Esters Market Size and Forecast 2025 to 2034

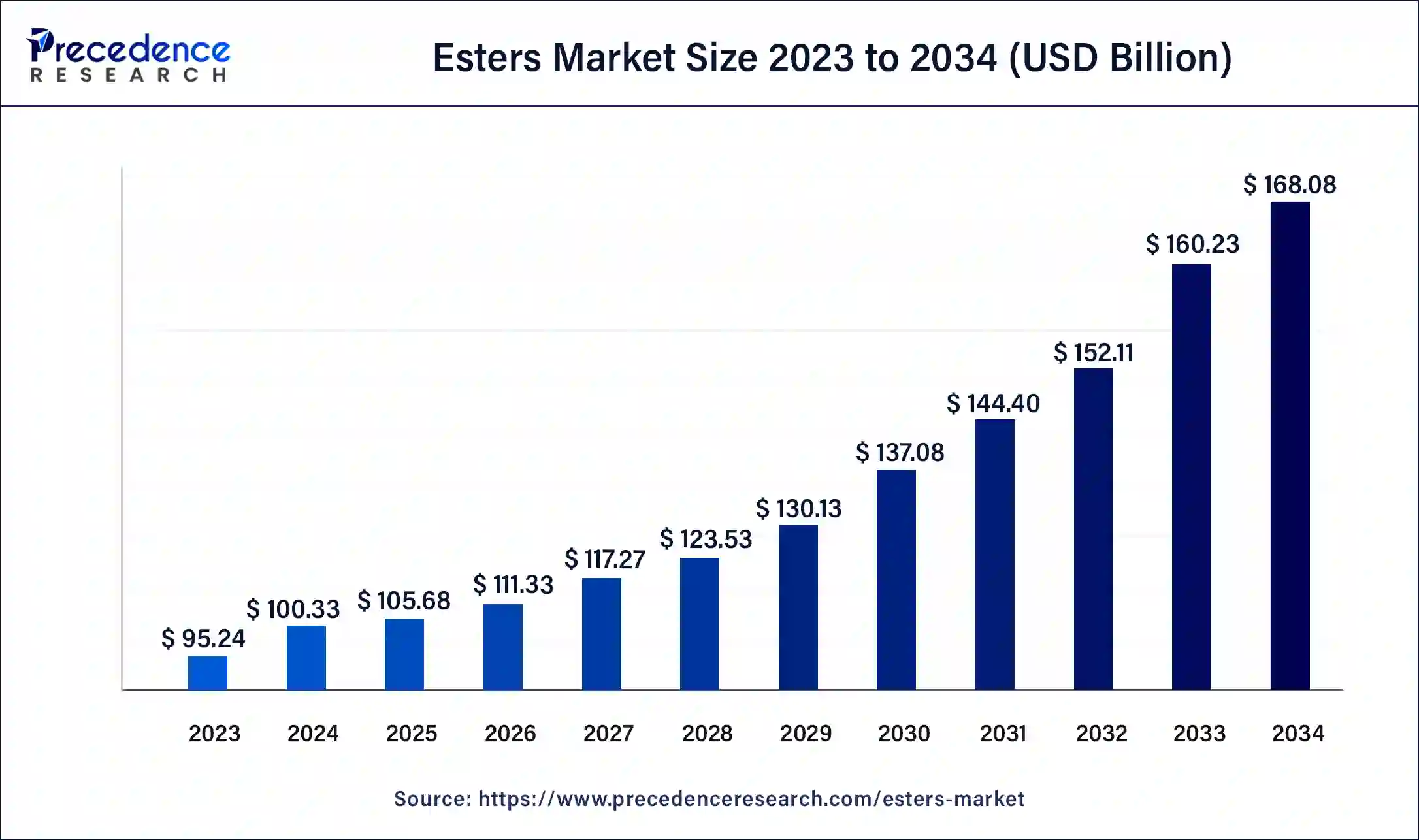

The global esters market size was calculated at USD 100.33 billion in 2024 and is expected to reach around USD 168.08 billion by 2034, expanding at a CAGR of 5.30% from 2025 to 2034. Growing demand of esters in cosmetics, food, and other industries boosts the growth of the esters market. Sustainable and eco-friendly ester products made from bio sources such as vegetable oils propel the ester market towards green and environmentally friendly products in different sectors.

Esters Market Key Takeaways

- The global esters market was valued at USD 100.33 billion in 2024.

- It is projected to reach USD 168.08 billion by 2034.

- The esters market is expected to grow at a CAGR of 5.30% from 2025 to 2034.

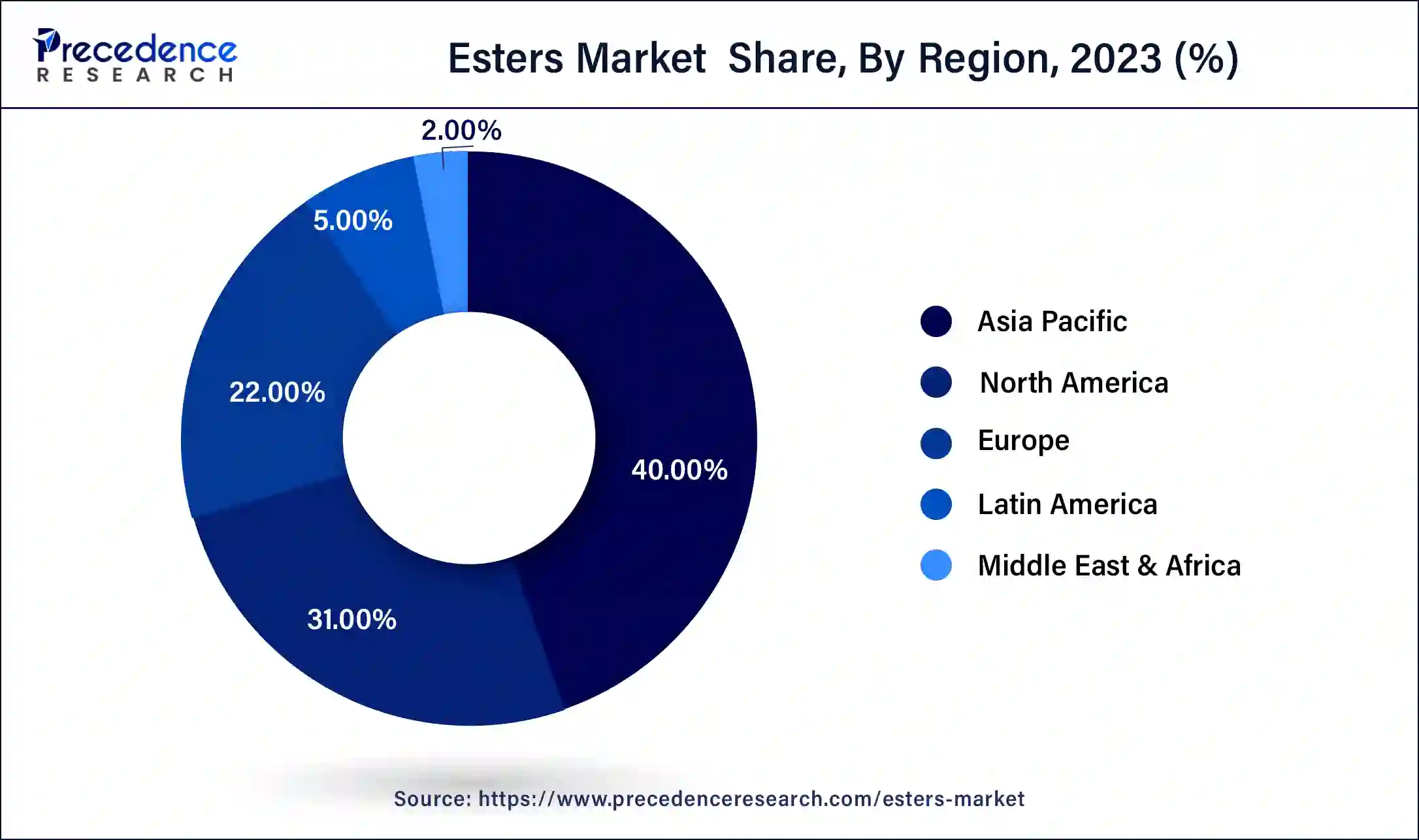

- Asia Pacific dominated the esters market in 2024 with the largest share of 40%.

- North America is the fastest growing region of esters market and is projected to grow positively in the forecast period.

- Based on product type, the polyol esters segment dominated the market in 2024.

- Based on end-use, the automative and aviation segment dominated the market in 2024 and is observed to witness a significant increase during the forecast period.

- Based on application, the lubricants segment dominated the esters market and accounted for the largest share in 2024.

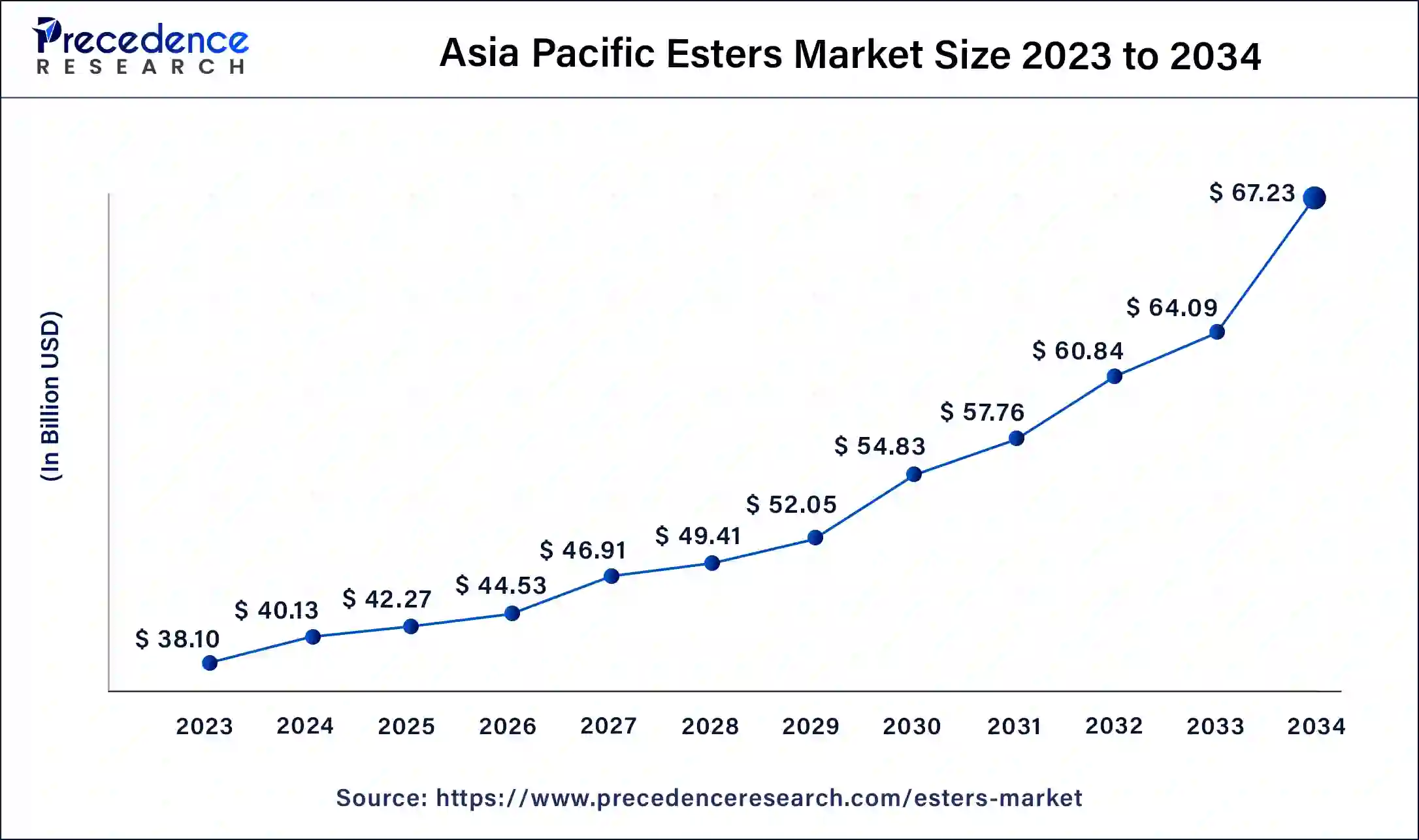

Asia Pacific Esters Market Size and Growth 2025 to 2034

The Asia Pacific esters market size was estimated at USD 40.13 billion in 2024 and is projected to surpass around USD 67.23 billion by 2034 at a CAGR of 5.30% from 2025 to 2034.

Asia pacific dominated the esters market and accounted to sustain as the largest marketplace in the forecast period. The growth is attributed to the high demand for different products from various end-user companies and the presence of large manufacturers in the region. Also, countries like China and India have well developed textile and chemical industries and requires esters for different purposes. Hence propels the market growth with high surge. Rise in consumable income of people increases the awareness of consuming nutritious food and drive the growth of the esters market.

- For instance, BASF announced in March 2022, the increment in production capacity of synthetic ester in China. The investment is due to the rising demand for high-performance lubricants in Asia Pacific, and also help BASF to form a strong position as a reliable supplier supporting consumers demand and market growth in the region.

North American region is the fastest growing region of esters market. The growth is accomplished by an increase in investments to strengthen various sectors including building and paints and coatings, uplifting the market growth and revenue in the region. Also, the enormous expansion of the automotive industry and rise in personal care profession in the region is expected to boost the overall market growth of the esters market. North America has abundant access to key raw materials required for ester production, such as alcohols and organic acids.

The region's access to shale gas, for example, has provided a relatively cheap and abundant supply of methanol, a key feedstock for many esters. North America generally has a favorable regulatory environment for chemical manufacturing, which encourages innovation and investment in the sector. Regulations regarding safety, environmental protection, and product quality also contribute to the region's reputation for producing high-quality esters.

Market Overview

Esters are basically derivatives of carboxylic acid. Most naturally occurring fats and oils are esters of glycerol and as they are obtained from natural sources, have a positive impact on human health. Esters are often aromatic, and those esters which have low molecular weights are volatile. These are widely used in perfumes and essential oils.

The high-performance activity of esters made it applicable in various other industries including pharmaceutical, food and beverage, automobile, aerospace, marine, cosmetics, personal care and others. Esters helps in producing premium quality lubricants to offer lubrication in various automotive parts and machines. They provide high thermal resistance, anti- oxidative, and lubricating properties for smooth working and avoiding various failures.

Manufacturers of esters are actively engaged in launching novel products with technological advancements. The main aim is to maintain the costs required for research and development. Also, expand industrial partnerships in a wide distribution network to diversify their product offerings on the international market and supply raw materials to ester products makers. Hence, all these factors are responsible for increasing the market value of esters and is expected to expand continuously.

Esters Market Growth Factors

- Leading market players are focused on investing more in Research and Development (R&D) activities to scale up the manufacturing plants and product lines, which help the esters market grow worldwide. It results in increased profitable income for manufacturers.

- Rapid industrialization and urbanization globally and an increasing demand for esters compounds such as polyesters significantly uplifts the esters market.

- Food and beverage manufacturers are using esters to add flavors, essence, and additives to attract customer tastes, which further drives the market growth for esters.

- Expansion and development of various sectors including automobile, aerospace, and machinery in fast pace are expected to boost the esters market for fulfilling the demand of consumers.

- The lubricating property of esters helps in smooth functioning of automotive and aerospace industries expanding the esters market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.30% |

| Market Size in 2024 | USD 100.33 Billion |

| Market Size in 2025 | USD 105.68 Billion |

| Market Size by 2034 | USD 168.08 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing demand of esters mainly in cosmetic and food industries

In cosmetic industries, the increase in demand for emulsifiers and stabilizers used in the production of various personal care and beauty products increases the ester market growth. Apart from this, esters are more attractively used in food industries. In the food sector, esters are increasingly used as food additives and preservatives for different food products including bakery products, ice-creams, processed foods, dairy products, etc.

- For instance, Nippon Fine Chemicals introduced an environmentally friendly factor series products of esters, oils, precursors of liposome and more. These consists of Plandool, Lusplan, Neosolue, Phytopresome, and PrimeLipid that are used for production of beauty and hair care products.

- Eastman company launched a novel collection of cellulose esters for using in various applications of contract foods such as inks, adhesives, tapes and labels, and other coatings.

All these industries favor the usage of esters for different purposes and increases the demand of esters which directly uplifts the growth of the esters market.

Restraint

High cost of raw materials required for the production of esters

The cost of raw materials such as crude oil and other petroleum derivatives required for the production of esters is relatively high thus hampering the growth of the esters market. They are produced chemically from materials derived from petroleum products and have an influence on the overall cost value of esters. Also, for the production of sustainable and renewable ester products such as oil and additives, it requires a large number of vegetables and crops. Lack of availability of adequate raw material such as vegetables and other crops due to weather, temperature, and other favorable conditions required for crop production hampers the productivity rate and also decreases the growth of the market.

Opportunity:

Increase in the use of sustainable and eco- friendly esters

The rising demand for sustainable and bio-based products from various sectors is creating opportunities for various industries. Various governments worldwide focusing on attractive initiatives and imposing strict regulations for the adoption of eco-friendly biodiesels and other bio-based ester products. Also, the increase in use of bio-based solvents in the paint and coating industry to minimize high volatile organic compounds composition in coatings solutions is an important factor supporting the market growth for bio-based Esters.

The synthetic petroleum-based coatings of polyurethane have been replaced by green bio-based coatings of polyurethane. These eco-friendly alternatives provide a suitable approach for the coating industry as they are easily available, biodegradable, inexpensive, and have minimal environmental impact.

- For instance, Oleris Esterol A is a bio-based product of fatty acid methyl esters extracted from a renewable castor oil source. It is made for industrial purpose only.

Product Insights

The polyol esters segment dominated the esters market and is observed to contribute a significant share in the forecast period. Polyol esters are available in a wide consistency range and offer prolonged, clean and varnish-free performance. They are product of choice for high-temperature applications. These esters are used as a base fluid and lubricant for textile, hydraulic fluids and metalworking formulations.

Polyol esters offer a wide range of properties, making them suitable for various applications. They can be tailored to meet specific requirements such as viscosity, lubricity, solubility, and stability, among others. They are compatible with a wide range of materials including metals, plastics, elastomers, and other chemicals. This compatibility enhances their versatility and suitability for different formulations.

Application Insights

The lubricants segment dominated the esters market and accounted for the largest market share in 2024. Lubricants made from esters and their derivatives are classified as automotive lubricants, aviation lubricants, industrial lubricants, marine lubricants and food-grade lubricants. Lubricants used in various industries are helpful in many ways including safety, efficiency and smooth working of automotives and machines. In food industries, lubricants are used to thicken the consistency of different products. It provides and maintain texture, appearance and taste of food products. Further growing demand of lubricating fluids and additives increases the growth of the esters market.

End-use Insights

The automative and aviation segment dominated the esters market and the segment is observed to grow while contributing a significant share during the forecast period. Esters are used to make lubricants and gasoline additives due to the presence of many attractive features, including their property of being volatile at low temperatures and balance a safe and clean operation at high temperatures. They help in increasing the overall efficiency and activity making them fair for transportation and aviation purposes. So, manufacturers are trying to increase and speed up the production rate of esters to fulfill the demand and requirements of ester globally. Hence, all these factors boost the growth of the esters market.

Esters Market Companies

- Mitsubishi Chemical Corporation

- Exxon Mobil Corporation

- Cargill, Inc.

- The Procter & Gamble Company

- Lanxess AG

- Arkema SA

- Evonik Industries AG

- Huntsman International LLC

- BASF SE

- Evonik

- Sigma-Aldrich Co. LLC.

- U-PICA Company.Ltd.

- Michelman Inc.

- NOF CORPORATION

- Fushun Anxin Chemical Co. Ltd.

Recent Developments

- In June 2023, M&I Materials announced the new launch of MIDEL range of ester transformer fluids. It is the world's first regenerated transformer ester fluid. In this technology, the used MIDEL synthetic ester is converted into MIDEL Regen. This initiative is a sustainable and ecofriendly approach of transformer fluid company.

- In May 2023, Global chemical company OQ Chemicals has successfully launched a new pilot plant for customized esters in Germany. This plant helps customers to produce esters according to their needs.

- In January 2023, Ester Industries unit announced the production of esters at a commercial level at a new Polyester film plant in Telangana.

Segments Covered in the Report

By Product Type

- Dibasic Esters

- Polyol Esters

- Methyl Esters

- Nitrate Esters

- Vinyl Esters

- Phosphate Esters

- Acrylic Esters

- Sucrose Esters

- Fatty Acid Esters

By Application

- Lubricants

- Automotive Lubricants

- Aviation Lubricants

- Industrial Lubricants

- Marine Lubricants

- Food-grade Lubricants

- Solvents

- Plasticizers

- Fuel and Oil Additives

- Flame Retardants

- Insecticides

- Explosives

- Surfactants

- Flavoring Agents

By End-use

- Chemicals

- Plastic and Polymers

- Soaps and Detergents

- Explosive

- Paints and Coatings

- Agrochemicals and Domestic Hygiene Products

- Pharmaceutical

- Industrial Chemicals

- Food

- Automotive and Aviation

- Marine

- Textiles

- Cosmetics and Personal Care Products

- General Manufacturing

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting