What is the ERP Software Market Size?

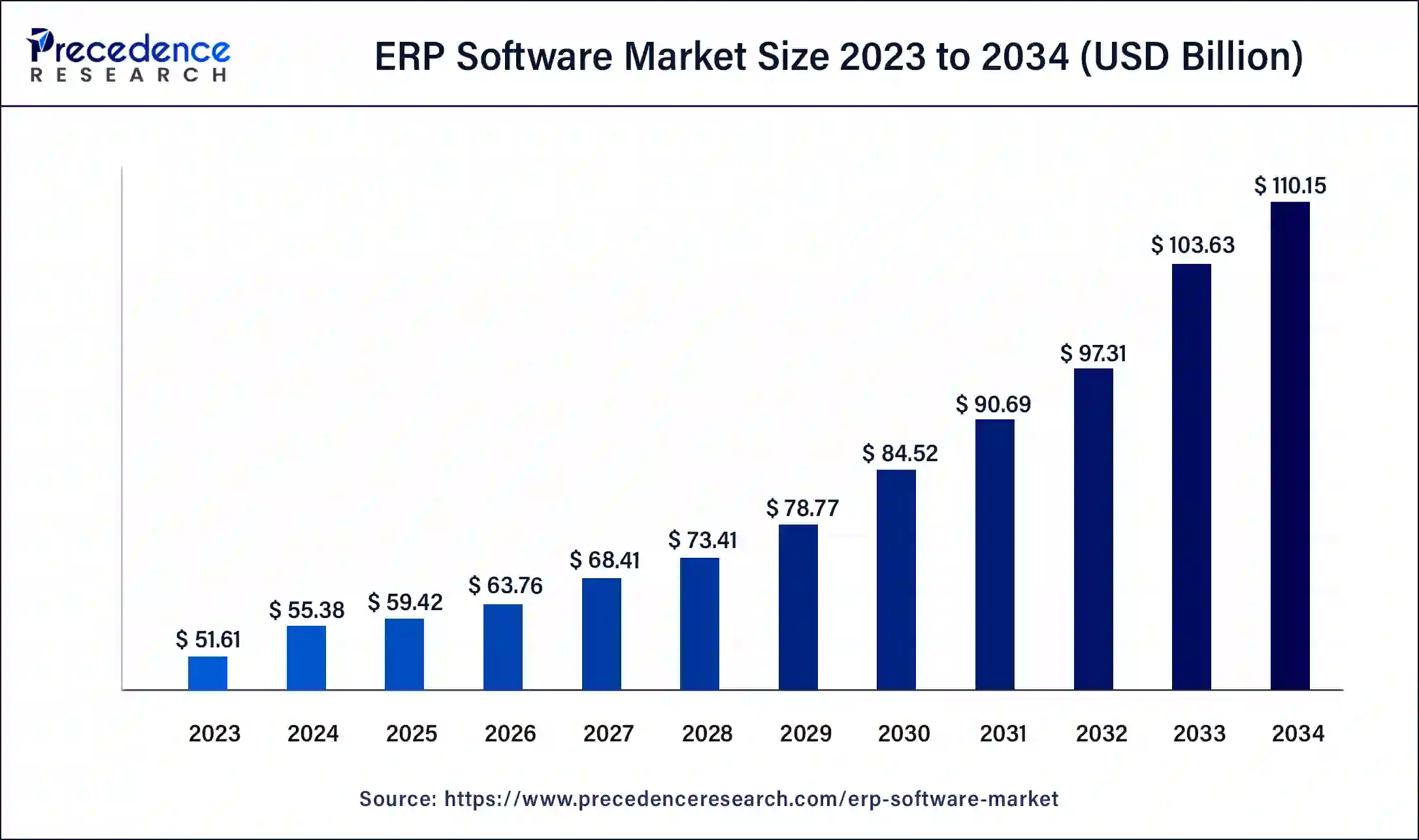

The global ERP software market size was valued at USD 59.42 billion in 2025, and is predicted to increase from USD 63.76 billion in 2026 to approximately USD 116.54 billion by 2035, expanding at a CAGR of 6.97% from 2026 to 2035. The North America ERP software market size reached USD 18.58 billion in 2025.

ERP Software Market Key Takeaways

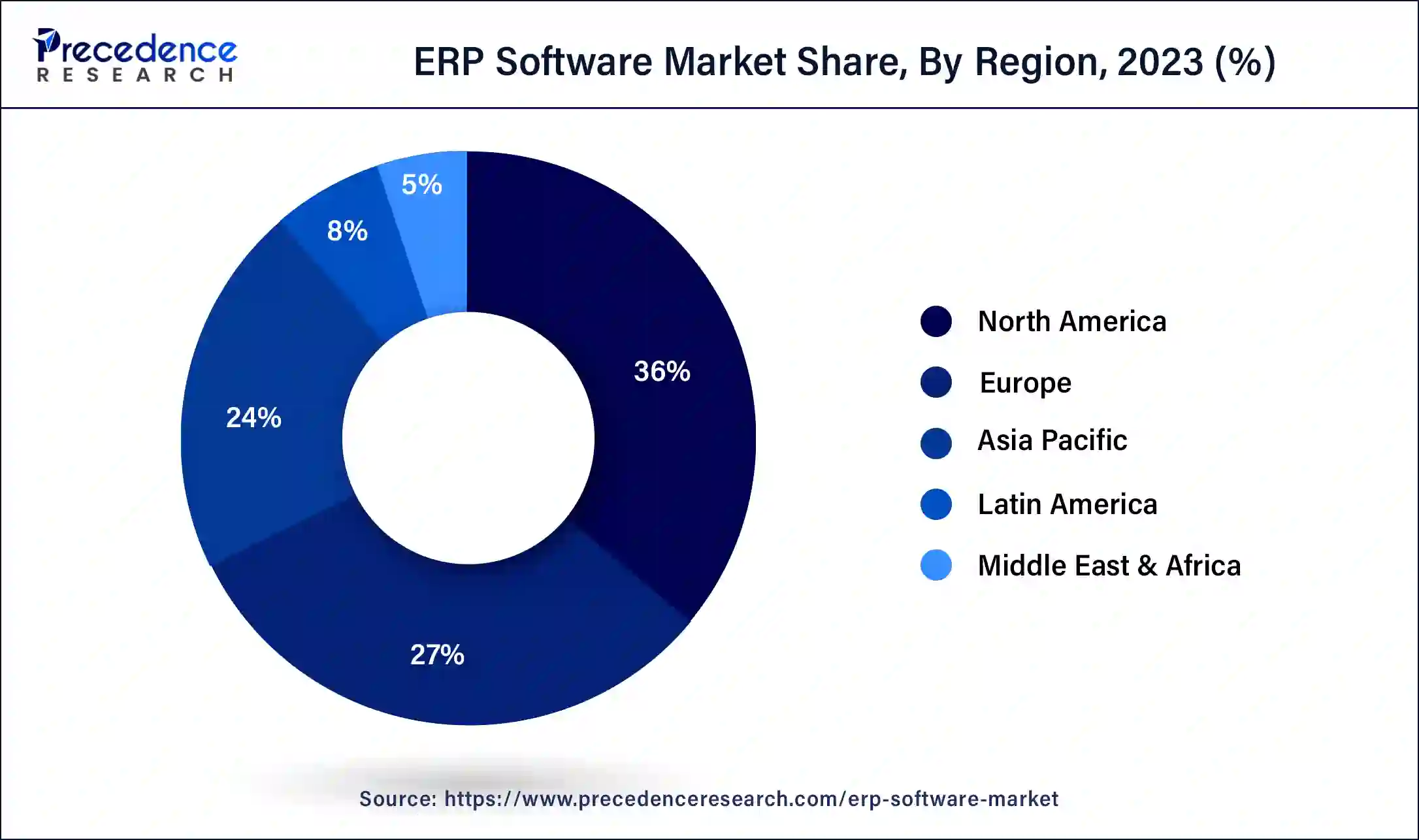

- North America contributed more than 36% of revenue share in 2025.

- Asia-Pacific region is expected to expand at the fastest CAGR during the forecast period.

- By Function, the finance segment captured around 26.4% of revenue share in 2025.

- By Function, the human resource segment is anticipated to grow at a significant CAGR of 9.1% between 2026 and 2035.

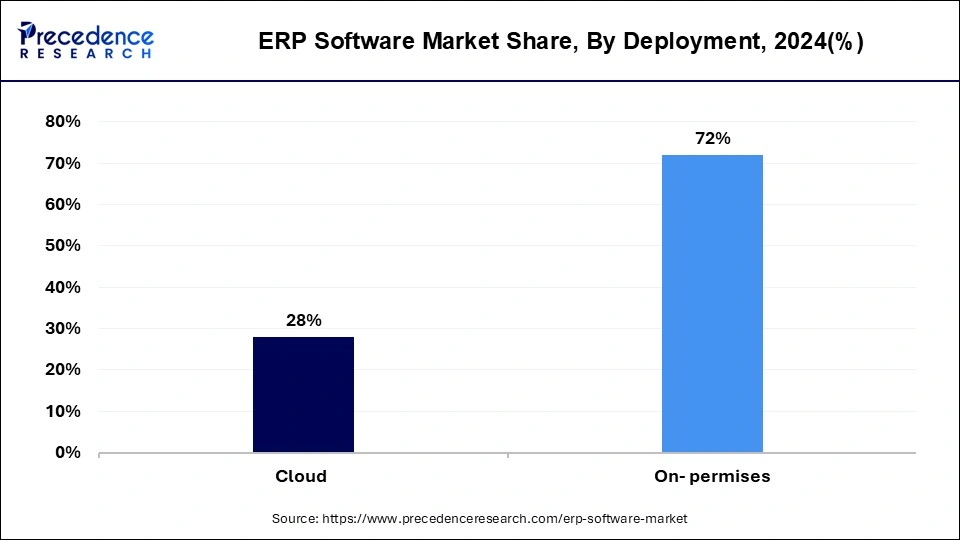

- By Deployment, the on-premises segment led the global market with the highest market share of 72% in 2025.

- By Deployment, the cloud segment is expected to grow at the fastest CAGR over the projected period.

- By Enterprise Size, the large enterprise segment registers the highest market share of 41.2% in 2025.

- By Enterprise Size, the medium enterprise segment is anticipated to expand at the fastest CAGR from 2026 to 2035.

- By Vertical, the services segment held the maximum revenue share of 27.1% in 2025.

- By Vertical, the manufacturing segment is anticipated to grow at a notable CAGR of 9.6% over the predicted period.

Market Overview

The ERP software market is shaped by several key trends and growth drivers including the increasing adoption of cloud-based ERP solutions has gained momentum, providing scalability, flexibility, and cost-effectiveness. Apart from this ERP systems are undergoing a significant transformation with the integration of artificial intelligence (AI) and advanced data analytics. This evolution empowers ERP platforms to become intelligent, offering predictive analysis capabilities that drive enhanced productivity and efficiency. Simultaneously, there is a growing trend in the market for industry-specific ERP solutions, meeting the distinct requirements of sectors such as healthcare and manufacturing.

Moreover, globalization and the need for real-time cross-border data sharing are pushing companies to invest in ERP for seamless international operations. The ERP market offers numerous business opportunities. Cloud-based ERP solutions have the potential to capture a broader customer base seeking cost-effective and scalable alternatives. AI and data analytics integration present opportunities to offer advanced insights and optimization services. ERP providers that specialize in industry-specific solutions can cater to markets. Addressing data security concerns through robust cyber security offerings can be a lucrative niche. Furthermore, offering user-friendly interfaces and simplified implementation processes can make ERP systems more accessible to a wider range of businesses.

Market Trends

- In June 2025, OCHIN, which is a healthcare provider network based in Oregon, U.S., announced Multiview Financial Software, which is a Canadian enterprise resource planning (ERP) software provider, as a preferred technology partner. Enhancing the strategic financial insight and operational efficiency, along with the main goal of making healthcare more accessible to everyone, will be the focus of this collaboration. At the same time, the materials and financial management products will be offered to the organization members by merging the solutions portfolio of OCHIN with the ERP system of Multiview.

- In August 2024, a total of $47 million in funding was secured in the Series B funding round by Opkey, which is a test automation platform. This round was led by PeakSpan Capital along with other existing investors. It was announced that the cloud ERP transformation programs will be streamlined, and the product development, as well as technological advancements, will be accelerated by utilizing this funding, by Opkey, which provides a no-code testing platform for automating their application testing in hours for technical users and businesses. Furthermore, YourNest Venture Capital, Vertica Capital Partners, and UST are its existing investors.

ERP Software Market Growth Factors

- The enterprise resource planning (ERP) software market comprises a dynamic and robust industry focused on providing integrated software solutions for comprehensive business management.

- ERP software serves as a centralized platform that streamlines various functions such as finance, human resources, supply chain, manufacturing, and customer relations within an organization. It facilitates data sharing, automation, and real-time information access, enabling efficient decision-making and process optimization.

- The nature of the ERP software market is characterized by continuous evolution and adaptation to changing business needs and technological advancements. It encompasses a wide range of vendors offering diverse ERP solutions catering to various industries and business sizes. Cloud-based ERP systems are gaining prominence due to their scalability and flexibility, while artificial intelligence and analytics integration are driving innovation.

- ERP software plays a pivotal role in enhancing operational efficiency, productivity, and competitiveness, making it an essential component of modern business infrastructure.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 116.54Billion |

| Market Size in 2025 | USD 59.42 Billion |

| Market Size in 2026 | USD 63.76 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.97% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Function, Deployment, Enterprise Size, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Data integration and operational efficiency

Data integration drives market demand for ERP software by providing a unified platform to centralize diverse data sources across an organization. This streamlines processes, enhances decision-making, and boosts operational efficiency. ERP systems offer businesses the ability to seamlessly integrate data from various departments, ensuring real-time access to critical information. As organizations increasingly prioritize data-driven decision-making, the demand for ERP software continues to surge, making it an indispensable tool for modern businesses seeking operational excellence and competitiveness.

Moreover, operational efficiency is a primary driver of market demand for enterprise resource planning (ERP) software. ERP systems streamline and automate business processes, reducing manual efforts and errors. This efficiency translates to cost savings, improved productivity, and enhanced competitiveness. As organizations increasingly seek to optimize their operations, ERP software becomes a crucial tool, driving its adoption and continued growth in the market.

Restraint

Data migration, maintenance and upkeep

Data migration poses a restraint on ERP software market demand due to its complexity and potential for data loss or inconsistencies during the process. Organizations may hesitate to adopt ERP systems because of the perceived risks involved in transferring critical data from legacy systems. The fear of disruptions and the resource-intensive nature of data migration can deter businesses from embracing ERP solutions, impacting their ability to streamline operations and drive efficiency.

Moreover, maintenance and upkeep pose a restraint on the market demand for ERP software. Businesses must allocate resources for ongoing updates, technical support, and system maintenance, incurring additional costs. These expenditures can deter some organizations, particularly smaller ones, from investing in ERP solutions. Furthermore, the need for continuous maintenance can disrupt regular operations and divert resources from other critical areas, impacting the perceived cost-effectiveness and convenience of ERP software, thereby limiting its market demand.

Opportunity

Cloud-based solutions, AI, and advanced analytics integration

Cloud-based ERP solutions are driving market demand by offering scalability, cost-effectiveness, and accessibility. They eliminate the need for on-premises infrastructure, reducing upfront costs. Scalability allows businesses to adjust resources as needed. The cloud also facilitates remote access, making it easier for organizations to support modern work environments. These benefits make cloud-based ERP systems an attractive choice for businesses of all sizes, enhancing their overall competitiveness and accelerating their adoption in the ERP software market.

Moreover, the integration of AI and advanced analytics is driving market demand for ERP software. These technologies enhance ERP systems with predictive analytics, real-time insights, and process automation. Businesses seek ERP solutions that can optimize operations, make data-driven decisions, and adapt to changing market dynamics. As AI and analytics become integral to staying competitive, ERP software equipped with these capabilities becomes increasingly essential, surging demand for innovative, intelligence-driven solutions in the ERP market.

Segment Insights

Function Insights

The finance sector held 26.4% revenue share in 2024. Finance in the enterprise resource planning (ERP) software market refers to the module within ERP systems that manages financial activities, including accounting, budgeting, and financial reporting. Trends in this domain include the increasing adoption of AI andmachine learning for automated financial processes, enhanced compliance and reporting capabilities, real-time financial analytics, and the integration of blockchain for secure and transparent financial transactions. Finance-focused ERP solutions are evolving to provide better control, visibility, and efficiency in managing financial operations, aiding businesses in making informed financial decisions.

The human resource sector is anticipated to expand at a significant CAGR of 9.1% during the projected period. In the enterprise resource planning (ERP) software market, Human Resource (HR) functions encompass the management of personnel, payroll, recruitment, and employee data. Recent trends in ERP software include the adoption of AI and machine learning for HR analytics and workforce planning. Enhanced employee self-service portals, mobile accessibility, and the integration of HR modules with other ERP functions have also become prevalent. Additionally, the COVID-19 pandemic has accelerated the shift towards remote work, driving the need for ERP solutions that facilitate virtual HR processes and foster employee engagement in distributed work environments.

Deployment Insights

On-premises is anticipated to hold the largest market share of 72% in 2024. On-premises deployment in the enterprise resource planning (ERP) software market refers to the traditional model where ERP software is installed and hosted on the company's own servers and infrastructure. While this approach offers greater control over data and customization, it often entails higher upfront costs and maintenance responsibilities. Recent trends show a gradual shift towards cloud-based ERP solutions due to their scalability, cost-effectiveness, and accessibility from anywhere. However, some industries with stringent data security and compliance requirements still prefer on-premises deployments, highlighting a continued niche demand for this deployment method.

The cloud sector is projected to grow at the fastest rate over the projected period. Cloud deployment in the enterprise resource planning (ERP) software market refers to hosting ERP systems on remote servers accessible via the Internet. This approach eliminates the need for on-premises hardware and offers scalability, cost-efficiency, and remote accessibility. In recent trends, cloud-based ERP solutions have witnessed growing adoption due to their flexibility, lower upfront costs, and rapid implementation. The COVID-19 pandemic further accelerated this trend as remote work and digital transformation became imperative. Vendors now focus on enhancing security, integrating AI and analytics, and offering hybrid cloud solutions to meet diverse customer needs in this dynamic ERP landscape.

Enterprise Size Insights

In 2024, the large enterprise sector had the highest market share of 41.2% on the basis of enterprise. Large enterprises, typically characterized by substantial employee counts, revenue, and complex operations, are a significant segment in the ERP software market. Large enterprises are increasingly adopting cloud-based ERP solutions for scalability, flexibility, and cost-effectiveness. Integration of AI, advanced analytics, and IoT into ERP systems is gaining traction to enhance data-driven insights and automation capabilities. Moreover, the demand for industry-specific ERP solutions tailored to the unique needs of large enterprises is on the rise, as they seek to optimize their complex processes and improve decision-making.

The medium enterprise is anticipated to expand at the fastest rate over the projected period. Medium-sized enterprises (MEs) typically have 50 to 499 employees and occupy a vital economic space. In the ERP software market, MEs are increasingly adopting cloud-based solutions for cost-effectiveness and scalability. They also seek user-friendly interfaces and modular ERP systems to tailor functionalities. MEs are integrating AI and analytics into ERP for data-driven insights. As data security concerns grow, MEs are focusing on robust cybersecurity features. Overall, MEs are leveraging ERP systems to enhance efficiency, decision-making, and competitiveness while adapting to evolving market dynamics.

Vertical Insights

The services segment held the largest revenue share of 27.1% in 2024. In the services sector, ERP software focuses on resource management, project planning, and customer relationship management. Key trends involve the rise of cloud-based ERP systems tailored for service-based businesses, enhancing scalability and remote work capabilities. Furthermore, ERP solutions in this vertical increasingly incorporate AI-driven insights to improve project efficiency, resource allocation, and client engagement. As services companies embrace digital transformation, ERP software helps them remain agile and competitive in a rapidly evolving market.

The manufacturing sector is anticipated to grow at a significantly faster rate, registering a CAGR of 9.6% over the predicted period. In the manufacturing sector, enterprise resource planning (ERP) software streamlines production, inventory, and supply chain operations. Trends in this vertical include the adoption of smart manufacturing technologies, where ERP systems integrate with IoT devices and AI for predictive maintenance and real-time monitoring. Additionally, Industry 4.0 principles drive the demand for ERP solutions with advanced analytics for process optimization and greater automation, enabling manufacturers to respond quickly to changing market demands and reduce costs.

Technological Advancement

Technological advancement in the enterprise resource planning software market features the most impactful and in-trend technology, popularly known as cloud computing and artificial intelligence for internet business solutions. Cloud enterprise resource planning software (ERP) is currently leading the advancement area of the ERP software market. ERP cloud consists of flexibility, low cost, and scalability.

For business functions, software is a must. The advancement profits various industries such as retail, healthcare, and manufacturing. The departmental operations highly depend on the smoothest technology to continue with its supply chain, finance, and HR related work. Cloud computing and machine learning enhance data analysis and automated workflows.

Regional Insights

What is the U.S. ERP Software Market Size?

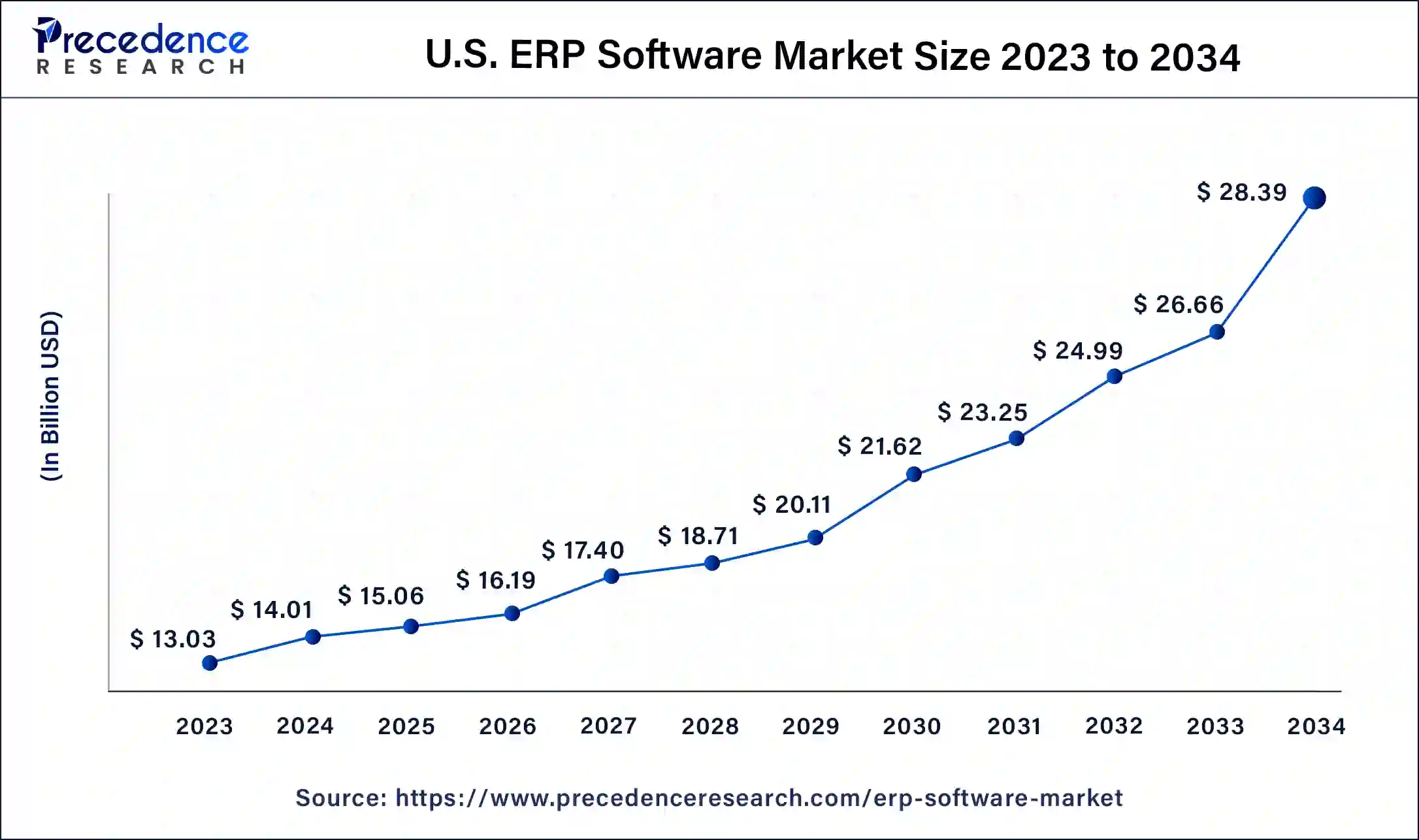

The U.S. ERP software market size was estimated at USD 15.06 billion in 2025 and is predicted to be worth around USD 30.08 billion by 2035, at a CAGR of 7.16% from 2026 to 2035.

North America has held the largest revenue share 36% in 2024. North America, comprising the United States and Canada, is a prominent region in the Enterprise Resource Planning (ERP) software market. The region is characterized by a strong demand for ERP solutions across various industries, including manufacturing, healthcare, and finance. Key trends in North America include a growing adoption of cloud-based ERP systems for scalability, a focus on AI and analytics integration to enhance decision-making, and a rising demand for industry-specific ERP solutions. The region's mature IT infrastructure and emphasis on digital transformation continue to drive innovation and growth in the ERP software market.

North America is currently dominating the ERP software market. With the increased revenue within the region, the scope to develop and encourage research and development in the region gets a clear path to implement innovations. North America has invested a lot in cloud-based solutions, with a constant practice to improve in this area, making the region more advanced and active in operations. With the rising demand for small and medium-sized enterprises, profits the regional economy and growth in the market.

U.S. Market Analysis

The U.S. leads the North American ERP software market due to widespread adoption of advanced technologies like cloud computing and AI, which enable digital transformation and automation across enterprises. Organizations in the U.S. are increasingly leveraging ERP systems for data-driven decision-making, seamless integration of business processes, and operational efficiency. Additionally, continual upgrades, large IT investments, and demand for scalable, intelligent solutions are driving sustained market growth.

What Makes Asia Pacific the Rapidly Growing Market?

The Asia-Pacific region is a dynamic and rapidly growing market for Enterprise Resource Planning (ERP) software. It encompasses diverse economies with varying industry needs, driving demand for ERP solutions tailored to specific sectors. The market trends in this region include the increasing adoption of cloud-based ERP systems, a rising emphasis on AI-driven analytics for data-driven decision-making, and a focus on localization to address unique regulatory and cultural requirements. Furthermore, globalization and expanding e-commerce activities have fueled the demand for ERP software, making the Asia-Pacific region a focal point for ERP market growth and innovation.

China Market Analysis

The ERP software market in China is growing due to the country's large manufacturing base and increasing enterprise automation across industries. Strong adoption by both state-owned and private companies, along with investments in cloud infrastructure and digital transformation, is driving demand for ERP solutions. Additionally, the presence of domestic ERP providers and the need for integrated management across production, logistics, and finance are fueling market growth.

How is the Opportunistic Rise of Europe in the Market?

Europe is expected to grow significantly in the ERP software market during the forecast period. The growing digitalization in Europe is increasing the use of ERP software by various enterprises for the management of supply chain and finance. Moreover, it is also an effective currency conversion tool and is multilingual, which is increasing its use. Advanced technologies are also being utilized to optimize its operation. Furthermore, as it provides data protection, its use is growing in the business sector. Thus, this is promoting the market growth.

Germany Market Analysis

The ERP software market in Germany is growing due to the country's strong industrial and manufacturing base, which drives demand for integrated business management solutions. Enterprises are increasingly adopting ERP systems to optimize production planning, supply chain coordination, and financial management. Additionally, Germany's focus on Industry 4.0, automation, and digital transformation is further accelerating ERP adoption across industries.

What Opportunities Exist in the Middle East & Africa for the ERP Software Market?

The Middle East & Africa (MEA) presents significant opportunities for ERP software due to ongoing digital transformation initiatives and improvements in technology infrastructure. Companies are adopting ERP systems to enhance operations, governance, and management of large-scale development and construction projects. Rising investments in smart cities, energy, logistics, and public services are expected to drive demand for cloud-based and modular ERP platforms across the region.

UAE Market Analysis

The ERP software market in the UAE is growing due to extensive digital infrastructure development and strong enterprise modernization initiatives. Increasing adoption across government, construction, logistics, and service sectors is driving demand for integrated solutions in finance, project management, and operations. Additionally, investments in cloud-based and modular ERP platforms are accelerating digital transformation and efficiency across industries.

What Potentiates the Latin American ERP Software Market?

The market in Latin America is being driven by increasing adoption of cloud-based technologies and the digitalization of SMEs. Companies are seeking centralized platforms to manage operations, improve cost control, transparency, and efficiency. Additionally, the growth of e-commerce, retail, and manufacturing hubs is supporting ERP implementation by providing cost-effective solutions for businesses facing high implementation costs.

Brazil Market Analysis

Brazil was the first country in Latin America to widely implement ERP software solutions. Its large manufacturing, retail, and services sectors, along with strong cloud computing infrastructure, have driven demand for ERP systems. Mid-sized companies are adopting these solutions to manage operations efficiently, scale affordably, and comply with regulatory requirements.

ERP Software Market Companies

- Epicor Software Corporation

- Hewlett-Packard Development Company, L.P.

- Infor Inc.

- International Business Machines Corporation

- Microsoft Corporation

- NetSuite Inc.

- Oracle Corporation

- Sage Group, plc

- SAP SE

- Unit4

Recent Developments

- In April 2025, Oracle gave tough competition to SAP in the ERP software market. The innovation and developmental progress of Oracle boost the market like never before.

- In November 2024, SAP's cloud approach by transform ERP for the new Artificial Intelligence Era. The revolutionary transitional change is supporting the market as well as businesses with its efforts in developing and upgrading to integrate the new technology into the business.

- In January 2025, the Sage and Tactics partnership formed a cloud solution for heavy civil contractors. To accelerate advancement and operations, a collaborative strategy has been approached to seek growth in the ERP software market.

- In 2022, International Business Machines Corporation (IBM) expanded its partnership with SAP SE, enhancing their collaboration to deliver innovative solutions that leverage IBM's cutting-edge technology and SAP's software expertise for mutual customer benefits.

- In 2022, Kooks Headers & Exhaust, U.S. manufacturer of auto racing headers and exhaust systems has selected SYSPRO Cloud ERP for its operations, aiming to leverage the system's capabilities to enhance efficiency, streamline processes, and support growth in their industry.

Segment Covered in the Report

By Function

- Finance

- HR

- Supply Chain

- Others

By Deployment

- On-premises

- Cloud

By Enterprise Size

- Large Enterprises

- Medium Enterprises

- Small Enterprises

By Vertical

- Service

- Manufacturing

- BFSI

- Healthcare

- Retail

- Government

- Aerospace & Defense

- Telecom

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content