What is the Digital Food Management Market Size?

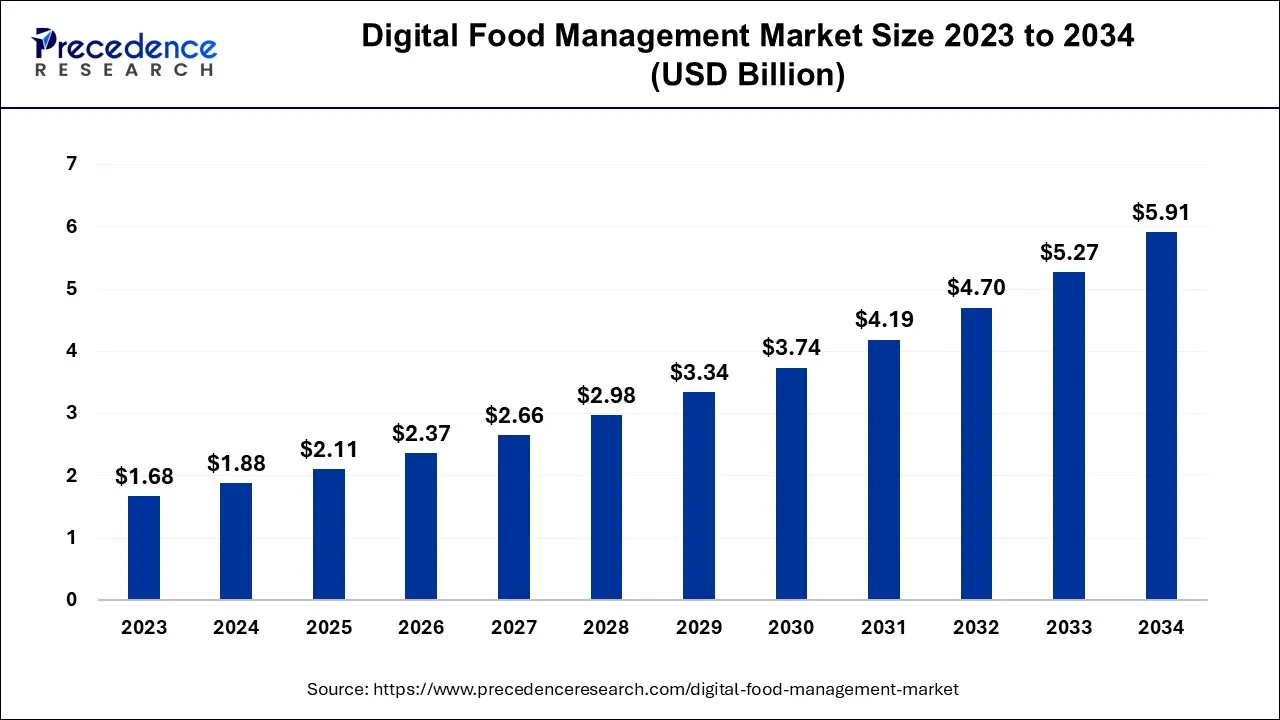

The global digital food management market size is valued at USD 2.11 billion in 2025 and is predicted to increase from USD 2.37 billion in 2026 to approximately USD 6.55 billion by 2035, expanding at a CAGR of 11.99% from 2026 to 2035.

Market Highlights

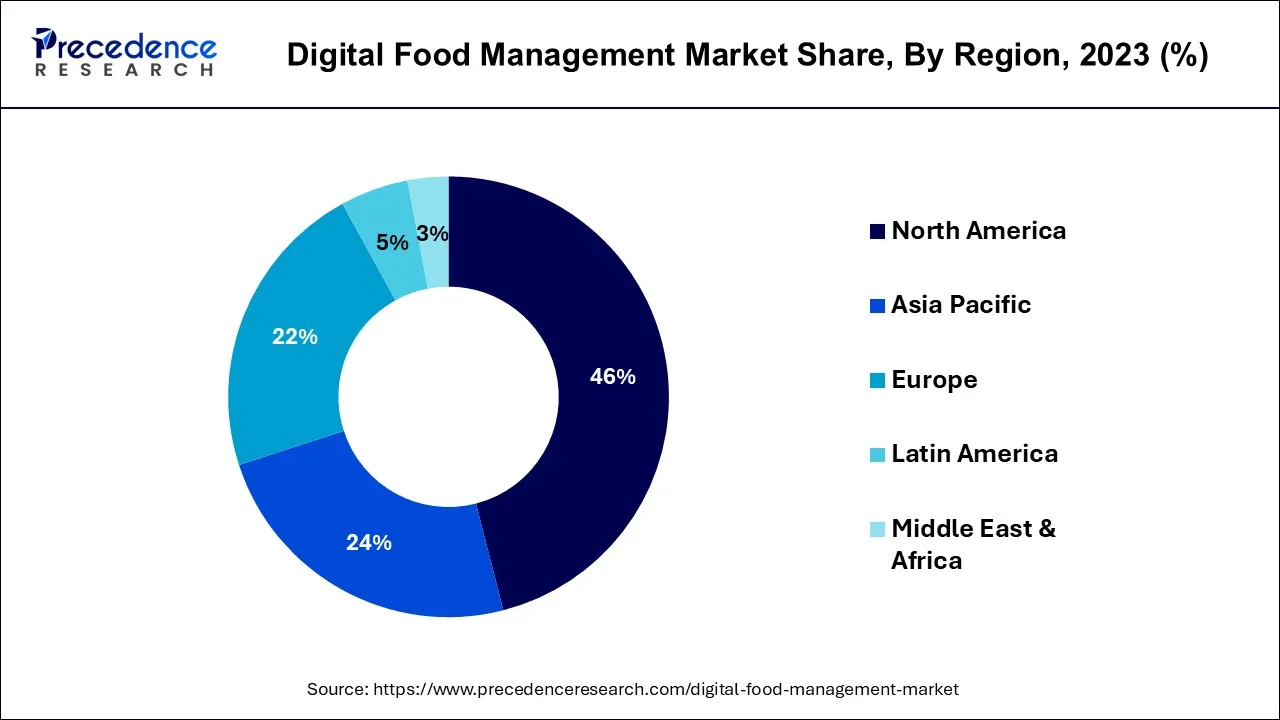

- By region, North America contributed more than 46% of the revenue share in the digital food management market in 2025. Asia-Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By type, the software solutions segment has held the largest market share of 62% in 2025. Whereas the services segment is anticipated to grow at a remarkable CAGR of 14.8% between 2026 and 2035.

- By application, the end user management segment generated over 38% of revenue share in 2025. On the other hand, the customer engagement segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the restaurants and cafes segment had the largest market share of 42% in 2025. Meanwhile, the catering services segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The digital food management market refers to the use of digital technologies andsoftwaresolutions to streamline and enhance various aspects of the food industry, including restaurant management, inventory control, menu planning, ordering, delivery, and customer engagement. It encompasses a range of software, hardware, and service solutions designed to improve operational efficiency, customer service, and food quality.

The market's growth is driven by the increasing demand for innovative and convenient solutions to address the evolving needs of the food service and hospitality industry, including the integration of online ordering, digital menus, and advanced inventory management systems to cater to the demands of modern consumers.

Digital Food Management Market Growth Factors

- Increasing demand for convenience, online ordering, and contactless dining drives market growth. Digital solutions streamline restaurant management, improving efficiency and customer service.

- The pandemic accelerated the adoption of digital food management for health and safety concerns. Cloud technology provides scalable and cost-effective options for food service businesses.

- The rise in smartphone use encourages the adoption of mobile apps for ordering and payments. Increased focus on online ordering and delivery services.

- Artificial intelligence enhances recommendations and operational efficiency, and the emergence of advanced technologies is observed to promote the market's growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.11 Billion |

| Market Size in 2026 | USD 2.37 Billion |

| Market Size by 2035 | USD 6.55 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 11.99% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increase in consumer demand for convenience and cloud-based solutions

Consumers are increasingly inclined toward convenient dining experiences. They crave the ability to effortlessly peruse menus, place orders, and handle payments, all through the convenience of their smartphones. This escalating demand has given rise to a plethora of mobile apps and online platforms for ordering, providing customers with access to a wide array of food services right at their fingertips. Particularly in a world reshaped by the COVID-19 pandemic, the convenience of digital ordering and payment solutions has become indispensable for restaurants and food service providers.

Furthermore, the digital food management landscape has witnessed a profound transformation through the incorporation of cloud-based solutions. Cloud technology delivers scalability, adaptability, and cost-efficiency, empowering businesses to streamline their operations effectively. It provides the essential infrastructure to manage the increasing volume of digital orders, payments, and data analytics, all of which collectively enhance customer service and operational efficiency. Consequently, cloud-based solutions have become a key to success in the digital food management market, propelling its expansion and empowering food service providers to cater to the ever-increasing consumer demand for convenience.

Restraint

Technical challenges and digital inequality

Implementing digital food management solutions often requires technical expertise and financial resources. Many small and independent food service businesses struggle to overcome these technical barriers. Customizing software, ensuring data security, and handling complex integrations can pose challenges. Additionally, the fast-paced evolution of technology necessitates continuous updates and investments, which can be daunting for some businesses. These technical challenges limit the adoption of digital food management solutions, especially among less technologically savvy businesses.

Moreover, not all customers have equal access to digital tools or the internet. The reliance on mobile apps and online ordering platforms can exclude those who lack smartphones or stable internet connections. Moreover, some elderly or less tech-savvy individuals may face difficulties navigating digital food ordering systems. This digital inequality hampers the reach of food businesses and creates a disparity in service accessibility, limiting the market's potential. These challenges highlight the importance of addressing technical barriers and ensuring inclusivity in digital food management solutions to fully unlock their market potential.

Opportunity

Contactless dining, integration of AI, and automation

The digital food management market is witnessing a surge in demand driven by several critical trends. Firstly, the increase in contactless dining, prompted by health and safety concerns during the COVID-19 pandemic, has become a permanent fixture. Consumers now expect contactless solutions, including digital menus, ordering, and payments, when dining out. Restaurants and food service establishments are compelled to adopt these technologies to meet customer expectations for a safe and seamless dining experience.

Moreover, AI-powered chatbots and virtual assistants enhance customer interactions and streamline order processing. Moreover, automation technologies like robotic chefs and smart kitchens are optimizing kitchen operations, reducing labor costs, and ensuring consistency in food preparation. These advancements improve efficiency and service quality while reducing operational expenses. Overall, the digital food management landscape is evolving to provide innovative solutions that meet the demands of a tech-savvy and safety-conscious consumer base. As AI and automation become more integrated, and contactless dining becomes the norm, the market is poised for significant growth, driven by both customer expectations and operational efficiency.

Segment Insights

Type Insights

According to the type, the software solutions segment has held 62% revenue share in 2025. In the digital food management market, software solutions encompass a wide range of applications designed to streamline and enhance various aspects of the foodservice industry. These software solutions include robust POS (Point of Sale) systems, digital ordering and reservation platforms, inventory management tools, and customer relationship management (CRM) software.

The market trend in this segment involves an increasing focus on cloud-based solutions, which provide scalability and accessibility from various devices, making it easier for restaurants to adapt to changing customer preferences, demand fluctuations, and evolving health and safety standards.

The service segment is anticipated to expand at a significantly CAGR of 14.8% during the projected period. Services in the digital food management market pertain to the expert guidance, technical support, and consultation offered to businesses in the food service industry. These services can range from installation, training, and maintenance of software solutions to help restaurants optimize their operations. A significant trend is the growing demand for customized services tailored to the unique needs of each establishment, ensuring they can harness the full potential of their digital food management tools. As the market continues to expand, service providers are expected to play a crucial role in helping businesses make the most of their digital technology investments.

Application Insights

Based on the application, end user management segment is anticipated to hold the largest market share of 38% in2025. In the digital food management market, end-user management focuses on streamlining kitchen and staff operations, ensuring efficient order processing, and maintaining inventory control. Trend-wise, we observe a growing adoption of kitchen display systems (KDS) to optimize food preparation and delivery times. AI-powered algorithms help restaurants manage staffing levels more effectively, ensuring efficient utilization of resources.

On the other hand, the customer engagement segment is projected to grow at the fastest rate over the projected period. Customer engagement in the digital food management market centers on enhancing the dining experience. It includes features like mobile apps for menu browsing, contactless ordering, and loyalty programs. A prominent trend is the integration of augmented reality and virtual reality for immersive menu exploration, enhancing customer engagement and satisfaction. Moreover, the market sees a rise in the use of data analytics for personalized promotions and gathering customer feedback for continuous improvements.

End-user Insights

In2025, the restaurant and cafe segment had the highest market share of 42% on the basis of the end user. In the digital food management market, the restaurant and cafe sector plays a pivotal role. With the rise of customer demand for convenience and contactless dining, restaurants and cafes are increasingly implementing digital solutions. They have integrated mobile apps and websites for online ordering, digital menus, and cashless payments.

In response to changing customer preferences and operational efficiency, restaurants are adopting table management systems that allow diners to reserve tables and check-in digitally. These technologies streamline operations, enhance customer experience, and support the growth of the restaurant and cafe segment within the digital food management market.

The catering services segment is anticipated to expand at the fastest rate over the projected period. Catering services have also experienced a transformation. Caterers are utilizing digital food management solutions to streamline the ordering process, manage event logistics, and offer an array of menu choices online. The trend towards personalized and customized catering options, often ordered through web-based platforms, has gained momentum. This trend is particularly evident in corporate events, weddings, and private parties. As a result, digital solutions for restaurants and catering services continue to reshape the food service landscape by improving accessibility, efficiency, and customer experience.

Regional Insights

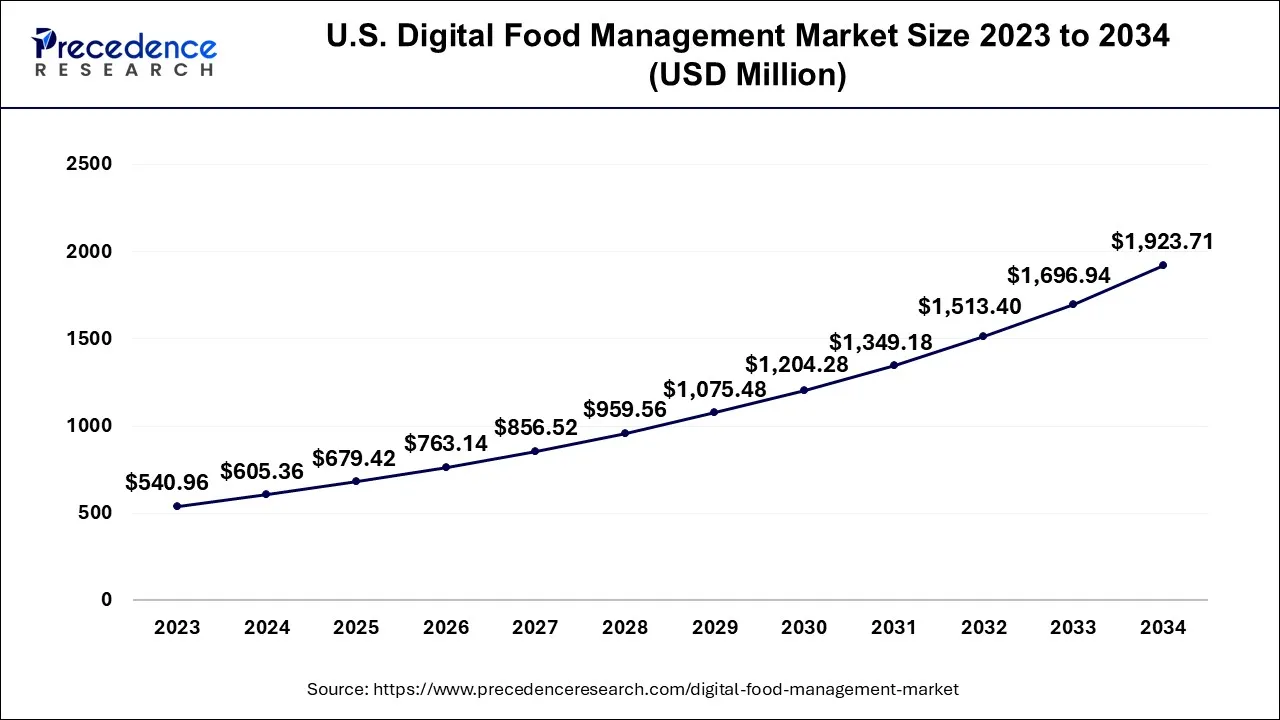

U.S. Digital Food Management Market Size and Growth 2026 to 2035

The U.S. digital food management market size is accounted for USD 679.42 million in 2025 and is projected to be worth around USD 2,150.48 million by 2035, poised to grow at a CAGR of 12.21% from 2026 to 2035.

What Made North America the Dominant Region in the Digital Food Management Market?

North America held the largest revenue share 46% in 2025. In North America, the digital food management market has witnessed a surge in demand due to changing consumer preferences and the need for contactless dining experiences amid the ongoing pandemic. Mobile apps for online ordering, curbside pickup, and digital menus have gained popularity. Moreover, food delivery services have expanded, with consumers increasingly relying on platforms like Uber Eats and DoorDash. The integration of AI-powered recommendation systems and personalized offers further enhances customer engagement.

U.S. Digital Food Management Market Analysis

The U.S. is a major contributor to the North American Market. The market in the country is growing due to rising online ordering and delivery of food. Foodservice and hospitality businesses are adopting advanced digital tools to meet growing consumer expectations for convenience, contactless ordering, and seamless mobile payments, transforming how customers browse menus, place orders, and pay for meals. The shift toward online ordering platforms, food delivery services, and cloud-based management systems, accelerated by the lasting effects of the pandemic, has increased demand for solutions that improve efficiency, reduce wait times, and enhance customer satisfaction.

What Makes Asia Pacific the Fastest-Growing Region in the Digital Food Management Market?

Asia Pacific is estimated to observe the fastest expansion. In this region, the adoption of digital food management solutions has been on the rise. With a growing urban population and busy lifestyles, consumers in countries like China and India are embracing food delivery apps and online payment methods. Additionally, there's an increasing emphasis on food safety and traceability, which digital solutions can address. The market is also driven by the expansion of cloud kitchens and virtual restaurant concepts, which rely heavily on digital platforms for order management and customer interactions.

India Digital Food Management Market Analysis

The market in India is rapidly growing due to the emergence of new business models, government support, the development of digital infrastructure, and shifting consumer lifestyles. The Union Minister of Consumer Affairs, Food, and Public Distribution launched digital initiatives for food storage, warehousing, and logistics to improve the supply chain, influencing the market in the country.

What Influences the Market in Europe?

In Europe, the digital food management market is characterized by a strong focus on sustainability and eco-friendly practices. Consumers are increasingly looking for transparency in the food supply chain and are keen on supporting local businesses. Additionally, European countries have stringent regulations related to food safety and labeling, driving the adoption of digital solutions that can ensure compliance. The region also witnesses a growing demand for online reservation and booking systems in restaurants and cafes to streamline operations and enhance the dining experience.

How is the Opportunistic Rise of Latin America in the Digital Food Management Market?

Latin America is experiencing an opportunistic rise in the market as foodservice and delivery platforms rapidly expand, driven by increasing smartphone penetration, urbanization, and consumer demand for convenient digital ordering and management tools. Restaurants and food businesses in countries like Brazil are adopting cloud‑based systems, POS solutions, and inventory management software to enhance efficiency and integrate with online delivery services, creating strong regional growth potential.

What Opportunities Exist in the Middle East & Africa (MEA) for the Market?

The MEA offers immense opportunities for the digital food management market. These opportunities arise from the rise of virtual and cloud kitchens, national digital agendas, and mobile and internet penetration. Additionally, government initiatives promoting digital transformation, investments in smart food tech, and expanding third‑party delivery ecosystems across the region are creating fertile ground for the broader adoption of digital food management platforms and services. For instance, in December 2025, East Africa made efforts to advance a unified digital innovation agenda to transform agrifood systems.

Digital Food Management Market Companies

- 365 RM UK Ltd.

- Booking Holdings Inc.

- FlexiBake Ltd.

- iNECTA LLC

- JAMIX Oy

- jiWebTech Technologies LLP

- Kellton Tech Solutions Ltd.

- Kitchen Brains

- Omega Softwares

- Oracle Corp.

- Roper Technologies Inc.

- SmartSuite Holdings LLC

- SweetWARE

- Toast Inc.

- TouchBistro Inc.

- Vision Software Technologies Inc.

- Zoho Corp. Pvt. Ltd.

Recent Developments

- In 2021, Google and Albertsons Companies joined forces to create and implement digital solutions for Albertsons' grocery stores. This strategic alliance centers on leveraging Google's AI and cloud computing technologies to enhance the customer experience, optimize supply chain management, and elevate employee productivity.

- In September 2024, TouchBistro launched its Inventory Management and Labor Management solutions for restaurants, following its acquisition of Peachworks, reinforcing its commitment to innovation and meeting the evolving needs of the restaurant industry. (Source:https://financialpost.com)

Segments Covered in the Report

By Type

- Software Solutions

- Hardware Solutions

- Services

By Application

- End User Management

- Inventory Management

- Ordering and Delivery

- Menu Planning

- Customer Engagement

- Others

By End User

- Restaurants and Cafes

- Fast Food Chains

- Catering Services

- Hotels and Hospitality

- Food Trucks

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting