What is the Email Encryption Software Market Size?

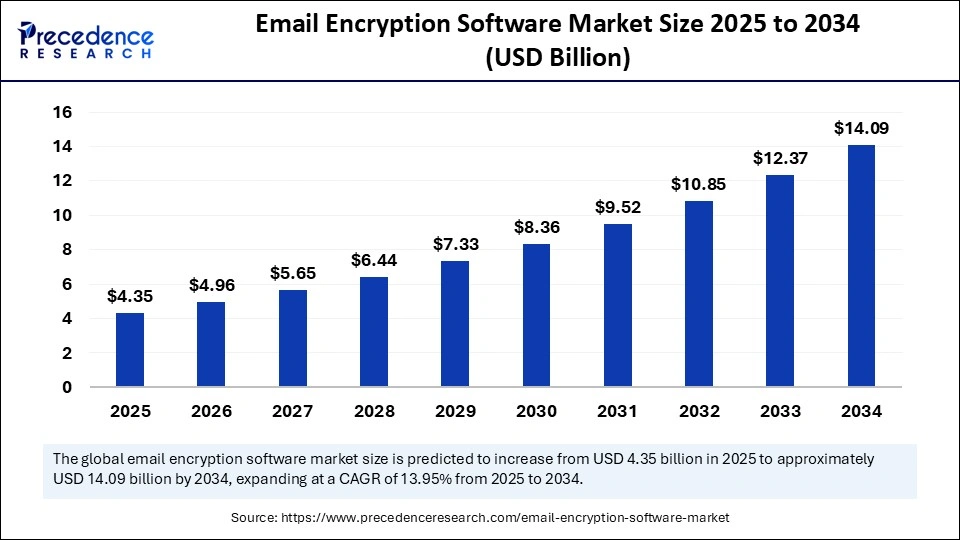

The global email encryption software market size is valued at USD 4.35 billion in 2025 and is predicted to increase from USD 4.96 billion in 2026 to approximately USD 14.09 billion by 2034, expanding at a CAGR of 13.95% from 2025 to 2034. The market for email encryption software is growing due to increasing concerns over data breaches and the rising need for secure communication in businesses and organizations.

Email Encryption Software Market Key Takeaways

- In terms of revenue, the global email encryption software market was valued at USD 3.82 billion in 2024.

- It is projected to reach USD 14.09 billion by 2034.

- The market is expected to grow at a CAGR of 13.95% from 2025 to 2034.

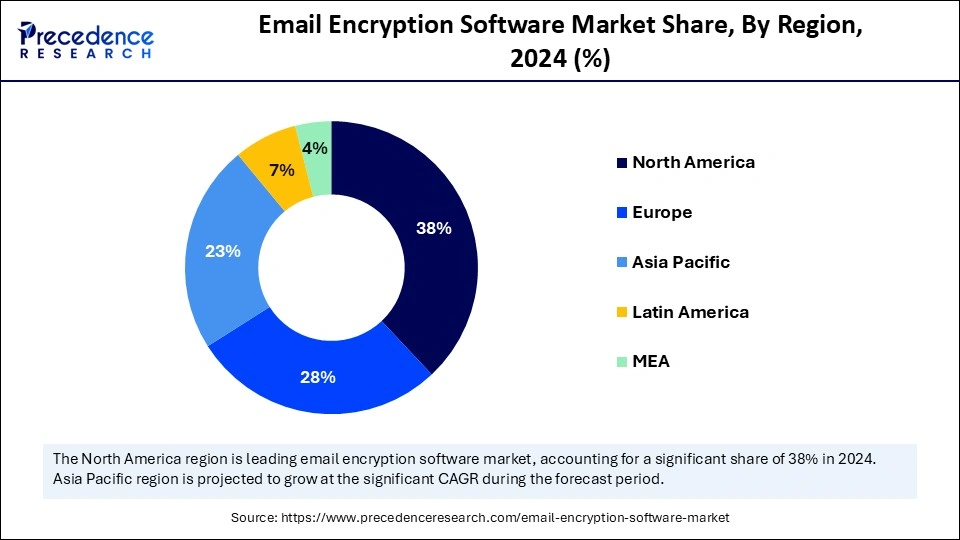

- North America dominated the email encryption software market with the largest market share of 38% in 2024.

- The Asia Pacific is expected to grow at a notable CAGR during the forecast period.

- By component, the software/platform segment held the biggest market share of 65% in 2024.

- By component, the services segment is expected to grow at the fastest CAGR during the forecast period.

- By encryption type, the gateway/transport layer encryption segment captured the highest market share of 40% in 2024.

- By encryption type, the end-to-end encryption segment is expected to grow at the fastest CAGR during the forecast period.

- By deployment model, the cloud-based segment contributed the maximum market share of 45% in 2024.

- By deployment model, the hybrid deployments segment is expected to grow at the fastest CAGR during the forecast period.

- By end-use industry, the BFSI segment generated the major market share of 30% in 2024.

- By end-use industry, the healthcare & life science sciences segment is emerging as the fastest growing during the forecast period.

Strategic Overview of the Global Email Encryption Software Industry

The email encryption software market is experiencing significant growth as organizations worldwide prioritize data security and compliance with regulations. As phishing attempts, data breaches, and cyberattacks become more frequent, companies are using more sophisticated encryption solutions to safeguard confidential information. The market is also driven by the need for safe collaboration across digital platforms, the growth of cloud-based services, and the trend toward remote work. The market is seeing innovation and competitive offerings because of the increasing demand for strong email encryption solutions in sectors like healthcare, finance, and government that must comply with strict data protection regulations.

Artificial Intelligence: The Next Growth Catalyst in Email Encryption Software

Artificial intelligence is increasingly steering the email encryption software market toward more intelligent, adaptive, and context-aware security solutions, enabling time threat detection, automated encryption decisions, and dynamic responses to increasingly sophisticated cyberattacks, particularly those powered by generative AI, driving heightened market demand, innovative product launches, and accelerated growth projections.

- In July 2025, KnowBe4 announced the launch of KnowBe4 Prevent. This AI native outbound email security tool uses machine learning and behavioral analytics to detect and block risky email actions in real time for SMBs.(Source: https://www.knowbe4.com)

Email Encryption Software Market Growth Factors

- Rising Cybersecurity Threats: Increasing incidents of data breaches, phishing attacks, and ransomware are pushing organizations to adopt robust email encryption solutions to safeguard sensitive information.

- Regulatory Compliance: Stringent data protection regulations such as GDPR, HIPAA, and CCPA require businesses to secure email communications, boosting demand for encryption software.

- Remote Work and Cloud Adoption: The shift toward remote work and cloud-based collaboration tools has increased the need for secure email channels to protect organizational data.

- Growing Awareness of Data Privacy: Organizations and individuals are increasingly aware of the importance of protecting confidential communications, driving the adoption of encryption technologies.

- Technological Advancements: Continuous innovation in encryption algorithms, integration with existing IT infrastructure, and AI-powered security features are enhancing the effectiveness and appeal of email encryption solutions.

Market Outlook:

- Market Growth Overview: The Email Encryption Software market is expected to grow significantly between 2025 and 2034, driven by the integration of AI and machine learning, integrated security solutions, and user-friendly interfaces.

- Sustainability Trends: Sustainability trends involve efficient energy consumption in data centers, regulatory alignment with data privacy and security, and a shift to cloud-native and optimized software.

- Major Investors: Major investors in the market include Microsoft, Google (Alphabet), Broadcom, Cisco, OpenText, Zix Corporation, AppRiver, and BlackRock, Inc.

- Startup Economy: The startup economy is focused on user-friendly interfaces and cloud-native platforms, strong privacy and open-source focus, and venture capital funding and acquisitions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 14.09 Billion |

| Market Size in 2025 | USD 4.35 Billion |

| Market Size in 2026 | USD 4.96 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.95% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Encryption Type, Deployment Model, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Regulatory & Privacy Imperatives

The need to comply with data privacy regulations is growing, as laws such as GDPR and HIPAA mandate that sensitive communications be handled securely, thereby increasing costs in the email encryption software market. These days, artificial intelligence is driving encryption solutions that help businesses streamline audits, create compliance logs, track usage, and encrypt data. For industries that need to show a strong commitment to safeguarding user data, the combination of privacy laws and intelligent encryption is particularly important.

- In April 2025, Google rolled out client-side end-to-end encryption for Gmail, allowing organizations to manage their own keys and reinforce compliance while maintaining seamless user workflows.

Growing User Awareness & Security Culture

Individual and business users alike are growing increasingly aware of the value of privacy. Effective and user-friendly encryption tools are becoming increasingly in demand as awareness of email encryption software market grows. Here, artificial intelligence is crucial because it can improve user experience, make encryption invisible in email workflows, and encourage broader adoption of robust security practices across enterprises.(Source: https://cpl.thalesgroup.com)

- In April 2025, Entrust announced its Unified Cryptographic security platform, integrating AI-driven key management, secrets handling, and certificate lifecycle control across environments, empowering organizations to proactively manage encryption infrastructure with ease.(Source: https://www.cgspam.org)

Restraints

High Implementation and maintenance Costs

Advanced AI-driven email encryption software deployment frequently necessitates large upfront infrastructure licensing and integration expenditures. These costs can be unaffordable for many SEMs, especially when combined with ongoing support and update expenses. Even though big businesses might cover these expenses, smaller businesses frequently postpone or restrict adoption, which slows down penetration as a whole of the email encryption software market.

Complexity of Deployment and User Training

Integrating email encryption solutions with legacy IT systems and current communication workflows can be challenging. Key management encryption protocols and system interoperability are frequently areas of difficulty for users. Because of the friction this complexity causes in day-to-day operations, the need for more training and assistance may slow down adoption rates.

Opportunities

Rising Demand from SMEs

Cybercriminals target small and medium-sized businesses (SMEs) more frequently, but they frequently lack sophisticated security infrastructure. SaaS opens a new growth area for vendors with the delivery of AI-powered, reasonably priced email encryption. Companies can reach a wider audience worldwide and take advantage of this underserved market by providing simple subscription-based solutions. As funding agencies and investors demand evidence of secure data practices, the growing global startup ecosystem also offers opportunities for the adoption of email encryption.

Post Quantum Cryptography Adoption

While traditional cryptographic techniques are vulnerable to the impending threat of quantum computing, vendors have a significant opportunity to develop and market encryption that is resistant to this threat. Providers can assist businesses in future-proofing their communication channels by integrating AI to control cryptographic maneuverability. Businesses preparing for long-term data security will have an advantage over those who adopt post-quantum encryption first.

Component Insights

Why Did the Software/Platform Segment Dominate the Email Encryption Software Market in 2024?

The software/platform segment is dominating the email encryption software market, with a market size of 65%, because integrated security suites that provide scalability, automation, and flexibility are widely used. Software solutions are the foundation of contemporary encryption strategies since businesses have priority to platforms that could integrate AI-driven threat detection, automated key management, and multi-cloud compatibility. Their dominance was further strengthened by their constant updates and smooth integration with collaboration tools.

The services segment is growing rapidly in the email encryption software market as businesses look for 24-hour monitoring, compliance audits, and managed security. Because they have smaller IT teams, SMEs in particular depend on outsourced services. This market is also expanding due to the rising need for integration and consulting services. Additionally, service providers provide tailored packages for sectors with compliance requirements. Both large and small businesses are steadily adopting this flexibility.

Encryption Type Insights

Why Did the Gateway/Transport Layer Encryption Segment Rise to the Top in the Email Encryption Software Market in 2024?

The gateway/transport layer encryption is dominating the email encryption software market, as it provides centralized, network-wide, policy-driven security. It guarantees GDPR and HIPAA compliance, streamlines administrative complexity, and is scalable for large-scale communications. It was better positioned because it was simple to integrate with the current infrastructure. Features for centralized monitoring and reporting are also advantageous to organizations. This makes it ideal for government organizations and big businesses.

The end-to-end encryption is the fastest-growing market because of adoption in industries with strict regulations, such as healthcare and finance, and growing privacy concerns. It adheres to zero-trust principles by ensuring that content can only be accessed by the sender and the recipient. Increasing demand was also driven by the use of secure messaging apps. Growth is also being fueled by rising consumer awareness of data protection. Businesses also appreciate E2EE because it guards against illegal access and insider threats.

Deployment Mode Insights

Why Did Cloud-Based Segments Dominate the Email Encryption Software Market in 2024?

Cloud-based segment is dominating the email encryption software market as companies give priority to cost savings, remote access, and scalability. The adoption of cloud-native email platforms such as Google Workspace and Microsoft 365 was fueled by the shift to hybrid work. Additionally, cloud encryption facilitates centralized security policies and quick updates. Because of its pay-as-you-go pricing and simplicity of integration, cloud computing is preferred by enterprises. Because of its scalability for distributed and remote teams, demand is consistently high.

The hybrid deployments segment is growing rapidly as regulated industries strike a balance between on-premises control and cloud flexibility. This model allows for scalable contemporary workloads while supporting the management of sensitive data. Businesses with stringent governance requirements have the highest demand. Additionally, hybrid approaches enable businesses to keep vital systems in-house while gradually shifting to the cloud. Adoption is accelerating in several industries thanks to this flexibility.

End Use Industry Insights

Why Did the BFSI Segment Dominate the Market in 2024?

The BFSI segment is dominating the email encryption software market due to strict compliance needs, high risk of cyberattacks, and constant handling of sensitive financial data. Banks and insurers invested heavily in encryption platforms to secure customer communication and prevent fraud. The sector's large IT budgets reinforced leadership. Regulatory fines for non-compliance also pushed rapid adoption. Growing fintech activity further expanded encryption demand within BFSI.

The healthcare and life sciences sectors are the fastest-growing, as the use of digital health and telemedicine has increased. Strong encryption is urgently needed as a result of the massive volumes of sensitive patient data generated by hospitals and research facilities. Adoption is further fueled by compliance regulations such as GDPR and HIPAA. The growing demand for connected medical devices and AI-based diagnostics increases security requirements. Because of this, one of the market's most dynamic sectors is healthcare.

Regional Insights

U.S. Email Encryption Software Market Size and Growth 2025 to 2034

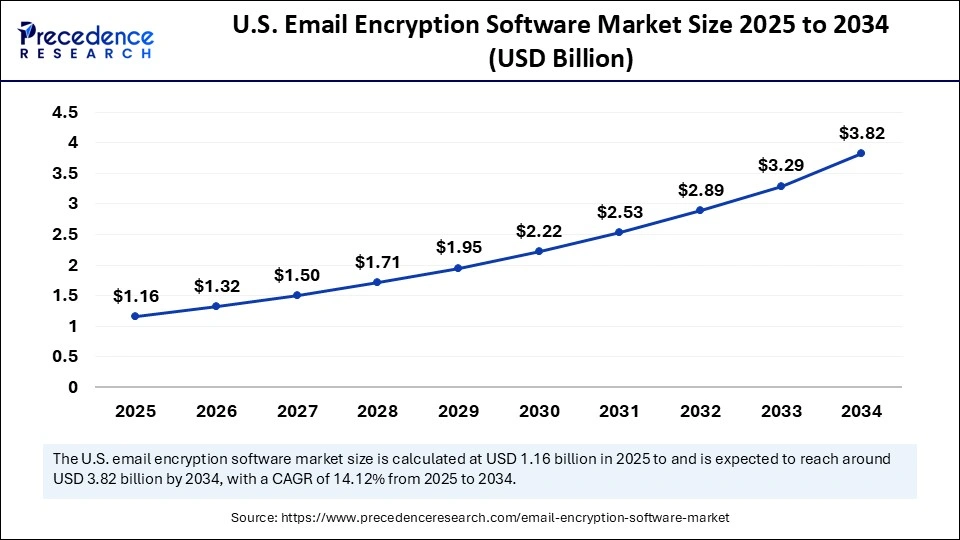

The U.S. email encryption software market size is exhibited at USD 1.16 billion in 2025 and is projected to be worth around USD 3.82 billion by 2034, growing at a CAGR of 14.12% from 2025 to 2034.

Why Did North America Dominate the Email Encryption Software Market in 2024?

North America dominated the email encryption software market due to the presence of major cybersecurity providers, advanced IT infrastructure, and strong regulations like HIPAA and CCPA. Enterprises widely adopted AI-enabled and cloud-based encryption in 2024, reinforcing the region's lead. High investment in data center modernization also supported growth. Government cybersecurity programs further accelerated enterprise adoption.

North America: U.S. Email Encryption Software Market Trends

The U.S. email encryption software market is driven by the need for stronger cybersecurity, regulatory compliance, and the shift to cloud-based and hybrid work. The integration of AI and ML for enhanced threat detection and automation, and a greater emphasis on user-friendly interfaces to boost adoption.

Asia Pacific is the fastest-growing region in the market, accelerated by growing cybercrime cloud adoption and digital transformation. Secure communication is becoming a top priority for businesses in the area of operational resilience and compliance. Growing IT spending in all industries is accelerating adoption. The growth of e-commerce, digital banking, and remote work further increases the demand for encryption solutions.

Asia Pacific: China Email Encryption Software Market Trends

China's rapid digital transformation, increasing cybersecurity awareness, and strict government regulations, particularly for on-premises solutions in critical sectors. A dual-deployment model sees cloud-based options gaining traction for scalability, while domestic players are favored due to regulatory hurdles for foreign companies.

Value Chain Analysis of the Email Encryption Software Market

- Technology Development & R&D

This foundational stage involves research into advanced encryption algorithms and the development of underlying security protocols.

Key Players: Microsoft, Google, and Proofpoint conduct extensive R&D, as do specialized security firms like Zix Corporation and Sophos. - Software Development and Product Design

This stage focuses on building the actual encryption software, including user interfaces, integration modules for existing email clients, and core functionalities like policy-based encryption and key management.

Key Players: Symantec (Broadcom), Cofense, and Mimecast - Integration and Deployment

This stage involves integrating the email encryption software with a customer's existing IT infrastructure, including email servers, data loss prevention (DLP) systems, and identity management platforms.

Key Players: System integrators, IT consulting firms, Accenture, and IBM Security. - Distribution and Sales

This stage involves marketing, selling, and distributing the encryption software to a wide range of customers, from SMBs to large enterprises.

Key Players: Microsoft Azure Marketplace and the AWS Marketplace. Distributors like Synnex Corporation and Ingram Micro also play a role. - Service, Support, and Maintenance

The final stage ensures the continuous, reliable operation of the encryption solution, including ongoing customer support, software updates, patch management, and monitoring for emerging threats.

Key Players: Proofpoint, Mimecast, and Zix.

Top Companies in the Email Encryption Software Market & Their Offerings:

- Virtru: Virtru simplifies email encryption by offering data-centric security that allows users to protect and control their information even after it has been sent. It is known for its user-friendly integration with popular email clients like Gmail and Outlook.

- Paubox: Paubox focuses on HIPAA-compliant email encryption solutions, particularly for the healthcare industry, by automatically encrypting outbound emails without requiring recipients to use special portals or passwords.

- GnuPG: As a free and open-source implementation of the OpenPGP standard, GnuPG provides robust end-to-end encryption for email, files, and communications.

- Avanan: Avanan, now part of Check Point, secures cloud email and collaboration platforms by using AI and ML to detect threats before they reach the inbox. Its technology goes beyond gateway security, offering an integrated approach to protect against a range of email-based threats, including phishing and malware.

- Egress Software Technologies: Egress specializes in adaptive email security, leveraging AI to continuously assess human risk and dynamically adapt policy controls to prevent data breaches. Its intelligent platform proactively defends against inbound and outbound threats by analyzing user behavior and threat data.

- Protonmail: Protonmail is a Swiss-based encrypted email service that uses end-to-end and zero-access encryption, ensuring only the sender and recipient can read messages. This privacy-focused approach, combined with its open-source code and legal jurisdiction, makes it a popular choice for individuals and organizations concerned with data security.

- Zivver: Zivver offers a secure communication platform that provides email encryption, secure file transfer, and other security features. It helps organizations, particularly in regulated sectors, manage data and prevent human error by providing control over sensitive information.

- Rmail: Rmail offers a suite of email security services, including email encryption, certified delivery, and e-signatures. It provides proof of delivery and compliance, catering to legal and corporate requirements for secure and auditable email communication.

- SendSafely: SendSafely provides a secure file transfer and email encryption platform that uses a secure portal for recipients to access encrypted messages and attachments.

- Kiteworks: Kiteworks (formerly Accellion) offers a secure content communication platform that includes email encryption, secure file sharing, and managed file transfer. The platform provides a unified approach to protecting sensitive information across various channels for enterprise clients.

- Zix: Zix provides a robust email encryption solution that automatically encrypts outbound emails containing sensitive data based on predefined policies. It is widely used in regulated industries like healthcare and finance, delivering emails securely and ensuring compliance without complex user intervention.

- LuxSci: LuxSci specializes in secure, HIPAA-compliant email solutions, particularly for the healthcare industry, offering automated encryption and secure marketing campaigns. Its services help healthcare organizations meet stringent regulatory requirements while improving patient engagement.

- Spike: Spike is a conversational email app that incorporates encryption features into a simplified, chat-like interface. While a broad communication tool, its inclusion of encryption contributes to the market by making secure communication more accessible and user-friendly for a general audience.

- Proofpoint: A major cybersecurity company, Proofpoint offers cloud-based email encryption as part of a broader security suite aimed at preventing data loss and ensuring regulatory compliance. Its policy-driven encryption and seamless integration with existing email systems make it a reliable choice for enterprises.

- Appriver: Appriver (now part of Zix, which is part of OpenText) provides cloud-based email security solutions, including encryption, spam and virus protection, and archiving. The company caters primarily to SMBs and is known for its easy-to-use, secure hosted services.

- Tuta: Tuta is a secure email service focused on end-to-end encryption and a strong commitment to privacy. As a Germany-based company, it offers an alternative to larger email providers for users prioritizing data protection and legal privacy standards.

- Trustifi: Trustifi is a cybersecurity software firm specializing in AI-powered email protection, securing inbound and outbound email with advanced encryption and data loss prevention (DLP). The company leverages AI to automatically detect and protect sensitive information and is gaining traction, especially among MSPs.

- Canary Mail: Canary Mail is an email client that integrates end-to-end encryption into its platform, providing a user-friendly interface for securing messages and attachments. Its focus on simplicity and integrated encryption makes secure communication accessible to individuals and businesses.

Email Encryption Software Market Companies

- Virtru

- Paubox

- GnuPG

- Avanan

- Egress Software Technologies

- Protonmail

- Zivver

- Rmail

- SendSafely

- Kiteworks

- Zix

- LuxSci

- Spike

- Proofpoint

- Appriver

- Tuta

- Trustifi

- Canary Mail

Recent Developments

- In September 2025, Turnium Technology Group announced a global strategic alliance to deliver quantum-safe email encryption solutions. Their IronCAP X system ensures end-to-end encryption, protecting against both current and future cyber threats, including those posed by quantum computers.

(Source: https://www.newsfilecorp.com) - In November 2024, Echoworx unveiled a Google Workplace add-on to enhance email encryption for enterprises. This development responds to the increasing need for contemporary, cloud-based security solutions, particularly as Google Workspace caters to over 6 million business users worldwide.

(Source: https://www.businesswire.com)

Segments Covered in the Report

By Component

- Software/Platform

- Services (Implementation, Training, Support, Managed Services)

By Encryption Type

- End-to-End Encryption

- Gateway/Transport Layer Encryption

- Client-Side Encryption

- Hybrid Encryption Models

By Deployment Model

- On-Premises

- Cloud-Based

- Hybrid

By End-Use Industry

- BFSI (Banking, Financial Services & Insurance)

- IT & Telecom

- Government & Defense

- Healthcare & Life Sciences

- Retail & E-Commerce

- Manufacturing

- Education

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content