What is the Endoscope Reprocessing Market Size?

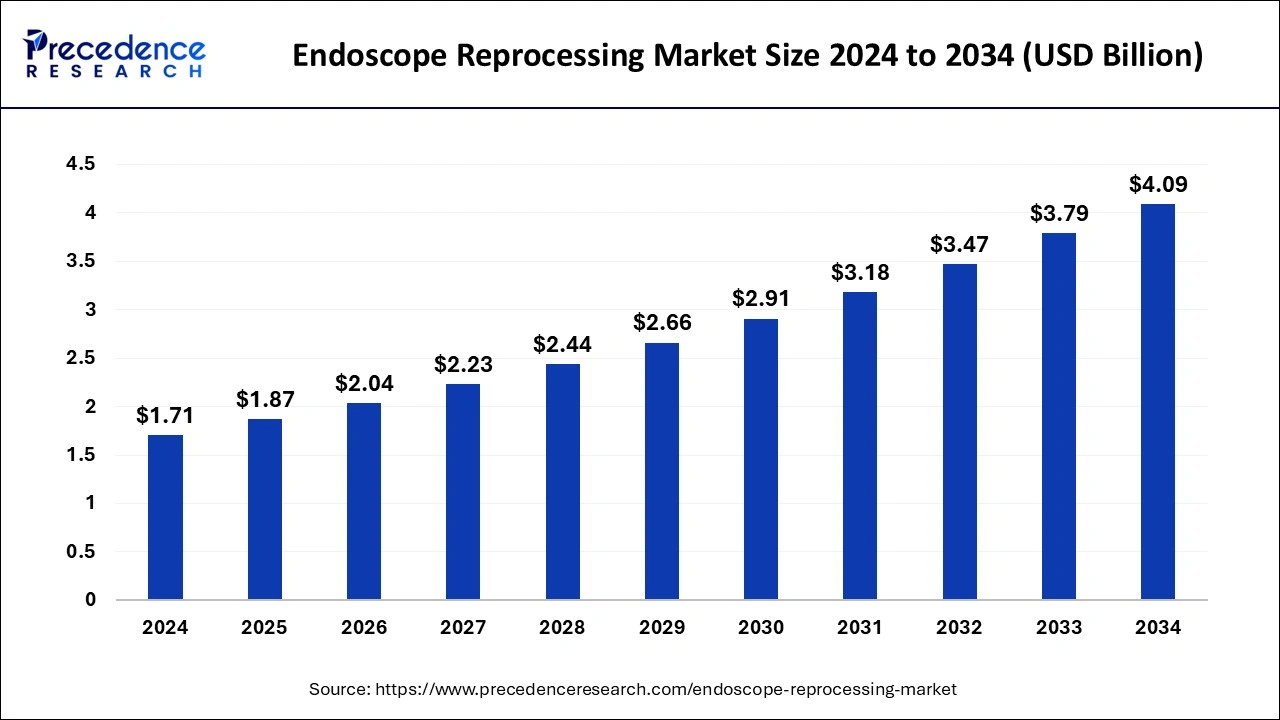

The global endoscope reprocessing market size is calculated at USD 1.87 billion in 2025 and is predicted to increase from USD 2.04 billion in 26 to approximately USD 4.40 billion by 2035, expanding at a CAGR of 8.93% from 2026 to 2035.The rising requirement for automation and patient safety in the healthcare industry is observed to boost the growth of the endoscope reprocessing market.

Endoscope Reprocessing Market Key Takeaways

- The global endoscope reprocessing market was valued at USD 1.87billion in 2025.

- It is projected to reach USD 4.40billion by 2035.

- The market is expected to grow at a CAGR of 8.93% from 2026 to 2035.

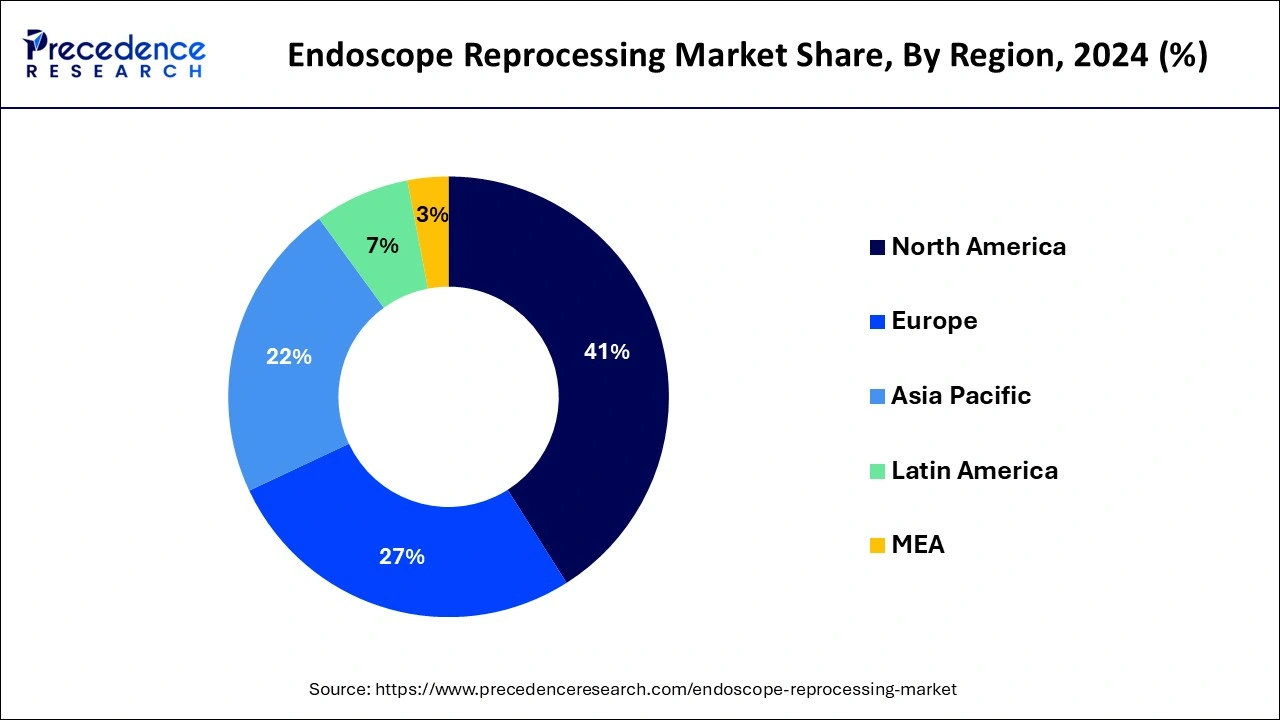

- North America dominated the market with the largest revenue share of 41% in 2025.

- By product type, the high-level disinfectants and test strips segment has contributed more than 31% of revenue share in 2025.

- By product type, the automated endoscope reprocessors segment is estimated to be the fastest-growing during the forecast period.

- By end-use type, the outpatient facilities segment has held a major revenue share of 57% in 2025.

- By end-use type, the hospitals segment is expected to be the fastest-growing during the forecast period.

AI Integration in the Endoscope Reprocessing Market

Cutting-edge technology, including robots, artificial intelligence (Al), and Internet of Things (IoT) integration, are used in ongoing improvements in AER systems. Al and robotics make it easier to perform accurate cleaning and disinfection procedures, reducing human error and guaranteeing complete decontamination. The performance and lifetime management of AER systems are improved by IoT integration, which makes remote monitoring, data analytics, and predictive maintenance possible. Al algorithms help to improve overall efficacy by recognizing any problems in endoscope reprocessing and optimizing cleaning procedures.Market Overview

Endoscope reprocessing is a process of decontaminating devices widely used in the health care setting, such as endoscope accessories and duodenoscopies. The endoscope reprocessing market is driven by the increasing cases of endoscopy-related infections and increasing hospital investment in endoscopy instruments. Endoscope reprocessing includes drying, disinfecting, cleaning, and transport of endoscopes takes place between each patient. Depending on the endoscope, it also includes chemical crushing, high-heat automatic disinfection, and manual scrubbing. There are seven steps involved in endoscope reprocessing: precleaning, cleaning, rinsing, disinfection, rinsing, drying, and storage. Endoscope reprocessing advantages include it requires low initial costs, adaptability, and immediate quality checks. These factors help to the growth of the market.

Endoscope Reprocessing Market Growth Factors

- The endoscope reprocessing advantages include reducing the risk of infections and improving patient outcomes in a healthcare facility.

- The benefits of endoscope processing include staff safety, process standardization, facility productivity, and finances. These benefits help to the growth of the market.

- Reprocessing of endoscopes helps to reduce the possibility of human errors. These factors help to the growth of the endoscope reprocessing market.

- The endoscope reprocessing is time-consuming and labor-intensive. It is used to remove inactive infectious microbes, biological debris, tissue, and blood, which helps devices be safe for the next patients.

- Endoscope reprocessing helps to perform detailed technical duties that are related to record-keeping, reassembly, sterilization, decontamination, and distribution of surgical and medical supplies to the many areas of the region. It helps the growth of the endoscope reprocessing market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.87 Billion |

| Market Size in 2026 | USD 2.04 Billion |

| Market Size by 2035 | USD 4.40 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.93% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising requirements of the endoscopy

The rising requirement for endoscopy for the diagnosis and treatent of diseases helps the growth of the market. Endoscopy is used to help the doctor determine the cause of abnormal symptoms. It helps to see inside the body at the time of surgical procedures like repairing tumors, stomach ulcers, or removing gallstones, for the treatment of digestive tract problems. Endoscopes are helpful in illumination in one direction and high-resolution images and help to examine internal organs such as the esophagus and the throat. These factors help to the growth of the endoscope reprocessing market.

Restraint

Disadvantages of the endoscope reprocessing

The disadvantages of endoscope reprocessing include its failure to dry the endoscope. It can provide an invalid reprocessing procedure, and the use of the endoscope in clinical settings leads to infection risk. There are many risks associated with the reprocessing of medical devices like endoscopy, including HAIs (Healthcare-Associated Infections), which are the major global safety concerns that may occur in medical care receiving patients and related remarkable mortality, morbidity, and healthcare costs. This leads to prolonged hospital stays and may cause accidental deaths, long-term disability, antimicrobial resistance increases, and a remarkable financial burden for the health system. In some cases, high-temperature sterilization can damage the device, and low-temperature sterilization can harm the patients and users. These factors can restrict the growth of the endoscope reprocessing market.

Opportunity

Research & development

There is an opportunity for endoscope reprocessing in the implementation of advanced technologies like automotive, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). Automated endoscope reprocessing advantages include reliability, efficiency, and consistency of endoscope reprocessing by standardizing and automizing many essential reprocessing steps to reduce human error possibilities. Automated endoscope reprocessing machines provide many different benefits over manual or hand-operated machines. Benefits of automated endoscope reprocessing include patient safety, staff safety, process standardization, facility productivity, and many financial benefits. These factors help to the growth of the endoscope reprocessing market.

Segment Insights

Product Type Insights

The high-level disinfectants and test strips segment dominated the endoscope reprocessing market in 2025. The high-level disinfectants in the endoscope reprocessing are critical to ensure they are safe for reuse. The process of high-level disinfectant includes the steps of manual cleaning prior to high-level disinfection, high-risk device sterilization, rinsing to remove residential disinfectant, and drying to prevent bacterial proliferation and storage.

The benefits of high-level disinfection include efficient cleaning and disinfecting of endoscopes by reducing cross-contamination risks and increasing operational efficiency, helping to get consistent results, increased safety for healthcare workers and patients, reducing human risk errors, helping to reduce the time required to disinfect and clean the endoscope, the healthcare facilities ensure the compliance with related guidelines and standards, and it also provides traceability and accountability.

The benefits of test strip endoscope reprocessing include automation and standardization by reducing human error and compliance with the regulatory guidelines, helping to reduce exposure of personnel to chemical sterilant or high-level disinfectant, test strips use reduces health problems associated with reprocessing among personnel, helping to reduce work-related repetitive movements which may cause injury, and also help to monitor efficiencies or low levels of hemoglobin, protein, and carbohydrates to ensure proper cleaning. These advantageous factors help the growth of the high-level disinfectants and test strips product type segment and contribute to the growth of the endoscope reprocessing market.

The automated endoscope reprocessors segment is the fastest-growing during the forecast period. The automated endoscope reprocessor helps in standardization by minimizing human errors and variations. It has a high efficiency in handling multiple endoscopes simultaneously and can complete the cycle in a shorter period than manual or traditional methods. The automated endoscope reprocessers are designed for accuracy, consistency, and cost-effective operations. The benefits of endoscope reprocessing include patient safety, staff safety, process standardization, productivity facilities, and many financial benefits. Automated endoscope reprocessors with documentation properties or features record details of each cycle, which may play a key role in quality control and compliance. It helps in safety by reducing technician contact with high-level contaminants and disinfectants from the endoscope. As compared to automated endoscope reprocessors, manual endoscope reprocessing may compromise the effectiveness of reprocessing because of susceptible inconsistencies due to human errors, is more time-consuming than the automated endoscope processing, less effective with high endoscope use, technicians may be more exposed to the disinfectants, which leads to health risk. These factors help the growth of the automated endoscope reprocessors product type segment and contribute to the growth of the endoscope reprocessing market.

End-use Insights

The outpatient facilities segment dominated the endoscope reprocessing market in 2025. For outpatient end-use type facilities, endoscope reprocessing is used which includes ambulatory surgical centers (ASCs). Ambulatory surgical centers (ASCs) are outpatient end-use types of facilities where many medical procedures, including endoscopic and colonoscopy procedures, are performed. These procedures help to diagnose and treat digestive system conditions, such as cancers, bleeding, polyps, ulcerative colitis, and Crohn's disease. The benefits of endoscope reprocessing include infection prevention by eliminating or removing transmission of pathogens to patients undergoing endoscopy, patient safety proper reprocessing ensures that the endoscopes are safe for successive use by minimizing infection risks.

Ambulatory surgical centers looking for certification and maintaining accreditation should follow reprocessing guidelines to prevent infection transmission and protect patients. An authentic reprocessing program with trained staff ensures consistent safety and quality. Endoscope reprocessing is used in ambulatory surgical centers (ASCs) to maintain high-quality care and patient protection. These factors help to grow the outpatient facilities end-use type segment and contribute to the growth of the endoscope reprocessing market.

The hospitals segment is the fastest-growing during the forecast period. The use of endoscope reprocessing in hospitals has many benefits, including infection control and patient safety, time efficiency, financial benefits, and reduced risk of damage. The proper endoscope reprocessing ensures that these types of medical devices are safe for patient use. By following the necessary steps, healthcare facilities may minimize infection risks that are linked with the endoscopes.

Single-use endoscopes contribute to better patient safety by reducing the risk of patient-to-patient infection transmission. The use of an automated endoscope reprocessing is high. A large number of cases can be scheduled and processed each day, which results in higher profitability for healthcare facilities. Automated endoscope reprocessing helps to increase productivity and reduce the handling of the endoscope at the time of processing, helping to prevent damage. Endoscope reprocessing may be time-consuming. By using effective endoscope processing methods, healthcare staff or doctors may redirect their time toward the patient's care. It also reduces the risk of damage and ensures consistent performance. These factors help the growth of the hospital end-use type segment and contribute to the growth of the endoscope reprocessing market.

Regional Insights

What is the U.S. Endoscope Reprocessing Market Size?

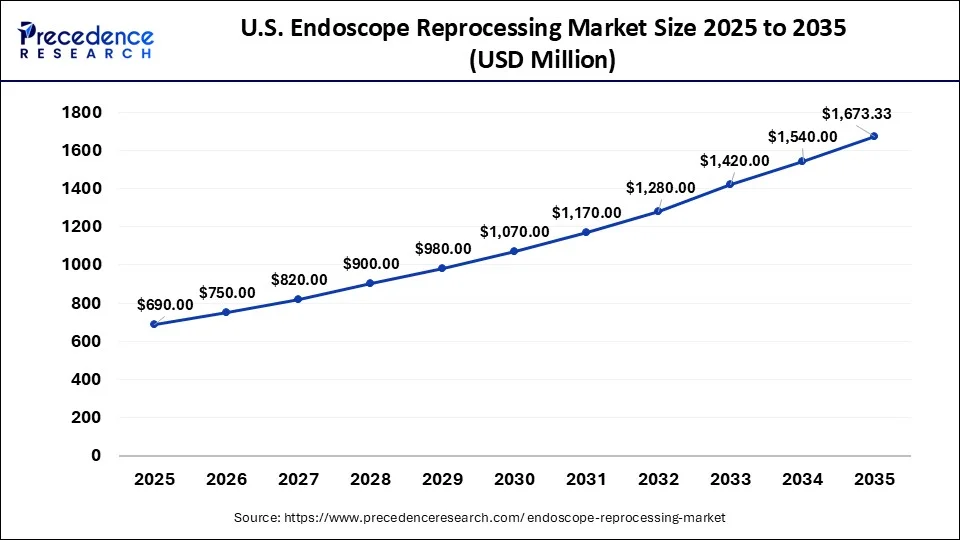

The U.S. endoscope reprocessing market size was valued at USD 690 million in 2025 and is expected to be worth around USD 1,673 million by 2035, growing at a CAGR of 9.26% from 2026 to 2035.

North America dominated the endoscope reprocessing market in 2025. The rising endoscope-related infections, increasing cancer rates, and beneficial reimbursement circumstances help the growth of the market in the North American region. The U.S. regulatory guidelines for endoscope processing help the growth of the market. The U.S. guidelines recommend 10 minutes for the drying cycle for endoscope reprocessing. In the United States, automated endoscope reprocessers are highly used. In Canada, the Infection Prevention and Control Guidelines for endoscope processing is a 3-stages process that helps the growth of the market. These factors help the growth of the endoscope reprocessing market in the North American region.

- In December 2022, the new plasma TYPHOONdry fast endoscope drying solution was introduced by PENTAX Medical America. This new solution has been designed to improve traceability and productivity. This is a completely automated process in which advanced technique is used for drying with the two different airflow levels. It can be placed into storage or used for the next patient after completing the drying process.

What are the Advancements in the Endoscope Reprocessing Market in Europe?

Europe is expected to witness significant growth in the market. This growth is supported by robust regulatory frameworks and high awareness of patient safety protocols. Countries such as Germany, France, and the UK are driving demand through strict compliance with European Society of Gastrointestinal Endoscopy (ESGE) guidelines. Hospitals and specialty clinics in the region are seen investing heavily in drying and storage cabinets in order to maintain endoscope sterility between uses.

Germany Endoscope Reprocessing Market Trends: Technological innovation and public health initiatives emphasizing infection prevention are contributing to steady replacement cycles for older reprocessing units across both public and private healthcare sectors. Hospitals and endoscopy centers are increasingly implementing tracking systems and digital documentation to enhance process control and regulatory compliance.

What are the Key Trends in the Endoscope Reprocessing Industry in Latin America?

Latin America is expected to witness substantial growth in the market. This growth is driven by the region's improving healthcare infrastructure and greater emphasis on infection prevention in endoscopy units. Hospitals are now replacing manual cleaning processes with automated re-processors. Private healthcare providers are seen as leading in implementing advanced reprocessing solutions, especially in countries like Brazil and Mexico.

Brazil Endoscope Reprocessing Market Trends: Medical conferences and training programs by global manufacturers are enhancing awareness about best practices in scope cleaning and storage. Government health agencies are gradually integrating HAI prevention targets into national healthcare policies, thus supporting steady growth.

How is the Middle East and Africa Growing in the Endoscope Reprocessing Industry?

The Middle East and Africa are expected to witness steady growth in the upcoming years. Increased investments in tertiary care facilities, medical tourism, and specialist surgical centers are driving market adoption in the region. Compliance with international infection control standards is also becoming a priority in major hospitals, pushing the adoption of such systems. Countries such as the UAE, Saudi Arabia, and South Africa are leading players.

Saudi Arabia Endoscope Reprocessing Market Trends: Partnerships between international suppliers and regional distributors are gaining traction, which is helping in improving equipment availability and after-sales support. Additionally, training programs and partnerships with global reprocessing solution providers are helping build local expertise and improve overall workflow efficiency.

Endoscope Reprocessing Market Companies

- ARC Group of Companies Inc.

- Belimed

- Cantel Medical

- Custom Ultrasonics

- Ecolab

- Fortive Corporation (Advanced Sterilization Products)

- Getinge AB

- Metrex Research, LLC.

- Olympus Corporation

- Steelco S.p.A

- STERIS

- Shinva Medical Instrument Co. Ltd.

- Summit Imaging, Inc.

- Tuttnaur

- Wassenburg Medical

Recent Developments

- In May 2023, a new standard of care for endoscope safety and reprocessing was published by the Gastroenterology & Endoscopy News.

- In October 2023, a provider of endoscope reprocessing and filtration systems, the Nuova SB System, launched an award of Medical Device Network Excellence Award 2023 with category award winner in innovation and product. It includes sterilization, purification, disinfection, and treatment systems.

Segments Covered in the Report

By Product Type

- High-Level Disinfectants & Test Strips

- Detergents & Wipes

- Automated Endoscope Reprocessors

- By Type

- Single Basin

- Double Basin

- By Portability

- Standalone

- Portable

- By Type

- Endoscope Drying, Storage, and Transport Systems

- Others

By End-use

- Hospitals

- Outpatient Facilities

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting