What is the Emergency Department Information System Market Size?

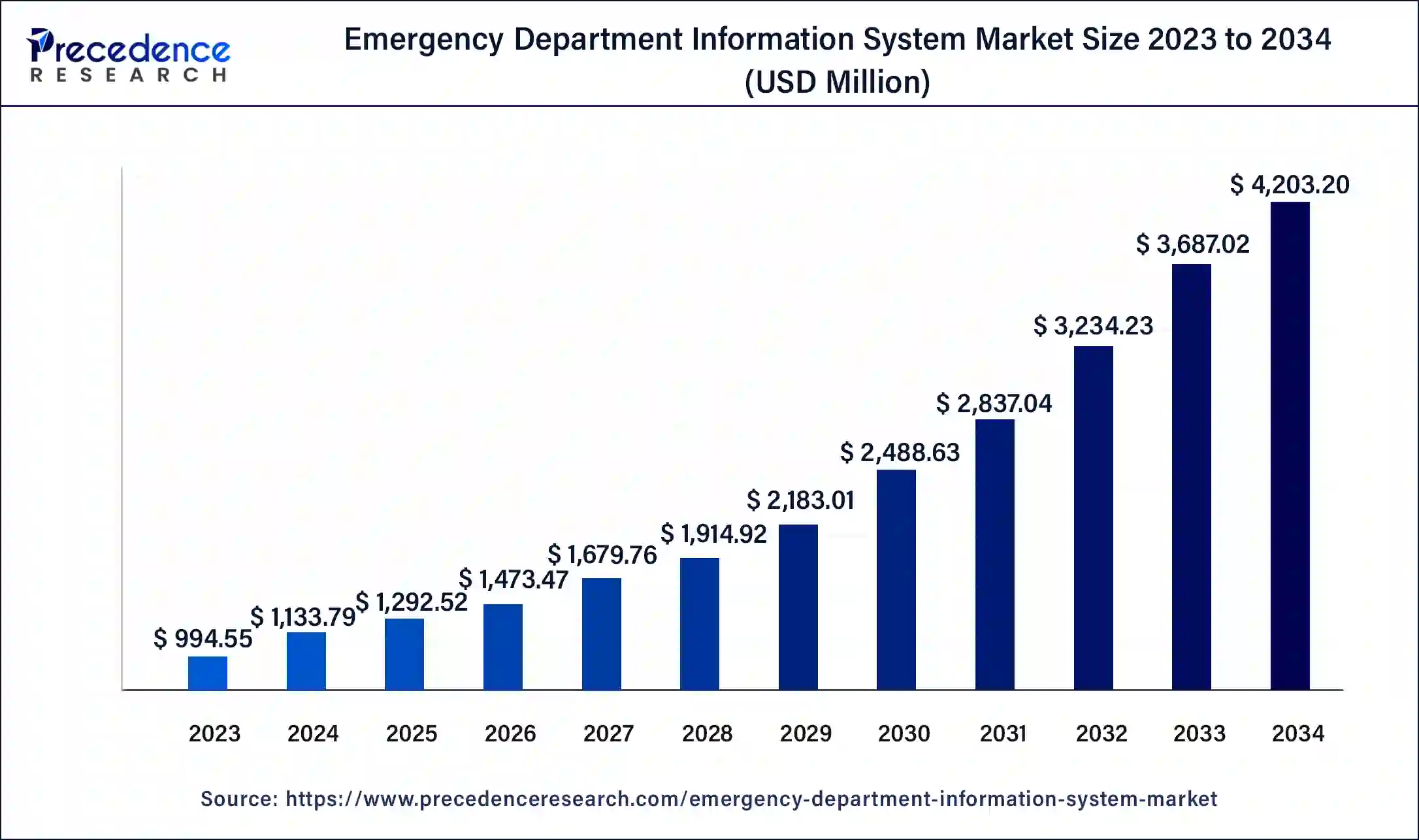

The global emergency department information system market size is calculated at USD 1.29 billion in 2025 and is predicted to increase from USD 1.47 billion in 2026 to approximately USD 4.68 billion by 2035, expanding at a CAGR of 13.75% from 2026 to 2035.

