Disposable Surgical Devices Market Size and Forecast 2025 to 2034

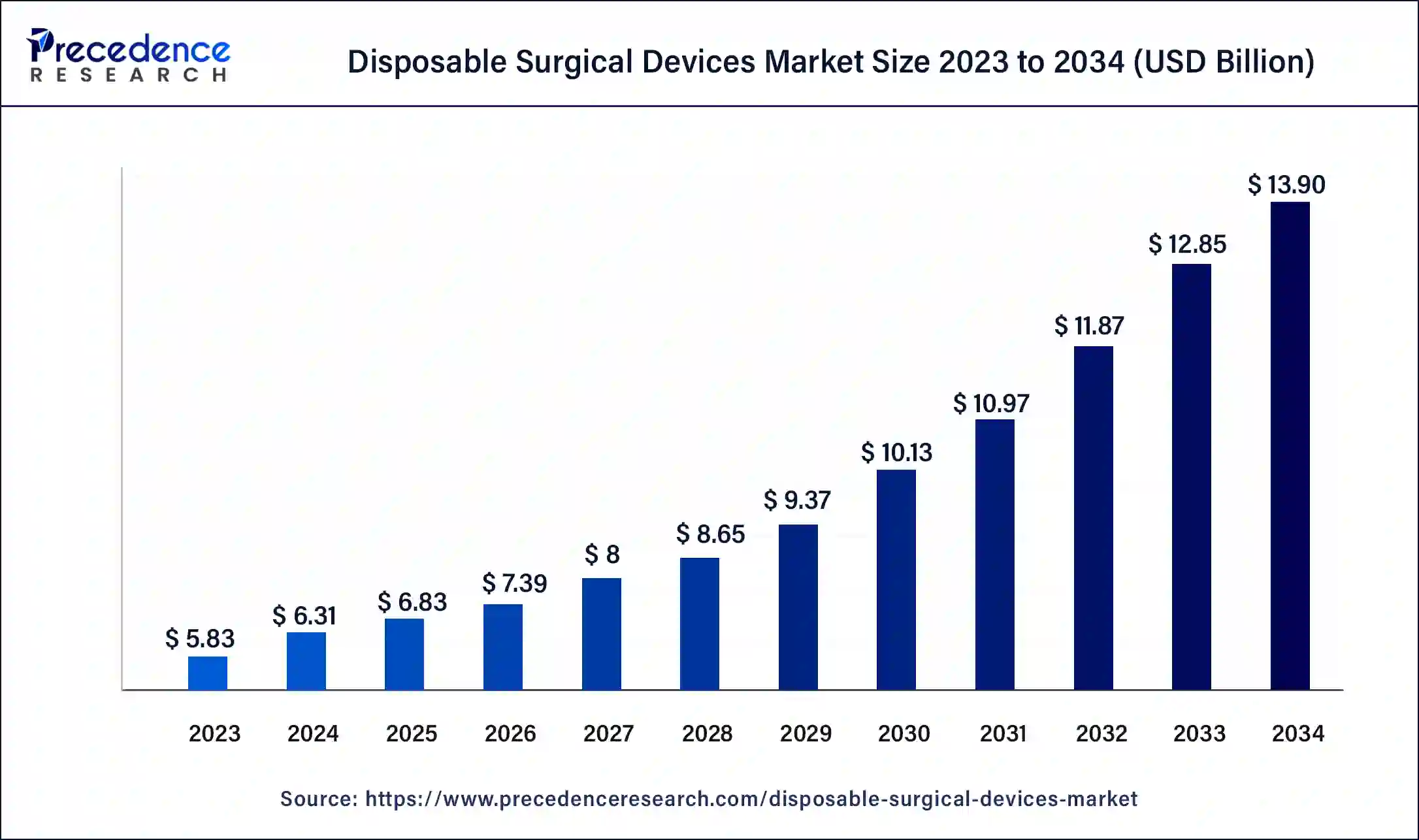

The global disposable surgical devices market size is projected to be worth around USD 13.90 billion by 2034 from USD 6.31 billion in 2024, at a CAGR of 8.22% from 2025 to 2034. The North America disposable surgical devices market size reached USD 1.98 billion in 2023.The disposable surgical devices market is driven by the rising rates of chronic illness.

Disposable Surgical Devices Market Key Takeaways

- The global disposable surgical devices market was valued at USD 6.31 billion in 2024.

- It is projected to reach USD 13.90 billion by 2034.

- The market is expected to grow at a CAGR of 8.22% from 2025 to 2034.

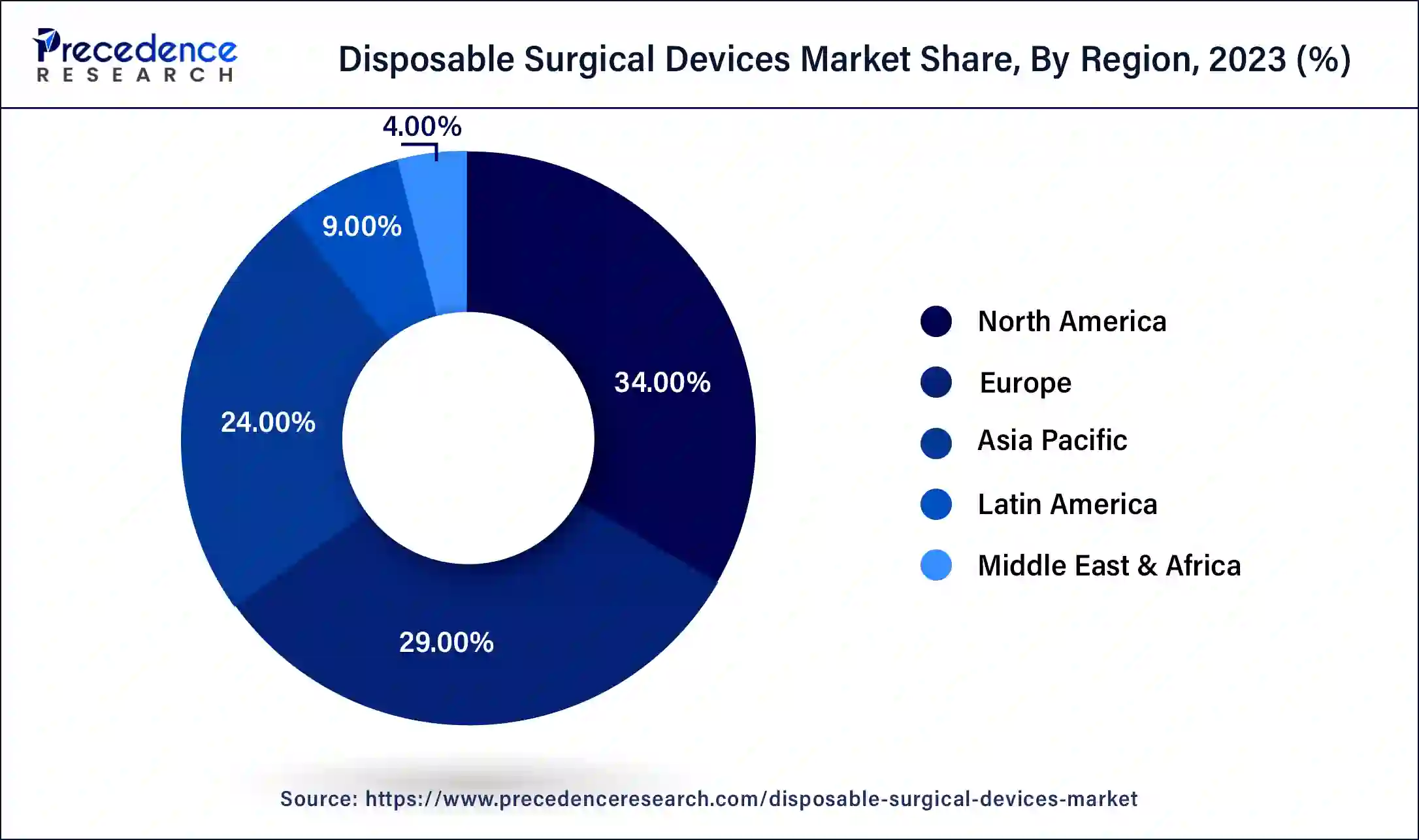

- North America dominated the disposable surgical devices market with the largest market share of 34% in 2024.

- Asia Pacific is observed to grow at the fastest rate during the forecast period.

- By product, the surgical sutures & staplers segment has contributed more than 47% of market share in 2024.

- By product, the electrosurgical devices segment is expected to grow at a solid CAGR of 9.03% during the forecast period.

- By application, the general surgery segment has generated the largest market share of 25% in 2024.

- By application, the plastic & reconstructive surgery segment is expected to expand at a notable CAGR during the forecast period.

U.S. Disposable Surgical Devices Market Size and Growth 2025 to 2034

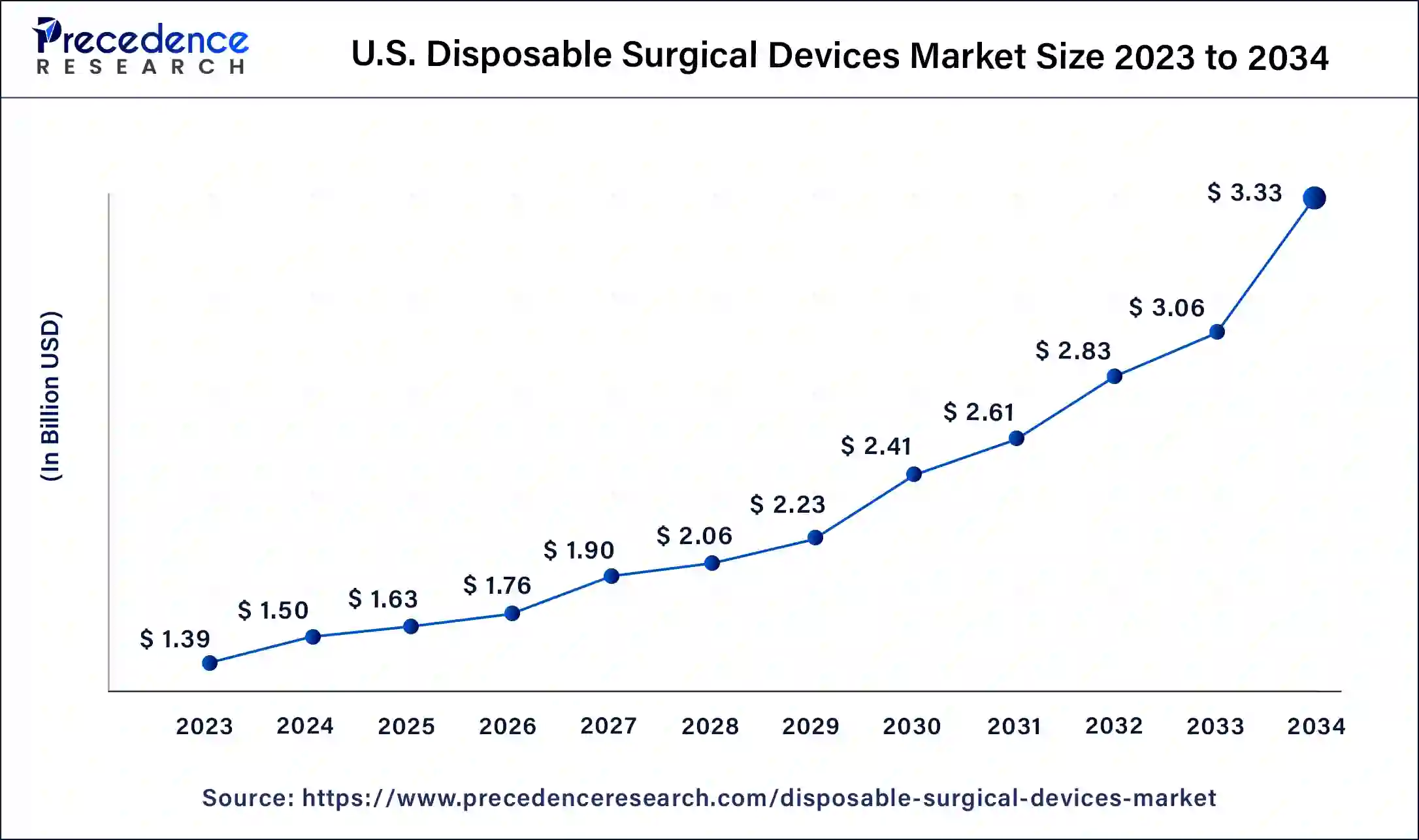

The U.S. disposable surgical devices market size is evaluated at USD 1.50 billion in 2024 and is projected to be worth around USD 3.33 billion by 2034, poised to grow at a CAGR of 8.30% from 2025 to 2034.

North America dominated in the disposable surgical devices market in 2024. One of the most sophisticated healthcare systems in the world is found in North America, especially in the United States. Because there are many hospitals, surgical centers, and outpatient clinics in the area, there is a constant need for disposable surgical instruments. Strict regulations about the safety and effectiveness of surgical devices have been set by the Food and Drug Administration (FDA) of the United States and other regulatory agencies in North America. Although this makes it difficult to enter the market, it guarantees that the available goods are high caliber, fostering confidence and promoting the broad use of disposable electronics.

Most Common Surgeries in U.S. in 2023

| Sr.No. | Name of Surgeries | Estimated Data |

| 1. | Cataract Removal | Approx 4 Million |

| 2. | C-section | Approx 1.3 Million |

| 3. | Gall Bladder Removal | Approx 1.2 Million |

| 4. | Heart Bypass Surgery | Approx 400,000 |

Asia Pacific is observed to grow at the fastest rate in the disposable surgical devices market during the forecast period. In nations such as South Korea, China, Japan, and Korea, a sizable fraction of the population is getting older, which is associated with an increased incidence of age-related operations and chronic illnesses. Because older people typically need more surgical procedures, there is a greater need for disposable surgical equipment.

The tightening of medical cleanliness standards in many of the region's nations encourages the use of single-use surgical instruments. The usage of disposables is being promoted by regulatory agencies to improve patient safety and adhere to global standards.

- According to the nationally representative survey, even though they were not medically required to have one, 1 in 5 pregnant women in India had a CS. India's rates are much higher than the 15% WHO guideline, presenting a serious public health risk. The rate of computer science delivery in private facilities is 47.4%, while in public facilities, it is 14.3%.

Market Overview

Innovative biocompatible materials and environmentally friendly disposal techniques are becoming increasingly significant in this sector. Single-use equipment may seem more expensive initially, but it saves money in the long run by eliminating the need for maintenance, cleaning, and sterilizing. It also simplifies hospital operations. The market for disposable surgical equipment is expanding due to an aging population, an increased need for surgeries, and greater awareness of the hazards associated with infections. As such, it is an essential part of the worldwide healthcare sector.

- In November 2023, for over $300 million, Cook Medical sold several medical device assets to Cooper Companies, primarily focused on the obstetrics, gynecology surgery, and Doppler monitoring industries. As part of the agreement, Cooper Companies paid $200 million upon the transaction's closure. The remaining $100 million will be paid by the business in two yearly installments.

Disposable Surgical Devices Market Trends

- Chronic diseases, commonly referred to as noncommunicable diseases (NCDs), are characterized by a protracted course and a confluence of behavioral, physiological, environmental, and genetic factors.

- The National Library of Medicine projects that in 2023, there will be 609,820 cancer deaths and 1,958,310 new cancer cases in the US.

- Mykare Health, a startup creating a marketplace for elective surgery, has raised $2.01 million from operators of accelerator programs such as OnDeck ODX, Huddle, and others.

- With nearly 6.1 million treatments, the US performed the most globally, followed by Brazil (3.3 million), which leads the globe in surgical procedures (2.1 million). According to estimates, the US and Brazil have the most plastic surgeons, followed by South Korea, Japan, China, and India.

How AI Will Help Medical Devices Industry?

The usage of machine learning in healthcare has increased due to the significant advancements in artificial intelligence (AI) over the past ten years. Through ML, AI can lower risk and improve the efficiency of medical device manufacturing. Computers can ingest big data, and they can learn from mistakes. Combined with automation, this boosts productivity and eliminates the chance of human error. Over the past few years, the COVID-19 pandemic has dramatically increased the popularity of the digital health industry. Telehealth and digital health metrics are still becoming more and more well-liked.

AI will, therefore, play a more significant role in ensuring that needs can be satisfied. AI and digital health are closely related, and AI can help patients have simpler access to and use of digital health. In 2022, the FDA expedited the clearance process for AI-powered medical equipment, and this practice is anticipated to last until 2023. Providers can incorporate AI into their regular operations as additional AI-based instruments and gadgets get authorized.

A group of Clemson University-led researchers from South Carolina have joined forces to use artificial intelligence to advance healthcare diagnosis and treatment in the state. The multi-institutional initiative named Artificial Intelligence-Enabled Devices for the Advancement of Personalized and Transformative Health Care in South Carolina, or ADAPT-SC, is set to receive a $20 million, five-year investment from the National Science Foundation.

Disposable Surgical Devices Market Growth Factors

- The need for surgical interventions is being driven by the rising prevalence of chronic diseases, including diabetes, cancer, and cardiovascular diseases, which is propelling the market for disposable surgical equipment.

- Disposable product usage is being aided by stricter rules prohibiting the reuse of surgical instruments to prevent infections. This drives the growth of the disposable surgical devices market.

- As minimally invasive surgical techniques have faster recovery times and fewer complications, their adoption is becoming increasingly popular. Disposable gadgets are frequently needed for these treatments.

- Developing sophisticated disposable surgical instruments with improved features and functionalities drives market expansion.

- The fast growth of healthcare infrastructure in developing nations drives demand for disposable surgical instruments.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.90 Billion |

| Market Size in 2025 | USD 5.83 Billion |

| Market Size in 2024 | USD 6.31 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

A growing number of surgeries

Age-related illnesses like cancer, orthopedic problems, and cardiovascular ailments are becoming more common as the world's population ages. As a result, there is an increased requirement for procedures and disposable surgical equipment. The ability of disposable surgical instruments to reduce infection is one of their main advantages. Inadequate sterilization of reusable devices may contribute to the spread of hospital-acquired infections (HAIs). Disposable devices are a popular option in many surgical settings since they minimize risk because they are only used once before being thrown away.

Restraint

High cost associated with single-use devices

Hospitals and clinics are examples of healthcare facilities that operate on tight budgets. Single-use disposable surgical instruments are expensive, raising operating costs and making it difficult for these organizations to manage their funds properly. This is especially true in areas with constrained healthcare budgets or publically financed healthcare systems, where cost containment is essential. Disposable devices have advantages, including lower cross-contamination risk and increased patient safety, but some people may question their usefulness because of their high cost. Particularly in the case of reusable choices, healthcare practitioners may wonder if the advantages justify the significant price outlay.

Opportunity

Expansion of healthcare infrastructure in emerging economies

The need for high-quality healthcare services is expanding in emerging nations due to the growth of the middle class. The need for increasingly sophisticated medical operations is being driven by this demographic transition, raising the need for disposable surgical instruments. To protect patients and lower the danger of infection, the middle class is more inclined to seek medical care in well-equipped facilities, which are more likely to utilize disposable surgical instruments. Emerging nations are embracing new medical device breakthroughs and technologies while developing their healthcare infrastructure. This involves creating and utilizing more sophisticated disposable surgical instruments that increase security and efficiency.

Product Insights

The surgical sutures & staplers segment dominated the disposable surgical devices market in 2023. Staplers and surgical sutures are necessary for wound closure following various surgical operations. Surgeons prefer these devices because they can limit the danger of infection and successfully enhance wound healing. The rise in minimally invasive surgical procedures has led to an increase in demand for specialized sutures and staplers. These procedures frequently call for more accurate, smaller wound closures requiring sophisticated suturing and stapling tools.

The electrosurgical devices segment is observed to be the fastest growing in the disposable surgical devices market during the forecast period. This market has grown due to the development of sophisticated electrosurgical tools, such as those with increased precision, energy efficiency, and improved safety features. Among these innovations is the incorporation of intelligent technology that enables feedback-controlled energy delivery and real-time tissue response monitoring.

Because surgical operations are increasingly focused on safety, disposable electrosurgical equipment that adheres to strict safety regulations has become more common, lowering the possibility of cross-contamination and infection.

- In June 2023, the latest electrosurgical generator from Olympus Corporation, a multinational medical technology corporation dedicated to improving people's lives through health, safety, and fulfillment, has been made available for purchase. It is intended for the treatment of enlarged prostates and bladder cancer.

Application Insights

The general surgery segment dominated the disposable surgical devices market in 2024. Appendicectomies, hernia repairs, gallbladder removals, and other abdominal surgeries are among the procedures that fall within the general surgery category. Because these are the most common surgeries done globally, there is a significant market for disposable surgical equipment. Disposable tools are a more affordable option, especially in high-volume procedures, as opposed to reusable equipment, which needs to be cleaned and maintained. Due to this financial benefit, disposable surgical instruments are now more desirable in general surgery. Most surgeries conducted worldwide are general surgeries, accounting for the most significant market share for disposable surgical instruments.

- Gallstones affect about 20 million people in the United States. Approximately 300,000 cholecystectomies are performed on these individuals each year.

The plastic & reconstructive surgery segment is observed to be the fastest growing in the disposable surgical devices market during the forecast period. Plastic surgery is becoming more widely available and appealing to a broader range of people thanks to advancements in surgical techniques, especially minimally invasive procedures. These methods frequently produce more natural-looking results, shorter recovery times, and fewer issues. Reconstructive procedures, such as breast reconstruction after mastectomy, are in greater demand due to the rise in cancer cases, especially breast cancer. Disposable surgical equipment must be used during these operations to protect patients and avoid cross-contamination.

Disposable Surgical Devices Market Companies

- B. Braun SE

- Smith+Nephew

- Aspen Surgical

- CooperSurgical Inc.

- Surgical Innovations

- Alcon Laboratories, Inc.

- Zimmer Biomet.

- Medtronic

- BD

- Ethicon

Recent Developments

- In September 2023, Prominent healthcare technology company Medtronic plc recently announced that its new disposable Simplera continuous glucose monitor (CGM), which has an easy two-step insertion procedure, has received CE Mark approval. Overtape is not necessary with the company's most recent non-fingerstick sensor. The InPen smart insulin pen, which offers real-time, individualized dose instructions to assist ease diabetes management, is seamlessly linked with it.

- In July 2023, EndoTheia, Inc. reported that their ground-breaking technology, which significantly enhances minimally invasive endoscopic surgery, has completed a first-in-human clinical study conducted at Vanderbilt University. EndoTheia is happy to inform you that all primary and secondary endpoints were reached with no unfavorable events.

Segments Covered in the Report

By Product

- Surgical Sutures & Staplers

- Handheld Surgical Devices

- Electrosurgical Devices

By Application

- Neurosurgery

- Plastic & Reconstructive Surgery

- Wound Closure

- Obstetrics & Gynecology

- Cardiovascular

- Orthopedic

- General Surgery

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting