What is the Engineered TCR (T-Cell Receptor) Therapy Market Size?

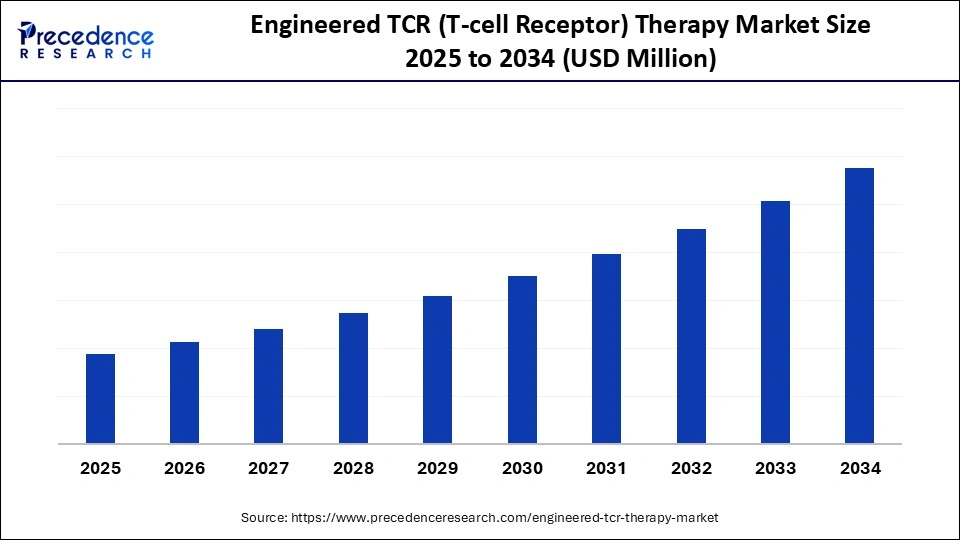

The global engineered TCR (T-Cell Receptor) therapy market is witnessing rapid growth as engineered T-cells offer targeted treatment options for cancers and viral infections.This market is growing due to rising cancer rates, the high demand for targeted solid tumor treatments, rapid technological innovations, positive clinical trial outcomes, and increased investment.

Engineered TCR (T-Cell Receptor) Therapy Market Key Takeaways

- North America dominated the market, holding the largest market share of 45% in 2024.

- Asia Pacific is expected to grow at a notable rate in the engineered TCR (T-Cell Receptor) therapy market.

- By therapy type, the affinity-enhanced TCR therapy segment held the largest share of the market at 50% in 2024.

- By therapy type, the gene-edited/non-viral TCR segment is expected to grow at the fastest rate during the forecast period.

- By delivery method, the viral vector-based segment held the largest share of 60% in the engineered TCR (T-Cell Receptor) therapy market during 2024.

- By delivery method, the non-viral TCR segment is expected to grow at the fastest rate during the forecast period.

- By indication, the solid tumors segment held the largest share at 68% in 2024.

- By indication, the infectious diseases segment is expected to grow at the fastest rate during the forecast period.

- By end-user, the pharmaceutical companies segment is expected to grow at the fastest rate of 55% in the engineered TCR (T-Cell Receptor) therapy market.

- By end-user, the CDMOSs segment held the largest share in the market in 2024.

What is the Engineered TCR (T-Cell Receptor) Therapy Market?

The engineered TCR (T-cell receptor) therapy market is emerging as a significant advancement in cancer treatment, providing the capacity to target intracellular tumor antigens that are inaccessible to CAR-T therapies. With continuing clinical trials and regulatory approvals, this technology is gaining traction and demonstrates great promise in treating solid tumors. In the years to come, the market is anticipated to be greatly driven by expanding research in immunotherapy, gene editing, and neoantigens.

- In August 2024, Adaptimmune received FDA accelerated approval for TECELRA, the first engineered TCR therapy approved for solid tumors.(Source: https://www.adaptimmune.com)

Key Technologies Shifts in the Engineered TCR (T-Cell Receptor) Therapy Market

- Gene Editing Advances: CRISPR/Cas9 and TALENs enable precise TCR modification, improving tumor targeting and reducing off-target effects. Improvements in editing efficiency and safety are accelerating the clinical adoption of these tools.

- Off-the-Shelf/Allogeneic Therapies: Universal TCR-T cells enable the treatment of multiple patients from a single batch, thereby reducing costs and treatment timelines. Gene editing and immune evasion strategies enhance safety and efficacy.

- Improved Cell Manufacturing Platforms: Automated, closed-loop bioreactors enhance scalability, reproducibility, and quality. Real-time monitoring ensures consistent cell viability and maintains optimal cell potency.

Engineered TCR (T-Cell Receptor) TherapyMarket Outlook

- Industry Growth Overview: The engineered TCR (T-cell receptor) therapy market is witnessing rapid expansion, propelled by advances in immune oncology, synthetic biology, and cell engineering. Increased demand for tailored immunotherapies and efficient solid tumor treatments is driving market investments. Global adoption is expected to be further accelerated by increased FDA approvals and the completion of late-stage clinical trials.

- Sustainability Trends: To increase the accessibility of therapies, businesses are concentrating on scalable and economical cell manufacturing techniques. Sustainability is being improved, and waste is being decreased through the use of automation, reusable culture systems, and closed-loop bioreactors. Partnerships that support ethical sourcing and green bioprocessing are increasingly important in R&D pipelines.

- Startup Ecosystem: As more biotech companies venture into the field of engineered TCRs, they are using gene editing platforms, bioinformatics, and artificial intelligence to find new TCR targets. Through cutting-edge discovery platforms and early clinical initiatives, startups like T-Knife, Immunoscape, and Anocca are spearheading innovation. The rapid scaling of these startups is being facilitated by venture capital funding and strategic partnerships with pharmaceutical giants.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type / TCR Design, Delivery Method, Delivery Method, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Restraint

Manufacturing Complexity & High Cost

The process of creating engineered TCR therapies is complex and includes several steps, such as gene editing, cell extraction, and controlled growth under GMP guidelines. These procedures are costly and time-consuming, making large-scale production a significant challenge and posing obstacles to growth in the engineered TCR (T-cell receptor) therapy market. Another difficulty is maintaining quality and consistency across batches, which raises the total cost of therapy. Standardized bioprocessing and automation are still in their early stages of development.

- In July 2025, MaxCyte announced a strategic platform licensing agreement with Anocca AB to support scalable manufacturing of TCR-T cell therapies.(Source: https://investors.maxcyte.com)

Opportunity

Off-the-Shelf/Allogeneic Therapies

The lengthy procedure of modifying each patient's own cells can be avoided with the development of allogeneic or off-the-shelf TCR therapies. This method significantly reduces patient wait times, manufacturing time, and treatment costs. Additionally, it makes therapies more accessible and permits quicker deployment in cases of emergency or aggressive cancer. The safety and scalability of such treatments are being further enhanced by ongoing gene editing research, presenting opportunities for growth in the engineered TCR (T-cell receptor) therapy market.

- In February 2025, Medigene & EpimAb entered a strategic partnership to co-develop off-the-shelf TCR-guided T-cell engager therapies for solid tumors using Medigene 3S TCR and EpimAb T-FIT platform.(Source: https://biopharmaboardroom.com)

Segmental Insights

Therapy Type Insights

Why Did the Affinity-Enhanced TCR Therapy Segment Dominate the Engineered TCR (T-cell Receptor) Therapy Market in 2024?

The affinity-enhanced TCR therapy segment dominated the engineered TCR (T-cell receptor) therapy market in 2024, holding a significant share of 50%, due to its ability to recognize tumor antigens with improved specificity and stronger binding, resulting in higher clinical efficacy. These therapies have been widely adopted in both hematologic and solid tumors, supported by multiple late-stage clinical trials and regulatory approvals. Their proven success in overcoming the limitations of natural TCRs has made them the preferred choice for many therapy developers.

The gene-edited/non-viral TCR segment is expected to be the fastest-growing segment in the market during the forecast period, driven by advancements in gene editing technologies, such as CRISPR, which enable accurate TCR modifications without the use of viral vectors. This strategy lowers production cost, eliminates risks related to viruses, and makes more scalable and readily available treatment options possible.

Delivery Method Insights

Why Did Viral Vector-Based Segment Dominate the Engineered TCR (T-cell Receptor) Therapy Market?

The viral vector-based segment dominated the market for engineered TCR (T-cell receptor) therapy, with an approximately 60% share in 2024, due to its proven effectiveness in transferring TCR genes into T-cells, guaranteeing consistent expression and strong antitumor action, as well as its consistent performance and regulatory familiarity. Retroviral and lentiviral systems are frequently utilized in clinical settings, leading to their adoption in significant pharmaceutical programs.

The non-viral/CRISPR-based delivery segment is expected to be the fastest-growing segment in the market during the forecast period, as it eliminates the risks associated with viral vectors and enables more precise genome editing. This technology supports both off-the-shelf and allogeneic therapies, reduces manufacturing complexity, and is increasingly preferred for the development of next-generation TCR therapies.

Indication Insights

Why Did the Solid Tumors Segment Dominate the Engineered TCR (T-cell Receptor) Therapy Market in 2024?

The solid tumors segment has dominated the engineered TCR (T-cell receptor) therapy market, with an approximate 68% share in 2024, as there is a significant unmet medical need for TCR therapies that are becoming increasingly effective.

Infectious diseases are predicted to be the fastest-growing segment in the market during the forecast period as research expands into viral and intracellular infections like HBV, HIV, and CMV. Advances in TCR specificity, off-the-shelf therapies, and immune-targeting technologies are driving rapid growth in this emerging field.

End User Insights

What Made the Pharmaceutical Companies' Segment Dominate the Engineered TCR (T-cell Receptor) Therapy Market?

Pharmaceutical companies dominated the market, accounting for approximately 55% in 2024, as they possess the tools, facilities, and expertise necessary to conduct advanced clinical trials, develop intricate TCR treatments, and navigate regulatory processes. Wide market penetration and adoption and guaranteed by their well-established pipelines and partnerships.

The CDMOs segment is predicted to be the fastest-growing segment in the market, driven by assisting startups and smaller biotech companies in developing TCR therapies. The growing demand for outsourcing viral and non-viral delivery gene editing platforms, as well as scalable manufacturing, is propelling the market's explosive expansion.

Regional Insights

What made North America dominate the engineered TCR (T-Cell Receptor) therapy market?

North America dominated the market, accounting for approximately 45% of the share in 2024, due to its effective regulatory frameworks, robust presence of top biotech and pharmaceutical companies, and sophisticated healthcare infrastructure. Accesses to state-of-the-art technology, established clinical trial networks, and high R&D investment have all contributed to its continued market dominance.

Asia Pacific is expected to be the fastest-growing market during the forecast period, driven by the growing adoption of advanced immunotherapies, the expansion of biotech startup operations, and increased healthcare investments. The regional market is expanding rapidly, thanks to the growing contributions of nations and the increasing number of clinical trials.

Country-level Investments/Funding Trends for Engineered TCR (T-Cell Receptor) Therapy Market

| Country | Investment Context | Key Funding/Investment Trends |

| United States | Market leaders with large research and manufacturing infrastructure, numerous clinical trials, and favorable regulatory support. | Significant funding from venture capital, pharmaceutical companies, and government organizations. |

| Germany | A European leader in new immunotherapies, endorsed by a robust regulatory framework and strong healthcare infrastructure | Increasing investments in biotech research and development, along with collaborations between companies and academic institutions. |

| India | A rapidly developing biotech sector centered on accessible and innovative therapies | Growing investment in cell therapy supported by government initiatives and academic industry partnerships. |

| UAE | A growing hub of cell therapy in the MENA region, emphasizing the town. | Efforts to evolve local manufacturing capabilities and reduce reliance on international treatment, fostering investment in cell therapy. |

Top Companies in the Engineered TCR (T-Cell Receptor) Therapy Market

- Immunocore Limited: Immunocore is a pioneer in T-cell receptor (TCR)-based bispecific therapies that redirect and activate T-cells to recognize intracellular cancer antigens. Its groundbreaking drug KIMMTRAK became the first FDA-approved TCR therapy for metastatic uveal melanoma, showcasing the company's leadership in targeted immuno-oncology.

- Immatics N.V.: Immatics develops next-generation TCR-engineered T-cell (TCR-T) therapies and peptide vaccines designed to recognize intracellular tumor targets. The company combines its proprietary XPRESIDENT and ACTengine platforms to discover, engineer, and manufacture personalized immunotherapies for solid tumors.

- Adaptimmune Therapeutics plc: Adaptimmune's proprietary SPEAR (Specific Peptide Enhanced Affinity Receptor) technology enables the development of potent TCR-T therapies for solid tumors. The company's leading programs, including Afamitresgene autoleucel, target MAGE-A4–positive cancers, with multiple late-stage clinical trials in progress.

- Atara Biotherapeutics Inc.: Atara focuses on allogeneic T-cell immunotherapies derived from Epstein-Barr virus (EBV)-specific T cells, enabling the development of off-the-shelf treatments. Its pipeline includes Tab-cel, a late-stage therapy for EBV-associated cancers and post-transplant lymphoproliferative disorders (PTLD).

- Alaunos Therapeutics Inc.: Alaunos develops personalized TCR-T therapies targeting tumor-specific neoantigens using its Sleeping Beauty non-viral gene transfer platform. The company aims to revolutionize solid tumor therapy by leveraging precision TCR sequencing and in vivo cell engineering approaches.

Other Companies in the Engineered TCR (T-Cell Receptor) Therapy Market

- Lion TCR Pte Ltd.

- TCRCure Biopharma Corp.

- Asher Biotherapeutics Inc.

- Be Biopharma Inc.

- China Immunotech Inc.

Recent Developments

- On 2 August 2024, Adaptimmune Therapeutics announced that the FDA granted accelerated approval to TECELRA (afamitresgene autoleucel) for adults with unresectable or metastatic synovial sarcoma expressing the MAGE-A4 antigen. This marked a significant milestone as TECELRA became the first TCR therapy approved for a solid tumor, highlighting the potential of engineered TCR therapies in addressing unmet medical needs.(Source: https://www.fda.gov)

- On 10 October 2024, Immatics released an update on Phase 1b clinical data for IMA203, reporting a 54% objective response rate and a 6-month median progression-free survival in heavily pretreated patients with solid tumors. These results underscore the promise of affinity-enhanced TCR therapies for solid tumors and support further clinical development of the IMA203 program.(Source: https://investors.immatics.com)

Segments Covered in the Report

By Therapy Type / TCR Design

- Natural TCR Therapy

- Affinity-Enhanced TCR Therapy

- Gene-Edited / Non-Viral TCR Therapy

By Delivery Method

- Viral Vector-Based TCR Therapy

- Non-Viral Vector / Gene Editing-Based Therapy

By Indication / Cancer Type

- Solid Tumors (melanoma, lung cancer, colorectal cancer, etc.)

- Hematologic Malignancies (leukemia, lymphoma, myeloma)

- Infectious Diseases (emerging clinical research)

By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting