What is the Electric Vehicle Charger Market Size?

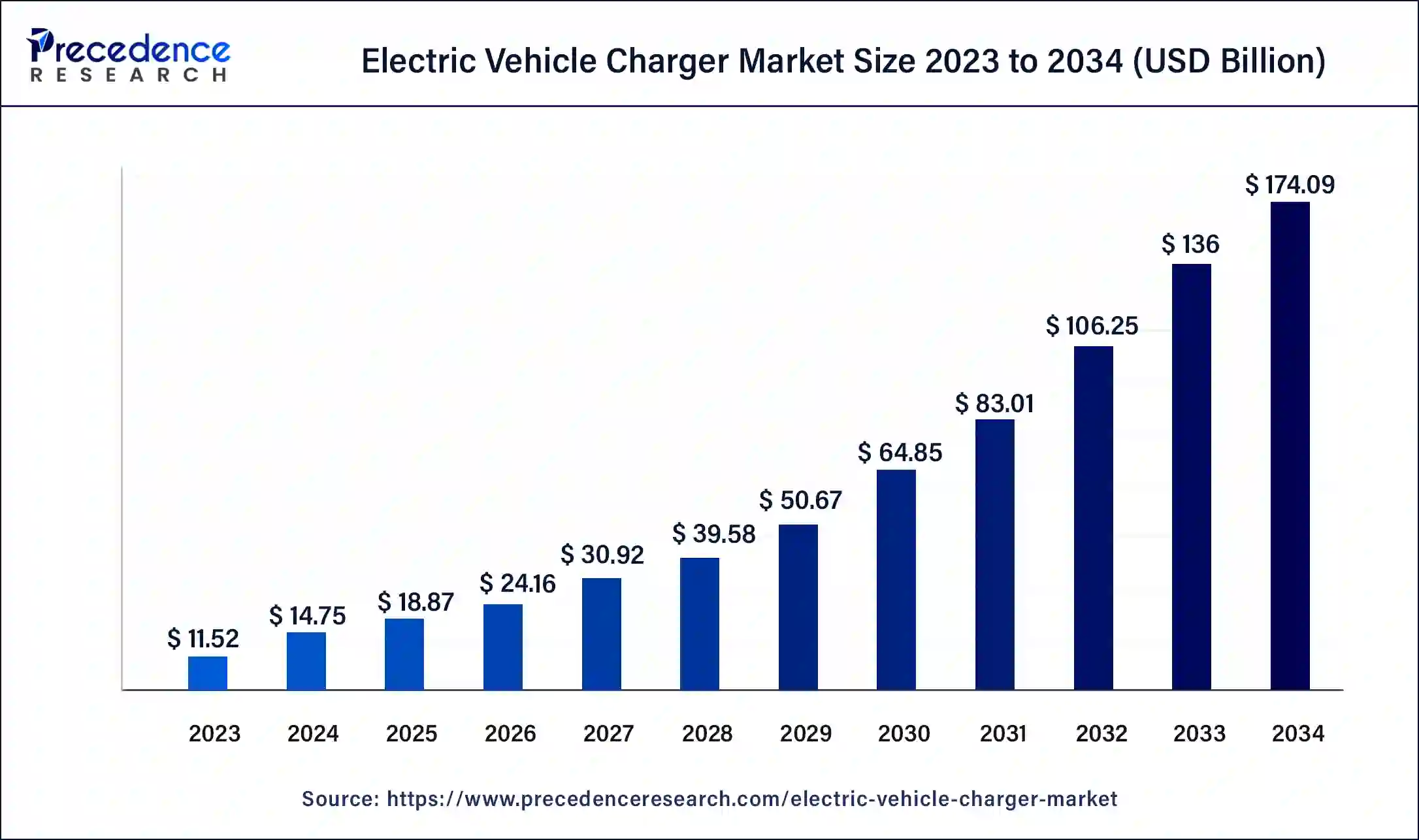

The global electric vehicle (EV) charger market size is valued at USD 18.87 billion in 2025 and is predicted to increase from USD 24.16 billion in 2026 to approximately USD 212.18 billion by 2035, expanding at a CAGR of 27.38% from 2026 to 2035.

Electric Vehicle Charger Market Key Takeaways

- In terms of revenue, the electric vehicle (EV) charger market is valued at $18.87 billion in 2025.

- It is projected to reach $212.18 billion by 2035.

- The electric vehicle (EV) charger market is expected to grow at a CAGR of 27.38% from 2026 to 2035.

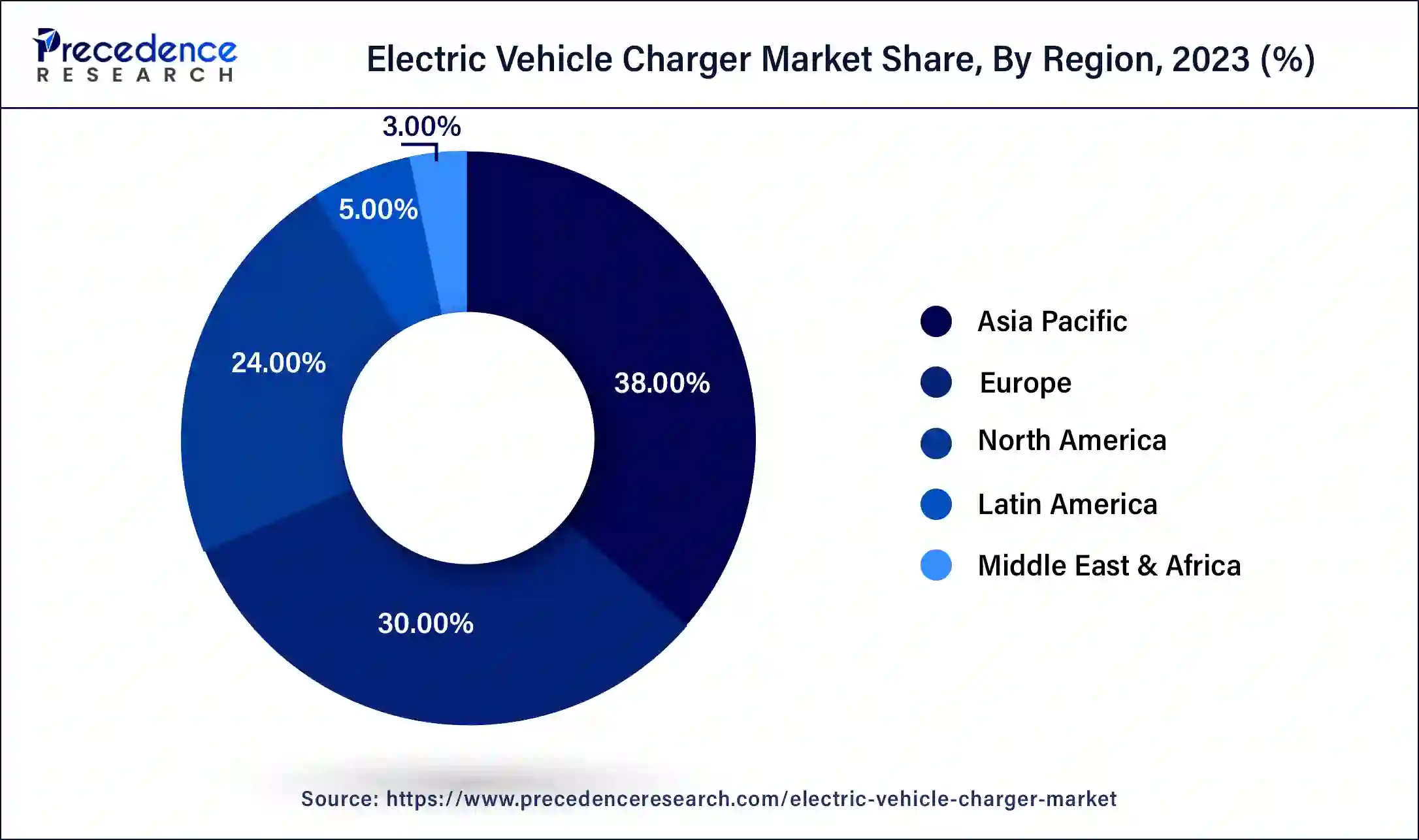

- Asia Pacific led the global market with the highest market share of 38% in 2025

- By vehicle type, the plug-in hybrid vehicle (PHEV) segment held the largest market share in 2025.

- By charging type, the on-board segment captured the biggest revenue share in 2025.

- By end use, the residential segment registered the maximum market share in 2025.

Key Factors Influencing Future Market Trends

- Government Policies and Incentives: The expansion of the EV charger market is dependent on government incentives, governmental intervention, and plans to decrease total greenhouse gas emissions. Governments around the world are helping to grow the market with funding for charging stations and by eliminating gasoline-propelled vehicles.

- Rising Adoption of Electric Vehicles: As more people understand climate change and pay more for fuel, they are deciding to purchase electric vehicles. The manufacturers and energy firms are increasing their spending on charging technology.

- Advancement in Urban Infrastructure:In cities, builders are putting charging stations in public parking lots, shopping malls, residential complexes, and offices. Smart city initiatives are now allowing for more efficient planning of charging stations and energy management.

- Technological Innovations in Charging Systems: They allow operators to reduce charging times and improve grid efficiency. Additionally, the invention of smart chargers can lessen the burden on energy demand during peak demand.

Electric Vehicle Charger Market Growth Factors

The global EV charger market is expected to witness a burgeoning growth in the forthcoming years owing to the various factors such as surging sales of electric vehicles across the globe, rising demand for zero emission vehicles, and growing government initiatives to foster the adoption of electric vehicles. The government in various developed and developing nations such as Canada, Japan, and India are offering subsidies to the consumers to boost the adoption of electric vehicles. The Canadian government provides a subsidy of around US$3,700 for buying electric vehicles in Canada. Further, the government of Japan offers a subsidy of around US$3,700 for purchasing BEV and a subsidy of around US$1,800 for buying PHEV. The technological developments in the electric vehicle and charging infrastructure such as ultra-fast chargers, portable charging station, load management with smart charging, automated payment systems for charging, and bi-directional charging are some of the prominent factors that are expected to foster the growth of the EV charger market across the globe.

The EV industry is foreseeing an incredible growth in the developed and developing regions around the globe. The higher dependence on the biofuels has resulted in increased levels of air pollution and as a consequences, the prevalence of various respiratory and other diseases is surging among the global population. To curb the carbon footprint and shift towards the clean and green energy are the major factors that are expected to drive the growth of the global EV charger market. The increasing consumer awareness regarding carbon emission from vehicles, increased environmental consciousness, improvements in the standard of living, and growing adoption of advanced technologies are altogether propelling the growth of the global EV charger market.

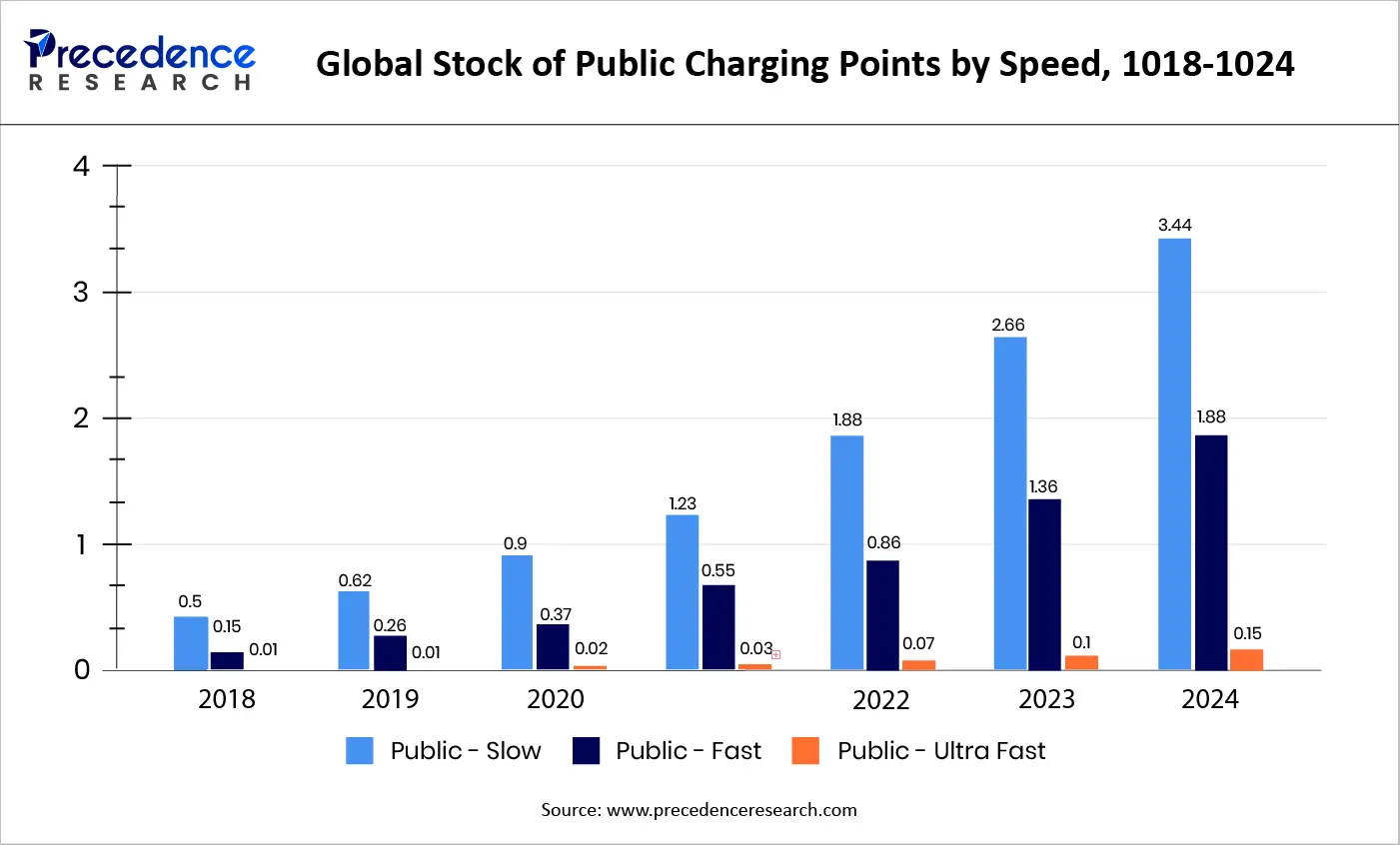

While home charging remains the primary charging method for most electric vehicle owners, the expansion of public charging infrastructure is increasingly critical to enable mass EV adoption among urban residents and households without private parking access. According to the International Energy Agency's Global EV Outlook 2024, more than 1.3 million public charging points were added globally in 2024, representing year-on-year growth of over 30%, with additions in 2024 alone roughly matching the total global stock recorded in 2020. The same IEA data show that nearly two-thirds of global public charger growth since 2020 has occurred in China, which now accounts for around 65% of global public charging points and about 60% of the electric light-duty vehicle stock.

Charger-to-vehicle ratios highlight structural differences in charging reliance, with China maintaining more than one public charger per ten electric cars, compared with approximately one per thirteen cars in the European Union, where higher access to home charging reduces public demand. Urban density, housing typology, and charging speed improvements are shaping deployment strategies, with fast and ultra-fast chargers expanding rapidly as systems mature and utilization efficiency improves.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 212.18 Billion |

| Market Size in 2025 | USD 18.87 Billion |

| Market Size in 2026 | USD 24.16 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 27.38% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Type, Charging Type, End User, Geography |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Vehicle Type Insights

Based on the vehicle type, the plug-in hybrid vehicle (PHEV) segment led the global EV charger market in 2025. The increasing government initiatives to encourage the sales of the electric vehicles are a key driver that led to the dominance of the PHEV segment in the global market. The increased demand for the alternative fuel vehicles across the globe has fostered the sales of the PHEV segment. The rising production capacities of the top EV manufacturers and the resulting increased production and deployment of the EV charging stations are together fueling the sales of the PHEVs and hence the growth of this segment in the global EV charger market is expected to continue throughout the forecast period. For instance, in January 2020, Volkswagen Group announced to boost its production of PHEVs by 60% as compared to the PHEVs production in the year 2018.

The battery electric vehicle (BEV) segment is anticipated to foresee the highest growth rate during the forecast period. The presence of BEVs is higher than the PHEVs in the market. The technological advancements in the batteries and the declining battery prices over time is expected to drive the sales of the BEVs in the forthcoming years, which will spur the demand for the EV chargers. For example, in October 2021, Tesla announced to use the lithium iron phosphate batteries to reduce the battery costs and increase profit margins. The prices of the EV batteries declined from US$1,100 per kWh in 2010 to US$137 per kWh in 2020, which has resulted in the reduction in the fuel prices and hence the demand for the BEVs is expected to grow at a significant pace.

Charging Type Insights

The on-board chargers segment dominated the global EV charger market in 2025. The increased adoption of the on-board chargers owing to its ability to be used with the readily available AC power has led to its increased demand across the globe. The AC charging is more flexible, easily available, and can fulfill almost all the need of certain users based on their EV vehicle uses. The adoption of EVs among the urban consumers is high and the easy availability of the AC power in the urban areas has resulted in the dominance of the on-board chargers across the globe.

Off-board chargers are gaining traction owing to its ability to quickly charge the batteries of the electric vehicles. The growing number of public charging stations is expected to boost the growth of the off-board charger in the forthcoming years. The off-board chargers receive the AC power and convert it into DC power to charge the batteries of the EVs. The off-board chargers can recharge approximately around 250 miles of range in about 30 minutes of time. The busy and hectic lifestyle of the people in the modern day world is expected to boost the demand for the off-board chargers in the upcoming future.

End Use Insights

The residential was the most dominant segment in the global EV charger market in 2025. The higher adoption of the on-board chargers in the residential units across the globe has resulted in the growth of the residential segment in the EV charger market. Most of the consumers opt for charging their vehicles at night and use the vehicles during day time for various purposes. The rising investments in the development of modern day residential infrastructures and growing adoption of the BEV charging infrastructure in the parking spaces of the residential units is expected to further boost the growth of this segment in the forthcoming years.

The commercial is expected to be the fastest-growing segment during the forecast period. This is attributable to the increasing number of charging stations at public spaces. The growing government initiatives and rising corporate investments in the development of EV charging infrastructure across the globe are the major factors that are expected to drive the growth of this segment in the upcoming future.

Regional Insights

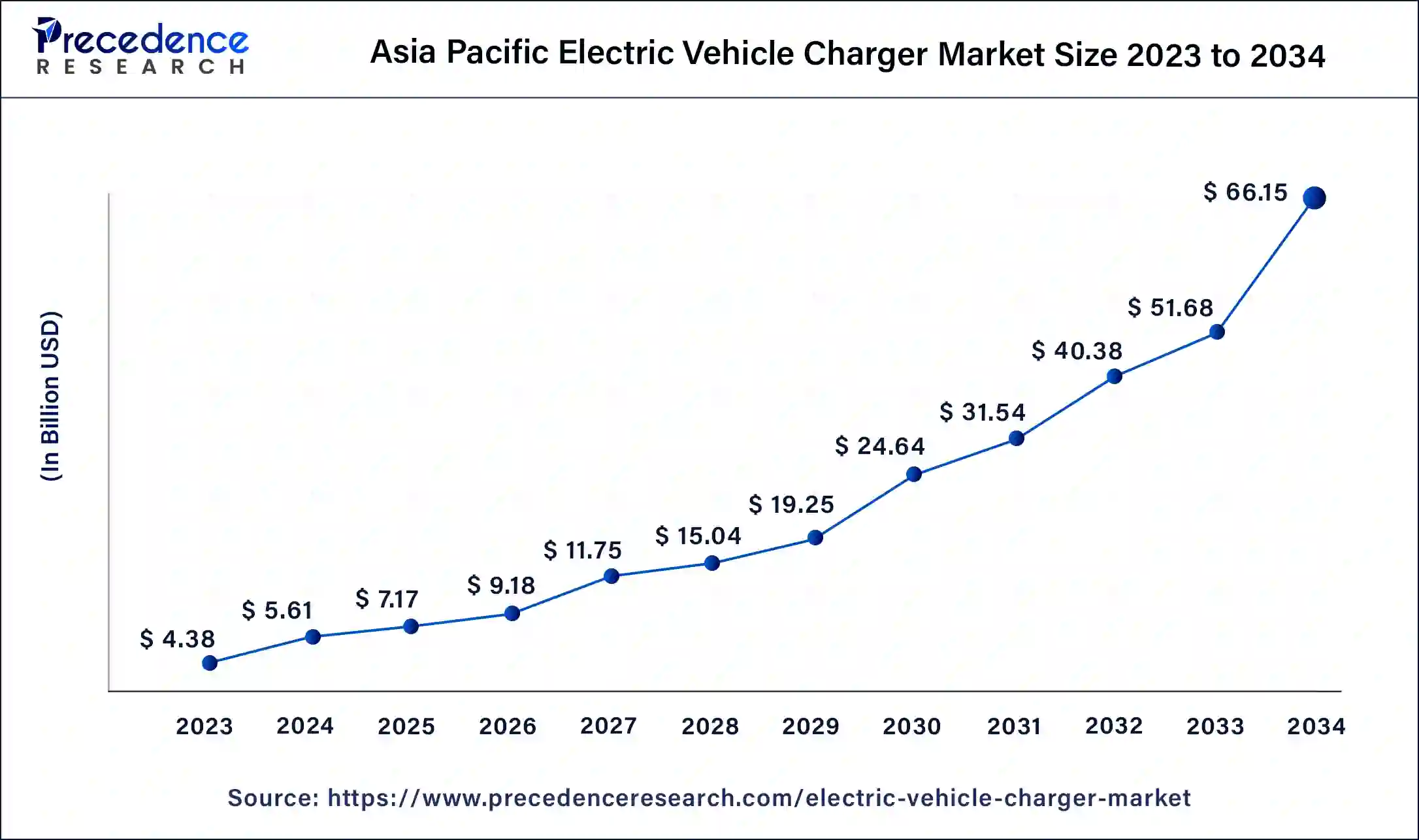

Asia Pacific Electric Vehicle Charger Market Size and Growth 2026 to 2035

The Asia Pacific electric vehicle (EV) charger market size is estimated at USD 7.17 billion in 2025 and is predicted to be worth around USD 78.51 billion by 2035, at a CAGR of 27.04% from 2026 to 2035.

Asia Pacific is estimated to be the dominant EV charger market in 2025. The Asia Pacific EV charger market is primarily driven by the increasing adoption of theEV charging infrastructureand growing demand for the electric vehicles. The surge in the adoption of EVs for public transport in the developing and highly populated countries like China and India is supporting the growth of the EV charger market. The developing economies like China, South Korea, and Japan are planning to increase the number of charging stations to promote the adoption of the electric vehicles in the country.

Europe was the second-largest EV charger market in 2025. The government regulations pertaining to pollution is strict and the adoption rate of EVs among the European consumers is also high. The increased awareness regarding the carbon emission, high disposable income of the consumers, and improved living standards are fueling the sales of the EVs, which is expected to fuel the growth of the EV charger market in Europe.

What are the Advancements in the Electric Vehicle Charger Market in North America?

North America is witnessing a significant amount of growth in the market and is expected to grow even more during the forecast period. This growth and development are supported by significant capital investments and favorable regulatory frameworks. Federal and regional initiatives are also driving the development of extensive public and private charging networks, especially to meet climate goals and accelerate EV adoption.

U.S Electric Vehicle Charger Market Trends: The U.S. electric vehicle charging infrastructure market is expanding at a rapid pace, driven by federal funding programs. Key growth areas include urban metro clusters, highway corridors, and fleet charging solutions for commercial transportation.

What are the Key Trends in the Electric Vehicle Charger Market in Latin America?

The Latin America market is witnessing substantial growth, driven by growing government support for clean mobility and increasing EV adoption all across the region. Key urban centers are witnessing significant investments in public and private charging infrastructure to address range anxiety and enhance convenience for EV users. Technological advancements are also helping in improving efficiency and user experience.

Brazil Electric Vehicle Charger Market Trends: Increasing investments in the country, especially in public and private charging infrastructure, are enhancing accessibility in urban and semi-urban areas. Partnerships between automakers, energy providers, and tech companies are gaining traction.

How is the Middle East and Africa region growing in the Electric Vehicle Charger Market?

The Middle East and Africa electric vehicle charger market is witnessing steady growth driven by increasing government initiatives to promote clean transportation. Rising EV adoption in urban centers is fueling the demand for accessible and fast-charging infrastructure. Strategic collaborations between local authorities and private players are accelerating network expansion across key regions.

Saudi Arabia Electric Vehicle Charger Market Trends: Increasing investments in renewable energy and smart grid infrastructure are enhancing the adoption of EV charging stations across urban and semi-urban areas. Additionally, rising environmental awareness and stricter emission regulations are encouraging both commercial and private EV adoption.

Value Chain Analysis of the Electric Vehicle Charger Market

- Raw Material Sourcing

Electric Vehicle chargers include components like semiconductors, power electronics, cables, and connectors. Key materials used are advanced polymers, aluminum, steel, and copper.

Key players: Infineon, TDK, Schneider - Manufacturing Process

In this stage, the PCBs are assembled with electronic components, housed within enclosures, and then attached with cables. It also includes weatherproofing, adding gaskets or seals, and treating metal parts against corrosion.

Key Players: Chargepoint, Tritium, Wallbox - Quality Checks

Before the final distribution process, multiple tests are conducted to ensure that the charger meets global performance and safety standards. It includes electrical, thermal, and functional performance tests.

Key Players: EV Box, Delta Electronics, Ionity

Electric Vehicle Charger Market Companies

- ABB Ltd.

- Robert Bosch GmbH

- Siemens AG

- Delphi Automotive

- Chroma ATE

- Aerovironment Inc.

- Silicon Laboratories

- Chargemaster PLC

- Schaffner Holdings AG

- POD Point

Recent Developments

- In May 2025, EVRE, an electric vehicle (EV) charging infrastructure company, launched a new manufacturing plant in Hyderabad exclusively for the production of EV chargers. This represents a substantial increase in separate production capabilities for our company and allows us to serve both domestic and export customers.

- In September 2024, Schneider Electric launched the next-generation Schneider Charge Pro, a Level 2 AC Commercial Electric Vehicle Charger. This model offers efficient and environmentally friendly charging in commercial fleet contexts and requires vehicle chargers to mandate workplace charging.

- In December 2024, Delta Electronics India signed an MOU and collaborated with ThunderPlus on the supply of high-efficiency 4kW rectifier modules for fast chargers for electric vehicles. This growing demand comes considering electric mobility in the country is becoming necessary due to the continued growth of this segment and the expansion of sustainable charging infrastructure.

- The EV charger market is moderately fragmented owing to the presence of several top market players. These market players are constantly involved in the various developmental strategies such as partnerships, mergers, acquisitions, collaborations, new product launches, and various others to strengthen their position and increase their market share.

Segments Covered in the Report

By Vehicle Type

- Plug-in Hybrid Vehicle (PHEV)

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

By Charging Type

- On-board Charger

- Off-board Charger

By End User

- Residential

- Commercial

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting