What is the EFEM and Sorters Market Size?

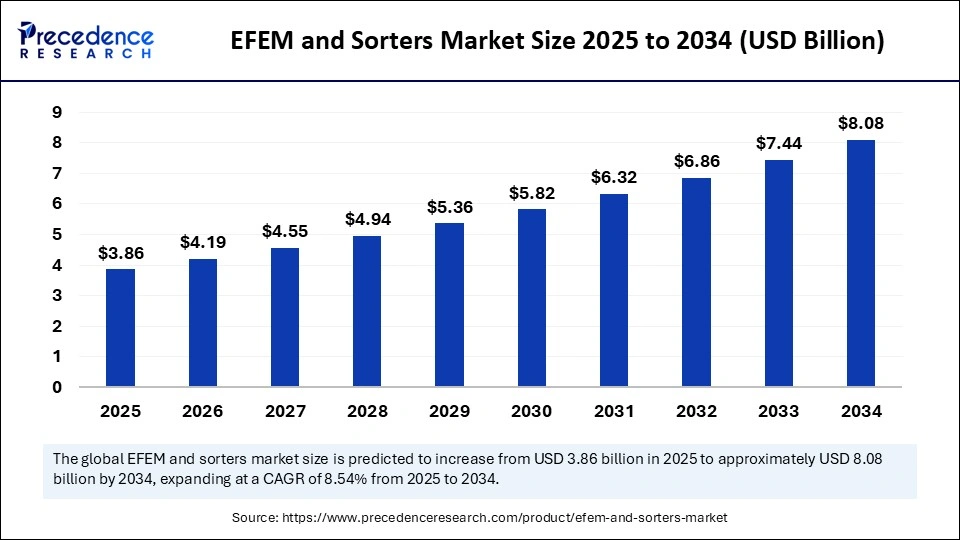

The global EFEM and sorters market size was calculated at USD 3.56 billion in 2024 and is predicted to increase from USD 3.86 billion in 2025 to approximately USD 8.08 billion by 2034, expanding at a CAGR of 8.54% from 2025 to 2034. The market is rapidly evolving, powered by increasing automation demands and the surge in the semiconductor and logistics industries.

Market Highlights

- Asia Pacific dominated the EFEM and sorters market in 2024.

- North America is anticipated to witness the fastest growth during the forecasted years.

- By equipment type, the EFEM segment captured the biggest market share in 2024.

- By equipment type, the integrated EFEM + sorter systems segment is anticipated to show considerable growth over the forecast period.

- By wafer size compatibility, the 300mm EFEMs and sorters segment contributed the highest market share in 2024.

- By wafer size compatibility, the 450mm EFEMs and sorters segment is anticipated to show considerable growth over the forecast period.

- By level of automation, the fully automated segment held the maximum market share in 2024.

- By level of automation, the smart/industry 4.0-enabled segment is anticipated to show considerable growth over the forecast period.

- By application, the front-end wafer fabrication segment led the market in 2024.

- By application, the wafer testing and inspection segment is anticipated to show considerable growth over the forecast period.

- By end-user, the foundries segment generated the major market share in 2024.

- By end-user, the OSATs segment is anticipated to show considerable growth over the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 3.56 Billion

- Market Size in 2025: USD 3.86 Billion

- Forecasted Market Size by 2034: USD 8.08 Billion

- CAGR (2025-2034): 8.54%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What are EFEM and Sorters?

The equipment front-end module (EFEM) and sorters are critical component in semiconductor manufacturing, which helps in automation and accuracy in handling wafers during the front-end fabrication and testing process. The EFEMs are an important interface device between semiconductor process tools and wafer carriers, ensuring clean wafer transfer in a cleanroom setting. Sorters are used to supplement EFEMs with the necessary operations such as wafer inspection, orientation, and defect detection, which further optimizes lot management and enhances the overall fab productivity.

The growth in the EFEM and sorters market is being experienced at a very strong rate, fueled by the ever-expanding industry of semiconductors, to expand the size of the wafer and the fab throughput. The transition between the smaller 300mm wafer to the larger 450mm wafer necessitates the more sophisticated wafer processing and sorting systems capable of holding the large amounts of accuracy and contamination at higher measuring levels. Industry 4.0 and smart fabs with IoT-connected sensors, analytics powered by AI, and automated decision-making are transforming the semiconductor manufacturing process.

How Is AI Integration Transforming the EFEM and Sorters Market?

The use of artificial intelligence is transforming the EFEM and sorters market by becoming more automated, precise, and predictive in semiconductor manufacturing. The AI-provided systems can maximize the handling of wafers with advanced machine learning algorithms and computer vision to enhance the accuracy of alignment, defect detection, and efficiency of sorting. This reduces the number of human errors and time wastage, which leads to a high rate of throughput and yield. Other features of AI include real-time data analysis, adaptive control of processes, whereby fabs can respond promptly to changes in processes and equipment failures. AI enhances productivity, and it also creates more sustainable and versatile semiconductor manufacturing settings, which is a key factor that makes EFEM and sorter technologies grow the market significantly.

What Factors Are Fueling the Rapid Expansion of the EFEM and Sorters Market?

- Industry 4.0 and Smart Fabs: Due to the necessity to use IoT, AI, and data analytics in automation systems of a fab, there is a higher demand for EFEM and high-level software functionality on sorter systems that will be able to support real-time tracking, predictive maintenance, and process optimization.

- Intensive-Throughput Manufacturing Requirement: The explosion in the production of semiconductor devices strains fabs to implement automated and high-speed wafer handling and sorting solutions to enhance efficiency, defect reduction, and large-scale production.

- Implementation of EUV Lithography: Extreme Ultraviolet (EUV) lithography requires very clean and precise solutions in handling the wafers. This procedure needs certain equipment, entails the use of EFEMs and sorters to enable a transfer and inspection with no contamination.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 3.56 Billion |

| Market Size in 2025 | USD 3.86 Billion |

| Market Size by 2034 | USD 8.08 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.54% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment Type, Wafer Size Compatibility, Level of Automation, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Electronic Equipment Miniaturisation to Augment Market Growth

The high needs of miniaturization of the electronic equipment are a notable force that is powering the EFEM and sorters market. With the new trend of consumers moving towards smaller but more powerful devices, semiconductor companies are under pressure to come up with smaller and more sophisticated chips. The same trend spreads to new markets like the electric and hybrid cars, where semiconductor serves a key objective of performance and efficiency, increasing the demand for these semiconductors.

Wireless communication technologies have been developing, such as 5G and beyond, which require the usage of high-precision, high-reliability semiconductor devices. The Internet of things ecosystem also increases the demand for various semiconductor elements in daily devices, increasing the volumes of wafer production. The resulting increase in the need to miniaturize and develop high-technological electronics is the cause of the growing market of automated systems of wafer handling and sorting.

Rising Demand for Semiconductor Devices and Automation

The EFEM and sorters market is driven by the increasing demand for semiconductor devices in the world, which is seen in consumer electronics, electric vehicles, telecommunications, and the internet of things. This pressure causes the production of more wafers, which requires high-quality automated wafer handling and sorting systems to increase the throughput and still achieve high precision. The move to larger wafers, 300mm to 450mm, is also part of the more sophisticated EFEM systems, which will ensure a contamination-free transfer of the wafers and higher productivity.

The introduction of such advanced technology as Extreme Ultraviolet (EUV) lithography requires ultra-clean and accurate automation devices to meet the requirements of the fabrication. It is possible to enhance EFEM and sorters with the development of Industry 4.0, i.e., the introduction of AI and IoT, through real-time monitoring, proactive maintenance, and process optimization.

Restraint

Lack of Standardisation to Impede Market Growth

The absence of standardization is one of the key issues that limit the EFEM and sorters market. Automated sorting systems mainly rely on the normal barcoding, packaging, and handling solutions to be effective. The lack of universally recognized standards makes the automated systems integration less reliable and consistent, leading to operational inefficiencies. This problem reflects more general problems in the logistics industry of China, where standardization gaps hinder the process of automation. Lack of standardized commodity labelling and packaging makes the automated picking and sorting machine run inefficiently, affecting its scalability.

Opportunity

Expansion of Smart Fabs and Industry 4.0 Implementation

The EFEM and sorters market has a growth opportunity on the current trend of smart fabs as Industry 4.0-based technology. The semiconductor manufacturers are progressing towards utilizing IoT, artificial intelligence, and big data analytics to create more productively, reduce failures, and improve yield. The combination of EFEM and sorter systems with AI-based automation and real-time data monitoring is capable of helping fabs to be more precise and efficient.

The increasing trend towards electric cars, 5G, and tomorrow-gadget consumer electronics is creating demand for fabs all over the globe and requiring scalable, flexible wafer handling solutions. The trend to very large wafer sizes, including 450mm, further drives the desire to have innovative EFEM and sorter technologies that would be able to accommodate complex and high production volumes.

Segment Insights

Equipment Type Insights

Why Does the EFEM Segment Lead the EFEM and Sorters Market?

The EFEM segment led the EFEM and sorters market and accounted for the largest revenue share in 2024, as it is an essential element in semiconductor production. The EFEMs as the important point of contact between wafer carriers, such as FOUPs, and process equipment. They ensure that there is no contamination during handling, that the wafer is properly aligned, and that cleanroom standards are met. Also, with the continued development of semiconductor nodes and the size of their wafer, there is a growing need for reliable and high-precision EFEM systems. Their vital role in facilitating a smooth combination of process tools into automation schemes remains a major source of high revenues and market dominance in the market.

The integrated EFEM + sorter systems segment is expected to grow at a significant CAGR over the forecast period, which is attributed to the preference by fab operators towards small-scale throughput automation systems. The combination of the EFEM and sorter functionalities in a single system allows optimizing the workflow of wafer handling and reducing the area needed, and increasing the functionality within the cleanroom. With increased production volumes by semiconductor fabs and the integration of Industry 4.0 technologies, there is an increased demand to automate production processes to ensure automation of complex tasks are undertaken smoothly. The maintenance of the integrated EFEM + sorter units is also easier, and the data-driven process control can be improved with the help of the centralized software platforms.

Wafer Size Compatibility Insights

Why Did 300mm EFEMs and Sorters Contribute the Most Revenue in EFEM and Sorters Market?

The 300mm EFEMs and sorters segment contributed the most revenue in 2024 and is expected to dominate throughout the projected period. Use of 300mm wafers by semiconductor fabrication is also a leading factor since the majority of high-technology fabs around the world use the wafer size as a compromise between cost-effectiveness and manufacturing capacity. There is a reliable, high-precision automation of EFEMs and sorters that support 300mm wafers, which are technologically mature, and can serve the high contamination control and throughput demands. The high base of 300mm fabs installed and continuous improvement of process technologies mean that there will always be a demand for compatible wafer handling equipment. In addition, semiconductor vendors are still improving at 300mm wafer fabrication because it has demonstrated positive yield and has been compatible with current process equipment.

The 450mm EFEMs and sorters segment is expected to grow substantially in the EFEM and sorters market, because the semiconductor segment will reach bigger wafer sizes to enhance production and lower the price of each chip. Switching to 450mm wafers will allow fabs to generate more throughput and lower the total cost of manufacturing, thus making 450 mm-compliant wafer handling solutions all the more appealing. With the investment of semiconductor makers in a new generation of fabs and pilot lines oriented on 450mm wafers, the demand for special EFEM and sorter machines to match this wafer size will increase. The adoption of the 450mm segment is likely to speed up with industry partnerships and standardization initiatives, which will make the 450mm segment a high-growth opportunity in the market.

Level of Automation Insights

Why Did the Fully Automated Segment Lead the EFEM and Sorters Market in 2024?

The fully automated segment led the EFEM and sorters market and accounted for the largest revenue share in 2024 because it played a crucial role in enhancing efficiency and reducing contamination of semiconductor fabs. Wafer handling systems are fully automated with minimal human interaction to reduce the risks of contamination as well as to maintain consistency in the transfer of the wafer between process tools and carriers. These systems are characterized by high precision and repeatability, which is vital in achieving the high levels of cleanliness requirements in the room, in addition to ensuring that the wafer remains intact even when subjected to sophisticated fabrication processes. The full automation of EFEM and sorter systems can help fabs to expand throughput and operational efficiency, simplifying working processes and minimizing the cycle time. The need to have these systems is also reinforced by the continued development of semiconductor process nodes and the increase in wafer size.

The smart/industry 4.0-enabled segment is expected to grow at a significant CAGR over the forecast period, due to the recently increased use of intelligent, predictive, and connected manufacturing systems by fabs. These are the modern automation solutions that are a combination of IoT, AI, machine learning, and big data analytics, offering the capability to monitor in real-time, process wafer variability, and carry out predictive maintenance. These smart technologies will enable fabs to automate the transfer processes with the help of wafers, detect defects at an earlier stage, eliminate wasteful time, and make a tremendous difference to yield and operational productivity. The shift to smart fabs is also in line with the wider Industry 4.0 trends to make semiconductor manufacturing more flexible, transparent, and data-driven. With the modernization and the upgrading of equipment, the demand for EFEM and sorter machines with smart capabilities increases at a high rate.

Application Insights

Why Did Front-End Wafer Fabrication Contribute the Most Revenue in the EFEM and Sorters Market?

The front-end wafer fabrication segment contributed the most revenue in 2024 and is expected to dominate throughout the projected period. The leadership of this segment is based on the fact that EFEMs are part of the front-end process tools, where the accuracy of handling the wafer is very important. With the increasing complexity of semiconductor devices, with smaller nodes and larger wafer sizes, front-end fabs are increasingly depending on new forms of EFEM and sorters to improve throughput and yield. Moreover, the ongoing growth of fab expansion and technology upgrade programs in the mature and emerging markets creates pressure on the demand for wafer handling solutions, particularly in the front-end fabrication processes.

The wafer testing and inspection segment is expected to grow substantially in the EFEM and sorters market, owing to the increasing complexity in the architectures of semiconductor devices. The density of inspection is increased in advanced nodes to sense defects that are minute defects and quality control of the chip. The growing use of AI-based vision systems and automatic sorting technology can make the process of detecting defects and managing lots more efficient. Furthermore, due to the shift in semiconductor testing to 3D packaging and heterogeneous integration, wafer testing systems require high flexibility in the types and sizes of wafer, which boosts the requirement to customize and expand sorter capabilities.

End-User Insights

Why Did the Foundries Segment Lead the EFEM and Sorters Market in 2024?

The foundries segment led the EFEM and sorters market and accounted for the largest revenue share in 2024 because it has bulk quantities of wafer production and high automation needs. Several companies have foundries that produce semiconductors on their behalf, and the wafers are produced on a large scale to satisfy the various needs of different industries. The demands of this high-volume production environment include highly integrated EFEM and sorter systems with the ability to handle wafers with high precision and contamination-free handling to ensure the efficiency of the fab and product yield. Also, the ongoing drive to reduce the size of process nodes and increase the size of wafers in foundries is leading to the need to seek cutting-edge front-end automation technology.

The OSATs segment is expected to grow at a significant CAGR over the forecast period. The Outsourced Semiconductor Assembly and Test (OSAT) will be driven by the increased need to apply automation in the back-end sorting and packaging of wafers. OSAT companies are particularly in the field of semiconductor assembly, packaging, and testing, where efficient wafer handling and sorting form the key element in throughput and quality control. With the development of semiconductor packaging technologies, most notably 3D packaging, system-in-package (SiP), and more advanced testing techniques, more demanding sorter systems are needed by OSATs, where a wide variety of wafer types have to be handled with precision. Automation lowers the number of people handling documents, improves the lot tracking, and accelerates throughput. This is an accelerating automation trend, making OSATs a fast-growing segment of the EFEM and sorter market.

Region Insights

Why Did Asia Pacific Dominate the EFEM and Sorters Market in 2024?

Asia Pacific held the dominating share of the market in 2024, due to the fact that it is the major center of semiconductor manufacturing in the world. Most of the major semiconductor fabs are located in countries such as Taiwan, South Korea, Japan, and China, largely due to their robust industrial base, government subsidies, and expertise in chip manufacturing. TSMC, Samsung, and other major participants based in the region have some of the largest and most sophisticated fabs in the world that are at the lead in demand for automated wafer handling and sorting equipment. Moreover, the current trend in the region to increase the size of the wafer and new technologies of the process, such as EUV lithography, make such solutions based on precision automation more urgent.

China is the largest and fastest-growing semiconductor market in the Asia Pacific; it is a key player in the domination of the market in the region. China has been developing infrastructure and developing its own equipment manufacturing capability with massive government-led programs designed to attain semiconductor self-sufficiency. This has seen front-end automated wafer handling and sorting systems being adopted in greater numbers in a bid to accommodate the aggressive semiconductor manufacturing goals of the country. The strategic thrust that China is making towards the production of high-tech semiconductors makes it a key growth driver in the Asia Pacific market, which guarantees the continued leadership in the regional market.

Why Is the North America Region Expected to Grow at the Fastest CAGR?

North America is estimated to grow at the fastest CAGR during the forecast period, due to the major government programs and individual investments that will focus on reviving semiconductor production. The U.S. CHIPS Act plays a crucial role in which it has offered significant funding and incentives to build a domestic fabric and develop technology. The legislative initiative aimed at decreasing reliance on foreign supply chains and increasing local semiconductor manufacturing capacity. The robust semiconductor equipment supplier network, coupled with the large investments in R and D of the region, hastens the market penetration of the next-generation front-end automation solutions, driving the market expansion.

- In North America, the U.S. has been the leading market with its vigorous self-reliance and innovation in semiconductor strategies. Large chip companies and foundries are heavily investing in advanced fabs using the latest process technologies such as EUV lithography and large wafer sizes, which demand very complex EFEM and sorter systems. Moreover, U.S. government policy that focuses on Industry 4.0 and smart manufacturing technologies encourages the use of AI-controlled automation in semiconductor-fab plants.

EFEM and Sorters Market Companies

- Brooks Automation

- Daifuku Co., Ltd.

- Hirata Corporation

- Kawasaki Robotics

- Konbu Systems

- MEKICS Co. Ltd.

- Rorze Corporation

- Ryoyo Electro Corporation

- Shibaura Mechatronics Corporation

- Shinko Electric Industries Co., Ltd.

- Sinfonia Technology Co., Ltd.

- TDK Corporation (Wafer Handling Subsidiaries)

- TEL (Tokyo Electron Limited)

- ULVAC, Inc.

- Yaskawa Electric Corporation

Recent Developments

- In January 2025, KASFAB Tools, which is a subsidiary company of UHP Technologies, established a 20,000-square-foot semiconductor equipment fabrication facility in Bengaluru, India. This will be a significant step for India to increase its manufacturing capabilities of semiconductors in the country.

(Source: https://www.prnewswire.com) - In November 2024, Daifuku was present at its booth in the theme of Automation of tomorrow, demonstrating CG images driven by the latest 3D technology in combination with real systems, particularly AGVs. The newest technologies or upcoming automation of logistics centers, semiconductor fabs, automotive plants, and airports were also in the spotlight of the exhibition by Daifuku.(Source: https://www.daifuku.com)

Segment Covered in the Report

By Equipment Type

- EFEM (Equipment Front-End Modules)

- Wafer Sorters

- Integrated EFEM + Sorter Systems

- Robotic Wafer Handling Arms

- Inspection and Metrology Modules (integrated into EFEM/sorters)

By Wafer Size Compatibility

- 200mm EFEMs and Sorters

- 300mm EFEMs and Sorters

- 450mm EFEMs and Sorters

By Level of Automation

- Manual/Semi-Automated

- Fully Automated

- Smart/Industry 4.0 Enabled (IoT, AI, Predictive Maintenance)

By Application

- Front-End Wafer Fabrication

- Wafer Testing and Inspection

- Packaging and Assembly

- R&D Labs and Pilot Lines

By End-User

- IDMs (Integrated Device Manufacturers)

- Foundries

- OSATs (Outsourced Semiconductor Assembly and Test)

- Research Institutes and Universities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting