Dry Chemistry Analyzers Market Size and Forecast 2025 to 2034

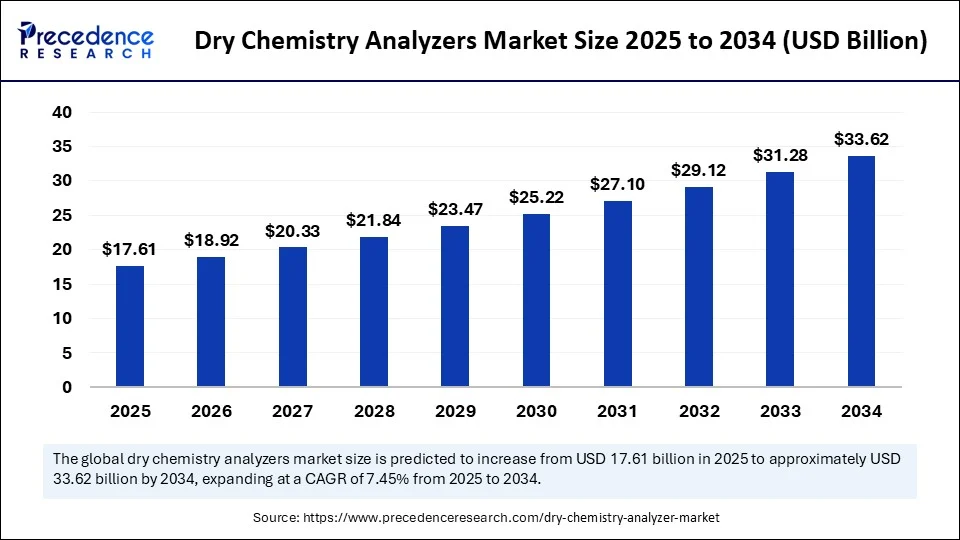

The global dry chemistry analyzers market size accounted for USD 16.39 billion in 2024 and is predicted to increase from USD 17.61 billion in 2025 to approximately USD 33.62 billion by 2034, expanding at a CAGR of 7.45% from 2025 to 2034. The dry chemistry analyzers market is driven by demand for fast, accurate, and cost-effective diagnostic tools in healthcare, pharmaceuticals, and point-of-care testing.

Dry Chemistry Analyzers MarketKey Takeaways

- In terms of revenue, the global dry chemistry analyzers market was valued at USD 16.39 billion in 2024.

- It is projected to reach USD 33.62 billion by 2034.

- The market is expected to grow at a CAGR of 7.45% from 2025 to 2034.

- North America dominated the dry chemistry analyzers market in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecast years.

- By product type, the analyzers segment held a significant share in 2024.

- By product type, the reagents segment is anticipated to show considerable growth in the market over the forecast period.

- By mechanism type, the semi-automatic segment captured the biggest market in 2024.

- By mechanism type, the fully automatic segment is anticipated to show considerable growth in the market over the forecast period.

- By modality, the centralized segment contributed the highest market share in 2024.

- By modality, the decentralized segment is anticipated to show considerable growth over the forecast period.

- By end-user, the hospitals and clinics segment accounted for major market share in 2024.

- By end-user, the biopharmaceutical companies segment is anticipated to show considerable growth in the market over the forecast period.

How is AI Enhancing the Accuracy of Dry Chemistry Analyzers?

Integrating artificial intelligence with dry chemistry analyzers enhances diagnostic accuracy, improves the time to analysis, and improves clinical diagnosis. AI algorithms can analyze large amounts of information, detect trends, and limit the potential for human error. The use of dry chemistry analyzers with AI capability eliminates manual processes in the sample analysis by automating sample analysis, result verification, and quality control, which allows most labs to achieve a significant increase in production. As the AI technologies progress, their use is likely to bring innovations and shorten the turnaround time of diagnostic tests and enhance the overall patient treatment and workflow efficiencies within the healthcare systems.

Market Overview

Dry chemistry analyzers are advanced diagnostic instruments that utilize test strips or slides. These analyzers offer quick, sensitive results with minimal sample preparation, making them suitable for clinical labs, point-of-care tests (POCT), and veterinary diagnostics. Their compact size, ease of use, and portability are contributing to their growing popularity in decentralized healthcare settings.

The dry chemistry analyzers market is experiencing positive growth due to the increasing demand for rapid, accurate, and convenient diagnostic products. Another significant driver is the growing emphasis on automation and real-time data analysis, which enhances operational efficiency in clinical and research environments. The rising prevalence of chronic diseases, such as diabetes and cardiovascular diseases, is also fueling the demand for routine and accessible biochemical testing at the point of care.

What Factors Are Fueling the Rapid Expansion of the Dry Chemistry Analyzers Market?

- Increasing the Prevalence of Chronic Disease: Extended use of the dry chemistry analyzers can lead to a diagnosis of the disease in its early stages and allow for monitoring the disease on a long-term basis, which is important to the treatment of the chronic condition and better patient care.

- Expansion of Point-of-Care-Testing: Decentralization of healthcare and the development of POC diagnostics contribute to the promotion of dry chemistry analyzers. This makes them portable, convenient to use, and fast, which allows health professionals to perform on-site testing during an emergency and in a remote area.

- Technological Advancements: Automation, sensor technology, and data integration innovations have proved to improve the accuracy, efficiency, and user-friendliness of dry chemistry analyzers. Such advancements promote general clinical use and facilitate easy integration with the healthcare IT infrastructure, enhancing their growth in the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 33.62 Billion |

| Market Size in 2025 | USD 17.61 Billion |

| Market Size in 2024 | USD 16.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.45% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Mechanism Type, Modality, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Point-of-care (POC) Diagnostics

The increasing demand for POC diagnostics drives the growth of the dry chemistry analyzers market. POC testing allows medical professionals to conduct tests and obtain results almost immediately at the point of care, such as in healthcare facilities, ambulances, or even a patient's home. These tests require minimal training, no liquid reagents, and small sample sizes, making them convenient for quick and reliable testing in various healthcare settings. The rise in chronic diseases like diabetes, cardiovascular disorders, and renal diseases further drives the need for POC testing. Dry chemistry analyzers offer an efficient and rapid method for daily tests, including blood glucose and lipid profiles, which are essential for managing these conditions.

Restraint

High Initial Investment and Technical Limitations

One significant challenge for the dry chemistry analyzers market is the high initial cost of purchasing and installing the devices, along with the necessary accessories. The analyzers also have ongoing costs for maintenance, calibration, and the purchase of testing supplies. Additionally, dry chemistry analyzers can be sensitive to external conditions and sample quality, which can impact the accuracy and reliability of test results. Factors like temperature, humidity, and improper sample handling can affect performance and lead to inconsistent readings, potentially limiting their use in specialized or high-precision laboratories.

Opportunity

Rise of Personalized Medicine and Remote Diagnostics

Personalized medicine is the approach to finding a personal solution in terms of cure and medical approach to health conditions according to the particular genetic setup, lifestyle, and health disorder of an individual. This methodology requires rapid, reliable, and readily available diagnostic instruments to provide up-to-date figures during decision-making. Their capacity to provide instant outcomes with minimal sample preparation makes the method desirable in personalized care environments, particularly management of chronic diseases. Furthermore, telemedicine and remote patient monitoring are enhanced by integrating dry chemistry analyzers into mobile health platforms, enabling patients to perform basic tests at home and share results with healthcare providers via the cloud.

Product Type Insights

Why Did the Analyzers Segment Lead the Dry Chemistry Analyzers Market in 2024?

The analyzers segment led the market and accounted for the largest revenue share in 2024. Dry chemistry analyzers are favored for their ease of use, requiring minimal maintenance and training, making them suitable for various clinical settings. The increasing demand for rapid and reliable diagnostics, especially in managing chronic conditions like diabetes and cardiovascular diseases, further drives their adoption. The analyzer segment maintains a leading position in the market due to the growing preference for quick and convenient testing in healthcare.

The reagents segment is expected to grow at a significant CAGR over the forecast period. Reagents are pre-pipetted to the test strips or slides in the form of stable, dry reagents and have a long shelf life, and show variability in performance. Upon contact with a biological sample, a chemical reaction occurs, indicated by a color change or fluorescence, which the analyzer uses to measure the analyte concentration. This method is user-friendly, convenient, and well-suited for both clinical and home testing environments.

Mechanism Type Insights

What Made Semi-Automatic the Dominant Segment in the Market in 2024?

The semi-automatic segment dominated the dry chemistry analyzers market with a major revenue share in 2024. The semi-automatic dry chemistry analyzer finds widespread usage in clinics and small laboratories where flexibility, low costs, and usability are the key issues. They can analyze serum, cerebrospinal fluid, urine, and whole blood sensibly and quickly with sufficient precision. Semi-automatic analyzers are smaller, easier to use, and cheaper than fully automated systems. Since there is a steady increase in the demand for point-of-care testing and simple diagnostics all around the world, especially in developing parts, semi-automatic analyzers fit in as an efficient and affordable type.

The fully automatic segment is expected to grow at the fastest rate in the dry upcoming period. This is mainly due to the increasing demand for rapid testing. Automatic dry chemistry analyzers help to minimize human errors and improve the efficiency of the work process. Modern automated systems offer more accurate and consistent outcomes with sensitive functions like multi-test panels, data management, and linkage with laboratory information systems. Their scalable, user-friendly interfaces and automated calibration procedures make work easier in the laboratory. Furthermore, with the healthcare sector's move towards automation and computerization, fully automatic analyzers are becoming more cost-effective and affordable.

Modality Insights

How Does the Centralized Segment Dominate the Dry Chemistry Analyzers Market in 2024?

The centralized segment dominated the market with the largest revenue share in 2024. Centralized dry chemistry analyzers are utilized most widely in high-volume, multi-test clinical laboratories and many hospital settings. Centralized analyzers are designed for large-volume processing, scalable use, and integration. They are often interfaced with Laboratory Information Systems (LIS) to provide a streamlined workflow, improve the accuracy of the data generated, and enable lab instruments to communicate effectively with hospital information systems. The centralized dry chemistry analyzers will continue to play an important role in addressing the challenges presented by an increasing number of chronic diseases and the demand for comprehensive laboratory diagnostics.

The decentralized segment is expected to grow at a significant CAGR over the forecast period. Located at or near the patient's clinic, mobile health units, and even homecare settings, decentralized dry chemistry analyzers are compact and portable devices. These analyzers empower healthcare professionals to make decisions in acute care settings and the management of chronic diseases, for instance, monitoring glucose or cholesterol levels. There is also a heightened emphasis within the industry on personalized medicine telehealth, which makes healthcare accessible even in underserved regions, therefore increasing the need for these analyzers.

End-User Insights

Why Did the Hospitals & Clinics Segment Dominate the Market in 2024?

The hospitals & clinics contributed the most revenue share in 2024. With their efficient provision of fast, qualitative, and precise test outcomes, dry chemistry analyzers have become a mandatory component of a hospital. With sophisticated sensors, these analyzers can reveal any trace of biochemical materials in blood and urine samples, among others, and provide accurate results that can guide superior clinical choices. The main advantage of these analyzers is that they can perform a multitude of tests quickly, even from moderate screening to life-saving diagnostics. The increased patient volumes undergoing diagnostic procedures bolstered the growth of the segment.

The biopharmaceutical companies segment is expected to grow at the fastest CAGR during the projection period. Dry chemistry analyzers are highly beneficial to biopharmaceutical companies due to their speed, portability, and ease of use, which are crucial in demanding lab environments. They efficiently monitor biochemical parameters in drug development and clinical trials, providing precise data essential for regulatory requirements and product safety. The speed and accuracy of dry chemistry analyzers also reduce turnaround times for critical tests, accelerating decision-making in experimental protocols.

Regional Insights

Why Did North America Dominate the Dry Chemistry Analyzers Market in 2024?

North America dominated the market by holding the largest revenue share in 2024. This is mainly due to the increased demand for laboratory tests in the region, driven by an aging population, and the prevalence of chronic diseases like diabetes, cardiovascular disorders, and kidney diseases is a primary driver. Additionally, the high level of point-of-care testing (POCT) usage, coupled with significant healthcare investment and favorable reimbursement levels, has contributed to the rapid assimilation of dry chemistry analyzers in the hospitals, clinics, and laboratories of the region. Ongoing research and development efforts continue to sustain this market leadership. The increased incidence of chronic illnesses, such as diabetes and heart disease, has propelled the need for fast and dependable testing, further increasing the utilization of dry chemistry analyzers in hospitals, diagnostic labs, and point-of-care settings. Positive reimbursement strategies and government policies aimed at enhancing healthcare access and quality further contribute to the market's development.

- In April 2024, the URIT UC-1800 Urine Analyzer successfully passed the U.S. FDA approval, which is the success of the URIT US-2000 series artificial intelligence. This module of dry chemicals analysis has only one speed of measuring (up to 480T/H), which opens the possibility of targeting high-end markets.

Why is Asia Pacific Undergoing the Fastest Growth in the Dry Chemistry Analyzers Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. This growth is mainly attributed to the growing demand from pharmaceutical and healthcare organizations. The growing aging population in developing nations is driving the demand for cost-effective and efficient diagnostic tools. Market growth is enhanced by improvements in healthcare infrastructure and increased awareness of point-of-care testing in rural, underserved communities.

China is a major market in the Asia Pacific, fueled by its large population and expanding healthcare facilities. The rising incidence of chronic diseases in China necessitates adequate and affordable diagnostic solutions. Market expansion is further supported by the rising middle-income bracket and increased healthcare spending in China. Additionally, the focus on digital health and telemedicine makes portable and user-friendly analyzers even more appealing.

What Are the Key Trends in the European Dry Chemistry Analyzers Market?

Europe is considered to be a significantly growing area. The adoption of dry chemistry analyzers in health sectors has increased due to technological developments, high regulatory standards, and an established healthcare system in Europe. The increased incidence of chronic diseases and the importance of early detection drive the need for rapid, point-of-care testing solutions, boosting market growth. The UK market is driven by its developed medical system and innovative medical diagnostics. Investment in personalized medicine and digital health has increased the use of sophisticated analyzers that provide fast, accurate results. Government policies promoting point-of-care testing in urban and rural clinics have also increased the application of portable and user-friendly dry chemistry analyzers.

Dry Chemistry Analyzers Market Companies

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Thermo Fisher Scientific Inc

- Danaher Corporation

- Abbott Laboratories

- Siemens Healthineers

- F. Hoffmann-La Roche Ltd

- Horiba

- ELITechGroup

- QuidelOrtho Corporation

- Randox

Recent Developments

- In July 2024, the Seamaty SD3, a fully automated dry chemistry analyzer used in Point-of-Care Testing (POCT), was released. It uses an innovative fan-shaped reagent tray design and is able to process 3 samples or tests in parallel, which improves the throughput and saves cost over analyzers that use traditional circular trays.

(Source: https://en.seamaty.com)

- In February 2024, Beckman Coulter Diagnostics launched its new DxC 500 AU Chemistry Analyzer during Medlab Middle East on February 5-8, 2024, in Dubai. This automated clinical chemistry analyzer belongs to a family of solutions aiming at bolstering the attributes of satellite and independent hospital laboratories, in addition to larger central hub laboratories.

(Source: https://www.labmedica.com)

- In July 2023, Siemens Healthineers Atellica acquired FDA clearance on its 1 in vitro diagnostic measurement system to carry out immunoassay and clinical chemistry testing. As a competitive advantage, analyzers enable labs with low to medium-volume testing to have high predictability of turnaround time, an improved ability to manage reporting, and better safety and security.

(Source: https://www.siemens-healthineers.com)

Segments Covered in the Report

By Product Type

- Analyzers

- Reagents

- Others (consumables, etc.)

By Mechanism Type

- Semi-automatic

- Fully automatic

By Modality

- Centralized

- Decentralized

By End-user

- Hospitals & clinics

- Biopharmaceutical Companies

- Diagnostic Laboratories

- Blood Banks

- Others (research institutes, etc.)

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting