What is the Elderly and Disabled Assistive Devices Market Size?

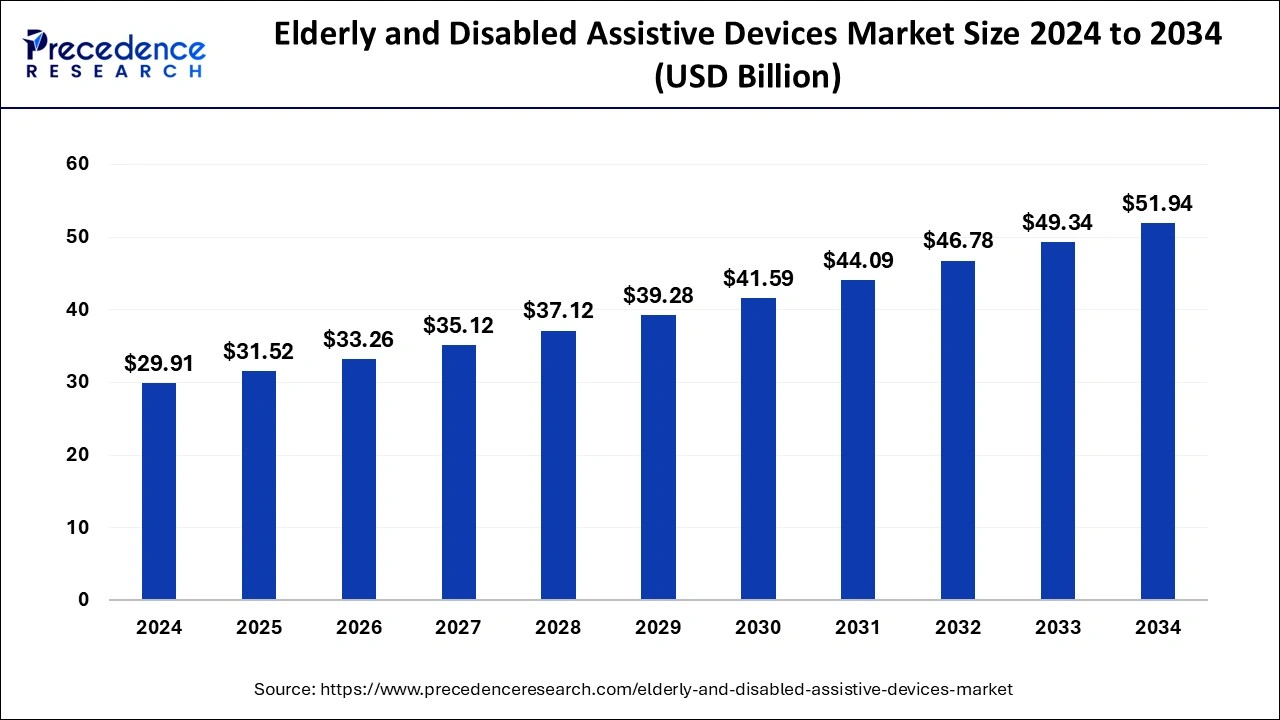

The global elderly and disabled assistive devices market size is valued at USD 31.52 billion in 2025 and is predicted to increase from USD 33.26 billion in 2026 to approximately USD 51.94 billion by 2034, expanding at a CAGR of 5.67% from 2025 to 2034. The rising cases of people with mobility impairment, disabilities, as well as the aging population across the globe, surging lifestyle changes and technological advancements with increased accessibility and affordability of assistive devices is driving the growth of the elderly and disabled assistive devices market.

Elderly and Disabled Assistive Devices Market Key Takeaways

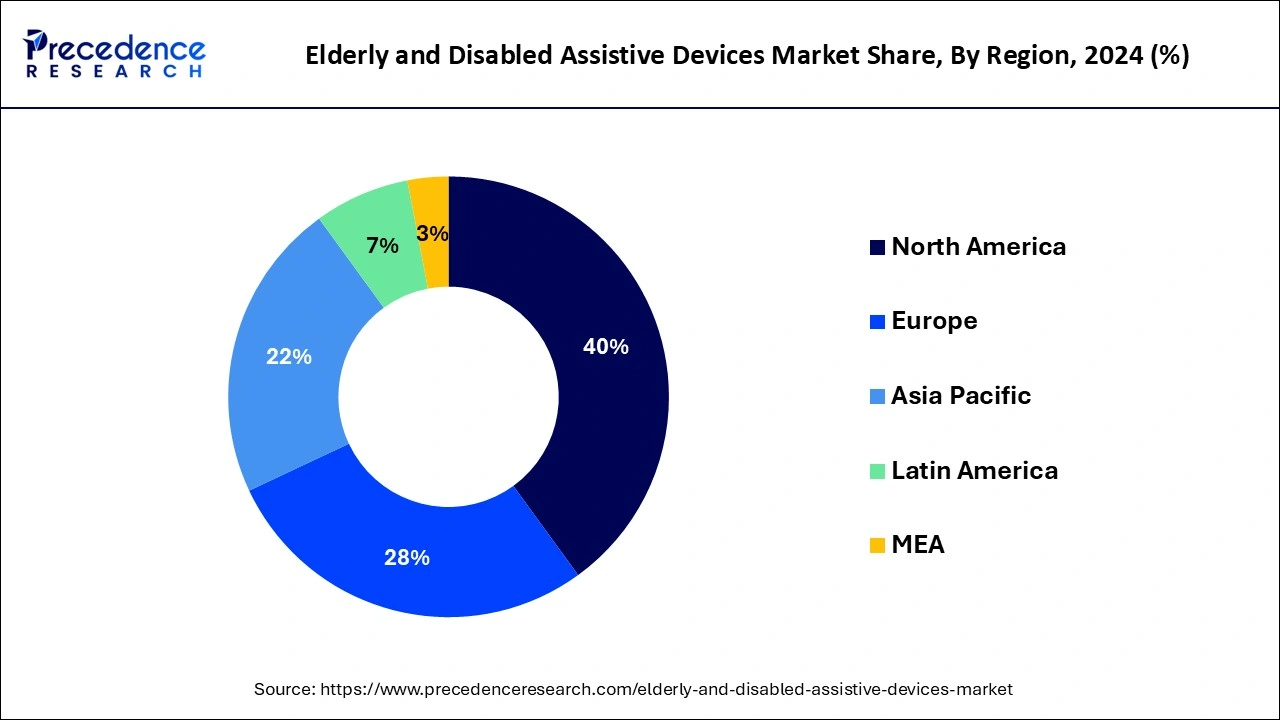

- North America dominated the global market with the largest market share of 40% in 2024.

- Asia pacific is projected to expand at the notable CAGR during the forecast period.

- By type, the mobility aids segment contributed the highest market share in 2024.

- By end user, the hospitals segment captured the biggest market share in 2024.

- By end user, the homecare segment is expected to grow at a significant CAGR from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 31.52 Billion

- Market Size in 2026: USD 33.26 Billion

- Forecasted Market Size by 2034: USD 51.94 Billion

- CAGR (2025-2034): 5.67%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Integration of Artificial Intelligence in Assistive Devices

The integration of artificial intelligence in elderly and disabled assistive devices is helping in transforming lives. AI applications in assistive devices enables enhanced features such as automated fall detection like by analysing gait patterns, personalized movement assistance, real-time health monitoring, improved communication aids, cognitive assistance and intelligent navigation. Also the adoption of smart home systems with AI support are helping in improving independence, safety and quality of life for users with physical limitations.

Market Outlook

- Industry Growth Overview: The market is expected to grow significantly between 2025 and 2034, fueled by the rapidly expanding geriatric population, rising disability rates, and an increased focus on independent living and home-based care. Key high-growth areas include tech-enabled mobility aids, smart home integration solutions, and AI-powered communication and vision aids.

- Sustainability Trends: Sustainability is focused on enhancing the quality of life while promoting resource efficiency in healthcare. Key trends include developing durable, energy-efficient devices, using eco-conscious design and materials, and integrating technology to enable effective remote monitoring, thereby reducing hospital visits and associated environmental impact.

- Global Expansion:Market expansion is prominent in fast-growing regions like Asia-Pacific and Latin America, where aging populations are significant and healthcare infrastructure is developing. North America and Europe remain major markets with mature healthcare systems and high adoption rates.

- Major Investors: A mix of venture capital, private equity, and strategic corporate investors (including major health-tech companies such as Philips and Medtronic, as well as large investment firms) is entering the market. They are driven by clear demographic drivers, strong long-term growth potential, and alignment with patient safety and quality-of-life initiatives.

- Startup Ecosystem: The ecosystem is maturing, particularly in innovations such as wearable sensors, robotics, AI-driven personal assistance, and accessible software solutions. Emerging firms are attracting significant funding by offering customizable, scalable, and affordable solutions that address specific user needs and support independent living models.

Elderly and Disabled Assistive Devices Market Growth Factors

- Surging worldwide demand for advanced assistive devices.

- Initiatives taken by various governments and world organizations for development and distribution of assistive devices to improve lives of assistive device users.

- Global rise in geriatric population and people with disabilities.

- Increased accessibility and affordability of assistive technologies.

- Rising number of manufacturers in the assistive devices market.

- Technological advancements and launch of new assistance devices.

- Authorisation of assistive devices by regulatory agencies.

- Huge investments by manufacturers in R&D for assistive devices.

- Promotion of public awareness campaigns signifying the benefits of assistive devices.

- Focus on independent living which drives the demand for assistive devices.

Report Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 31.52 Billion |

| Market Size in 2026 | USD 33.26 Billion |

| Market Size by 2034 | USD 51.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.67% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segmental Insights

Type Insights

Based on the type, the mobility aids segment dominated the global elderly and disabled assistive devices market in 2024. The surging number of disabilities owing to various diseases and aging population has boosted the demand for the mobility aids across the globe. Moreover, the rising investments by the market players in adoption of the technological advancements in the devices have significantly driven the growth of this segment. Further, the rising number of road traffic accidents and growing disabilities pertaining to it is fueling the growth of the mobility aids devices. According to the WHO, between 20 and 50 million higher number of people suffer non-fatal injuries due to road traffic accidents and this injury results in disability. These factors have resulted in the dominance of this segment in the past years.

On the other hand, the bathroom safety is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rising focus towards the improvement of the quality of life of the disabled and the old age population. The surging technological advancements have encouraged the development of various advanced assistive devices that eases the daily functioning of the disabled people.

End User Insights

Based on the end user, the hospitals segment dominated the global elderly and disabled assistive devices market in 2024. This is attributed to the increased number of road accidents and rising number of hospital admissions for the treatment of various diseases like paralysis, cerebral palsy, stroke, amputation, and multiple sclerosis. These diseases are the major contributors to the growth of the elderly and disabled assistive devices market. Moreover, the huge demand for the wheel chairs and other mobility devices for the mobility of the patients in hospital premises has fueled the growth of this segment.

On the other hand, the homecare is expected to be the fastest-growing segment during the forecast period. The rising adoption of the disabled assistive devices in home is driving the growth of this segment. Moreover, the permanent disabilities due to aging and various other factors are driving the market growth. The rising healthcare expenditure and increasing awareness regarding the availability of various advanced devices is augmenting the segment's growth.

Regional Insights

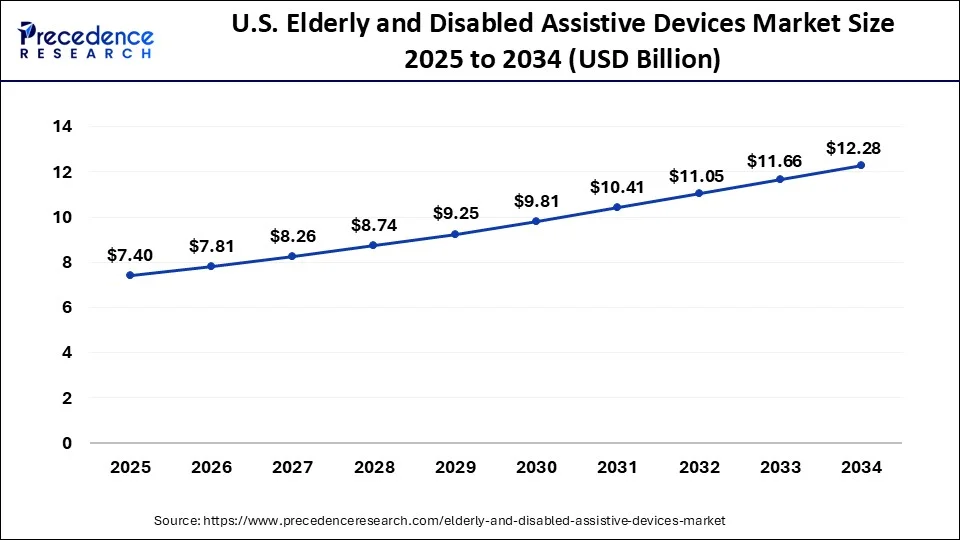

U.S. Elderly and Disabled Assistive Devices Market Size and Growth 2025 to 2034

The U.S. elderly and disabled assistive devices market size is exhibited at USD 7.40 billion in 2024 and is projected to be worth around USD 12.28 billion by 2034, growing at a CAGR of 5.77% from 2025 to 2034.

U.S. Elderly and Disabled Assistive Devices Market Trends

The U.S. plays a distinctive role in the global market, primarily driven by a robust healthcare infrastructure, high R&D investments, and widespread adoption of advanced technologies. Its role focuses on pioneering cutting-edge innovations such as AI-powered mobility aids, smart-home integration, and advanced hearing and vision solutions, supported by a clear, albeit stringent, regulatory framework from agencies like the FDA and government programs such as Medicare and Medicaid

North America was the leading market in 2024. This is simply attributed to the presence of huge geriatric population and surging prevalence of various chronic diseases such as cancer, diabetes, and CVDs, which are considered a major cause of disability. According to the US Census Bureau, there were around 54.1 million geriatric people in US in 2019, aged 65 years or above. This number is expected to reach at 95 million 2050. Moreover, the increased healthcare expenditure, high disposable income, and increased awareness regarding various advanced devices are some of the prominent factors that has augmented the growth of the elder and disabled assistive devices market in North America.

Asia Pacific is expected to be the fastest-growing market during the forecast period. This is mainly de to the rapidly growing geriatric population, rising prevalence of various non-communicable diseases, and rising prevalence of road traffic accidents. According to the United Nations, about 80% of the global geriatric population will be living in the low and middle income countries. Moreover, around 93% of the global road traffic accidents occur in low and middle income countries, as per the WHO. The surging penetration of the advanced healthcare systems and the rising accessibility to the advanced care is fueling the market growth in Asia Pacific region. The easy availability of the disabled assistive devices coupled with rising healthcare expenditure is propelling the growth of the Asia Pacific elderly and disabled assistive devices market.

India Elderly and Disabled Assistive Devices Market Trends

India is emerging as a significant force in the global market by focusing on scalable, cost-effective, and practical solutions to address unique public health challenges, such as a large rural-urban healthcare gap and affordability concerns for a vast population. Utilizing its growing local manufacturing capabilities and government initiatives such as the ADIP scheme, India aims to democratize access to essential aids, positioning it as a crucial market for implementation and a hub for tech talent.

A Strategic Roadmap for the Elderly and Disabled Assistive Devices Market in Europe

Europe is expected to see significant growth in the market, driven by an aging population and well-developed social welfare systems. The emphasis is on technological innovation, product quality, and regulatory adherence. Demand covers a broad spectrum of products, including advanced mobility solutions, assistive communication devices, and remote patient monitoring systems for independent living. Countries like Germany, the UK, and France lead in both demand and production, with a strong focus on integrating these devices into a comprehensive healthcare system to lower institutional care costs.

Germany Elderly and Disabled Assistive Devices Market Trends

Germany is a cornerstone of the European market, known for its high-quality engineering and a deeply integrated care system. The demand for devices is significant, driven by one of the continent's largest aging populations. The market emphasizes technologically advanced, durable products like premium electric wheelchairs, sophisticated hearing aids, and smart home assistance technologies, positioning the country as a hub for both innovation and a key market for global manufacturers.

How is the Opportunistic Rise of Latin America in the Elderly and Disabled Assistive Devices Market?

Latin America plays an evolving role in the elderly and disabled assistive devices, primarily driven by an aging population, increased awareness of disabilities, and a rising standard of living. Key demand drivers include government initiatives to promote inclusiveness and better healthcare infrastructure. The market in countries like Brazil, Mexico, and Argentina focuses primarily on mobility aids, such as wheelchairs and crutches, as well as basic personal care devices to address the region's specific needs and increase accessibility.

Brazil Elderly and Disabled Assistive Devices Market Trends

Brazil commands the largest share of the assistive devices market in Latin America, driven by its sizable elderly population and government policies promoting accessibility and inclusion. Demand is varied, ranging from basic mobility aids to sophisticated rehabilitation equipment. Both public and private sectors are investing in healthcare infrastructure and supportive initiatives. Due to local demand and the need for cost-effective solutions, the market still relies heavily on imports of specialized, high-technology devices from global leaders.

What Supports the Growth of the Elderly and Disabled Assistive Devices Market in the Middle East and Africa?

The Middle East and Africa are emerging as key players, focusing on modern, high-tech solutions such as advanced hearing aids and smart home accessibility features, aligned with national initiatives in social welfare and smart city development. In Africa, the market leans more toward basic, essential mobility aids due to lower per capita income and underdeveloped infrastructure, with demand driven by NGOs and government health programs striving to improve the quality of life for a large disabled population.

Saudi Arabia Elderly and Disabled Assistive Devices Market Trends

Saudi Arabia is experiencing a significant increase in the adoption of assistive devices for the elderly and people with disabilities, aligning with its Vision to improve social welfare and healthcare services. The country is investing in advanced assistive technologies, including smart wheelchairs, digital hearing aids, and rehabilitation. The market is supported by government funding, an aging population, and a push to create inclusive public spaces and housing to meet demand for high-quality, modern devices.

Value Cain Analysis

- R&D: Innovates and improves assistive devices in the realms of usability, comfort, and functionality for elderly and disabled users.

Key Players: Aether Biomedical, AI Squared, Arcatron Mobility Pvt. Ltd., Cochlear - Clinical Trials and Regulatory Approvals: Oversees and regulates stringent safety testing of the devices against their claimed standards of use or ensures regulatory compliance before marketing.

Key players: Abbott, Baxter, Boston Scientific Corporation, Central Drugs Standard Control Organization (CDSCO) - Formulation and Final Dosage Preparation: Develops and codes signs for device structure, selecting materials and features to ensure that they are reliable and accessible to users.

Key Players: Akums, Blue Chip Medical Products, Inc., Inclusive Technology Ltd. - Packaging and Serialization: Provides packaging that protects and is easy to handle while affixing traceability identifiers across the chain of authenticity to ensure safety and monitor supply.

Key Players: Amcor PLC, DuPont de Nemours Inc. - Distribution to Hospitals and Pharmacies: Being able to handle logistics will ensure swift utilization of assistive devices, meaning native presence through healthcare avenues and retail.

Key players: Cardinal Health, McKesson Corporation - Patient Support and Services: Train clients, provide technical support, temporary maintenance, and provide feedback to tackle systems for increased satisfaction and long device life.

Key Players: Sonova Holding AG, Starkey Hearing Technologies

Key Company Insights

The elderly and disabled assistive devices market is moderately fragmented with the presence of several top market players. These market players are investing heavily in the value-added services to gain competitive advantage and gain market share. Furthermore, these market players are engaging in various developmental strategies such as product launches, partnerships, joint ventures, and mergers to exploit the prevailing market opportunities.

Elderly and Disabled Assistive Devices Market Companies

- AI Squared:Develops assistive software and applications enhancing accessibility for visually impaired and elderly users.

- Drive Medical: Manufactures mobility aids, wheelchairs, and daily living products to support elderly and disabled individuals.

- GN Resound Group: Provides advanced hearing aids and assistive listening devices for individuals with hearing impairments.

- Invacare:Produces wheelchairs, mobility scooters, and respiratory care devices, addressing mobility and healthcare needs of the elderly and disabled.

- Nordic Capital:Invests in healthcare and assistive technology companies, driving innovation and expansion in elderly care solutions.

- Pride Mobility Products Corporation:Designs and manufactures power chairs, scooters, and lift chairs for enhanced mobility and independence.

- Siemens Ltd.: Offers advanced medical and diagnostic equipment that indirectly supports assistive care for elderly and disabled populations.

- Sonova Holding AG: Supplies hearing solutions, including cochlear implants and hearing aids, improving auditory accessibility.

- Starkey Hearing Technologies:Develops hearing aids and smart hearing devices tailored for seniors and hearing-impaired users.

- William Demant Holding A/S:Provides hearing instruments, audiological equipment, and assistive listening solutions for elderly and disabled individuals

Latest Updates on Elderly and Disabled Assistive Devices Market in 2025

Voice-controlled home automation systems

They offer significant benefits for elderly and disabled individuals and enable them to control their homes through simple voice commands, improving independence and safety. Easy operation of lights, temperature, entertainment systems, and even door locks are achieved by this technology to reduce the need for physical exertion. Voice commands eliminate the need for physical manipulation of devices hence it becomes easier for individuals with mobility limitations to operate appliances and lights. Voice-controlled systems can integrate with security systems, allowing for easy locking and unlocking of doors, monitoring home security, and activating emergency alerts.

Sensor-based assistive devices

They offer a way for elderly and disabled individuals to regain or improve their mobility and independence through technology. These devices are made with sensors and smart technology and they help with various aspects of mobility, from obstacle avoidance and pathfinding to rehabilitation and fall prevention. Devices such as ultrasonic sensors, cameras, and range sensors are used to detect obstacles in the environment. The system analyzes the sensor data to determine safe and efficient paths for the user to navigate, often incorporating learning-based algorithms to optimize routes. Sensor-based systems can provide reminders for medication, appointments, or other important tasks. Intelligent wheelchairs combine obstacle avoidance, navigation, and safety features with technologies such as GPS and telehealth systems for real-time monitoring.

Latest Announcements

- On September 12, 2024, the U.S. Food and Drug Administration (FDA) authorized the first over-the-counter (OTC) hearing aid software device, Hearing Aid Feature which can be used with compatible versions of Apple AirPods Pro headphones for amplifying sounds for individuals 18 years or older with perceived mild to moderate hearing impairment. Michelle

- Tarver, Acting Director of the FDA's Center for Devuces and Radiological Health said that, “Hearing loss is a significant public health issue impacting millions of Americans. Today's marketing authorization of an over-the-counter hearing aid software on a widely used consumer audio product is another step that advances the availability, accessibility and acceptability of hearing support for adults with perceived mild to moderate hearing loss.”

Recent Developments

- In February 2025, Nvidia in partnership with the American Society for Deaf Children and creative agency Hello Monday, launched a language learning platform called Signs using artificial intelligence for American Sign Language learners featuring a 3-D avatar to demonstrate signs. ( Source:https://edition.cnn.com)

- In January 2025, AssisTech Foundation launched incubation program to support a network of about 450 startups developing assistive technologies for the disability sector.( Source: https://www.deccanherald.com )

- In March 2024, Yamada Orthopedic Clinic introduced Futto leg wearable to boost walking ability of hikers, elderly, and partially disabled. (Source: https://www.notebookcheck.net)

- On 3 December 2024, Steel Authority of India Limited (SAIL), a Maharatna Public Sector Enterprise, celebrated the ‘International Day of Persons with Disabilities' with the distribution of assistive devices to people with disabilities. The initiative was held in collaboration with the Artificial Limbs Manufacturing Corporation of India (ALIMCO) and assistive aids such as tricycles, motorized tricycles, smart canes, smartphones for visually impaired and hearing aids were given for enhancing the mobility and communication of the beneficiaries.

- In October 2024, the Kenya Union of Blind (KUB) announced the launch of the Smart White Cane device for blind and partially sighted people with the aim of enhancing the safety and independence across Kenya. The device utilizes ultrasonic sensors for detecting obstacles in a 3 metre radius when outside whereas 1.8 metres indoors.

Segments Covered in the Report

By Service Type

- Mobility Aids Devices

- Wheelchairs

- Mobility Scooters

- Cranes & Crutches

- Walkers & Rollators

- Transfer Lifts

- Door Openers

- Others (Cushions, Pillow, and Back Support)

- Living Aids Devices

- Reading and Vision Aids

- Video Magnifiers

- Braille Translators

- Reading Machines

- Others (Books and Kitchen Appliances)

- Hearing Aids

- Receiver-in-the-Ear (RITE) Aids

- Behind-the-Ear (BTE) Aids

- In-the-Ear (ITE) Aids

- Canal Hearing Aids

- Bone Anchored Hearing Aids (BAHA)

- Cochlear Implants

- Reading and Vision Aids

- Medical Furniture

- Medical Beds

- Medical Furniture Accessories

- Door Openers

- Others

- Bathroom Safety Devices

- Commodes

- Bars, Grips, and Rails

- Shower Chairs

- Ostomy Products

By End User

- Hospitals

- Nursing Homes

- Assisted Living Facilities

- Homecare

By Geography

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content