,000-$95,000 for Hologic and GE Healthcare Inc products, whereas the 3D model of the same company is between $90,000-$200,000. Moreover, the 3D models of premium equipment of Hologic Inc. and GE Healthcare are priced between $1,40,000 and $2,75,000. The high cost of breast tomosynthesis equipment is a significant concern for the clients, the high cost of equipment results in hefty diagnosis processes, which limits healthcare providers from installing such equipment ultimately restraining the growth of the digital breast tomosynthesis equipment market.

Opportunities

Incorporation of AI with breast tomosynthesis technique

Technology, such as AI and machine learning, play an integral part in acknowledging risk. Analytical, integrative techniques and advanced data are used as information for an individual based on multiple data sources, such as medical health records, smartphone health data, and germline genome data, to assess cancer risk. The demand is growing due to the aging population, changing patient expectations, lifestyle changes, and the never-ending innovation cycle. Artificial intelligence (AI) has the potential to revolutionize healthcare and help address challenges by rapidly improving breast imaging and mammography. Digital breast tomosynthesis serves its purposes in almost every step: generating a picture, denoising risk prediction, cancer detection, and, finally, selecting therapy and, later, the results.

Segment Insights

Product Insights

Standalone 3D System shows significant growth in the digital breast tomosynthesis equipment market. Advancements in the healthcare infrastructure across the globe demand advanced machinery for diagnosing breasts under 3D mammography, which can make tumor detection easier by limiting the effect of covering the breast tissue. The 3d standalone system has brought modification in mammography. Allowing radiologists to take images from various angles for proper cancer diagnosis by looking into multiple pictures helped specialists discover more significant cancer growths than with 2D images alone. 3D mammography can help reduce the chances of false outcomes. Rising cases of cancer require a rapid diagnosis.

2D-3D Combination Systems are expected to grow in the digital breast tomosynthesis equipment market. This combination of 2D-3D systems helps us to detect cancerous factors more than a single mammography method. Integrating 2D and 3D capabilities into a single system streamlines the imaging process. Instead of using separate equipment for 2D and 3D imaging, healthcare providers can perform both procedures with a single device, reducing patient waiting times and optimizing resource utilization. Furthermore, image acquisition and interpretation workflows can be more efficient as radiologists can switch seamlessly between 2D and 3D modes. As the benefits of tomosynthesis become more recognized and its adoption increases, the integration of 2D capabilities allows for a smoother transition for healthcare providers who may still rely on 2D mammography for some reference. It provides a more gradual and adaptable approach to fully embracing 3D tomosynthesis.

End-user Insights

Hospitals are dominating the end-user segment in the digital breast tomosynthesis equipment market during the predicted period. The rising prevalence of breast cancer in female is highly growing and so the demand for hospitals have increased on a large scale. Cancer patients undergoing nausea, pain, and shortness of breath highly prefer hospitals for casualty as it provides specialized treatments under brilliant teams of doctors, nurses, allied professionals and support staff.

Diagnostic Centers is the fastest growing segment in the digital breast tomosynthesis equipment market throughout the forecast period. Governments worldwide are implementing various initiatives to improve breast cancer screening rates and outcomes. For example, some governments offer free or subsidized breast cancer screening programs, increasing the demand for DBT equipment and diagnostic services. Increase in awareness among women about the importance of early detection of breast cancer, leading to an increased demand for breast cancer screening services.

Regional Insights

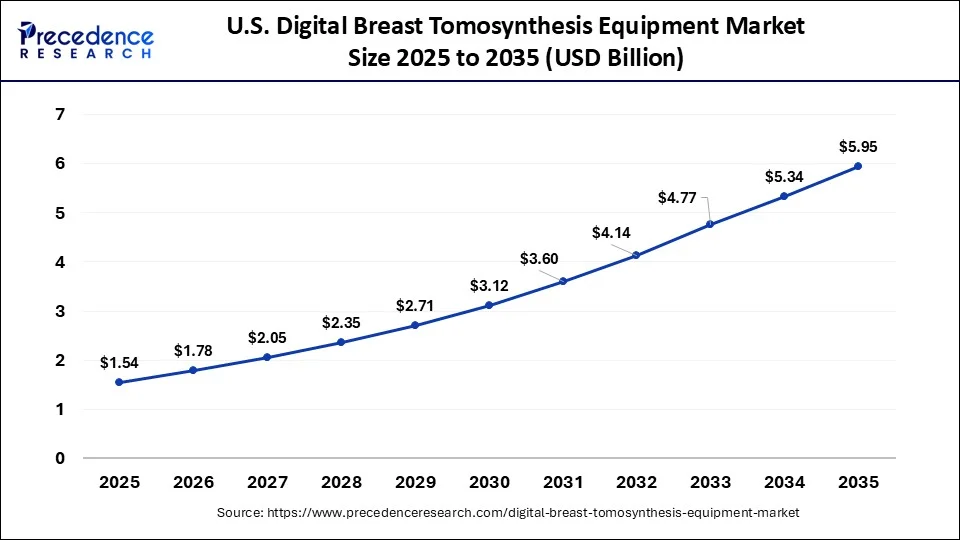

U.S. Digital Breast Tomosynthesis Equipment Market Size and Growth 2026 to 2035

The U.S. digital breast tomosynthesis equipment market size was evaluated at USD 1.54 billion in 2025 and is projected to be worth around USD 5.95 billion by 2035, growing at a CAGR of 14.47% from 2026 to 2035.

North America held the largest share of 47.14% in 2025, the region is expected to maintain dominance during the forecast period.

Breast cancer is significant in North America because of its growth due to well-trained healthcare professionals, greater affordability, well-developed healthcare infrastructure, and a rise in breast cancer. Breast cancer is frequent in women in the United States, and about 13% of every American woman may have invasive breast cancer.

For instance, in 2022, an estimation of 287,850 new patients with invasive breast cancer will be detected in women in the United States, in addition to 51,400 new breast cancer cases. Growing instances require more healthcare infrastructure to provide medical support to patients and raise the use of digital breast tomosynthesis to detect breast issues.

Asia- Pacific shows lucrative growth in the digital breast tomosynthesis equipment market during the forecasted timeframe.

Asia Pacific regions mainly the countries like India with lack of proper hygiene, and poor lifestyle leads to the increase a greater number of breast cancer, requirement for good hospital such as Fortis hospital considered as the best cancer hospitals in India with a stellar reputation to have digitalmagnetic resonance imaging(MRI) technology and expertise inradiation therapy.

For instance, In December 2022, AI-derived medical imaging instrument company Lunit signed a deal to supply AI-derived breast cancer screening solutions to Hong Kong Women's Imaging diagnosis imaging center and Mongolia's National Cancer Center, indicating an increasing demand for advanced mammography solutions worldwide.

What Are the Driving Factors of The Digital Breast Tomosynthesis Equipment Market in Europe?

Europe is turning to mammography to diagnose early breast cancer cases, according to experts, the greatest benefit from the teleradiology networks, which are gradually expand up to the whole Europe, and the integration of tomosynthesis into public healthcare systems, realizing the delivery of preventive diagnostics and treatments even in underprivileged areas through synced policy-driven initiatives.

Germany Digital Breast Tomosynthesis Equipment Market Trends:

Germany is the fastest-growing market in the region due to its superior healthcare infrastructure and generous support for preventive diagnostics, which accompanied the trend for precise imaging that led to the adoption of complex digital breast tomosynthesis systems with AI-powered software that ensures fast and accurate screening results throughout the country, thus making the nation's leadership in the field of health technology management.

Digital Breast Tomosynthesis Equipment Market-Value Chain Analysis

- R&D: Innovation and Engineering of DBT Technology with Increased Image Quality and Reduced Dose

Key Players: Hologic, Siemens Healthineers, GE HealthCare, Philips - Clinical Trials and Regulatory Approvals: Safety, efficacy, and regulatory approvals for DBT through trials

Key Players: Hologic, Siemens Healthineers, GE HealthCare - Packaging and Serialization: Equipment transport tracking, authenticity, inventory, logistics, packaging, and serialization

Key Players: Hologic, Siemens Healthineers, GE HealthCare, Philips - Distribution to Hospitals, Pharmacies: Installing training, ensuring accessibility professional use of distribution to hospitals and pharmacies

Key Players: Philips, Henry Schein, Cardinal Health

Digital Breast Tomosynthesis Equipment Market Companies

- Hologic: Genius AI Detection is the product offered by Hologic, and it comes with advanced dimensional systems which are increasing the productivity of radiologists, the confidence of the doctor, and the accuracy of the workflows of the diagnosis in detecting even subtle cancers.

- Siemens: Siemens is the producer of the Mammomat B brilliant systems, which provide hospitals and clinics with wide angles for tomosynthesis, high-resolution imaging, and the aforementioned clinical workflows, which are all supporting preventive screening.

- Fujifilm: Fujifilm is widening access by means of Amulet digital mammography solutions, partnerships, campaigns, and support of diagnostic centers and early detection programs through nationwide outreach initiatives.

Other Major Key Players

- GE

- Internazionale Medico Scientifica

- Planmed

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- Abbott

- BD

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- Koninklijke Philips N.V.

- Shimadzu Medical (India) pvt. Ltd

- General Electric

- Quest Diagnostics Incorporated

- Sysmex India Pvt. Ltd

- Hitachi, Ltd

- Canon Inc.

Recent Developments

- In December 2025, Novarad's MammoIQ breast imaging platform features advanced mammography image processing, MQSA tracking, and multi-modality viewing of MRI, ultrasound, and PET imaging. This enhances visualization and regulatory capabilities within a single system. (Source: https://www.diagnosticimaging.com )

- In December 2025, DeepHealth launched the DeepHealth Breast Suite, an innovative set of modular, AI-powered applications for breast cancer screening and detection. It integrates technologies from iCAD to enhance detection, density assessment, and risk evaluation. The Suite improves accuracy and standardization. (Source: https://www.globenewswire.com )

- In September 2023, Siemens Healthineers launched a new mammography system with new imaging technologies. The Mammomat B. delivers high-quality 3D images in just five seconds. A unique combination of speed, great depth, and spatial resolution. Faster turnaround time makes testing easier for patients

- In April 2024, QT Imaging Holdings, Inc. a medical device company engaged in the research, development, and commercialization of new body imaging technologies is pleased to announce the positive results of QTI Breast Acoustic CTTM Scan in studies that found a mass in the second blind reading of numerous academic papers.

- In August 2024, Izotropic Corporation, a leading medical device company marketing the IzoView breast CT imaging system, is pleased to announce that it is seeking regulatory approvals in the United States and the European Union to develop IzoView, a diagnostic tool for patients with thick tissues, a variant associated with increased risk of breast cancer.

Segments Covered in the Report

By Product

- 2D-3D Combination System

- Standalone 3D System

By End-user

- Hospitals

- Diagnostic Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting