Electric Vehicle Charging Cables Market Size and Forecast 2025 to 2034

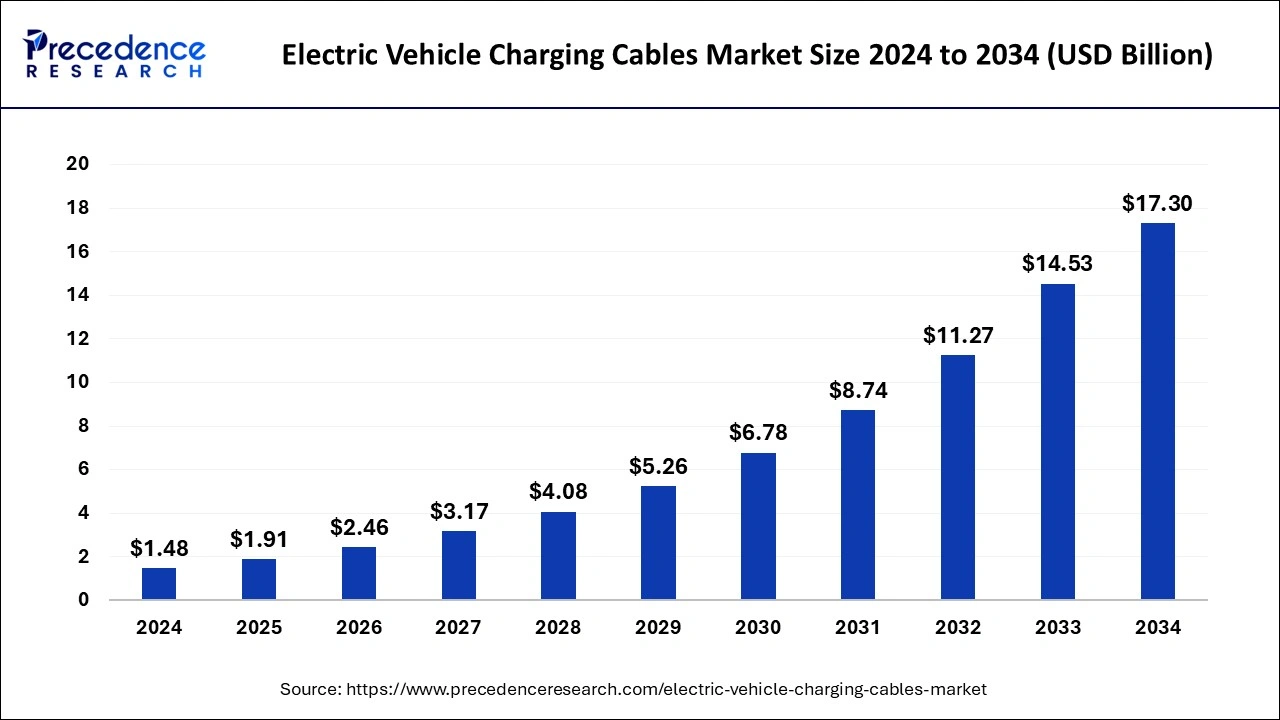

The global electric vehicle (EV) charging cables market size was accounted for USD 1.48 billion in 2024, and is expected to reach around USD 17.30 billion by 2034, expanding at a CAGR of 27.87% from 2025 to 2034. The market growth is driven by the rising adoption of electric vehicles, advancements in charging technologies, and supportive government policies promoting clean energy solutions.

Electric Vehicle Charging Cables Market Key Takeaways

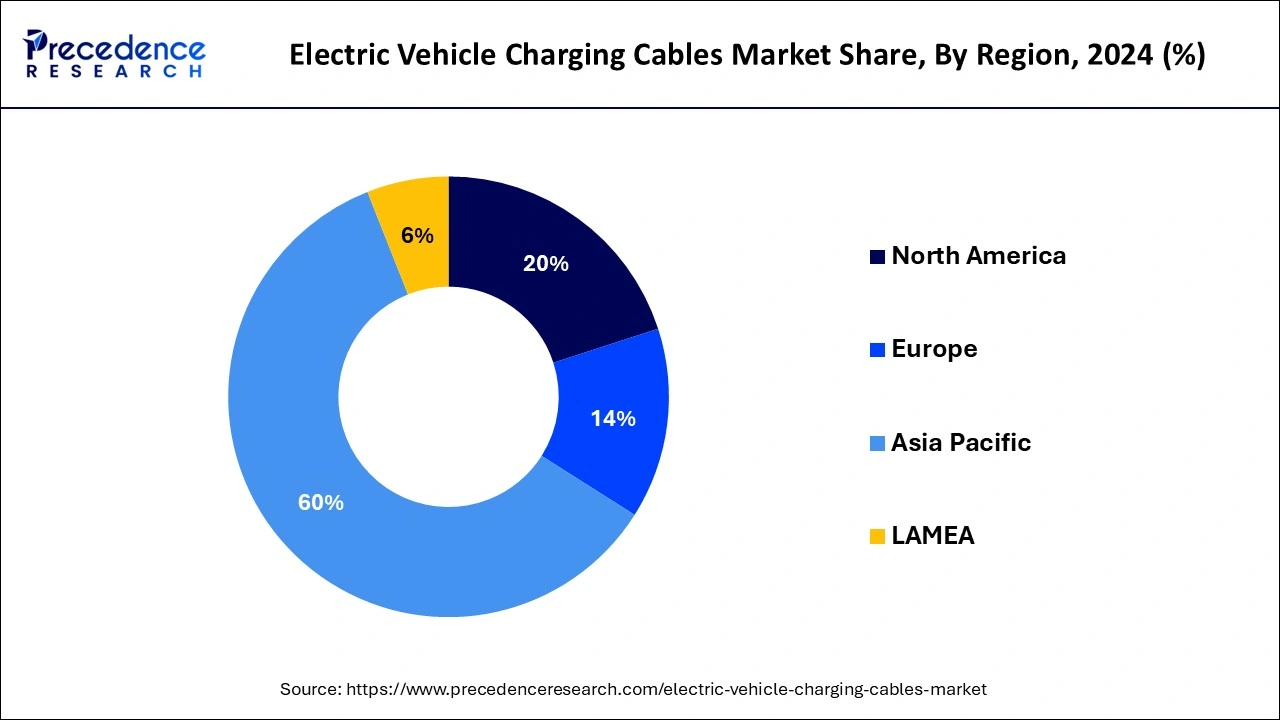

- Asia Pacific has captured a 60% market share in 2024.

- By power supply, the AC segment has generated a market share of over 76% in 2024.

- By cable length, the below 5 meters cable length segment accounted for 55% market share in 2024.

- By charging level, the level 2 segment accounted for 48% market share in 2024.

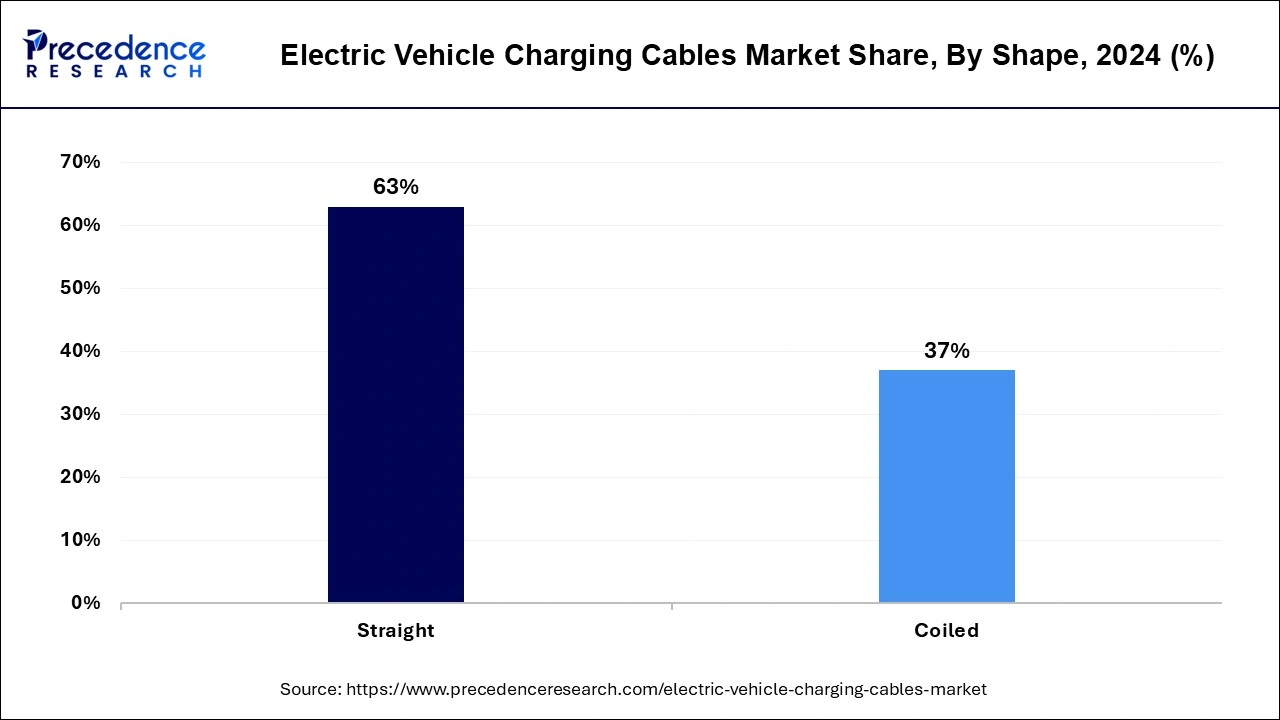

- By cable shape, the straight cable made up 64% market share in 2024.

- By application, the private charging segment has reached 73% revenue share in 2024.

Impact of Artificial Intelligence on the Electric Vehicle Charging Cables Market

Artificial intelligence (AI) and machine learning (ML) algorithms positively impact the electric vehicle charging ecosystem by transforming charging solutions. AI and ML technologies are responsible for delivering a seamless user experience. They adapt the charging process by analyzing the probabilistic distribution of charging requests and balancing load to provide a shorter waiting time for electric vehicle owners. These smart systems also include real-time monitoring of the charging stations, where any developing fault or maintenance problem can be detected and solved before it becomes a threat. Additionally, AI algorithms are applied to develop ideal charging cables, considering the user's mannerisms, climate conditions, and energy consumption.

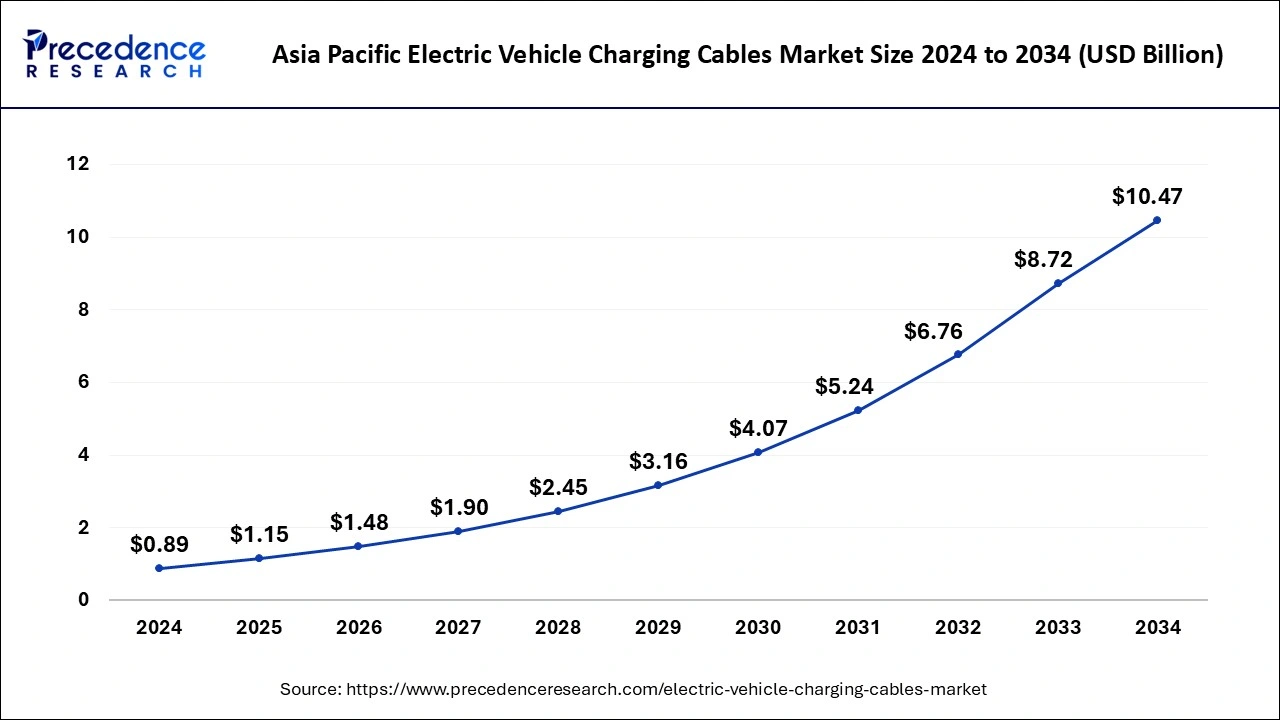

Asia Pacific Electric Vehicle Charging Cables Market Size and Growth 2025 to 2034

The Asia Pacific electric vehicle (EV) charging cables market size was estimated at USD 0.89 billion in 2024 and is predicted to be worth around USD 10.47 billion by 2034, at a CAGR of 27.95% from 2025 to 2034.

In 2024, Asia Pacific led the market and accounted for 60% of total revenue. China, South Korea, and Japan are principally responsible for this region's growth. The greatest market for electric car charging cables is China. The governments of China and Japan have developed different policies and efforts to encourage key market participants to produce Electric Vehicle Charging Infrastructurein their home countries because they anticipated the growing potential of the worldwide market for EV supply equipment. The region's high density ofElectric Vehicle Charging Stationsis anticipated to boost regional market expansion throughout the projection period.

The COVID-19 outbreak, however, has a particularly negative impact on South Korea and China, which gives the situation an interesting twist for the auto industry. Since CATL, LG Chem, and Samsung HDI are the main Chinese and South Korean providers of EV batteries, their supply may be limited, and finding them from alternate sources would be extremely difficult. Manufacturers in Europe are undoubtedly really concerned about this as they strive to meet their own emissions objectives. In a prolonged situation, EV demand may be impacted further by the need for EV charging lines due to decreased government subsidies, declining oil costs, and the economic effects of the pandemic.

From 2025 to 2034, North America is expected to experience a CAGR of 32.5%, which will be preceded by Europe and Asia Pacific. This is due to manufacturers' increased focus on creating electric cars with excellent performance, greater efficiency, and quicker speeds. The presence of significant EV supply equipment manufacturers in the area and the expanding installation of sophisticated charging infrastructure are projected to propel the regional market.

Electric Vehicle Charging Cables Market Growth Factors

- The rising production and adoption of electric vehicles (EVs) and the rapid expansion of charging stations across the globe boost the market growth.

- Increased government incentives and regulations promoting the use of electric vehicles support market growth.

- Advancements in EV charging technologies improve the efficiency of charging stations.

- Growing public and private investment in EV infrastructure accelerates the market's growth.

- Increasing focus on reducing carbon emissions encourages the transition to electric vehicles, significantly contributing to market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.91 Billion |

| Market Size by 2034 | USD 17.30 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 27.87% |

| Largest Maret | Asia PAcific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Shape, Power Supply, Charging Level, Application, Length, Mode, and Diameter |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

- Increased sales of electric vehicles - The adoption of electric cars has increased over the past several years as a result of the technology's maturation, falling costs, increased support for clean transportation, increased charging opportunities, and increased public awareness. Additionally, worries about car emissions and the depletion of non-renewable energy sources have prompted a number of governments to invest in electric vehicles. Even tax credits for buying electric vehicles have encouraged buyers to buy more EVs.

- Growth in the need for high-speed charging infrastructure - Electric car charging cable producers are creating sophisticated cables for high-speed charging in response to the increase in demand for high-speed charging stations. The global market for electric car charging cables is expected to be fueled by an increase in government spending to provide charging infrastructure. The market for electric car charging cables is expected to continue to grow quickly due to the manufacture of electric components throughout the world.

Key Market Challenges

- Expensive EV charging cables - A fast charging cable costs around $126, which is a lot more than a slower charging cable. The price of charging cables for rapid charging stations might prevent this technology from being used as much. The total cost of installing a slow charging station, for instance, is $1700 in the UK, which is highly expensive. Additionally, as charging cable technology continues to progress, users will increasingly embrace the newest models. Therefore, the initial expense of installing the charging station might cause significant losses for certain people. All of these elements could prevent this market from expanding.

Key Market Opportunities

Demand for quick speed charging

- To meet the need for quick speed charging, cable makers are working to produce advanced EV charging cables. Typical DC charging voltages range from 400 Volts to 480 Volts and may provide up to 50kW of power. Many businesses engage in R&D, for example Phoenix Contact, which has created a high-power fast charging cable with advanced cooling technology that uses a water-glycol combination to quickly recharge automobiles. The interface of the charging has changed as a result of technological improvements.

Rise in demand for vehicle electrification across the globe

- The market for electric car charging cables is projected to increase due to the implementation of strict emission rules worldwide to limit the emission of dangerous gases from automobiles. The need for charging stations is growing as electric car use increases. During the forecast period, this is projected to be a major element that would likely propel the market for electric car charging cables.

Shape Insights

Straight wires are typically employed when several stations are close together. Though less sturdy, these cables are less expensive than coiled cables. Increasing thickness of the cable affects the current carrying capability of these cables. Since Type 1 (J1772) connections are found on the majority of charging stations, straight cables are frequently utilised while charging electric vehicles. The single-phase capacity of this kind of EV cable is 7.4 kW. Nissan, Toyota, Mitsubishi, Volvo, BMW, Audi, and Mercedes Benz are among the automakers who utilise a Type 1 EV direct charging connection. To make EV cables easier to handle, their diameter must be tiny, yet doing so exposes them to overheating. Therefore, a liquid-cooling system is installed on these wires. The US and Japan both employ Type 1 AC charging cords that adhere to SAE J1772/IEC 62196-2 specifications. An efficient cable design takes into account a number of important factors. A connection, an insulating substance, and an electrical conductor are a few examples.

During the projected period, straight cables are anticipated to have the greatest market in Asia Pacific. The majority of the nations in this area have cost-sensitive economies. Straight cables might cost up to 30% less than coiled cables, according to specialists in the field. Because they are less costly and easier to handle than coiled cables, straight cables are chosen. Apart from being inexpensive, straight cables are lightweight, simple to store, and straightforward to use. Additionally, the bulk of the region's public EV chargers feature straight-shaped wires.

Power Supply Insights

With a share of 76%, the AC category led the market in 2024. Depending on the car and the criteria of the charging infrastructure, alternate charging provides a 120 V with a 22-kW charging speed. Around the world, household and semi-commercial stations mostly use AC power supplies. This kind of power supply power outlet is inexpensive to install and provides a meagre power output. Additionally, wall-mounted chargers for electric vehicles are favoured over floor-mounted chargers since they reduce the expense of subterranean electrification.

Additionally, domestic stations are ideally suited for wall-mounted chargers. Due to many developments in public stations, the DC category is predicted to have the greatest CAGR of 28.5% from 2024 to 2033. DC fast chargers quickly transfer energy, giving users of electric vehicles a lot of freedom. Additionally, it is projected that during the forecast period, rising demand for speedier in less time would fuel the segment's growth.

Charging Level Insights

The market has been divided into level 1, level 2, and level 3 charge levels. As they are increasingly employed in residential and semi-commercial applications, including individual houses, condominiums, apartments, hotels, parking lots, and retail facilities, the level 2 category led the market in 2023 with a 49% share.

From 2025 to 2034, the level 3 segment category is predicted to have the greatest CAGR, at a rate of 28%. A Level 3 system has CHAdeMO technology, which recharges using 480V. A level 3 charger can recharge an electric car battery that has been completely depleted by 80% in far less than 15 minutes. The main driver of the segment's growth is the high-power charging ability that can be accomplished in less than 30 minutes. The category is expected to see growth throughout the forecast period as a result of the rising demand for fast charging station in nations like China, South Korea, and Japan as well as the quick improvement of high-power electric car charging infrastructure.

Electric Vehicle Charging Cables Market Companies

- Tesla

- Phoenix Contact

- Dyden Corporation

- TE Connectivity

- Coroplast

- Leoni AG

- BESEN International Group

- TE Connectivity

- General Cable Technologies Corporation

- Chengdu Khons Technology Co., Ltd.

- Manlon Polymers

- Eland Cables

- EV TEISON

- Aptiv Plc.

- Brugg Group

Latest Announcements by Industry Leaders

- In December 2024, ChargePoint, a leading provider of networked EV charging solutions, and General Motors (GM) collaborated to expand EV charging infrastructure in the U.S. The partnership aims to install hundreds of ultra-fast charging ports at strategic locations nationwide, incorporating cutting-edge EV charging technology to enhance accessibility and enable faster charging. Rick Wilmer, CEO of ChargePoint, stated that the transition to electric mobility continues to be driven by leaders such as General Motors, who offer innovative EVs and commit to making chargers as ubiquitous as possible. Together, the companies will deliver a seamless and reliable fast-charging experience by combining advanced charging hardware with ChargePoint's industry-leading software platform.

Recent Developments

- In August 2024, 3V Infrastructure announced its formation with a mission to expand access to EV charging. Focused on installing and operating Level 2 EV chargers in long-dwell properties like multifamily housing and hotels, the company eliminates upfront and ongoing costs for property owners and managers. Backed by up to USD 40 million in strategic growth capital from an affiliate of Greenbacker Capital Management, 3V Infrastructure is poised to drive significant advancements in EV charging accessibility.

- In March 2024, In March 2024, itselectric, a Brooklyn-based EV charging network, announced the launch of its first-generation charger, the "Brooklyn-718." This first-ever EV charger with a detachable cable is certified under UL Standards, which meet the rigorous safety tests required by UL Standards, providing cities across the U.S. an immediately deployable solution to meet their on-street charging needs.

- In March 2024, Siemens Smart Infrastructure introduced a new variant of its SICHARGE D EV fast charger, featuring a maximum output of 400 kW for IEC markets. Designed for future-proof charging, the SICHARGE D adheres to all relevant standards and protocols while offering the capability to charge up to four vehicles simultaneously with a single grid connection. This innovative solution reduces charging times and provides financial and space-saving benefits for Charge Point Operators (CPOs).

Segments Covered in the Report

By Shape

- Straight

- Coiled

By Power Supply

- AC charging

- DC charging

By Charging Level

- Level 1

- Level 2

- Level 3

By Application

- Private charging

- Public charging

By Length

- 2-5 meters

- 6-10 meters

- >10 meters

By Mode

- Mode 1 & 2

- Mode 3

- Mode 4

By Diameter

- Up to 10mm

- 10mm to 20mm

- More than 20mm

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting