What is Epigenetics Drugs and Diagnostic Technologies Market Size?

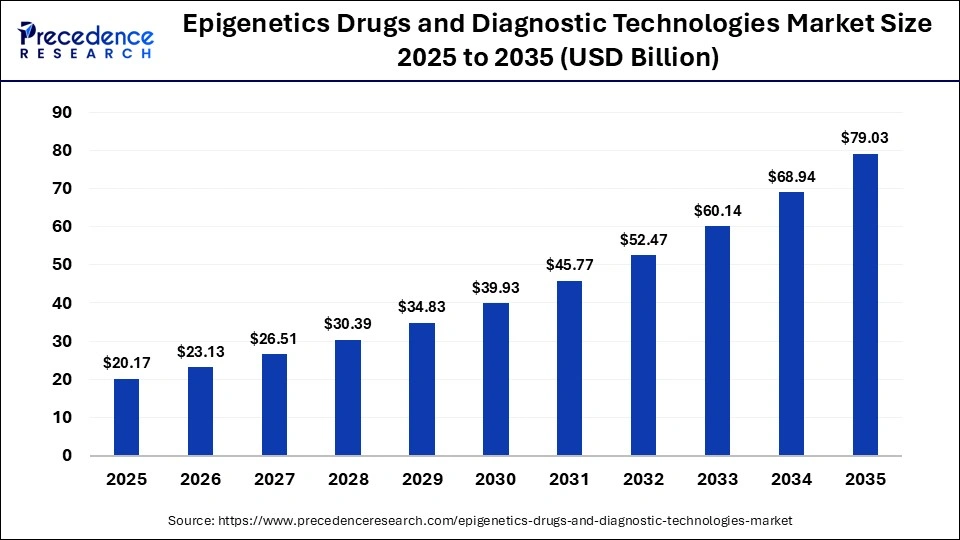

The global epigenetics drugs and diagnostic technologies market size was calculated at USD 20.17 billion in 2025 and is predicted to increase from USD 23.13 billion in 2026 to approximately USD 79.03 billion by 2035, expanding at a CAGR of 14.63% from 2026 to 2035. The growing awareness of gene expression techniques, their role in disease treatment, and evolving regulatory practices drive the market. The increasing need for precision medicine and targeted therapies is driving investment in epigenetics research and clinical practice.

Market Highlights

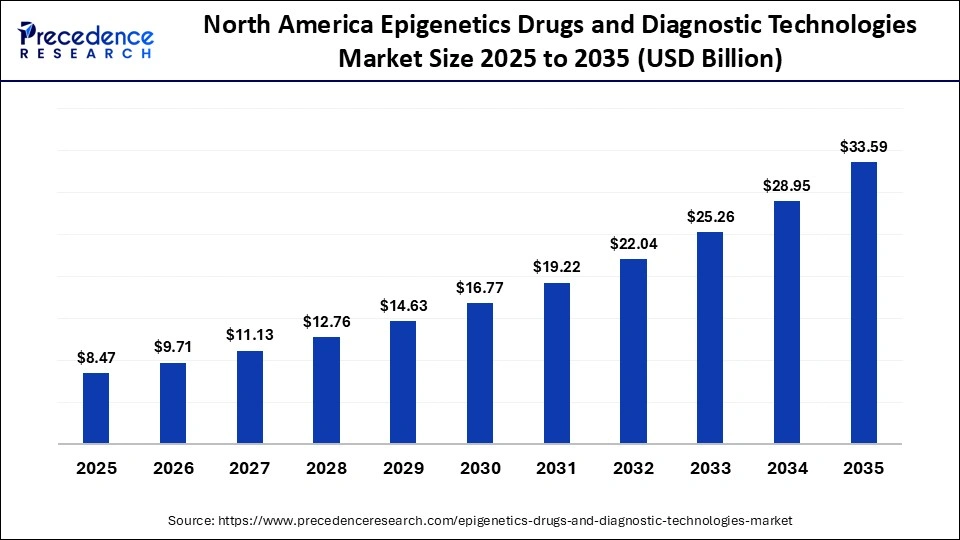

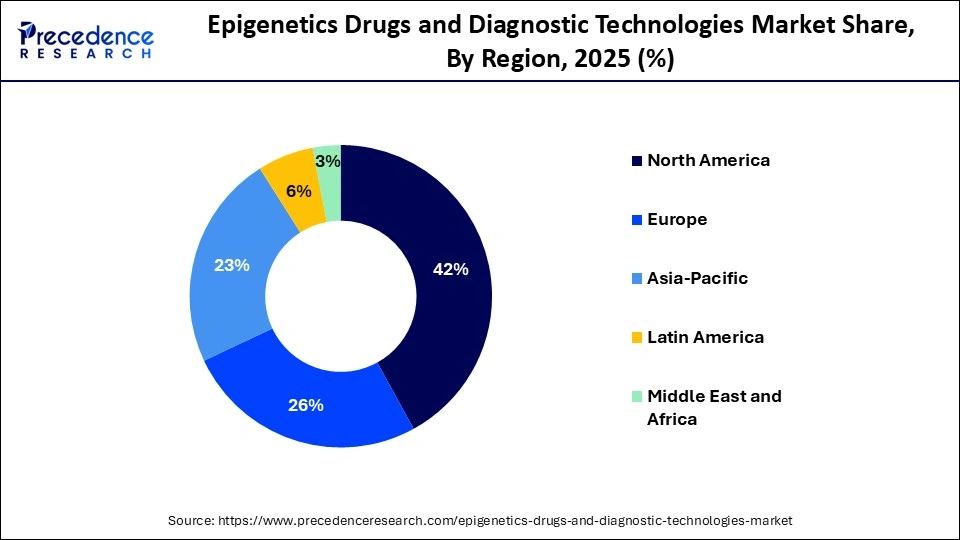

- North America dominated the epigenetics drugs & diagnostic technologies market with a share of approximately 42% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

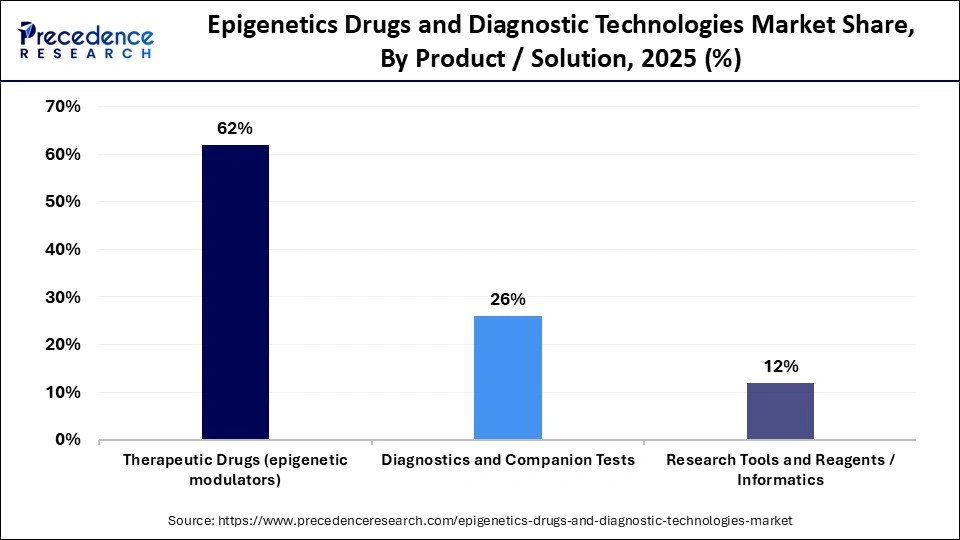

- By product/solution, the therapeutic drugs segment held a dominant position in the market with a share of approximately 62% in 2025.

- By product/solution, the diagnostics & companion tests segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By therapeutic modality, the small-molecule epigenetic modulators segment led the global market with a share of approximately 55% in 2025.

- By therapeutic modality, the oligonucleotide/RNA-targeting approaches segment is expected to grow with the highest CAGR in the market during the studied years.

- By indication/therapeutic area, the oncology (solid tumors) segment dominated the global market with a share of approximately 48% in 2025.

- By indication/therapeutic area, the neurological & CNS disorders segment is expected to expand rapidly in the market with a CAGR in the coming years.

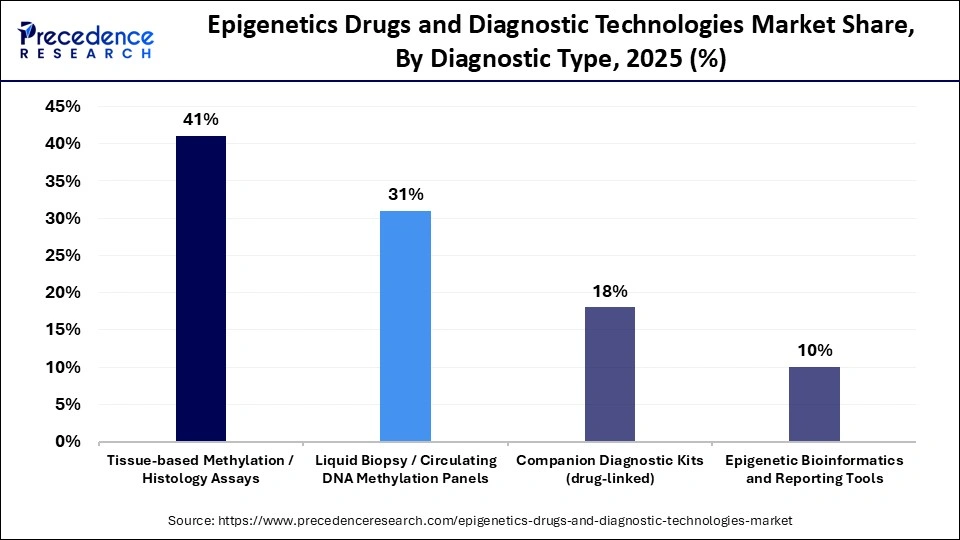

- By diagnostic type, the tissue-based methylation/histology assays segment held a major revenue share of approximately 41% in the epigenetics drugs & diagnostic technologies market in 2025.

- By diagnostic type, the liquid biopsy/circulating DNA methylation panels segment is expected to gain the highest market share between 2026 and 2035.

- By clinical development stage (therapeutics), the phase II segment held a major revenue share of approximately 34% in the market in 2025.

- By clinical development stage (therapeutics), the phase I/preclinical segment is expected to show the fastest growth over the forecast period.

- By end-user, the hospitals & oncology centers segment contributed the biggest revenue share of approximately 44% in the market in 2025.

- By end-user, the pharmaceutical/biotech companies segment is expected to account for the highest growth in the predicted timeframe.

- By reimbursement/commercial model, the prescription/reimbursed therapeutics segment held a major revenue share of approximately 57% in the market in 2025.

- By reimbursement/commercial model, the subscription/software-as-a-service segment is expected to gain the highest market share between 2026 and 2035.

Epigenetics: Rewriting Disease at the Molecular Level

The epigenetic drugs and diagnostic technologies market is developing as a key element of the next-generation therapeutic and personalized healthcare. Recent findings in molecular biology have shown the effect of epigenetic changes on cancer, neurological, and chronic diseases. The pharmaceutical industry has been keen to incorporate new epigenetic technologies in the discovery of drugs. There is also improved technology in diagnostics, which allows early diagnosis and choice of therapy. Collectively, these advances are changing the ways in which complex diseases are studied and managed.

Impact of AI on the Epigenetics Drugs and Diagnostic Technologies Market

Artificial intelligence (AI) is changing epigenetics by facilitating the analysis of complex genomic and epigenomic data in a short time. Machine learning (ML) algorithms can be used to determine epigenetic biomarkers and predict therapeutic response with increased precision. AI is used to discover the targets and is implemented in the identification of concealed patterns in chromatin modification data. It also assists in the optimization of drugs and the stratification of patients in clinical trials. With the increasing computational power, AI will become part and parcel of the innovation in epigenetics.

Epigenetics Drugs and Diagnostic Technologies Market Trends

- Epigenetic Profiling: The profiling provides deeper insights into gene regulation and disease mechanisms. It helps identify predictive biomarkers through the support of the accredited tools for targeted therapies. Their growing use in research and clinical settings is strengthening personalized treatments.

- Diagnostics and Applications of Liquid: Non-invasive nature and ability to capture real-time epigenetic changes are incipient as a transformative diagnostics approach. This allows an early detection of the diseases, therapy monitoring, and relapse prediction.

- Growth of AI-driven Drug Discovery: AI-driven platforms are increasingly used to analyze complex epigenomic datasets and identify novel therapeutic targets. ML enhances lead optimization and reduces drug development timelines. This trend is improving success rates in early-stage epigenetics drug pipelines.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 20.17 Billion |

| Market Size in 2026 | USD 23.13 Billion |

| Market Size by 2035 | USD 79.03 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product/Solution, Therapeutic Modality, Indication/Therapeutic Area, Diagnostic Type,Clinical Development Stage (Therapeutics), End-User, Reimbursement/Commercial Model, and region |

| End UseRegions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product/Solution Insights

Why Did the Therapeutic Drugs Segment Dominate the Market?

The therapeutic drugs segment held a major revenue share of approximately 62% in the epigenetics drugs and diagnostic technologies market in 2025 because they have direct effects on disease modification. These agents act on the enzymes that regulate gene expression. Therapeutic drugs, such as DNMT inhibitors and HDAC inhibitors, can provide symptomatic relief and provide a targeted effect. There is oncological clinical evidence that supports massive adoption.

The diagnostics and companion tests segment is expected to show the fastest growth over the forecast period, driven by the growing demand for precision medicine. Companion tests are used to identify patients who may be more susceptible to epigenetic treatments. Sensitivity and specificity are improved by the development of molecular assays. Advances in diagnostic technologies and the need for point-of-care diagnostics boost the segment's growth.

Therapeutic Modality Insights

Which Therapeutic Modality Segment Dominated the Market?

The small-molecule epigenetic modulators segment accounted for the highest revenue share of approximately 55% in the epigenetics drugs and diagnostic technologies market in 2025, as they are effective and can be produced with ease. They allow an epigenetic control to be reversed. Small-molecule epigenetics have high oral bioavailability and are comparatively cost-effective, enhancing patient convenience and affordability.

The oligonucleotide/RNA-targeting approaches segment is expected to gain the highest market share between 2026 and 2035, due to high specificity and the ability to provide targeted effects. These technologies enable fine control of genes. Delivery systems are promoting feasibility. There is an excellent interest in rare and CNS disorders, which results in growth.

Indication/Therapeutic Area Insights

What Made Oncology (Solid Tumors) the Dominant Segment in the Market?

The oncology (solid tumors) segment contributed the biggest revenue share of approximately 48% in the epigenetics drugs and diagnostic technologies market in 2025, driven by the rising prevalence of solid tumors and advances in cancer therapeutics. The growing need for early diagnosis and personalized treatment promotes the need for epigenetic drugs and diagnostics. Epigenetic drugs may provide a synergistic effect with other anticancer drugs by enhancing the sensitivity of cancer cells to anticancer drugs.

The neurological and CNS disorders segment is expected to witness the fastest growth in the market over the forecast period, as epigenetics plays a crucial role in neurodegeneration. Studies have shown an association between epigenetic dysregulation and cognitive impairment. New diagnostics are making it possible for a timely intervention. The increasing R&D investments and high disease complexity augment the segment's growth.

Diagnostic Type Insights

Which Diagnostic Type Segment Dominated the Market?

The tissue-based methylation/histology assays segment contributed the biggest revenue share of approximately 41% in the epigenetics drugs and diagnostic technologies market in 2025, due to advances in genomic technologies and the growing awareness of early diagnosis and screening. Dominance is assisted by high accuracy and protocols. The use of these tests is common in the field of oncology. Adoption is maintained by clinical acquaintance.

The liquid biopsy/circulating DNA methylation panels segment is expected to expand rapidly in the market in the coming years, due to the demand for non-invasive testing. It enables real-time monitoring of disease and early detection. Advanced technology facilitates high detection sensitivity. There is a growing adoption of adoption in both clinical and other research environments.

Clinical Development Stage (Therapeutics) Insights

How the Phase II Segment Dominated the Market?

The phase II segment held the largest revenue share of approximately 34% in the epigenetics drugs and diagnostic technologies market in 2025, as multiple candidates move through early discovery. Phase II trials are conducted to assess a drug's efficacy and appropriate dose. Deep pipeline strength encourages supremacy. As of 11th February 2026, a total of 84 phase II trials were registered on the clinicaltrials.gov website related to epigenetics.

The phase I/preclinical segment is expected to grow with the highest CAGR in the market during the studied years, due to the growing research activities and increasing public-private partnerships. Novel drugs undergo preclinical testing in animals and subsequent phase I trials in humans to assess their safety and efficacy. Stringent regulatory guidelines necessitate researchers to conduct phase I/preclinical studies.

End-User Insights

How the Hospitals and Oncology Centers Segment Dominated the Market?

The hospitals and oncology centers segment registered its dominance over the global epigenetics drugs and diagnostic technologies market with a share of approximately 44% in 2025, as they are key participants in cancer diagnostics, planning of treatment, and patient monitoring. The increasing number of patients and the transition to precision medicine further support the segment's growth. Hospitals & oncology centers have favorable infrastructure and skilled professionals to provide complete care.

The pharmaceutical/biotech companies segment is expected to grow with the highest CAGR in the market during the studied years due to increasing R&D investments. These companies use epigenome profiling technologies and analytical AI to discover new drug targets and streamline clinical programs. The growing competition among pharma and biotech companies encourages them to expand their product pipeline.

Reimbursement/Commercial Model Insights

Why Did the Prescription/Reimbursed Therapeutics Segment Dominate the Market?

The prescription/reimbursed therapeutics segment led the global epigenetics drugs and diagnostic technologies market with a share of approximately 57% in 2025, due to the availability of favorable reimbursement policies and new product approvals. The increasing healthcare expenditure and the rising prevalence of chronic disorders propel the segment's growth. The availability of customized insurance plans by both government and private organizations promotes the segment's growth.

The subscription/software-as-a-service segment is expected to witness the fastest growth during the predicted timeframe, due to the increasing use of bioinformatics for research purposes. Software-as-a-service (SaaS) tools leverage AI/ML technologies for screening huge datasets and identifying potential candidates with high efficacy and suitable pharmacokinetic properties.

Regional Insights

How Big is the North America Epigenetics Drugs and Diagnostic Technologies Market Size?

The North America epigenetics drugs and diagnostic technologies market size is estimated at USD 8.47 billion in 2025 and is projected to reach approximately USD 33.59 billion by 2035, with a 14.77% CAGR from 2026 to 2035.

Why North America Dominated the Market?

North America dominated the epigenetics drugs and diagnostic technologies market with a share of approximately 42% in 2025, due to the presence of an effective research ecosystem and the rising adoption of newer molecular technologies. The increasing investments in genomics, precision medicine, and cancer research foster market growth. Developed healthcare systems facilitate the quick clinical implementation of epigenetic findings.

The growing collaboration among academic institutions, pharmaceutical firms, and biotechnology firms spurred innovation. Regulatory authorities are becoming more conducive to companion diagnostics and new forms of therapeutic practices. Government bodies also launch initiatives to raise awareness about disease screening, early diagnosis, and precision medicine.

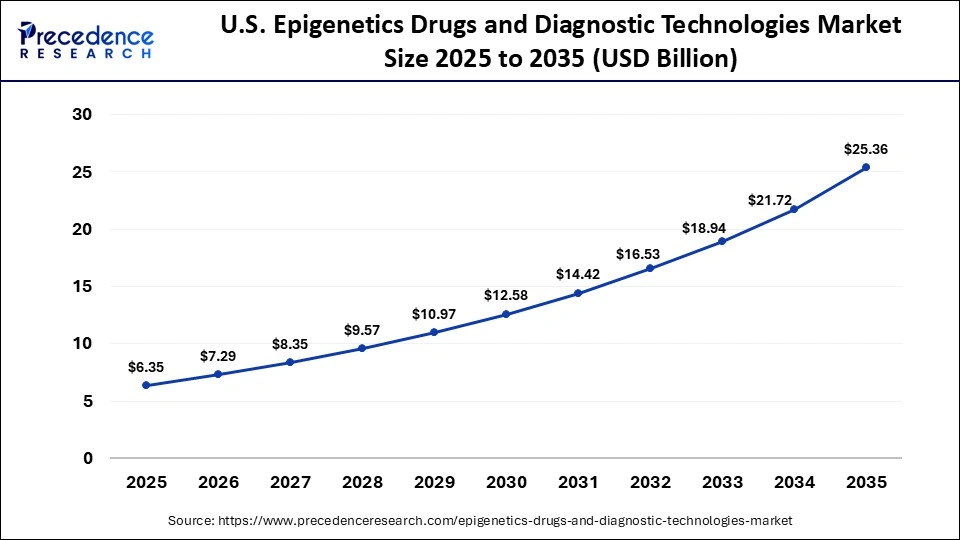

What is the Size of the U.S. Epigenetics Drugs and Diagnostic Technologies Market?

The U.S. epigenetics drugs and diagnostic technologies market size is calculated at USD 6.35 billion in 2025 and is expected to reach nearly USD 25.36 billion in 2035, accelerating at a strong CAGR of 14.85% between 2026 to 2035.

Country Level Analysis

The U.S. is ahead of the pack in terms of high clinical trial activity and has a solid pipeline of epigenetic therapies. Multinational pharmaceutical and biotechnology firms have been actively involved in the development of biomarker-based drugs.

Canada is experiencing gradual growth due to public investments in research and excellence in genomics academically. Translational research is enhanced because of cross-border collaboration. Liquid biopsy technologies are being adopted in large cancer centers. In general, the region is dominant due to its continued innovation and ability to commercialize.

How is Asia-Pacific Growing in the Epigenetics Drugs and Diagnostic Technologies Market?

Asia-Pacific is expected to host the fastest-growing market in the coming years, with the increasing access to healthcare and the increased expenditure on life sciences research. Rapid embracement of sophisticated diagnostics is changing the way diseases are detected and monitored. Governments in the region are funding precision medicine initiatives.

The increasing number of patients presents a high demand for oncology and neurological therapies. The availability of skilled researchers is increasing, so clinical development is increasing faster. The research environment in the region is also cost-effective, which is appealing to the world.

Country Level Analysis

China holds a major regional share in APAC because it has huge genomics initiatives and biotechnology capacity. Japan is interested in translational research and the rising adoption of epigenetic diagnostics. India is becoming a major center for clinical trials and bioinformatics-driven discovery.

South Korea is spending a lot of money on drug development platforms, which use AI. The regional cooperation improves data sharing and innovation.

Will Europe Grow in the Epigenetics Drugs and Diagnostic Technologies Market?

Europe is considered to be a significantly growing area, due to great harmonization of regulations and focus on accuracy in healthcare. The region also has an established set of epigenetics and molecular biology research institutions. Personalized treatment strategies are being defined by the growing use of companion diagnostics.

Innovation is promoted by public-funded research and cross-country research programs. The need for advanced oncology therapies is on the rise. The rising prevalence of chronic disorders, such as cancer and neurological disorders, growing research activities, and favorable regulatory support foster market growth.

Country Level Analysis

Germany has been at the forefront in industrial-level research and clinical adoption of epigenetic technologies. The UK has a good momentum in terms of translational research and biotech innovation. France focuses on a healthcare-led system of diagnostic usage. The Nordic countries develop digital health and molecular testing systems. Southern European countries are involved in more joint research projects. Such regional cooperation and the alignment of the regulation lead to stable market development.

Epigenetics Drugs and Diagnostic Technologies Market Value Chain Analysis

Who are the Major Players in the Global Epigenetics Drugs and Diagnostic Technologies Market?

The major players in the epigenetics drugs and diagnostic technologies market include Acetylon Pharmaceuticals, Astex Pharmaceuticals, CellCentric, Celleron Therapeutics, Celgene Corporation, Chroma Therapeutics, Pfizer Inc., F. Hoffmann-La Roche Ltd., Merck & Co Inc., Novartis AG, Bristol-Myers Squibb Company, Thermo Fisher Scientific Inc., AstraZeneca PLC, Illumina Inc., QIAGEN NV, Exact Sciences Corporation, Abcam PLC, Syndax Pharmaceuticals Inc., Astex Pharmaceuticals Inc., Diagenode LLC, Cisbio Bioassays, 4SC AG, Verogen Inc., Watchmaker Genomics Inc., Oryzon Genomics SA, and Cell Centric Ltd.

Recent Developments in the Epigenetics Drugs and Diagnostic Technologies Market

- In September 2025, Epigenica AB released EpiFindertm GenomePro, which is a powerful epigenomic research system that enables a high-throughput, multiplexed analysis of histone modifications and DNA methylation within a single workflow. The system enables researchers to produce huge amounts of quantitative, genome-wide information on extremely small sample inputs with the help of optimized reagents and efficient protocols. (Source: https://www.epigenica.se)

- In November 2024, EpiMedTech Global secured U.S. FDA registration for EPIAGE, an advanced epigenetic age assessment test that leverages DNA methylation analysis and next-generation sequencing. The test applies a triple-sequencing approach to deliver highly accurate and reproducible measurements of biological age, offering deeper insight beyond chronological aging.(Source: https://epimedtech.com)

- In January 2024, HKG Therapeutics Limited introduced a medication genetic test known as the Meta gene Mutations Panel, aimed at measuring important gene changes in relation to health and aging. Through such a simple sample of saliva, the test can analyze important genetic markers related to methylation pathways, including DNA repair and detoxification. (Source: https://www.prnewswire.com)

Segments Covered in the Report

By Product/Solution

- Therapeutic Drugs (epigenetic modulators)

- DNMT inhibitors

- HDAC inhibitors

- BET inhibitors

- EZH2 inhibitors

- Other epigenetic-targeted small molecules

- Diagnostics and Companion Tests

- DNA methylation assays (PCR, sequencing)

- Histone modification assays

- Epigenetic biomarker panels

- Research Tools and Reagents/Informatics

By Therapeutic Modality

- Small-molecule Epigenetic Modulators

- Biologics & Peptide-based Modulators

- Oligonucleotide/RNA-targeting Approaches

- Epigenetic Editing (CRISPR/dCas-based)

- Combination Therapies (epigenetic + other agents)

By Indication/Therapeutic Area

- Oncology (solid tumors)

- Hematologic Malignancies

- Neurological & CNS Disorders

- Metabolic & Fibrotic Diseases

- Inflammatory/Autoimmune Conditions

- Other Indications

By Diagnostic Type

- Tissue-based Methylation/Histology Assays

- Liquid Biopsy/Circulating DNA Methylation Panels

- Companion Diagnostic Kits (drug-linked)

- Epigenetic Bioinformatics & Reporting Tools

By Clinical Development Stage (Therapeutics)

- Commercial/Approved Therapies

- Phase III

- Phase II

- Phase I/Preclinical

By End-User

- Hospitals & Oncology Centers

- Clinical & Reference Laboratories

- Pharmaceutical/Biotech Companies (R&D & CDx)

- Research Institutes & Academic Centers

- Contract Research Organizations (CROs)

By Reimbursement/Commercial Model

- Prescription/Reimbursed Therapeutics

- Self-paid/Out-of-pocket Diagnostic Tests

- Contract Research/Service Revenues

- Subscription/Software-as-a-Service

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting