What is the Electrical Stimulation Devices Market Size?

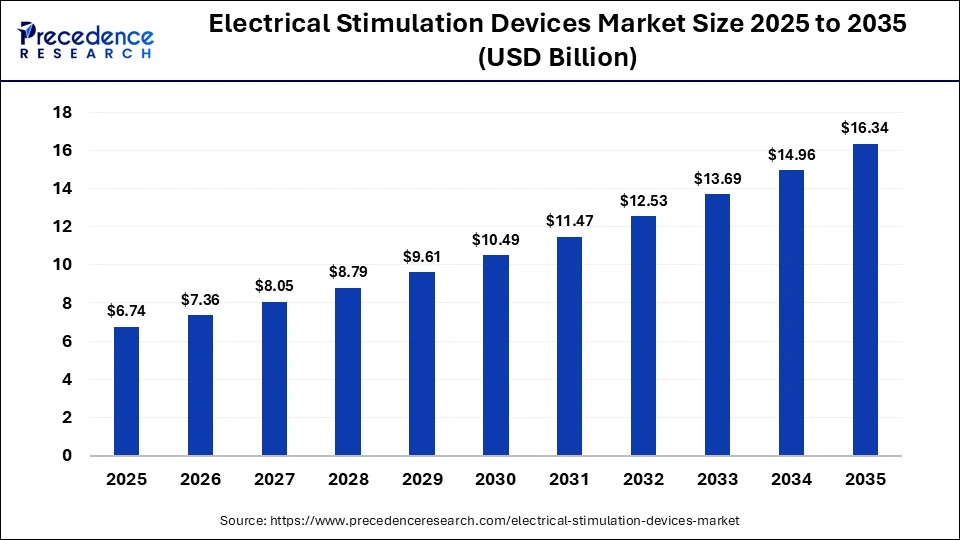

The global electrical stimulation devices market size was calculated at USD 6.74 billion in 2025 and is predicted to increase from USD 7.36 billion in 2026 to approximately USD 16.34 billion by 2035, expanding at a CAGR of 9.26% from 2026 to 2035. The market is witnessing substantial growth due to increasing demand for non-invasive, AI-driven pain management and rehabilitation technologies that provide effective alternatives to drugs for chronic and neurological disorders.

Market Highlights

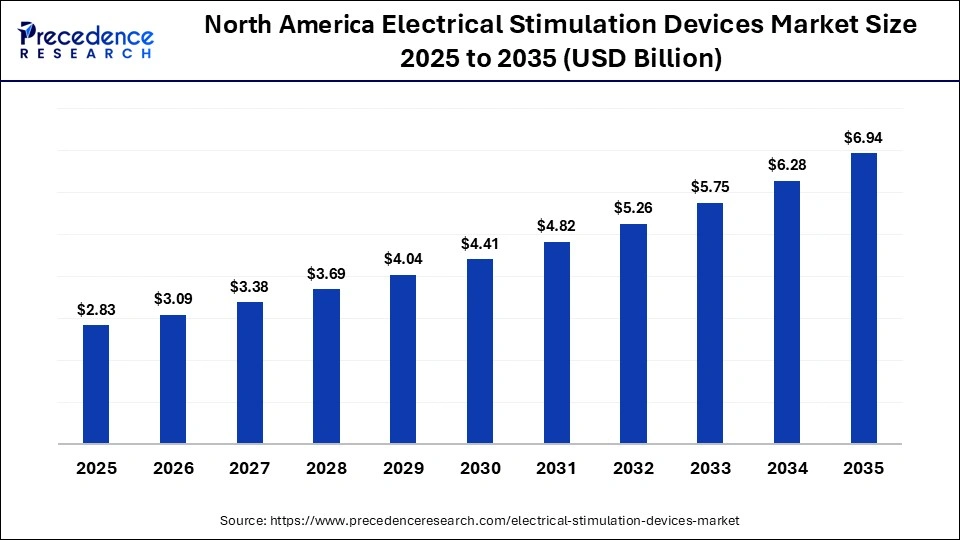

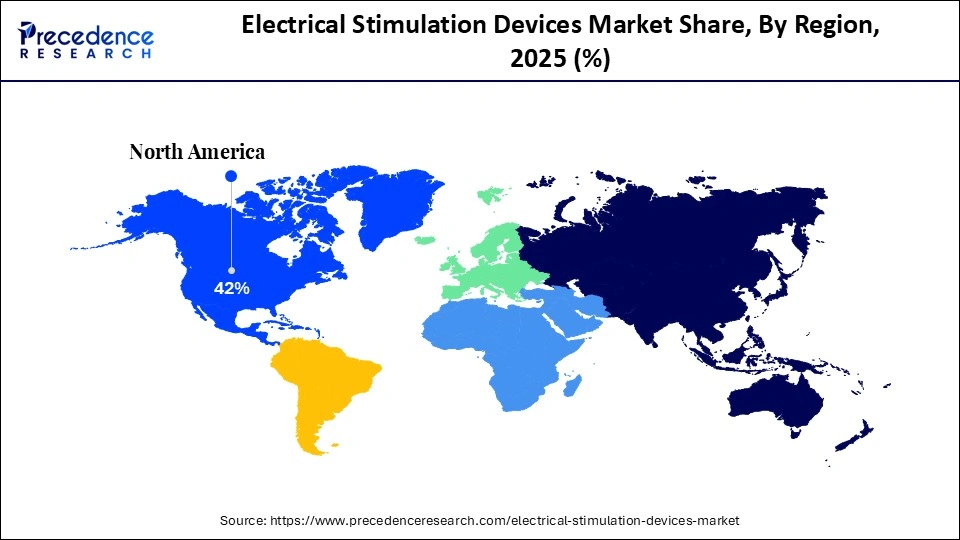

- North America dominated the market with a major market share of 42% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By device type, the spinal cord stimulation devices segment held the biggest market share in 2025.

- By device type, the deep brain stimulation devices segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By application, the pain management segment accounted for the largest market share in 2025.

- By application, the incontinence and pelvic health segment is projected to grow at a solid CAGR between 2026 and 2035.

- By end-user, the hospitals segment contributed the highest market share in 2025.

- By end-user, the home-care settings segment is growing at a strong CAGR between 2026 and 2035.

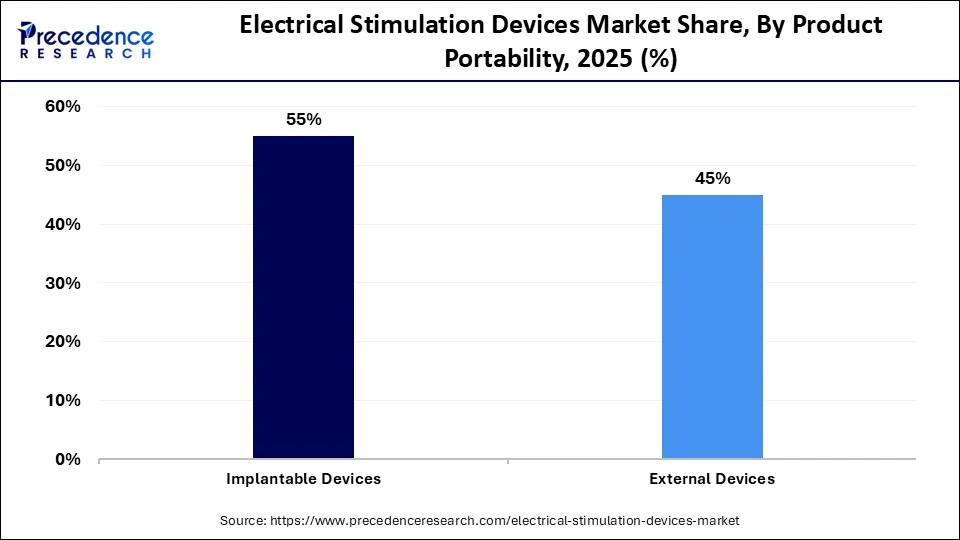

- By product portability, the implantable devices segment contributed the highest market share of 55% in 2025.

- By product portability, the external devices segment is expected to grow at a robust CAGR between 2026 and 2035.

What are Electrical Stimulation Devices?

Electrical stimulation devices are therapeutic tools that deliver electrical impulses to nerves or muscles, usually via surface or implanted electrodes. The market comprises medical devices that use mild electrical currents to treat pain, rehabilitate muscles, and manage neurological disorders. These devices are used to alleviate chronic or acute pain associated with Parkinson's disease, epilepsy, and other conditions, as well as to strengthen muscles, reduce swelling, and prevent atrophy. Market growth is driven by rising chronic pain prevalence, technological advancements in neurostimulation, and increasing adoption of home care and wearable devices.

How is AI Transforming the Electrical Stimulation Devices Market?

Artificial intelligence (AI) is transforming the electrical stimulation devices market by enabling closed-loop systems that use machine learning for real-time, personalized therapy adjustments, improving efficacy, and minimizing side effects. AI helps identify which patients will respond best to specific treatments, optimizing outcomes for chronic pain, epilepsy, and movement disorders. AI not only analyzes neural and physiological data in real time, allowing devices to automatically adjust stimulation parameters to specific patient needs and reduce the burden of manual adjustments, but also integrates with wearable patches to provide data-driven, actionable insights for remote patient care.

Major Trends in the Electrical Stimulation Devices Market

- Rise of Home-Based and Portable Devices: There is a surge in demand for portable, user-friendly, and wearable TENS/EMS devices that allow patients to continue therapy at home.

- Integration of Smart and AI Technology:Devices are increasingly incorporating artificial intelligence (AI) and smart technology to enable better data tracking, personalized, closed-loop treatment, and remote programming.

- Shift toward Non-Invasive Pain Management: A strong preference for non-invasive treatments is growing as a safe, effective, and opioid-free alternative for treating chronic pain and neurological disorders.

- Expansion of Neuromodulation and Specialized Applications:There is increased focus on advanced applications like deep brain stimulation, sacral neuromodulation for incontinence, and functional electrical stimulation for rehabilitation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.74Billion |

| Market Size in 2026 | USD 7.36 Billion |

| Market Size by 2035 | USD 16.34Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.26% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Device Type , Application, End-User, Product Portability , and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Device Type Insights

What Made Spinal Cord Stimulation Devices the Dominant Segment in the Market?

The spinal cord stimulation devices segment dominated the electrical stimulation devices market in 2025. This dominance is primarily attributed to advancements in closed-loop, rechargeable technology and the increasing adoption of these devices for failed back surgery syndrome. The transition toward smaller, more efficient rechargeable batteries and minimally invasive implantation techniques has significantly enhanced patient comfort and acceptance, making these devices a preferred option over traditional treatments with enhanced patient comfort and adoption.

The deep brain stimulation devices segment is expected to grow at the fastest CAGR during the forecast period. The growth of this segment is mainly driven by the rising incidence of Parkinsons disease, essential tremors, and dystonia. This is increasingly recognized as a preferred non-pharmacological treatment option for improving quality of life and reducing medication dependency, particularly for movement disorders. Technological innovations like adaptive, rechargeable systems and increasing adoption of dual-channel devices for better outcomes.

Application Insights

How Did the Pain Management Segment Lead the Electrical Stimulation Devices Market?

The pain management segment led the market in 2025. This is largely due to the urgent need for effective, long-term pain management solutions, alongside a demand for non-opioid, non-pharmacological alternatives for chronic pain, including neuropathic, musculoskeletal, and cancer-related pain. Additionally, technological advancements in wearable and implantable devices, combined with an increasing geriatric population and increasing prevalence of chronic conditions. Electrical stimulators are widely used for various types of pain, including neuropathy, musculoskeletal disorders, and cancer.

The incontinence and pelvic health segment is expected to witness the fastest growth in the upcoming period. This growth is primarily attributed to a shift toward home-based, non-surgical, and minimally invasive treatments for urinary and fecal incontinence. Patients and clinicians increasingly prefer electrical stimulation devices, such as vaginal probes and wearable devices, over invasive surgeries for treating incontinence. The integration of AI-based closed-loop systems, app-guided therapy, and portable wearable devices enhances user convenience and treatment effectiveness.

End-User Insights

Why Did the Hospitals Segment Dominate the Electrical Stimulation Devices Market?

The hospitals segment dominated the market with a major revenue share in 2025, driven by their role as primary hubs for complex inpatient and outpatient procedures that require advanced, high-cost technology. Hospitals are the main venue for complex, high-cost, and invasive procedures, such as implantable neuromodulation devices. Additionally, increasing patient volume, infrastructure development, and specialized multidisciplinary care contribute to their leading position. Established specialized staff and robust reimbursement frameworks for procedures in hospitals further strengthen this dominance.

The home-care settings segment is expected to grow at the fastest rate in the market. This growth is primarily driven by the increasing demand for portable, user-friendly pain management and rehabilitation devices that enable patients to manage chronic conditions at home. The integration of smart sensors, IoT connectivity, and app-enabled, user-friendly designs facilitates remote patient monitoring and improves adherence to therapy protocols. There is a growing preference for non-invasive, drug-free pain relief over traditional pharmacological methods, which promotes the use of portable stimulators.

Product Portability Insights

What Made Implantable Devices the Leading Segment in the Electrical Stimulation Devices Market?

The implantable devices segment led the market in 2025, primarily due to the growing demand for long-term chronic pain management and the technological shift toward miniaturized, intelligent, and MRI-compatible implantable systems. Implantable neurostimulation devices provide continuous, targeted therapy for chronic conditions such as Parkinson's disease, epilepsy, and neuropathic pain. The ability to deliver consistent therapy without user intervention makes them the preferred choice for long-term management, significantly enhancing the adoption of implantable devices over wearable alternatives.

The external devices segment is expected to experience the fastest growth during the forecast period. This growth is primarily driven by high demand for portable, wearable, and user-friendly non-invasive technology for pain management and rehabilitation. The integration of AI, wireless, and app-controlled technologies in these devices enhances efficacy and allows for real-time monitoring and personalized therapy. Additionally, the demand for compact, wearable, and handheld devices offers flexibility, enabling self-management of conditions outside clinical settings.

Regional Insights

How Big is the North America Electrical Stimulation Devices Market Size?

The North America electrical stimulation devices market size is estimated at USD 2.83 billion in 2025 and is projected to reach approximately USD 6.94 billion by 2035, with a 9.38% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Electrical Stimulation Devices Market?

North America dominated the electrical stimulation devices market by capturing the largest share in 2025. This dominance is attributed to its well-established healthcare infrastructure, high adoption of advanced medical technologies, substantial R&D investments, and a high prevalence of chronic pain and neurological disorders. Strong reimbursement frameworks in the U.S. and Canada for procedures like Spinal Cord Stimulation and Deep Brain Stimulation encourage both patients and physicians. The region is home to major players like Medtronic, Boston Scientific, Abbott, and Nevro Corp., which consistently introduce cutting-edge devices and maintain strong distribution networks.

What is the Size of the U.S. Electrical Stimulation Devices Market?

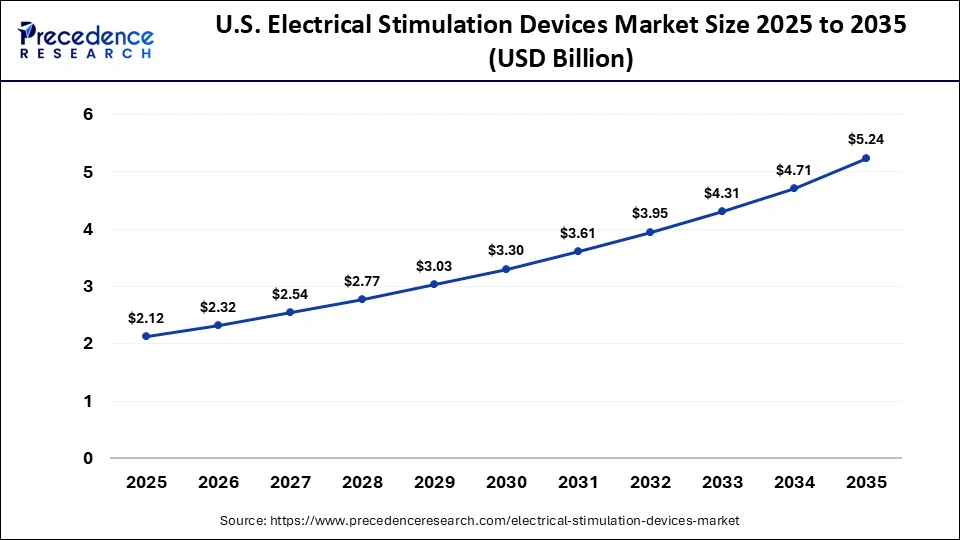

The U.S. electrical stimulation devices market size is calculated at USD 2.12 billion in 2025 and is expected to reach nearly USD 5.24 billion in 2035, accelerating at a strong CAGR of 9.47% between 2026 and 2035.

U.S. Electrical Stimulation Devices Market Trends

The U.S. is a key contributor to the market within the region, driven by a high prevalence of chronic pain, neurological disorders like Alzheimer's and Parkinson's, and sports injuries. Additionally, it is a primary hub for technological advancements in neuromodulation and electrotherapy, with companies focusing on AI-driven closed-loop systems, miniaturization, and advanced implantable devices. The market is home to major players such as Medtronic, Boston Scientific, Abbott Laboratories, Zynex Medical, and NeuroMetrix.

Why is Asia Pacific Considered the Fastest-Growing Region in the Electrical Stimulation Devices Market?

Asia Pacific is expected to grow at the fastest rate during the forecast period. This is mainly due to the high prevalence of neurological and chronic pain conditions, an aging population, and improving healthcare infrastructure in developing economies like China and India. Expanding healthcare infrastructure, increased healthcare spending, and favorable reimbursement policies in countries like China and India are propelling market growth. Growing preference for non-invasive, drug-free pain management options, such as TENS and EMS units, for use at home is accelerating adoption.

India Electrical Stimulation Devices Market Trends

India stands out as a significant market within the region, mainly characterized by an aging population, increasing lifestyle-induced disorders, and growing awareness of rehabilitation therapies. India is emerging as a production hub for medical technology, supported by government initiatives like Make in India and the establishment of Centers of Excellence at IITs to develop indigenous products and serve as hubs for advanced healthcare infrastructure.

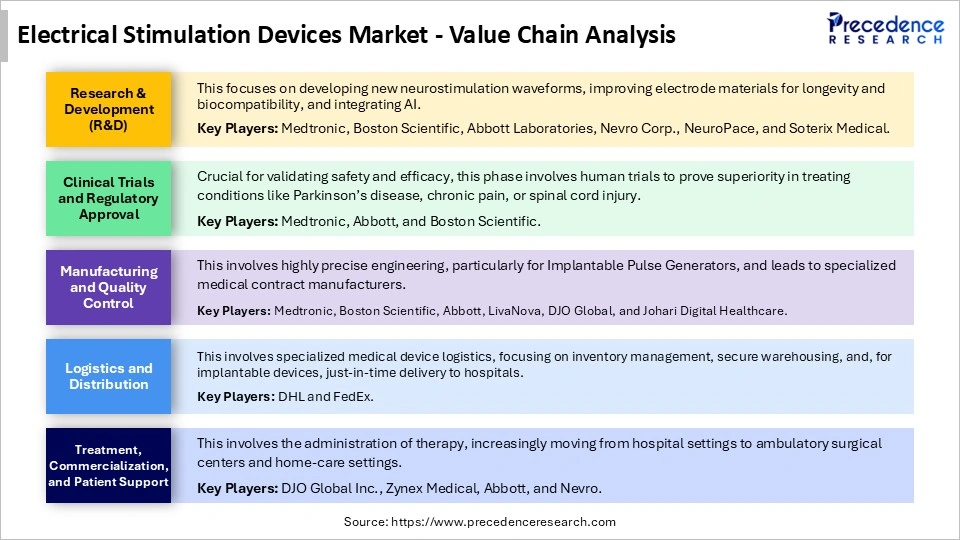

Electrical Stimulation Devices Market Value Chain Analysis

Who are the Major Players in the Global Electrical Stimulation Devices Market?

The major players in the electrical stimulation devices market include Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, DJO Global, Inc., Nevro Corp., NeuroMetrix, Inc., Zynex, Inc., BTL Industries, LivaNova PLC, OMRON Corporation, BioMedical Life Systems, Inc., Axonics, Inc., Stryker Corporation, Stimwave Technologies, Bioness

Recent Developments

- In January 2026, Swedish startup Flow Neuroscience received FDA approval for the FL-100 headset, the first brain stimulation device for home use to treat depression. This FL-100 allows patients to receive treatment at home under the supervision of mental health professionals. Flow co-founder Daniel Mansson stated, this milestone proves that the home is the next great frontier for neurology, emphasizing the shift toward accessible and effective mental health care.(Source: https://www.forbes.com)

- In February 2025, Medtronic plc announced FDA approval for its BrainSense™ Adaptive deep brain stimulation (aDBS) system. This enhancement personalizes therapy for Parkinson's disease by adjusting in real time based on a patient's brain activity, which reduces the need for manual adjustments. “Medtronic is the only company to offer an adaptive DBS system that dynamically responds to a patient's needs,” said Brett Wall, Medtronic's president of Neuroscience Portfolio.(Source: https://news.medtronic.com)

- In April 2024, Medtronic also received FDA approval for the Inceptiv™ closed-loop spinal cord stimulator for chronic pain treatment. This device senses biological signals along the spinal cord and automatically adjusts stimulation in real time. Inceptiv listens to the body and seamlessly adjusts, said Dr. Krishnan Chakravarthy, marking a significant advance in chronic pain management.(Source: https://news.medtronic.com)

Segments Covered in the Report

By Device Type

- Deep Brain Stimulation Devices

- Spinal Cord Stimulation Devices

- Sacral Nerve Stimulation Devices

- Vagus Nerve Stimulation Devices

- Other Electrical Stimulation Devices

By Application

- Pain Management

- Musculoskeletal Disorder Management

- Neurological & Movement Disorder Management

- Incontinence & Pelvic Health

- Metabolism & G-I-T Regulation

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Home-Care Settings

- Others

By Product Portability

- Implantable Devices

- External Devices

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content