E-commerce Automotive Aftermarket Size and Forecast 2025 to 2034

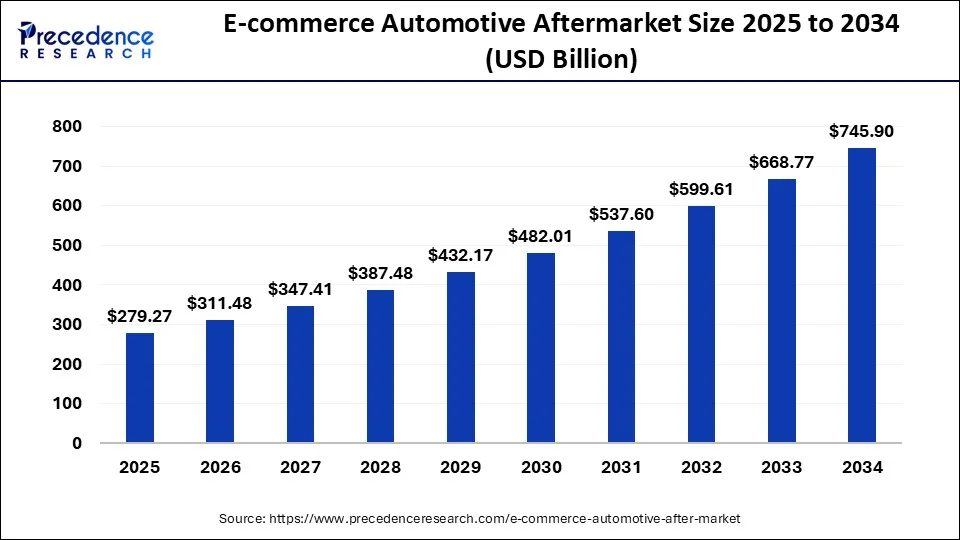

The global e-commerce automotive aftermarket size was calculated at USD 250.39 billion in 2024 and is expected to reach around USD 745.90 billion by 2034. The market is expanding at a solid CAGR of 11.53% over the forecast period 2025 to 2034. The North America e-commerce automotive aftermarket size reached USD 82.63 billion in 2024. The rising demand for online shopping across the world is driving the growth of the e-commerce automotive aftermarket.

E-commerce Automotive Aftermarket Key Takeaways

- The global e-commerce automotive aftermarket was valued at USD 250.39 billion in 2024.

- It is projected to reach USD 745.90 billion by 2034.

- The e-commerce automotive aftermarket is expected to grow at a CAGR of 11.53% from 2025 to 2034.

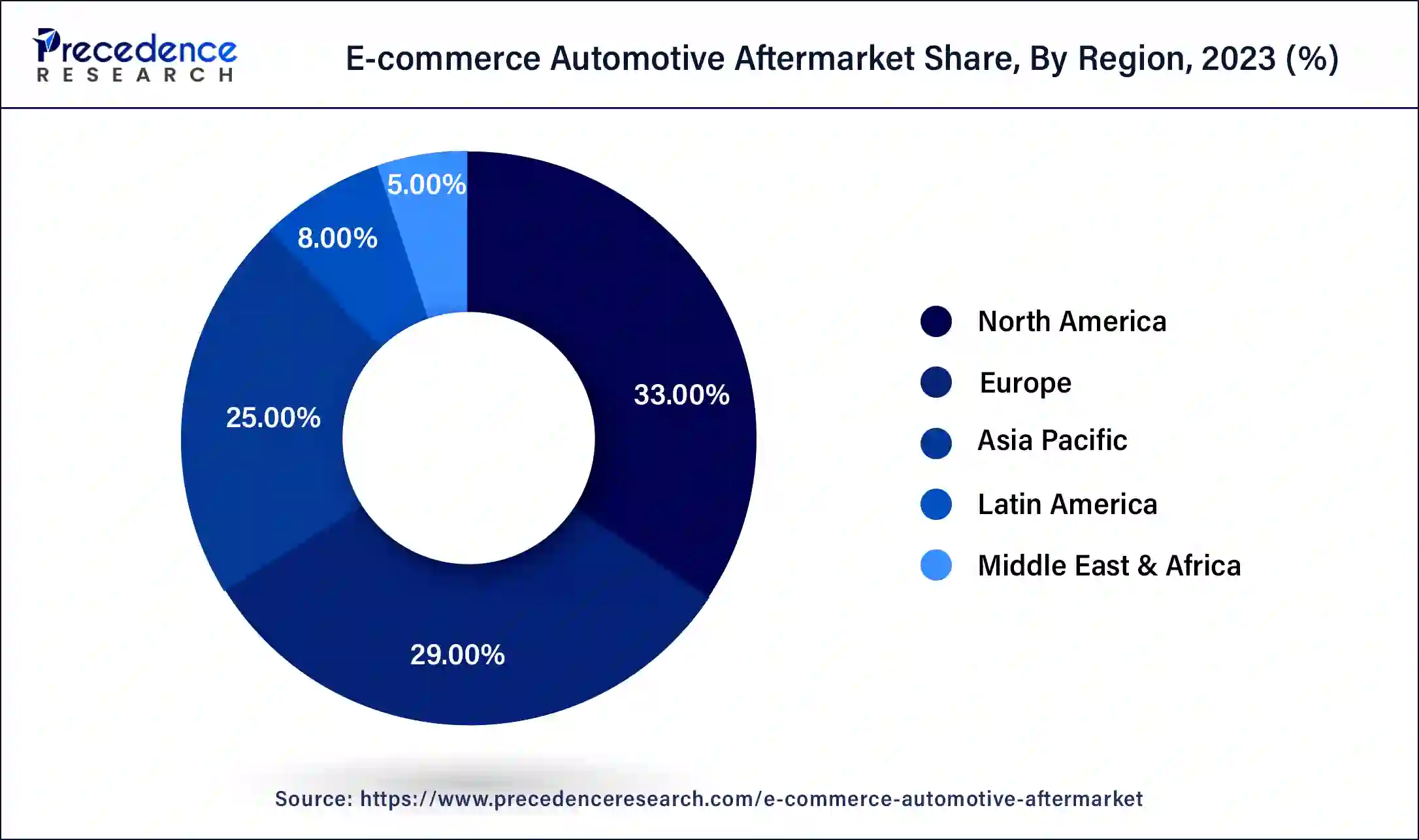

North America led the e-commerce automotive aftermarket with the highest share of 33% in 2024. - Europe is expected to attain the fastest rate of growth during the forecast period.

- By end-use, the business to customer segment has accounted market share of 86% in 2024.

- By replacement parts, the transmission and steering segment held the largest share of the market in 2024.

- By replacement parts, the electrical parts segment is estimated to exhibit the fastest growth rate during the forecast period.

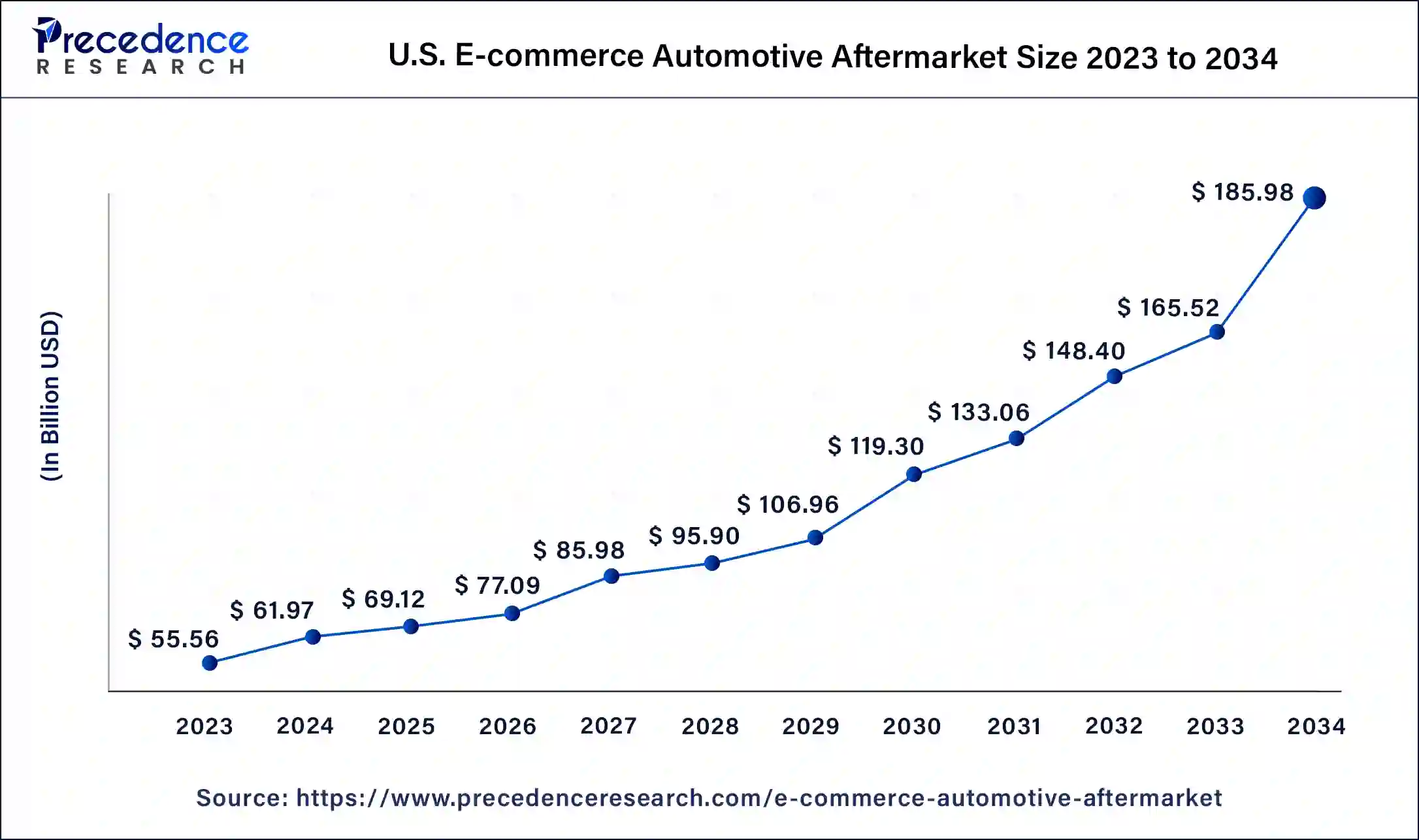

U.S. E-commerce Automotive Aftermarket Size and Growth 2025 to 2034

The U.S. e-commerce automotive aftermarket size was exhibited at USD 61.97 billion in 2024 and is projected to be worth around USD 185.98 billion by 2034, poised to grow at a CAGR of 11.62% from 2025 to 2034.

North America held the largest share of the e-commerce automotive aftermarket in 2024. The market's growth in this region is mainly driven by the rising technological advancements in the automotive industry and several government initiatives to develop the e-commerce sector in countries such as the U.S. and Canada. The growing developments in the automotive industry in countries such as the U.S. and Canada, along with rising government funding for developing the EV industry across this region, have helped the industry to grow in this region.

Moreover, the presence of several local market players in the market, such as Advance Auto Parts, Inc., Amazon, RockAuto LLC, TecAlliance TecCom, and some others, are continuously engaged in providing automotive aftermarket products for the automotive industry and adopting several strategies such as partnerships, launches, and business expansions, which in turn drives the growth of the e-commerce automotive aftermarket in this region.

- In July 2023, the U.S. Customs and Border Protection (CBP) relaunched an e-commerce strategic plan. This plan is developed to develop the overall e-commerce sector across the country.

- In May 2024, the U.S. government announced that it would invest around 1.3 billion USD in developing EV infrastructure across the country.

- In October 2023, JNPSoft OptiCat announced the launch of the TecAlliance TecCom global e-business platform. This launch is done to provide automotive aftermarket products mainly across the North American region and other parts of the world.

Europe is expected to be the fastest-growing region during the forecast period. The rising trend of SUV vehicles, along with growing advancements in automotive technologies, has increased the demand for the e-commerce automotive aftermarket industry across the region, boosting the market growth. Moreover, the presence of automotive companies such as BMW, Ferrari, Stellantis, Volvo, Lamborghini, Xpeng, Mercedes Benz, and some others has increased the demand for automotive spare parts through online platforms in several countries such as Italy, Germany, France, Netherlands, and some others, has boosted the market growth to some extent in the European region.

Additionally, the presence of various local companies in the market, such as Alliance Automotive Group, ORAP, Autozilla Solutions, and some others, are offering automotive aftermarket components across the European region, which, in turn, is expected to drive the growth of the e-commerce automotive aftermarket industry in this region.

- In June 2023, Volkswagen launched a new SUV named ‘Tiguan' in Europe. This SUV comes with several superior features, such as a modern cockpit design, a Car2X warning system, front assist (emergency braking system), side assist (lane change assist), and others. It also has eight different mild hybrids (eTSI), turbocharged petrol (TSI), plug-in hybrid (eHybrid), and turbocharged diesel (TDI) drives.

- In February 2022, XPENG announced a partnership with Emil Frey to provide aftermarket sales and services through online platforms in the European region.

- In October 2022, Alliance Automotive Group launched a new e-commerce website to provide U.K. customers with aftermarket parts for their vehicles.

Market Overview

The e-commerce automotive aftermarket market is one of the important industries in the automotive domain. This industry mainly deals in delivering automotive aftermarket parts to people and companies across the world. The growing developments in the automobile industry, along with the integration of modern technologies in vehicles, drive the growth of the aftermarket. This industry comprises replacement parts that mainly include engine parts, braking parts, electronics, steering and controls, suspension systems, lightning parts, and some others. The end-users of this industry mainly include business-to-business (B2B) and business-to-customer (B2C). The e-commerce automotive aftermarket industry is expected to grow exponentially with the growth in e-commerce and automotive industries.

- According to AutoZone's annual report, the company's other segments include ALLDATA and e-commerce. The other segment generated net sales of US$312,072,000 in the last fiscal year, which ended in August 2023.

E-commerce Automotive Aftermarket Growth Factors

- The increasing developments in the technological sector have led to market growth.

- Government initiatives to strengthen the EV industry around the world.

- There is an upsurge in the number of e-commerce companies across the world.

- There are growing investments from public and private sector entities to develop the e-commerce automotive aftermarket industry.

- The rising trend of car modification has helped the industry to grow significantly.

- The development in the logistics sector is a major factor that accelerates industrial growth.

- The advancements in technologies for developing e-commerce applications for end-to-end logistics operations.

- There is a growing demand for process automation for performing repetitive tasks in various industries.

- The availability of spare parts for discontinued vehicles in e-commerce platforms.

- The increasing number of DIY (Do It Yourself) consumers around the world is driving the growth of the e-commerce automotive aftermarket industry.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 745.90 Billion |

| Market Size in 2025 | USD 279.27 Billion |

| Market Size in 2024 | USD 250.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.53% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Powertrain, Replacement Parts, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for unique automotive accessories

The craze for modern cars has increased due to changes in lifestyles and growing disposable incomes in developed nations. With the rising trend of luxurious cars, the demand for suitable accessories to enhance the looks and uniqueness of the vehicles increases. Some car accessories are easily available in the offline market, but a few accessories might not be found easily in the local shops, which in turn increases the demand for e-commerce platforms among people as most of the accessories are easily available in such online platforms. Thus, the growing demand for unique car accessories is expected to drive the growth of the e-commerce automotive aftermarket industry during the forecast period.

- In June 2024, Boult launched X1 GPS dash cams and Cruise Cam X1 for automobiles in India. These car accessories are designed to provide advanced safety features, superior video quality, and seamless connectivity while driving, and these accessories are available on Amazon.

- In February 2023, Amazon launched an automotive OEM e-commerce site. Through this launch, Amazon collaborated with major automotive brands such as Stellantis, GM, and BMW, enabling people to order and purchase aftermarket parts through Amazon's online platform.

Restraint

Delivery issues and fraudulent activities

The trend of purchasing car accessories and spare parts from online platforms is increasing rapidly with the growing sales of cars around the world. Although there are numerous benefits associated with it, there are also several difficulties associated with it. Firstly, the delivery time of car components by e-commerce platforms might get delayed due to logistics and stock-related issues. Secondly, there is a growing number of fraudulent activities from scammers posting false car components on their platforms and delivering low-grade automotive components to customers. Thus, delivery-related issues, along with problems associated with fraudulent activities, are expected to restrain the growth of the e-commerce automotive aftermarket industry during the forecast period.

Opportunity

Increasing demand for ADAS components to reshape the industrial landscape

The sales of automobiles have increased rapidly across the world in recent times. The trend of autonomous vehicles is increasing rapidly due to driving convenience along with safety features. With the rising trend of autonomous vehicles, the demand for ADAS components has increased among people and car makers across the world. Thus, the growing availability of ADAS components in e-commerce platforms is likely to create ample growth opportunities for the market players in the coming years.

- In January 2024, Texas Instruments launched a new automotive chip named ‘AWR2544'. This is a satellite-based single-chip radar sensor that enables a high autonomy level and improves sensor fusion along with decision-making capabilities in ADAS. This component can be ordered online through Texas's own website and some other e-commerce platforms.

Replacement Parts Insights

The transmission and steering segment dominated the market in 2024. The growing demand for transmission and steering components such as clutch assembly systems, gearboxes, axles, wheels, tires, and some others drive the market growth. Also, the rising preference for garages and workshops to purchase transmission and steering from e-commerce platforms is likely to boost the market growth to some extent. Moreover, the availability of discontinued automotive spare parts in e-commerce platforms is expected to propel the growth of the e-commerce automotive aftermarket during the forecast period.

- In October 2023, UniClutch launched two clutch systems in the U.S. These clutch systems provide maximum performance and efficiency that will benefit automotive technicians in replacing old clutch components in automotive. This product can be directly ordered from the company's online platforms and some e-commerce platforms such as Parts in Motion, 4WD247, and others.

The electrical parts segment is expected to grow with the fastest CAGR during the forecast period. The demand for car electrical components such as starter motors, spark plugs, batteries, and others has driven the market growth. Also, the availability of electrical components in e-commerce platforms, along with the ongoing trend of online shopping worldwide, is likely to boost the market growth. Moreover, the availability of large stocks in e-commerce automotive aftermarket companies allows people to choose from a wide variety of options according to their requirements. This, along with the offers and discounts that e-commerce platforms provide to customers, is expected to drive the growth of the e-commerce automotive aftermarket during the forecast period.

- In April 2024, CATL launched a new EV battery. This EV battery is manufactured for commercial vehicles and comes with 15 15-year warranty and a claimed range of 932,000 miles (1.5 million km). This battery is available on several e-commerce platforms, including Alibaba and some others.

End-Use Insights

The business to business segment held a dominant share in 2024. The growing demand for automotive spare parts by car companies and distributors of aftermarket components has driven the market growth. Also, the increased sales from B2B systems are significantly higher than those from B2C systems, which is likely to propel the market growth. Moreover, rising productivity and efficiency in B2B systems, along with the availability of flexible payment options, are expected to drive the growth of the e-commerce automotive aftermarket industry during the forecast period.

- In December 2023, Epicor launched an automotive B2B e-commerce platform. This platform aims to provide automotive replacement parts for customers and distributors.

The business to customers segment is expected to attain significant growth during the forecast period. The growing proliferation of smartphones among people, along with the development of internet facilities in several countries across the world, strengthens the B2C system, thereby driving market growth. Also, the advantages of B2C systems, such as direct communication with customers and far-reaching marketing/advertising campaigns for gaining consumer attraction, have driven the market growth. Moreover, the rise in the number of DIY (Do It Yourself) consumers across the world is expected to propel the growth of the e-commerce automotive aftermarket industry during the forecast period.

- According to the Canadian Telecommunications Association, more than 99.5% of Canada's population was using a 4G (LTE) network in 2022.

- In April 2023, Toyota Kirloskar Motor launched an online retail sales platform. This new B2C platform, ‘Wheels on Web,' will provide spare parts to individual consumers.

E-Commerce Automotive Aftermarket Companies

- Advance Auto Parts, Inc

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- CARiD

- EBay Inc.

- AutoZone Inc.

- Flipkart Private Limited

- O'Reilly Auto Parts

- NAPA Auto Parts

- RockAuto, LLC

- U.S. Auto Parts Network, Inc.

Recent Developments

- In December 2023, Garrett Motion launched an advanced e-commerce platform. This e-commerce platform is named ‘Garrett Marketplace' and deals in providing aftermarket automotive parts for racing enthusiasts.

- In October 2023, BUSINESSX-Cart announced a partnership with Turn 14 Distribution. This partnership is done to provide automotive retailers with powerful tools for boosting online sales and streamlining their customers to deliver auto parts.

- In August 2023, Schaeffler announced the acquisition of Koovers. This acquisition was made to develop Schaeffler's fast-growing B2B e-commerce business related to automotive spare parts in India.

- In January 2023, AutoNation launched a new e-commerce platform. This e-commerce platform is launched to allow customers to purchase automotive parts from online platforms.

- In June 2022, Advance Auto Parts announced the opening of a global capability center (GCC) in Hyderabad, India. This announcement is made to offer automotive aftermarket parts to cater to the demand-supply chain in India.

- In February 2022, Bosch announced to acquisition a 26% stake in a B2B e-commerce company named ‘Autozilla Solutions.' This acquisition will strengthen Bosch's online demand-supply chain of electronic spare parts for automobiles.

Segments Covered in the Report

By Vehicle Powertrain

- Internal Combustion Engine (ICE) Vehicles

- Battery Electric Vehicles

By Replacement Parts

- Engine Parts

- Piston and Piston Rings

- Engine Valves and Parts

- Fuel Injection Systems

- Power Train Components

- Transmission and Steering

- Clutch Assembly Systems

- Gearbox

- Axles

- Wheels

- Tires

- Braking Systems

- Brake Calipers

- Brake Pads

- Rotor and Drums

- Brake Disk

- Lighting

- Headlamps

- Tail lamps

- Others

- Electrical Parts

- Starter Motor

- Spark Plugs

- Battery

- Others

- Suspension Systems

- Wipers

- Others

By End-Use

- D2B

- B2C

- D2C

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting