What is the Electric Power Transmission and Distribution Equipment Market Size?

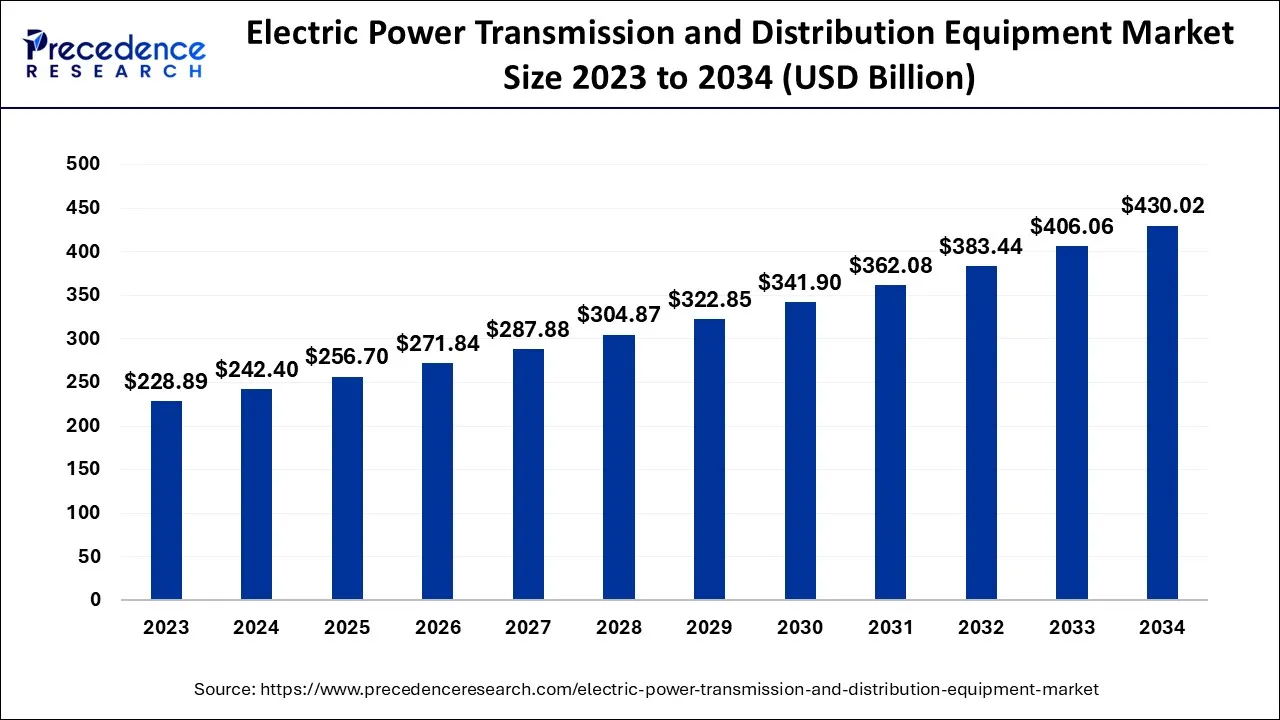

The global electric power transmission and distribution equipment market size is valued at USD 256.70 billion in 2025 and is predicted to increase from USD 271.84 billion in 2026 to approximately USD 453.09 billion by 2035, expanding at a CAGR of 5.85% from 2026 to 2035.

Electric Power Transmission and Distribution Equipment Market Key Takeaways

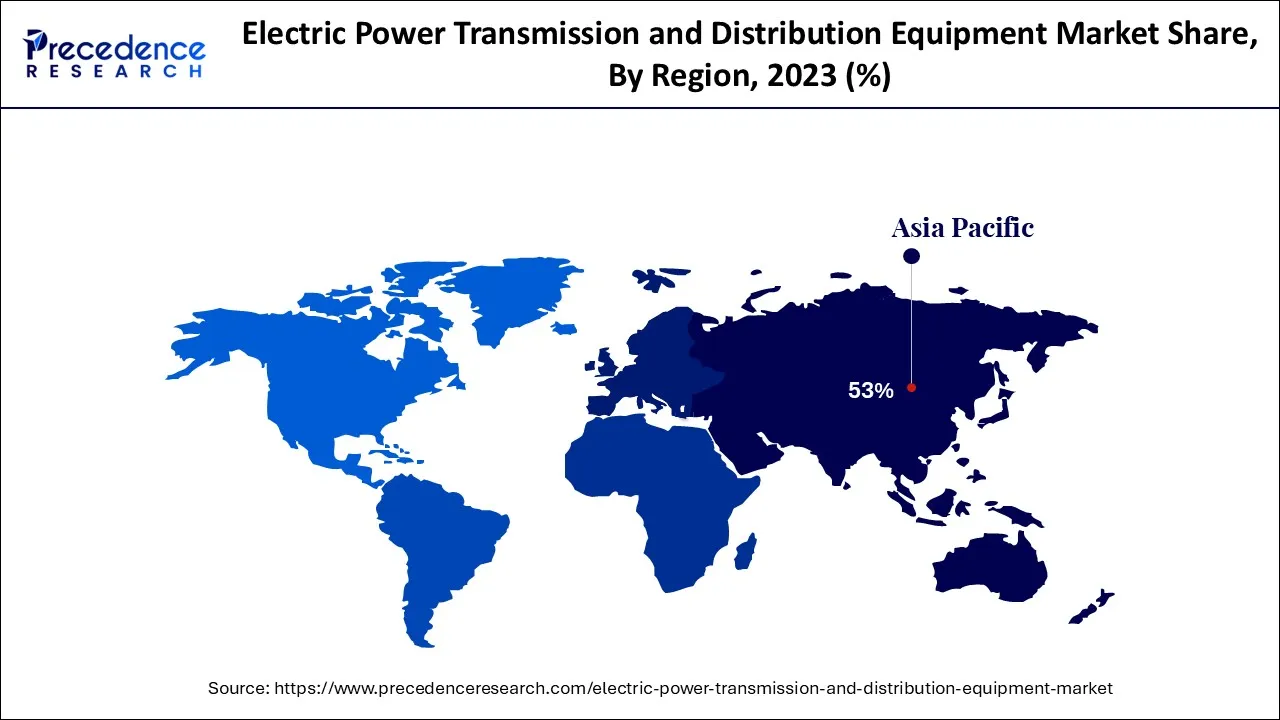

- Asia Pacific generated more than 53% of revenue share in 2025 and the region will continue its dominance over the forecast period.

- By product, the cables and lines segments contributed more than 27% of revenue share in 2025 and the transformer segment is expected to grow at a noticeable rate in the market forecast period.

- By sales channel, the indirect channel segment generated more than 55% of revenue share in 2025 and the direct channel segment had significant growth in the market share in 2025.

Market Overview

The moments of electrical energy through the interconnected lines are known as transmission networks. It is a form of electric transmission. Electric transmission and distribution types of equipment are one of the most important parts of power generation, transmission, and distribution systems. The continuous development of the transmission and distribution equipment to fulfill the future requirement of the power grid. Recently, the energy industry has focused on renewable sources to meet the demand for power.

The transmission networks allow the flow of electrical energy. It includes switches, transmitters, insulators, capacitors, etc. The increasing infrastructure development in residential and commercial sectors will result in a higher demand for electric power transmission and distribution equipment. Increasing technological adoption across the globe will be expected to boost the market demand for the electric power transmission and distribution equipment market.

The Schneider Electric Group is a leader in integrating cutting-edge process and energy technologies, an endpoint to cloud connecting products, controls, software, and services. The company recently published its revenue report for the first quarter of 2023. The revenue report stated that the company's revenue increased by 16% organically. The company's revenue reached 8.5 billion Euros in quarter 1 of 2023.

Artificial Intelligence: The Next Growth Catalyst in Electric Power Transmission and Distribution Equipment

AI is fundamentally transforming the electric power transmission and distribution (T&D) equipment industry by enabling the shift from traditional, one-way systems to intelligent, AI-driven smart grids. The technology enhances grid efficiency, reliability, and resilience through applications like predictive maintenance for key assets such as transformers and power lines, which helps prevent failures and extend equipment lifespan.

Furthermore, AI is crucial for seamlessly integrating variable renewable energy sources (like solar and wind) into the grid by providing accurate load forecasting and real-time balancing of supply and demand.

Electric Power Transmission and Distribution Equipment Market Growth Factors

Electric power transmission and distribution equipment is used for transferring energy from the power generation plant to the located substations and other places. The continuous development in technology for better transmission of electrical energy in an efficient and safer way. electric power transmission is the process of moving large amounts of electrical energy from power plants to substations. The final step in the transmission of power to customers is distribution, which takes place near substations and population areas.

Electrical energy is also distributed through a distribution system network. Electrical transmission differs from electrical distribution in that it transports a significant amount of high-voltage electricity across a considerable distance. The development of electric power transmission and distribution technology is driving the growth of the global market by supplying the expanding demand for energy from the residential, commercial, and industrial sectors.

The market for electric transmission and distribution equipment is able to grow as a result of the rise in investments in renewable energy facilities and the growing awareness of the need to decrease energy losses. Rapid urbanization, a rise in transformer R&D, and governments of various countries giving domestic energy infrastructure development priority are the other factors that create possibilities for growth.

Market Outlook

- Market Growth Overview: The electric power transmission and distribution equipment market is expected to grow significantly between 2025 and 2034, driven by the rising energy demand, growing need for advanced T&D to manage intermittent solar, and rising demand for charging infrastructure and grid upgrades.

- Sustainability Trends: Sustainability trends involve smart grid integration, renewable energy management, and grid modernization and digitalization.

- Major Investors: Major investors in the market include Siemens, ABB, Schneider Electric, GE Vernova, Tata Power, KEC International, Power Grid Corp of India, and CG Power.

- Startup Economy: Startup economy focuses on renewable energy integration and management, advanced equipment technology, and asset management.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 256.70 Billion |

| Market Size by 2035 | USD 453.09 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.85% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Products, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising urbanization drives the market for electric transmission and distribution equipment

Rising urbanization and the increasing demand for smart appliances across the globe is expected to drive the growth of the electric transmission and distribution equipment market. The rising need for electric appliances in the population for a better lifestyle and convenience drives the growth of the market. In urbanization, the increasing industrialization infrastructure, and commercial area tends to the higher demand of the electric transmission and distribution equipment market. The increasing requirement for technologically advanced electrical equipment for smart houses, offices, etc., and the changing lifestyle habits of people around the globe are expected to increase the demand growth of the electric transmission and distribution equipment market. The increase in disposable income and adaptation of digitization positively impacts the growth of the electric transmission and distribution equipment market.

Restraints

High cost of installation

Although there are many benefits and uses of electrical power transmission and distribution equipment, there are some market-hampering factors that restrain the growth of the overall market. The initial cost of material and installation of the power grid or the electric power generation is expensive, at the time of installation amount of protective devices are used like a transformer, overhead components, switchgear, etc. it also needed the relay, circuit breakers, and contractor to avoid a dangerous outbreak. More insulator is required for better connectivity. These factors show that the initial installation cost is higher than expected and would hamper the growth of the electric power transmission and distribution equipment market.

Opportunities

Rising focus on the utilization of renewable energy

Renewable energy is the best alternative to fossil fuel energy most organizations are looking for investment in emission-free energy. The increasing awareness of global warming in the people and shifting mindset to the renewable source of energy would drive the market to renewable energy. There are some sources of renewable energy such as wind, solar, geothermal energy, biomass, etc. Renewable energy reduced fossil fuel use and reduced the cost of electricity. In the recent era, many nations adopting renewable energy as their primary source of energy and this will positively impact the growth of electric power transmission due to the reduced cost of electricity, thus renewable energy source becomes the future opportunity for electric power transmission and distribution equipment market growth.

Segment Insights

Product Insights

The cables and lines segment had the largest market revenue in 2025. The growth of the segment is attributed to the increase in thesmart grid, power distribution, and power transmission. Cables have insulation, which sets them apart from naked overhead conductors in this regard. As a result, the aspect of relative safety may be guaranteed. Flexible power cables are used by portable machines, equipment, and electronics. The rated voltage, current, maximum working temperature, and intended uses of the client are taken into consideration in the design and production of these cables.

The Transformer segment is expected to increase its market share in the forecast period. The growth of the segment increased due to rapid urbanization and industrialization across the globe. The transformer is essentially an alternating current power transmission and distribution tool that controls voltage. However, the fundamental goal of utilizing transformers was to maintain equilibrium between the power produced at extremely high voltages and the consumption of electricity at very low voltages. Transformers are employed in a number of industries, including the transmission of electrical energy and the grid for power generation.

Sales Channel Insights

The Indirect Sales Channel dominated the market with the largest market share in2025. The segment is increasing due to the rising number of end-users like commercial, catalog distribution, and e-commerce. In the indirect sales channel, the commercial segment took the maximum part of the market growth. Increasing commercialization in urban areas of the countries such as the United States, Canada, India, and China results in higher demand in the market. The increasing e-commerce industry also contributes to the growth of the market.

The Direct Sales Channel is expected to grow at a significant rate during the predicted period. Increasing consumer demand by going personally and validating the product lifecycle would drive the segment demand.

Regional Insights

What is the Asia Pacific Electric Power Transmission and Distribution Equipment Market Size?

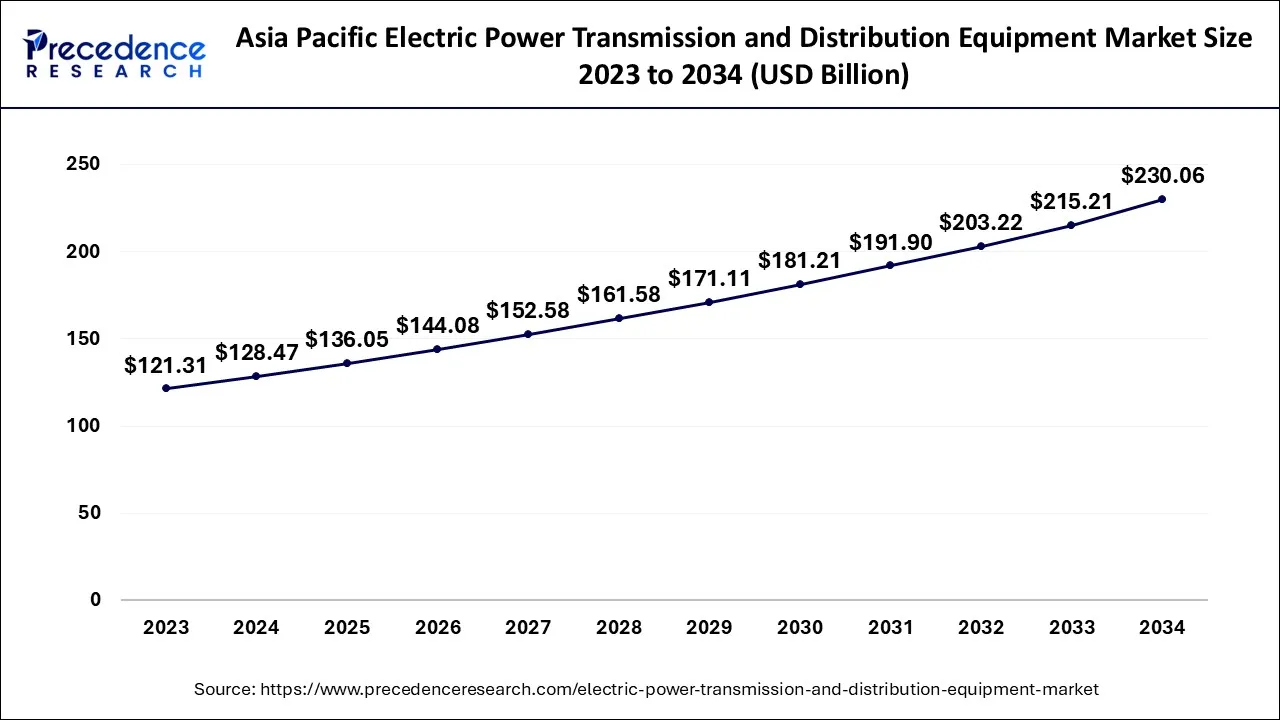

The Asia Pacific electric power transmission and distribution equipment market size is exhibited at USD 136.05 billion in 2025 and is projected to be worth around USD 244.91 billion by 2035, growing at a CAGR of 6.05% from 2026 to 2035.

How did Asia Pacific dominate the Electric Power Transmission and Distribution Equipment Market in 2025?

Asia-Pacific dominated the market with the highest revenue share in 2025.The region continues its dominance over the forecast period due to the increasing industrialization and commercialization across the region. The increasing population growth and the rising standards of lifestyle and disposable income of people tend to the higher demand for smart houses, smart appliances, and smart offices would drive the demand growth of the electric power transmission and distribution equipment market.

India Electric Power Transmission and Distribution Equipment Market Analysis

India is transitioning due to electrification programs, renewable energy integration, the rising electricity demand, and infrastructure modernization. The World Bank Group supported India's electricity sector by financing three projects. In October 2025, Toshiba announced a major total investment of 55 billion yen to accelerate the power transmission and distribution (T&D) equipment business.

What Factors Drive North America's Lead in the Electric Power Transmission and Distribution Equipment Market?

North America has a significant market share in the electric power transmission and distribution equipment market. The early and rapid adoption of the technology results in the growth of the market in the region. The rising adoption of renewable sources of energy for electricity consumption drives the market to grow. The rising investments in electric power transmission and distribution equipment would, along with the presence of major key players in the market, drive the growth of the market in the region.

Which Region is Growing Significantly in the Electric Power Transmission and Distribution Equipment Market?

The electric power transmission and distribution equipment market in Europe is expected to witness significant growth during the forecast period. The growth is attributed to the increasing consumption of electricity and rising technological advancements in the electric power transmission industry. The rising focus on the utilization of renewable energies across multiple industries will boost the market's growth during the forecast period in Europe.

U.S. Electric Power Transmission and Distribution Equipment Market Analysis

The U.S. is advancing in the market, owing to the high adoption of smart grids, real-time monitoring systems like AI and IoT, and digital substations. In September 2025, the U.S. Department of Energy (DOE) launched the Speed to Power initiative that will accelerate large-scale grid infrastructure projects.

Germany Electric Power Transmission and Distribution Equipment Market Trends

Germany's shift towards renewables necessitates grid upgrades to handle intermittent supply and new connection points, rising investment in smart grids, AI, and advanced monitoring systems. Rising demand for electricity and new generation capacity, fueling demand for transmission and distribution assets.

South America: What are the Major Factors Contributing to the Electric Power Transmission and Distribution Equipment Market within South America?

South America is expected to experience notable growth during the forecast period due to significant investments in replacing switchgear, old transformers, and transmission lines with more efficient and modern appliances. Strong demand for high-voltage transmission lines, substations, transformers, and distribution equipment is being driven by large-scale grid expansion projects and the integration of renewable energy sources such as wind and solar.

Utilities across the region are focusing on grid modernization through digital substations, smart monitoring systems, and advanced protection and control technologies to reduce power losses and improve operational efficiency.

MEA: What Opportunities Exist in the Middle East and Africa in the Electric Power Transmission and Distribution Equipment Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by grid modernization, smart-grid initiatives, rapid urbanization, and the growing population. Significant focus on integrating renewable energy projects, such as solar and wind power, is boosting demand for advanced transmission lines, substations, transformers, and smart distribution technologies to support grid stability and efficiency.

Value Chain Analysis of the Electric Power Transmission and Distribution Equipment Market

- Raw Material Sourcing and Component Manufacturing: This initial stage involves the extraction and processing of fundamental materials like copper, aluminum, steel, and insulating materials, which are essential for producing T&D equipment such as wires, cables, transformers, and switchgear.

Key Players: Prysmian Group, Nexans, and TE Connectivity. - Equipment Manufacturing and Assembly: In this critical stage, raw materials and components are transformed into finished T&D products, including transformers, switchgear, circuit breakers, and smart meters.

Key Players: Siemens AG, ABB Ltd., Schneider Electric SE, General Electric (GE), Vernova, Eaton Corporation Plc, and Mitsubishi Electric Corporation. - Distribution and Sales: This stage focuses on getting the manufactured equipment from the factories to the end-users (primarily utility companies, industrial clients, and commercial sectors).

Electric Power Transmission and Distribution Equipment MarketCompanies

- ABB Ltd. provides a comprehensive portfolio of products, systems, and services for power transmission and distribution, including transformers, switchgear, and grid automation systems designed to enhance grid reliability and efficiency.

- Mitsubishi Electric contributes to the market through advanced power equipment such as gas-insulated switchgear, transformers, and monitoring systems, which help stabilize the supply and distribution of electricity across various grids.

- Larsen & Toubro focuses on engineering, procurement, and construction (EPC) solutions for transmission lines, substations, and distribution networks, playing a crucial role in building and modernizing power infrastructure.

- Schneider Electric offers integrated energy management and automation solutions, including medium voltage equipment, transformers, and smart grid technology, optimizing electricity distribution from the grid to the point of consumption.

- Siemens is a major supplier of transmission products, from high-voltage direct current (HVDC) systems and substations to smart grid software, facilitating the efficient and reliable transport of electricity over long distances.

- Kirloskar Group manufactures a variety of power generation, transmission, and distribution equipment, including transformers, switchgear, and diesel generator sets, supporting both utility and industrial power needs.

Other Major Key Players

- Eaton

- Engine

- Bharat Heavy Electricals Limited

- EDF

Recent Developments

- In October 2025, ABB introduced the SACE Emax 3 air circuit breaker, featuring integrated predictive-maintenance analytics. This is a zero-trust cybersecurity for AI data centers. (Source:https://new.abb.com )

- In May 2023,India's largest electric power transmission company “Powergrid” collaborated and signed the Memorandum of Understanding (MoU) with Safdarjung Hospital and VMMC to provide medical equipment for urology cancer patients. The memorandum signed for the giving financial support to Safdarjung Hospital and VMMC to afford advanced medical equipment.

- In May 2023,researchers from Oregon State University stated that, smart meters are the focus of electric grid destabilization. Smart meters are electrical equipment. A smart meter is a digital gadget that gathers information about power use and transmits it to a nearby utility through a communications link.

- In May 2023,the first and biggest battery energy storage from TotalEnergies was introduced in Europe. The project, which is expected to be online by the end of next year, will get 40 Intensium Max High Energy lithium-ion containers from TotalEnergies battery subsidiary Saft.

- In May 2023, a leader in automating and managing energy, Schneider Electric announced the launch of circuit breaker ‘EvoPact' for its medium voltage equipment.

- In October 2025, ABB Ltd. launched the next-generation low-voltage power distribution solution to support the deployment of AI-ready data centers. The cutting-edge MNS switchgear is a leading choice for technology giants and integrates the novel SACE Emax 3 air circuit breaker.

Source: https://new.abb.com - In October 2025, Mitsubishi Electric planned to collaborate with the Industrial Technology Research Institute (ITRI) in Taiwan. The collaboration is aimed at developing large-capacity power-conversion systems by using power semiconductors.

Source: https://www.mitsubishielectric.com

Segments Covered in the Report

By Products

- Transformer

- Power Transformer

- Distribution Transformer

- Switchgear

- Circuit Breaker

- Fuse

- Distribution Control Panel

- Others

- Insulators & Fittings

- Cables & Lines

- Others

By Sales Channel

- Indirect Channel

- Commercial Distribution

- Catalog Distribution

- Retail Box Stores

- E-commerce

- Direct Channel

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting