What is Fabry Disease Treatment Market Size?

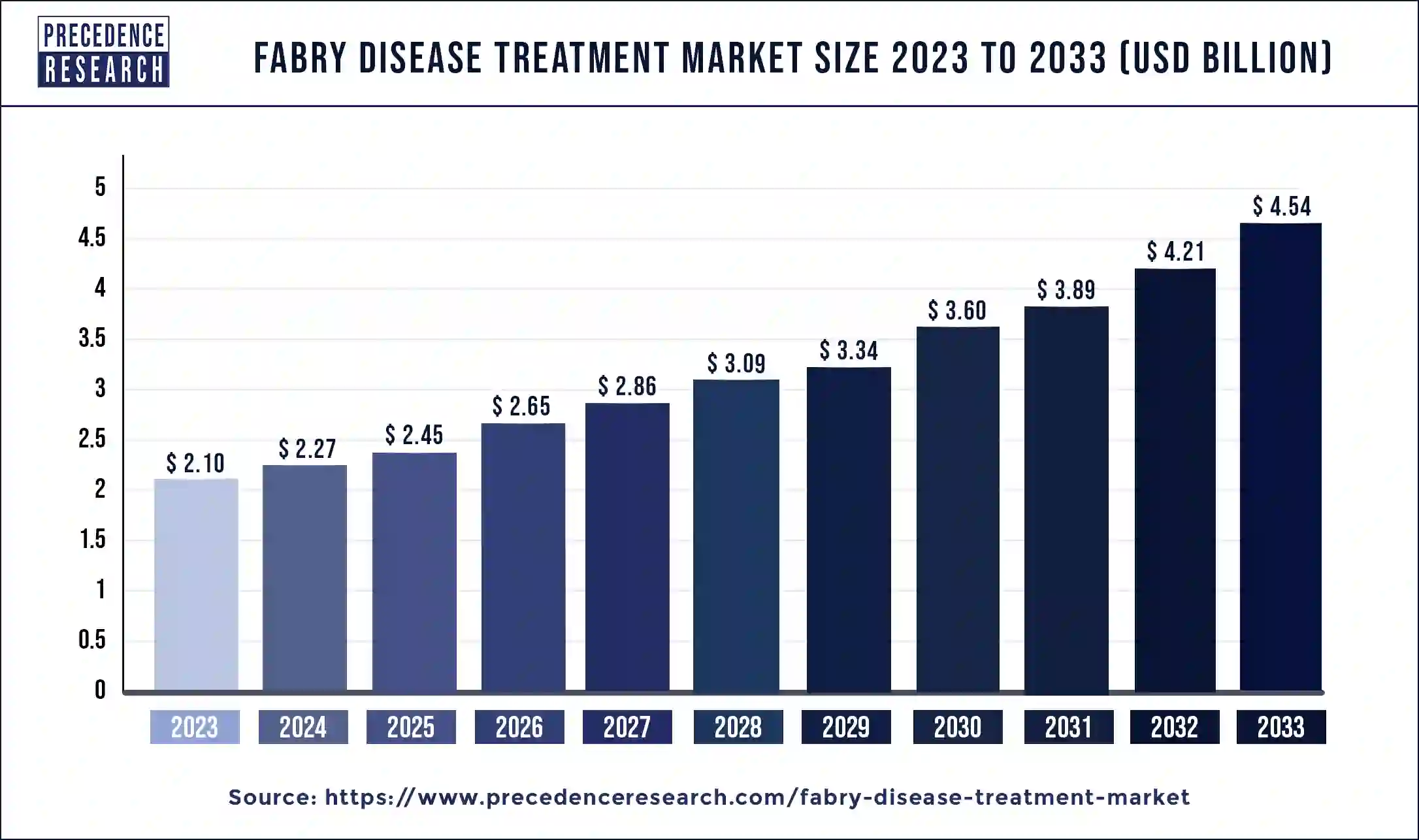

The global fabry disease treatment market size is valued at USD 2.45 billion in 2025 and is predicted to increase from USD 2.65 billion in 2026 to approximately USD 5.20 billion by 2035, growing at a CAGR of 7.82% from 2026 to 2035. The global Fabry disease treatment market is poised for growth due to the escalating prevalence of this condition.

Market Highlights

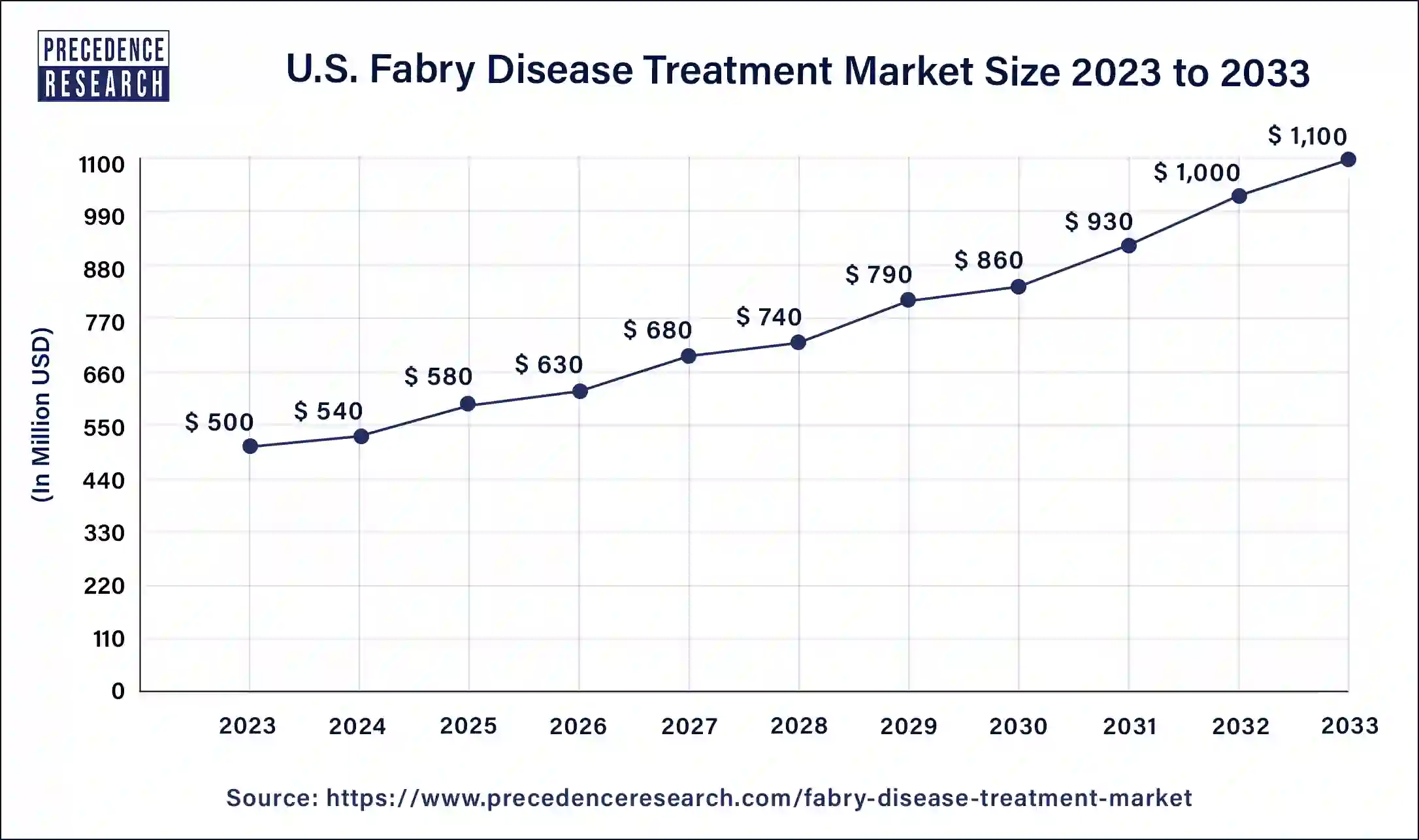

- The North America fabry disease treatment market size accounted for USD 580 million in 2025 and is expected to attain around USD 1,300 million by 2035, poised to grow at a CAGR of 8.41% between 2025 and 2034.

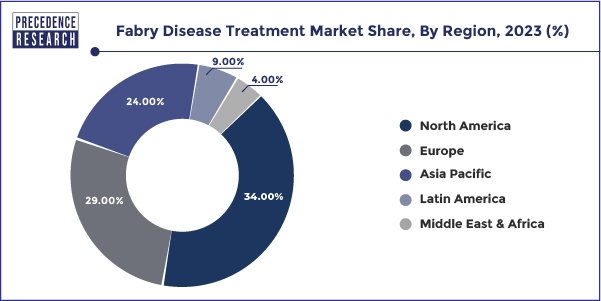

- North America dominated the market in 2025.

- Asia Pacific is expected to host the fastest-growing market over the forecast period.

- By treatment, the enzyme replacement therapy segment dominated the market in 2025.

- By treatment, the substrate reduction therapy segment grows at a rapid pace in the market over the forecast period.

Market Overview

The Fabry disease treatment market is experiencing robust growth from increased usage of biotechnology, a wider understanding, and improved diagnostics capabilities. Fabry disease is a rare genetic disorder the condition is due to deficiency of the enzyme alpha-galactosidase A that requires lifelong management of the disease therefore treatment is essential.

The market has driven primarily by increased demand for ERTs such as agalsidase beta and oral chaperone therapies, such as migalastat. Further, as newer gene therapies now start to emerge, there is a shift in the treatment paradigm towards long-lasting or potentially curative treatment. There is a significant investment into research and development and partnerships between firms in biotechnology are creating faster pipelines. Expect continued growth in this market segment as patient advocacy leads to better genetic testing and knowledge of the disease.

What is the Role of AI in the Fabry Disease Treatment Market?

Different artificial intelligence (AI) models can transform Fabry disease diagnosis, help monitor progression in affected organs and potentially contribute to personalized therapy development. In diagnostics, AI algorithms can analyze medical images like CT scans, X-rays, and MRIs, identifying subtle anomalies that may be missed by the human eye. This aids in the early detection of diseases like cancer and allows timely interventions to improve patient outcomes. AI improves diagnostics accuracy by identifying patterns in medical images, predicting disease risk, and interpreting high amounts of patient data, may faster and more precisely than human professionals.

AI algorithms analyze medical data to assist doctors in making improved diagnoses by studying patient histories, lab results, and genetic information. By identifying patterns and correlations within the data, AI improves diagnostic accuracy and allows personalized treatment planning.

Heartbeats & Enzymes: The Race to Rewrite a Rare Genetic Story

Fabry disease is a rare, X-linked lysosomal storage disorder caused by deficient activity of the enzyme α-galactosidase A, producing a multisystem disease that affects the kidney, heart, nervous system and quality of life. The therapeutic market clusters around enzyme-replacement therapies (ERTs), small-molecule pharmacological chaperones, substrate-reduction approaches, gene therapies, and supportive care, cardiorenal management, and pain control. Because Fabry is chronic, often progressive and requires lifelong management, the market's value is driven by long-term treatment demand, speciality pricing, and the high unmet need for improved durability, convenience, and access.

Technological Advancement

Better patient outcomes result from recent therapeutic breakthroughs and newly developed diagnostic tools that enhance the diagnosis and management of this rare inherited metabolic disorder. The patient-specific approaches used in these therapies lead to improved treatment impacts and better quality of life. Modern gene therapies display considerable promise as a long-lasting cure for Fabry disease.

Major Trends of the Fabry Disease Treatment Market

- Pivot to Curative-Intent Gene Therapies: The sector is evolving from chronic management to transformative "one-and-done" solutions. Late-stage clinical assets, such as Sangamo's ST-920, are leading the shift toward endogenous enzyme production, which seeks to disrupt the traditional biweekly infusion model through long-term clinical durability.

- Expansion of Oral Chaperone Market Share: There is a pronounced increase in the adoption of oral chaperones, led by Amicus Therapeutics' Galafold. By offering a non-invasive daily alternative for amenable mutations, this segment is driving significant revenue growth and improving patient quality-of-life (QoL) metrics over conventional intravenous enzyme replacement therapy (ERT).

- Optimization via Next-Generation ERTs: While ERT remains the foundational revenue driver, the introduction of pegylated formulations, such as Elfabrio, is redefining the standard of care. These next-generation therapies enhance pharmacological efficacy and reduce immunogenicity, allowing for more flexible, extended dosing schedules that mitigate the administrative burden on healthcare systems.

- Early Detection as a Growth Catalyst: The integration of Fabry disease into newborn screening programs across North America and the Asia-Pacific is significantly expanding the treatment-eligible patient population. This shift toward early diagnosis facilitates timely intervention, optimizing long-term clinical outcomes and driving sustained market demand.

Market Outlook

- Industry Outlook:Industry players, large biopharma, specialized rare-disease companies and clinical innovators are focusing on combination strategies: improving established ERT formulations with longer half-life, improved tissue penetration, advancing mutation-specific chaperones, and progressing genetic medicines with the potential for durable correction. Commercial success will depend on clinical differentiation cardio-renal outcomes, neuropathy relief), safety in vulnerable populations, and pragmatic delivery models home infusions vs clinic, refrigerated logistics. Partnerships across biotech, CDMOs, and patient groups will be essential to accelerate trials, ensure robust registries, and negotiate sustainable reimbursement pathways.

- Sustainability Trend: Sustainability in the Fabry space spans environmental, economic and access dimensions. Environmentally, manufacturers are optimizing biologics production to reduce energy, solvent and water footprints (process intensification, single-use systems, solvent recycling). Economically, payers and manufacturers are experimenting with outcome-based contracts, annuity-style payments for one-time gene therapies, and risk-sharing to align cost with long-term benefit. From an access sustainability viewpoint, there is growing emphasis on building local diagnostic capacity, training clinicians, and creating equitable supply chains so life-saving therapies do not remain limited to high-income geographies.

- Major Investment: Investment is concentrated in clinical development and manufacturing scale-up for next-generation therapies: vector production capacity for gene therapies, high-potency biologics fill-finish lines, and specialized sterile/aseptic infrastructure for ERTs. Investors are also funding companion diagnostics, newborn screening programs, and real-world evidence platforms that can validate long-term outcomes. Strategic acquisitions of niche biotech innovators by larger players remain a primary route to obtain differentiated peptide scaffolds, vector platforms or mutation-specific compounds.

- Start-up Ecosystem: Start-ups are a critical source of innovation: those developing gene-editing or AAV/mRNA gene-replacement approaches; companies producing oral chaperones tailored to specific genotypes; firms optimizing enzyme engineering for deeper tissue penetration cardiac, renal and longer half-life; and digital-health ventures creating patient registries, remote monitoring tools and adherence platforms. Many early-stage players pursue partnership or licensing with established pharmaceutical companies to advance late-stage trials and scale manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.45 Billion |

| Market Size in 2026 | USD 2.65 Billion |

| Market Size by 2035 | USD 5.20Billion |

| Fabry Disease Treatment Market Growth Rate from 2026 to 2035 | CAGR of 7.82% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Distribution Channel,Treatment,Route of Administration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The increasing prevalence of Fabry disease

The global fabry disease treatment market is expected to grow due to the increasing prevalence of the condition. Research indicates that Fabry disease affects 1 in 1,000 to 9,000 people. As the population grows, the likelihood of this hereditary disorder being passed on to newborns also rises. It has been observed that milder symptoms are more familiar with age than the severe form.

Fabry disease can affect individuals of all ethnicities and genders, leading to a broader patient base. Moreover, growing awareness of Fabry disease and increased discussions in the scientific and medical communities have led to better understanding and earlier diagnosis of the condition, further driving the Fabry disease treatment market growth.

- In April 2024, Russia decided to launch the production of the Fabry disease drug this year. The project will be implemented by the Russian drugmaker Petrovax together with the Gamaleya Research Institute of Epidemiology and Microbiology, one of Russia's leading medical and research institutions.

Restraint

Commodity price volatility and supply chain disruptions

Changes in the prices of raw materials, such as certain commodities, can affect the profit margins and operational costs of companies in the Fabry disease treatment market, exposing them to financial risks. Market saturation could also occur as similar products or services increase competition and put pressure on pricing and profitability, especially for companies with undifferentiated offerings.

Additionally, supply chain disruptions caused by natural disasters, geopolitical tensions, or other factors can hinder production and distribution, leading to delays, increased costs, and potential loss of market share in the Fabry disease treatment market.

Opportunity

Technology Advancements in the Fabry Disease Treatment Market:

The landscape of Fabry disease treatment is rapidly progressing due to advancements in technology which is influencing care and outcomes. First, next generation enzyme replacement therapies (ERTs) present the possibility of improved stability, shorter infusion times, as well as enhanced cellular uptake.

Second, oral chaperone therapies (e.g. migalastat) provide a more convenient option for patients since they stabilize the misfolded enzyme. Third, gene therapies are emerging with the possibility of a durable, and potentially curative treatment, by treating the underlying genetic defect of Fabry disease. There are also changes in the factors due to enhanced diagnostic technologies, such as high throughput sequencing for genetics and biomarker measurement, which improve diagnosis speed and accuracy.

Moreover, leveraging a deeper level of digital integration, it is becoming clearer how these advancements are improving the management of Fabry disease, treatment adherence, and the diagnostic journey. Collectively, these will help provide new treatments and personalized and evidenced-based care to Fabry disease.

Government Initiatives for Fabry Disease Treatment:

The treatment market for Fabry disease is benefiting from government action to stimulate research, development, and access for patients to therapies for rare diseases. Key drivers include orphan drug legislation incentives (market exclusivity, tax credits, fee waivers) for pharmaceutical companies and the availability of orphan drugs and potential treatments for Fabry Disease.

Regulatory authorities are allowing therapies to access fast-track and priority pathways that allow drugs to get to patients faster. Some governments are also funding clinical trials and natural history studies, absorbing the costs associated with early-stage research. Government action towards public-private partnerships and some national initiatives are also helping patients navigate the collaborative roads to diagnostics, screening and access to treatment.

Other nations have launched rare disease frameworks. To assist with better access to effective therapies, some of these frameworks include dedicated funding, less stringent regulatory pathways to bring new treatments to market faster, or enhancements in health insurance funding and coverage for life-saving treatment options.

Government-wide mechanisms that are facilitating better innovation, collaboration, access, and ultimately, better outcomes for Fabry Disease patients are examples of the foundation that needs to be established to drive similar datasets in disease innovation and outcomes for rare diseases.

Segment Insights

Route of Administration Insights

The intravenous (IV) route of administration segment enjoyed a prominent position in the market during 2025.

- In December 2023, humanized anti-soluble aggregated amyloid-beta (Aβ) monoclonal antibody ‘LEQEMBI Intravenous Infusion' (200mg, 500mg, lecanemab) launched in Japan was announced by Esai Co., Ltd. and Biogen Inc.

The oral route of administration segment predicted to witness significant growth in the market over the forecast period.

- In May 2025, the U.S. Food and Drug Administration (FDA) accepted its New Drug Application (NDA) submission for an investigational once daily, 25 mg oral formulation of Wegovy (Semaglutide) for chronic weight management in adults living with obesity or overweight and established cardiovascular disease was announced by Novo Nordisk.

By Distribution Channel Insights

How did the Hospital Pharmacy Segment Capture a Significant Portion of the Fabry Disease Treatment Market?

The hospital pharmacies serve as critical clinical hubs for the administration of high-value Fabry disease therapeutics, providing the sophisticated cold-chain infrastructure necessary for intravenous infusions. These facilities leverage specialized personnel to manage complex, multi-systemic treatment protocols and mitigate immediate adverse events, ensuring high levels of regulatory compliance.

How did the Online Pharmacy Segment Projected to Expand Rapidly in the Fabry Disease Treatment Market in the Coming Years?

The proliferation of online and specialty pharmacies is significantly enhancing patient adherence by providing seamless access to oral chaperone therapies and home-based care options. This decentralized infrastructure, supported by robust digital health platforms and telemedicine, effectively shifts the management of Fabry disease away from traditional hospital channels toward more convenient home settings.

By Treatment Insights

How did the Enzyme Replacement Therapy Segment Dominate in the Fabry Disease Treatment Market?

The enzyme replacement therapy (ERT) continues to command the highest revenue share as the established global standard of care for Fabry disease. Dominant products like Fabrazyme and Replagal maintain market leadership by successfully reducing Gb3 accumulation, thereby mitigating neuropathic pain and critical organ dysfunction. While intravenous infusion remains the primary delivery method, its dominance is reinforced by expanding global reimbursement policies and improved diagnosis rates.

How did the Substrate Reduction Therapy Segment Gain a Significant Share of the Fabry Disease Treatment Market over the studied period of 2025 to 2034?

The substrate reduction therapy (SRT) is gaining significant market share by offering a convenient oral alternative that eliminates the burden of chronic intravenous infusions. This therapeutic class addresses critical unmet needs by limiting substrate accumulation at the metabolic level, making it a vital option for patients with enzyme replacement therapy (ERT) sensitivities.

Regional Insights

What is the U.S. Fabry Disease Treatment Market Size?

The U.S. fabry disease treatment market size is estimated at USD 580 million in 2025 and is predicted to be worth around USD 1,300 million by 2035 with a CAGR of 8.41% from 2026 to 2035.

North America dominated the Fabry disease treatment market in 2025. The Fabry disease treatment market in the region is growing due to the higher adoption of novel therapies, advanced healthcare facilities, and favorable reimbursement policies.Health insurance programs covering expensive medications like Fabrazyme and supportive government healthcare policies are encouraging drug companies to invest more in R&D for rare diseases. Additionally, government initiatives to fund and support rare disease treatments are expected to drive market growth throughout the study period further.

- In May 2024, the American Kidney Fund (AKF) started a complete education and awareness effort through an initiative to make Fabry disease better known to the public. Patients with chronic kidney disease (CKD) who have no identified underlying cause should undergo Fabry disease testing according to this initiative. Fabry disease is a rare genetic condition that can cause kidney damage and other medical complications.

- In May 2023, Chiesi Global Rare Diseases and Protalix BioTherapeutics announced that the U.S. Food and Drug Administration (FDA) had approved ELFABRIO (pegunigalsidase alfa-ix) in the United States for the treatment of adult patients with Fabry disease.

Asia Pacific is expected to host the fastest-growing Fabry disease treatment market over the forecast period. Several factors are driving the market's growth during the forecast period, including a surge in the geriatric population, the development of a broad range of Fabry disease treatments, and improved accessibility to pharmaceutical products. Moreover, the rise in inherited neurological disorders, the presence of critical generic pharmaceutical companies, and increased government initiatives and specialized communities positively impact market growth. Significant advancements and improvements in Fabry disease treatment in the region further contribute to this growth.

- In November 2023, India's Rajiv Gandhi Centre for Biotechnology announced that it would assist all districts, taluk hospitals, and family groups in Kerala to identify rare pediatric genetic diseases.

Fabry Future: How North America is Leading the Charge in Innovative Treatments

The North American Fabry disease treatment market is witnessing significant revenue growth owing to enhanced healthcare resources, timely and accurate diagnostics, and a strong flow of new treatments for the disease. The United States market is expected to dominate the region, with easier access to an array of treatment options, including enzyme replacement therapies and oral chaperone treatments.

U.S. Fabry Disease Treatment Market Trends

The U.S. offers an advanced healthcare system that allows for accurate and timely treatment to be identified, in addition to sufficient reimbursement regulations for Fabry disease management, and increased professional education and awareness about treatment options for Fabry disease, which can collectively increase management of the disease.

As long as there is ongoing research development, improvement in diagnostic practices and processes, and an appropriate structure for funding and reimbursement of healthcare services for rare genetic diseases, North America will remain a "place to be" for the Fabry disease treatment market, and will ultimately contribute to further patient growth and improvements in patient experiences and outcomes in the market across its regions.

North America held the largest share of the Fabry disease treatment market in 2025.

- In April 2022, Camzyos (mavacampten) for the Treatment of Adults with the symptomatic New York Association Class II-III Obstructive Hypertropic Cardiomyopathy (HCM) to improve functional capacity and symptoms was approved by the U.S. Food and Drug Administration.

Asia-Pacific:

The Pacific Surge: Asia's Rapid Rise in Fabry Disease Treatment

The Asia Pacific market for Fabry disease treatment is advancing rapidly, with a multitude of reasons for this growth. Awareness is rising in the Asia Pacific region for health care professionals, allowing for improved early diagnosis, and treatment leading to improved outcomes. Advances in diagnosis have led to additional patients being treated and treated patients have improved outcomes.

The acceleration of government support for rare disease programs and interest from biopharmaceutical companies committed to the area for Fabry disease treatment are driving this area in the Asia Pacific. Countries such as China, Japan, India, and South Korea are leading these developments in Fabry disease treatment, largely responsible for improving outcomes for people living with this rare disease due to higher levels of disposable income, accelerating urbanization, and an improved desire for more sophisticated health care. As a result, the Asia Pacific market should become a significant contributor of the global market for Fabry disease treatment.

Asia Pacific is projected to host the fastest growing market in the coming years.

- In April 2024, tentative approval from the United States Food and Drug Administration (USFDA) for its Abbreviated New Drug Application (ANDA) for Migalastat capsules, 123 mg, to market a generic equivalent of Galafold Capsules, 123 mg of Amicus Therapeutics US LLC.

China Fabry Disease Treatment Market Trends

China's market is experiencing steady growth, driven by increasing awareness of rare genetic disorders, enhanced diagnostic capabilities, and greater government attention to rare disease management. Enzyme replacement therapies (ERTs) continue to dominate the market, providing the standard of care, while emerging therapies such as chaperone therapies, substrate reduction therapies, and gene therapies are gaining attention and expanding treatment options.

Europe:

The Europe Fabry disease treatment market is growing steadily in all aspects. What drives this market is several factors. There is a huge well-developed healthcare system that allows for early diagnosis of Fabry disease and successful management. Some European countries have better environments overall, such as Germany, the UK, and France, as there are options for more advanced treatment as well as comprehensive healthcare for patients experiencing Fabry disease.

More recently, with the availability of Enzyme Replacement Therapy's (ERT's) to oral chaperone therapies, that has increased options for patients and improved patient outcomes. Furthermore, there is strong reimbursement in place and readable policy developments as functional legislation to ensure the treatment of patients with Fabry disease is improving.

Added to the large scale introduction by healthcare providers in researching new developments and in development and more recently due to the covid-19 pandemic, there is more in depth research on options - Currently in Europe the level research and development continues to seem to enhance every type of therapeutic option available with promising new advancements in gene therapies and substrate reduction therapy's., thus Europe will always be a prominent place in the treatment of Fabry disease.

Why is Latin America notable for Growth in the Fabry Disease Treatment Market?

In Latin America, access is uneven. Urban tertiary centres in Brazil, Mexico, and Argentina provide advanced diagnostics and specialist care, but many patients face delayed diagnosis and limited access to high-cost therapies. Key challenges include reimbursement complexity, budget ceilings for rare-disease drugs, logistics for cold-chain biologics and limited local manufacturing of advanced modalities. Opportunities lie in: regional procurement consortia, tiered-pricing models, expansion of newborn screening programs to increase early detection, build-out of infusion and registry infrastructure, and public-private partnerships to bring gene-therapy trials and manufacturing partnerships to the region.

Brazil Fabry Disease Treatment Market Trends

Brazil's market is experiencing gradual growth, driven by increased awareness of rare genetic disorders and expanding access to treatment through public health programs. Revenue is expected to rise steadily as more patients are diagnosed and enrolled in enzyme replacement therapy (ERT), which remains the standard of care, while newer therapies such as oral chaperones and substrate-reduction treatments are beginning to gain traction.

Market Value Chain Analysis

- Raw Material Sourcing: Raw-material sourcing for Fabry therapeutics depends on modality. ERTs require high-quality cell-culture media, amino acids, chromatography resins, vials and sterile packaging components. Gene therapies need plasmid DNA, viral-vector production substrates, GMP-grade enzymes for packaging, and specialized PPE and single-use bioprocess equipment.

- Technological Advancements:Technologies propelling the market include: advanced protein-engineering PEGylation, Fc-fusion, glycol-engineering to extend enzyme half-life and tissue targeting, viral-vector and non-viral gene-delivery platforms aiming for one-time durable correction, gene-editing tools CRISPR/Cas and base editors aimed at permanent genomic repair and improved analytical platforms mass spectrometry.

Key Players in Fabry Disease Treatment Market and Their Offerings

- JCR Pharmaceuticals: A global specialty biopharmaceutical company based in Hyogo, Japan, dedicated to developing and commercializing therapies for rare and genetic diseases. JCR focuses on biotherapeutics utilizing proprietary cell construction and culture technologies, with a specific focus on regenerative, cell, and gene therapies.

- Sanofi Genzyme: Formerly an independent American biotechnology company, Genzyme was acquired by the French pharmaceutical giant Sanofi in 2011. It now operates as Sanofi's global centre of excellence for rare diseases, headquartered in Cambridge, Massachusetts.

- Green Cross Corporation: A South Korea-based holding company for a group of healthcare-related subsidiaries, including GC Pharma. The pharmaceutical arm (GC Pharma) is a leading biopharmaceutical company specialising in the development and production of plasma-derived products, vaccines, and treatments for rare diseases, such as Hunter syndrome and haemophilia A.

- Chiesi Group: An international pharmaceutical company headquartered in Parma, Italy, with a strong focus on research, development, and commercialization of innovative medicines in three main areas: Air respiratory health, e.g., asthma and COPD, Rare Disease, and Care special care and neonatology.

- Regenxbio Inc.: A leading American biotechnology company dedicated to improving lives through the curative potential of gene therapy.

Recent Developments

- In February 2025, uniQure completed enrolment in the first cohort of its Phase I/IIa clinical trial for AMT?191, received a favorable IDMC safety recommendation, and began preparing for a second-dose cohort later in the first quarter.(Source- https://biotuesdays.com)

- In February 2025 at the WORLD Symposium, Sangamo presented Phase 1/2 STAAR study results for isaralgagene civaparvovec (ST?920) reporting positive kidney function trends and a strong safety profile, paving the way for accelerated approval discussions and planned BLA submission in 2026. (Source- https://www.cgtlive.com)

- In October 2024, the publication of results from the Phase-3 BRIGHT study of ELFABRIO (pegunigalsidase alfa-iwxj) 2 mg/kg administered every four weeks for 52 weeks in adult patients with Fabry disease who were previously treated with agalsidase alfa or beta administered every two weeks was announced by Chiesi Global Rare Diseases, a business unit of the Chiesi Group, established to deliver innovative therapies and solutions for people living with rare diseases.

- In May 2024, an education and awareness campaign to increase visibility of Fabry Disease was launched by American Kidney Fund (AKF) in partnership with Sanofi Genzyme, a company working to support the rare disease community for more than 35 years.

Segments Covered in the Report

By Treatment

- Enzyme Replacement Therapy (ERT)

- Chaperone Treatment

- Substrate Reduction Therapy (SRT)

- Others

By Route of Administration

- Intravenous

- Oral

By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting