What is the Electronic Manufacturing Services Market Size?

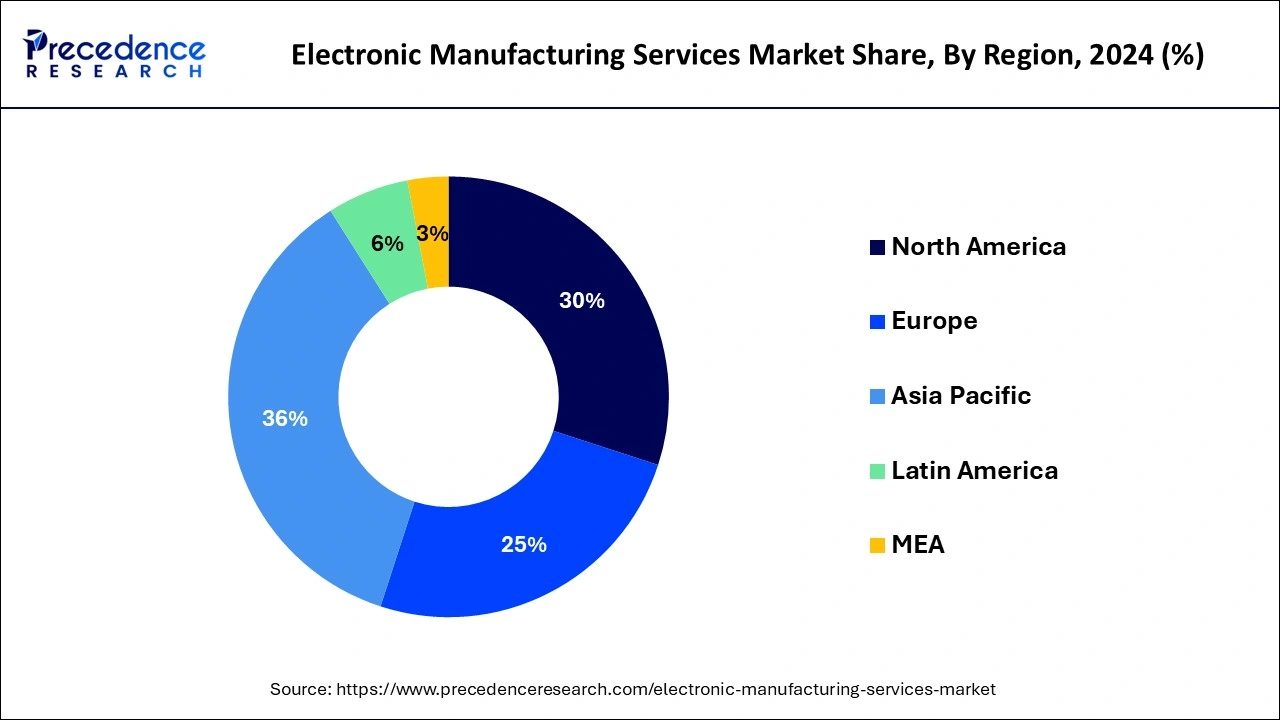

The global electronic manufacturing services market size is calculated at USD 617.90 billion in 2025 and is predicted to increase from USD 661.34 billion in 2026 to approximately USD 1,130.89 billion by 2034, expanding at a CAGR of 6.95% from 2025 to 2034.

Electronic Manufacturing Services Market Key Takeaways

- The global electronic manufacturing services market was valued at USD 577.32 billion in 2024.

- It is projected to reach USD 1,130.89 billion by 2034.

- The market is expected to grow at a CAGR of 6.95% from 2025 to 2034.

- Asia Pacific has held the largest market share of 36% in 2024.

- Europe is expected to show significant growth over the forecast period.

- By service type, the engineering services segment dominated the market in 2024.

- By service type, the electronics manufacturing services segment is projected to be the fastest-growing segment over the forecast period.

- By industry type, the IT and telecom segment dominated the market in 2024.

- By industry type, the automotive segment is experiencing notable growth in the market.

Market Overview

The electronics manufacturing services market comprises of specialized companies that handle all aspects of manufacturing electronic components and devices. This includes design, assembly, testing, and logistics. EMS suppliers support original equipment manufacturers (OEMs), enabling them to concentrate on their main strengths. Furthermore, EMS providers offer cost-effective and efficient solutions to various industries such as telecommunications, automotive, consumer electronics, and healthcare.

EMS providers' expertise in electronic production ensures top-notch products and empowers OEMs to meet market demands with flexibility and innovation. Today's electronic manufacturing services market is driven by diverse consumer preferences, leading to a rise in demand for personalized electronic items. Consumers also seek products related to their specific needs and interests. EMS providers facilitate effective customization of electronic products to ensure they meet individual customer requirements, which drives market growth.

Electronic Manufacturing Services Market Growth Factors

- Companies are rapidly outsourcing their production activities across various industries, which can lead to the electronic manufacturing services market expansion.

- Globalization of the electronics store chain can have a positive impact on the growth of the electronic manufacturing services market.

- Industries like IT & telecom, aerospace, and automotive are the key factors that can fuel the market growth.

- The rising number of electronic device servicing centers worldwide can continue the market expansion.

- Growing consumer demand for electronic manufacturing is also an important factor propelling the electronic manufacturing services market growth in the future.

Electronic Manufacturing Services Market Outlook

- Industry Growth Overview:

The market is expected to experience faster growth between 2025 and 2034 due to the rising demand for sophisticated electronic devices across the world. These services are crucial in automotive, medical, aerospace, consumer technology, and industrial automation industries. The rising adoption of electric cars, IoT devices, and semiconductor devices is likely to drive market growth. Furthermore, the growing complexity of products and the reduction in time-to-innovation are cementing the acceptance of EMS by both well-established OEMs and new technology companies. - Technology / Innovation Trends:

Technological advancements are transforming the EMS landscape, with automation, robotics, and AI-driven quality inspection becoming essential rather than optional. Companies such as Foxconn, Jabil, and Flex are investing heavily in fully automated SMT lines and digital-twin production systems to boost yield and reduce defects. Additionally, growth in semiconductor packaging, miniaturization, and high-density PCBs is likely to push EMS vendors toward more technologically advanced and capital-intensive solutions. - Major Investors:

Private equity and institutional investors are increasingly targeting the EMS industry due to its predictable revenue models and rising demand for sophisticated assembly capabilities. Firms like Bain Capital, Apollo Global Management, KKR, and Blackstone are diversifying their portfolios to include electronics manufacturing and embedded systems integration companies. Furthermore, investments are being made in high-growth areas, including automotive electronics, defense hardware, and industrial robotics, sectors characterized by high engineering intensity and barriers to entry. - Startup Ecosystem:

The EMS startup ecosystem is quickly evolving, fueled by innovations in additive manufacturing, high-precision optical inspection systems, and AI-powered production optimization tools. Nano Dimension (Israel), Celestial AI (US), and VVDN Technologies (India) are among the startups receiving significant venture funding. They are overcoming manufacturing bottlenecks in centralized production by offering faster, modular, and highly customized electronics manufacturing methods. Additionally, this pipeline of emerging firms is shaping the future of the electronics manufacturing industry with new software-based industrial technologies.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.95% |

| Market Size in 2025 | USD 617.90 Billion |

| Market Size in 2026 | USD 661.34 Billion |

| Market Size by 2034 | USD 1,130.89 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service Type and By Industry Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising functionalities across various industries

The global electronic manufacturing services market is primarily driven by the growing demand for various functionalities such as engineering, component assembly, and premium circuit board design. Contract manufacturers play a crucial role by offering functional testing and sub-assembly production services. Moreover, electronic contract manufacturing provides outsourcing services for core production skills by allowing OEMs to focus on their strengths. This strategic outsourcing helps enhance operational efficiency, reduce production costs, and minimize the need for fixed capital investment.

- In March 2024, Chinese electronics maker Xiaomi launched a 'connected' smart EV. Xiaomi is a well-known maker of smart consumer electronics in China, with its new EV boasting lots of new smart features. Chinese electronics maker Xiaomi is joining the country's booming but crowded market for electric cars with a sporty, high-tech sedan.

Restraint

Increased competition

As technology evolves, consumer preferences also change. To stay competitive, electronics manufacturers must have efficient processes for introducing new products. The global electronic manufacturing services market faces increased competition, leading to shrinking profit margins and economic losses. Economic instability and fluctuating demand can further impact the electronic manufacturing services market. Additionally, concerns about confidentiality and security raise risks of information leaks and intellectual property theft.

Opportunities

Focus on core competencies

A key reason for the electronic manufacturing services market growth is the focus on the core strengths of companies in various industries. They recognize the importance of specializing in what they do best to stay competitive in today's fast-paced business world. By outsourcing tasks like manufacturing to EMS providers, companies can concentrate on vital areas like marketing, innovation, and research and development. This shift in resources enhances efficiency and profitability. EMS providers play a crucial role in supporting businesses by streamlining processes and ensuring high-quality output.

Industrial applications to drive the demand for EMS

As the environmental movement gains momentum, there's a growing demand for electric motor controls that enhance the efficiency of industrial motors. Also, there's a pressing need for increased integration at minimal costs to support the widespread adoption of new technologies, ensuring improved safety and reliability. This surge in demand is particularly evident in electronic products used in smart motors, including digital signal controllers for voltage control operations. Moreover, the advent of Industry 4.0 promises significant enhancements in factory data automation efficiency and productivity. The concurrent progress in industrial IoT and artificial intelligence (AI) also contributes to this growth trajectory. While the electronics industry has yet to fully realize the potential of intelligence and automation, the transition toward Industry 4.0 is underway, as evidenced by recent trends in the electronics manufacturing services market.

- In October 2022, Rockwell Automation Inc. announced that it had signed a definitive contract to acquire CUBIC, which specializes in modular systems for constructing electrical panels. The collaboration is expected to benefit a company by offering faster time to the electronic manufacturing services market, enabling broader plant-wide applications for intelligent motor control, and generating smart data to increase sustainability and productivity for a wide range of customers.

Service Insights

The engineering services segment dominated the electronic manufacturing services market in 2024. The rise in investment in research and development for high-performance electronic assembly materials is attributed to the dominance of the electronics manufacturing services segment in the market. Circuit boards are gaining significance in tablets and other electronic devices, driving this trend.

In the electronic manufacturing services market, the electronics manufacturing services segment is projected to be the fastest-growing segment over the forecast period. Companies in the industrial automation sector require continuous access to all system-generated data. However, due to the complexity of many operational utility applications, acquiring this data can be challenging. Regions such as Europe and North America are increasingly implementing Supervisory Control and Data Acquisition (SCADA) systems to ensure accurate data collection.

- In February 2024, NEOTech, a leading provider of electronic manufacturing services (EMS), design engineering, and supply chain solutions in the high-tech industrial, medical device, and aerospace/defense markets, announced the upcoming launch of a state-of-the-art New Product Introduction (NPI) and electronics manufacturing center of excellence at its Fremont, CA facility.

Industry Insights

The IT & telecom segment dominated the electronic manufacturing services market in 2024. The growth of the industry is fueled by technological advancements, rising demand for mobile devices, and the need for cost-effective manufacturing solutions to meet the dynamic needs of the telecom sector. This emphasizes the industry's dependence on EMS providers to boost productivity, innovation, and competitiveness in the rapidly evolving telecommunications market.

The automotive segment is experiencing notable growth in the electronic manufacturing services market. This growth is driven by increasing digitization, the integration of IoT in vehicles, and the growing popularity of electric vehicles. Companies in these industries are turning to outsourcing services to improve flexibility and reduce expenses. Also, the rise of the electric vehicle market is propelled by increased component production outsourcing.

Regional Insights

Asia PacificElectronic Manufacturing Services Market Size and Growth 2025 to 2034

The Asia Pacific electronic manufacturing services market size is estimated at USD 222.44 billion in 2025 and is predicted to be worth around USD 412.77 billion by 2034, at a CAGR of 6.95% from 2025 to 2034.

Asia Pacific dominated the electronic manufacturing services market in 2024. China is a key player in its region because of lower maintenance costs, material availability, and faster production compared to other countries like the United States. Cities like Shenzhen and Penang in China have become major hubs for electronic manufacturing services (EMS), attracting companies like Apple Inc. However, Pegatron, based in Taiwan, had to move its production to countries like Vietnam and Indonesia due to rising costs and trade issues. Many Asian businesses had to reassess their investments and relocate their operations due to the uncertainty caused by trade tensions.

- In January 2023, VVDN Technologies announced that it would expand its portfolio by offering automotive engineering and manufacturing services to automotive OEMs, suppliers, fleet owners, and start-ups globally.

Unquestionably, China leads the EMS global market, as a result of its manufacturing infrastructure, low labor cost and supply chain ecosystem. Shenzhen and Guangzhou, for example, are two of the largest EMS cities in China that can support high-volume electronic production for consumer electronics, telecom and automotive OEMs. With initiatives from the Chinese government such as "Made in China 2025" and their aggressive rollouts of 5G networks, there is now EMS demand coming from products that are high tech and IoT based. The presence of OEMs and ODMs in China has established the country as the base for manufacture of products from cradle to grave.

What Potentiates the Growth of the Market in Europe?

Europe is expected to show significant growth in the electronic manufacturing services market over the forecast period. Major European automotive companies like Mercedes, BMW, Ferrari, and Audi are teaming up with electronic manufacturing services (EMS) suppliers for various aspects like PCB production, engineering, prototyping, and design to advanceconnected car technologies. Furthermore, The European Union's initiatives to boost the production of electric vehicles, electronic lighting, and safety equipment are also fueling the growth of EMS in the region.

Germany stands out as the leader of the EMS market in Europe because of Germany's engineering excellence and a well-established automotive and industrial automation vertical. The German EMS providers are known for their high quality and precision. These providers of EMS tend to focus on the more technical aspects of PCB assembly and provide services in the industrial IoT, medical electronics. The German government has also identified Industry 4.0 and smart

manufacturing technologies as priorities; and this has compelled the EMS industry to operate alongside robotics, AI, and real-time data analytics, seamlessly integrated as though it is one functional operation. Germany also has the benefit of being centrally located with access to the EU market; and the actual market opportunity is much larger in the EU for multinational and large domestic clients seeking reliability and quality.

What Makes North America the Fastest-Growing Region in the Electronic Manufacturing Services Market?

North America is expected to grow at the fastest rate in the coming period due to high demand for advanced electronics in automotive systems, medical devices, aerospace technology, defense equipment, and industrial automation. The presence of large EMS suppliers, engineering hubs, and product design centers in the region is likely to strengthen its competitive position. Additionally, diversification of the supply chain by U.S. OEMs is expected to drive increased outsourcing of EMS services in the region.

The U.S. is a major contributor to the market, driven by demand for advanced and specialized electronic manufacturing products, with a primary focus on the aerospace, defense, healthcare, and automotive industries. Companies are investing in innovation and product quality and are focused on protecting their intellectual property. However, companies also tend to produce in high-mix, low-volume. The current trend of reshoring for product safety and innovation, rising labor costs overseas, and disruptions to global supply chains may increasingly incentivize greater investment in domestic capabilities. Companies like Jabil and Sanmina, leading manufacturers in the global EMS industry, are optimizing their operations to serve next-gen technologies, particularly autonomous systems, EVs, and AI-driven devices.

Mexico is also a major player in the market, serving as the primary EMS hub, supported by proximity to U.S. OEMs, competitive labor costs, and well-established electronics corridors in Baja California and Nuevo León. Mexican EMS providers are expected to benefit from the growth in automotive electronics, industrial control, and consumer electronics. The stability in regulations and improved export infrastructure are anticipated to attract additional foreign investment in high-mix, mid-volume production.

What Opportunities Exist in Latin America?

Latin America offers significant opportunities in the electronic manufacturing services market, supported by growing manufacturing bases in Brazil, especially for automotive electronics and telecommunications devices. The region is expected to keep growing due to near-shoring trends by North American OEMs seeking low-cost, nearby production options. Additionally, border manufacturing ecosystem, backed by a skilled workforce and strong export infrastructure, is likely to play a key role in the EMS growth in the region.

What Factors Support the Growth of the Market in the Middle East & Africa?

The electronic manufacturing services market in the Middle East & Africa is driven by rising investments in telecommunications, smart-city infrastructure, and renewable-energy electronics. Local manufacturing is growing in factories across countries, including the UAE, Saudi Arabia, and South Africa, and this is expected to boost regional demand for IoT devices, sensors, and power electronics. The government's electronic localization and technology transfer programs are expected to spur EMS alliances with international companies.

The UAE has become a leading player thanks to its quick investments in smart-city infrastructure and telecommunications equipment. It is expected that the free-zone manufacturing zones in Dubai and Abu Dhabi will attract international EMS companies seeking a local assembly option. The region is expected to develop into a key second manufacturing hub serving technology markets across the Middle East and Africa.

Top Companies in the Electronic Manufacturing Services Market & Their Offerings

- Sanmina Corporation (U.S.): A global EMS provider offering end-to-end product design, PCB assembly, precision manufacturing, and supply-chain services for communications, medical, industrial, and defense sectors.

- Vinatronic Inc. (U.S.): A specialized EMS company delivering high-reliability PCB assembly and custom electronics manufacturing for aerospace, medical, and industrial applications.

- Inventec (Taiwan): A major EMS and ODM vendor focused on notebooks, servers, IoT devices, and cloud computing hardware manufacturing.

- Hon Hai Precision Industry Co. Ltd (Foxconn) (Taiwan): The world's largest electronics manufacturer, producing consumer electronics, communications equipment, and high-volume smart devices for global brands.

- Bharat FIH – A Foxconn Technology Group (India): India's leading EMS provider for mobile phones and electronics, delivering large-scale manufacturing, assembly, and testing for major smartphone brands.

- SIIX Corporation (Japan): A global EMS and logistics company specializing in electronic components, automotive electronics, industrial devices, and consumer electronics assembly.

- Benchmark Electronics Inc. (U.S.): A high-end EMS provider delivering engineering, prototyping, precision manufacturing, and testing for aerospace, medical, and advanced industrial markets.

- Flex Ltd (Singapore): A global EMS leader offering design, manufacturing, supply-chain orchestration, and circular-economy solutions across automotive, healthcare, industrial, and consumer electronics.

- Quanta Computer Inc. (Taiwan): One of the world's largest notebook and server manufacturers, specializing in EMS/ODM production for cloud, AI, and high-performance computing systems.

- Osram Opto Semiconductors GmbH (Germany): A major optoelectronics manufacturer producing LEDs, photonic components, and customized semiconductor packaging services.

- Kimball Electronics Inc. (US): An EMS provider focused on durable electronics manufacturing for automotive, medical, and industrial end markets.

- Jabil Inc. (US): A top-tier EMS player offering advanced engineering, global manufacturing, additive production, and supply-chain solutions for diverse industries.

- Celestica Inc. (Canada): A global EMS and supply-chain provider specializing in aerospace, communications, enterprise computing, and industrial electronics manufacturing.

- Wistron Corporation (Taiwan): A major EMS/ODM manufacturer delivering information and communication technology (ICT) products, servers, and consumer electronics.

- General Electric Company (U.S.): Through its industrial electronics and energy divisions, GE provides specialized manufacturing and integration of high-reliability electrical and electronic systems.

Other Major Companies

- Argus Systems

- Plexus Corporation

- Sparton Corporation

- Koninklijke Philips N.V.

- Integrated Microelectronics Inc

Recent Developments

- On June 28, 2025, Motilal Oswal released a bullish outlook on India's leading EMS providers, forecasting a strong CAGR through FY27, signalling robust expansion driven by new orders and capacity add-ons. (Source: https://m.economictimes.com)

- In July 2023, Analog Devices, Inc., one of the global semiconductor leaders, and Hon Hai Technology Group (Foxconn), one of the largest global electronics manufacturing services providers, announced the completion of a Memorandum of Understanding (MoU) to develop the next-generation digital car cockpit and a high-performance battery management system (BMS).

- In May 2023, Infineon Technologies AG, one of the global leaders in automotive semiconductors, and Hon Hai Technology Group (Foxconn), one of the largest global electronics manufacturing services providers, aim to establish a partnership in the electric vehicles (EV) field to develop advanced electromobility with efficient and intelligent features jointly. The Memorandum of Understanding (MoU) aims to develop silicon carbide (SiC) and leverage Infineon's automotive SiC innovations in automotive systems.

- In June 2022, Flex announced the development of its operations in the Mexican state of Jalisco's automotive sector. The business is building a brand-new, cutting-edge 145,000-square-foot facility that will act as a strategic in-region automotive manufacturing hub to produce advanced electronic components that will hasten the transition to the era of electric and autonomous vehicles.

- In March 2022, Sanmina Corporation (Sanmina), a leading integrated manufacturing solutions company, and Reliance Strategic Business Ventures Limited (RSBVL), a wholly-owned subsidiary of Reliance Industries Limited (RIL), India's largest private sector company, announced that they have agreed to create a joint venture through investment in Sanmina's existing Indian entity (Sanmina SCI India Private Ltd, "SIPL").

Segments Covered in the Report

By Service Type

- Electronics Manufacturing

- Engineering Services

- Test & Development Implementation

- Logistics Services

- Others

By Industry Type

- Computer

- Consumer Electronics

- Aerospace & Defense

- Medical & Healthcare

- IT & Telecom

- Automotive

- Semiconductor Manufacturing

- Robotics

- Heavy Industrial Manufacturing

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content