Emergency Department Information System Market Key Takeaways

- The global emergency department information system market was valued at USD 1.29billion in 2025.

- It is projected to reach USD 4.68 billion by 2035.

- The emergency department information system market is expected to grow at a CAGR of 13.75% from 2026 to 2035.

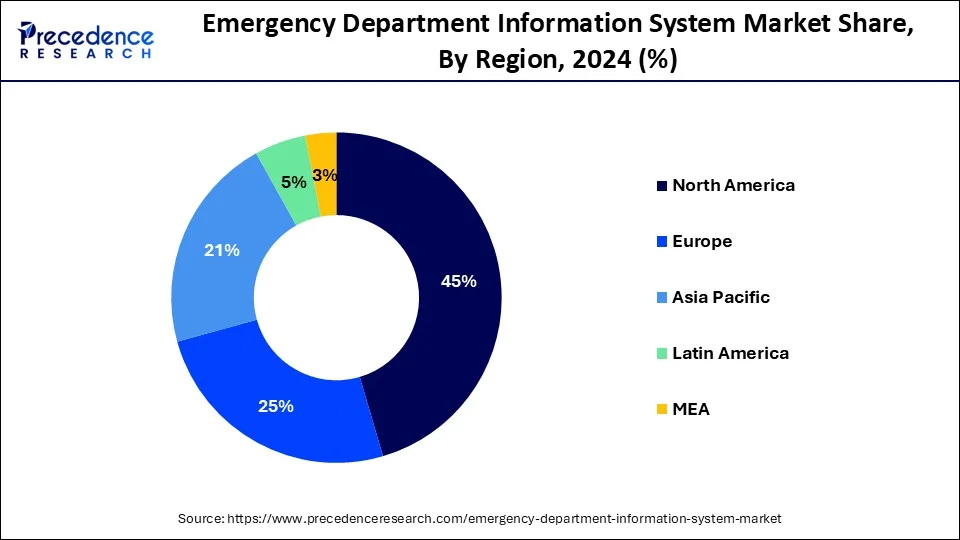

- North America led the global market with the highest market share of 45% in 2025.

- Asia Pacific is expected to witness the fastest rate of growth in the emergency department information system market during the forecast period.

- By software type, the best of breed (B.O.B.) solutions segment is expected to hold the dominating share of the market during the forecast period.

- By software type, the enterprise solutions segment is expected to grow at a notable rate.

- By application, the computerized physician order entry (CPOE) segment held the largest segment of the emergency department information system market in 2025.

- By application, the E-prescribing segment is expected to grow at a significant rate during the forecast period.

- By deployment, the software-as-a-services (SaaS) segment is expected to hold the dominating share of the market during the forecast period.

- By deployment, the on-premises emergency department information system segment is expected to grow at a notable rate.

Market Overview

The emergency department information system (EDIS) market is experiencing rapid growth driven by factors such as the increasing elderly population, rising prevalence of chronic diseases, and the expanding use of data-driven technologies. As demonstrated by partnerships and collaborations in the IT sector, like the notable one between Inflectra and Checkpoint Technologies, there is a growing emphasis on optimizing IT software solutions for efficient enterprise program management and enhanced software quality.

The demand for EDIS is poised to escalate due to the aging demographic, with projections indicating a substantial rise in the elderly population globally. This surge, coupled with the heightened adoption of technology to streamline emergency healthcare processes, positions the EDIS market as a pivotal player in addressing the evolving needs of healthcare systems worldwide.

Emergency Department Information System Market Data and Statistics

- In May 2022, Inflectra, a provider specializing in IT Software Lifecycle Management solutions, formed a strategic partnership with Checkpoint Technologies, renowned for its top-tier software solutions. This collaboration capitalizes on the strengths of Inflectra's enterprise platforms, such as SpiraPlan for program and portfolio management, and Checkpoint's proficiency in quality assurance and software testing. The alliance is poised to enhance technological solutions for customers, addressing business challenges with a dedicated focus on ensuring software quality.

- In September 2021, Atlanta-based artificial intelligence (AI) solution firm Vital secured USD 15 million in Series A funding. The financing round was spearheaded by Transformation Capital, with active participation from existing investors, namely First Round Capital and Threshold Ventures. Vital specializes in AI-powered solutions designed to enhance patient experience and foster loyalty, particularly in hospital emergency departments (EDs) and during inpatie.

Emergency Department Information System Market Growth Factors

- The integration of advanced technologies, including artificial intelligence and data-driven solutions, is a key driver for the EDIS market. Innovative systems enhance diagnostic capabilities, optimize workflow, and facilitate seamless communication between healthcare professionals. The adoption of these technologies leads to improved patient outcomes, reduced response times, and overall efficiency gains within emergency departments.

- The expanding coverage of health insurance globally is contributing significantly to the growth of the EDIS market. With more individuals gaining access to healthcare services, there is a consequent rise in emergency department visits. EDIS systems are instrumental in managing patient data, ensuring accurate billing, and enhancing overall operational efficiency, aligning with the increased demand stemming from improved health insurance coverage.

- Recent global health crises, exemplified by events such as the COVID-19 pandemic, have underscored the importance of robust emergency healthcare systems. The EDIS market is experiencing growth as healthcare providers invest in systems that enhance preparedness and response capabilities. These systems aid in managing surges in patient volume, facilitating efficient triage, and ensuring seamless communication among healthcare professionals during crises, positioning EDIS as a critical component of pandemic resilience.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 13.75% |

| Market Size in 2025 | USD 1.29 Billion |

| Market Size in 2026 | USD 1.47 Billion |

| Market Size by 2035 | USD 4.68 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Software Type, By Application, and By Deployment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

An increase in the geriatric population

- According to the Administration for Community Living's 2020 Profile of Older Americans, the United States is projected to have 80.58 million people aged 65 and above by 2040, escalating to 94.7 million by 2060.

The escalating growth of the emergency department information system (EDIS) market is significantly propelled by the increasing geriatric population worldwide. As demographic dynamics shift towards an aging society, there is a simultaneous rise in the prevalence of chronic diseases and a greater susceptibility to acute medical conditions among the elderly. This demographic cohort tends to require more frequent medical attention, leading to a surge in emergency department visits and hospital admissions.

The EDIS market addresses the unique healthcare needs of the geriatric demographic by offering specialized systems that streamline emergency care processes. These systems facilitate efficient patient management, timely information dissemination, and seamless communication among healthcare professionals.

With the elderly population being more prone to complex health issues, EDIS plays a crucial role in optimizing the delivery of emergency medical services, ensuring rapid assessment, and contributing to better patient outcomes. The market's growth is thus intricately linked to the imperative of accommodating and efficiently managing the healthcare demands of an aging population through advanced and tailored information systems.

Restraint

Integration challenges and resistance to technological

Integration challenges and resistance to technological change act as significant restraints on the demand for emergency department information systems (EDIS). The healthcare landscape often features a myriad of existing information systems, such as electronic health records (EHR), and integrating EDIS seamlessly with these systems poses a complex task. Compatibility issues and interoperability concerns hinder the efficient exchange of critical patient data, deterring healthcare providers from readily embracing EDIS solutions.

Moreover, the healthcare industry traditionally exhibits resistance to technological change. Healthcare professionals and staff may be accustomed to established workflows, and the introduction of new technology like EDIS necessitates comprehensive training and a cultural shift. Overcoming this resistance requires strategic change management, education, and demonstrating the tangible benefits of EDIS adoption. The reluctance to deviate from familiar practices can slow down the adoption curve, limiting the market demand for emergency department information systems despite their potential to enhance patient care and streamline emergency medical services.

Opportunity

Data analytics and predictive modeling

Data analytics and predictive modeling are pivotal in creating significant opportunities within the emergency department information system (EDIS) market. In the context of EDIS, leveraging data analytics allows healthcare providers to analyze historical patient data, identify patterns, and predict patient inflows and resource needs. Predictive modeling aids in optimizing emergency department operations, anticipating patient trends, and allocating resources effectively.

- Notably, a study in the Journal of the American Medical Informatics Association showcased a 15% reduction in patient wait times and enhanced overall efficiency through the implementation of predictive modeling in emergency departments.

These insights underscore the substantial advantages that data analytics and predictive modeling bring to EDIS, creating opportunities to elevate patient care, resource management, and operational effectiveness in emergency healthcare settings.

Segment Insights

Software Type Insights

The best of breed (B.O.B.) solutions segment is observed to hold the dominating share of the emergency department information system market during the forecast period. In the emergency department information system (EDIS) market, the "Best of Breed" (B.O.B.) solutions segment refers to specialized software that excels in specific functionalities, offering superior performance in a particular aspect of emergency healthcare management.

This trend is gaining traction as healthcare providers seek tailored solutions to address specific challenges, such as improved patient triage or streamlined communication. Best of Breed solutions in EDIS aim to deliver unparalleled efficiency in targeted areas, contributing to the overall optimization of emergency department operations and patient care.

The enterprise solutions segment is expected to generate a notable revenue share in the market. In the emergency department information system (EDIS) market, the enterprise solutions segment refers to comprehensive software solutions designed to manage and streamline various aspects of emergency department operations. These solutions typically integrate functions such as patient triage, electronic health records, and resource allocation to enhance overall efficiency.

- Aidoc revealed a collaboration with Novant Health in January 2022, focusing on integrating Aidoc's AI platform. The platform, comprising seven FDA-cleared solutions, is strategically designed to expedite the assessment and alerting processes for patients with acute medical conditions. This partnership underscores a shared commitment to leveraging advanced technology for swift and accurate medical evaluations within the healthcare landscape.

Current trends in the enterprise solution segment involve an increased focus on interoperability with existing healthcare systems, the integration of advanced analytics for data-driven insights, and the incorporation of telehealth capabilities to facilitate remote patient monitoring and consultations.

Application Insights

The computerized physician order entry segment dominated the emergency department information system market in 2024; the segment is observed to continue the trend throughout the forecast period. The Computerized Physician Order Entry (CPOE) segment in the emergency department information system (EDIS) market refers to the digital system enabling healthcare professionals to enter medical orders electronically. This includes prescriptions, diagnostic tests, and treatment plans, enhancing accuracy and reducing errors in emergency care.

A prominent trend in this segment involves the integration of intelligent decision support systems within CPOE, aiding clinicians in making informed decisions swiftly. This trend aligns with the broader industry focus on leveraging technology to optimize workflow efficiency and enhance patient outcomes within emergency healthcare settings.

The E-prescribing segment is expected to grow at a significant rate throughout the forecast period. E-prescribing stands as a crucial component within the emergency department information system (EDIS) market, encompassing the electronic creation and transmission of prescriptions. This streamlined approach not only boosts precision but also mitigates errors in the prescription process.

The prevailing inclination toward the extensive embrace of e-prescribing within the EDIS market underscores the sector's dedication to refining medication administration and bolstering patient safety. This specific segment ensures immediate access to prescription details, aids in decision-making, and harmonizes with the broader healthcare industry's shift towards digital innovations. Its role is pivotal in facilitating efficient and secure prescription management within emergency healthcare settings.

Deployment Insights

The software-as-a-services (SaaS) segment is observed to hold the dominating share of the emergency department information system market during the forecast period. The growing preference for SaaS-based EDIS solutions is driven by their scalability, straightforward implementation, and reduced initial costs. This aligns with the industry's broader shift toward cloud-based solutions, promising increased accessibility and seamless updates. The SaaS segment's convenience and efficiency make it a pivotal player, holding a major share in the evolving landscape of EDIS deployment.

The on-premises segment is expected to generate a notable revenue share in the market. In the emergency department information system (EDIS) market, the on-premises deployment refers to the installation and operation of the software within the organization's physical infrastructure. This deployment model offers localized control, ensuring data security and compliance with regulatory standards. Despite the growing popularity of cloud-based solutions, the on-premises segment in the EDIS market remains resilient due to the healthcare sector's emphasis on maintaining control over sensitive patient data and the need for seamless integration with existing on-site infrastructure. Organizations opt for on-premises solutions to enhance data security, customization, and overall operational control.

Regional Insights

What is the U.S. Emergency Department Information System Market Size?

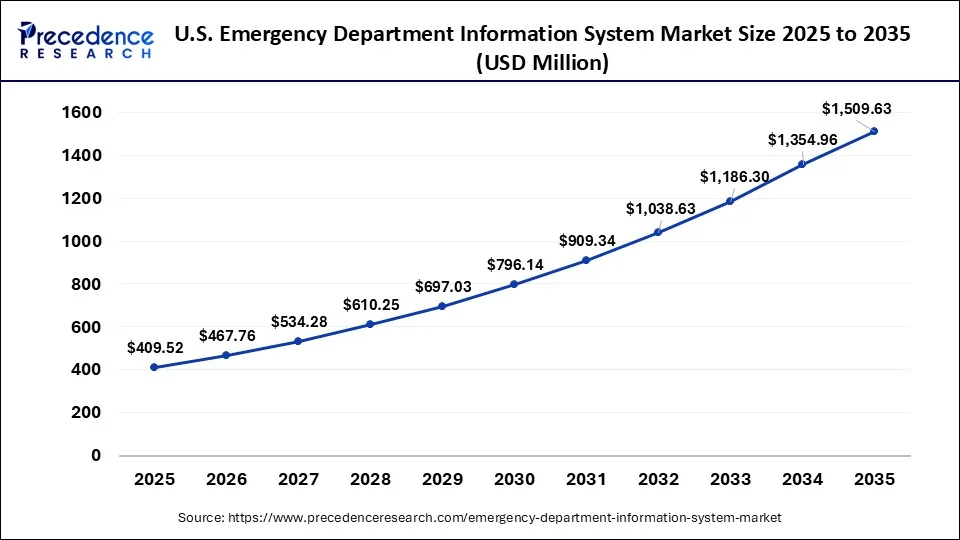

The U.S. emergency department information system market size was estimated at USD 409.52 million in 2025 and is predicted to be worth around USD 1,509.63 million by 2035, at a CAGR of 13.94% from 2026 to 2035.

North America dominates the emergency department information system market due to robust healthcare infrastructure, technological advancements, and a high level of awareness regarding the benefits of EDIS adoption. The region's well-established healthcare systems prioritize efficiency and patient care, driving the demand for advanced information systems.

- The United States Office of Information and Technology's June 2021 revision of the Emergency Department Integration Software (EDIS) program services installation in hospitals. This update aims to enhance the tracking and management of patient care delivery in emergency departments (EDs).

Favorable government initiatives, stringent regulatory compliance standards, and a concentration of key market players contribute to North America's dominance in the EDIS market, making it a leading hub for the implementation and growth of emergency healthcare technologies.

Asia-Pacific is poised for rapid growth in the emergency department information system (EDIS) market due to escalating healthcare demands, increasing investments in healthcare infrastructure, and a growing awareness of advanced healthcare technologies. The region's expanding population, coupled with rising incidences of chronic diseases, drives the need for efficient emergency care solutions. Moreover, supportive government initiatives, a surge in digital health adoption, and collaborations with key market players position Asia-Pacific as a promising market for EDIS, offering substantial opportunities for advancements in emergency healthcare management.

Meanwhile, Europe is growing at a notable rate in the emergency department information system market is attributed to factors such as the region's advanced healthcare infrastructure, increasing adoption of digital health solutions, and initiatives promoting healthcare information technology. The European Commission's focus on enhancing healthcare digitization and interoperability further propels EDIS growth. For the latest and specific statistics, I recommend consulting recent reports from reputable market research firms and healthcare organizations in the region.

What are the Advancements in the Emergency Department Information System Market in Latin America?

Latin America is expected to witness a substantial amount of growth throughout the forecast period. This growth is due to factors like the high prevalence of chronic diseases, a growing need for emergency departments, and rising investments in the healthcare domain. Furthermore, the region is witnessing an increasing reliance on IT specialists in healthcare settings, which is opening up various opportunities and contributing to market expansion.

Brazil Emergency Department Information System Market Trends: The country's market landscape appears to be fragmented yet evolving, with both local and international companies competing for market presence. There is also a high focus on improving patient care and operational efficiency, thus propelling market adoption.

What are the Key Trends in the Emergency Department Information System Market in the Middle East and Africa?

The Middle East and Africa region is witnessing steady growth in the market and is expected to maintain this trajectory in the upcoming years. This growth is driven by factors such as increasing investments in healthcare infrastructure, a rising population, and the increasing need for efficient and advanced healthcare delivery systems. Countries like South Africa and the UAE are leading players in the region due to their supportive government initiatives aimed at modernizing healthcare services.

Saudi Arabia Emergency Department Information System Market Trends: The country's market landscape appears to be still in its developing stages. As healthcare systems in this region continue to evolve, the demand for EDIS is expected to grow even more, opening up new opportunities for companies and stakeholders.

Emergency Department Information System Market Companies

- McKesson Corporation

- Cerner Corporation

- Epic Systems Corporation

- Allscripts Healthcare Solutions, Inc.

- Siemens Healthineers AG

- Philips Healthcare

- T-System, Inc.

- EPOWERdoc

- Wellsoft Corporation

- Softek Illuminate

- EDM Systems

- Optum (UnitedHealth Group)

- Athenahealth, Inc.

- TriTech Software Systems

- Infor

Recent Developments

- In August 2025, Epic Systems Corporation announced a significant upgrade to its EDIS platform, incorporating artificial intelligence capabilities aimed at streamlining patient triage processes. This strategic move is likely to enhance the efficiency of emergency departments, allowing for quicker decision-making and improved patient care. The integration of AI into their systems may position Epic as a leader in technological innovation within the market.

(Source: https://www.forbes.com ) - In February 2025, Allscripts Healthcare Solutions launched a new analytics module designed to provide real-time insights into emergency department operations. This initiative reflects a growing trend towards data-driven decision-making in healthcare. By equipping providers with advanced analytics, Allscripts could potentially improve operational efficiency and patient outcomes, thereby reinforcing its competitive stance in the EDIS market.

(Source: https://www.monexa.ai ) - In March 2022, HeartBeam, Inc. made significant strides by announcing a Business Associate Contract and Clinical Trial Arrangement (CTA) with Phoebe Putney Healthcare System. This partnership aims to conduct a trial assessing the effectiveness of HeartBeam's ED Myocardial Infarction (MI) technology solution. By engaging in this clinical trial, HeartBeam seeks to validate and refine its innovative solution for detecting and managing myocardial infarctions in emergency department settings.

- In January 2022, Aidoc and Novant Health forged a strategic collaboration with a focus on improving patient satisfaction and reducing emergency room stays. Novant Health's proactive approach involves leveraging Aidoc's advanced AI system, equipped with seven FDA-cleared techniques for rapid evaluation and notification of individuals with severe illnesses. This alliance underscores the commitment to utilizing cutting-edge technology to enhance emergency healthcare processes, streamline patient care, and ultimately improve outcomes within the healthcare system.

Segments Covered in the Report

By Software Type

- Enterprise Solutions

- Best of Breed (B.O.B.) Solutions

By Application

- Computerized Physician Order Entry (CPOE)

- Clinical Documentation

- Patient Tracking & Triage

- E-Prescribing

- Others

By Deployment

- On-Premises

- Software-As-A-Services (SaaS)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting