What is the Dimethyl Ether Market Size?

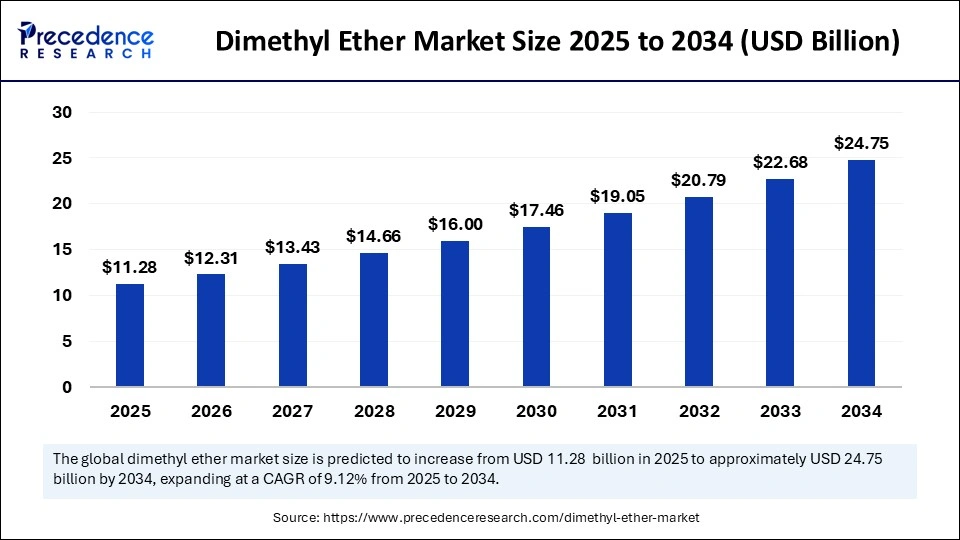

The global dimethyl ether market size is accounted at USD 11.28 billion in 2025 and predicted to increase from USD 12.31 billion in 2026 to approximately USD 24.75 billion by 2034, expanding at a CAGR of 9.12% from 2025 to 2034. Rising demand for clean alternative fuels, increasingly stringent environmental regulations, and the development of renewable DME for sustainable energy applications are driving the growth of the dimethyl ether market.

Dimethyl Ether MarketKey Takeaways

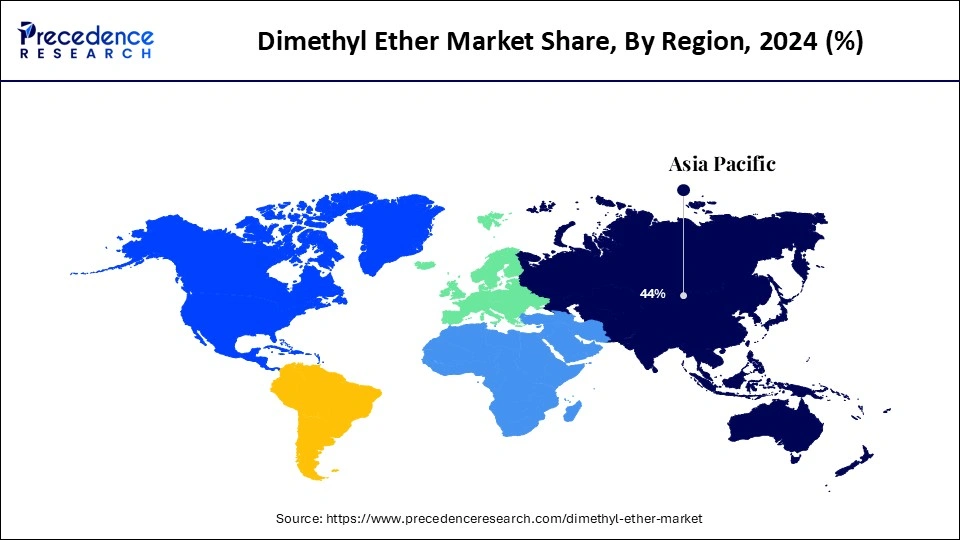

- Asia Pacific accounted for the largest revenue share 64% in 2024.

- North America is anticipated to witness the fastest growth from 2025 to 2034.

- By raw material, the LPG blending segment held a major revenue share in 2024.

- By raw material, the aerosol propellant segment is anticipated to show considerable growth in the market from 2025 to 2034.

- By application, the natural gas segment contributed the highest revenue share of 61% in 2024.

- By application, the coal-derived DME segment is anticipated to show considerable growth in the market from 2025 to 2034.

How Is Artificial Intelligence Transforming the Dimethyl Ether Market?

The dimethyl ether market is being actively advanced by AI, especially generative AI, through improved production and streamlined supply chain processes. AI applies to the design and performance of catalysts through advancements in design, enabling greater yields, longer catalyst life, and reduced feedstock, which in turn, will improve plant operating costs, and reduce steered-down industries' and greenhouse emissions, and environmental damage.

Artificial intelligence, to improve fuel production, supports monitoring of real-time operating conditions, including integrated system control of manufacturing processes. AI-driven advanced data analytics are contributing to supply chains to improve logistics, inventory, and distribution, to improve how goods are moved while being profitable.

What are the Diverse Applications of the Dimethyl Ether?

Dimethyl Ether (methoxy methane) is a widely used, colorless, odorless, non-toxic gas that burns cleanly and is versatile. To produce DME, hydrocarbon conversion to synthesis gas, to methanol, and then dehydration using silica-alumina, is employed. There is a growing recognition of DME in the energy sector because it is considered a cleaner alternative to diesel.

People are adopting dimethyl ether more often because it's a cleaner substitute for fossil fuels. A major reason for growth is that the automotive industry is using DME as a substitute for diesel because it gives better performance. The raw materials, like coal, natural gas, biomass, and methanol, enable the market to enjoy cost-effective production. As more people worry about the environment and strict regulations on emissions, this is encouraging a rise in the use of low-sulfur and low-carbon fuels such as DME.

Which Key Trends Are Accelerating Growth in the Dimethyl Ether Market?

- Technology Advancements: DME's applications have expanded due to technological advancements that have developed its use as a clean alternative to diesel fuel in transportation, as well as DME's role as a blending agent in liquefied petroleum gas.

- Creating Renewable DME: There is growing interest in producing DME renewably, and now scientists and business leaders are working with special resources to create processes that use renewable and sustainable materials, mainly from biomass, waste material from farming, or methanol made from eco-friendly energy.

- Support from the Government: Governments are making it easier for bio-based and renewable fuels by passing policies that help move us away from using fossil fuels.

Dimethyl Ether Market Outlook:

- Global Expansion: The broader expansion is propelled by a rise in demand for cleaner energy, stringent emissions regulations, and its use in LPG blending.

- Major Investors: Giant chemical and energy companies like Shell, Mitsubishi, Jiutai Energy, and Haldor Topsoe are widely investing in both fossil fuel-based and renewable DME production.

- Industry Overview: DME is diversifying its application in the blending of LPG for cleaner cooking and heating, as a diesel substitute in vehicles, and as an option to ozone-depleting propellants, including CFCs in personal care and household products.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 24.75 Billion |

| Market Size in 2025 | USD 11.28 Billion |

| Market Size in 2026 | USD 12.31 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.12% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Automotive Shift and Energy Innovation

Market growth is quick in dimethyl ether as automotive and energy changes are occurring rapidly. Since more people are interested in the environment and because strict emission laws are spreading globally, many have started switching away from conventional diesel, gasoline, and LPG. DME releases no sulfur and fewer particles, which makes it attractive for building cleaner fleets and increases its use in transportation.There is an increased desire to limit carbon emissions and reform carbon-based fuels, and this is causing DME to be considered more useful. Because such a variety of sectors rely on DME, the market is predicted to develop and grow steadily. The industry is propelled by changes in demand and by the addition of new technologies and rules.

Blended DME Gains Ground as a Cleaner LPG Alternative

A major reason for the growth in the market is that it is being used as a clean and efficient option. Many nations work towards being environmentally friendly by lowering their carbon emissions; DME helps meet this goal by supporting cleaner combustion in various applications. A main advantage of DME is that it can blend easily with LPG without changing the primary parts of an existing system, including storage, pipeline, and burner systems. Because they are compatible, there is a smooth shift and spending less on increasing the supply in places where LPG is mainly used for heating and cooking.

Mixing DME with LPG boosts how well the fuel burns, which causes particles, carbon monoxide, and flames to be less, resulting in better air quality. Fewer people are driving diesel vehicles since they realize they cause less pollution, do not have any sulfur to help protect the environment, and cut greenhouse gases. Efforts to move towards clean energy by authorities and solid support for DME lead people to recognize it as an important fuel for overall DME sales and home use.

Restraint

Stringent Government Regulations

One main obstacle holding back the market for dimethyl ether is the stringent set of rules by governments relating to fuel, its distribution, and the environment. Many governments require strict standards for emissions, the type of fuel used, and chemicals, which means DME producers have to face many restrictions. They often require hard requirements such as an assessment of environmental impact, regulations for the service and transport of products, and compliance with existing safety regulations.

The differences in regulations depending on the country pose issues when operating internationally. As the world aims for tougher climate targets, there may be new rules limiting the types of biofuels and DME that can be used in airplanes. It is very expensive for companies in this sector to comply with regulations, potential project approvals can face delays, and unpredictable changes in rules all significantly slow down the DME industry.

Opportunity

Dimethyl Ether's Role in the Transition to Sustainable Fuels

The dimethyl ether is clean and used in various industries, it is seeing growth in the market. Since countries worldwide are working to reduce greenhouse gases and look for cleaner solutions, DME is considered an appropriate alternative to fossil fuels. The LPG is higher in sustainability than diesel, there is a large market opening with green initiatives in the truck, bus, and marine industries.

Because India, China, Indonesia, and Brazil are using more energy and concentrating on clean energy, many new business opportunities are also happening there. DME is also popular as an aerosol propellant, a solvent, and a chemical intermediate, encouraging more companies to become involved. More rules for environmental protection, updated technologies, and increased demand for sustainability push Dimethyl Ether globally into greater expansion.

Application Insights

Why Is the LPG Blending Segment Leading the Dimethyl Ether Market?

The LPG blending segment led the dimethyl ether market and accounted for the largest revenue share of 61% in 2024. Increasing worldwide attention on controlling harmful emissions from regular fuels is causing this growth. DME is increasingly combined with LPG to help combustion become more efficient and to decrease carbon monoxide, particulate matter, and greenhouse gas emissions. An advantage of DME is that it matches the LPG network, requiring no extra expense and no construction of new distribution lines. Gaining government restrictions and increased care for the environment among customers are encouraging more use of DME-LPG blends. Also, the raw material base for these blends includes natural gas, coal, and biomass. Additional investments by integrated gas and new energy companies in production are aiding in meeting the increased need.

- In June 2024, Vijay Kumar Saraswat, a member of the Indian government's think-tank Niti Aayog, announced that the Indian government will move to start the production of dimethyl ether (DME) for blending into LPG up to about 20%, in its endeavour to reduce LPG imports.

(Source: https://globalflowcontrol.com)

The aerosol propellant segment is expected to grow at a significant CAGR over the forecast period, concentrated on personal care, cosmetics, and pharmaceuticals as demand grows. Because DME doesn't harm the ozone layer, unlike chlorofluorocarbons (CFCs) and hydrofluorocarbons (HFCs), it's preferred in the aerosol industry.

It allows manufacturers to comply with tough environmental standards because DME is cleaner than harmful propellants. DME is ideal for modern uses, especially because of its contribution to environmental sustainability, which helps the aerosol propellant segment in its growth.

Raw Material Insights

The natural gas contributed the most revenue in 2024 and is expected to dominate throughout the projected period. Better ways to extract and process natural gas, thanks to significant investment in R&D by the oil and gas industry, have allowed more natural gas to be available and affordable. Natural gas as a feedstock to generate DME has advantages due to its low emissions and predictable chemistry; thus, there will be no complication or need to treat natural gas as a costly feedstock. Converting natural gas to DME is seen as a process that saves both energy and costs, and natural gas-based DME is more environmentally friendly because of its lower ozone depletion potential and lower global warming potential than traditional refrigerants like CFCs.

The coal-derived DME segment is expected to witness substantial growth in the coming years. Coal is a cheap and widely available feedstock for DME production. Countries with coal resources are creating and supporting strategies for reducing greenhouse gas emissions. DME from coal represents a cleaner that helps to lower levels of particulate and sulphur emissions. The coal industry could leverage the new technology and endorsement from government support and which promotes cleaner energy, might lower the impact on the environment.

Regional Insights

Asia Pacific Dimethyl Ether Market Size and Growth 2025 to 2034

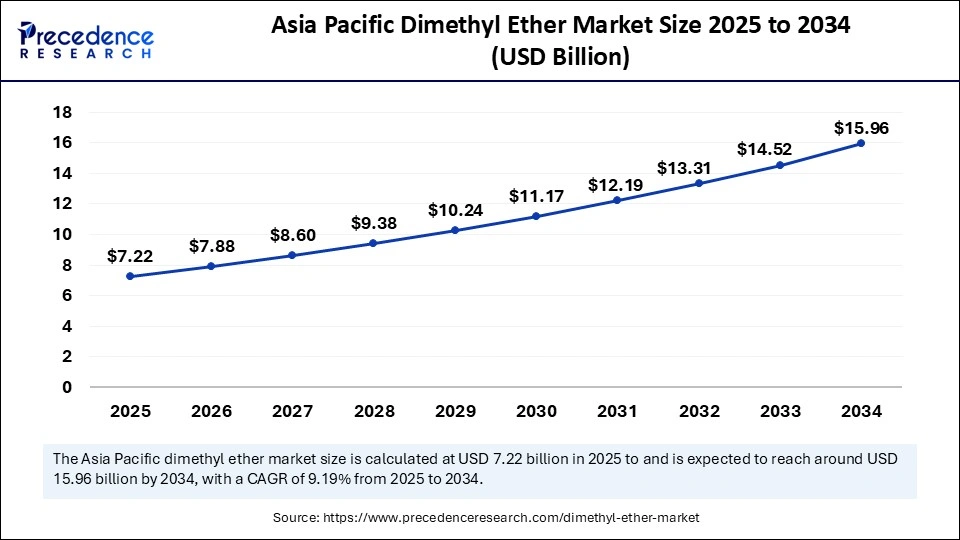

Asia Pacific dimethyl ether market size is exhibited at USD 7.22 billion in 2025 and is projected to be worth around USD 15.96 billion by 2034, growing at a CAGR of 8.26% from 2025 to 2034.

Why Does Asia Pacific Dominate the Dimethyl Ether Market?

Asia Pacific held the dominating share of the dimethyl ether market with the largest revenue share of 64% in 2024. With more industries and increased energy demand, people began asking for cleaner ways to power plants, leading to increased utilization of DME and increased regulation of DME. As coal consumption grows, countries in the Asia Pacific with strict environmental compliance regulations have demanded reductions in greenhouse gas and toxic gas emissions. The strict environmental rules in several Asia Pacific countries aim to cut emissions of greenhouse gases and pollution, so DME becomes an appealing option compared to other fuels.

There is a strong foundation for making DME in large quantities because of China's huge coal and natural gas reserves. Significant investments that promote infrastructure and research, paired with actual or impending air pollution and carbon emissions policies, support the development of DME technologies.

- In November 2024, Balaji Amines Limited, one of the largest producers of Aliphatic Amines & Specialty Chemicals in India, involved in the manufacturing of Methyl Amines, Ethyl Amines, and Derivatives of Amines as well as various Specialty Chemicals, unveiled four new projects that are being commissioned in FY25.

(Source: https://www.indianchemicalnews.com)

What Factors Are Driving the Rapid Growth of the Dimethyl Ether Market in North America?

North America is experiencing the fastest growth in the dimethyl ether market. The lower-sulfur content and combustibility of DME work to its advantage as it is often being deployed to reduce emissions and result in cleaner air through the deployment as a highly combustible fuel source for heavy-duty vehicles, public transportation, and indoors for factories and other transport. They support the trends of clean energy, which include the rise in renewable DME, greater investment in clean fuel alternatives, and there are friendly policies to support clean energy development.

Policies developed by government agencies regarding the reduction of dependence on fossil fuel sources and fulfilling fundamental climate stability objectives are helping advancements with renewable DME technology deployment. Companies in the US are working on catalyst development and also the diversification of various feedstock types, particularly with biomass and waste, to make DME production more efficient and sustainable.

- In May 2024, Lummus Technology announced a unique renewable DME process technology using catalytic distillation called CDDMESM. This technology aims to serve the DME market in the US and sustainably provide low-carbon consumers with an alternate fuel source.

(Source: https://www.lummustechnology.com)

Which Key Trends Are Shaping the Growth of the Dimethyl Ether Market in Europe?

The European dimethyl ether market is expected to account for a substantial market share in 2024, due to the region's strong efforts to decrease emissions and switch to cleaner transport fuels. The strict emission rules of the European Commission, included in the EU's movement toward sustainable transportation, encourage businesses to use low-emission fuels to reach environmental goals. Increasing interest in eco-friendly fuels and products for industry boosts the use of DME in the region.

Raising Steps into Environmental Solutions: Impacts on the German Market

Germany is serious about clean energy and has an advanced chemical industry. The country's modern technology makes it simple to make and move DME fuels, which aids in faster introduction to the market. The national efforts of Germany are based on the EU's environmental priorities, intending to bring down carbon emissions and use renewable energy sources. Because Germany is active in environmental sustainability and has a strong industrial sector, it encouraging DME acceptance within the country and throughout Europe.

- In March 2023, DCC plc and Oberon Fuels announced a strategic alliance to manufacture renewable dimethyl ether (rDME) production plants in Europe. This partnership is designed to help enhance the competitiveness of low-carbon fuel alternatives and help accelerate decarbonization objectives.

(Source: https://www.dcc.ie)

Implementation of the Diesel Option is Fostering MEA

In the future, the MEA dimethyl ether market will experience a notable growth, with the specific involvement of the United Arab Emirates (UAE) and Saudi Arabia in the execution of the seamless use of DME as a diesel alternative for logistics and heavy-duty vehicles. This further helps in decarbonization efforts in the transport sector.

Blooming in the Chemical Industry Focus: Leverages the Saudi Arabian Market

Ongoing developments encompass several leading firms, such as Saudi Aramco and SABIC, which are heavily investing in the progression of their chemicals businesses, like large-scale crude-oil-to-chemicals (COTC) complexes and general chemical production.

Dimethyl Ether Market: Value Chain Analysis

- Feedstock Procurement

This mainly drives the sourcing from different fossil fuels, biomass, or recycled sources.

Key Players: Jiutai Energy Group, Mitsubishi Corporation, Royal Dutch Shell plc, etc. - Waste Management and Recycling

This encompasses production from waste through processes, such as waste-to-DME plants, which convert waste into a low-carbon fuel and lower landfill pollution.

Key Players: Dimeta B.V., NextChem (Maire Tecnimont Group), Enerkem, etc. - Regulatory Compliance and Safety Monitoring

This prominently emphasises its nature as an extremely flammable, pressurized gas with the possibility of forming explosive mixtures with air.

Key Players: WLGA, Air Liquide S.A., DGL Group, etc.

Key Players Offerings:

- Jiutai Energy Group (China)- It is one of the significant producers and suppliers of dimethyl ether (DME), with an annual capacity of 1,150,000 tons.

- Haldor Topsoe (Denmark)- A vital company that facilitates catalysts, technology licensing, and process solutions for the production of dimethyl ether (DME).

- Oberon fuels (U.S.)- This explores commercial production of renewable DME (rDME) for use as a low-carbon transportation fuel.

- GRILLO-Werke AG (Germany)- It mainly provides high-purity dimethyl ether (DME) under the product name "GRILLO-one".

- The Chemours Company (U.S.)- A major leader introduced Teflon fluoropolymers, Krytox performance lubricants, and Viton fluoroelastomers.

Recent Developments

- In May 2025, a pure-energy company based in South Korea called Bio Friends Inc. established a dimethyl ether (DME) production facility in Namrup, Assam, as the first stage of India's commitment to alternative fuels. The production of DME was finalized with a memorandum of understanding (MoU) signed as part of the recently concluded Advantage Assam summit held in Guwahati in February 2025.

(Source: https://www.indiatodayne.in) - In March 2025, ISCC PLUS certification for producing green DME at the Nouryon facility in Rotterdam was announced to provide green credentials on the company's commitment to sustainability and provide customers with ways to minimize carbon footprints without compromising quality.

(Source: https://www.nouryon.com)

- In March 2025, Daya Anagata Nusantara (Danantara), Indonesia's newly established sovereign wealth fund, will fund four dimethyl ether (DME) projects. The Director-General of Mineral and Coal in the Ministry of Energy and Mineral Resources, Tri Winarno, announced that the amount of investment allocated for these DME projects is $11 million.

(Source: https://www.petromindo.com)

Dimethyl Ether Market Companies

- Jiutai Energy Group (China)

- Haldor Topsoe (Denmark)

- Oberon fuels (U.S.)

- GRILLO-Werke AG (Germany)

- The Chemours Company (U.S.)

- MITSUBISHI GAS CHEMICAL COMPANY, INC. (Japan)

- Toyo Engineering Corporation (Japan)

- Shell Global (U.K.)

- Nouryon (Netherlands)

- PCC Group (Poland)

Market Segment

By Raw Material

- Natural gas

- Coal

- Others

By Application

- LPG blending

- Aerosol propellant

- Transportation fuel

- Others

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content